Uniglobe Markets Review 2025: A Trusted Forex Broker for Trading Success

Uniglobe Markets

Saint Lucia

Saint Lucia

-

Minimum Deposit $100

-

Withdrawal Fee $varies

-

Leverage 500:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Unavailable

-

Indices Available

Licenses

Softwares & Platforms

Customer Support

+442035040120

(English)

+442035040120

(English)

Supported language: English, Arabic

Social Media

Summary

Uniglobe Markets, founded in 2014 and based in Saint Lucia, is an unregulated offshore broker targeting clients in Asia, Africa, and the Middle East. It offers high leverage of up to 1:500, various account types, and a range of instruments like forex, CFDs, metals, and cryptocurrencies. The broker uses MetaTrader 5 for trading and requires a minimum deposit of $100. However, its lack of regulation and limited transparency may raise concerns regarding the safety of client funds. Customer support is available 24/5 via live chat, email, and phone.

- Wide range of trading instruments

- Competitive spreads and high leverage

- MetaTrader 4 and MetaTrader 5 platform support

- Multiple account types for different trading needs

- No deposit or withdrawal fees charged by the broker

- 24/5 customer support through various channels

- Attractive promotional offers and bonuses

- Suitable for traders looking for high potential returns

- Unregulated broker with limited investor protection

- Lack of transparency regarding prohibited countries and negative balance protection

- No investor compensation scheme in case of broker insolvency

- Potential difficulties in resolving disputes with an unregulated entity

- Limited educational resources compared to regulated brokers

- High leverage can amplify losses

- Mixed user reviews regarding customer support quality

- Risks associated with trading with an offshore, unregulated broker

- Limited recourse in the event of fraud or misconduct

- Not suitable for risk-averse traders or those prioritizing safety and reliability

Overview

Uniglobe Markets is an offshore forex and CFD broker founded in 2014 and registered in Saint Lucia. The broker targets clients primarily in Asia, Africa, and the Middle East, offering high leverage, multiple account options, and various bonuses and promotions. However, Uniglobe Markets is not regulated by any top-tier financial authorities, which raises concerns about the safety and security of client funds.

With a focus on providing access to a wide range of financial instruments, Uniglobe Markets offers trading on forex, share CFDs, indices, metals, commodities, and cryptocurrencies. The broker supports the popular MetaTrader 5 trading platforms, catering to both beginner and advanced traders.

While Uniglobe Markets claims to prioritise client satisfaction and offers attractive trading conditions, its lack of regulation and limited transparency are significant drawbacks. Traders should exercise caution and thoroughly research the broker before committing funds.

For a more in-depth analysis of Uniglobe Markets' services, regulation, trading conditions, and user experience, please visit their official website at uniglobemarkets.com

Overview Table

| Feature | Details |

|---|---|

| Founded | 2014 |

| Headquarters | Saint Lucia |

| Regulation | Unregulated |

| Trading Platforms | MT5 |

| Minimum Deposit | $100 |

| Leverage | Up to 1:500 |

| Instruments | Forex, CFDs, indices, metals, commodities, crypto |

| Customer Support | 24/5 via live chat, email, phone |

Key Facts

- Uniglobe Markets was established in 2014 and is based in Saint Lucia.

- The broker is not regulated by any major financial authorities.

- Over 250 trading instruments are available, including forex, share CFDs, indices, metals, commodities, and cryptocurrencies.

- MetaTrader 4 and MetaTrader 5 are the supported trading platforms.

- Maximum leverage of up to 1:500 is offered, which is considered high risk.

- Multiple account types are available to suit different trading needs and budgets.

- The minimum deposit requirement starts at $100.

- Various payment methods are accepted, including bank wire, credit/debit cards, and e-wallets.

- Educational resources and trading tools are provided, but they are limited compared to other brokers.

- Customer support is available 24/5 through live chat, email, and phone.

Uniglobe Markets Licenses and Regulatory

One of the most critical aspects to consider when evaluating a forex broker is their regulatory status. A well-regulated broker is required to adhere to strict guidelines designed to protect clients' interests and maintain market integrity. Unfortunately, Uniglobe Markets falls short in this regard.

Uniglobe Markets is registered in St. Vincent and the Grenadines (SVG), a jurisdiction known for its lax financial regulations. The broker does not hold any licenses from reputable regulatory bodies such as the Financial Conduct Authority (FCA) in the United Kingdom, the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC).

The lack of proper regulation means that Uniglobe Markets is not subject to the same level of oversight and scrutiny as brokers regulated by top-tier authorities. This lack of supervision raises concerns about the broker's transparency, financial stability, and commitment to fair trading practices.

Moreover, unregulated brokers like Uniglobe Markets do not participate in investor compensation schemes, which leaves clients vulnerable in the event of the broker's insolvency. Regulated brokers, on the other hand, often provide negative balance protection and segregate client funds from the company's operating capital to ensure that traders' money is safe.

While Uniglobe Markets may offer attractive trading conditions and promotions, their lack of regulation is a significant red flag that should not be ignored. Traders should prioritise working with regulated brokers to minimise the risk of fraud, mismanagement, and financial loss.

Regulations List:

- Uniglobe Markets is not regulated by any major financial authorities.

Trading Instruments

Uniglobe Markets offers a diverse range of tradable assets, allowing clients to access various financial markets through a single platform. The broker's offerings span six main categories:

| Asset Class | Details |

|---|---|

| Forex | Over 50 currency pairs, including major, minor, and exotic pairs. Spreads starting from 0.0 pips on some accounts. |

| Share CFDs | Trade CFDs on a wide range of international company shares without owning the underlying asset. |

| Indices | CFDs are available on global indices like the S&P 500, FTSE 100, and DAX 30. |

| Metals | Access to precious metals like gold and silver via CFDs. |

| Commodities | Trade CFDs on oil, natural gas, and agricultural products. |

| Cryptocurrencies | CFD trading on major cryptocurrencies like Bitcoin, Ethereum, and Litecoin. |

With over 250 instruments available, Uniglobe Markets caters to diverse trading preferences and strategies. The broker's wide asset selection is a significant advantage, as it allows traders to diversify their portfolios and capitalise on opportunities across different markets.

However, it is essential to note that trading CFDs carries a high level of risk, as these instruments are leveraged products. Traders should have a solid understanding of the markets they trade and employ proper risk management techniques to minimise potential losses.

Trading Platforms

Uniglobe Markets provides clients with access to the MetaTrader 5 (MT5) trading platform, which is widely recognised as the industry standard for forex and CFD trading.

MetaTrader 5 (MT5)

MT5 is the successor to MT4 and provides an even more advanced trading environment. In addition to the features offered by MT4, MT5 includes improved charting tools, a built-in economic calendar, and a more advanced programming language for developing EAs. The platform also supports trading across a wider range of financial markets, including stocks and futures, making it suitable for more diverse trading strategies.

MT5 is available for desktop, web, and mobile devices (iOS and Android), providing traders with the flexibility to manage their accounts and execute trades on the go.

Trading Platforms Comparison Table

| Feature | MT5 |

|---|---|

| User-friendly interface | Yes |

| Advanced charting tools | Yes |

| Technical indicators | 40+ |

| Automated trading (EAs) | Yes |

| Mobile trading apps | Yes (iOS, Android) |

| Web trading | Yes |

| Customizable templates | Yes |

| Built-in economic calendar | Yes |

| Multi-asset trading | Extensive |

| Programming language | MQL5 |

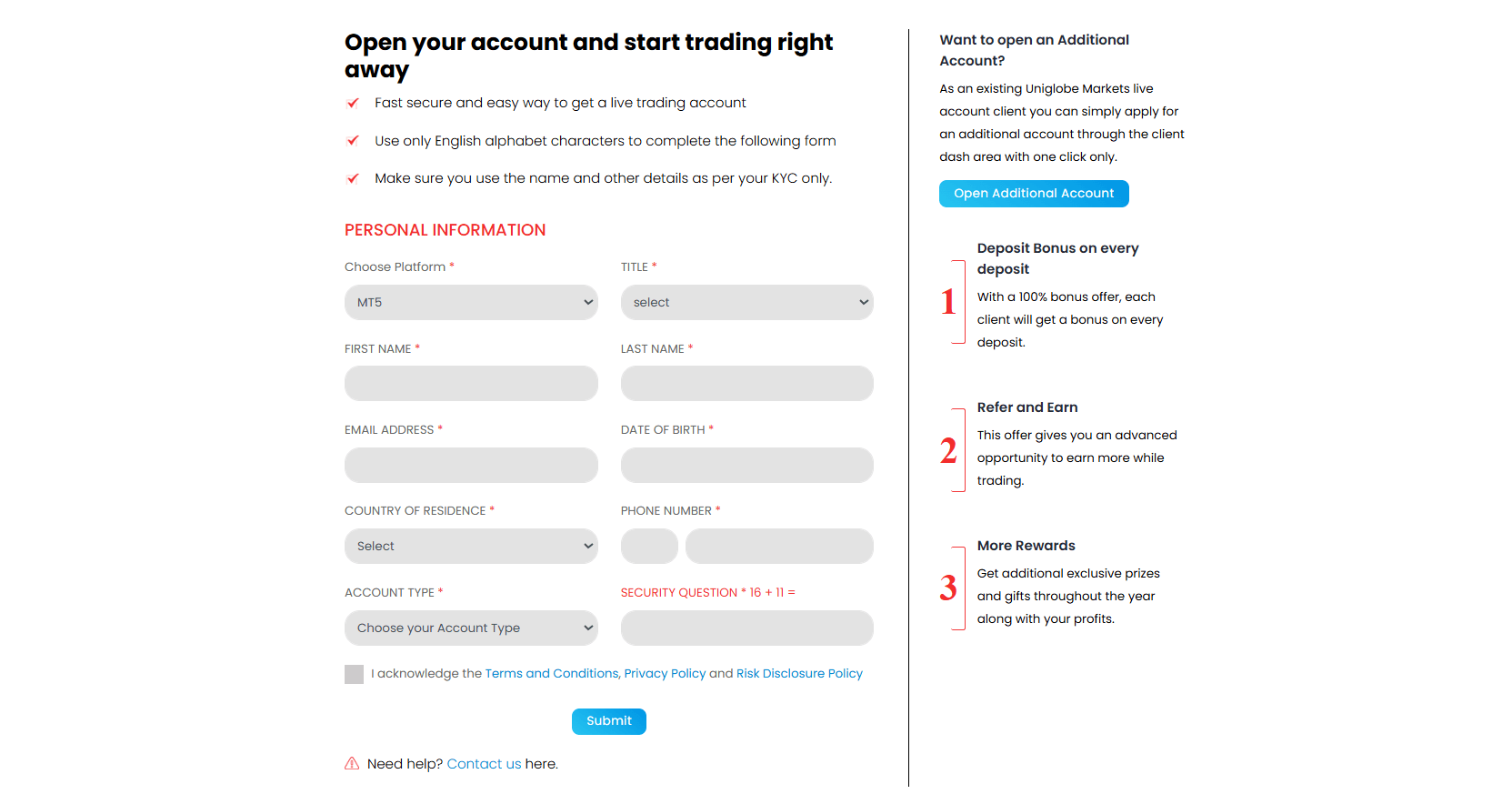

Uniglobe Markets How to Open an Account: A Step-by-Step Guide

To start trading with Uniglobe Markets, follow these steps:

- Visit the Uniglobe Markets official website and click on the "Open an Account" button.

- Fill in the required personal information, such as your name, email address, phone number, and country of residence.

- Choose the account type that best suits your trading needs and experience level (e.g., Micro, Premium, ECN).

- Select your preferred base currency for the account (USD is the default option).

- Agree to the broker's terms and conditions and submit your registration form.

- Check your email for a verification link and click on it to confirm your account.

- Log in to your newly created account and navigate to the deposit section.

- Choose your preferred deposit method (e.g., bank wire, credit/debit card, e-wallet) and follow the instructions to fund your account. The minimum deposit requirement varies depending on the account type, starting from $100 for Micro accounts.

- Once your account is funded, download and install the MetaTrader 5 trading platform on your device.

- Log in to the trading platform using the credentials provided by Uniglobe Markets, and you can start trading.

Please note that Uniglobe Markets may require additional documentation, such as proof of identity and proof of address, to comply with anti-money laundering (AML) and know-your-customer (KYC) regulations. Be prepared to submit these documents when requested to ensure a smooth account opening process.

Charts and Analysis

Uniglobe Markets provides a range of educational resources and trading tools to support clients in their trading activities, although the depth and breadth of these materials are somewhat limited compared to industry leaders.

| Feature | Description |

|---|---|

| Market Analysis | Daily market updates and insights into major financial markets and economic events. |

| Educational Articles | Blog articles on trading topics like fundamental and technical analysis, mainly for beginners. |

| Trading Tools | Access to customisable charts, technical indicators, and graphical tools on the MT5 platform. |

| Economic Calendar | Provides upcoming economic events, but less detailed compared to some competitors. |

| Demo Account | Free demo account available to practise trading strategies with virtual funds. |

While Uniglobe Markets provides a foundation for trader education and market analysis, the broker's resources are not as extensive or in-depth as those offered by some of its competitors. Traders seeking more advanced educational content, such as webinars, video tutorials, or comprehensive trading guides, may need to look elsewhere to supplement their knowledge.

Uniglobe Markets Account Types

Uniglobe Markets offers five different account types to cater to the diverse needs and preferences of traders:

Micro Account

- Minimum deposit: $100

- Leverage: Up to 1:500

- Spreads: From 1.5 pips

- Commission: None

- Ideal for beginner traders with limited capital

Uniglobe Premium Account

- Minimum deposit: $500

- Leverage: Up to 1:300

- Spreads: From 1.3 pips

- Commission: None

- Suitable for more experienced traders seeking better trading conditions

ECN Classic Account

- Minimum deposit: $1,000

- Leverage: Up to 1:200

- Spreads: From 0.0 pips

- Commission: $10 per round lot

- Designed for traders who prefer raw spreads and faster execution

ECN Elite Account

- Minimum deposit: $10,000

- Leverage: Up to 1:100

- Spreads: From 0.0 pips

- Commission: $7 per round lot

- Tailored for high-volume traders and professionals

Uniglobe VIP Account

- Minimum deposit: $50,000

- Leverage: Up to 1:100

- Spreads: From 0.0 pips

- Commission: $2 per round lot

- Exclusive account type with personalized service and priority support

All account types provide access to the MT5 trading platform, as well as a range of trading instruments, including forex, CFDs, indices, metals, commodities, and cryptocurrencies.

The variety of account types offered by Uniglobe Markets is a significant advantage, as it allows traders to choose an account that aligns with their trading style, experience level, and capital. However, it is essential to consider the higher minimum deposit requirements for the more advanced account types, which may not be suitable for all traders.

Traders should also be aware of the potential risks associated with high leverage, as it can amplify both gains and losses. It is crucial to use leverage responsibly and maintain proper risk management practices.

Account Types Comparison Table

| Features | Micro | Uniglobe Premium | ECN Classic | ECN Elite | Uniglobe VIP |

|---|---|---|---|---|---|

| Minimum Deposit | $100 | $500 | $1,000 | $10,000 | $50,000 |

| Leverage | Up to 1:500 | Up to 1:300 | Up to 1:200 | Up to 1:100 | Up to 1:100 |

| Spreads (pips) | From 1.5 | From 1.3 | From 0.0 | From 0.0 | From 0.0 |

| Commission (per lot) | None | None | $10 | $7 | $2 |

| Trading Platform | MT5 | MT5 | MT5 | MT5 | MT5 |

| Tradable Assets | Forex, CFDs, indices, metals, commodities, crypto | Same | Same | Same | Same |

| Customer Support | 24/5 | 24/5 | 24/5 | 24/7 | 24/7 |

| Islamic Account | Available | Available | Available | Available | Available |

| Demo Account | Yes | Yes | Yes | Yes | Yes |

Negative Balance Protection

Uniglobe Markets does not explicitly state whether they offer negative balance protection to their clients. This lack of transparency is concerning, as negative balance protection is an essential safeguard that many regulated brokers provide to ensure traders do not lose more than their account balance. Without negative balance protection, traders are at risk of incurring substantial losses that could exceed their initial deposit. This is particularly true when trading with high leverage, as even small market movements can result in significant losses. Brokers that offer negative balance protection typically cover any negative balances that may occur due to unexpected market events or technical issues, such as slippage or widened spreads during times of high volatility. This protection provides traders with peace of mind, knowing that their losses are limited to the funds in their trading account. Given Uniglobe Markets' unregulated status and lack of clear information regarding negative balance protection, traders should be cautious when considering this broker. It is essential to thoroughly research and compare the risk management features offered by different brokers before making a decision. Traders are advised to prioritise regulated brokers that offer negative balance protection, as this demonstrates a commitment to client safety and fair trading practices. Regulated brokers are also more likely to have investor compensation schemes in place, providing additional protection for traders' funds.

Uniglobe Markets Deposits and Withdrawals

Uniglobe Markets offers a range of payment methods for deposits and withdrawals, providing clients with flexibility and convenience in managing their funds.

Deposit Methods

| Method | Details |

|---|---|

| Bank Wire Transfer | Available, no deposit fees from broker (third-party bank fees may apply) |

| Credit/Debit Cards | Visa, Mastercard; no deposit fees from broker |

| E-wallets | Neteller, Skrill; no deposit fees from broker |

| Cryptocurrencies | Bitcoin, Ethereum; no deposit fees from broker |

| Minimum Deposit | Starts from $100 (Micro account) to $50,000 (VIP account) |

| Maximum Deposit | No maximum deposit limit specified |

Withdrawal Methods

| Method | Details |

|---|---|

| Bank Wire Transfer | Available |

| Credit/Debit Cards | Visa, Mastercard |

| E-wallets | Neteller, Skrill |

| Processing Time | Within 24 hours after verification |

| Additional Verification | May require proof of identity and address (AML/KYC compliance) |

Support Service for Customer

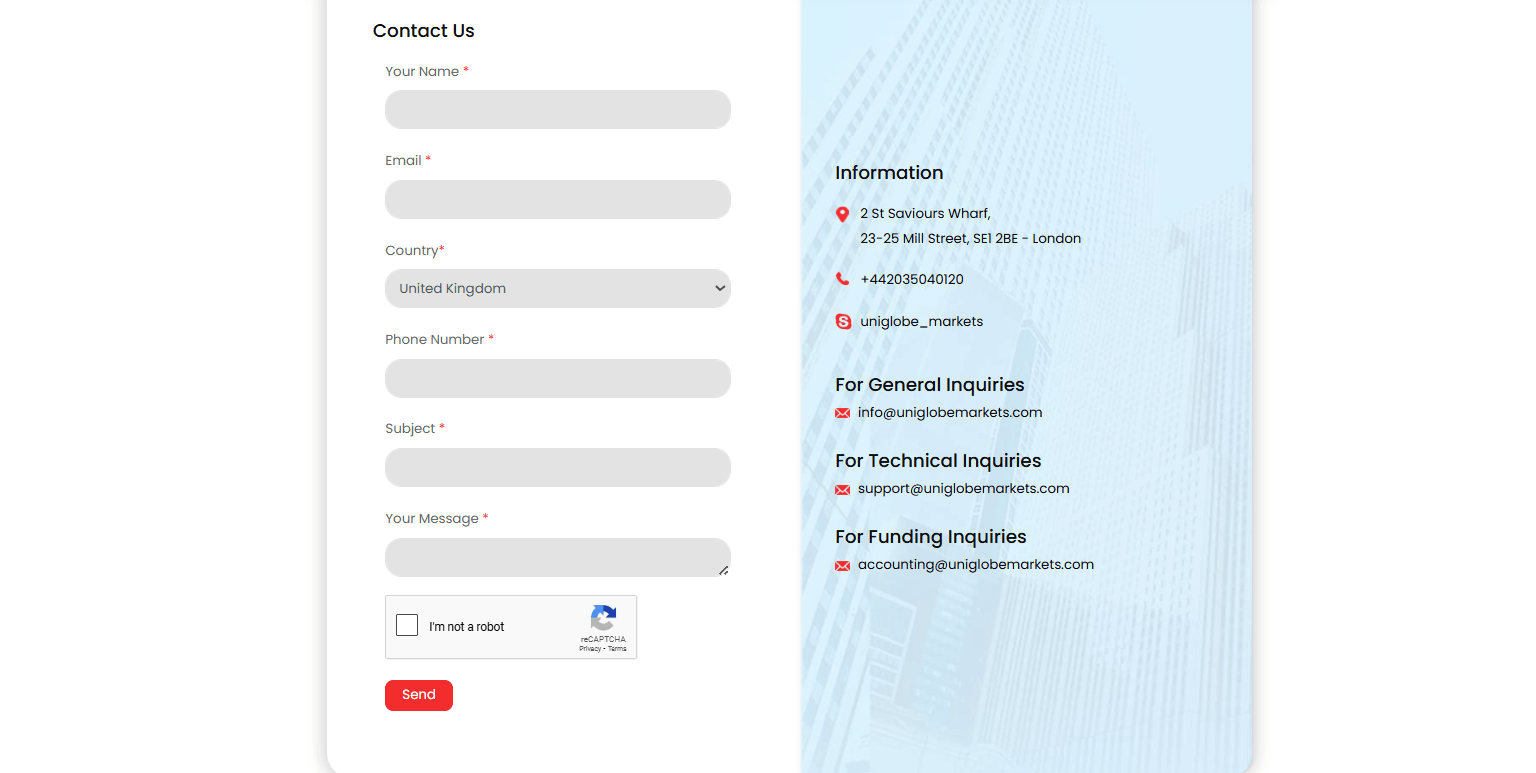

Uniglobe Markets recognises the importance of reliable customer support in providing a positive trading experience for its clients. The broker offers several channels through which traders can reach out for assistance:

- Live Chat: Clients can access the live chat feature on the Uniglobe Markets website for instant support during trading hours.

- Email: Traders can send their enquiries or concerns to the broker's support email address (support@uniglobemarkets.com).

- Phone: Uniglobe Markets provides a dedicated phone number (+442035040120) for clients to contact the support team directly.

- Social Media: The broker maintains active profiles on popular social media platforms, such as Facebook, Twitter, and Instagram, where clients can reach out for assistance or stay updated with the latest news and promotions.

Customer Support Comparison Table

| Feature | Availability |

|---|---|

| Live Chat | Yes |

| Email Support | Yes |

| Phone Support | Yes |

| Social Media Support | Yes |

| Multilingual Support | Limited |

| Support Hours | 24/5 |

| 24/7 Support | Only for ECN Elite and Uniglobe VIP accounts |

| Support Quality | Mixed user reviews |

| Regulated Support | No |

Prohibited Countries

Uniglobe Markets does not provide a clear list of prohibited countries on its website. The lack of transparency regarding restricted jurisdictions is a concern, as traders from certain regions may be unknowingly attempting to access the broker's services without proper authorisation.

Many brokers explicitly state the countries in which they are not allowed to operate due to regulatory restrictions or their own internal policies. This information helps traders make informed decisions and avoid potential legal issues.

The absence of a prohibited countries list may be attributed to Uniglobe Markets' unregulated status. As the broker is not licensed by any reputable financial authority, it may not be subject to the same level of oversight and restrictions as regulated brokers.

However, it is essential to note that even if Uniglobe Markets does not explicitly prohibit certain countries, traders are still responsible for ensuring compliance with their local laws and regulations. Trading with an unregulated broker may be illegal in some jurisdictions, and individuals should seek professional advice before engaging in any trading activities.

Traders should also be aware that unregulated brokers may not provide the same level of protection and recourse as regulated entities. In the event of a dispute or issue with the broker, traders from prohibited countries may have limited options for resolving their concerns.

To ensure a safe and compliant trading experience, traders are advised to choose brokers that are properly regulated by reputable authorities in their country of residence. Regulated brokers are required to adhere to strict guidelines and provide clear information about their services, fees, and restricted jurisdictions.

Special Offers for Customers

Uniglobe Markets provides a range of promotional offers and bonuses to attract new clients and incentivise trading activity.

| Program | Details |

|---|---|

| Referral Program | Earn commission based on referred friends' trading volume |

| Loyalty Program | Tiered benefits (e.g., reduced spreads, faster withdrawals, exclusive event invitations) |

| Trading Competitions | Compete for prizes (cash, gadgets, luxury vacations) based on trading volume or profitability |

While these promotional offers may seem attractive, traders should carefully review the terms and conditions associated with each promotion. Some offers may have high trading volume requirements or restrict withdrawals until specific criteria are met, which can impact the overall profitability of trading.

Moreover, the use of bonuses and promotions is a common marketing tactic among unregulated brokers to attract clients. Regulated brokers are often subject to stricter guidelines regarding the use of incentives and are required to clearly disclose the terms and potential risks associated with such offers.

Traders should prioritise choosing a broker based on factors such as regulation, trading conditions, and overall reliability, rather than being swayed by short-term promotional offers. It is essential to consider the long-term sustainability and safety of trading with a particular broker.

Conclusion

After thoroughly reviewing Uniglobe Markets, I have mixed feelings about recommending them as a reliable and trustworthy broker. While they offer a wide range of trading instruments, competitive trading conditions, and attractive promotional offers, their lack of regulation and transparency raises significant concerns.

One of the most critical aspects of choosing a broker is ensuring that they are properly regulated by reputable financial authorities. Uniglobe Markets, however, is not regulated by any top-tier regulatory bodies, such as the FCA, ASIC, or CySEC. Instead, they are registered in St Vincent and the Grenadines, a jurisdiction known for its lax financial oversight. This lack of regulation means that clients' funds are not protected by investor compensation schemes, and there is limited recourse in the event of a dispute or broker insolvency.

Another area of concern is the limited transparency regarding certain aspects of their operations. For example, Uniglobe Markets does not provide a clear list of prohibited countries, which may lead to traders unknowingly engaging in trading activities that are not permitted in their jurisdiction. The broker also does not explicitly state whether they offer negative balance protection, which is a crucial risk management feature that many regulated brokers provide.

On the positive side, Uniglobe Markets offers a diverse range of trading instruments, including forex, CFDs, indices, metals, commodities, and cryptocurrencies. They also provide access to the popular MetaTrader 5 platforms, which are known for their reliability and advanced trading tools. The broker offers competitive spreads and leverage of up to 1:500, which may appeal to traders looking for higher potential returns.

However, it is essential to remember that high leverage can also amplify losses, and trading with an unregulated broker carries additional risks. Uniglobe Markets' educational resources and customer support, while available, are not as comprehensive or reliable as those offered by many regulated brokers.

In conclusion, while Uniglobe Markets may offer some attractive features and trading conditions, their lack of regulation and limited transparency make them a high-risk choice for most traders. I strongly advise traders to prioritise working with regulated brokers that offer robust investor protections, segregated client funds, and a proven track record of reliability. Before committing funds to any broker, traders should thoroughly research their reputation, read user reviews, and verify their regulatory status with the relevant authorities.

Review raw-spread accounts in the low-cost broker reviews index.

Institutional bridging? Try the Blackwell Global review.