TeraFX Review 2025: Scam or Legit Broker?

TeraFx

United Kingdom

United Kingdom

-

Minimum Deposit $100

-

Withdrawal Fee $varies

-

Leverage 500:1

-

Spread From 0.6

-

Minimum Order 0.01

-

Forex Available

-

Crypto Unavailable

-

Stock Unavailable

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Softwares & Platforms

Customer Support

+442030484764

(English)

+442030484764

(English)

Supported language: Arabic, Chinese (Simplified), English, French, German, Spanish

Social Media

Summary

TeraFX, established in 2010 and regulated by the UK's FCA, is a trusted forex and CFD broker. It offers trading across over 60 currency pairs, commodities, indices, and metals via both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. The broker provides leverage up to 1:500 for eligible clients and ensures fund safety through segregated accounts with top-tier banks. TeraFX caters to both beginner and experienced traders with competitive trading conditions and FCA-compliant practices.

- FCA regulated, ensuring a high level of client protection and transparency

- Advanced MT4 and MT5 trading platforms for a seamless trading experience

- Competitive spreads and commission-free trading on most account types

- Solid range of tradable assets, including forex, indices, commodities, and metals

- Responsive, knowledgeable, and multi-lingual customer support

- Educational resources to support traders' learning journey

- Unique features like Fast Withdrawal and Callback options for enhanced user experience

- Negative balance protection for added client security

- Demo accounts available for risk-free practice trading

- Commitment to providing a secure and user-friendly trading environment

- Educational resources may not be as comprehensive as some larger brokers

- Product offering may not be as extensive as some competitors

- Limited cryptocurrency trading options compared to some brokers

- No 24/7 customer support available

- Relatively high minimum deposit for ECN and Pro accounts

- Not suitable for US clients due to regulatory restrictions

- Limited funding options compared to some brokers

- Inactivity fees may apply to dormant accounts

- No social trading or copy trading features available

- Withdrawal fees may apply in certain circumstances

Overview

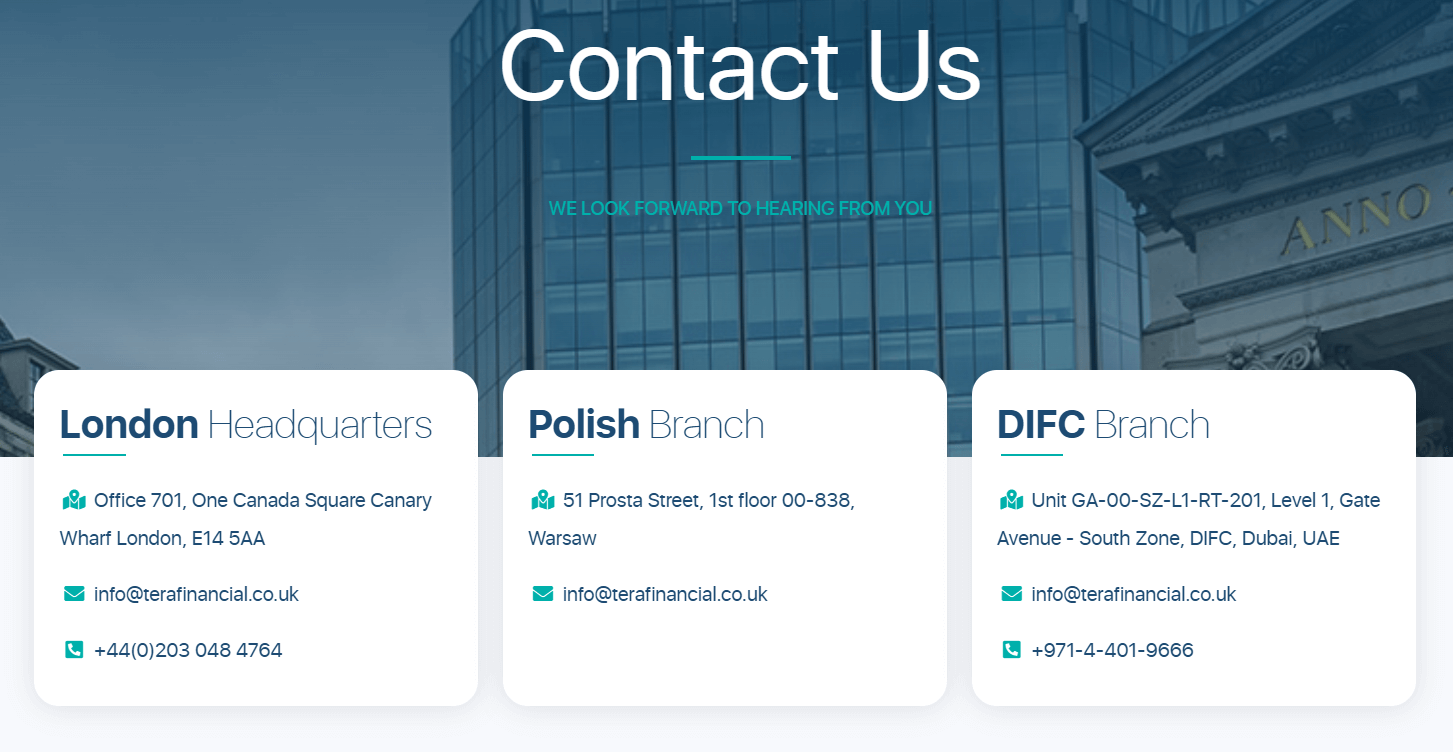

TeraFX is a UK-based online forex and CFD broker, established in 2011. Regulated by the Financial Conduct Authority (FCA) under license number 564741, TeraFX offers a secure trading environment for retail and professional clients. With headquarters in London and a branch office in Dubai, TeraFX provides access to over 60 forex pairs and CFDs on indices, commodities, and metals.

TeraFX leverages advanced trading platforms, including MetaTrader 4 (MT4) for forex and CFD trading and MetaTrader 5 (MT5) for spread betting. The broker offers competitive pricing with raw spreads from 0.6 pips and a commission-free model for most account types. Clients can choose from several account options tailored to different trading styles and experience levels, with a minimum deposit of $100.

While TeraFX's product range may be more limited compared to some larger multi-asset brokers, the company's FCA regulation, tight spreads, and quality platforms make it a viable choice for many traders. However, as with any broker, thorough due diligence is recommended. For more details, visit TeraFX's official website at www.terafx.com.

Overview Table

| Category | Details |

|---|---|

| Headquarters | London, United Kingdom |

| Established | 2010 |

| Regulation | Financial Conduct Authority (FCA), license no. 564741 |

| Trading Platforms | MetaTrader 4 (MT4), MetaTrader 5 (MT5) |

| Instruments | Forex (60+ pairs), CFDs on indices, commodities, metals |

| Minimum Deposit | $100 |

| Account Types | Starter, Premium, ECN, Pro, Corporate (forex/CFD); Retail, Pro, Corporate (spread betting) |

| Spreads | From 0.6 pips on EUR/USD |

| Commissions | Zero on most account types |

| Leverage | Up to 30:1 for retail clients, up to 500:1 for professional clients |

| Funding Options | Bank transfer, credit/debit cards, Skrill, Neteller |

Facts List

- TeraFX is authorised and regulated by the Financial Conduct Authority (FCA), a top-tier regulator in the UK.

- The broker offers competitive spreads starting from 0.6 pips on the popular EUR/USD currency pair.

- TeraFX provides the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms for forex, CFD, and spread betting.

- Clients can choose from several account types, including Starter, Premium, ECN, Pro, and Corporate accounts, catering to different trading needs and experience levels.

- The minimum deposit to open an account with TeraFX is $100, which is relatively low compared to some other brokers.

- TeraFX operates a commission-free model on most of its account types, helping to reduce overall trading costs.

- The broker offers leverage up to 30:1 for retail clients and up to 500:1 for professional clients, in line with FCA regulations.

- TeraFX provides a range of educational resources, including webinars, tutorials, and a financial glossary, to support clients' trading knowledge.

- The company has a global presence with its headquarters in London and a branch office in Dubai, serving clients worldwide.

- While TeraFX has generally positive reviews, some isolated complaints about slow withdrawals emphasise the importance of thorough due diligence when selecting a broker.

TeraFx Licenses and Regulatory

TeraFX operates under the regulatory oversight of the Financial Conduct Authority (FCA), a highly respected financial regulator in the United Kingdom. The FCA is known for its stringent regulations and high standards of compliance, ensuring that regulated firms adhere to strict guidelines to protect clients' interests.

TeraFX's FCA license, registered under Tera Europe Limited with license number 564741, demonstrates the broker's commitment to operating transparently and ethically. Being FCA-regulated requires TeraFX to maintain segregated client funds, submit regular financial reports, and adhere to strict capital requirements. This provides clients with an enhanced level of security and trust, as the FCA's oversight helps to minimise the risk of fraud or malpractice.

While some brokers may hold licenses with multiple regulatory bodies, it is important to note that the FCA is considered one of the most reputable and stringent regulators globally. An FCA license is often seen as a benchmark for trustworthiness and reliability in the industry.

Regulation List

- Financial Conduct Authority (United Kingdom)

- License Number: 564741

- Regulated Entity: Tera Europe Limited

Trading Instruments

TeraFX offers a focused range of tradable assets, primarily concentrating on forex and CFDs on indices, commodities, and precious metals. While their asset selection may not be as extensive as some larger multi-asset brokers, TeraFX provides a solid foundation for traders interested in these specific markets.

TeraFX offers over 60 currency pairs for trading, including major, minor, and exotic pairs. This extensive forex selection allows traders to diversify their portfolios and take advantage of various market conditions. With competitive spreads starting from 0.6 pips on the popular EUR/USD pair, TeraFX provides attractive trading conditions for forex enthusiasts.

| Category | Details |

|---|---|

| Forex | 60+ currency pairs, including majors, minors, and exotics |

| CFDs on Indices | Major global stock indices, such as S&P 500, FTSE 100, DAX 30 |

| CFDs on Commodities | Key commodities like oil and gas |

| CFDs on Precious Metals | Gold and silver |

| Spread Betting (UK only) | Available on forex, indices, and commodities |

While TeraFX's asset selection may not be as comprehensive as some of its competitors, the broker's focus on forex and CFDs allows it to provide a more specialised trading experience. The availability of spread betting for UK clients further enhances TeraFX's appeal to a specific market segment.

Trading Platforms

TeraFX provides clients with access to industry-leading trading platforms, ensuring a seamless and efficient trading experience. The broker's primary offerings include the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, which are widely recognised for their reliability, advanced features, and user-friendly interface.

MetaTrader 4 (MT4)

MT4 is the most widely used trading platform in the forex industry, known for its stability, advanced charting tools, and extensive customisation options. TeraFX offers MT4 for forex and CFD trading, allowing clients to access a wide range of markets through a single platform. Key features of MT4 include:

- Interactive charts with 9 timeframes and 30+ technical indicators

- 24 graphical objects for in-depth market analysis

- Customizable trading templates and expert advisors (EAs)

- One-click trading and instantaneous order execution

- Mobile accessibility through iOS and Android apps

MetaTrader 5 (MT5)

TeraFX also provides the next-generation MetaTrader 5 platform for spread betting. MT5 is an advanced platform that builds upon the features of MT4, offering additional tools and capabilities for versatile trading. Notable features of MT5 include:

- Expanded technical analysis options with 38 indicators and 44 graphical objects

- Advanced algorithmic trading capabilities with MQL5 programming language

- Optimized for faster processing and execution speeds

- Option to trade forex, commodities, indices, and stocks

Web Trader

For traders who prefer not to install additional software, TeraFX offers a web-based trading platform accessible through any modern browser. The Web Trader provides a streamlined interface for trading and managing accounts, with key features such as:

- Real-time quotes and charts for major currency pairs

- One-click trading and customizable watchlists

- Instant access without downloads or installations

- Compatible with Windows, Mac, and Linux operating systems

Mobile Trading

TeraFX understands the importance of mobile accessibility in today's fast-paced trading environment. The broker offers mobile trading apps for both MT4 and MT5 platforms, allowing clients to trade on the go from their iOS and Android devices. The mobile apps provide a seamless trading experience with features such as:

- Real-time quotes and interactive charts

- One-click trading and secure account management

- Push notifications for important market events and price alerts

- Synchronization with desktop trading accounts

By offering a diverse range of trading platforms, TeraFX caters to the varying needs and preferences of traders. Whether you prefer the familiarity of MT4, the advanced features of MT5, the convenience of web-based trading, or the flexibility of mobile apps, TeraFX has you covered.

Trading Platforms Comparison Table

| Feature | MT4 | MT5 | Web Trader | Mobile Apps |

|---|---|---|---|---|

| Markets | Forex, CFDs | Spread Betting | Forex | Forex, CFDs, Spread Betting |

| Timeframes | 9 | 21 | 6 | 9 |

| Indicators | 30+ | 38 | 20+ | 30+ |

| Graphical Objects | 24 | 44 | 15+ | 24 |

| One-Click Trading | Yes | Yes | Yes | Yes |

| Expert Advisors (EAs) | Yes | Yes | No | Yes |

| Customizable Templates | Yes | Yes | No | Yes |

| Push Notifications | No | No | No | Yes |

| Operating Systems | Windows, Mac, iOS, Android | Windows, Mac, iOS, Android | Windows, Mac, Linux | iOS, Android |

TeraFx How to Open an Account: A Step-by-Step Guide

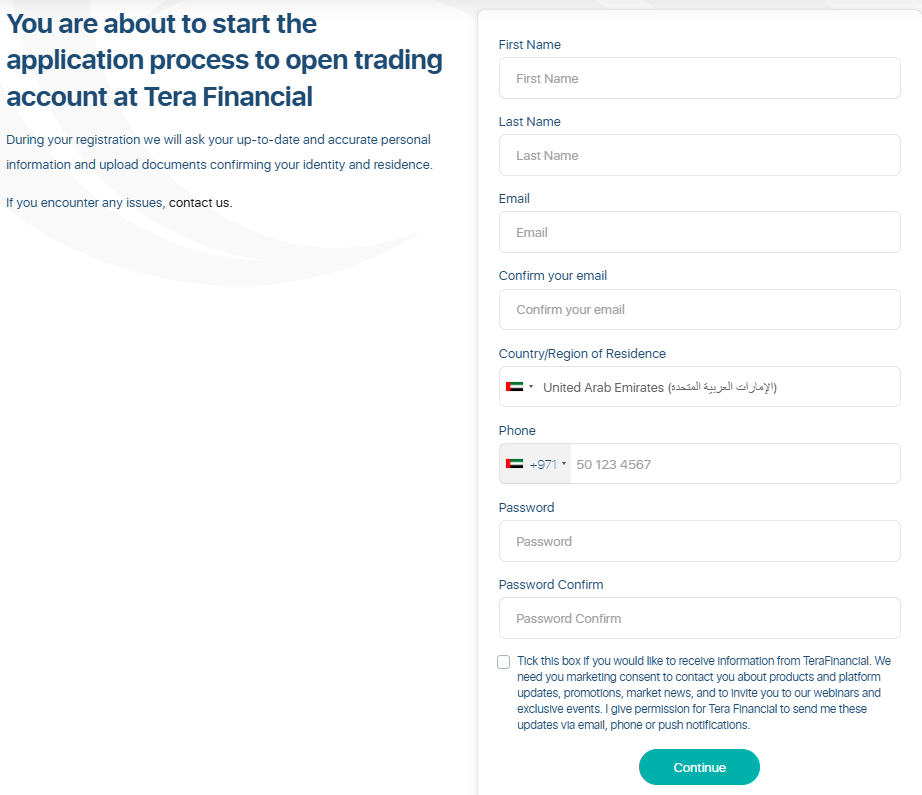

Opening an account with TeraFX is a straightforward process designed to get you started on your trading journey quickly and efficiently. To begin, you'll need to meet a few basic requirements and provide some essential information. Here's a step-by-step guide to opening an account with TeraFX:

Step 1: Visit the TeraFX website (www.terafx.com) and click on the "Open Live Account" button.

Step 2: Choose your account type (Starter, Premium, ECN, Pro, or Corporate for forex/CFD trading; Retail, Pro, or Corporate for spread betting).

Step 3: Fill out the registration form with your personal information, including your name, email address, phone number, country of residence, and desired account currency (USD, EUR, GBP, or PLN).

Step 4: Provide proof of identity and address by uploading a valid government-issued ID (e.g., passport, driver's license) and a recent utility bill or bank statement.

Step 5: Complete the brief questionnaire about your trading experience and financial knowledge to help TeraFX assess the suitability of their services for your needs.

Step 6: Agree to TeraFX's terms and conditions and submit your application.

Step 7: Once your application is approved, fund your account using one of the available payment methods, such as bank transfer, credit/debit card, or e-wallets like Skrill or Neteller.

Step 8: Download and install the appropriate trading platform (MetaTrader 4 for forex/CFD trading, MetaTrader 5 for spread betting, or use the Web Trader for browser-based trading).

Step 9: Log in to your trading account using the credentials provided by TeraFX and start trading.

To open an account with TeraFX, you'll need to meet the following requirements:

- Be at least 18 years old

- Provide a valid government-issued ID and proof of address

- Have a stable internet connection and a compatible device (computer, tablet, or smartphone)

- Meet the minimum deposit requirement of $100 (or equivalent in other currencies)

TeraFX accepts the following payment methods for funding your account:

- Bank transfer (1-5 business days processing time)

- Credit/debit card (instant processing)

- Skrill (instant processing)

- Neteller (instant processing)

Please note that while TeraFX strives to process applications and deposits quickly, some payment methods may take longer than others. If you have any questions or concerns during the account opening process, feel free to contact TeraFX's customer support team for assistance.

Charts and Analysis

TeraFX provides a range of educational resources and tools to support its clients in their trading journey. These resources are designed to cater to traders of all levels, from beginners to experienced professionals, helping them enhance their knowledge and skills in the financial markets.

| Feature | Details |

|---|---|

| Economic Calendar | TeraFX offers an economic calendar that keeps traders informed about upcoming market events and economic releases. It provides detailed information on the expected impact of each event, helping traders make informed decisions and adjust their strategies. The calendar is available on TeraFX's website and trading platforms, ensuring easy access to this valuable resource. |

| Webinars | TeraFX hosts regular webinars conducted by industry experts and experienced traders. These sessions cover market analysis, trading strategies, risk management, and platform tutorials. Clients can access the webinars live or view recorded sessions at their convenience, allowing for an interactive learning experience with the opportunity to ask questions and engage with the presenters. |

| Educational Videos | TeraFX offers a collection of educational videos designed to be short and informative. These videos provide quick insights and tips on chart analysis, trading psychology, and money management. They are available on the TeraFX website and YouTube channel, making them easily accessible for traders seeking practical knowledge. |

| Trading Guides and E-books | TeraFX provides a range of downloadable trading guides and e-books that delve into various trading strategies, market analysis techniques, and risk management principles. Authored by experienced traders and financial experts, these PDF resources offer in-depth insights and practical advice, allowing traders to study at their own pace across different devices. |

| Market News and Analysis | TeraFX's website features a dedicated section for market news and analysis. This section includes daily market reviews, technical analysis, and fundamental insights, helping traders stay informed on global financial trends and trading opportunities. The market updates are produced by TeraFX's in-house research team and reputable third-party sources, ensuring reliable and up-to-date information. |

| Glossary | TeraFX provides a comprehensive glossary of trading terminology aimed at newcomers and experienced traders alike. Organised alphabetically with cross-references, the glossary explains common terms, acronyms, and concepts used in the financial markets, making it a handy reference tool. |

While TeraFX's educational resources are not as extensive as some of the larger, multi-asset brokers, they provide a solid foundation for traders to enhance their knowledge and skills. The combination of webinars, videos, trading guides, and market analysis caters to different learning styles and preferences, ensuring that clients can access the information in a format that suits them best.

TeraFx Account Types

TeraFX offers a range of account types tailored to suit the diverse needs of traders, from novices to experienced professionals. These account types differ in terms of minimum deposit requirements, trading instruments, spreads, and other features, allowing clients to choose the most suitable option based on their trading style, experience, and financial goals.

Forex and CFD Trading Accounts

- Starter Account: The Starter Account is an entry-level account designed for beginners or traders with limited experience. It offers access to 82 trading instruments, including forex pairs and CFDs on indices, commodities, and precious metals. The minimum deposit for this account is $100, making it accessible to a wide range of traders. The Starter Account features competitive spreads and no commission charges, allowing traders to keep their trading costs low.

- Premium Account: The Premium Account is designed for more experienced traders who require access to a broader range of trading instruments. This account offers 147 trading instruments, including additional forex pairs and CFDs on global indices, commodities, and metals. Like the Starter Account, the Premium Account requires a minimum deposit of $100 and features competitive spreads with no commission charges. Traders can also access premium customer support and exclusive market analysis with this account type.

- ECN Account: The ECN (Electronic Communication Network) Account is designed for experienced traders who prioritise fast execution speeds and tight spreads. This account offers access to 82 trading instruments and features raw spreads starting from 0.0 pips. However, the ECN Account charges a commission per trade, which is typically offset by the tighter spreads. The minimum deposit for the ECN Account is $500, reflecting the advanced nature of this account type.

- Pro Account: The Pro Account is designed for professional traders and high-volume investors who require advanced trading tools and preferential trading conditions. This account offers access to the full range of trading instruments, including forex pairs, CFDs on indices, commodities, and metals. The Pro Account features competitive spreads and personalised support from a dedicated account manager. The minimum deposit for this account is $10,000, reflecting the higher level of service and benefits provided.

- Corporate Account: The Corporate Account is designed for institutional investors and large corporations who require customised trading solutions and dedicated support. This account type offers access to all trading instruments and features competitive spreads and commissions. Corporate Account holders benefit from personalised service, including a dedicated account manager, customised reporting, and tailored trading solutions. The minimum deposit for the Corporate Account is subject to negotiation, reflecting the bespoke nature of this account type.

Spread Betting Accounts (UK only)

- Retail Account: The Retail Account is designed for UK-based traders who prefer spread betting over traditional forex and CFD trading. This account offers access to a wide range of spread betting markets, including forex, indices, commodities, and metals. The Retail Account features competitive spreads and no commission charges, making it suitable for novice and experienced traders alike. The minimum deposit for this account is $100.

- Pro Account: The Pro Account for spread betting is similar to the Pro Account for forex and CFD trading, offering advanced trading tools and preferential trading conditions for professional traders and high-volume investors. This account provides access to all spread betting markets and features tighter spreads and higher leverage compared to the Retail Account. The minimum deposit for the Pro Account is $10,000.

Demo Accounts

TeraFX offers demo accounts for both forex/CFD trading and spread betting. These accounts allow traders to practise trading strategies and familiarise themselves with the trading platforms in a risk-free environment. Demo accounts offer access to real-time market data and a virtual balance of $10,000, enabling traders to test their skills without risking real money.

Overall, TeraFX's diverse range of account types caters to the needs of different traders, from beginners to professionals. The varied minimum deposit requirements, trading instruments, and account features ensure that clients can select an account type that aligns with their trading style and financial goals. By offering both forex/CFD trading and spread betting accounts, TeraFX provides flexibility for traders in different regions and with different trading preferences.

Account Types Comparison Table (Forex/CFD)

| Feature | Starter | Premium | ECN | Pro | Corporate |

|---|---|---|---|---|---|

| Min. Deposit | $100 | $100 | $500 | $10,000 | Custom |

| Trading Instruments | 82 | 147 | 82 | All | All |

| Spreads | From 0.6 | From 0.6 | From 0 | Variable | Variable |

| Commissions | No | No | Yes | No | Negotiable |

| Leverage | 1:30 | 1:30 | 1:500 | 1:500 | Custom |

| Execution | STP | STP | ECN | ECN | ECN |

| Customer Support | 24/5 | 24/5 | 24/5 | 24/5 | Dedicated |

Account Types Comparison Table (Spread Betting)

| Feature | Retail | Pro |

|---|---|---|

| Min. Deposit | $100 | $10,000 |

| Trading Instruments | All | All |

| Spreads | Variable | Tight |

| Commissions | No | No |

| Leverage | 1:30 | 1:500 |

| Execution | STP | ECN |

| Customer Support | 24/5 | 24/5 |

Negative Balance Protection

TeraFX understands the importance of risk management and is committed to protecting its clients' funds. As such, the broker offers negative balance protection to all its retail clients. This means that TeraFX will absorb any negative balances that may occur due to trading losses, ensuring that clients cannot lose more than their account balance. It's important to note that negative balance protection applies to each individual account separately. If a client has multiple trading accounts with TeraFX, each account will be treated independently for negative balance protection purposes.

Terms and Conditions

While TeraFX offers negative balance protection, traders should be aware of the following terms and conditions:- Negative balance protection applies to trading losses only. It does not cover any other debits to the account, such as fees, charges, or withdrawals.

- The broker reserves the right to assess the circumstances leading to a negative balance and may, at its discretion, choose not to provide negative balance protection if it determines that the client has engaged in abusive trading practices or has violated the broker's terms and conditions.

- Negative balance protection is not a substitute for proper risk management. Traders should still employ sound risk management strategies and never rely solely on negative balance protection to manage their trading risks.

TeraFx Deposits and Withdrawals

TeraFX offers a range of convenient and secure deposit and withdrawal options to facilitate the smooth transfer of funds for its clients. The broker understands the importance of efficient and reliable payment processing, ensuring that traders can focus on their trading activities without worrying about the safety of their funds.

Deposit Options

TeraFX accepts the following deposit methods:

| Deposit Method | Description | Minimum Deposit | Maximum Limit | Processing Time |

|---|---|---|---|---|

| Bank Transfer | Clients can deposit funds directly from their bank account; suitable for larger deposits and offers a secure transfer method. | $100 | No maximum limit | Generally 1-5 business days |

| Credit/Debit Cards | Deposits via Visa and Mastercard; convenient for smaller deposits with instant funding upon successful payment processing. | $100 | No maximum limit | Instant |

| E-wallets | Supports popular e-wallets such as Skrill and Neteller; ideal for fast and secure online payments. | $100 | Up to $10,000 per transaction | Instant |

Withdrawal Options

TeraFX offers the following withdrawal methods:

| Withdrawal Method | Description | Minimum Withdrawal | Maximum Limit | Processing Time |

|---|---|---|---|---|

| Bank Transfer | Clients can withdraw funds directly from their TeraFX trading account to their bank account. Suitable for larger withdrawals with secure transfer. | $100 | No maximum limit | Generally 1-5 business days |

| Credit/Debit Cards | Withdrawals via Visa and Mastercard. This method is convenient for smaller withdrawals and offers fast processing. | $100 | No maximum limit | Generally 1-3 business days |

| E-wallets | Supports withdrawals via popular e-wallets such as Skrill and Neteller. Ideal for fast and secure online payments. | $100 | Up to $10,000 per transaction | Generally 1-3 business days |

Fees and Processing Times

TeraFX does not charge any fees for deposits or withdrawals, regardless of the payment method used. However, clients should be aware that their bank or payment provider may charge fees for transactions, and these fees are the responsibility of the client.

Processing times for deposits and withdrawals may vary depending on the payment method and the client's bank or payment provider. TeraFX strives to process all transactions as quickly as possible, but clients should allow for potential delays due to banking procedures or verification requirements.

Verification Requirements

To comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, TeraFX requires clients to verify their identity and address before processing withdrawals. Clients may be asked to provide the following documents:

- Proof of identity: A valid government-issued ID, such as a passport or driver's license.

- Proof of address: A recent utility bill, bank statement, or official government document that displays the client's name and address.

Once the verification process is complete, clients can proceed with their withdrawal requests.

Unique Features

TeraFX offers a unique "Fast Withdrawal" feature for verified clients. This feature allows eligible clients to request withdrawals that are processed within 24 hours, providing a convenient and efficient way to access funds.

Overall, TeraFX provides a range of secure and convenient deposit and withdrawal options, catering to the diverse needs of its clients. The broker's commitment to fast and fee-free transactions, combined with its stringent security measures and unique features, sets it apart from many competitors in the industry.

Support Service for Customer

In the fast-paced world of online trading, reliable customer support is crucial for a positive trading experience. Traders often require assistance with account-related queries, technical issues, or general guidance, and a responsive support team can make all the difference. TeraFX understands the importance of customer support and offers a range of channels to ensure that clients can reach out for help whenever they need it.

Support Channels

TeraFX provides the following customer support channels:| Support Channel | Description & Contact Details |

|---|---|

| Live Chat | Clients can access instant support via the live chat feature on the TeraFX website. This channel is ideal for quick queries and real-time assistance. |

| Traders can send their questions or concerns to the TeraFX support team via email at customerservices@terafx.co.uk. This channel is suitable for more detailed enquiries that may require a longer response time. | |

| Phone | TeraFX offers phone support for clients who prefer to speak directly with a representative. UK: +44 (0)203 048 4764 Dubai: +971 4 401 9666 |

| Social Media | Clients can reach out via TeraFX's official social media channels, such as Facebook, Twitter, and Instagram. While not the primary support channel, the team aims to respond to queries and messages promptly. |

Support Languages

TeraFX offers customer support in multiple languages to cater to its global client base. The primary support language is English, but the company also provides support in Arabic, Chinese, Spanish, and German, subject to availability.Support Hours

TeraFX's customer support team is available 24/5, from Monday to Friday. This means that clients can access support at any time during the trading week, regardless of their time zone. The company aims to provide round-the-clock assistance to ensure that traders can get the help they need when they need it.Response Times

TeraFX strives to provide prompt and efficient customer support across all channels. The average response times for each support channel are as follows:- Live Chat: Immediate to 5 minutes

- Email: 1-4 hours

- Phone: Immediate to 10 minutes

- Social Media: 1-6 hours

Unique Features

TeraFX offers a unique "Callback" feature for clients who prefer not to wait on hold when calling the support team. Clients can request a callback through the company's website, and a support representative will contact them at the specified time. Overall, TeraFX provides a comprehensive and reliable customer support system, offering multiple channels, multi-lingual assistance, and extended support hours. The company's commitment to prompt and efficient support sets it apart from many competitors in the industry and contributes to a positive trading experience for its clients.Customer Support Comparison Table

| TeraFX | Competitor 1 | Competitor 2 | |

|---|---|---|---|

| Live Chat | Yes | Yes | No |

| Yes | Yes | Yes | |

| Phone | Yes | Yes | Yes |

| Social Media | Yes | No | Yes |

| Support Hours | 24/5 | 24/5 | 24/7 |

| Languages | English, Arabic, Chinese, Spanish, German | English, Spanish | English, French, German |

| Response Time | Fast | Average | Slow |

| Callback Option | Yes | No | No |

Prohibited Countries

In the global landscape of online trading, regulatory requirements and legal restrictions vary from country to country. As a result, TeraFX is not permitted to provide its services in certain jurisdictions. These restrictions are in place to ensure compliance with local laws, licensing requirements, and geopolitical factors.

Reasons for Restrictions

The primary reasons behind TeraFX's country restrictions include:

- Regulatory Compliance: Each country has its own set of regulations governing the provision of financial services. TeraFX must adhere to these regulations and obtain the necessary licenses to operate legally in a given jurisdiction. In some cases, the regulatory requirements may be too stringent or costly for the company to comply with, leading to a decision not to offer services in that country.

- Licensing Requirements: In many countries, brokers are required to obtain specific licenses to offer trading services legally. These licenses may involve extensive application processes, financial requirements, and ongoing compliance obligations. If TeraFX determines that the licensing requirements in a particular country are not feasible or cost-effective, it may choose not to pursue a license and, consequently, not offer services in that jurisdiction.

- Geopolitical Factors: Political instability, economic sanctions, or international trade restrictions can also influence a broker's decision to operate in certain countries. TeraFX must consider the potential risks and legal implications associated with providing services in regions subject to such factors.

Prohibited Countries List

TeraFX is currently unable to provide its services to residents of the following countries and regions:

- United States of America (USA)

- Canada

- Japan

- Australia

- Belgium

- Israel

- Palestine

- Iran

- North Korea

- Sudan

- Syria

- Cuba

- Crimea and Sevastopol

- United Kingdom (UK) – Spread Betting services only

Please note that this list is subject to change based on evolving regulatory landscapes and TeraFX's business decisions.

Consequences of Trading from Prohibited Countries

Attempting to trade with TeraFX from a prohibited country may result in severe consequences, including:

- Account Termination: If TeraFX discovers that a client is trading from a prohibited country, the company reserves the right to immediately terminate the client's account and block access to the trading platform.

- Funds Forfeiture: In some cases, clients from prohibited countries may face the risk of having their funds frozen or forfeited, as TeraFX may be unable to process withdrawals to these jurisdictions due to legal restrictions.

- Legal Action: Depending on the severity of the violation and the applicable laws, clients who attempt to trade from prohibited countries may face legal action or penalties from local authorities.

It is crucial for traders to ensure that they are not residents of or trading from any of the prohibited countries before attempting to open an account with TeraFX. Clients are strongly advised to review the terms and conditions and seek professional legal advice if they are unsure about their eligibility to trade with the broker.

Special Offers for Customers

TeraFX does not offer any sign-up bonuses, deposit bonuses, or other promotional incentives to new or existing clients.

Conclusion

Throughout this comprehensive review of TeraFX, I have delved into various aspects of their operations, from regulatory compliance and trading platforms to customer support and educational resources. By consolidating these findings, I aim to provide a cohesive summary that addresses TeraFX's safety, reliability, and overall reputation as a broker.

One of the key factors that contribute to TeraFX's trustworthiness is their regulatory compliance. As a broker authorised and regulated by the Financial Conduct Authority (FCA) in the United Kingdom, TeraFX adheres to strict guidelines designed to protect clients' interests. The FCA's oversight ensures that TeraFX operates with transparency, maintains segregated client funds, and follows best practices in the industry.

In terms of trading platforms, TeraFX offers the widely recognised MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, which are known for their reliability, advanced features, and user-friendly interface. These platforms cater to the needs of both novice and experienced traders, providing a seamless trading experience across various devices.

TeraFX's educational resources, including webinars, tutorials, and a comprehensive glossary, demonstrate their commitment to supporting traders in their learning journey. The broker's emphasis on education helps clients make informed trading decisions and enhances their overall trading experience.

The broker's customer support is another area where they excel. With multiple channels available, including live chat, email, and phone support, TeraFX ensures that clients can access assistance whenever they need it. The support team is knowledgeable, responsive, and multi-lingual, catering to the needs of a global client base.

While TeraFX's product offering may not be as extensive as some larger brokers, they provide a solid range of tradable assets, including forex, indices, commodities, and metals. The broker's competitive spreads and commission-free trading on most account types make them an attractive choice for cost-conscious traders.

However, it is essential to note that no broker is without limitations. TeraFX's educational resources, while helpful, may not be as comprehensive as those offered by some competitors. Additionally, the broker's regulatory compliance, while a strong point, does not eliminate all risks associated with trading.

Overall, I believe that TeraFX is a reliable and trustworthy broker that prioritises client safety and user experience. Their FCA regulation, advanced trading platforms, educational resources, and responsive customer support make them a compelling choice for traders seeking a secure and user-friendly trading environment. As with any broker, it is crucial for potential clients to carefully evaluate their own trading needs and conduct thorough due diligence before committing to a brokerage.