Tickmill Review 2025: A Top Forex Broker for Low Spreads & Fast Execution

Tickmill

United Kingdom

United Kingdom

-

Minimum Deposit $100

-

Withdrawal Fee $0

-

Leverage 500:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Unavailable

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Cyprus Market Making (MM)

Cyprus Market Making (MM)

South Africa Retail Forex License

South Africa Retail Forex License

Japan Forex Trading License

Japan Forex Trading License

UAE Financial Services License

UAE Financial Services License

Softwares & Platforms

Customer Support

+442036082100

(English)

+442036082100

(English)

Supported language: Chinese (Simplified), English, Russian, Spanish

Social Media

Summary

Tickmill is a globally recognized forex broker known for its low spreads, fast execution, and competitive trading conditions. It offers various account types, including Classic, Raw, and VIP, with leverage up to 1:500. Traders can access a wide range of markets, including forex, indices, commodities, and bonds, through MT4 and MT5 platforms. Tickmill is regulated by multiple authorities and provides strong customer support. Additionally, it offers educational resources, trading tools, and a VIP program for high-volume traders.

- Strong regulatory compliance with licenses from top-tier authorities like FCA and CySEC

- Competitive pricing, with tight spreads and low commissions on the Raw account

- Advanced trading platforms, including MetaTrader 4, MetaTrader 5, and a proprietary web-based platform

- Comprehensive customer support available through multiple channels and in several languages

- Educational resources, such as webinars, tutorials, and analytical tools, to support client learning

- Special offers, including sign-up bonuses and refer-a-friend programs, adding value for clients

- Trustworthy reputation built on a commitment to client fund segregation and security

- User-friendly trading experience suitable for traders of all skill levels

- Ongoing development of proprietary platform, demonstrating a focus on innovation

- Well-rounded brokerage with a client-centric approach

- Educational resources could be more comprehensive and better organized compared to some competitors

- No 24/7 customer support available

- Limited range of tradable assets compared to some larger multi-asset brokers

- Proprietary trading platform currently only available to clients of the Seychelles entity

- VIP account requires a high minimum deposit of $50,000, which may be inaccessible for some traders

- No guaranteed stop-loss orders available

- Relatively high minimum deposit of $100 for the Raw account compared to some competitors

- Inactivity fees apply after 90 days of no trading activity

- No option for direct crypto deposits/withdrawals

- No dedicated mobile app for trading (only available through web browser)

Overview

Tickmill is an online forex and CFD broker established in 2014 by experienced industry professionals Ingmar and Illimar Mattus. With a global presence spanning the UK, Cyprus, Seychelles, South Africa, and the UAE, Tickmill serves over 327,000 clients worldwide as of 2025. The broker is regulated by top-tier authorities such as the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Financial Sector Conduct Authority (FSCA) in South Africa, ensuring a secure trading environment for its clients.

Tickmill has consistently earned recognition for its competitive pricing, advanced trading platforms, and professional trading environment, securing multiple "Best in Class" honours in the 2025 ForexBrokers.com Annual Awards for categories including Commissions & Fees, MetaTrader, Algo Trading, and Copy Trading. The broker's official website provides comprehensive information on account types, tradable assets, platforms, pricing, regulation and more.

While Tickmill's range of offerings may be more targeted compared to the largest multi-asset brokers, it excels in delivering low-cost, high-quality trading solutions for forex and popular CFD markets, catering particularly well to professional and algorithmic traders. As Tickmill continues to expand its asset selection, proprietary platform development, and regulatory licenses, it is well-positioned to attract a broader mainstream audience over time while maintaining its core strengths in competitive pricing, reliable trade execution, and advanced trading tools.

Overview Table

| Feature | Information |

|---|---|

| Year Established | 2014 |

| Headquarters | United Kingdom |

| Regulated By | FCA (UK), CySEC (Cyprus), FSCA (South Africa), FSA (Seychelles), DFSA (UAE) |

| Number of Clients | 327,000+ |

| Number of Employees | 250+ |

| Tradable Symbols | 600+ CFDs including 62 Forex Pairs, 20 Indices, 9 Metals, 8 Commodities, 12 Crypto, 100+ Futures |

| Minimum Deposit | $100 |

| Platforms | MetaTrader 4/5, CQG, AgenaTrader, Mobile, Web |

| Best For | High volume forex traders, algorithmic trading |

| Website | www.tickmill.com |

Facts List

- Tickmill was founded in 2014 by Ingmar and Illimar Mattus, who have extensive experience in the forex industry and financial services.

- The broker is regulated by top-tier authorities, including the FCA (UK), CySEC (Cyprus), FSCA (South Africa), FSA (Seychelles), and DFSA (UAE).

- Tickmill offers over 600 tradable symbols, including 62 forex pairs, 20 indices, 9 metals, 8 commodities, 12 cryptocurrencies, and 100+ futures and options contracts.

- Clients can choose between the Classic account with no commissions and average spreads of 1.6 pips or the Raw account with spreads from 0.0 pips + $3 per lot commission.

- Tickmill provides the full MetaTrader 4/5 suite with advanced tools and add-ons, earning it Best in Class for MetaTrader in the 2025 ForexBrokers.com Awards.

- Professional traders have access to CQG and AgenaTrader platforms for futures and options, APIs for automated trading, and VPS hosting.

- Tickmill's research offering includes in-house technical and fundamental analysis, third-party content from Acuity Trading and the CME, and educational resources like webinars and eBooks.

- The broker recently launched the Tickmill Trader proprietary web and mobile platform, though it is currently available only to clients of the Seychelles entity.

- With a Trust Score of 86/99, Tickmill is considered a safe broker that segregates client funds and provides negative balance protection.

- Tickmill has grown to serve over 327,000 clients globally with a staff of 250+, positioning itself as a trusted choice for serious forex and CFD traders.

Tickmill Licenses and Regulatory

Tickmill operates under a robust regulatory framework, holding licenses from multiple top-tier authorities across several jurisdictions. This comprehensive oversight provides clients with a high level of security and trust, ensuring that the broker adheres to strict financial regulations and industry best practices.

Tickmill's primary licenses include the Financial Conduct Authority (FCA) in the United Kingdom and the Cyprus Securities and Exchange Commission (CySEC), two of the most respected regulatory bodies in the forex industry. These Tier-1 licenses require the broker to maintain high standards of financial reporting, capital adequacy, and client fund segregation. The FCA and CySEC also enforce strict rules around fair and transparent pricing, order execution, and consumer protection.

In addition to its UK and Cyprus licenses, Tickmill is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa, the Financial Services Authority (FSA) in Seychelles, and the Dubai Financial Services Authority (DFSA) in the United Arab Emirates. While these licenses may not carry the same weight as the FCA and CySEC, they demonstrate Tickmill's commitment to operating legally and ethically in multiple jurisdictions.

The significance of Tickmill's multi-jurisdictional regulatory approach lies in the added layer of protection and recourse it provides to clients. In the event of a dispute or issue, traders can seek assistance from their local regulatory authority, ensuring their concerns are addressed promptly and fairly. The presence of multiple licenses also indicates that Tickmill has undergone rigorous vetting processes and has met the stringent requirements set by each regulator.

Compared to the industry standard, Tickmill's regulatory profile is robust and aligns with that of other reputable brokers. While some competitors may hold licenses from a single regulator, Tickmill's multi-jurisdictional approach sets it apart and demonstrates a commitment to maintaining high standards across its global operations.

Regulations List

- Financial Conduct Authority (FCA) – United Kingdom

- Cyprus Securities and Exchange Commission (CySEC) – Cyprus

- Financial Sector Conduct Authority (FSCA) – South Africa

- Financial Services Authority (FSA) - Seychelles

- Dubai Financial Services Authority (DFSA) – United Arab Emirates

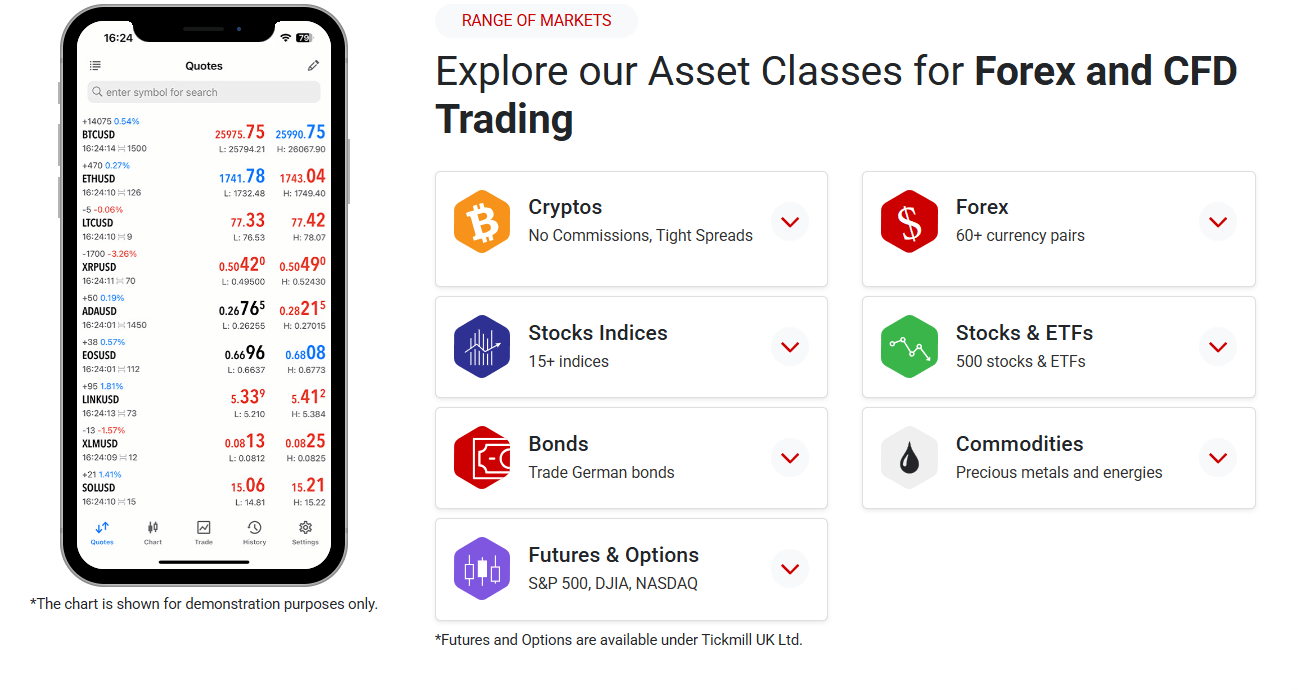

Trading Instruments

Tickmill offers a diverse range of tradable assets, catering to the needs of both novice and experienced traders. With over 600 instruments available, the broker provides ample opportunities for portfolio diversification and exposure to various market sectors.

| Asset Class | Available Instruments | Key Features & Benefits |

|---|---|---|

| Forex | 62 currency pairs | Spreads from 0.1 pips (Raw account), includes majors, minors, and exotics |

| Indices | 20 global indices | Includes S&P 500, FTSE 100, DAX 30, Nikkei 225; broad market exposure |

| Metals | 9 metal CFDs | Trade gold, silver, and platinum with leverage |

| Bonds | 4 government bonds | Portfolio diversification and hedging opportunities |

| Commodities | 8 commodity CFDs | Includes oil, gas, wheat, and sugar for exposure to essential goods |

| Cryptocurrencies | 12 crypto CFDs | Includes Bitcoin, Ethereum, Litecoin (not available to UK retail clients) |

| Futures & Options | 100+ symbols | Access through CQG & AgenaTrader for advanced trading strategies |

The breadth and depth of Tickmill's tradable assets demonstrate the broker's adaptability to market trends and commitment to meeting the diverse needs of its clients. By providing access to a wide range of instruments across multiple asset classes, Tickmill empowers traders to build flexible and well-diversified portfolios.

Compared to industry standards, Tickmill's asset selection is comprehensive and competitive. While some larger multi-asset brokers may offer a more extensive selection, Tickmill's offering is well-rounded and caters to the majority of traders' needs.

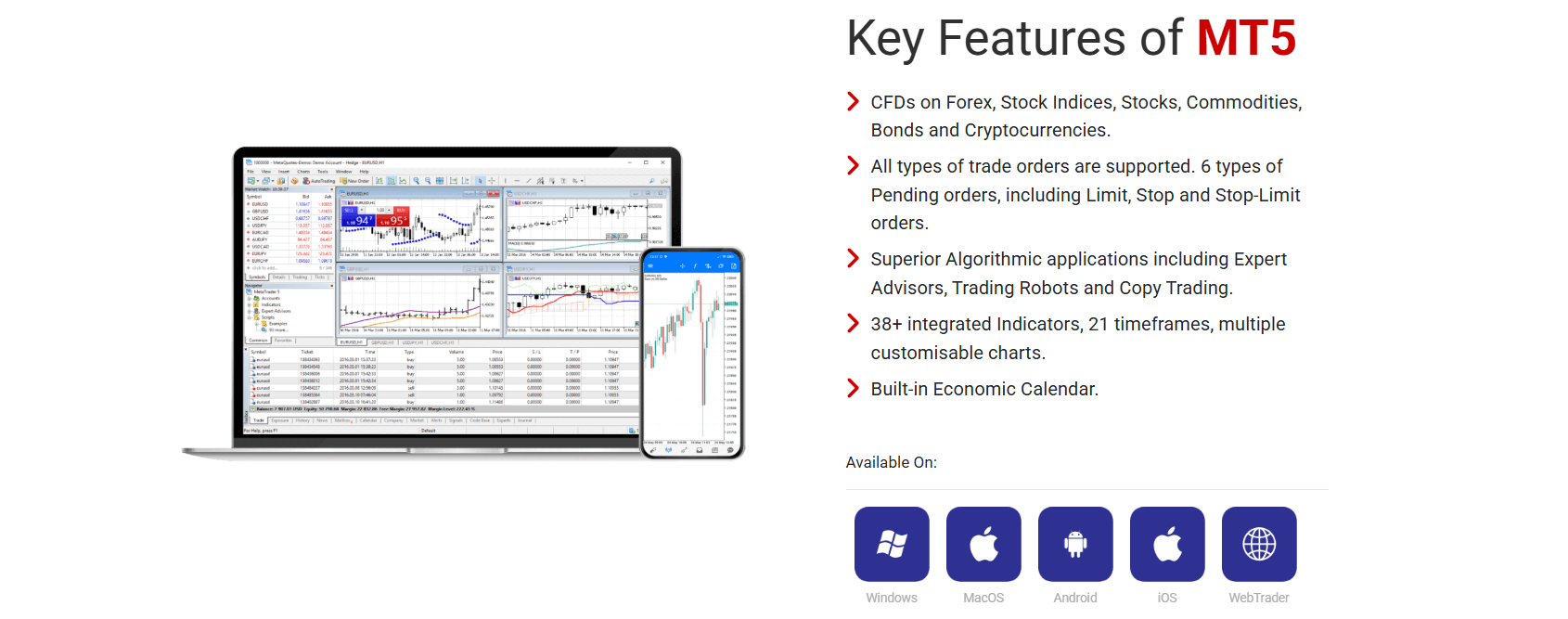

Trading Platforms

Tickmill offers a comprehensive suite of trading platforms, catering to the diverse needs and preferences of its clients. The broker's platform selection includes industry-standard options like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), as well as speciality platforms for specific asset classes.

MetaTrader Platforms

As a core offering, Tickmill provides access to the widely popular MT4 and MT5 platforms. These platforms are known for their user-friendly interface, extensive charting tools, and advanced technical indicators, making them suitable for traders of all skill levels.

MT4 and MT5 are available for desktop, web, and mobile devices, allowing traders to access their accounts and execute trades from anywhere, at any time. The platforms support automated trading through expert advisors (EAs), enabling clients to implement complex trading strategies and algorithms.

Tickmill's MetaTrader offering includes a range of additional tools and features, such as:

- Custom indicators and EAs from FX Blue

- VPS hosting for seamless automated trading

- Advanced Trading toolkit for enhanced functionality

- Integration with Myfxbook for auto-trading and analytics

Proprietary Platform

In addition to the MetaTrader suite, Tickmill has recently launched its own proprietary trading platform, Tickmill Trader. This web-based platform offers a modern, intuitive interface with advanced charting, customisable layouts, and integrated trading tools.

While still in its early stages and currently only available to clients of the broker's Seychelles entity, Tickmill Trader shows promise as a comprehensive trading solution. Notable features include:

- Streamlined order management and execution

- Advanced charting with multiple timeframes and drawing tools

- Customizable watchlists and workspaces

- Integrated news and analysis

- Performance analytics and reporting

Specialty Platforms

For professional traders and those interested in futures and options, Tickmill provides access to the CQG and AgenaTrader platforms. These advanced platforms offer sophisticated charting, risk management tools, and direct market access to major global exchanges.

CQG and AgenaTrader are designed for experienced traders who require a high level of customisation and control over their trading environment. They support advanced order types, spreads, and automated trading strategies.

Mobile Trading

Tickmill's platform offering extends to mobile devices, with dedicated apps for MT4 and MT5 available on iOS and Android. The mobile apps provide full trading functionality, including real-time quotes, charting, and order management, allowing traders to monitor and control their positions on the go.

The broker's proprietary Tickmill Trader platform is also accessible via mobile web browsers, although a dedicated mobile app is not yet available.

Tickmill's diverse platform offering aligns with industry standards and meets the expectations of modern traders. By providing access to popular third-party platforms alongside its own proprietary solution, the broker caters to a wide range of trading styles and preferences.

The availability of automated trading tools, advanced charting, and mobile access demonstrates Tickmill's commitment to providing a seamless and efficient trading experience. As the broker continues to develop and enhance its proprietary platform, clients can expect an even more comprehensive and user-friendly trading environment.

Trading Platforms Comparison Table

| Feature | MT4 | MT5 | Tickmill Trader | CQG | AgenaTrader |

|---|---|---|---|---|---|

| Platform Type | Third-party | Third-party | Proprietary | Third-party | Third-party |

| Asset Classes | Forex, CFDs | Forex, CFDs, Futures | Forex, CFDs | Futures, Options | Futures, Options |

| Desktop | Yes | Yes | No | Yes | Yes |

| Web | Yes | Yes | Yes | Yes | Yes |

| Mobile | Yes | Yes | Yes (web-based) | Yes | Yes |

| Automated Trading | Yes (EAs) | Yes (EAs) | No | Yes | Yes |

| Custom Indicators | Yes | Yes | No | Yes | Yes |

| Integrated Tools | FX Blue, VPS, Myfxbook | FX Blue, VPS, Myfxbook | News, Analytics | Advanced risk management | Advanced order types |

| Availability | All clients | All clients | Seychelles clients only | UK clients only | All clients |

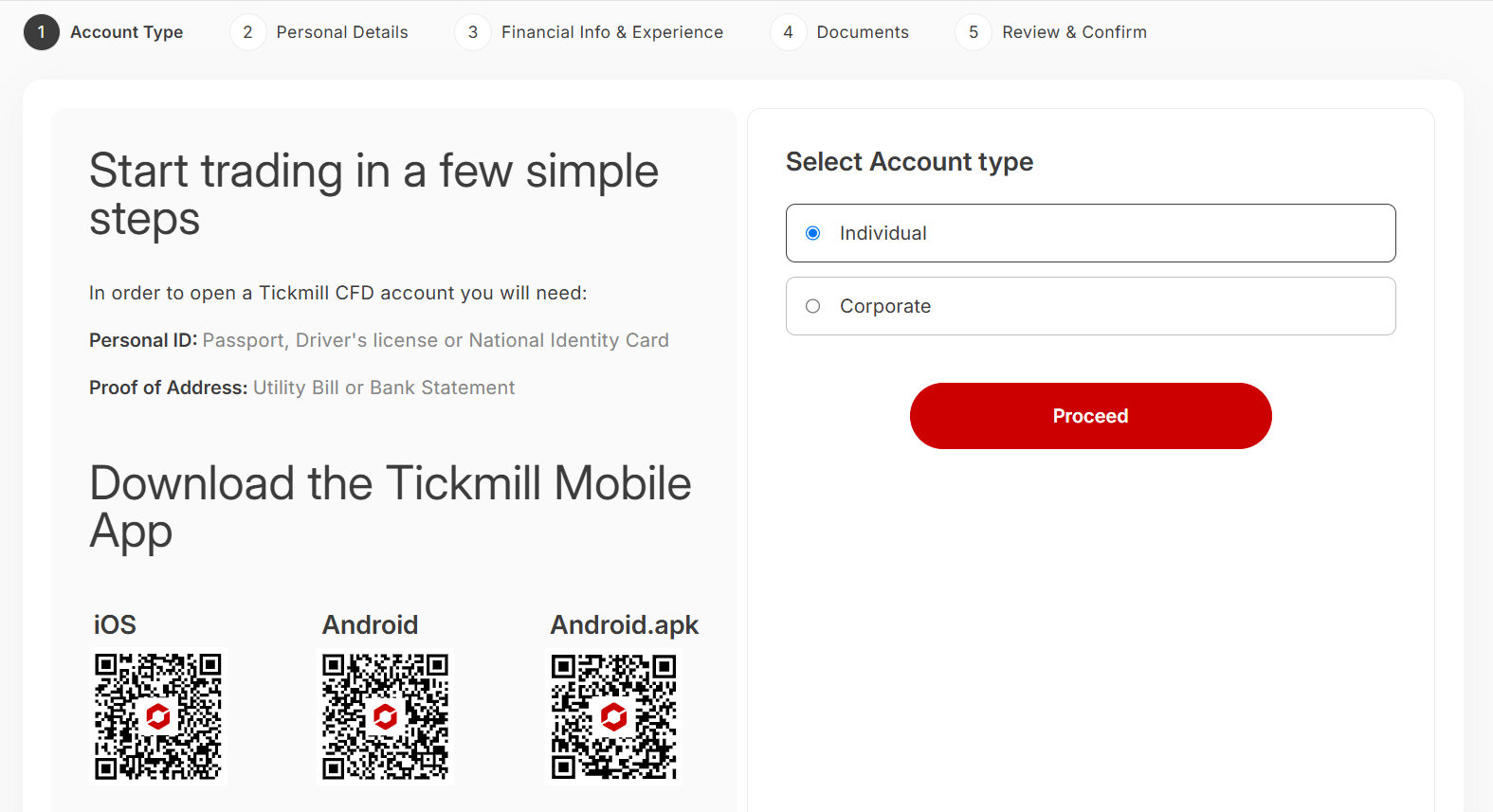

Tickmill How to Open an Account: A Step-by-Step Guide

Opening an account with Tickmill is a straightforward process that can be completed online in a few simple steps. Before getting started, it's essential to ensure that you meet the broker's minimum requirements and have the necessary documentation ready.

Requirements

- Minimum deposit: $100

- Valid government-issued ID (e.g., passport, driver's license)

- Proof of residence (e.g., utility bill, bank statement)

Step 1: Visit the Tickmill website Go to the official Tickmill website at www.tickmill.com and click on the "Open Account" button in the top right corner of the page.

Step 2: Choose your account type Select the account type that best suits your trading needs and experience level. Tickmill offers two main account types: Classic and Raw.

- Classic account: Commission-free trading with spreads from 1.76 pips

- Raw account: Low spreads from 0.0 pips + $3 per lot commission

Step 3: Fill out the registration form Provide your personal details, including your full name, date of birth, address, and contact information. You'll also need to answer some questions about your trading experience and financial knowledge.

Step 4: Verify your identity Upload a copy of your government-issued ID and proof of residence. Tickmill requires these documents to comply with anti-money laundering (AML) and know-your-customer (KYC) regulations.

Step 5: Choose your trading platform Select your preferred trading platform from the available options, such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), or Tickmill's proprietary web-based platform.

Step 6: Fund your account Choose your preferred payment method and deposit funds into your trading account. Tickmill accepts various payment options, including bank wire transfers, credit/debit cards, and e-wallets like Skrill and Neteller. Processing times may vary depending on the payment method:

- Bank wire transfers: 1-5 business days

- Credit/debit cards: Instant

- E-wallets: Instant

Step 7: Start trading Once your account is funded and verified, you can download and log in to your chosen trading platform and start trading the markets.

Tickmill offers a user-friendly account opening process that can be completed entirely online, with no minimum deposit required for Raw accounts. The broker's quick verification process ensures that clients can start trading as soon as possible while still complying with necessary regulatory requirements.

Charts and Analysis

Tickmill provides a comprehensive suite of educational resources and tools to support its clients in their trading journey. These resources cater to traders of all skill levels, from beginners seeking to understand the basics of forex trading to advanced traders looking to refine their strategies.

| Category | Details |

|---|---|

| Market Analysis | Daily blog posts and YouTube videos covering forex, commodities, and indices. |

| Webinars | Weekly live sessions on trading strategies, psychology, and risk management. |

| Trading Tools | Advanced charting (MT4/MT5), Autochartist signals, Myfxbook analytics, AI-driven insights. |

| Economic Calendar | Tracks key global events to help traders plan their strategies. |

| Educational Content | Articles and guides on forex basics, market trends, and trading techniques. |

The broker also offers a series of downloadable eBooks that provide in-depth insights into trading concepts and strategies. These eBooks are available in multiple languages and cater to traders of all skill levels.

While Tickmill's educational resources are comprehensive and well-structured, there is room for improvement when compared to industry leaders. Some competitors offer more extensive libraries of video content, interactive courses, and personalised learning paths.

However, Tickmill's commitment to providing a diverse range of educational materials demonstrates its dedication to supporting its clients' growth and development as traders. By continually expanding and refining its educational offerings, Tickmill can further enhance its value proposition and attract a wider audience of traders seeking to improve their skills and knowledge.

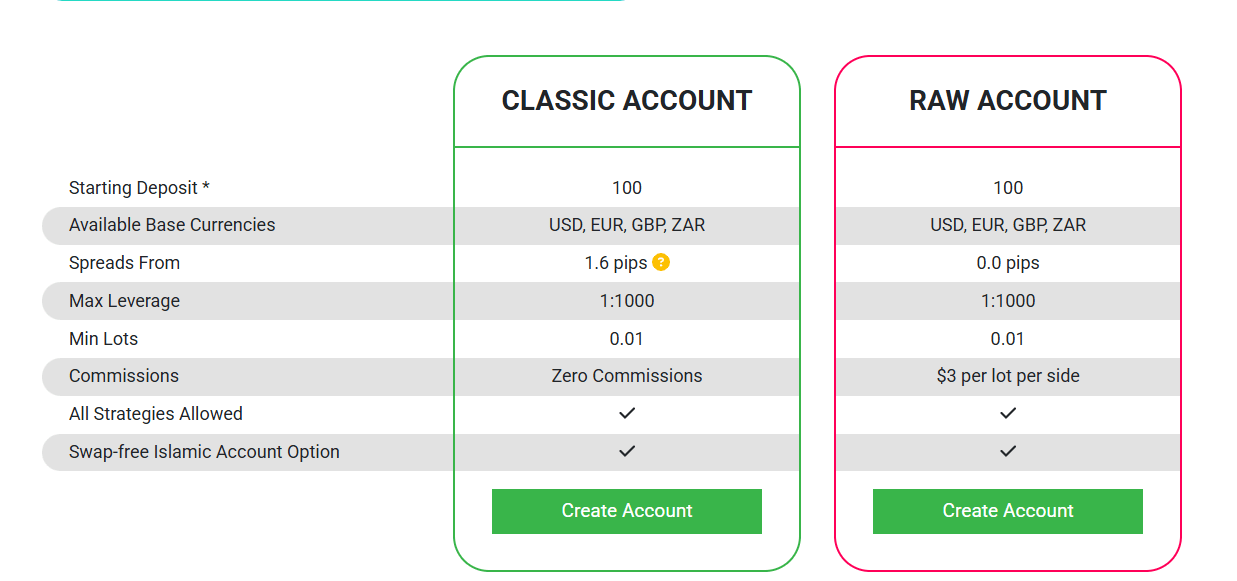

Tickmill Account Types

Tickmill offers three main account types designed to cater to the diverse needs of traders with varying levels of experience and trading styles. These account types differ in terms of spreads, commissions, and minimum deposit requirements, providing clients with the flexibility to choose an account that best suits their individual preferences.

Classic Account

The Classic account is Tickmill's commission-free trading account, making it an attractive option for beginners and casual traders. With competitive spreads starting from 1.6 pips on major currency pairs, this account type offers a straightforward pricing structure that is easy to understand and manage.

Key features of the Classic account include:

- Spreads from 1.6 pips on major forex pairs

- No commissions

- Minimum deposit of $100

- Leverage up to 1:500

- Access to all trading instruments

Raw Account

The Raw account is designed for more experienced traders who prioritise low spreads and are willing to pay a small commission per trade. With spreads starting from just 0.1 pips on major currency pairs, this account type offers some of the most competitive pricing in the industry.

Key features of the Raw account include:

- Spreads from 0.0 pips on major forex pairs

- Commission of $3 per lot per trade

- Minimum deposit of $100

- Leverage up to 1:500

- Access to all trading instruments

VIP Account

The VIP account is tailored for high-volume traders and institutional clients who demand the best possible trading conditions. This account type offers the lowest spreads and commissions, as well as personalised support from a dedicated account manager.

Key features of the VIP account include:

- Spreads from 0.0 pips on major forex pairs

- Commission of $1.5 per lot per trade

- Minimum deposit of $50,000

- Leverage up to 1:200

- Access to all trading instruments

- Dedicated account manager

- Exclusive market insights and analysis

Demo Account

In addition to its live trading accounts, Tickmill offers a demo account that allows prospective clients to test the broker's trading platforms and conditions risk-free. The demo account is an excellent tool for beginners to practise trading strategies and familiarise themselves with the markets before committing real funds.

Tickmill's range of account types demonstrates the broker's commitment to accommodating the diverse needs of its client base. By offering competitive pricing, flexible leverage options, and a choice between commission-free and low-spread accounts, Tickmill ensures that traders can select an account type that aligns with their trading style and goals.

However, it is worth noting that Tickmill's account types may not be as extensive as some of its competitors, particularly those offering Islamic accounts or specialised accounts for specific trading strategies. Nonetheless, the broker's existing account types cover the essential needs of most retail traders.

Account Types Comparison Table

| Feature | Classic Account | Raw Account | VIP Account | Demo Account |

|---|---|---|---|---|

| Spread | From 1.6 pips | From 0.0 pips | From 0.0 pips | From 1.6 pips |

| Commission | None | $3 per lot per trade | $1.5 per lot per trade | None |

| Minimum Deposit | $100 | $100 | $50,000 | N/A |

| Leverage | Up to 1:500 | Up to 1:500 | Up to 1:200 | Up to 1:500 |

| Trading Instruments | All | All | All | All |

Negative Balance Protection

Tickmill recognises the importance of safeguarding its clients' funds and mitigating the risk of negative balances. As such, the broker offers negative balance protection to all clients, regardless of their account type or trading style. Under Tickmill's negative balance protection policy, if a client's account balance falls below zero due to trading losses, the broker will absorb the negative balance and reset the account to zero. This means that traders cannot lose more than their initial deposit, providing peace of mind and limiting potential financial liabilities. It is important to note that negative balance protection does not absolve traders of their responsibility to manage risk effectively. Traders should still employ sound risk management techniques, such as setting appropriate stop-loss levels, managing leverage responsibly, and diversifying their trading portfolio. Tickmill's commitment to negative balance protection demonstrates the broker's dedication to creating a secure and transparent trading environment for its clients. By absorbing negative balances, Tickmill ensures that traders can focus on their trading strategies without worrying about incurring debts beyond their initial investment. Traders should be aware that while negative balance protection is an essential safety net, it should not be relied upon as a primary risk management tool. Responsible trading practices, combined with the broker's protective measures, can help traders navigate the markets more effectively and sustainably.

Tickmill Deposits and Withdrawals

Tickmill offers a range of convenient deposit and withdrawal options to cater to the diverse needs of its global client base. The broker aims to make fund transfers as smooth and efficient as possible, ensuring that traders can focus on their trading activities without unnecessary delays or complications.

Deposit Methods

| Method | Fees | Processing Time | Minimum Deposit |

|---|---|---|---|

| Bank Wire Transfer | No fees (banks may charge) | 1-5 business days | $100 |

| Credit/Debit Cards | No fees | Instant | $50 |

| E-wallets (Skrill, Neteller, UnionPay) | No fees | Instant | $50 |

Withdrawal Methods

| Method | Fees | Processing Time | Minimum Withdrawal |

|---|---|---|---|

| Bank Wire Transfer | No fees (banks may charge) | 1-5 business days | $50 |

| Credit/Debit Cards | No fees (card issuers may charge) | 1-5 business days | $50 |

| E-wallets (Skrill, Neteller, UnionPay) | No fees | Instant | $50 |

Verification Requirements

To ensure the security of traders' funds and comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, Tickmill requires traders to verify their accounts before processing withdrawals. This verification process involves submitting proof of identity and proof of address. Traders should note that Tickmill may request additional documentation in some cases, such as proof of ownership for the deposit method used, or a signed withdrawal request form. Tickmill's deposit and withdrawal policies are designed to prioritise the security of traders' funds while offering a range of convenient options to suit different preferences. The broker's transparent fee structure and reasonable minimum transaction amounts make it accessible to traders with varying account sizes. By offering instant deposits via credit/debit cards and e-wallets, Tickmill ensures that traders can capitalise on market opportunities without delay. The broker's commitment to processing withdrawals within 2 business days, subject to account verification, provides traders with peace of mind and confidence in the accessibility of their funds.Support Service for Customer

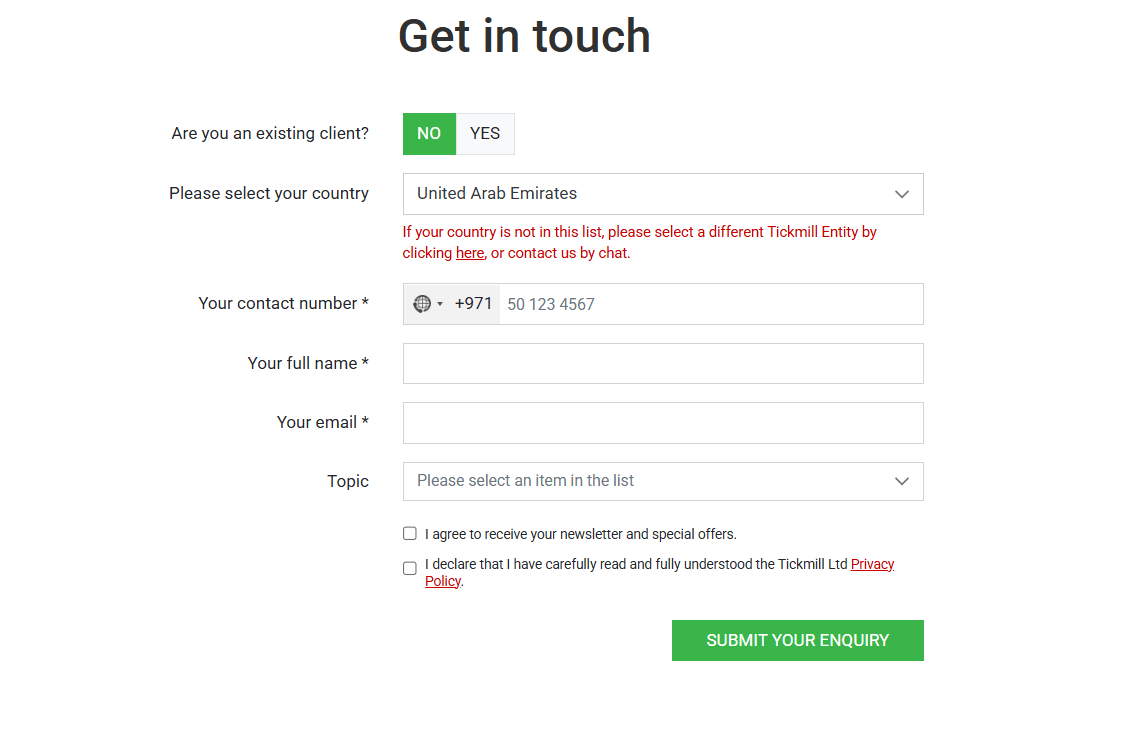

In the fast-paced world of online trading, reliable customer support is crucial for a positive trading experience. Traders need to know that they can quickly get assistance when they encounter issues or have questions about the trading platform, their account, or market conditions.

Live Chat

Traders can access Tickmill's live chat support directly from the broker's website. This option allows for quick and efficient communication with a support representative, making it ideal for urgent enquiries or simple questions.Phone

Tickmill provides a dedicated phone support line for each of its main offices:- United Kingdom: +44 (0)20 3608 2100

- Cyprus: +357 25247650

- Seychelles: +248 434 7072

- Traders can call these numbers during business hours to speak directly with a customer support representative.

Social Media

Traders can also reach out to Tickmill via social media platforms such as Facebook, Twitter, and LinkedIn. While not intended for formal support enquiries, these channels allow traders to stay up-to-date with the latest news and promotions from the broker. Tickmill offers support in multiple languages to cater to its global client base, including English, Spanish, German, and Arabic. The broker's website is also available in several languages, making it easier for traders to navigate and find the information they need. In terms of support hours, Tickmill's customer support team is available during business hours from Monday to Friday. While the broker does not offer 24/7 support, its extensive range of support channels ensures that traders can get assistance in a timely manner. Tickmill aims to provide prompt and helpful responses to all support enquiries. The broker's live chat support typically offers the fastest response times, with most enquiries being addressed within a few minutes. Email enquiries are usually responded to within 24 hours, while phone support wait times may vary depending on the volume of calls. While Tickmill does not provide specific guarantees for response times, the broker's commitment to delivering high-quality customer support is evident in its range of support channels and multilingual assistance.Customer Support Comparison Table

| Feature | Tickmill |

|---|---|

| Live Chat | Yes |

| Email Support | Yes (support@tickmill.com) |

| Phone Support | Yes (UK, Cyprus, Seychelles) |

| Social Media Support | Yes (Facebook, Twitter, LinkedIn) |

| Support Languages | English, Spanish, German, Arabic |

| Support Hours | Monday - Friday (Business Hours) |

| Average Response Time – Live Chat | Within a few minutes |

| Average Response Time – Email | Within 24 hours |

| 24/7 Support | No |

Prohibited Countries

Due to various regulatory requirements, licensing restrictions, and geopolitical factors, Tickmill is unable to provide services to residents of certain countries. These restrictions are put in place to ensure that the broker operates in compliance with international laws and regulations.

The primary reasons behind these restrictions include:

- Local Regulations: Some countries have strict laws governing the provision of online trading services. These regulations may require brokers to obtain specific licenses or meet certain requirements before they can legally operate within the jurisdiction.

- Licensing Limitations: Tickmill's licenses from regulatory bodies such as the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC) may limit the broker's ability to offer services in certain countries.

- Geopolitical Factors: Political instability, economic sanctions, or other geopolitical factors may make it difficult or impossible for Tickmill to operate in specific regions.

It is essential for traders to be aware of these restrictions before attempting to open an account with Tickmill. Attempting to trade from a prohibited country may result in the rejection of the account application, the closure of existing accounts, or the inability to withdraw funds.

Prohibited Countries List

Tickmill is prohibited from offering its services to residents of the following countries and regions:

- Afghanistan

- Bosnia and Herzegovina

- Burundi

- Central African Republic

- Democratic Republic of the Congo

- Eritrea

- Guinea-Bissau

- Haiti

- Iran

- Iraq

- Lebanon

- Liberia

- Libya

- Mali

- Myanmar

- North Korea

- Republic of the Congo

- Somalia

- South Sudan

- Sudan

- Syria

- Turkmenistan

- United States of America

- Venezuela

- Yemen

- Zimbabwe

Traders should note that this list is subject to change based on updates to international regulations or changes in Tickmill's licensing agreements. It is recommended to check the broker's website or contact their customer support for the most up-to-date information on prohibited countries.

If you are a resident of one of the countries listed above, you will not be able to open an account with Tickmill. It is crucial to provide accurate information during the account registration process, as providing false or misleading information may result in the termination of your account and potential legal consequences.

For traders who are unsure about their eligibility to trade with Tickmill, it is advisable to contact the broker's customer support team for clarification before attempting to open an account. The support team can provide guidance on the specific restrictions that apply to your country of residence and help you understand your options.

Regions where Tickmill is allowed to operate:

- Europe, Asia, Africa, Oceania, South America, North America (excluding the United States)

Special Offers for Customers

Tickmill provides a range of special promotions and offers designed to attract new traders and reward existing clients for their loyalty. These offers can help traders maximise their potential returns and enhance their overall trading experience.

Sign-up Bonus

Tickmill currently offers a sign-up bonus of up to $30 for new clients who open a live trading account and meet certain trading volume requirements. To be eligible for the bonus, traders must:

- Open a new live trading account with Tickmill

- Deposit a minimum of $100 into their account

- Trade a minimum of 5 standard lots within 30 days of account opening

The sign-up bonus is credited to the trader's account once the trading volume requirement is met and can be used for trading purposes or withdrawn.

Refer-a-Friend Program

Tickmill's refer-a-friend program allows existing clients to earn rewards by introducing new traders to the broker. For each friend referred who opens a live trading account and meets the minimum deposit and trading volume requirements, the referring client can receive a bonus of up to $50.

The refer-a-friend program has the following conditions:

- The referred friend must open a new live trading account with Tickmill

- The referred friend must deposit a minimum of $100 into their account

- The referred friend must trade a minimum of 5 standard lots within 30 days of account opening

The refer-a-friend bonus is credited to the referring client's account once the trading volume requirement is met and can be used for trading purposes or withdrawn.

VIP Program

Tickmill's VIP program offers exclusive benefits to high-volume traders, including:

- Dedicated account manager

- Personalized trading support

- Invitations to VIP events and seminars

- Priority withdrawal processing

- Access to advanced trading tools and resources

To qualify for the VIP program, traders must maintain a minimum account balance of $50,000 and meet specific trading volume thresholds. The exact requirements vary depending on the trader's account type and trading activity.

Third-Party Partnerships

Tickmill has partnered with several third-party service providers to offer additional benefits to its clients, such as:

- Autochartist: Traders can access Autochartist's advanced pattern recognition and trading signals directly from the Tickmill trading platform.

- VPS Hosting: Tickmill offers free VPS hosting to traders who maintain a minimum account balance and trading volume, ensuring reliable and uninterrupted access to the trading platform.

- Trading Central: Tickmill clients can access Trading Central's expert market analysis and trading insights to inform their trading decisions.

Conclusion

Throughout this comprehensive review, I have thoroughly examined various aspects of Tickmill's operations, including their regulatory compliance, geographical reach, trading platforms, account types, customer support, and special offers. By consolidating these findings, I aim to provide a coherent assessment of Tickmill's safety, reliability, and overall reputation as a forex and CFD broker.

One of the key factors that contribute to Tickmill's trustworthiness is their adherence to regulatory requirements across multiple jurisdictions. With licenses from top-tier regulatory bodies such as the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC), Tickmill demonstrates a commitment to operating transparently and ethically. These licenses ensure that the broker follows strict guidelines related to client fund segregation, financial reporting, and fair business practices.

In terms of trading platforms, Tickmill offers a robust selection that caters to the needs of both beginner and advanced traders. The MetaTrader 4 and MetaTrader 5 platforms, along with Tickmill's proprietary web-based platform, provide users with reliable, feature-rich trading environments. The broker's ongoing development of their own platform shows a dedication to innovation and improving the user experience.

Tickmill's range of account types, including the Classic, Raw, and VIP accounts, accommodates traders with varying levels of experience and investment capital. The competitive spreads and transparent commission structures, particularly for the Raw account, make Tickmill an attractive choice for cost-conscious traders. The broker's high-quality customer support, available through multiple channels and in several languages, ensures that clients can access assistance whenever needed.

The broker's educational resources, including webinars, tutorials, and analytical tools, provide traders with the knowledge and insights needed to make informed trading decisions. While there is room for improvement in terms of the depth and organisation of these resources, Tickmill's commitment to supporting their clients' learning journey is evident.

Tickmill's special offers, such as the sign-up bonus and refer-a-friend program, add value for both new and existing clients. However, it is essential for traders to carefully review the terms and conditions associated with these promotions to ensure they align with their trading goals and expectations.

Based on the analysis conducted, I believe that Tickmill is a reliable and trustworthy broker that prioritises the safety and satisfaction of its clients. Their strong regulatory standing, advanced trading platforms, and commitment to customer support make them a compelling choice for traders seeking a secure and user-focused trading environment.

Visit the broker watchlist to track upcoming platform upgrades.

See stock-CFD depth in our Fortrade review.