Is Vittaverse Broker Safe? 2025 Review for Global Traders

Vittaverse

Seychelles

Seychelles

-

Minimum Deposit $15

-

Withdrawal Fee $varies

-

Leverage 2000:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

Financial Services Authority Seychelles

Financial Services Authority Seychelles

Softwares & Platforms

Customer Support

+2488889398988

(English)

+2488889398988

(English)

Supported language: English

Social Media

Summary

Vittaverse is an offshore CFD broker (est. 2022) registered in Saint Vincent and the Grenadines, offering 300+ instruments via MT5 and cTrader. It markets high leverage up to 1:2000, far beyond regulated limits, and promotes bonuses and zero-fee funding. The broker claims a Seychelles FSA license and Financial Commission membership (€20k coverage), but verification is essential. With minimal oversight, no tier-1 regulation, and only a short operational history, Vittaverse poses high risks for retail traders despite its professional trading platforms and negative balance protection.

- Low minimum deposit - Starting from just $15 for Standard accounts makes trading accessible to small investors

- Industry-standard platforms - MT5 and cTrader are legitimate, professional-grade platforms with extensive features

- Multiple account types - Three tiers (Standard, ECN Pro, VIP) cater to different trader profiles and capital levels

- Negative balance protection - Prevents traders from owing money beyond deposited funds across all accounts

- Zero-commission funding - Current promotional campaign covers all deposit and withdrawal processing fees

- High leverage available - Up to 1:2000 leverage for traders seeking aggressive trading opportunities

- 24/7 customer support - Round-the-clock live chat provides immediate assistance

- Cryptocurrency deposits - Accepts USDT, Bitcoin, and Ethereum for quick and convenient funding

- Copy trading available - cTrader Copy feature allows beginners to follow experienced traders

- Wide asset selection - Over 300 instruments across forex, metals, indices, stocks, ETFs, and crypto

- Minimal regulatory oversight - Only MISA (Comoros) license verified; offshore jurisdiction offers limited protection

- Unverified regulatory claims - Seychelles FSA license requires independent verification; SVG registration provides no regulation

- Extreme leverage risk - 1:2000 leverage can lead to rapid account destruction during market volatility

- Very young broker - Established only in 2022, lacking long-term track record and stability

- Offshore jurisdiction red flags - No segregated client funds or government-backed compensation schemes

- Restrictive bonus terms - Promotional bonuses come with conditions that may prevent withdrawals

- Limited investor protection - €20,000 FinCom coverage is minimal compared to regulated market standards

- Geographic restrictions - Not available to US residents and other jurisdictions

- No tier-1 regulation - Lacks oversight from FCA, ASIC, CySEC, or other reputable regulators

- High-risk environment - Combination of extreme leverage and minimal regulation unsuitable for most retail traders

Overview

Vittaverse is a multi-asset CFD broker established in 2022, registered in Saint Vincent and the Grenadines (SVG); local incorporation does not provide regulatory oversight for forex/CFD brokers. The broker offers trading through MetaTrader 5 and cTrader platforms across web, desktop, and mobile devices, marketing over 300 instruments spanning forex, metals, indices, stocks, energy, ETFs, and cryptocurrencies.

The broker claims membership with The Financial Commission offering up to €20,000 in compensation coverage. Vittaverse also displays a Seychelles FSA license (SD200) on its website, though independent verification through official FSA registries is strongly recommended before relying on this claim.

Operating with an offshore model, Vittaverse offers leverage up to 1:2000 for eligible clients (dynamic by asset/equity as of June 2025), significantly exceeding the 30:1 maximum imposed by mainstream regulators like ESMA, FCA, and ASIC. The broker provides negative balance protection across all account types and runs promotional campaigns including welcome bonuses and zero-commission funding.

Overview Table

| Feature | Details |

|---|---|

| Company Name | Vittaverse Ltd |

| Established | 2022 |

| Registration | SVG (no regulatory oversight for forex/CFD) |

| Site-Claimed License | Seychelles FSA SD200 |

| EDR Coverage | FinCom up to €20,000 |

| Trading Platforms | MT5, cTrader |

| Minimum Deposit | $15 (Standard Account) |

| Maximum Leverage | Up to 1:2000 (dynamic) |

| Tradable Assets | 300+ instruments |

| Customer Support | 24/7 Live Chat, Email |

| Restricted Countries | USA, North Korea |

Facts List

- Claims Seychelles FSA license SD200

- Registered in Saint Vincent and the Grenadines, which doesn't regulate forex/CFD brokers

- Offers leverage up to 1:2000 across all account types for eligible clients

- Provides MT5 and cTrader platforms with copy trading and automation features

- Minimum deposit starts from $15 for Standard accounts

- Negative balance protection available across all account types

- Financial Commission member with €20,000 compensation coverage

- Promotional offers include 40% Welcome Bonus and 50% Recovery Bonus

- Zero-commission funding campaign for deposits and withdrawals

- Established in 2022 with limited operational history

Vittaverse Licenses and Regulatory

Vittaverse operates under an offshore regulatory framework that differs significantly from tier-1 jurisdictions. The verified MISA (Comoros) license BFX2024072 provides basic regulatory oversight but lacks the stringent client protection measures found in EU, UK, or Australian regulations.

The broker's SVG registration is merely a corporate registration that doesn't constitute regulation, as Saint Vincent and the Grenadines does not provide regulatory oversight for forex/CFD brokers. The claimed Seychelles FSA license SD200 requires independent verification through official FSA channels before being considered valid.

Financial Commission membership provides an external dispute resolution mechanism with compensation up to €20,000, though this private scheme doesn't match the protection levels of government-backed compensation schemes in regulated markets.

Trading Instruments

Vittaverse offers over 300 tradable instruments across multiple asset classes. The broker provides access to major, minor, and exotic forex pairs, precious metals including gold and silver, global indices like DAX and S&P 500, selected stocks via CFDs, energy commodities, ETFs, and cryptocurrencies including Bitcoin and Ethereum.

| Asset Class | Examples | Number of Instruments | Trading Hours |

|---|---|---|---|

| Forex | EUR/USD, GBP/USD, Exotics | 50+ pairs | 24/5 |

| Metals | XAU/USD, XAG/USD | 4-6 instruments | Market hours |

| Indices | DAX, SPX, NDX | 15+ indices | Exchange hours |

| Stocks | Major US/EU stocks | Selected CFDs | Exchange hours |

| Energy | Crude Oil, Natural Gas | 3-5 instruments | Market hours |

| ETFs | Selected funds | Limited selection | Exchange hours |

| Crypto | BTC, ETH, others | 10+ pairs | 24/7 |

Trading Platforms

Vittaverse provides two industry-standard platforms. MetaTrader 5 offers a comprehensive multi-asset terminal with 21 timeframes, 38+ indicators, Expert Advisors support, and full backtesting capabilities. cTrader delivers a modern interface with advanced features including cTrader Automate for C# algorithmic trading, integrated copy trading, depth of market display, and open API access.

Trading Platform Comparison Table

| Feature | MT5 | cTrader |

|---|---|---|

| Interface Style | Classic Terminal | Modern, Clean |

| Automation | EAs (MQL5) | cBots (C#) |

| Copy Trading | Third-party solutions | Native cTrader Copy |

| Depth of Market | Available | Advanced with visualization |

| WebTrader | Yes | Yes |

| Mobile Apps | iOS/Android | iOS/Android |

| Indicators | 38+ Built-in | Extensive library |

| Backtesting | Strategy Tester | Advanced backtesting |

| API Access | MQL5 Gateway | Open API |

| Cloud Computing | MQL5 Cloud | cTrader Cloud |

| One-Click Trading | Yes | Yes |

| Custom Timeframes | Yes | Yes |

Vittaverse How to Open an Account: A Step-by-Step Guide

- Visit Official Website - Navigate to vittaverse.com and locate the registration button

- Complete Registration Form - Provide personal details including full name, email, and phone number

- Verify Email - Check inbox for verification link and confirm email address

- Submit KYC Documents - Upload government-issued photo ID (passport/driver's license) and proof of address (utility bill/bank statement dated within 3 months)

- Select Account Type - Choose between Standard ($15 minimum), ECN Pro ($100 minimum), or VIP ($12,000 minimum)

- Choose Trading Platform - Select either MT5 or cTrader based on your preference

- Fund Your Account - Make initial deposit using available payment methods (crypto, cards, or bank transfer)

- Download Platform - Install desktop/mobile app or access web version

- Login and Configure - Use provided credentials, set up charts, and test with small positions

Charts and Analysis

Vittaverse provides educational resources including video courses covering trading basics and a markets/news portal with equity and cryptocurrency analysis. The broker offers comprehensive charting and analysis tools built into the provided trading platforms (MT5 and cTrader), featuring extensive technical indicators, market depth analysis, and automated trading capabilities.

| Educational Resource | Type | Availability | Content Focus | Suitable For |

|---|---|---|---|---|

| Video Courses | Educational | Website | Trading basics, platform tutorials | Beginners |

| Markets/News Portal | Analysis | Daily updates | Equity and crypto commentary | All levels |

| MT5 Built-in Charts | Charting | Platform | 21 timeframes, 38+ indicators | All traders |

| cTrader Advanced Charts | Charting | Platform | Multiple chart types, custom indicators | Intermediate-Advanced |

| Economic Calendar | Data tool | Platform/Web | High-impact events, data releases | All traders |

| MT5 Technical Analysis | Technical | Platform | Built-in indicators, custom EAs | Technical traders |

| cTrader Market Sentiment | Analytics | Platform | Real-time positioning data | Advanced traders |

| Platform Tutorials | Educational | Help section | Step-by-step guides | New users |

| Market Depth Analysis | Data tool | cTrader | Order book visualization | Scalpers/Day traders |

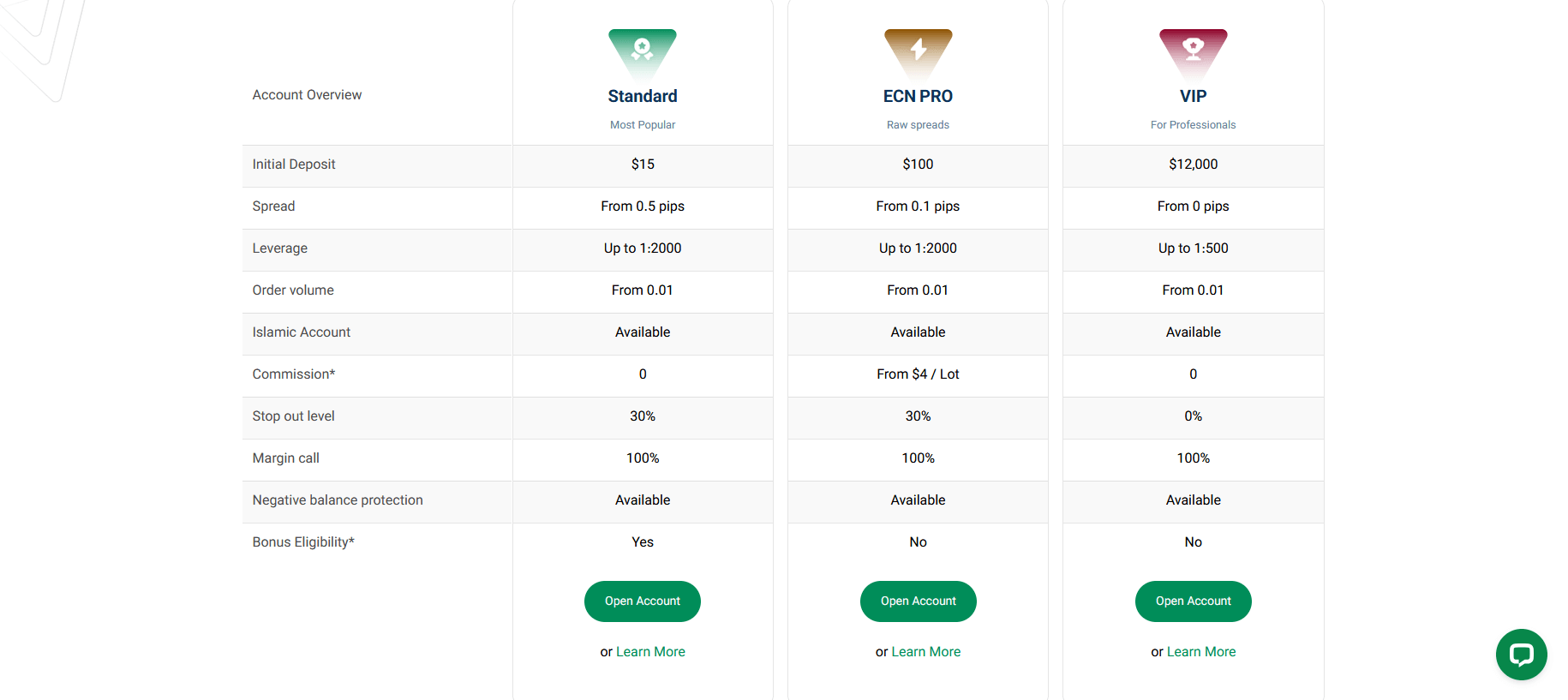

Vittaverse Account Types

The broker offers three distinct account tiers catering to different trader profiles. Standard accounts require a $15 minimum deposit with spreads from 0.5 pips and no commissions. ECN Pro accounts need $100 minimum, offering raw spreads from 0.0 pips with commissions from $4 per lot. VIP accounts require $12,000 minimum deposit, featuring zero spreads, zero commissions, and 0% stop-out level.

Account Types Comparison Table

| Feature | Standard | ECN Pro | VIP |

|---|---|---|---|

| Minimum Deposit | $15 | $100 | $12,000 |

| Spreads | From 0.5 pips | From 0.0 pips | From 0.0 pips |

| Commission | None | From $4/lot | None |

| Maximum Leverage | 1:2000 | 1:2000 | 1:500 |

| Stop-out Level | 30% | 30% | 0% |

| Margin Call | 50% | 50% | 50% |

| Negative Balance Protection | Yes | Yes | Yes |

| Platforms Available | MT5, cTrader | MT5, cTrader | MT5, cTrader |

| Execution Type | Market | ECN | VIP Priority |

| Minimum Trade Size | 0.01 lot | 0.01 lot | 0.01 lot |

| Maximum Trade Size | 100 lots | 100 lots | 200 lots |

| Expert Advisors | Allowed | Allowed | Allowed |

| Scalping | Allowed | Allowed | Allowed |

| Hedging | Allowed | Allowed | Allowed |

Negative Balance Protection

Vittaverse provides negative balance protection across all account types, preventing trader accounts from falling below zero during extreme market volatility or gap events. This protection shields clients from owing money beyond their deposited funds, though it doesn't eliminate normal trading risks or protect against losses up to the account balance. The protection activates automatically when account equity falls below zero due to market movements.

Vittaverse Deposits and Withdrawals

The broker operates a zero-commission funding campaign, covering processing fees for deposits and withdrawals. Vittaverse supports cryptocurrency transactions including USDT, Bitcoin, and Ethereum, alongside traditional payment methods that vary by region and KYC status. Processing times range from instant for crypto to 1-5 business days for bank transfers.

Payment Methods

| Method | Minimum Deposit | Minimum Withdrawal | Deposit Fee | Withdrawal Fee | Processing Time |

|---|---|---|---|---|---|

| USDT | $15 | $10 | Zero (Campaign) | Zero (Campaign) | Instant-1 hour |

| Bitcoin | $15 | $10 | Zero (Campaign) | Zero (Campaign) | 10-60 minutes |

| Ethereum | $15 | $10 | Zero (Campaign) | Zero (Campaign) | 10-30 minutes |

| Bank Cards | $15 | $10 | Zero (Campaign) | Zero (Campaign) | Instant-24 hours |

| Bank Transfer | $100 | $50 | Zero (Campaign) | Zero (Campaign) | 1-5 business days |

Support Service for Customer

Vittaverse provides 24/7 live chat support through their website and email assistance at support@vittaverse.com. The Client Services Agreement establishes formal complaint handling procedures with acknowledgment within 7 business days and resolution targets within 30-60 days.

Customer Support Availability Table

| Channel | Availability | Average Response Time | Languages | Priority Level |

|---|---|---|---|---|

| Live Chat | 24/7 | Immediate | Multiple | High |

| 24/5-24/7 | Within 24 hours | English+ | Medium | |

| Complaint Process | Business Hours | 7-60 days | English | Formal |

| Platform Support | 24/5 | Within 2 hours | English | High |

Prohibited Countries

Vittaverse services are not available to residents of the United States of America and North Korea. Additional restrictions may apply based on local regulations in other jurisdictions. Traders should verify their eligibility based on their country of residence before attempting to open an account.

Special Offers for Customers

Current promotions include:

- 40% Welcome Bonus: Up to $2,000 credit, non-withdrawable, 30-day validity for Standard MT5 accounts

- 50% Recovery Bonus: For qualifying first deposits with specific drawdown terms and 30-day validity

- Zero-Commission Campaign: Covers all processing fees on deposits and withdrawals (ongoing promotion)

Conclusion

Vittaverse presents a high-risk offshore brokerage option that may appeal to experienced traders comfortable with minimal regulatory oversight. Established only in 2022, the broker lacks the long-term track record essential for establishing trust in financial services. The verifiable MISA (Comoros) license offers minimal protection compared to tier-1 regulators, while the claimed Seychelles FSA license requires independent verification before being considered credible.

The most significant concern is the leverage offering up to 1:2000, which dramatically exceeds the 30:1 maximum enforced in properly regulated markets. This extreme leverage can amplify losses to catastrophic levels within seconds during volatile market conditions. Combined with promotional bonuses that are prohibited in regulated jurisdictions and an SVG registration that provides no actual regulatory oversight, these factors create an environment where substantial financial losses are highly probable.

The broker does offer some legitimate features worth noting. MetaTrader 5 and cTrader are industry-standard platforms providing professional-grade tools, extensive analytical capabilities, and reliable execution. The negative balance protection across all accounts prevents traders from owing money beyond their deposits. The variety of account types with low entry barriers provides flexibility for different trading styles.

However, for the vast majority of retail traders, particularly beginners or those seeking secure investment platforms, Vittaverse presents unacceptable risks. The offshore regulatory framework means no segregated client funds, no government-backed compensation schemes, and limited recourse in disputes. The aggressive marketing tactics, including deposit bonuses with restrictive terms, are designed to attract deposits rather than protect client interests.

Traders considering Vittaverse should instead evaluate brokers regulated by the Financial Conduct Authority (UK), Australian Securities and Investments Commission, or Cyprus Securities and Exchange Commission. These regulators enforce strict operational standards, segregated client funds, and compensation schemes protecting traders up to substantial amounts in case of broker insolvency. While Vittaverse offers competitive trading conditions and legitimate platforms, the minimal regulation and extreme leverage make it inappropriate for anyone who cannot afford to lose their entire deposit.