ThinkMarkets Review 2025: A Comprehensive Guide to This Multi-Regulated Forex Broker

ThinkMarkets

United Kingdom

United Kingdom

-

Minimum Deposit $50

-

Withdrawal Fee $0

-

Leverage 500:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Cyprus Market Making (MM)

Cyprus Market Making (MM)

South Africa Retail Forex License

South Africa Retail Forex License

Japan Forex Trading License

Japan Forex Trading License

Australia Retail Forex License

Australia Retail Forex License

Softwares & Platforms

Customer Support

Supported language: Arabic, Chinese (Simplified), English, German, Spanish

Social Media

Summary

ThinkMarkets is a globally regulated broker offering forex, commodities, indices, cryptocurrencies, and shares with competitive pricing and advanced trading technology. It supports multiple platforms, including MetaTrader 4, MetaTrader 5, and its proprietary ThinkTrader, known for powerful analysis tools and an intuitive interface. The broker provides tight spreads, fast execution, and negative balance protection, making it suitable for both retail and professional traders. ThinkMarkets also offers strong educational resources, market insights, and 24/7 customer support. However, its product range and research tools may not be as extensive as some competitors.

- Multi-regulated by top-tier authorities, ensuring a safe trading environment

- Wide range of 4,000+ tradable instruments across multiple asset classes

- Competitive spreads from 0 pips and low commissions on ThinkZero account

- Choice of powerful platforms, including MT4, MT5, and ThinkTrader

- Extensive educational resources and market analysis for all skill levels

- 24/7 multilingual customer support via live chat, email, and phone

- Innovative features like Traders' Gym and Trade Interceptor Scanner

- Segregated client funds held with top-tier banks for enhanced security

- Swap-free Islamic accounts are available for clients adhering to Sharia principles

- Global presence with offices in major financial hubs worldwide

- Higher minimum deposit of $500 for ThinkZero account compared to some brokers

- Inactivity fees of $10/month after 12 months of no trading activity

- Limited range of crypto trading options compared to some competitors

- Not available to clients in the US, Japan, and Canada due to regulatory restrictions

- Relatively high spreads on some currency pairs during volatile market conditions

- No bonuses or promotions offered to new or existing clients

- Withdrawal processing times may take up to 3 business days for some methods

- Some payment providers may impose their own deposit/withdrawal fees

- VPS hosting service is not free and requires a minimum deposit of $500

- Occasional platform glitches or delays during high-volume trading sessions

Overview

ThinkMarkets, established in 2010, is a globally recognized, multi-regulated forex and CFD broker with a strong presence in over 180 countries. Headquartered in London and Melbourne, ThinkMarkets is regulated by top-tier financial authorities such as the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC). The broker has also secured licenses from reputable regulators in Cyprus, South Africa, and Seychelles, reinforcing their commitment to providing a secure and transparent trading environment.

Throughout its history, ThinkMarkets has earned numerous accolades for its exceptional services, including "Best Forex Trading Experience" and "Best Forex Trading Innovation" at the UK Forex Awards. The broker offers a wide range of tradable instruments, including over 40 forex pairs, cryptocurrencies, indices, metals, commodities, stocks, futures, and ETFs, catering to the diverse needs of traders worldwide.

Clients can access the global markets through the broker's intuitive trading platforms, such as MetaTrader 4, MetaTrader 5, and the proprietary ThinkTrader platform. ThinkMarkets prides itself on providing competitive trading conditions, with spreads starting from 0.0 pips, fast execution speeds, and deep liquidity for large order sizes.

For more detailed information on ThinkMarkets' offerings, visit their official website at thinkmarkets.com.

Overview Table

| Category | Details |

|---|---|

| Regulation | FCA, ASIC, CySEC, FSA, FSCA |

| Founded | 2010 |

| Headquarters | London, UK and Melbourne, Australia |

| Instruments | Forex, CFDs, Indices, Commodities, Stocks, ETFs, Futures |

| Platforms | MT4, MT5, ThinkTrader, TradingView |

| Minimum Deposit | $50 - $500 (depending on account type) |

| Spreads | Starting from 0.0 pips |

| Leverage | Up to 1:500 |

| Customer Support | 24/7 multilingual support |

| Awards | "Best Forex Trading Experience" and "Best Forex Trading Innovation" at UK Forex Awards |

Facts List

- ThinkMarkets is regulated by six top-tier financial authorities worldwide, including the FCA, ASIC, CySEC, FSA, and FSCA.

- The broker offers three main account types: Standard, ThinkTrader, and ThinkZero, catering to different trading styles and preferences.

- Clients can access over 4,000 tradable instruments, including forex pairs, CFDs, indices, commodities, stocks, ETFs, and futures.

- ThinkMarkets provides a choice of trading platforms, including the popular MetaTrader 4 and MetaTrader 5, as well as their proprietary ThinkTrader platform and TradingView integration.

- The broker offers competitive trading conditions, with spreads starting from 0.0 pips, fast execution speeds, and deep liquidity for large order sizes.

- ThinkMarkets provides a comprehensive Trading Academy with educational resources suitable for traders of all levels, including articles, videos, webinars, and ebooks.

- Clients can benefit from robust market analysis tools, such as the Economic Calendar, Traders' Gym for strategy testing, and daily market insights.

- The broker offers 24/7 multilingual customer support via live chat, phone, and email in 21 languages.

- ThinkMarkets has won several awards for its exceptional services, such as "Best Forex Trading Experience" and "Best Forex Trading Innovation" at the UK Forex Awards.

- The broker maintains segregated client funds with top-tier banks and offers negative balance protection to ensure the safety of traders' capital.

ThinkMarkets Licenses and Regulatory

ThinkMarkets is a multi-regulated forex broker, holding licenses from several top-tier financial authorities worldwide. This multi-jurisdictional approach to regulation demonstrates the broker's commitment to maintaining high standards of security, transparency, and integrity in its operations.

| Regulator | Country | License Number |

|---|---|---|

| Financial Conduct Authority (FCA) | United Kingdom | 629628 |

| Australian Securities and Investments Commission (ASIC) | Australia | 424700 |

| Cyprus Securities and Exchange Commission (CySEC) | Cyprus | 215/13 |

| Financial Services Authority (FSA) | Seychelles | SD060 |

| Financial Sector Conduct Authority (FSCA) | South Africa | 49835 |

In comparison to industry standards, ThinkMarkets stands out as a well-regulated broker with a strong commitment to compliance. While many brokers may hold a single license, ThinkMarkets' multi-jurisdictional approach sets it apart, showcasing its dedication to meeting the highest standards of regulatory compliance across various regions.

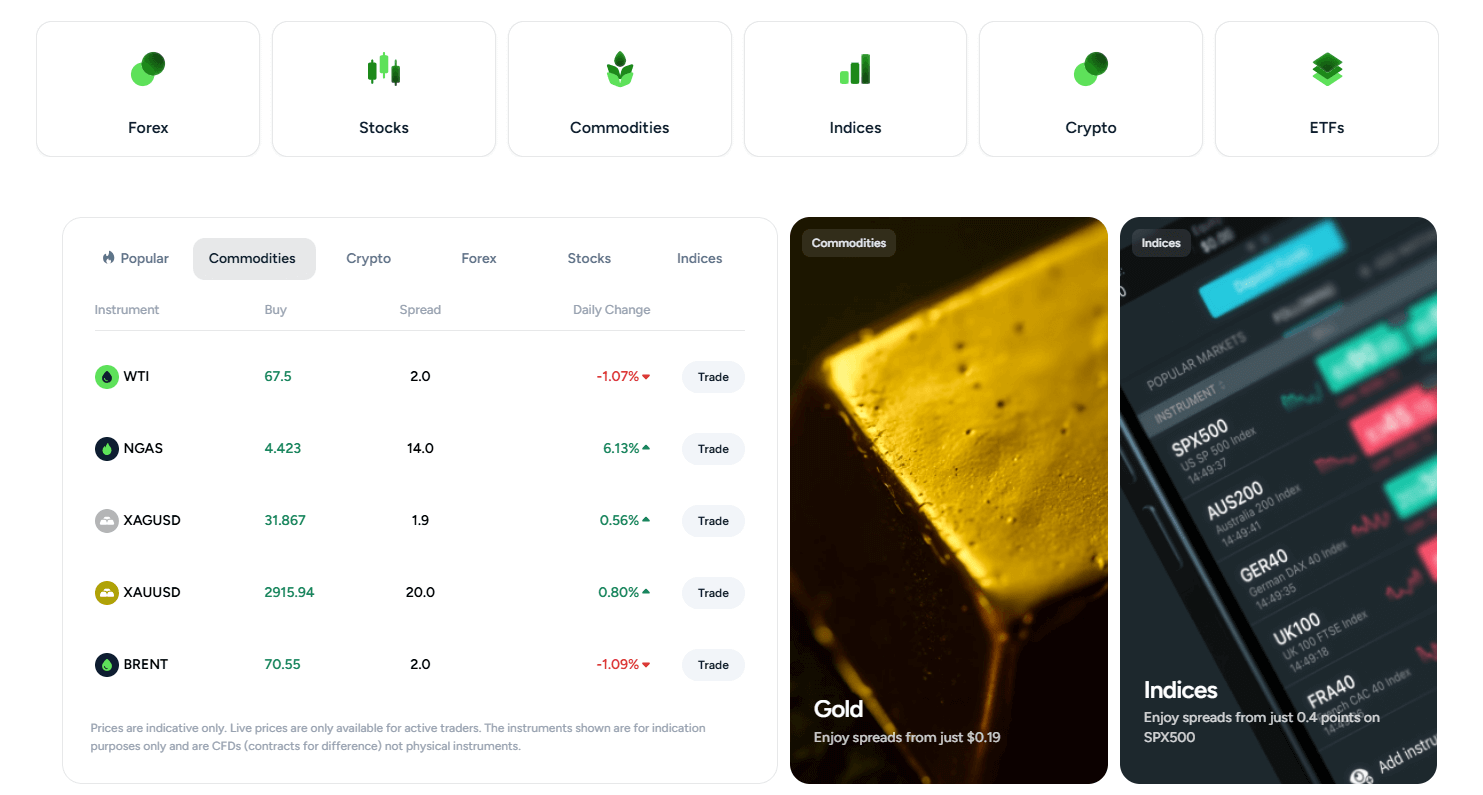

Trading Instruments

ThinkMarkets offers a diverse range of tradable assets, catering to the varying needs and preferences of traders worldwide. With over 4,000 instruments available, the broker provides ample opportunities for traders to diversify their portfolios and capitalize on market movements across multiple asset classes.

| Asset Class | Offerings | Key Features |

|---|---|---|

| Forex | Currency pairs (e.g., EUR/USD, GBP/USD) | Tight spreads (as low as 0.0 pips), deep liquidity, fast execution |

| CFDs | Speculation on various assets | Includes indices, commodities, stocks, ETFs, futures |

| Indices | Global market indices | S&P 500, NASDAQ 100, FTSE 100, DAX 30, ASX 200; flexible contract sizes |

| Commodities | CFD trading on commodities | Gold, silver, crude oil, natural gas, wheat, coffee; leverage up to 1:500 |

| Stocks | Global stocks | NYSE, NASDAQ, LSE, ASX; zero commission on select accounts |

| ETFs | CFD trading on ETFs | Exposure to diverse market sectors, flexible contract sizes |

| Futures | Futures contracts | Includes indices, commodities, and interest rates; competitive spreads and deep liquidity |

| Cryptocurrencies | CFD trading on digital assets | Bitcoin, Ethereum, Litecoin, Ripple; 24/7 trading and flexible leverage |

Compared to industry standards, ThinkMarkets' offering of over 4,000 tradable instruments is impressive, surpassing many of its competitors. The broker's commitment to providing a comprehensive range of assets, combined with competitive spreads and deep liquidity, positions ThinkMarkets as a strong contender in the online trading space.

Trading Platforms

ThinkMarkets offers a range of powerful trading platforms to cater to the diverse needs and preferences of its clients. Traders can choose from industry-standard platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), as well as the broker's proprietary platform, ThinkTrader.

| Platform | Key Features | Access Options |

|---|---|---|

| MetaTrader 4 (MT4) | User-friendly, advanced charting, customizable, supports Expert Advisors (EAs) | Desktop, web, mobile |

| MetaTrader 5 (MT5) | Enhanced features, wider market access, advanced order types, built-in Economic Calendar | Desktop, web, mobile |

| ThinkTrader | Proprietary, intuitive interface, multiple order types, real-time news and analysis, customizable | Web, mobile apps |

| TradingView | Advanced charting and social trading tools, integrated trading via ThinkMarkets | Browser-based, integrated with account |

| Mobile Trading | Dedicated mobile apps offering real-time quotes, advanced charting, secure account management | iOS, Android |

Platform Features

ThinkMarkets' trading platforms offer a range of features designed to enhance the trading experience and support informed decision-making. These features include:

- Advanced charting tools with multiple timeframes and chart types

- A wide range of technical indicators and drawing tools

- Real-time news and market analysis

- Customizable alerts and notifications

- One-click trading and advanced order types

- Automated trading through Expert Advisors (EAs) on MT4 and MT5

The availability of stable, popular, and feature-rich trading platforms is crucial for ensuring a satisfactory trading experience. ThinkMarkets' selection of platforms, including MT4, MT5, and ThinkTrader, demonstrates the broker's commitment to meeting the diverse needs of its clients and staying up-to-date with market demands.

Trading Platforms Comparison Table

| Platform | Accessibility | Markets | Automated Trading | Advanced Charting | Technical Indicators | Drawing Tools | Order Types | News & Analysis | Customizable Interface |

|---|---|---|---|---|---|---|---|---|---|

| MT4 | Desktop, Web, Mobile | Forex, Indices, Commodities | Yes (EAs) | Yes | 30+ | 31+ | 4 Pending Order Types | Yes | Yes |

| MT5 | Desktop, Web, Mobile | Forex, Indices, Commodities, Stocks | Yes (EAs) | Yes | 38+ | 44+ | 6 Pending Order Types | Yes | Yes |

| ThinkTrader | Web, Mobile | Forex, Indices, Commodities, Stocks | No | Yes | 100+ | 50+ | Multiple Order Types | Yes | Yes |

| TradingView | Web, Mobile | Forex, Indices, Commodities, Stocks | No | Yes | 100+ | 50+ | Multiple Order Types | Yes | Yes |

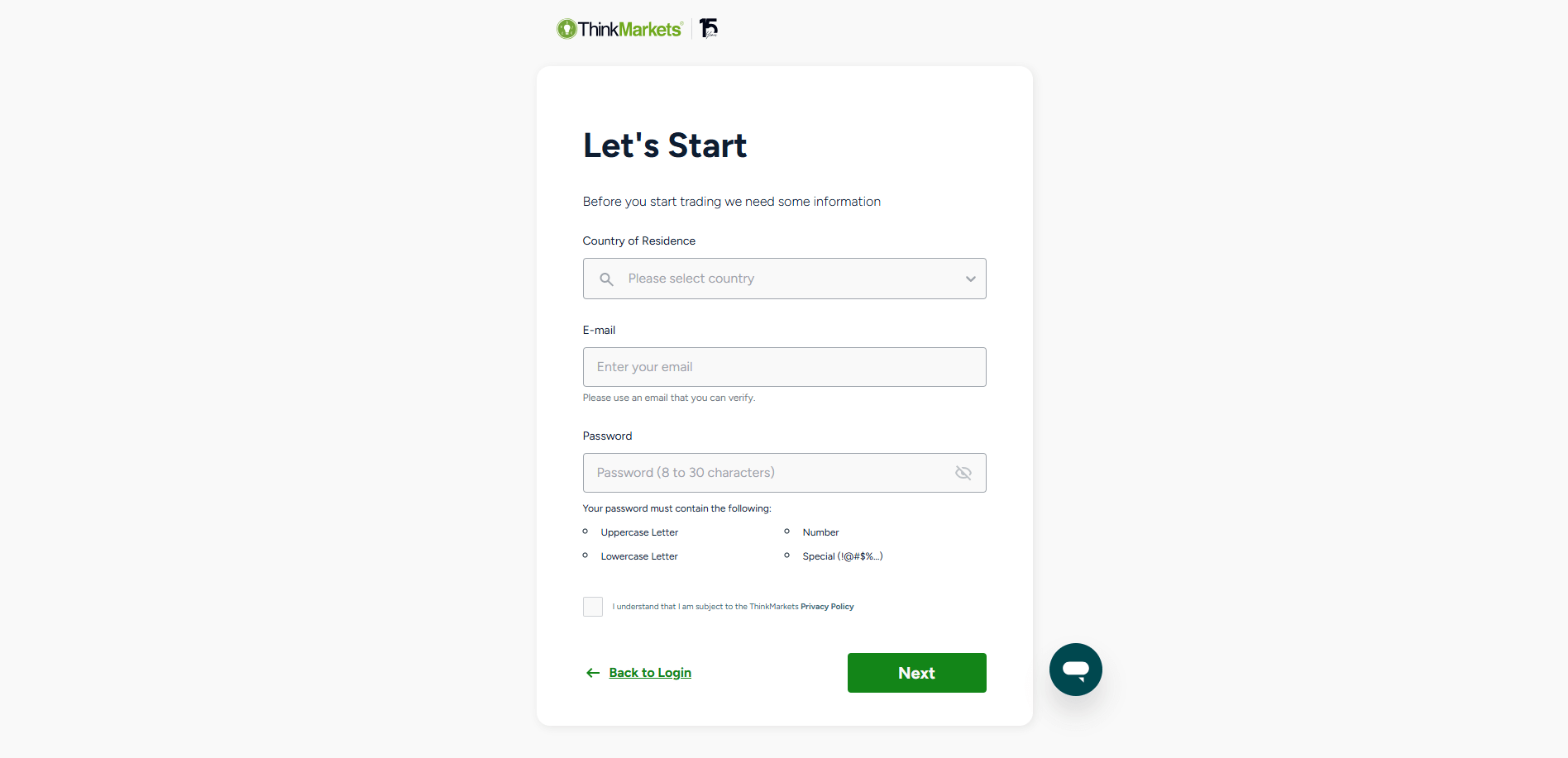

ThinkMarkets How to Open an Account: A Step-by-Step Guide

ThinkMarkets account opening is a straightforward process that can be completed online in a few simple steps. Before getting started, ensure that you meet the minimum requirements and have the necessary documents ready.

Requirements

- Minimum deposit: $50 for ThinkTrader accounts, $250 for Standard accounts, and $500 for ThinkZero accounts

- Identification documents: Proof of identity (e.g., passport, driver's license) and proof of address (e.g., utility bill, bank statement)

- Payment method: Choose from a range of options, including credit/debit cards, bank wire transfers, and e-wallets like Skrill and Neteller

Step 1: Visit the ThinkMarkets website and click on the "Create Account" button.

Step 2: Select the account type you wish to open (ThinkTrader, Standard, or ThinkZero) and provide your personal information, including your name, email address, phone number, and country of residence.

Step 3: Complete the online application form, providing accurate information about your trading experience, financial knowledge, and employment status. This information is required to comply with regulatory requirements and ensure that ThinkMarkets can offer you the most appropriate services.

Step 4: Upload your identification documents (proof of identity and proof of address) to verify your account. ThinkMarkets uses secure encryption to protect your personal information.

Step 5: Choose your preferred payment method and fund your account. ThinkMarkets offers a range of convenient deposit options, including credit/debit cards, bank wire transfers, and e-wallets. Processing times may vary depending on the chosen method, but most deposits are credited to your account instantly.

Step 6: Once your account is funded and verified, you can download the trading platform of your choice (MT4, MT5, or ThinkTrader) and start trading.

Charts and Analysis

ThinkMarkets offers a wide range of trading educational resources and tools designed to support traders in enhancing their knowledge and skills. These resources cater to traders of all levels, from beginners to experienced professionals, and cover a wide range of topics related to forex, CFDs, and financial markets.

| Service | Description | Key Features |

|---|---|---|

| Market Analysis | In-depth insights via blogs, articles, and videos by expert analysts. | Daily briefings, weekly outlooks, monthly forecasts. |

| Economic Calendar | A tool that tracks scheduled economic events impacting financial markets. | Lists events like GDP reports, central bank meetings, and employment data. |

| Webinars & Seminars | Live and recorded sessions conducted by industry experts. | Covers trading strategies, risk management, market analysis, and platform tutorials. |

| Trading Guides & E-books | Downloadable resources covering a range of topics from basic to advanced trading techniques. | Educational material for improving trading skills. |

| Video Tutorials | Instructional videos that walk traders through platform features and functionalities. | Topics include platform navigation, order placement, chart analysis, and use of trading tools and indicators. |

| Trading Glossary | An extensive resource explaining common trading terms, concepts, and acronyms. | Helps beginners familiarize themselves with industry jargon. |

Compared to industry standards, ThinkMarkets' educational offerings are comprehensive and well-developed. The broker's resources cover a wide range of topics and cater to traders of all levels, from beginners to advanced traders. The quality and depth of ThinkMarkets' educational content are on par with, if not exceeding, many of its competitors in the online trading space.

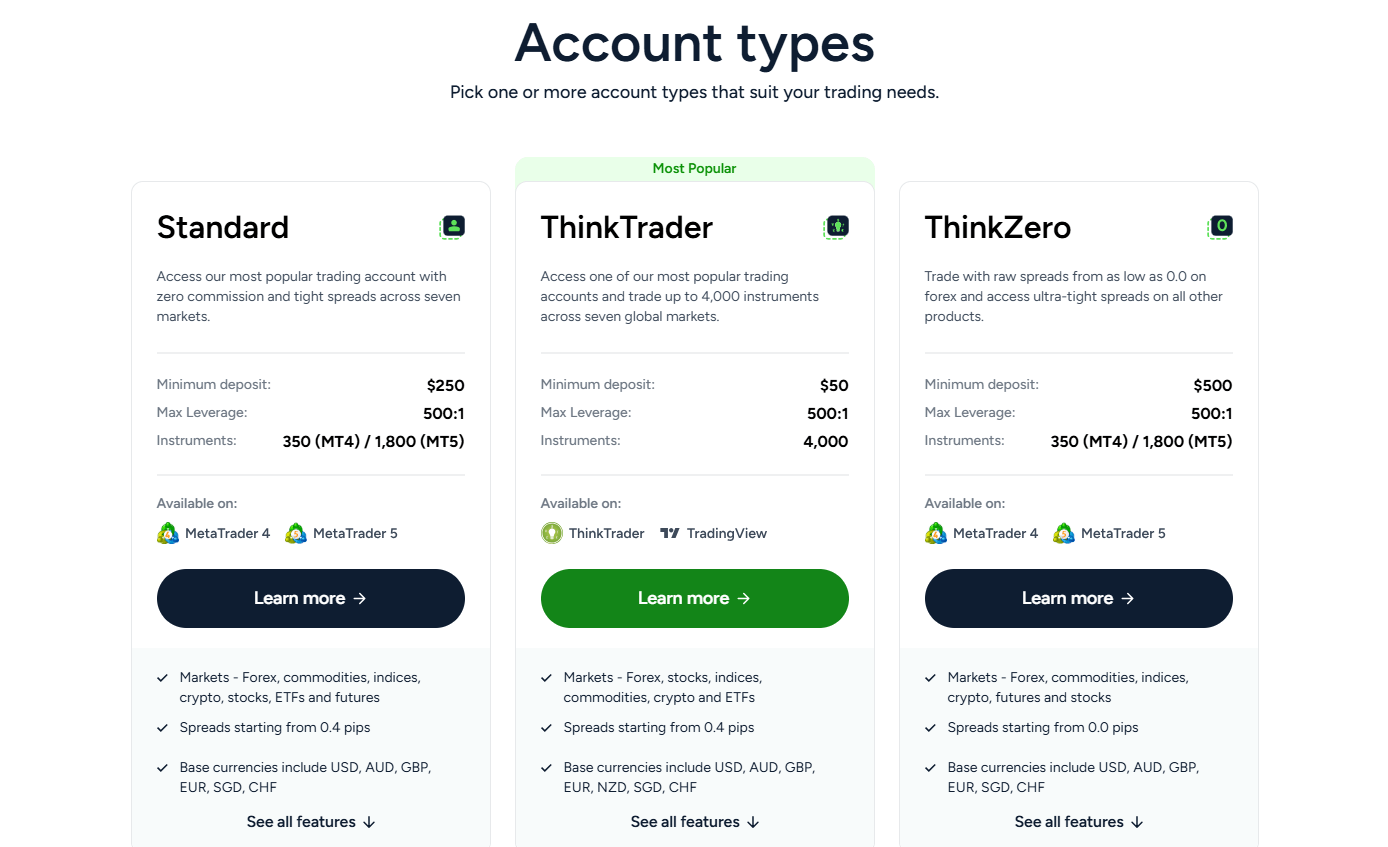

ThinkMarkets Account Types

ThinkMarkets offers a range of trading account options designed to cater to the diverse needs and preferences of traders. Whether you're a beginner or an experienced trader, ThinkMarkets has an account type that suits your trading style and goals. ThinkMarkets also offers Demo account to help beginner traders.

| Account Type | Key Features | Minimum Deposit | Platforms | Markets |

|---|---|---|---|---|

| Standard Account | Spreads from 0.4 pips, no commission fees | $250 | MT4, MT5, ThinkTrader | Forex, Indices, Commodities, CFDs |

| ThinkZero Account | Raw spreads from 0.0 pips, $3.50 commission per side per 100k traded | $500 | MT4, MT5 | Forex, Indices, Commodities, CFDs |

| ThinkTrader Account | Spreads from 0.4 pips, no commission, proprietary platform | $50 | ThinkTrader | Forex, Indices, Commodities, CFDs |

| Islamic Account | Compliant with Sharia law; no swap/rollover fees | Varies – contact support | All account types | Forex, Indices, Commodities, CFDs |

| Demo Account | Free, risk-free environment with virtual funds | N/A | All trading platforms | Same as live accounts |

ThinkMarkets' range of account types caters to the diverse needs of traders, offering flexibility in terms of spreads, commissions, minimum deposits, and platform choices. By providing multiple account options, ThinkMarkets ensures that traders can select the account type that best aligns with their trading style, experience level, and financial goals.

The availability of competitive spreads, low commissions, and a wide range of tradable assets across all account types sets ThinkMarkets apart from many of its competitors. The broker's commitment to offering a diverse range of account options demonstrates its focus on providing a superior trading experience to its clients.

Account Types Comparison Table

| Feature | Standard | ThinkZero | ThinkTrader |

|---|---|---|---|

| Minimum Deposit | $250 | $500 | $50 |

| Spreads | From 0.4 pips | From 0.0 pips | From 0.4 pips |

| Commissions | None | $3.5 per side per 100k | None |

| Platform | MT4, MT5, ThinkTrader | MT4, MT5 | ThinkTrader |

| Markets | Forex, indices, commodities, CFDs | Forex, indices, commodities, CFDs | Forex, indices, commodities, CFDs |

| Islamic Account | Available | Available | Available |

| Demo Account | Available | Available | Available |

By offering a range of account types with competitive spreads, low commissions, and a wide selection of tradable assets, ThinkMarkets ensures that traders can choose the account that best suits their individual trading needs and goals. The broker's commitment to providing flexible account options and a superior trading experience sets it apart in the competitive online trading landscape.

Negative Balance Protection

To protect their clients from the risks associated with negative balances, ThinkMarkets offers negative balance protection on all their trading accounts. This means that if a trader's losses exceed their account balance, ThinkMarkets will absorb the negative balance, ensuring that the trader's liability is limited to the funds available in their account. Under ThinkMarkets' negative balance protection policy, clients will never owe the broker money due to trading losses. This protection applies to all trading activities, including both normal market conditions and extreme market volatility. It is important to note that negative balance protection does not cover losses incurred due to swap charges or other fees. Traders should ensure they have sufficient funds in their accounts to cover any applicable fees. ThinkMarkets' commitment to negative balance protection demonstrates the broker's dedication to safeguarding their clients' funds and promoting responsible trading practices. By offering this protection, ThinkMarkets provides traders with peace of mind, knowing that their losses will never exceed their account balance. Traders should always be aware of the risks associated with trading and use appropriate risk management strategies, such as setting stop-loss orders and managing leverage responsibly. While negative balance protection provides an additional layer of security, it should not be relied upon as a substitute for proper risk management.

ThinkMarkets Deposits and Withdrawals

ThinkMarkets offers a range of convenient deposit and withdrawal options to cater to the diverse needs of its global client base. The broker understands the importance of efficient and secure transactions, ensuring that traders can easily fund their accounts and access their funds when needed. The broker does not charge fees for deposits and withdrawals.

Deposit Methods

| Payment Method | Minimum Deposit | Processing Time | Fees | Notes |

|---|---|---|---|---|

| Credit/Debit Cards | $50 | Instant | None from ThinkMarkets | Accepts Visa and Mastercard |

| Bank Wire Transfer | $250 | 1-3 business days | None from ThinkMarkets (bank fees may apply) | |

| E-wallets | $50 | Instant | None from ThinkMarkets (provider fees may apply) | Supports Skrill and Neteller |

| Cryptocurrencies | Varies | 1-2 hours | Not specified from ThinkMarkets | Deposits via BitPay (includes Bitcoin, Ethereum, and others) |

Withdrawal Methods

| Payment Method | Minimum Withdrawal | Processing Time | Fees | Notes |

|---|---|---|---|---|

| Bank Wire Transfer | $50 | 1-3 business days | None from ThinkMarkets (incoming bank fees may apply) | |

| E-wallets | $50 | Within 24 hours | None from ThinkMarkets (provider fees may apply) | Supports Skrill and Neteller |

| Credit/Debit Cards | $50 | 3-5 business days | None from ThinkMarkets |

ThinkMarkets' Deposit and Withdrawal Policies

- Account Verification: To comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, ThinkMarkets requires traders to verify their accounts before processing withdrawals. This involves submitting proof of identity and proof of address.

- Withdrawal to Original Deposit Method: ThinkMarkets processes withdrawals to the same method used for depositing funds. If the original deposit method is no longer available, traders may be required to provide additional documentation to verify ownership of the alternative withdrawal method.

- Withdrawal Timeframes: ThinkMarkets strives to process all withdrawal requests within 24 hours of receipt. However, the actual time taken for funds to reach the trader's account may vary depending on the withdrawal method and any additional processing time required by the receiving financial institution.

Support Service for Customer

In the fast-paced world of online trading, reliable customer support is crucial for a positive trading experience. Traders often require assistance with account-related queries, technical issues, or general guidance, and a responsive support team can make all the difference. ThinkMarkets recognizes the importance of customer support and offers a range of channels through which traders can reach out for help.

Support Channels

| Support Option | Description | Response/Availability | Key Notes |

|---|---|---|---|

| Live Chat | Real-time assistance on the website. | Immediately during business hours | Quick help for general or urgent queries. |

| Support via email (support@thinkmarkets.com). | Within 24 hours | For account-related or technical issues. | |

| Phone | Local and toll-free numbers available in several countries. | During regional business hours | Direct call support. |

| Social Media | Support via official Twitter, Facebook, and Instagram channels. | Prompt responses | Monitored regularly by the support team. |

Support Languages

ThinkMarkets provides customer support in multiple languages to cater to their global client base. The available support languages include English, Arabic, Spanish, Italian, and Mandarin Chinese.Support Hours

ThinkMarkets offers 24/7 customer support, ensuring that traders can access assistance at any time, regardless of their location or time zone. This round-the-clock support is particularly beneficial for traders who are active during non-standard business hours or those located in different parts of the world.Response Times

ThinkMarkets aims to provide prompt and efficient customer support across all channels. For live chat, the average response time is under 1 minute, allowing traders to get immediate assistance. Email queries are typically responded to within 24 hours, while phone support aims to connect traders with a representative within a few minutes.Country-Specific Contact Details

ThinkMarkets provides country-specific contact details for phone support, making it easier for traders to reach out using a local or toll-free number. Some of the key contact numbers include:- Australia: +61 3 9093 3400

- United Kingdom: +44 20 3514 2374

- United Arab Emirates: +971 4 453 6369

- Spain: +34 900 839 895

- Italy: +39 800 599 742

Customer Support Comparison Table

| Support Channel | Availability | Response Time | Languages |

|---|---|---|---|

| Live Chat | 24/7 | < 1 minute | English, Arabic, Spanish, Italian, Mandarin |

| 24/7 | Within 24 hours | English, Arabic, Spanish, Italian, Mandarin | |

| Phone | 24/7 | Within minutes | English, Arabic, Spanish, Italian, Mandarin |

| Social Media | 24/7 | Within hours | English, Arabic, Spanish, Italian, Mandarin |

Prohibited Countries

ThinkMarkets is a globally regulated broker, operating in multiple jurisdictions worldwide. However, due to various regulatory requirements, licensing restrictions, and geopolitical factors, the broker is prohibited from offering its services in certain countries and regions.

List of Prohibited Countries

ThinkMarkets is prohibited from offering its services in the following countries and regions:

- United States

- Canada

- Japan

- New Zealand

- Islamic Republic of Iran

- Democratic People's Republic of Korea (North Korea)

- Cuba

- Sudan

- Syria

- Belgian residents are not permitted to trade forex and CFD instruments

Consequences of Trading from Prohibited Countries

Attempting to trade with ThinkMarkets from a prohibited country may result in several consequences, including:

- Account Closure: If ThinkMarkets identifies that a trader is accessing their services from a prohibited country, the broker may immediately close the trading account and terminate the business relationship.

- Funds Forfeiture: In some cases, traders from prohibited countries may risk forfeiting their account balances if they are found to be in violation of the broker's terms and conditions.

- Legal Action: Depending on the jurisdiction and the severity of the violation, traders from prohibited countries may face legal action or penalties for attempting to access ThinkMarkets' services.

It is essential for traders to ensure that they are not residing in or accessing ThinkMarkets' services from any of the prohibited countries listed above. Traders should always review the broker's terms and conditions and seek clarification from the customer support team if they are unsure about their eligibility to trade.

Special Offers for Customers

ThinkMarkets does not currently offer any special promotions, bonuses, or loyalty programs for traders. The broker focuses on providing competitive trading conditions, a wide range of tradable assets, and reliable customer support rather than short-term promotional offers.

Conclusion

As I approach the end of this comprehensive review of ThinkMarkets, I can confidently say that they have established themselves as a reliable and trustworthy broker in the competitive world of online trading. Throughout my analysis, I have found that ThinkMarkets consistently prioritizes the safety and satisfaction of their clients, as evidenced by their strong regulatory compliance, advanced trading platforms, and commitment to providing exceptional customer support.

One of the standout features of ThinkMarkets is their multi-regulatory framework, with oversight from top-tier authorities such as the FCA, ASIC, and CySEC. This demonstrates their dedication to operating transparently and adhering to strict financial guidelines, providing traders with peace of mind knowing that their funds are secure.

In terms of trading offerings, ThinkMarkets excels in providing a diverse range of instruments, with over 4,000 tradable assets across forex, CFDs, indices, commodities, and more. This extensive selection caters to the needs of both novice and experienced traders, allowing them to diversify their portfolios and take advantage of various market opportunities.

ThinkMarkets' trading platforms are another area where they shine, offering a choice of industry-standard options like MetaTrader 4 and 5, as well as their intuitive proprietary platform, ThinkTrader. These platforms are equipped with advanced charting tools, comprehensive technical indicators, and automated trading capabilities, empowering traders to make informed decisions and execute their strategies efficiently.

Furthermore, ThinkMarkets goes above and beyond in supporting the educational journey of their clients, providing an extensive library of resources, including articles, webinars, and expert market analysis. Their innovative Traders' Gym feature allows users to test and refine their strategies using historical data, a valuable tool for developing trading skills in a risk-free environment.

One potential drawback to consider is the higher minimum deposit requirement for the ThinkZero account, which may be a barrier for some traders. However, ThinkMarkets offers alternative account types with lower minimum deposits, ensuring accessibility for a wider range of clients.

Overall, I highly recommend ThinkMarkets as a reputable and client-centric broker. Their commitment to safety, transparency, and innovation sets them apart in the industry, making them an excellent choice for traders seeking a reliable and feature-rich platform to pursue their financial goals.

Browse every scorecard in the broker ratings catalogue.

Want tight ECN spreads? Scan the VT Markets review.