Trader’s Way Broker Review 2025: Is It Legit or a Scam?

Trader's Way

-

Minimum Deposit $10

-

Withdrawal Fee $varies

-

Leverage 1000:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Unavailable

-

Indices Available

Licenses

Softwares & Platforms

Customer Support

+18499370815

(English)

+18499370815

(English)

Supported language: English

Social Media

Summary

Trader's Way is an offshore broker established in 2011 and registered in Dominica, offering access to forex, crypto, commodities, indices, and energies. It provides high leverage up to 1:1000 and supports MT4, MT5, and cTrader platforms. While it offers a low minimum deposit of $10 and a variety of account types, the broker remains unregulated, which may be a concern for traders prioritizing safety and compliance. Despite a dated website, it offers 24/5 customer support and a decent range of educational resources.

- Wide range of tradable assets

- Multiple account types to suit different trading styles

- Popular trading platforms (MT4, MT5, cTrader)

- Low minimum deposit requirement ($10)

- Negative balance protection

- Educational resources and market analysis

- Responsive customer support

- Various deposit and withdrawal methods

- Attractive special offers and promotions

- Accessible to traders worldwide (excluding prohibited countries)

- Lacks regulation from reputable authorities

- Potential risks associated with an unregulated broker

- Limited recourse for traders in the event of disputes

- Some deposit and withdrawal methods may incur fees

- Educational resources may not be as comprehensive as other brokers

- No 24/7 customer support

- High leverage can amplify risks for inexperienced traders

- Prohibited in certain countries (e.g., US, UK)

- The website may appear outdated compared to industry standards

- Potential for wider spreads during market volatility

Overview

Trader's Way, an online broker established in 2011, has made a name for itself by offering traders access to a wide range of markets, including forex, cryptocurrencies, commodities, and indices. Registered in Dominica, this broker has expanded its reach globally, catering to the diverse needs of traders worldwide. Despite its extensive experience in the industry, spanning over a decade, Trader's Way remains an unregulated entity, which may raise concerns for some traders prioritising the security and oversight that comes with regulatory compliance.

The broker's official website, while providing essential information about its offerings, appears to be somewhat basic and outdated compared to industry standards. This lack of modern design and user experience could be interpreted as a reflection of the broker's limited investment in client-facing aspects of its operations. Nevertheless, Trader's Way has managed to attract a client base by offering a range of trading accounts, high leverage options, and access to popular trading platforms.

One of the standout features of Trader's Way is its provision of leverage up to 1:1000, which can significantly amplify both potential profits and losses. While such high leverage may appeal to risk-tolerant traders seeking to maximise their market exposure, it is crucial for users to understand and manage the inherent risks associated with leveraged trading.

Overview Table

| Broker | Trader's Way |

|---|---|

| Established Year | 2011 |

| Regulation and Licenses | None |

| Trading Instruments | Forex, Commodities, Indices, Crypto |

| Minimum Deposit | $10 |

| Trading Platforms | MT4, MT5, cTrader, Mobile Apps |

| Customer Support | 24/5 via Live Chat, Email, Phone |

| Prohibited Countries | USA, UK |

Facts List

- Founded in 2011, Trader's Way has over a decade of experience in the online trading industry.

- The broker is registered in Dominica but remains unregulated, which may concern some traders.

- Trader's Way offers a diverse range of trading instruments, including 41 forex pairs, commodities, indices, and cryptocurrencies.

- Clients can choose from four account types: MT4.VAR, MT4.ECN, MT5.ECN, and CT.ECN, catering to different trading styles and preferences.

- The broker provides access to popular trading platforms such as MetaTrader 4, MetaTrader 5, and cTrader, along with mobile trading apps.

- Leverage options up to 1:1000 are available, allowing traders to amplify their market exposure, albeit with increased risk.

- The minimum deposit required to open an account is just $10, making it accessible to a wide range of traders.

- Educational resources, including webinars, tutorials, and market analysis, are available to support traders in their learning journey.

- Customer support is offered 24/5 through live chat, email, and telephone, ensuring assistance is available when needed.

- Trader's Way is prohibited from offering its services to residents of the United States and United Kingdom.

Trader's Way Licenses and Regulatory

Despite its long-standing presence in the online trading industry, Trader's Way operates without any effective regulatory oversight. The broker is registered in the Commonwealth of Dominica, a jurisdiction known for its relaxed financial regulations. The lack of regulation from respected authorities such as the Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC) may be a red flag for traders who prioritise the protection and security that comes with regulatory compliance.

Regulatory oversight is crucial in the online trading industry, as it ensures that brokers adhere to strict guidelines, maintain transparency, and prioritise the interests of their clients. Regulated brokers are required to segregate client funds, maintain adequate capital reserves, and follow best execution practices. The absence of such oversight at Trader's Way may expose traders to potential risks, including the mishandling of funds or the lack of recourse in the event of disputes.

While the broker's long-standing presence in the industry may offer some level of trust, traders must carefully consider the implications of dealing with an unregulated entity. It is essential to conduct thorough due diligence, assess the broker's reputation, and understand the potential risks before committing funds to an unregulated platform like Trader's Way.

Trading Instruments

Trader's Way offers a diverse range of tradable assets, allowing clients to access various financial markets from a single platform. The broker's offerings span across multiple asset classes, including:

| Asset Class | Details |

|---|---|

| Forex | Over 41 currency pairs including major, minor, and exotic pairs. Competitive spreads and high-leverage options. Suitable for traders of all levels. |

| Commodities | Access to gold, silver, oil, and natural gas. Useful for portfolio diversification and capitalising on global economic trends. |

| Indices | Trade global indices like the S&P 500, NASDAQ, FTSE 100, and DAX. Enables speculation on broader market movements. |

| Cryptocurrencies | Trade major digital assets such as Bitcoin, Ethereum, Litecoin, and Ripple. High volatility offers strong trading opportunities. |

| Energies | Includes Brent Crude and Natural Gas. Prices influenced by geopolitical events and global supply-demand dynamics. |

Trading Platforms

To start trading with Trader's Way, clients can choose from a range of trading platforms and tools:

MetaTrader 4 (MT4)

MT4 is a widely used trading platform known for its user-friendly interface, advanced charting tools, and extensive customisation options. Trader's Way offers the MT4 platform for both desktop and mobile devices, allowing traders to access their accounts and execute trades on the go.

MetaTrader 5 (MT5)

MT5 is the successor to MT4, offering enhanced features and functionalities. Traders can benefit from advanced technical analysis tools, multiple timeframes, and the ability to trade across different asset classes from a single platform.

cTrader

cTrader is a state-of-the-art trading platform designed for both beginners and experienced traders. With its intuitive interface, advanced order types, and powerful charting tools, cTrader provides a seamless trading experience. Trader's Way offers the cTrader platform for those seeking a high-performance trading solution.

Mobile Trading

Trader's Way provides mobile trading apps for both iOS and Android devices, enabling traders to monitor their accounts, access real-time market data, and execute trades from their smartphones or tablets. The mobile apps offer a streamlined trading experience, ensuring that traders can stay connected to the markets even when on the move.

Trading Platform Comparison Table

| Platform | MetaTrader 4 | MetaTrader 5 | cTrader |

|---|---|---|---|

| User Interface | User-friendly, customizable | Advanced, customizable | Intuitive, modern |

| Charting Tools | 30+ built-in indicators, 9 timeframes | 38+ built-in indicators, 21 timeframes | Advanced charting, multiple timeframes |

| Automated Trading | Supports Expert Advisors (EAs) | Supports EAs and algorithmic trading | Supports cBots and cAlgo |

| Order Types | Market, Limit, Stop, Trailing Stop | Market, Limit, Stop, Trailing Stop, Buy Stop Limit, Sell Stop Limit | Market, Limit, Stop, Trailing Stop, OCO, IFD |

| Asset Classes | Forex, CFDs | Forex, CFDs, Stocks, Futures | Forex, CFDs |

| Mobile Trading | iOS and Android apps available | iOS and Android apps available | iOS and Android apps available |

Trader's Way How to Open an Account: A Step-by-Step Guide

Opening an account with Trader's Way is a straightforward process that can be completed online in a few simple steps:

- Visit the official Trader's Way website and click on the "Open Live Account" button.

- Select your preferred account type (MT4.VAR, MT4.ECN, MT5.ECN, or CT.ECN) based on your trading needs and experience.

- Fill in the required personal information, including your name, email address, phone number, and country of residence.

- Choose your preferred base currency and leverage options.

- Provide proof of identity and address by uploading a valid government-issued ID and a recent utility bill or bank statement.

- Review and accept the broker's terms and conditions.

- Submit your application and wait for the broker to verify your account.

- Once your account is approved, fund it using one of the available deposit methods.

- Download and install the trading platform of your choice (MT4, MT5, or cTrader).

- Log in to your trading account using the provided credentials and start trading.

Charts and Analysis

Trader's Way provides its clients with access to a range of tools and resources for analysing market trends, conducting technical analysis, and making informed trading decisions. These include:

| Feature | Description |

|---|---|

| Live Charts | Advanced charting tools are available on MT4, MT5, and cTrader, with multiple timeframes, customisable indicators, and drawing tools for in-depth price analysis. |

| Technical Analysis Tools | Wide range of built-in indicators, including moving averages, oscillators, and trend-following tools to assist in market sentiment assessment and price prediction. |

| Economic Calendar | Highlights key upcoming events like central bank meetings, GDP reports, and employment data, enabling traders to anticipate market volatility. |

| Market News and Analysis | Regular updates, expert analysis, and financial news to keep traders informed about market trends and potential trading opportunities. |

| Webinars & Educational Resources | Access to live webinars, tutorial videos, e-books, and trading guides—suitable for beginners and advanced traders seeking to improve their market knowledge. |

Trader's Way Account Types

Trader's Way offers four main account types, each designed to cater to different trading styles, experience levels, and investment goals:

MT4.VAR

This account type is suitable for traders who prefer the flexibility of variable spreads. With a minimum deposit of just $10, MT4.VAR accounts offer trading conditions that mirror the live market, making it an attractive option for beginners and those looking to trade with smaller account sizes.

MT4.ECN

Designed for experienced traders seeking direct market access, MT4.ECN accounts provide tight spreads and fast execution speeds. With a minimum deposit of $10, this account type offers competitive trading conditions and the ability to use advanced trading strategies such as scalping and hedging.

MT5.ECN

Similar to the MT4.ECN account, the MT5.ECN account is geared towards experienced traders who prefer the advanced features and functionality of the MetaTrader 5 platform. This account type offers competitive spreads, low commissions, and access to a wide range of trading instruments.

CT.ECN

Tailored for traders who favour the cTrader platform, CT.ECN accounts provide an intuitive trading experience with advanced charting tools and order types. With a minimum deposit of $10 and competitive trading conditions, this account type is suitable for traders of all levels who seek a professional trading environment.

Account Types Comparison Table

| Feature | MT4.VAR | MT4.ECN | MT5.ECN | CT.ECN |

|---|---|---|---|---|

| Platform | MetaTrader 4 | MetaTrader 4 | MetaTrader 5 | cTrader |

| Spread Type | Variable | Variable | Variable | Variable |

| Minimum Deposit | $10 | $10 | $10 | $10 |

| Commission per Lot | No | From $3 | From $3 | From $3 |

| Maximum Leverage | Up to 1:1000 | Up to 1:1000 | Up to 1:1000 | Up to 1:500 |

| Minimum Order Size | 0.01 | 0.01 | 0.01 | 0.01 |

| Hedging Allowed | Yes | Yes | Yes | Yes |

| Scalping Allowed | Yes | Yes | Yes | Yes |

| Expert Advisors (EAs) | Yes | Yes | Yes | Yes |

| Mobile Trading | Yes | Yes | Yes | Yes |

Negative Balance Protection

Trader's Way offers negative balance protection to its clients, ensuring that traders cannot lose more than the funds available in their trading accounts. This feature is essential for managing risk and protecting traders from potentially devastating losses. In the event of extreme market volatility or unexpected price movements, it is possible for a trader's account balance to turn negative, meaning they would owe money to the broker. However, with negative balance protection, Trader's Way absorbs any losses that exceed the account balance, preventing traders from falling into debt. This protection is particularly important for traders using high leverage, as even small price movements can lead to significant losses. By offering negative balance protection, Trader's Way demonstrates its commitment to responsible trading practices and client welfare. It is crucial for traders to understand that while negative balance protection can mitigate losses, it should not be relied upon as a substitute for proper risk management. Traders should always employ sound risk management strategies, such as setting appropriate stop-loss orders and managing their position sizes, to maintain control over their trading activities.

Trader's Way Deposits and Withdrawals

Trader's Way supports a variety of deposit and withdrawal methods, ensuring that clients can easily manage their funds and maintain flexibility in their trading activities. The available options include:

Deposit Methods

| Method | Options | Fees | Processing Time |

|---|---|---|---|

| Cryptocurrencies | Bitcoin, Ethereum, Litecoin, Ripple, USD Coin, Tether | Usually free (network fees may apply) | Instant to a few hours |

| E-wallets | Skrill, Neteller, Perfect Money, FasaPay | Skrill: 1.9% deposit fee Neteller: Free deposit | Instant to a few hours |

| Bank Transfers | Abra | Varies depending on bank/location | 1–5 business days |

| TC Pay | – | May vary | Instant to 1 day |

| Local Transfers | Malaysia, Vietnam, Nigeria, India | Varies by country | 1–2 days |

Withdrawal Methods

| Method | Options | Fees | Processing Time |

|---|---|---|---|

| Cryptocurrencies | Bitcoin, Ethereum, Litecoin, Ripple, USD Coin, Tether | Small network fee | Instant to a few hours |

| E-wallets | Skrill, Neteller, Perfect Money, FasaPay | Skrill: 1% withdrawal fee Neteller: Fees may apply | Instant to a few hours |

| Bank Transfers | Abra | Varies depending on bank/location | 1–5 business days |

| TC Pay | – | May vary | Instant to 1 day |

| Local Transfers | Malaysia, Vietnam, Nigeria, India | Varies by country | 1–2 days |

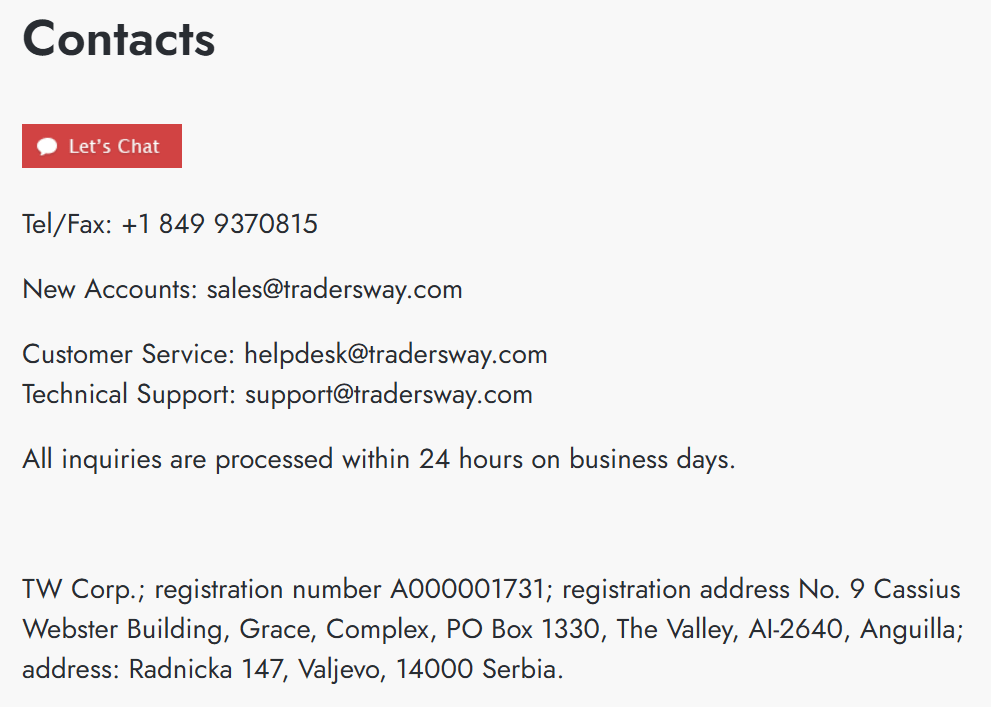

Support Service for Customer

- Live Chat: Traders can access instant support through the live chat feature available on the broker's website. This option is ideal for quick queries and general assistance.

- Email Support: Clients can send their enquiries, concerns, or requests to the dedicated email addresses provided by Trader's Way. The broker aims to respond to all email enquiries within 24 hours during business days.

- Phone Support: Trader's Way offers phone support in multiple languages, allowing clients to speak directly with a customer support representative for more complex issues or urgent matters.

- Social Media: The broker maintains an active presence on popular social media platforms, such as Facebook, Twitter, and Telegram, providing an additional channel for clients to reach out for support or stay updated with the latest news and promotions.

Customer Support Comparison Table

| Support Channel | Availability | Languages | Response Time |

|---|---|---|---|

| Live Chat | 24/5 | English | Instant |

| 24/5 | English | Within 24 hours | |

| Phone | 24/5 | Multiple | Instant |

| Social Media | 24/7 | English | Within 24 hours |

Prohibited Countries

Due to regulatory restrictions and legal requirements, Trader's Way does not offer its services to residents of certain countries. The list of prohibited countries includes:

- United States

- United Kingdom

Residents of these countries are not permitted to open an account or trade with Trader's Way. The broker adheres to the local laws and regulations of each jurisdiction in which it operates, and as such, it cannot provide services to individuals residing in prohibited countries.

Special Offers for Customers

Trader's Way occasionally provides special promotions and bonus offers to both new and existing clients. These offers may include:

- Welcome Bonus: New clients may be eligible for a welcome bonus upon making their first deposit. The bonus amount and terms may vary depending on the promotion.

- Deposit Bonus: From time to time, Trader's Way may offer deposit bonuses to clients who fund their accounts with a specified amount. These bonuses can help boost trading capital and provide additional opportunities for traders.

- Loyalty Program: The broker may reward loyal clients with exclusive benefits, such as tighter spreads, lower commissions, or access to premium educational resources, based on their trading activity and account balance.

- Trading Contests: Trader's Way may host trading contests that allow participants to compete for prizes, such as cash rewards or bonus funds, based on their trading performance over a specified period.

Conclusion

Trader's Way, as an online broker, offers a range of attractive features that cater to various trading preferences and experience levels. With a wide selection of tradable assets, including forex, commodities, indices, and cryptocurrencies, traders have the opportunity to diversify their portfolios and take advantage of numerous markets.

One of the standout aspects of Trader's Way is its impressive range of account types, each designed to suit different trading styles and strategies. From the beginner-friendly MT4.VAR account to the advanced MT4.ECN, MT5.ECN, and CT.ECN accounts, traders can choose the option that best aligns with their needs. The low minimum deposit requirement of just $10 makes it accessible for traders of all levels to begin their journey with Trader's Way.

The broker's choice of trading platforms is another notable feature, with the popular MetaTrader 4, MetaTrader 5, and cTrader platforms available. These platforms offer a user-friendly interface, advanced charting tools, and a wide range of technical indicators, empowering traders to make informed decisions and execute their strategies efficiently.

However, one significant drawback of Trader's Way is its lack of regulation. Operating without the oversight of reputable regulatory bodies such as the FCA, ASIC, or CySEC may raise concerns for some traders regarding the safety and security of their funds. The absence of regulation also means that traders have limited recourse in the event of disputes or issues with the broker.

Despite this, Trader's Way has taken steps to protect its clients by offering negative balance protection, which ensures that traders cannot lose more than their account balance. The broker also provides a variety of educational resources, including webinars, tutorials, and market analysis, to help traders enhance their skills and knowledge.

Customer support is another area where Trader's Way aims to excel, with multiple channels available, including live chat, email, phone, and social media. The broker's support team is available 24/5 to assist clients with their enquiries and concerns.

In terms of deposits and withdrawals, Trader's Way supports a range of methods, including cryptocurrencies, e-wallets, bank transfers, and local transfers. While some methods may incur fees, the broker strives to process transactions promptly and efficiently.

In conclusion, Trader's Way offers a comprehensive trading experience with a diverse range of tradable assets, account types, and trading platforms. The broker's low minimum deposit requirement and attractive special offers make it an appealing choice for many traders. However, the lack of regulation is a significant concern that should not be overlooked. Traders must carefully consider the potential risks associated with an unregulated broker and weigh them against their individual trading needs and risk tolerance. As with any financial decision, thorough research and due diligence are essential before committing funds to any trading platform.