Vantage Review 2025: A Trusted Broker for Forex and CFD Trading

Vantage Markets

Australia

Australia

-

Minimum Deposit $50

-

Withdrawal Fee $0

-

Leverage 500:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Unavailable

-

Stock Available

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

South Africa Retail Forex License

South Africa Retail Forex License

Australia Retail Forex License

Australia Retail Forex License

Forex Trading License

Forex Trading License

Softwares & Platforms

Customer Support

+611300945517

(English)

+611300945517

(English)

Supported language: Chinese (Simplified), English, Indonesian, Vietnamese

Social Media

Summary

Vantage Markets is a globally trusted Forex and CFD broker offering access to forex, commodities, indices, shares, and cryptocurrencies. Regulated in multiple jurisdictions, it provides traders with advanced platforms like MT4 and MT5, competitive spreads, and lightning-fast execution. With innovative tools, copy trading options, and excellent customer support, Vantage caters to both beginners and professionals. Its secure and user-friendly trading environment makes it a top choice for traders worldwide.

- Strong regulatory compliance with top-tier authorities

- Wide range of tradable instruments for diversification

- Competitive spreads and low minimum deposits

- Advanced trading platforms (MT4/5, Vantage App, TradingView)

- Comprehensive educational resources and market analysis

- 24/7 multilingual customer support

- Negative balance protection and segregated client funds

- Variety of account types for different trading styles

- Transparent fee structure with no hidden costs

- Special offers and loyalty program for added value

- Not available to residents of certain countries, including the USA

- Limited range of deposit and withdrawal options compared to some competitors

- Relatively high minimum deposit for Pro ECN account ($10,000)

- No direct telephone support for general inquiries

- Educational resources could be more comprehensive and structured

- Lack of social trading features on proprietary platforms

- Overnight fees charged on leveraged positions

- Inactivity fees applied after 6 months of no trading activity

- Limited customization options on the Vantage App compared to MT4/5

- No support for automated trading on the Vantage App

Overview

Vantage Markets is a global forex and CFD broker established in 2009. Headquartered in Sydney, Australia, it has additional offices in the UK, Cayman Islands, and China. Vantage is regulated by top-tier authorities, including ASIC (Australia), FCA (UK), CIMA (Cayman Islands), VFSC (Vanuatu), and is registered with the FSCA in South Africa.

With over 1,000 tradable instruments spanning forex, indices, commodities, ETFs, share CFDs, and bonds, Vantage caters to a diverse community of 5+ million traders. The broker offers competitive spreads from 0 pips, leverage up to 1000:1, and a low $50 minimum deposit. Clients can choose from various account types and trade on advanced platforms like MetaTrader 4/5, TradingView, and the proprietary Vantage App.

Vantage provides comprehensive educational resources, including webinars, courses, and expert analysis. Premium clients can access PRO Trader Tools and copy trading via MyFXBook and DupliTrade. The broker ensures fund security through segregated accounts and negative balance protection. However, Vantage's services are not available to residents of the USA, Canada, and some other jurisdictions. For a more detailed breakdown traders can visit Vantage Markets' official website at vantagemarkets.com.

Overview Table

| Aspect | Details |

|---|---|

| Foundation | 2009 |

| Headquarters | Sydney, Australia |

| Regulation | ASIC, FCA, CIMA, VFSC, FSCA |

| Instruments | 1000+ (Forex, Indices, Commodities, ETFs, Share CFDs, Bonds) |

| Minimum Deposit | $50 |

| Maximum Leverage | 1000:1 |

| Spreads | From 0 pips |

| Platforms | MetaTrader 4/5, TradingView, Vantage App |

| Unique Features | PRO Trader Tools, Copy Trading, Negative Balance Protection |

| Customer Support | 24/7 via Live Chat, Email, Contact Form, Help Center |

Facts List

- Vantage Markets was founded in 2009 and is headquartered in Sydney, Australia.

- The broker is regulated by ASIC, FCA, CIMA, VFSC, and registered with the FSCA.

- Vantage offers over 1,000 tradable instruments, including forex, indices, commodities, ETFs, share CFDs, and bonds.

- Clients can access competitive spreads from 0 pips and leverage up to 1000:1.

- The minimum deposit required to open an account is $50.

- Vantage supports trading on advanced platforms such as MetaTrader 4/5, TradingView, and its proprietary Vantage App.

- Premium clients can benefit from PRO Trader Tools and copy trading via MyFXBook and DupliTrade.

- The broker provides comprehensive educational resources, including webinars, courses, and expert analysis.

- Client funds are protected through segregated accounts and negative balance protection.

- Vantage's services are not available to residents of the USA, Canada, and some other jurisdictions.

Vantage Markets Licenses and Regulatory

Vantage Markets operates under a robust regulatory framework, holding licenses from multiple respected authorities worldwide. The broker's primary regulator is the Australian Securities and Investments Commission (ASIC), which oversees its operations through the entity Vantage Global Prime Pty Ltd. ASIC is known for its stringent regulatory standards, ensuring that brokers adhere to strict financial services laws and prioritize client protection.

In addition to ASIC, Vantage holds licenses from the Financial Conduct Authority (FCA) in the United Kingdom, the Cayman Islands Monetary Authority (CIMA), and the Vanuatu Financial Services Commission (VFSC). The broker is also registered with the Financial Sector Conduct Authority (FSCA) in South Africa. This multi-jurisdictional regulation demonstrates Vantage's commitment to compliance and its ability to serve clients across various regions.

| Regulatory Authority | License No. | Entity Name |

|---|---|---|

| Australian Securities and Investments Commission (ASIC) | 428901 | Vantage Global Prime Pty Ltd |

| Financial Conduct Authority (FCA) | 590299 | Vantage Global Prime LLP |

| Cayman Islands Monetary Authority (CIMA) | 1383491 | Vantage International Group Limited |

| Vanuatu Financial Services Commission (VFSC) | 700271 | Vantage Global Limited |

| Financial Sector Conduct Authority (FSCA) | FSP No. 51268 | Vantage Markets (PTY) LTD (Registration) |

Compared to industry standards, Vantage's regulatory standing is commendable. While many brokers operate with a single license or focus on offshore regulation, Vantage's multi-jurisdictional approach sets it apart. By adhering to the strict standards set by top-tier regulators like ASIC and the FCA, Vantage demonstrates a commitment to client security and regulatory compliance that exceeds the norm.

Trading Instruments

Vantage Markets offers an extensive range of tradable assets, catering to the diverse needs and preferences of traders worldwide. With over 1,000 instruments available, the broker provides access to a comprehensive array of markets, enabling clients to build versatile portfolios and seize opportunities across various asset classes.

| Asset Class | Details |

|---|---|

| Forex | Offers a wide selection of currency pairs, including majors, minors, and exotics. Competitive spreads starting from 0.0 pips on popular pairs like EUR/USD and GBP/USD. Deep liquidity and opportunities for diversification. |

| Indices | Access to global stock indices such as the S&P 500, NASDAQ 100, FTSE 100, and DAX 30. Competitive spreads and flexible contract sizes for market-wide trading opportunities. |

| Commodities | Includes precious metals (gold, silver), energy products (crude oil, natural gas), and agricultural goods. Provides hedging opportunities against market volatility with leverage options. |

| Share CFDs | Trade individual stocks from global markets without owning the underlying assets. Competitive spreads and flexible contract sizes for diversified stock trading. |

| ETFs | Access to a selection of Exchange-Traded Funds (ETFs), allowing exposure to various market sectors or investment themes. Competitive spreads and leverage options for diversified trading strategies. |

| Bonds | Trade government and corporate bond CFDs from different countries. Provides exposure to fixed-income markets with opportunities to benefit from interest rate fluctuations. |

The breadth and depth of Vantage Markets' tradable assets reflect the broker's commitment to meeting the diverse needs of its global client base. By offering a comprehensive range of instruments across multiple asset classes, Vantage empowers traders to build versatile portfolios, manage risk effectively, and seize opportunities in various market conditions.

Compared to industry standards, Vantage's offering of over 1,000 tradable instruments stands out as a testament to the broker's adaptability and dedication to providing a comprehensive trading experience. This extensive array of assets enables clients to diversify their portfolios, implement a wide range of trading strategies, and potentially capitalize on market movements across the globe.

Trading Platforms

Vantage Markets offers a range of trading platforms to cater to the diverse needs and preferences of its clients. The broker provides access to both industry-standard platforms and proprietary software, ensuring that traders can choose the tools that best suit their trading style and experience level.

| Platform | Details |

|---|---|

| MetaTrader 4 (MT4) | Industry-leading platform with a user-friendly interface, advanced charting tools, and extensive customization. Supports automated trading via Expert Advisors (EAs). Allows trading in forex, indices, commodities, and more. |

| MetaTrader 5 (MT5) | Enhanced successor to MT4, offering advanced charting, a wider range of technical indicators, and additional asset classes like stocks and futures. Supports automated trading and custom script development. |

| TradingView | Integrated web-based charting and analysis platform. Features a user-friendly interface, advanced charting tools, and a broad range of technical indicators. Allows seamless market analysis and trade execution. |

| Vantage App | Proprietary mobile trading app for iOS and Android. Offers real-time quotes, advanced charting, and an intuitive interface for placing and managing trades on the go. |

| Web Trading | Web-based access to MT4, MT5, and TradingView via Vantage Markets' website. Enables trading from any device with an internet connection, eliminating the need for software installation. |

The variety of trading platforms offered by Vantage Markets demonstrates the broker's commitment to providing clients with the tools they need to succeed in the markets. By offering industry-standard platforms like MT4 and MT5, along with proprietary solutions like the Vantage App and web-based trading, the broker ensures that traders can choose the platform that best suits their needs and preferences.

Compared to industry standards, Vantage Markets' offering of multiple platforms, including both downloadable software and web-based solutions, stands out as a testament to the broker's adaptability and dedication to meeting the diverse needs of its client base. By providing access to popular platforms like MT4 and MT5, along with proprietary tools and integrations, Vantage Markets ensures that its clients have the resources they need to succeed in the fast-paced world of online trading.

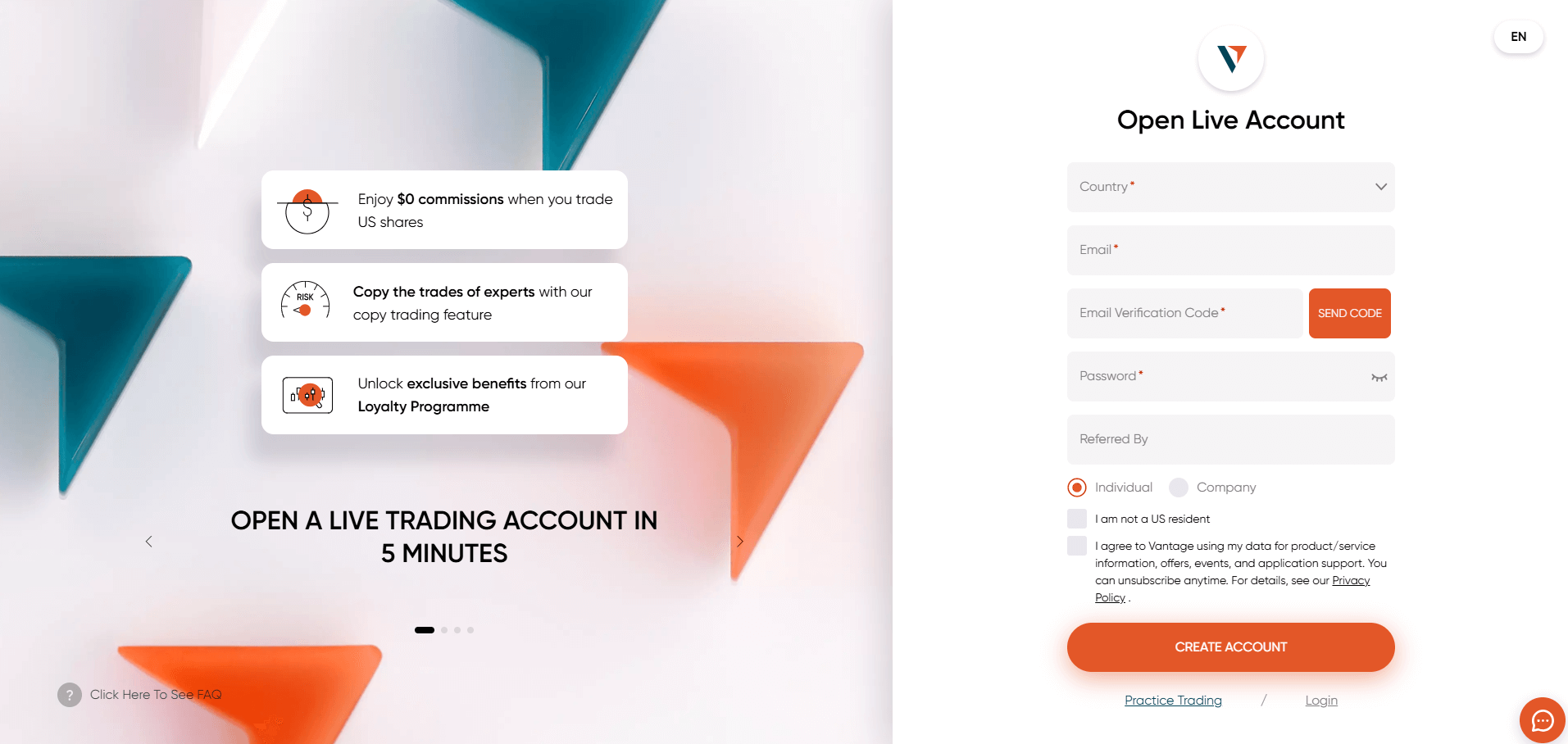

Vantage Markets How to Open an Account: A Step-by-Step Guide

Opening an account with Vantage Markets is a straightforward and user-friendly process. The broker has streamlined the application procedure to ensure that clients can start trading as quickly as possible, while still adhering to necessary regulatory requirements and security measures.

Step 1: Visit the Vantage Markets Website To begin the account opening process, visit the Vantage Markets website. Click on the "Open an Account" button, which is prominently displayed on the homepage.

Step 2: Choose Your Account Type Vantage Markets offers several account types to cater to the diverse needs of traders. Select the account type that best suits your trading style, experience level, and investment goals. The available account types include Standard STP, Raw ECN, Pro ECN, and Swap-Free accounts.

Step 3: Complete the Registration Form Fill out the online registration form with your personal information, including your full name, email address, phone number, and country of residence. You will also need to create a secure password for your account.

Step 4: Verify Your Identity To comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, Vantage Markets requires clients to verify their identity. You will need to provide a valid government-issued ID, such as a passport or driver's license, along with proof of address, such as a utility bill or bank statement.

Step 5: Fund Your Account Once your account is verified, you can fund it using one of the many payment methods accepted by Vantage Markets. The broker accepts deposits via credit/debit cards, bank wire transfers, and various e-wallets, such as Skrill and Neteller. The minimum deposit required to open an account is $50, and deposits are processed instantly in most cases.

Step 6: Download and Install a Trading Platform Vantage Markets offers several trading platforms, including the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Download and install the platform of your choice on your desktop or mobile device, or access the web-based versions directly through your browser.

Step 7: Start Trading Once your account is funded and your trading platform is set up, you can start trading the wide range of instruments offered by Vantage Markets. The broker provides access to forex, indices, commodities, shares, ETFs, and bonds, allowing you to diversify your portfolio and take advantage of various market opportunities.

Throughout the account opening process, Vantage Markets provides dedicated customer support to assist you with any questions or concerns you may have. The broker's support team is available 24/5 via live chat, email, and telephone, ensuring that you can get the help you need whenever you need it.

By offering a simple and efficient account opening process, Vantage Markets demonstrates its commitment to providing a seamless and user-friendly experience for its clients. The broker's streamlined application procedure, combined with its low minimum deposit requirement and wide range of payment methods, makes it easy for traders of all levels to get started with online trading.

Charts and Analysis

Vantage Markets offers a comprehensive suite of educational trading resources and tools to support its clients in their trading journey. The broker recognizes the importance of continuous learning and skill development in the dynamic world of online trading and has invested in providing a diversified range of educational materials to cater to traders of all levels.

| Feature | Details |

|---|---|

| Trading Charts | Available on MT4, MT5, and TradingView, featuring a wide range of technical indicators, drawing tools, and customizable options for in-depth market analysis. |

| Market Analysis | Regular blog posts and video updates from expert analysts covering key market events, economic data releases, and geopolitical developments across forex, indices, commodities, and shares. |

| Economic Calendar | Real-time updates on important market-moving events such as central bank meetings, GDP releases, and employment data, helping traders plan their strategies. |

| Webinars and Seminars | Live sessions hosted by industry experts covering topics from basic trading concepts to advanced strategies. Provides interactive opportunities for Q&A and discussion. |

| Downloadable Educational Resources | Library of e-books, trading guides, and course materials on topics such as risk management, technical analysis, fundamental analysis, and trading psychology. Available in multiple languages. |

| Market News and Insights | Real-time news feed with headlines from reputable sources, along with in-depth articles and analysis on key market trends published on the broker’s blog. |

Compared to industry standards, Vantage Markets' educational offering is comprehensive and well-rounded. The broker's commitment to providing a diverse range of resources, from trading charts and market analysis to webinars and downloadable materials, demonstrates its dedication to supporting the learning and development of its clients.

By investing in a robust suite of educational tools, Vantage Markets empowers its clients to enhance their trading knowledge, develop new skills, and stay informed about market developments. This commitment to education sets the broker apart from competitors who may offer more limited resources or focus solely on providing trading platforms.

Vantage Markets Account Types

Vantage Markets offers a range of trading account types to cater to the diverse needs and preferences of its clients. Whether you're a beginner or an experienced trader, the broker has an account type that suits your trading style, risk tolerance, and investment goals.

| Feature | Standard STP Account | Raw ECN Account | Pro ECN Account | Swap-Free Account | Demo Account |

|---|---|---|---|---|---|

| Spreads | From 1.4 pips | From 0.0 pips | From 0.0 pips | From 1.4 pips | Simulated market spreads |

| Commission | No commission | $3 per lot per side | $1.5 per lot per side | No commission | No commission |

| Minimum Deposit | $50 | $50 | $10,000 | $50 | No deposit (virtual funds) |

| Execution Type | STP (Straight Through Processing) | ECN (Electronic Communication Network) | ECN | STP | Simulated execution |

| Swap-Free Option | No | No | No | Yes | Not applicable |

| Ideal For | Beginner traders | Active & experienced traders | Professional traders & institutions | Traders avoiding swap/rollover fees | Strategy testing & platform practice |

In addition to these account types, Vantage Markets also offers customized solutions for high-volume traders and institutional clients. These bespoke accounts provide personalized service, dedicated account managers, and tailored trading conditions to meet the specific needs of these clients.

By offering a diverse range of account types, Vantage Markets demonstrates its commitment to providing a flexible and inclusive trading environment. Whether you're a novice trader looking to start with a small investment or a professional trader seeking the most competitive trading conditions, the broker has an account type that aligns with your needs and goals.

This flexibility in account types sets Vantage Markets apart from competitors who may offer a more limited selection or fail to cater to the specific needs of different trader segments. By providing a comprehensive suite of account options, the broker empowers its clients to choose the best fit for their trading style and risk appetite, ultimately enhancing their overall trading experience.

Account Types Comparison Table

| Feature | Standard STP | Raw ECN | Pro ECN |

|---|---|---|---|

| Minimum Deposit | $50 | $50 | $10,000 |

| Spread | From 1.4 | From 0.0 | From 0.0 |

| Commission (per lot) | $0 | $3 | $1.5 |

| Execution | STP | ECN | ECN |

| Maximum Leverage | Up to 1:500 | Up to 1:500 | Up to 1:500 |

| Instruments | 1000+ | 1000+ | 1000+ |

| Platforms | MT4, MT5 | MT4, MT5 | MT4, MT5 |

| Swap-Free | Available | Available | Available |

| Hedging | Allowed | Allowed | Allowed |

| Scalping | Allowed | Allowed | Allowed |

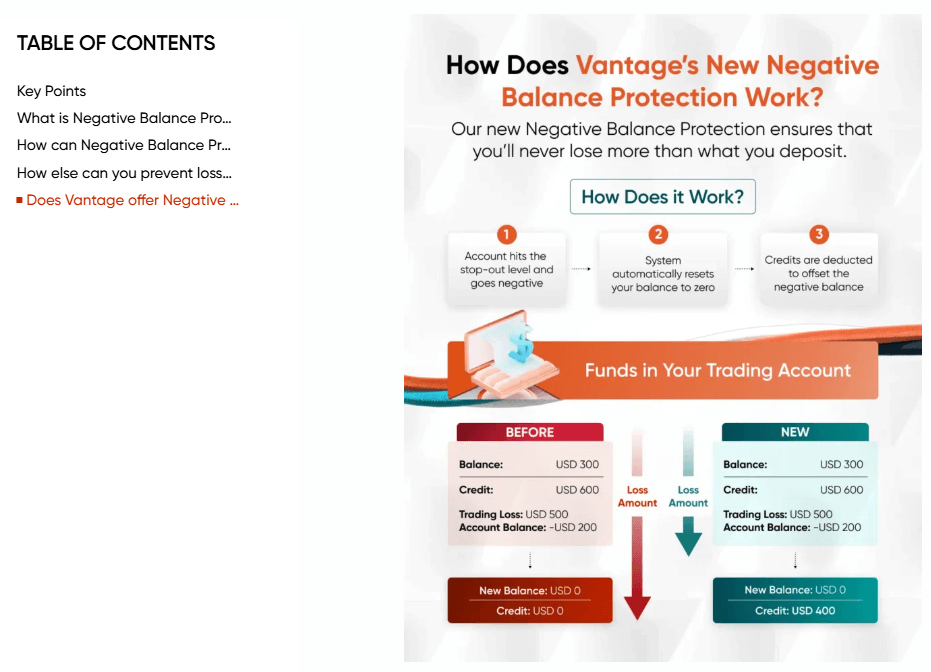

Negative Balance Protection

In the fast-paced world of online trading, unexpected market events or extreme volatility can sometimes result in losses that exceed a trader's account balance. This scenario, known as a negative balance, can be a significant source of stress and financial burden for traders. Recognizing the importance of managing risk and safeguarding clients' funds, Vantage Markets offers negative balance protection to its clients.

Importance of Negative Balance Protection:

Negative balance protection is a vital risk management tool that helps traders limit their potential losses and manage their risk more effectively. By ensuring that traders cannot lose more than their account balance, negative balance protection provides a safety net that allows traders to focus on their trading strategies without worrying about the possibility of owing money to the broker.

Vantage Markets Deposits and Withdrawals

Deposit Methods

Vantage Markets supports several convenient deposit methods, including:| Payment Method | Processing Time | Minimum Deposit | Fees | Additional Notes |

|---|---|---|---|---|

| Credit/Debit Cards (Visa, Mastercard, Maestro) | Instant | $50 | No fees | Fast and secure transactions |

| Bank Wire Transfer | 1-3 business days | $50 | No fees (bank charges may apply) | Available worldwide, subject to bank processing times |

| E-wallets (Skrill, Neteller, PayPal) | Instant | $50 | No fees | Convenient digital payment options |

| Local Payment Methods | Varies by region | Varies | No fees | Includes POLi (Australia), Doku (Indonesia), and other country-specific methods |

Withdrawal Methods

Vantage Markets offers the following withdrawal methods:| Payment Method | Processing Time | Minimum Withdrawal | Fees | Additional Notes |

|---|---|---|---|---|

| Bank Wire Transfer | 1-3 business days | $50 | No fees (bank charges may apply) | Funds withdrawn directly to a bank account |

| E-wallets (Skrill, Neteller, PayPal) | Instant - 24 hours | $50 | No fees | Convenient and fast withdrawal options |

| Credit/Debit Cards (Visa, Mastercard, Maestro) | 3-5 business days | $50 | No fees | Subject to card issuer's policies |

Processing Times

Deposit processing times vary depending on the payment method used. Credit/debit card deposits and e-wallet transfers are usually instant, while bank wire transfers can take up to 3-5 business days to clear. Withdrawal requests are processed within 24 hours, subject to the broker's verification procedures. Once processed, the funds will be credited to the trader's chosen payment method. E-wallet withdrawals are usually instant, while bank wire transfers can take up to 3-5 business days to reach the trader's account.Verification Requirements

To comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, Vantage Markets requires traders to verify their identity before processing withdrawals. Traders will need to submit proof of identity, such as a passport or driver's license, and proof of address, such as a utility bill or bank statement. Vantage Markets may also request additional documentation, such as proof of payment method ownership, to ensure the security of clients' funds and prevent unauthorized withdrawals.Unique Features

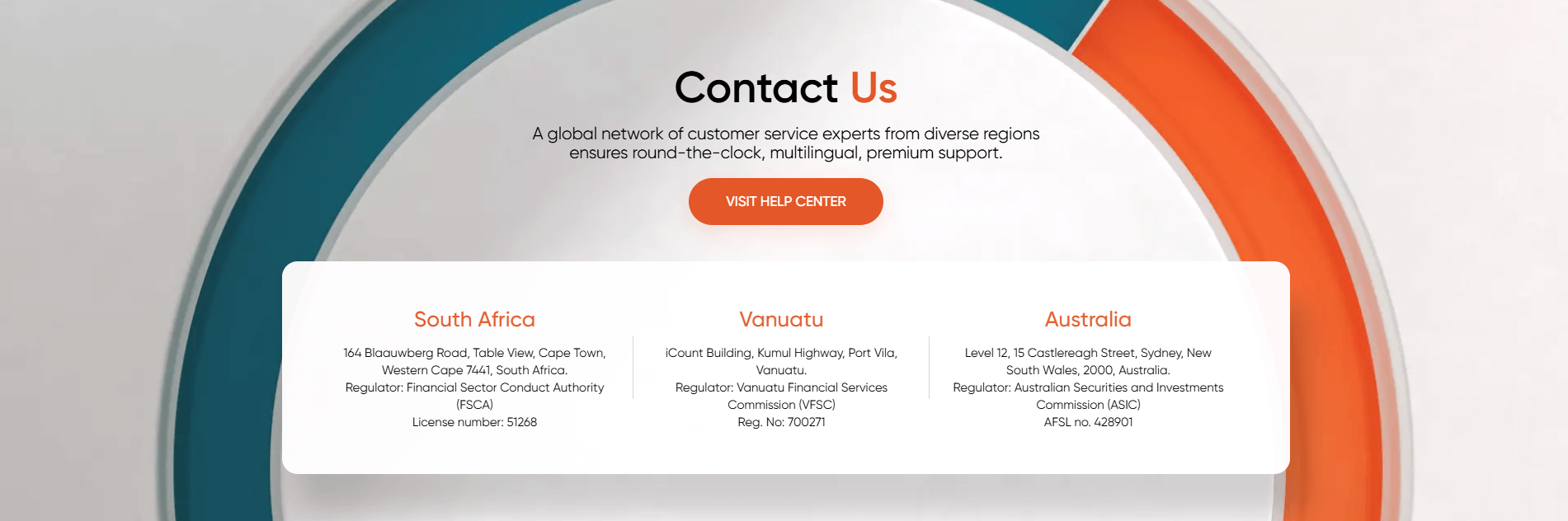

One of the standout features of Vantage Markets' deposit and withdrawal process is the broker's commitment to fast and efficient transactions. The broker processes all withdrawal requests within 24 hours, ensuring that traders can access their funds quickly and easily.Support Service for Customer

Reliable customer support is a crucial aspect of a positive trading experience. In the fast-paced world of online trading, traders need access to prompt and knowledgeable assistance to address their concerns, resolve issues, and make informed decisions. Vantage Markets recognizes the importance of customer support and has invested in providing multiple channels and resources to ensure that traders receive the help they need when they need it.

| Support Channel | Details |

|---|---|

| Live Chat | Instant support via the Vantage Markets website, ideal for quick queries and general assistance. |

| Traders can email support@vantagemarkets.com for detailed inquiries or concerns requiring a written record. | |

| Phone | Dedicated phone support in multiple countries. Main support number: +1 (345) 769 1640. |

| Social Media | Support available via official channels like Facebook, Twitter, and Instagram, with prompt responses to inquiries. |

Support Languages

Vantage Markets offers customer support in multiple languages to cater to its global client base. The available support languages include: - English - Chinese - Thai - Vietnamese - Indonesian - Arabic - SpanishSupport Hours and Response Times

Vantage Markets provides 24/7 customer support, ensuring that traders can access help at any time, regardless of their location or time zone. The support team is available around the clock to address urgent concerns and provide timely assistance. Response times vary depending on the support channel and the complexity of the inquiry. Live chat inquiries are typically addressed within minutes, while email responses may take up to 24 hours. Phone support aims to provide immediate assistance, with minimal wait times. Vantage Markets has set targets to ensure that all inquiries are addressed promptly and efficiently. The broker aims to resolve most issues within 24 hours, with more complex cases being escalated to specialized teams for further investigation and resolution.

Additional Resources

In addition to the direct support channels, Vantage Markets provides a comprehensive Help Center on its website. The Help Center features a searchable database of frequently asked questions (FAQs), tutorials, and guides covering various aspects of trading, account management, and platform usage. The Help Center is an excellent resource for traders who prefer self-service options or want to find answers to common questions quickly. The articles and guides are regularly updated to ensure that they provide accurate and relevant information.Customer Support Comparison Table

| Feature | Vantage Markets |

|---|---|

| Support Channels | Live Chat, Email, Phone, Social Media, Help Center |

| Support Languages | English, Chinese, Thai, Vietnamese, Indonesian, Arabic, Spanish |

| Support Hours | 24/7 |

| Live Chat Response | Within minutes |

| Email Response | Up to 24 hours |

| Phone Support | Immediate assistance, minimal wait times |

| Help Center | Comprehensive FAQs, Tutorials, Guides |

| Support Team | Knowledgeable and multilingual |

| Resolution Target | Most issues resolved within 24 hours |

Prohibited Countries

As an international broker, Vantage Markets adheres to the regulatory requirements and legal restrictions of various jurisdictions worldwide. While the broker strives to provide its services to a wide global audience, there are certain countries and regions where Vantage Markets is not allowed to operate or offer its trading services.

Reasons for Restrictions: The reasons behind these restrictions can vary, but generally, they are related to local regulations, licensing requirements, or geopolitical factors. Some countries have strict laws governing online trading and foreign exchange services, requiring brokers to obtain specific licenses or approvals to operate legally. In other cases, international sanctions or political instability may prevent Vantage Markets from offering its services in certain regions.

Prohibited Countries List

Vantage Markets does not provide its services to residents of the following countries and regions:

- United States of America (USA)

- Canada

- Japan

- New Zealand

- Islamic Republic of Iran

- Democratic People's Republic of Korea (North Korea)

- Cuba

- Sudan

- Syria

- Crimea region of Ukraine

- Any other country or region subject to United Nations Security Council (UNSC) sanctions

It is important to note that this list is not exhaustive and may be subject to change based on evolving regulatory landscapes and geopolitical developments. Traders are advised to consult the official Vantage Markets website or contact the broker's support team for the most up-to-date information on prohibited countries.

Consequences of Trading from Prohibited Countries: Attempting to trade with Vantage Markets from a prohibited country may result in legal consequences and account termination. The broker employs strict measures to identify and prevent access from restricted regions, including IP address checks and account verification procedures.

Traders who provide false or misleading information about their country of residence may face account suspension, forfeiture of funds, and potential legal action. It is crucial for traders to be truthful and accurate when providing personal information during the account opening process.

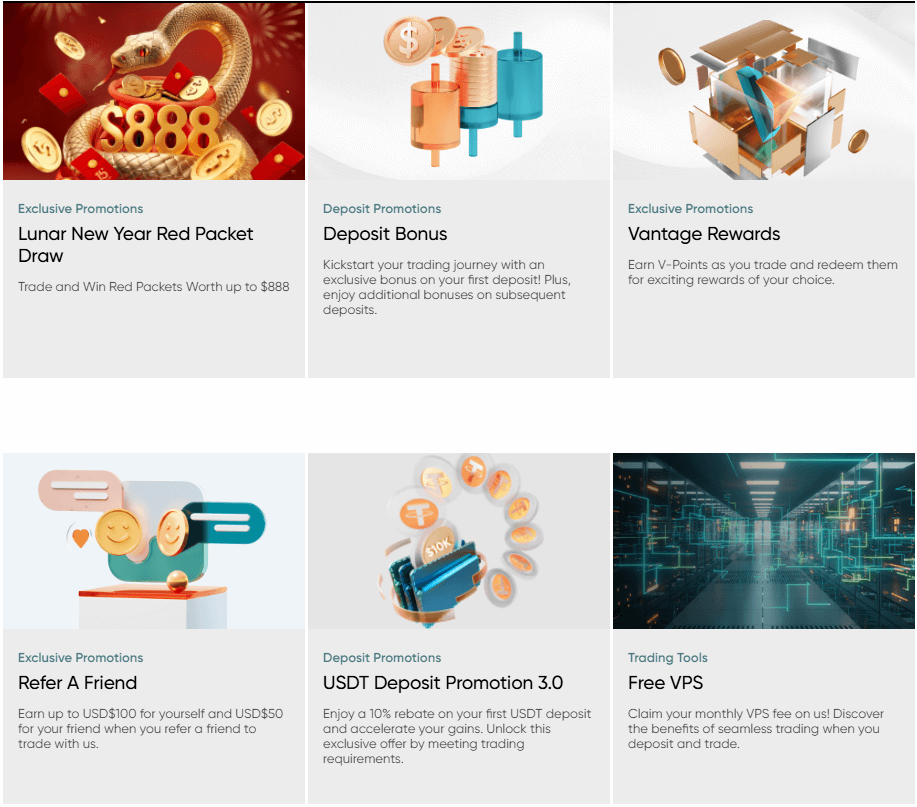

Special Offers for Customers

Vantage Markets offers a range of special promotions and offers designed to enhance the trading experience for both new and existing clients. These offers provide traders with additional value, incentives, and opportunities to maximize their trading potential.

| Program | Details |

|---|---|

| Refer a Friend Program | Existing clients earn rewards for referring new traders. Both the referrer and the referred client receive a cash bonus when the new trader meets the required trading volume. Bonus amount varies based on volume. |

| Loyalty Program | Clients earn points based on trading volume, which can be redeemed for benefits like trading fee discounts, exclusive market analysis, and VIP event invitations. Higher tiers offer greater rewards. |

| Trading Competitions | Periodic competitions where traders compete for cash prizes, trading bonuses, or other rewards. Competitions focus on specific goals like highest percentage gains or trading particular instruments. |

| Seasonal Promotions | Promotions tied to specific events or holidays, offering incentives like deposit bonuses, reduced trading fees, or rewards for achieving trading milestones. |

| Partnerships & Collaborations | Collaborations with third-party providers to offer exclusive benefits, such as discounted trading education, market analysis tools, and VPS hosting services. |

It is important to note that the specific terms and conditions of each offer may vary and are subject to change. Traders should carefully review the details of each promotion, including any minimum deposit requirements, trading volume thresholds, or time limitations, before participating. The official Vantage Markets website provides the most up-to-date information on the current promotions and their associated terms.

In addition to these special offers, Vantage Markets consistently strives to provide a competitive and rewarding trading environment for its clients. The broker regularly reviews and updates its promotional offerings to ensure that traders have access to attractive incentives and opportunities to enhance their trading experience.

Conclusion

As I come to the end of this comprehensive review of Vantage Markets, I can confidently say that they have established themselves as a reliable and trustworthy broker in the online trading industry. Throughout my analysis, I have found numerous aspects that demonstrate Vantage Markets' commitment to providing a secure, transparent, and user-focused trading environment.

One of the key factors that sets Vantage Markets apart is their strong regulatory compliance. With licenses from top-tier authorities such as ASIC, FCA, CIMA, and VFSC, they adhere to strict guidelines and best practices to ensure the safety of client funds and maintain a fair trading environment. The segregation of client funds and the provision of negative balance protection further enhance the security of trading with Vantage Markets.

Another area where Vantage Markets excels is in their offering of advanced trading platforms and tools. By providing industry-standard platforms like MetaTrader 4 and 5, alongside their proprietary Vantage App and TradingView integration, they cater to the diverse needs of traders at all levels. The availability of a wide range of trading instruments, including forex, indices, commodities, shares, ETFs, and bonds, allows traders to diversify their portfolios and access global markets with ease.

Vantage Markets' commitment to education and support is also commendable. Their comprehensive educational resources, including webinars, tutorials, and market analysis, empower traders to make informed decisions and enhance their trading skills. The 24/7 multilingual customer support ensures that traders can access assistance whenever they need it, through various channels such as live chat, email, and phone.

The broker's transparency extends to their account types and fee structure. With low minimum deposits, competitive spreads, and a range of account options catering to different trading styles and experience levels, Vantage Markets ensures that traders can find a suitable solution for their needs. The absence of hidden fees and the clear presentation of costs further demonstrate their commitment to transparency.

While Vantage Markets has some restrictions on clients from certain countries due to regulatory reasons, they still manage to serve a wide global clientele. Their special offers and promotions, such as the Refer a Friend program and Loyalty Program, add value and incentivize traders to engage with the platform.

Overall, I believe that Vantage Markets is a solid choice for both beginner and experienced traders seeking a reliable and well-rounded broker. Their strong regulatory standing, advanced trading platforms, comprehensive educational resources, and transparent fee structure make them a compelling option in the competitive online trading landscape.

As with any broker, it is essential to consider individual trading goals, risk tolerance, and preferences before making a decision. However, based on my thorough review, I can confidently recommend Vantage Markets as a reputable and trustworthy broker that prioritizes the interests of its clients.

As I come to the end of this comprehensive review of Vantage Markets, I can confidently say that they have established themselves as a reliable and trustworthy broker in the online trading industry. Throughout my analysis, I have found numerous aspects that demonstrate Vantage Markets' commitment to providing a secure, transparent, and user-focused trading environment.

One of the key factors that sets Vantage Markets apart is their strong regulatory compliance. With licenses from top-tier authorities such as ASIC, FCA, CIMA, and VFSC, they adhere to strict guidelines and best practices to ensure the safety of client funds and maintain a fair trading environment. The segregation of client funds and the provision of negative balance protection further enhance the security of trading with Vantage Markets.

Another area where Vantage Markets excels is in their offering of advanced trading platforms and tools. By providing industry-standard platforms like MetaTrader 4 and 5, alongside their proprietary Vantage App and TradingView integration, they cater to the diverse needs of traders at all levels. The availability of a wide range of trading instruments, including forex, indices, commodities, shares, ETFs, and bonds, allows traders to diversify their portfolios and access global markets with ease.

Vantage Markets' commitment to education and support is also commendable. Their comprehensive educational resources, including webinars, tutorials, and market analysis, empower traders to make informed decisions and enhance their trading skills. The 24/7 multilingual customer support ensures that traders can access assistance whenever they need it, through various channels such as live chat, email, and phone.

The broker's transparency extends to their account types and fee structure. With low minimum deposits, competitive spreads, and a range of account options catering to different trading styles and experience levels, Vantage Markets ensures that traders can find a suitable solution for their needs. The absence of hidden fees and the clear presentation of costs further demonstrate their commitment to transparency.

While Vantage Markets has some restrictions on clients from certain countries due to regulatory reasons, they still manage to serve a wide global clientele. Their special offers and promotions, such as the Refer a Friend program and Loyalty Program, add value and incentivize traders to engage with the platform.

Overall, I believe that Vantage Markets is a solid choice for both beginner and experienced traders seeking a reliable and well-rounded broker. Their strong regulatory standing, advanced trading platforms, comprehensive educational resources, and transparent fee structure make them a compelling option in the competitive online trading landscape.

As with any broker, it is essential to consider individual trading goals, risk tolerance, and preferences before making a decision. However, based on my thorough review, I can confidently recommend Vantage Markets as a reputable and trustworthy broker that prioritizes the interests of its clients.

All 180+ verdicts live in our master broker list.

App-first traders should scan the Moomoo review.