TMGM Review 2025: Regulated Broker with Tight Spreads

TMGM

Australia

Australia

-

Minimum Deposit $50

-

Withdrawal Fee $varies

-

Leverage 1000:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Unavailable

-

Indices Available

Licenses

Australia Retail Forex License

Australia Retail Forex License

Softwares & Platforms

Customer Support

+61280368388

(English)

+61280368388

(English)

Supported language: Chinese (Simplified), English, French, Italian, Malay, Portuguese, Spanish, Thai, Vietnamese

Social Media

Summary

TMGM is a global broker offering a wide range of trading instruments, including forex pairs, CFDs on shares, indices, commodities, and cryptocurrencies. Traders can access over 10,000 share CFDs, global indices like the S&P 500 and Dow Jones, and popular commodities such as gold and oil. TMGM provides competitive spreads, with some starting as low as 0.0 pips on certain accounts, and offers flexible contract sizes. The broker also supports cryptocurrency trading with leverage and tight spreads.

- Well-regulated by tier-1 authorities ASIC

- Wide range of 12,000+ tradable instruments

- Competitive spreads starting from 0.0 pips on edge account

- Fast execution speeds

- Multiple trading platforms including MT4 and MT5

- Negative balance protection for added security

- 24/7 multilingual customer support

- Low minimum deposit of $50

- Supports automated trading with EAs and VPS

- Offers Islamic swap-free accounts

- Limited educational resources compared to some competitors

- No proprietary mobile trading app, only MT4/5

- Inactivity fee charged on dormant accounts

- High leverage a risk for inexperienced traders

- Doesn't accept clients from the US

- Withdrawals only processed via bank transfer

- No current promotions or bonus offers

- Lacks support for PayPal deposits/withdrawals

- Some instruments have higher spreads than others

- Website can be confusing to navigate in places

Overview

Established in 2013, TMGM (Trademax Global Markets) is an Australian-based forex and CFD broker serving traders worldwide. Headquartered in Sydney, TMGM has expanded its presence to encompass offices in Melbourne, Adelaide, and Canberra. The broker has also gained a foothold internationally with an office in Auckland, New Zealand.

TMGM's commitment to providing high-quality trading services has earned it recognition within the industry. The broker holds a license from a tier-1 regulator, the Australian Securities and Investments Commission (ASIC). It is also regulated offshore by the Vanuatu Financial Services Commission (VFSC).

With a diverse offering of over 12,000 tradable instruments, including 60+ forex pairs, indices, metals, energies, shares, and cryptocurrencies, TMGM caters to the needs of both novice and experienced traders. The broker provides access to popular trading platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

TMGM's competitive spreads start from 0.0 pips on its ECN account, with a low minimum deposit requirement of just $50. The broker's fast execution speeds, averaging under 30 milliseconds, make it an attractive choice for high-frequency traders and scalpers.

While TMGM excels in its wide product range and tight pricing, it has room for improvement in its research and educational resources. The broker's website offers a variety of account types, trading tools, and customer support options, which are detailed further in this comprehensive review. For more information, visit TMGM's official website at tmgm.com.

Overview Table

| Category | Details |

|---|---|

| Broker Name | TMGM (Trademax Global Markets) |

| Founded | 2013 |

| Headquarters | Sydney, Australia |

| Regulation | ASIC, VFSC |

| Minimum Deposit | $50 |

| Leverage | Up to 1:1000 |

| Instruments | Forex, CFDs, Shares, Cryptocurrencies |

| Platforms | MT4, MT5 |

| Account Types | edge, classic |

| Spread | From 0.0 pips |

| Commission | $7 round turn on ECN for forex, $5 for metals |

| Fees | No deposit or withdrawal fees |

| Customer Support | 24/7 live chat, phone, email |

Facts List

- TMGM was founded in 2013 and is headquartered in Sydney, Australia.

- TMGM is regulated by ASIC (tier-1) and offshore by VFSC.

- TMGM offers over 12,000 tradable instruments including forex, CFDs, shares, and cryptocurrencies.

- Clients can trade on popular platforms like MetaTrader 4 and MetaTrader 5.

- Spreads start from 0.0 pips on the ECN account with a commission of $7 per round turn for forex.

- The minimum deposit to open an account is just $50.

- TMGM provides leverage up to 1:1000 and supports high-frequency trading strategies.

- Average execution speeds are under 30 milliseconds, suitable for scalping.

- The broker offers 24/7 customer support via live chat, phone, and email.

- TMGM has offices in Australia and New Zealand but does not accept U.S. clients.

TMGM Licenses and Regulatory

TMGM operates under a robust regulatory framework, holding licenses from multiple respected authorities worldwide. This multi-jurisdictional approach to regulation provides an enhanced level of security and trust for TMGM's clients.

The broker's primary entity, Trademax Australia Limited, is authorised and regulated by the Australian Securities and Investments Commission (ASIC) under license number 436416. ASIC is widely regarded as one of the strictest financial regulators globally, known for its proactive stance on consumer protection. Brokers licensed by ASIC must adhere to stringent rules, including the segregation of client funds, maintaining adequate capital reserves, and regular auditing.

TMGM’s regulatory framework plays a key role in building trust and ensuring client protection across its global operations. The broker is authorised and regulated by the Australian Securities and Investments Commission (ASIC) under license number 436416. ASIC is considered one of the most stringent and reputable tier-1 financial regulators in the world, known for enforcing high standards of transparency, risk management, and operational integrity. This license requires TMGM to meet strict capital requirements, maintain segregated client accounts, and undergo regular audits—providing traders with a high level of security.

In addition to its ASIC regulation, TMGM also holds an offshore license issued by the Vanuatu Financial Services Commission (VFSC), under license number 40356. This license is held by Trademax Global Limited, a part of the TMGM group. While VFSC regulation is less rigorous than ASIC’s, it still requires brokers to meet certain operational standards and compliance procedures, offering a basic level of oversight.

By holding multiple regulatory licenses, TMGM demonstrates a strong commitment to transparency, client fund protection, and adherence to international regulatory standards. Many brokers in the forex and CFD space choose to operate under a single offshore license to avoid stricter requirements. In contrast, TMGM’s decision to operate under the supervision of a respected authority like ASIC sets it apart from less regulated competitors.

This multi-jurisdictional regulatory structure not only reinforces TMGM’s reputation as a reliable and trustworthy broker but also provides traders with greater peace of mind, knowing that the broker is accountable to strict compliance frameworks and oversight.

Regulations List

- Australian Securities and Investments Commission (ASIC) – Licence number 436416, issued to Trademax Australia Limited

- Vanuatu Financial Services Commission (VFSC) – Licence number 40356, issued to Trademax Global Limited

Trading Instruments

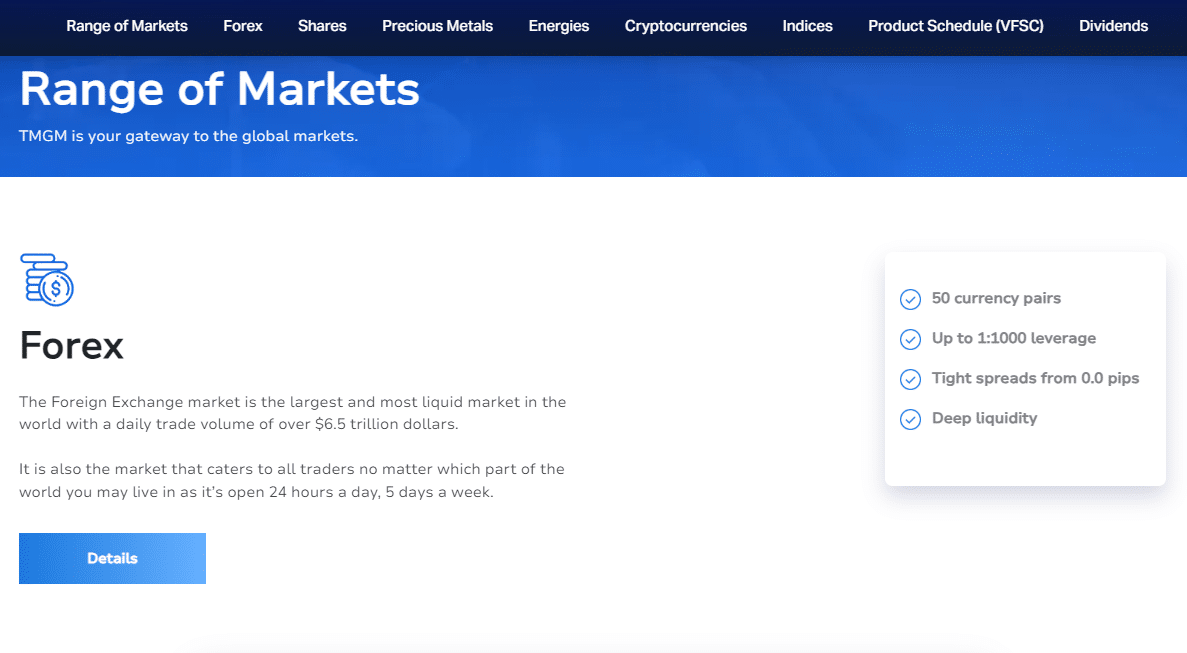

TMGM offers an extensive range of tradable assets, catering to the diverse needs and preferences of traders worldwide. With over 12,000 instruments available, TMGM provides a comprehensive trading experience across multiple asset classes.

| Instrument Type | Available Pairs/Instruments | Key Features |

|---|---|---|

| Forex Pairs | EUR/USD, GBP/USD, USD/JPY, USD/CHF, USD/SEK, USD/NOK, USD/ZAR, and more. | Competitive spreads starting from 0.0 pips (on Edge account). |

| CFDs on Shares | Over 10,000 share CFDs across US, UK, Europe, and Asia-Pacific. | Access to global markets and a wide range of sectors/industries. |

| Indices | US30 (Dow Jones), SPX500 (S&P 500), NAS100 (Nasdaq), UK100 (FTSE 100), GER30 (DAX), AUS200 (ASX 200). | Competitive spreads, flexible contract sizes. |

| Commodities | Gold, Silver, Crude Oil, Brent Oil, Natural Gas, Wheat, and more. | Diversify portfolios and hedge against market volatility. |

| Cryptocurrencies | Bitcoin, Ethereum, Litecoin, Ripple. | Competitive spreads and leverage on cryptocurrency CFDs. |

The breadth and depth of TMGM's tradable assets are a testament to the broker's commitment to meeting the needs of a diverse trading community. By offering a wide range of instruments across multiple asset classes, TMGM empowers traders to create well-diversified portfolios and adapt their strategies to various market conditions.

Having a diverse portfolio of tradable assets is crucial for investors, as it allows for greater flexibility and risk management. By spreading investments across different asset classes and markets, traders can potentially mitigate the impact of market volatility and capitalize on opportunities in various sectors. TMGM's extensive offering demonstrates the broker's adaptability to market trends and its ability to cater to the evolving needs of its clients.

Compared to industry standards, TMGM's range of tradable assets is impressive. While some brokers may specialize in specific asset classes, TMGM offers a comprehensive selection that rivals many of its competitors. This positions TMGM as a versatile and well-rounded broker, capable of serving the needs of both novice and experienced traders.

Trading Platforms

TMGM offers a range of trading platforms to cater to the diverse needs of its clients. The broker's platform selection includes the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

MetaTrader 4 (MT4)

MT4 is a widely used trading platform known for its user-friendly interface, advanced charting capabilities, and extensive customisation options. TMGM's MT4 platform comes equipped with a comprehensive set of trading tools, including 30 built-in indicators, 9 timeframes, and 3 chart types. The platform supports automated trading through Expert Advisors (EAs), allowing traders to implement their strategies effortlessly.

MetaTrader 5 (MT5)

MT5 is the successor to MT4, offering enhanced features and functionality. TMGM's MT5 platform provides access to a wider range of markets, including forex, CFDs, and exchange-traded instruments. The platform boasts advanced charting tools, 38 technical indicators, 21 timeframes, and the ability to open up to 100 charts simultaneously. Like MT4, MT5 supports automated trading and allows for the development of custom indicators and EAs.

Web and Mobile Trading

TMGM ensures accessibility by offering web-based and mobile trading options. The WebTrader platform allows clients to trade directly from their web browser without the need for software installation. The platform provides a streamlined trading experience with essential features such as real-time quotes, charts, and account management tools.

For traders on the go, TMGM offers mobile trading apps for both MT4 and MT5. The mobile apps, available for iOS and Android devices, provide full trading functionality, including the ability to place and manage trades, access real-time quotes, and analyse charts.

The availability of stable and popular trading platforms is crucial for ensuring a satisfactory trading experience. TMGM's choice to offer MT4 and MT5 demonstrates its commitment to providing clients with reliable and feature-rich trading solutions. These platforms cater to different trading styles and preferences, allowing clients to select the one that best suits their needs.

TMGM's technological offerings align with current market demands and client expectations. The broker's platforms provide a wide range of trading tools, indicators, and automation capabilities, empowering traders to make informed decisions and implement their strategies effectively. The inclusion of web-based and mobile trading options further enhances accessibility and flexibility.

Trading Platforms Comparison Table

| Feature | MT4 | MT5 |

|---|---|---|

| Markets | Forex, CFDs | Forex, CFDs, Exchange-traded |

| Number of Indicators | 30 | 38 |

| Timeframes | 9 | 21 |

| Chart Types | 3 | 21 |

| Max. Charts | Unlimited | 100 |

| Automated Trading | Yes (EAs) | Yes (EAs) |

| Web Trading | Via WebTrader | Via WebTrader |

| Mobile Apps | iOS, Android | iOS, Android |

TMGM How to Open an Account: A Step-by-Step Guide

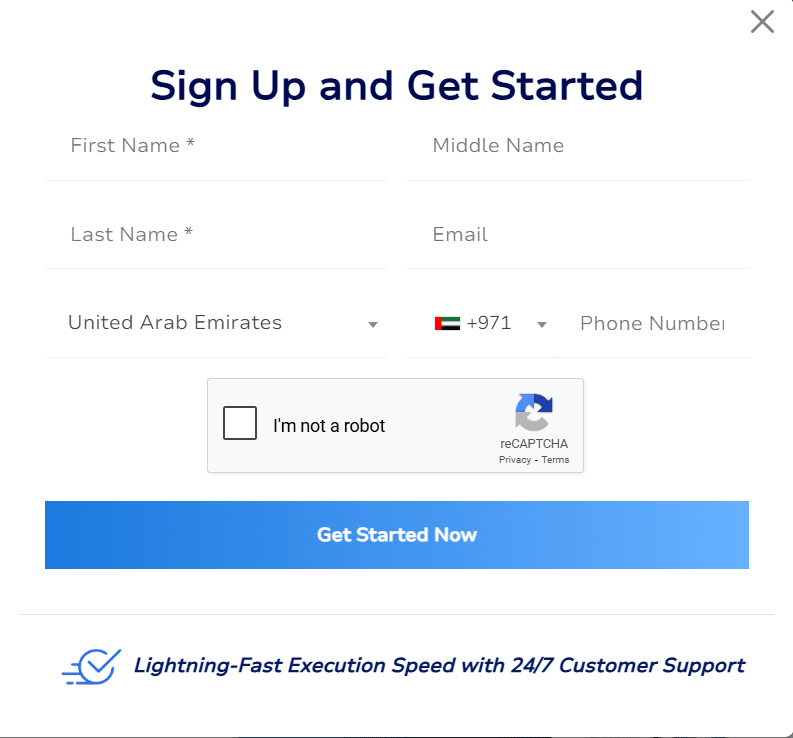

Opening an account with TMGM is a straightforward and user-friendly process. The broker has streamlined the account registration procedure to ensure that clients can start trading as quickly as possible. Follow these simple steps to open an account with TMGM:

Step 1: Visit the TMGM website (www.tmgm.com) and click on the "Create Account" button located at the top right corner of the homepage.

Step 2: Fill out the online registration form with your personal details, including your full name, email address, phone number, country of residence, and preferred account currency. TMGM offers several base currencies, including USD, EUR, GBP, AUD, CAD, and NZD.

Step 3: Choose your account type from the available options: Classic, Edge. The Classic account is suitable for beginners, while the Edge account caters to more experienced traders with its tighter spreads and commission-based pricing.

Step 4: Verify your email address by clicking on the confirmation link sent to your registered email. This step is essential to ensure the security of your account and to enable communication with TMGM.

Step 5: Complete your profile by providing additional information, such as your date of birth, address, and employment details. This information is required to comply with anti-money laundering (AML) and know-your-customer (KYC) regulations.

Step 6: Upload the necessary identification documents to verify your identity. This typically includes a valid government-issued ID, such as a passport or driver's license, and a proof of address, such as a utility bill or bank statement. TMGM employs advanced verification systems to ensure a quick and efficient account verification process.

Step 7: Choose your preferred funding method and make your initial deposit. TMGM accepts various payment methods, including bank wire transfers, credit/debit cards, and e-wallets like PayPal and Skrill. The minimum deposit required to open an account with TMGM is $50.

Step 8: Once your account is funded and verified, you can download the trading platform of your choice (MT4, MT5) and start trading.

TMGM's account opening process is designed to be user-friendly and efficient, allowing clients to start trading with minimal hassle. The broker's support team is available 24/7 to assist with any questions or issues that may arise during the account registration process.

Charts and Analysis

TMGM provides a range of educational trading resources and tools to support its clients in their trading journey. These resources are designed to cater to traders of all levels, from beginners to experienced professionals, helping them enhance their knowledge and skills in the financial markets.

| Feature | Details |

|---|---|

| Market Analysis | TMGM offers daily market analysis and insights through its blog and YouTube channel. Expert analysts provide in-depth coverage of market developments, key economic events, technical analysis, and trading opportunities. Analyses are available as written articles, video updates, and webinars. |

| Economic Calendar | TMGM provides an integrated economic calendar to keep traders informed about market-moving events like central bank decisions, GDP releases, and employment reports. Customisable alerts and filters enable clients to focus on relevant events, and the calendar is accessible through the client portal. |

| Trading Central | Through a partnership with Trading Central, TMGM offers clients access to advanced technical analysis and market insights. This includes automated technical analysis, market alerts, and trading ideas, all integrated directly into TMGM's trading platforms. |

| Educational Courses | TMGM offers a variety of educational courses and tutorials covering topics from basic forex trading to advanced technical analysis and risk management. These resources are available as written guides, video tutorials, and interactive webinars, catering to different learning styles. |

| Webinars | Regular webinars hosted by expert traders and analysts provide insights on market analysis, trading psychology, platform tutorials, and risk management strategies. These interactive sessions allow participants to ask questions and engage with presenters in real time. |

Compared to industry standards, TMGM's educational offerings are comprehensive and well-rounded. The broker's commitment to providing a diverse range of resources demonstrates its dedication to supporting its clients' trading education and success. By investing in high-quality educational content and partnering with leading providers like Trading Central, TMGM ensures that its clients have access to the tools and knowledge they need to navigate the financial markets effectively.

TMGM Account Types

TMGM offers a range of trading account types to cater to the diverse needs and preferences of its clients. Whether you're a beginner or an experienced trader, TMGM has an account type that suits your trading style and goals.

Classic Account

The Classic account is TMGM's standard trading account, designed for traders of all levels. This account type offers competitive spreads starting from 1.0 pips and a minimum deposit of just $50. With leverage Up to 1:1000 and access to a wide range of trading instruments, including forex, metals, and CFDs, the Classic account provides a solid foundation for traders to execute their strategies.

Edge Account

The Edge account is tailored for more experienced traders seeking tighter spreads and lower commissions. This account type offers raw spreads starting from 0.0 pips, with a commission of $7 per standard lot round turn for forex pairs and $5 for metals. The Edge account also features leverage Up to 1:1000 and access to the same extensive range of trading instruments as the Classic account.

Demo Account

TMGM offers a demo account that allows traders to practise their strategies and familiarise themselves with the trading platforms in a risk-free environment. The demo account features virtual funds and real-time market data, providing an authentic trading experience without the risk of losing real money.

Islamic Account

For traders who adhere to Islamic principles, TMGM provides swap-free Islamic accounts. These accounts are compatible with both the Classic and Edge account types, ensuring that Muslim traders can participate in the financial markets while complying with their religious beliefs.

TMGM's diverse range of account types demonstrates the broker's commitment to accommodating the needs of different types of traders. By offering competitive spreads, flexible leverage, and access to a wide range of markets, TMGM ensures that its clients can choose an account type that aligns with their trading objectives and risk tolerance.

Account Types Comparison Table

| Feature | Classic | Edge |

|---|---|---|

| Minimum Deposit | $50 | $50 |

| Spread | From 1.0 | From 0.0 |

| Commission | $0 | $7 (FX), $5 (metals) |

| Leverage | Up to 1:1000 | Up to 1:1000 |

| Markets | Forex, metals, CFDs | Forex, metals, CFDs |

| Platforms | MT4, MT5 | MT4, MT5 |

Negative Balance Protection

TMGM understands the importance of protecting its clients from the risks associated with negative balances. As such, the broker offers negative balance protection to all its clients, regardless of their account type or trading style. Under TMGM's negative balance protection policy, traders cannot lose more than the funds available in their trading account. If a trader's account balance falls into negative territory due to any of the factors mentioned above, TMGM will absorb the loss and reset the account balance to zero. It is important to note that negative balance protection does not eliminate the risk of trading or guarantee profits. Traders should still exercise caution and employ sound risk management strategies, such as setting appropriate stop-loss orders and managing their leverage responsibly. TMGM's commitment to providing negative balance protection demonstrates the broker's dedication to safeguarding its clients' funds and promoting a secure trading environment. By offering this protection, TMGM aims to build trust with its clients and provide peace of mind, allowing traders to focus on their trading strategies without worrying about the risk of excessive losses. Traders should be aware that while TMGM offers negative balance protection, there may be specific terms and conditions associated with this policy. It is essential to review and understand these terms to ensure compliance and maintain eligibility for the protection.

TMGM Deposits and Withdrawals

TMGM offers a range of convenient deposit and withdrawal options to ensure that clients can manage their funds efficiently and securely. The broker aims to provide a seamless experience for traders when it comes to funding their accounts and withdrawing their profits.

Deposit Methods

| Deposit Method | Description | Processing Time | Additional Details |

|---|---|---|---|

| Bank Wire Transfer | Traders can deposit funds directly from their bank account to their TMGM trading account. | 1-3 business days | Suitable for larger deposits. |

| Credit/Debit Card | TMGM accepts deposits via Visa and Mastercard, offering a convenient way to fund accounts. | Instant | Supports various currencies including USD, EUR, GBP, AUD, and NZD. |

| E-wallets | Deposits using popular e-wallets such as PayPal, Skrill, and Neteller. | Instantly credited | Fast and secure transactions. |

| Local Bank Transfers | TMGM supports local bank transfers in select countries such as Australia, China, and several Southeast Asian nations. | Varies | Allows deposits in local currency without incurring conversion fees. |

Withdrawal Methods

| Aspect | Details |

|---|---|

| Withdrawal Method | Bank Wire Transfer – Submit a withdrawal request via the client portal and the funds are transferred to the registered bank account. |

| Processing Time | Typically 1-3 business days |

| Fees | No fees charged by TMGM; third-party fees may apply (e.g., bank transfer charges or e-wallet transaction fees) |

| Minimum Transaction Limit | $50 for all account types (applies to deposits) |

| Maximum Limit | No maximum limit for deposits or withdrawals |

Verification Requirements

To comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, TMGM requires clients to verify their identity and address before processing withdrawals. Traders need to submit proof of identification, such as a passport or driver's license, and proof of address, such as a utility bill or bank statement. This verification process ensures the security and integrity of clients' funds.Unique Features

One of the standout features of TMGM's deposit and withdrawal process is the broker's commitment to fast and efficient transactions. The instant funding option via credit/debit cards and e-wallets allows traders to start trading quickly without waiting for lengthy processing times. Additionally, TMGM's support for local bank transfers in several countries demonstrates the broker's efforts to cater to the needs of its global client base. In conclusion, TMGM provides a range of deposit and withdrawal options to suit the preferences and requirements of its traders. With no fees, competitive processing times, and a focus on security and compliance, TMGM ensures that clients can manage their funds with ease and confidence.Support Service for Customer

In the fast-paced world of online trading, reliable customer support is crucial for a positive trading experience. Traders need to know that they can quickly reach out for assistance whenever they encounter issues or have questions about the platform, their accounts, or trading in general. TMGM understands the importance of providing excellent customer support and offers multiple channels for traders to get in touch with their team.

- Live Chat: Traders can access the live chat feature directly from the TMGM website. This option is ideal for quick queries and immediate assistance.

- Email: For less urgent matters or more detailed enquiries, traders can send an email to support@tmgm.com. The support team aims to respond to all emails within 24 hours.

- Phone: TMGM offers phone support through their international hotline: +61 2 8036 8388. This option is suitable for traders who prefer to discuss their concerns or questions over the phone.

- Social Media: Traders can also reach out to TMGM via their official social media channels, such as Facebook, Twitter, and Instagram. The support team monitors these channels and aims to provide prompt responses.

Multilingual Support

To cater to its global client base, TMGM offers customer support in multiple languages, including English, Spanish, Portuguese, Chinese, Thai, Vietnamese, French, Indonesian, Italian, Malay, and Korean. This ensures that traders from different regions can communicate effectively with the support team and receive assistance in their preferred language.Suppor Hours

TMGM's customer support is available 24 hours a day, 7 days a week. This round-the-clock support ensures that traders can get help whenever they need it, regardless of their time zone or trading hours. The support team is well-equipped to handle queries and concerns promptly and efficiently.Response Times

TMGM strives to provide quick and efficient support to its clients. The average response time for live chat enquiries is under 2 minutes, ensuring that traders can get immediate assistance for urgent matters. Emails are typically responded to within 24 hours, while phone calls are answered promptly during business hours.Customer Support Comparison Table

| Feature | TMGM |

|---|---|

| Support Channels | Live Chat, Email, Phone, Social Media |

| Languages | English, Spanish, Portuguese, Chinese, Thai, Vietnamese, French, Indonesian, Italian, Malay, Korean |

| 24/7 Support | Yes |

| Live Chat Response | Under 2 minutes |

| Email Response | Within 24 hours |

| Phone Support | Yes |

Prohibited Countries

TMGM is committed to complying with international regulations and operating within the legal framework of each country it serves. As a result, there are certain countries and regions where TMGM is currently unable to offer its services due to local regulations, licensing requirements, or geopolitical factors.

Reasons for Restrictions

The primary reasons behind TMGM's country restrictions include:

- Local Regulations: Some countries have strict laws and regulations governing online trading and foreign exchange services. These regulations may require brokers to obtain specific licenses or adhere to particular guidelines, which can be challenging or impractical for international brokers like TMGM.

- Licensing Requirements: Each country has its own set of licensing requirements for financial service providers. Obtaining and maintaining these licenses can be a complex and costly process, and TMGM may choose not to pursue licensing in certain jurisdictions.

- Geopolitical Factors: Political instability, economic sanctions, or international trade agreements can also influence a broker's ability to operate in specific regions. TMGM must consider these factors to ensure compliance with international laws and to protect its clients' interests.

List of Prohibited Countries

Currently, TMGM is not able to offer its services to residents of the following regions:

- United States

Consequences of Trading from Prohibited Countries

Attempting to trade with TMGM from a prohibited country can result in several consequences, including:

- Account Closure: If TMGM discovers that a client is trading from a prohibited country, the broker reserves the right to immediately close the account and terminate the trading relationship.

- Funds Forfeiture: In some cases, clients from prohibited countries may risk having their funds frozen or forfeited if they are found to be in violation of local or international regulations.

- Legal Consequences: Trading with an unauthorised broker from a prohibited country may also result in legal consequences, such as fines or penalties, depending on the specific laws and regulations of the country in question.

It is essential for traders to carefully review the list of prohibited countries and ensure they are not residing in or trading from a restricted region before opening an account with TMGM. By doing so, traders can protect themselves from potential legal and financial risks and ensure a smooth and compliant trading experience.

Special Offers for Customers

At the time of writing, TMGM does not appear to have any active special offers, bonuses, or promotions listed on their website or in their other official materials that I could locate through my research.

The broker seems to focus on providing competitive spreads, fast execution, and a wide range of tradable instruments as their main selling points, rather than short-term promotional offers.

However, it's always a good idea to check TMGM's official website or contact their customer support directly to enquire about any current or upcoming promotions, as these offers can change over time.

Conclusion

After conducting an in-depth review of TMGM, I have gained a comprehensive understanding of their operations, services, and overall standing in the online brokerage industry. By examining various aspects of their business, such as regulatory compliance, trading platforms, account types, and customer support, I can confidently provide an assessment of their reliability and suitability for traders.

One of the key factors that distinguish TMGM is its strong commitment to regulatory compliance and client protection. The broker is licensed by top-tier regulator ASIC (Australian Securities and Investments Commission) and also holds offshore regulation from the Vanuatu Financial Services Commission (VFSC). This multi-jurisdictional regulatory framework ensures that TMGM operates under strict guidelines, promoting transparency, operational integrity, and the safeguarding of client funds. The segregation of client accounts and implementation of negative balance protection further reinforce TMGM's dedication to maintaining a secure and reliable trading environment for all its clients.

Another area where TMGM excels is in their offering of trading platforms. With the industry-standard MetaTrader 4 and MetaTrader 5, TMGM caters to the needs of both beginner and advanced traders. These platforms provide a wide range of tools, indicators, and automation capabilities, empowering traders to implement their strategies effectively. The availability of web-based and mobile trading options further enhances accessibility and flexibility.

TMGM's account types are designed to accommodate various trading styles and preferences. The Classic and Edge accounts offer competitive spreads and leverage, making them suitable for a broad range of traders. The Islamic account option demonstrates TMGM's commitment to inclusive trading, allowing traders to comply with Sharia principles.

In terms of customer support, TMGM provides a comprehensive and reliable service. With 24/7 availability through multiple channels, including live chat, email, phone, and social media, traders can access assistance whenever they need it. The support team's multilingual capabilities further demonstrate TMGM's dedication to serving a global clientele.

While TMGM does not currently appear to offer any special promotions or bonuses, their focus on providing competitive trading conditions, a wide range of instruments, and robust educational resources may be more appealing to traders who prioritise these factors over short-term incentives.

Based on my analysis, I believe that TMGM is a trustworthy and reliable broker that prioritises the needs of its clients. Their strong regulatory standing, advanced trading platforms, and commitment to customer support make them a compelling choice for traders seeking a secure and user-friendly trading environment.

However, it's essential to note that trading carries inherent risks, and no broker can guarantee profits. Traders should always conduct their own research, consider their risk tolerance, and develop a well-informed trading plan before committing funds to any broker.

In conclusion, TMGM stands out as a reputable and well-rounded broker that offers a solid foundation for traders of all levels. Their dedication to regulatory compliance, advanced trading tools, and client-centric approach make them a strong contender in the competitive online brokerage landscape.

Browse platforms with ZAR base accounts in our South-African broker shortlist.

See how a CySEC player stacks up in the Arum Capital review.