Valetax Review 2025: FSC Broker with MT4/MT5 & $1 Deposit

Valetax

Mauritius

Mauritius

-

Minimum Deposit $1

-

Withdrawal Fee $varies

-

Leverage 2000:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Unavailable

-

Indices Available

Licenses

Forex & CFD Brokerage License

Forex & CFD Brokerage License

Softwares & Platforms

Customer Support

+23069315022

(English)

+23069315022

(English)

Supported language: English

Social Media

Summary

Valetax is an offshore broker licensed by the Mauritius FSC and registered in St. Vincent & the Grenadines.

It provides access to MT4 and MT5 platforms across desktop, web, and mobile, with multiple account types starting from just $1. Tradable assets include forex, metals, energies, indices, and cryptocurrencies, with leverage up to 1:2000. Clients benefit from 24/7 support and flexible payment options, including USDT and regional online banking. However, offshore regulation and mixed reviews raise trust and safety concerns, so risk management is essential.

- Very low minimum deposits from $1

- MT4 and MT5 platform availability

- Multiple account types for different needs

- 24/7 customer support advertised

- USDT cryptocurrency deposits accepted

- High leverage up to 1:2000 available

- Wide range of payment methods

- No commission on most accounts

- Scalping and EA trading allowed

- Multiple asset classes available

- Offshore regulation only (Mauritius FSC)

- No top-tier regulatory oversight

- Multiple safety warnings from reviewers

- Negative balance protection not universal

- Limited educational resources

- Bonus terms may restrict withdrawals

- Prohibited in major markets like US

- Mixed customer feedback reported

- Limited company transparency

- Higher risk profile overall

Overview

Valetax operates as a multi-asset CFD broker through two entities: Valetax International Limited in Mauritius and Valetax Global Limited in St. Vincent & the Grenadines. The Mauritius entity holds FSC Investment Dealer licence GB21026312, providing forex, metals, energies, indices, and cryptocurrency trading through MetaTrader 4 and MetaTrader 5 platforms. With minimum deposits starting from just $1 and leverage reaching up to 1:2000, Valetax targets both novice and experienced traders seeking accessible trading conditions.

However, the offshore regulatory framework raises important considerations. Independent safety reviewers consistently flag Valetax as higher-risk compared to brokers regulated in top-tier jurisdictions like the UK, Australia, or the United States. While Mauritius FSC provides a recognized regulatory framework, it lacks the robust investor protection schemes, compensation funds, and strict oversight standards found in major financial centers. This regulatory positioning significantly impacts fund safety, dispute resolution options, and overall client protection levels.

Overview Table

| Feature | Details |

|---|---|

| Company Entities | Valetax International Limited (Mauritius), Valetax Global Limited (SVG) |

| Primary Regulation | Mauritius FSC License GB21026312 |

| Trading Platforms | MT4, MT5 (Desktop, Web, Mobile) |

| Minimum Deposit | From $1 (varies by account) |

| Maximum Leverage | Up to 1:2000 |

| Spread Type | Variable, from 0.0 pips (ECN) |

| Account Types | 6 types: Cent, Standard, ECN, Booster, Bonus, PRO |

| Asset Classes | Forex, Metals, Energies, Indices, Cryptocurrencies |

| Payment Methods | Bank transfers, e-wallets, USDT, regional banking |

| Customer Support | 24/7 Live Chat |

Facts List

- Licensed by Mauritius FSC under Investment Dealer license GB21026312

- Operates through two legal entities in offshore jurisdictions

- Offers industry-standard MT4 and MT5 platforms across all devices

- Provides six distinct account types catering to different trading styles

- Minimum deposits start from $1 on select accounts

- Maximum leverage reaches 1:2000, significantly above industry standards

- Restricted in major markets including United States, Singapore, Iran, North Korea

- Accepts cryptocurrency deposits through USDT

- Negative balance protection varies by region with specific exclusions

- Multiple third-party reviewers advise caution due to offshore status

Valetax Licenses and Regulatory

Valetax International Limited operates under Mauritius Financial Services Commission license GB21026312 as an Investment Dealer (Full Service, excluding underwriting). While the FSC Mauritius represents a legitimate regulatory body, it's crucial to understand this falls into the offshore category rather than top-tier regulation.

The second entity, Valetax Global Limited, maintains registration in St. Vincent & the Grenadines (23398 BC 2016), which provides no financial regulatory oversight—merely corporate registration. This dual-entity structure is common among offshore brokers but offers significantly less protection than single-entity operations under strict regulators.

Compared to FCA, ASIC, or SEC regulation, Mauritius FSC oversight lacks several critical protections: no comprehensive compensation schemes, limited capital adequacy requirements, less stringent segregation rules for client funds, and reduced enforcement capabilities for international disputes.

Trading Instruments

Valetax provides access to multiple asset classes through CFD trading. The forex offering covers major, minor, and select exotic pairs, with spreads varying significantly by account type. Precious metals include gold and silver against major currencies. Energy traders can access WTI and Brent crude contracts. Major global indices from US, European, and Asian markets are available, along with select cryptocurrency pairs for digital asset exposure.

| Asset Class | Examples | Typical Spreads | Available On |

|---|---|---|---|

| Forex | EUR/USD, GBP/USD, USD/JPY | From 0.0 pips (ECN) | All accounts |

| Metals | XAU/USD, XAG/USD | From 0.3 pips | All accounts |

| Energies | WTI, Brent | Variable | All accounts |

| Indices | US30, GER40, UK100 | Variable | All accounts |

| Cryptocurrencies | BTC/USD, ETH/USD | Variable | Selected accounts |

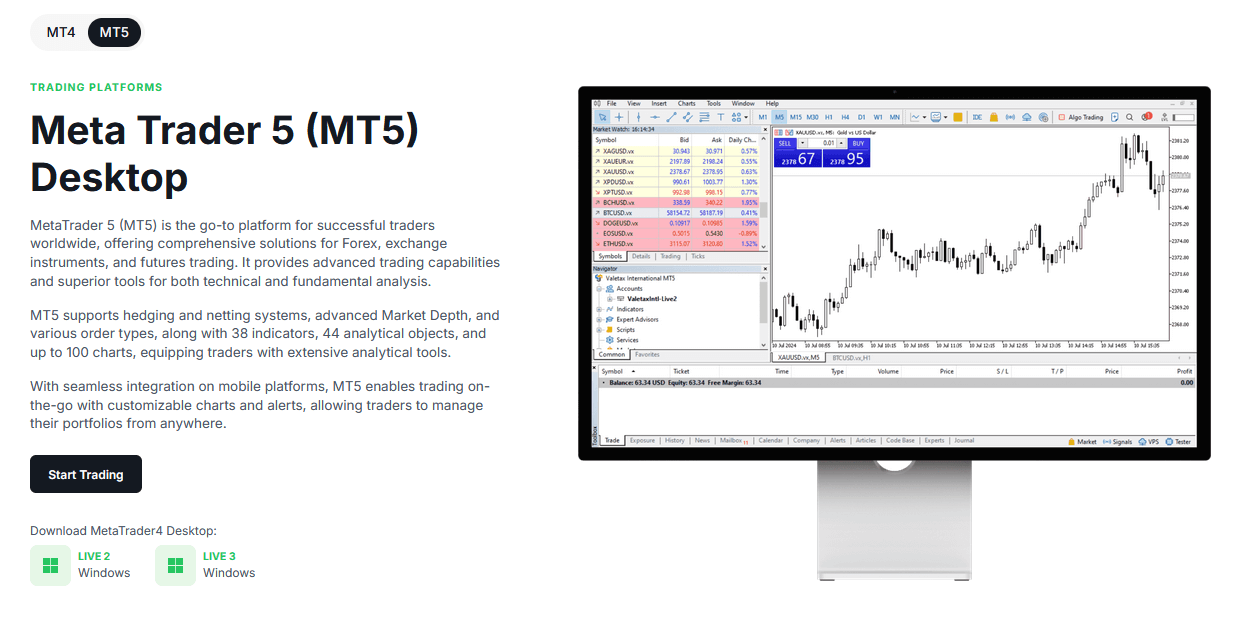

Trading Platforms

Valetax delivers trading services exclusively through MetaQuotes software—MetaTrader 4 and MetaTrader 5. Both platforms are available across desktop (Windows/Mac), web browser, and mobile applications (iOS/Android). MT5 represents the more advanced option with additional timeframes, depth of market, and enhanced analytical tools. The web versions provide instant access without installation, while mobile apps enable position management on-the-go.

Trading Platform Comparison Table

| Feature | MT4 Desktop | MT5 Desktop | Web Trader | Mobile Apps |

|---|---|---|---|---|

| Installation Required | Yes | Yes | No | Yes |

| Expert Advisors | Full support | Full support | Limited | No |

| Indicators | 30+ built-in | 38+ built-in | Basic set | Limited |

| Timeframes | 9 | 21 | 9 | 9 |

| Depth of Market | No | Yes | No | No |

| One-Click Trading | Yes | Yes | Yes | Yes |

| Hedging Allowed | Yes | Yes | Yes | Yes |

Valetax How to Open an Account: A Step-by-Step Guide

- Visit Valetax website and click registration

- Complete email verification process

- Access member area for KYC submission

- Upload government-issued ID and proof of address

- Select preferred account type (Cent/Standard/ECN/Booster/Bonus/PRO)

- Choose base currency and leverage settings

- Fund account using available payment methods

- Download MT4/MT5 platform

- Login with provided credentials

- Begin trading with appropriate position sizing

Charts and Analysis

Valetax provides trading tools primarily through the MetaTrader platforms rather than proprietary educational content. The broker's educational offerings appear limited compared to industry leaders, relying heavily on third-party MetaTrader features and basic market information tools.

| Resource Type | Availability | Quality Level | Accessibility | Value for Beginners | Value for Advanced |

|---|---|---|---|---|---|

| Platform Tutorials | Basic | Standard | Member area | Moderate | Low |

| Economic Calendar | Yes | Third-party | Website/MT4/MT5 | High | High |

| Technical Indicators | 30+ (MT4), 38+ (MT5) | Industry standard | Platform only | Moderate | High |

| Chart Patterns | Via MT platforms | Standard | Platform only | Low | Moderate |

| Market News Feed | Yes | Third-party feeds | Platform/Website | Moderate | Moderate |

| Webinars | Not evident | N/A | N/A | N/A | N/A |

| Educational Videos | Limited/None | N/A | N/A | N/A | N/A |

| Trading Guides | FAQ only | Basic | Website | Low | Low |

| Market Analysis | Limited | Basic | Website | Low | Low |

| Demo Account | Yes | Standard | All platforms | High | Moderate |

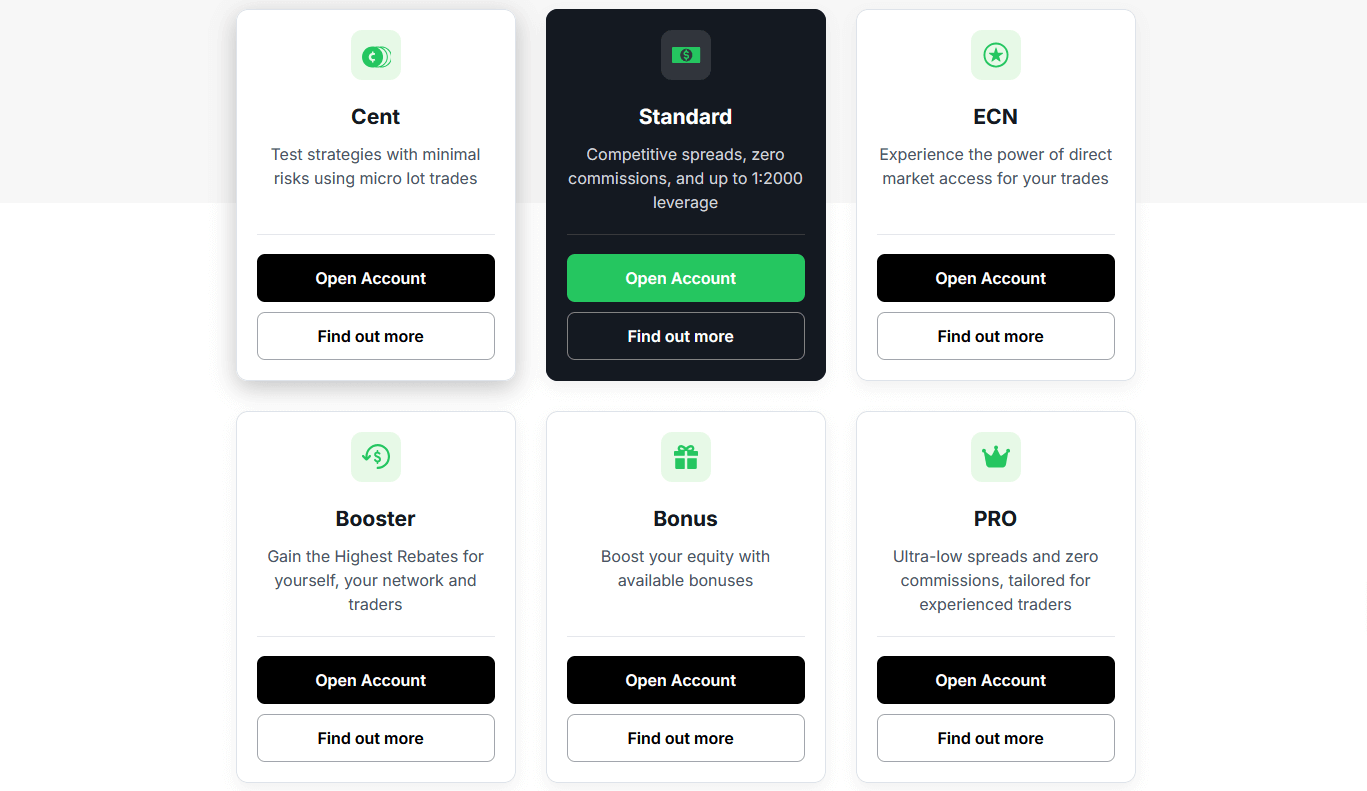

Valetax Account Types

Valetax structures six account types targeting different trader profiles. The Cent account enables micro-lot trading with $1 minimum deposit. Standard accounts offer typical retail conditions with no commissions. ECN provides direct market access with raw spreads plus commission. Booster focuses on rebate programs. Bonus accounts include promotional offers with specific terms. PRO accounts require $500 minimum for tighter spreads.

Account Types Comparison Table

| Feature | Cent | Standard | ECN | Booster | Bonus | PRO |

|---|---|---|---|---|---|---|

| Min Deposit | $1 | $1 | $50 | $1 | $1 | $500 |

| Typical Spread | 1.2 pips | 1.2 pips | 0.0 pips | 2.0 pips | 2.0 pips | 0.6 pips |

| Commission | No | No | $4/lot | No | No | No |

| Max Leverage | 1:1000 | 1:2000 | 1:2000 | 1:2000 | 1:500 | 1:2000 |

| Platforms | MT4/MT5 | MT4/MT5 | MT4/MT5 | MT4/MT5 | MT4 only | MT4/MT5 |

| Min Lot Size | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 |

| Margin Call | 60% | 60% | 60% | 60% | 60% | 60% |

| Stop Out | 30% | 30% | 30% | 30% | 30% | 30% |

Negative Balance Protection

Valetax indicates negative balance protection availability varies by region, specifically noting exclusions for Malaysia and Indonesia while offering protection in other regions. This geographic variation in fundamental protection raises concerns about consistency and reliability. Offshore brokers typically provide NBP through internal policy rather than regulatory mandate, meaning enforcement and reliability differ from regulated requirements in major jurisdictions.

Valetax Deposits and Withdrawals

Payment processing includes regional online banking for specific countries, USDT cryptocurrency transfers, e-wallets, and traditional bank transfers. Minimum deposits vary from $1 to $500 depending on account type. Processing times range from instant to several hours based on method. USDT transactions carry a 1.5 USDT fee, while other methods may include processor charges.

Payment Methods Comparison Table

| Method | Minimum | Processing Time | Fees | Availability |

|---|---|---|---|---|

| Bank Transfer | Varies | 1-3 days | Varies | Global |

| Local Banking (MY/ID) | 50 MYR/IDR | Instant-hours | None | Regional |

| E-wallets | Varies | Instant-hours | Varies | Selected regions |

| USDT | 50 USDT | Minutes-hours | 1.5 USDT | Global |

| Cards | Varies | Instant | Varies | Limited regions |

Support Service for Customer

Valetax advertises 24/7 customer support primarily through live chat integrated into their website and member area. Email support is available through contact forms, with phone support mentioned in some third-party listings though not prominently featured on the main website.

Customer Support Availability Table

| Channel | Availability | Response Time | Languages |

|---|---|---|---|

| Live Chat | 24/7 | Minutes | Multiple |

| 24/7 | Hours-1 day | Multiple | |

| Phone | Business hours | Immediate | Limited |

| FAQ/Help Center | Always available | N/A | English |

Prohibited Countries

Valetax restricts services to residents of the United States, Singapore, Iran, North Korea, and other sanctioned jurisdictions. These restrictions stem from regulatory requirements and international sanctions compliance.

Special Offers for Customers

Valetax promotes various bonuses and rebate programs, particularly through Booster and Bonus account types. These promotions typically include deposit bonuses and trading rebates but come with specific terms including turnover requirements and withdrawal restrictions that traders must carefully review.

Conclusion

Valetax presents a mixed profile for potential traders. The broker offers accessible trading conditions with low minimum deposits and familiar MetaTrader platforms. However, the offshore regulatory status under Mauritius FSC, combined with cautionary flags from independent reviewers, positions this as a higher-risk option compared to established brokers in major jurisdictions. The extremely high leverage up to 1:2000 and regional variations in protection policies further emphasize the need for careful consideration. Traders prioritizing fund safety and regulatory protection should compare Valetax against top-tier regulated alternatives.