VT Markets Review 2025: Is This Regulated Forex Broker Worth It?

VT Markets

Australia

Australia

-

Minimum Deposit $50

-

Withdrawal Fee $varies

-

Leverage 500:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

Australia Retail Forex License

Australia Retail Forex License

South Africa Retail Forex License

South Africa Retail Forex License

Forex & CFD Brokerage License

Forex & CFD Brokerage License

Softwares & Platforms

Customer Support

+27101412968

(English)

+27101412968

(English)

Supported language: English, Chinese (Simplified), Arabic, Spanish, French, German, Italian

Social Media

Summary

VT Markets is a globally recognized forex and CFD broker founded in 2015 and regulated by ASIC, FSCA, and FSC. With over 600,000 clients in 150+ countries, it offers 1,000+ tradable instruments including forex, stocks, crypto, and ETFs. The broker supports multiple platforms such as MT4, MT5, TradingView, and its own app, offering tight spreads, high leverage up to 500:1, and low minimum deposits starting at $50. VT Markets also provides advanced tools like copy trading, VPS hosting, and strong educational resources, backed by 24/7 multilingual customer support.

- Regulated by multiple respected authorities, providing a robust framework for client protection

- Wide range of tradable assets catering to diverse trading preferences

- Competitive trading conditions with low minimum deposits, tight spreads, and flexible leverage

- Access to popular trading platforms and proprietary mobile app

- Comprehensive educational resources suitable for traders of all skill levels

- 24/7 customer support in multiple languages

- Negative balance protection and segregation of client funds

- Copy trading available through VTrade platform

- Regular promotional offers and loyalty programs to reward active traders

- VPS hosting option for faster execution speeds and improved platform stability

- Some clients have reported slow withdrawal processing times

- Occasional disputes and mixed user feedback regarding client support

- Limited transparency on certain information like swap rates and margin call conditions

- Services are not available to residents of several major countries due to regulatory restrictions

- Higher than average spreads for certain currency pairs and CFDs

- Inactivity fees charged on dormant accounts

- Limited customization options for trading platforms compared to some competitors

- Proprietary and less well known trading app compared to MetaTrader

- Does not offer MT4 or MT5 floating spreads accounts like some other brokers

- Educational content quantity and frequency of updates could be improved

Overview

VT Markets is an international forex and CFD broker founded in 2015 and headquartered in Australia. With a presence in over 10 offices worldwide and serving clients from more than 150 countries, VT Markets has established itself as a well-balanced derivatives broker.

The company offers an extensive range of tradable instruments, including forex, stocks, indices, commodities, bonds, ETFs, futures, and cryptocurrencies, catering to the diverse needs of its 600,000+ active clients. VT Markets actively participates in industry events and sponsors the Newcastle United Premier League soccer team and Maserati MSG Racing in Formula E.

For more comprehensive information, visit the official VT Markets website.

Overview Table

| Key Information | Details |

|---|---|

| Regulated Regions | Australia (ASIC), South Africa (FSCA), Mauritius (FSC) |

| Currencies Accepted | USD, AUD, GBP, EUR, CAD, JPY, HKD, Cryptocurrencies |

| Minimum Deposit | $50 base currency (e.g., USD 50), $100 for bank transfers |

| Bonuses/Promotions | Active Trader Program, Deposit Bonus, Refer a Friend, Loyalty Program |

| Tradable Assets | Forex, Stocks, ETFs, Crypto, Bonds, Indices, Commodities, Futures |

| Costs | No deposit fees; some withdrawal fees; $0–$6 per lot commission (based on account type) |

| Max Leverage | 500:1 (Forex), 25:1 (Crypto), 33:1 (Stocks), 100:1 (Bonds), 20:1 (Indices/Commodities) |

| Trading Platforms | MT4, MT5, VT Markets App, TradingView, VTrade |

| Restricted Regions | United States, Singapore, FATF-listed countries |

| Customer Support Languages | 20+ languages including English, Chinese, Arabic, Russian |

Facts List

- Established in 2015, VT Markets serves 600,000+ clients across 150+ countries

- Regulated by ASIC (Australia), FSCA (South Africa), FSC (Mauritius)

- Offers 1000+ instruments: forex, stocks, crypto, indices, bonds, commodities

- Low $50-100 minimum deposit and leverage up to 500:1

- Trading via MT4, MT5, TradingView, proprietary VT Markets app

- Hybrid STP/ECN execution model with $0-6/lot commissions

- Negative balance protection and segregated client funds

- VPS hosting, copy trading via VTrade, and loyalty rewards program

- Extensive educational resources including articles, videos, podcasts

- 24/7 customer support via live chat, WhatsApp, email in 20+ languages

VT Markets Licenses and Regulatory

VT Markets operates under a brand name with multiple entities registered in various jurisdictions, ensuring compliance with the regulatory frameworks of each region.

The company is authorised and regulated by three respected authorities:

- VT Global Pty Ltd – Regulated by the Australian Securities & Investments Commission (ASIC) under license number 516246. ASIC is known for its strict oversight, providing a high level of protection for clients.

- VT Markets (Pty) Ltd – Registered and regulated by the Financial Sector Conduct Authority (FSCA) of South Africa under license number 50865. The FSCA ensures that financial service providers adhere to fair and transparent practices.

- VT Markets Limited – Authorised and regulated by the Financial Services Commission (FSC) of Mauritius under Investment Dealer License number GB23202269. The FSC maintains a robust regulatory environment for investment dealers.

Trading Instruments

VT Markets offers a comprehensive range of tradable assets, providing traders with ample opportunities to diversify their portfolios and capitalise on market movements. With over 1000 instruments available, the broker caters to the needs of both novice and experienced traders. The official VT Markets website provides an in-depth look at the specific instruments offered within each asset class.

| Asset Class | Details |

|---|---|

| Forex | 61 currency pairs, including majors, minors, and exotics, with competitive spreads |

| Stocks | 700+ share CFDs from various sectors such as tech, finance, and retail |

| Indices | 19 global indices covering US, European, Asian, and Pacific markets |

| Commodities | 23 instruments across metals, energies, and agriculture |

| Cryptocurrencies | 47 major and minor crypto pairs, with spreads lower than the industry average |

| ETFs | 57 exchange-traded funds focused on financial markets |

| Futures | 12 contracts on popular commodities and indices |

| Bonds | 7 government bonds from the US and Europe |

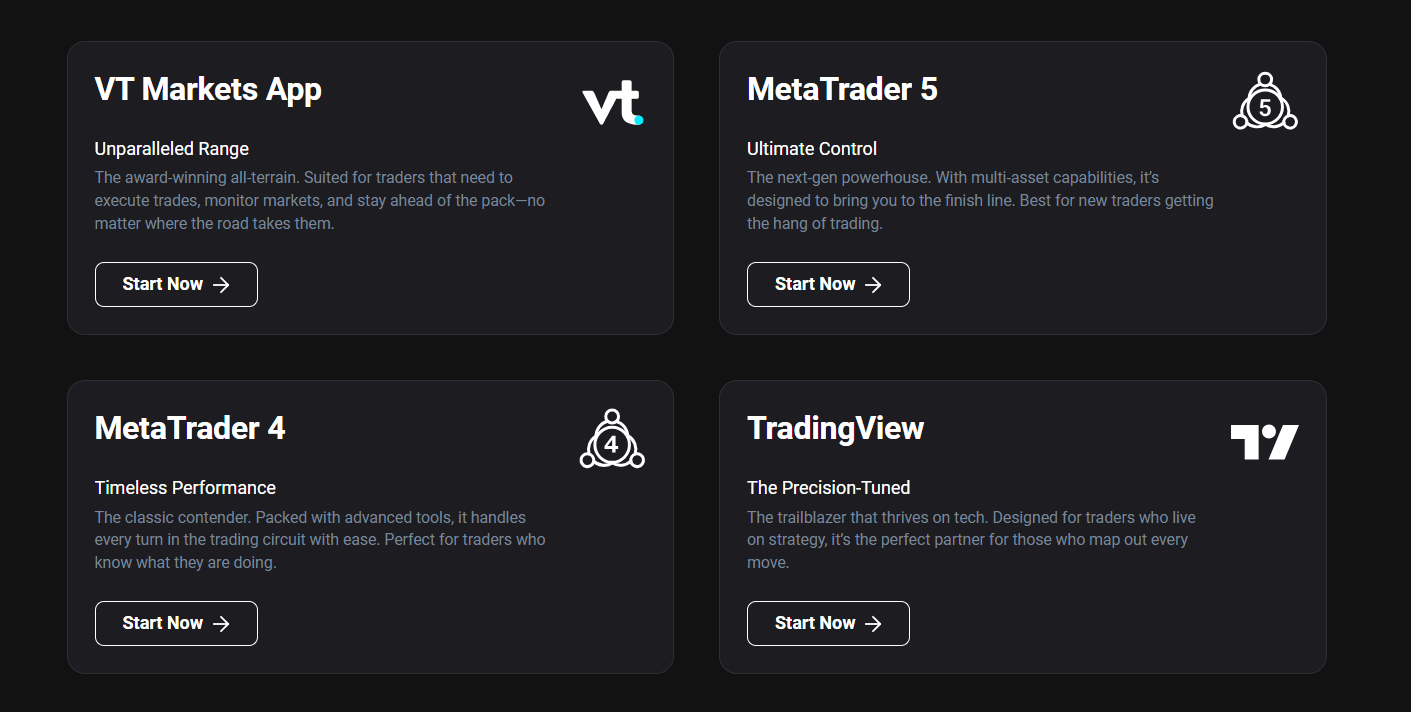

Trading Platforms

VT Markets offers a range of powerful trading platforms to cater to the diverse needs and preferences of its clients. Traders can choose from industry-standard platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), as well as VT Markets' proprietary WebTrader+ platform powered by TradingView.

MetaTrader 4 and MetaTrader 5

- Available for desktop, web, and mobile devices

- Supports automated trading via Expert Advisors (EAs)

- Built-in strategy tester for backtesting and optimizing trading strategies

- One-click trading and advanced charting tools

WebTrader+ (TradingView)

- Web-based platform accessible from any browser

- Advanced charting and technical analysis tools

- Seamless integration with TradingView's social trading features

- Intuitive interface suitable for both novice and experienced traders

VT Markets App

- Dedicated mobile trading app for iOS and Android devices

- Manage multiple accounts and access all tradable instruments

- Real-time quotes, charts, and market news

- Secure and convenient trading on the go

Trading Platforms Comparison Table

| Feature | MT4 | MT5 | WebTrader | VT Markets App |

|---|---|---|---|---|

| Automated Trading (EAs) | Yes | Yes | No | No |

| Web-based | No | No | Yes | Yes |

| Mobile App | Yes | Yes | Yes | Yes |

| Advanced Charting | Yes | Yes | Yes | Yes |

| Copy Trading | No | No | No | Yes |

| TradingView Integration | No | No | No | Yes |

| VPS Hosting | Yes | Yes | No | No |

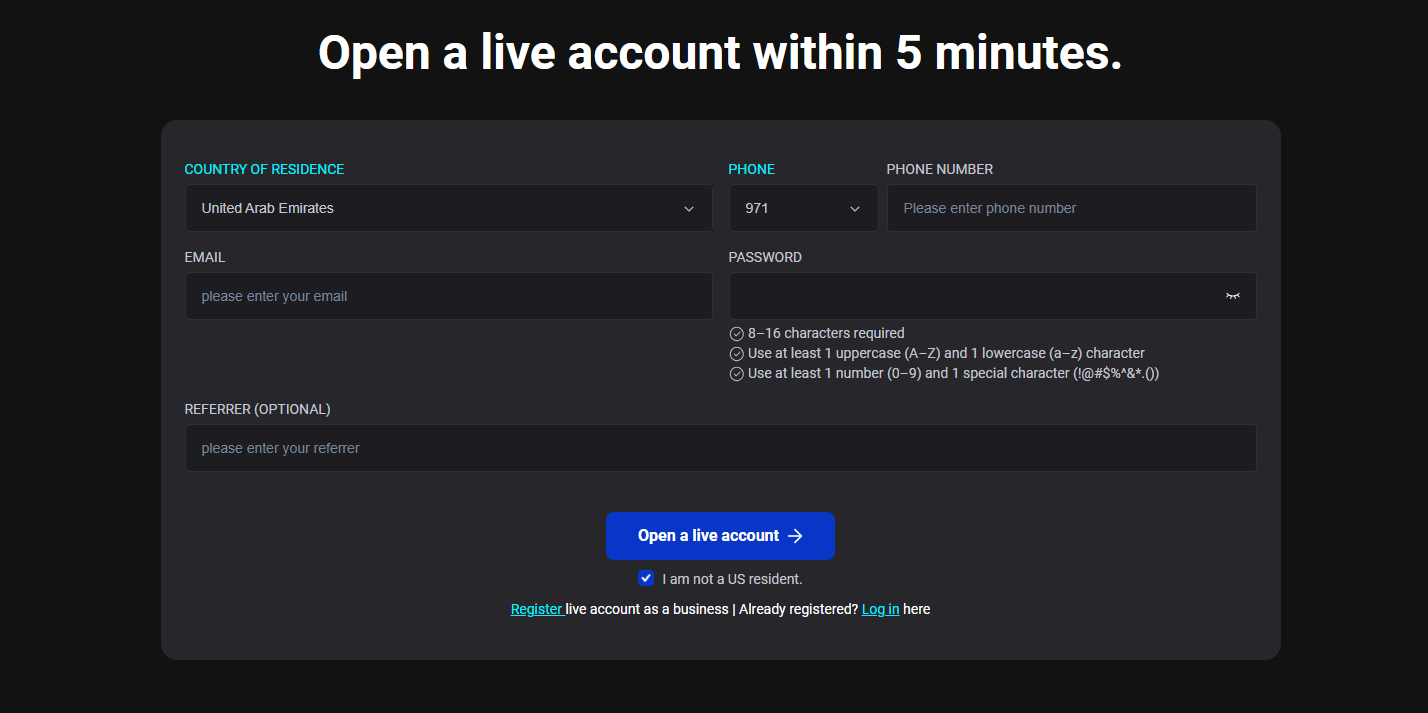

VT Markets How to Open an Account: A Step-by-Step Guide

Opening an account with VT Markets is a straightforward process that can be completed online in a few simple steps. Here's a step-by-step guide on how to get started:

- Visit the official VT Markets website vtmarketsglobal.com and click on the "Open an Account" or "Sign Up" button.

- Fill out the registration form with your personal details, including full name, email address, phone number, and country of residence.

- Choose your preferred account type (e.g., Standard STP, Raw ECN) and base currency.

- Provide proof of identity and address by uploading a valid government-issued ID and a recent utility bill or bank statement.

- Complete the online questionnaire to assess your trading knowledge and experience.

- Review and accept the broker's terms and conditions.

- Once your account is approved, fund it using one of the available payment methods, such as credit/debit card, bank wire transfer, or e-wallet.

Charts and Analysis

VT Markets equips traders with a comprehensive suite of tools and resources to make informed trading decisions and enhance their market analysis. The broker offers a wide range of charting tools, technical indicators, and educational materials, empowering clients to develop their trading skills and strategies.

| Feature Category | Details |

|---|---|

| Charting Tools | - Advanced charting with multiple timeframes and chart types - Over 50 built-in technical indicators and drawing tools - Customizable layouts and templates - Real-time price updates and historical data |

| Market Analysis | - Daily market reviews and weekly outlooks - In-depth analysis of key economic events and trends - Insights from professional analysts and trading experts - Sentiment indicators and heat maps |

| Educational Resources | - Beginner-friendly trading guides and tutorials - Webinars and video courses on various trading topics - Economic calendar with upcoming events and releases - Trading glossary and FAQs |

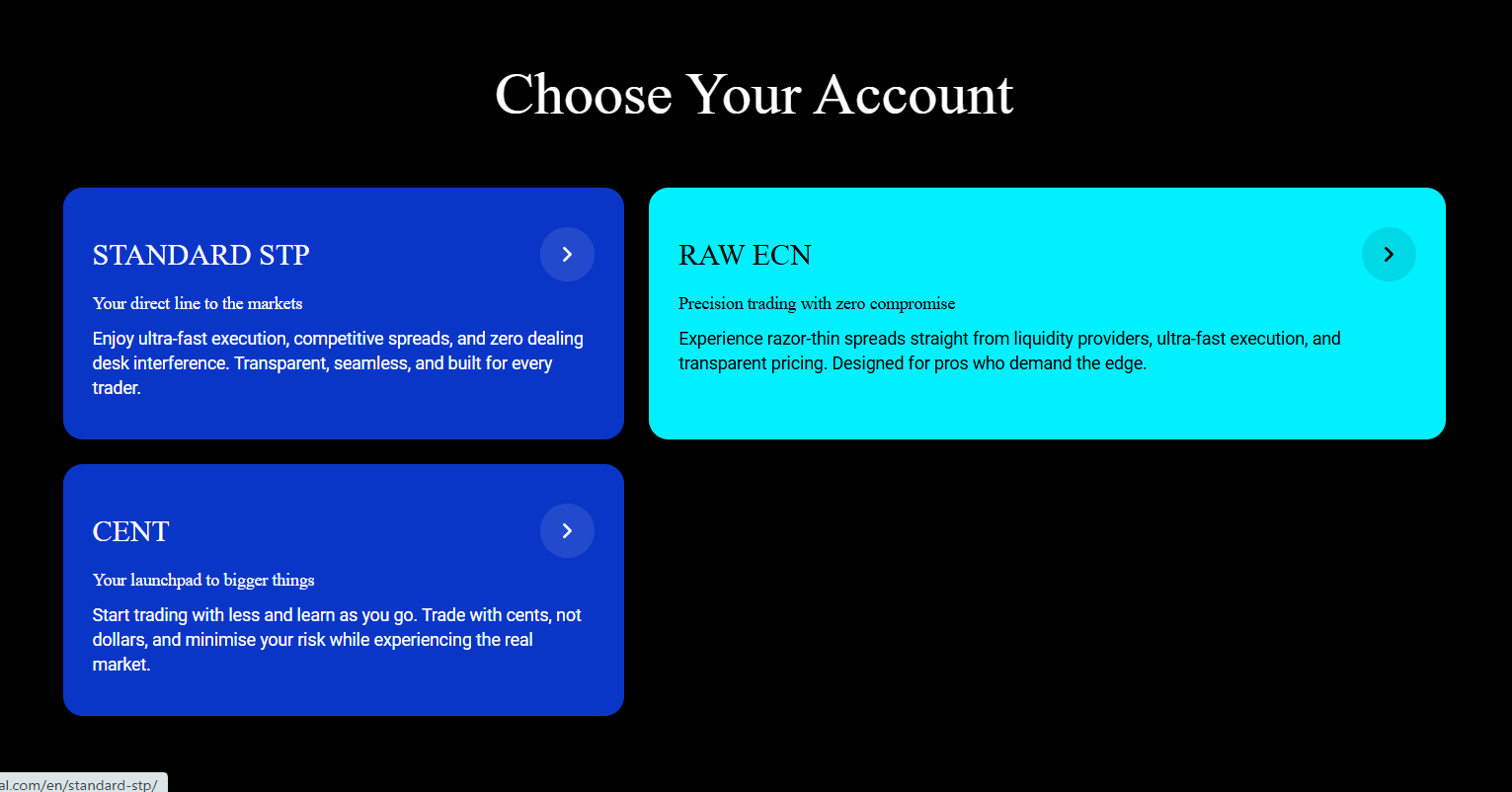

VT Markets Account Types

VT Markets offers a range of account types tailored to suit the diverse needs and preferences of traders, from novice to experienced. Each account type comes with unique features, trading conditions, and benefits, allowing clients to select the most suitable option based on their trading style, investment goals, and risk tolerance.

Standard STP Account

- Spreads from 1.2 pips

- No commissions

- Minimum deposit of $100

- Leverage up to 500:1

- STP execution

- Suitable for beginner to intermediate traders

Raw ECN Account

- Spreads from 0.0 pips

- $6 commission per round turn

- Minimum deposit of $100

- Leverage up to 500:1

- ECN execution with direct market access

- Ideal for experienced and high-volume traders

Cent Account

- Micro lot trading from 0.01 lots

- Minimum deposit of $50

- Spreads from 1.1 pips (STP) or 0.0 pips + $6 commission (ECN)

- Leverage up to 500:1

- Perfect for new traders or those looking to test strategies with smaller trade sizes

Swap-Free Account

- Available for Standard STP and Raw ECN accounts

- Designed for Islamic traders or those who prefer to avoid overnight interest charges

- No swap or rollover fees on overnight positions

Account Types Comparison Table

| Feature | Standard STP | Raw ECN | Cent STP | Cent ECN |

|---|---|---|---|---|

| Minimum Deposit | $100 | $100 | $50 | $50 |

| Spreads From | 1.2 pips | 0.0 pips | 1.1 pips | 0.0 pips |

| Commissions (per lot) | $0 | $6 | $0 | $6 |

| Execution Type | STP | ECN | STP | ECN |

| Leverage Up To | 500:1 | 500:1 | 500:1 | 500:1 |

| Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots | 0.01 lots |

| Swap-Free Option | ✓ | ✓ | ||

| Ideal For | Beginners to Intermediate | Experienced and High-Volume | New Traders and Strategy Testing | New Traders and Strategy Testing |

Negative Balance Protection

VT Markets recognises the importance of protecting its clients from the potential risks associated with leveraged trading. To ensure that traders do not lose more than their account balance, the broker offers negative balance protection across all its trading accounts. Negative balance protection is a crucial risk management feature that prevents a trader's account from falling into a negative balance, even in volatile market conditions. In the event that a trader's losses exceed their account balance, VT Markets will absorb the negative balance, ensuring that the client does not owe any additional funds to the broker. This protection is particularly important for traders who use high leverage, as sudden market movements can result in significant losses that may exceed the account balance. By offering negative balance protection, VT Markets provides a safety net for its clients, allowing them to trade with peace of mind knowing that their losses are limited to the funds in their account. It is essential for traders to understand that while negative balance protection is an important risk management tool, it should not be relied upon as a substitute for proper risk management practices. Traders should always use appropriate stop-loss orders, manage their position sizes, and never risk more than they can afford to lose. VT Markets' commitment to providing negative balance protection demonstrates its dedication to creating a secure and responsible trading environment for its clients. By safeguarding traders from the potential risks of negative balances, the broker ensures that clients can focus on their trading strategies without worrying about incurring additional losses.

VT Markets Deposits and Withdrawals

VT Markets offers a wide range of convenient deposit and withdrawal methods to facilitate smooth and secure transactions for its clients. The broker understands the importance of efficient fund transfers and strives to provide a seamless experience for both depositing and withdrawing funds.

Deposit Methods

| Method | Processing Time | Fees |

|---|---|---|

| Credit/Debit Card (Visa, Mastercard) | Instant | No fees (third-party fees may apply) |

| Bank Wire Transfer | Varies by bank | No fees (third-party fees may apply) |

| E-wallets (Neteller, Skrill) | Instant | No fees (third-party fees may apply) |

| UnionPay Transfer | Instant to few hours | No fees (third-party fees may apply) |

| Local Payment Methods | Varies by country | No fees (third-party fees may apply) |

Withdrawal Methods

| Method | Processing Time | Fees |

|---|---|---|

| Credit/Debit Card (Visa, Mastercard) | 1–3 business days | May incur third-party processing fees |

| Bank Wire Transfer | 1–3 business days | First withdrawal monthly: Free; subsequent: $20 per transaction |

| E-wallets (Neteller, Skrill) | 1–3 business days | Neteller: 2% fee Skrill: 1% fee |

| UnionPay Transfer | 1–3 business days | May incur third-party processing fees |

| Local Payment Methods | 1–3 business days | May vary depending on local providers |

| Fasapay | 1–3 business days | 0.5% handling fee |

Support Service for Customer

VT Markets places a strong emphasis on providing exceptional customer support to ensure that its clients receive the assistance they need in a timely and efficient manner. The broker offers multiple channels for traders to reach out to its dedicated support team, including:

- Live Chat: Available 24/5 on the VT Markets website

- Email: support@vtmarkets.com

- WhatsApp: Dedicated support via WhatsApp

- Social Media: Support through Facebook, Twitter, and Instagram

Customer Support Comparison Table

| Support Channel | Availability | Languages Supported |

|---|---|---|

| Live Chat | 24/5 | Multiple |

| 24/7, response within 24 hours | Multiple | |

| 24/5 | Multiple | |

| Social Media | 24/7, response within 24 hours | Multiple |

Prohibited Countries

VT Markets adheres to strict regulatory requirements and legal obligations, which means that the broker cannot offer its services to residents of certain countries. These restrictions are put in place to ensure compliance with international laws and to protect both the broker and its clients.

VT Markets is prohibited from accepting clients from the following countries and regions:

-

United States

-

Canada

-

European Union

-

Japan

-

New Zealand

-

Singapore

Special Offers for Customers

VT Markets provides a range of special offers and promotions designed to enhance the trading experience for its clients and reward their loyalty. These offers can help traders maximise their potential returns and take advantage of additional benefits.

Some of the notable promotions include:

- Welcome Bonus: New clients can receive a 50% bonus on their first deposit up to $500. This bonus is credited to the trading account and can be used to increase trading capital.

- Referral Program: Clients can earn up to $200 for each friend they refer to VT Markets who registers, funds their account, and meets the specified trading volume requirements.

- Loyalty Program: The VT Markets Club Bleu loyalty program rewards traders with points for each trade they make. These points can be redeemed for various rewards, including cash bonuses, trading credits, and merchandise.

- Trading Competitions: VT Markets regularly hosts trading competitions, giving clients the chance to win prizes such as cash, luxury vacations, and high-end gadgets. These competitions are designed to encourage active trading and reward skilled traders.

- VPS Hosting Rebate: Clients who maintain a specified trading volume can receive a rebate on the cost of VPS hosting, which can help improve trading execution and reduce latency.

Conclusion

Throughout this comprehensive review, I have thoroughly examined various aspects of VT Markets, evaluating its safety, reliability, and overall reputation as a broker. By analyzing factors such as regulatory compliance, trading conditions, platforms, and customer support, I have gained valuable insights into the broker's strengths and potential areas for improvement.

One of the key findings is that VT Markets operates multiple entities across different jurisdictions, each subject to the regulatory oversight of respected authorities such as ASIC, FSCA, and FSC. This multi-jurisdictional regulation provides a robust framework for client protection and ensures that the broker adheres to strict industry standards. However, it is important to note that the level of protection may vary depending on the specific entity and the client's country of residence.

In terms of trading conditions, VT Markets offers a diverse range of tradable assets, competitive spreads, and flexible account types catering to both novice and experienced traders. The broker's negative balance protection and segregation of client funds demonstrate its commitment to maintaining a secure trading environment. However, some users have reported issues with slow withdrawal processing times and occasional disputes with the broker.

VT Markets provides access to popular trading platforms like MT4 and MT5, as well as its proprietary VT Markets app and TradingView integration. These platforms offer a range of advanced features and tools for technical analysis and automated trading. The broker also supports copy trading through its VTrade platform, allowing users to mirror the trades of successful traders.

When it comes to educational resources and market analysis, VT Markets offers a comprehensive collection of articles, webinars, and tutorials, catering to traders of all skill levels. The broker's customer support is available 24/7 through various channels, including live chat and email, with support provided in multiple languages.

While VT Markets presents an attractive package with its wide range of assets, competitive trading conditions, and educational resources, it is crucial for potential clients to carefully consider their individual needs and conduct thorough due diligence before choosing a broker. The mixed user feedback regarding withdrawal processing and dispute resolution highlights the importance of thoroughly researching and comparing multiple brokers before making a decision.

In conclusion, VT Markets has established itself as a reputable broker with a strong presence in the online trading industry. Its multi-jurisdictional regulation, diverse trading offerings, and commitment to client education make it an appealing choice for many traders. However, as with any financial decision, it is essential to weigh the potential benefits against the reported concerns and conduct thorough research to ensure the broker aligns with your individual trading needs and risk tolerance.

Identify algorithmic-friendly names in the EA broker reviews set.

Compare raw-spread pricing in our Axi review.