| Feature | Details |

|---|---|

| Market Analysis | Daily market reviews, technical analysis, and trading ideas provided by expert analysts. |

| Economic Calendar | Displays upcoming high-impact events to help traders anticipate market movements. |

| Video Tutorials | Covers platform usage, technical analysis, and risk management. |

| Webinars | Regular sessions hosted by experts on market analysis and trading strategies. |

| E-books and Guides | Downloadable content covering trading fundamentals, technical analysis, and trading psychology. |

| Glossary | A comprehensive glossary of trading terms is available on the website. |

Windsor Review 2025: Focused on Forex, CFDs & Global Markets

Windsor Brokers

Cyprus

Cyprus

-

Minimum Deposit $50

-

Withdrawal Fee $varies

-

Leverage 1000:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Unavailable

-

Stock Unavailable

-

Indices Available

Licenses

Cyprus Market Making (MM)

Cyprus Market Making (MM)

Japan Forex Trading License

Japan Forex Trading License

Belize Financial Services License

Belize Financial Services License

Broker-Dealer License

Broker-Dealer License

Softwares & Platforms

Customer Support

+35725500500

(English)

+35725500500

(English)

Supported language: Arabic, Chinese (Simplified), English, Spanish

Social Media

Summary

Windsor Brokers is a well-established brokerage firm founded in 1988 and headquartered in Limassol, Cyprus. The company offers a wide range of trading instruments, including forex, CFDs on commodities, indices, shares, ETFs, and bonds. Clients can trade via MT4, MT5, and the Windsor mobile app, with competitive spreads and flexible account options. Regulated by CySEC, JSC, FSA, IFSC, and CMA, Windsor ensures a secure trading environment. The broker also provides 24/5 customer support, educational resources, and market analysis tools.

- Strong regulatory compliance with licenses from CySEC, FSA, IFSC, and JSC

- Wide range of tradable assets including forex, CFDs, futures, options, and more

- Competitive spreads and fast execution speeds

- MT4 & MT5 trading platforms available for desktop, web, and mobile

- Excellent 24/5 customer support through multiple channels

- Negative balance protection and client fund segregation for added security

- Focus on providing a fair and transparent trading environment

- Reliable and reputable broker with a long operational history since 1988

- Comprehensive educational resources and trading tools

- Suitable for both beginner and experienced traders

- No current promotions or bonuses offered

- Not available to residents of the USA, Belgium, and Japan

- Limited leverage compared to some competitors (1:30 for EU clients)

- Charges fees for deposits and withdrawals

- No social trading or copy trading opportunities

- Requires a minimum deposit of $50 to open an account

- Only offers the MT4 & MT5 trading platforms

- No cryptocurrency trading available

- Inactivity fees apply after 90 days of no trading activity

- Some user reports of slow withdrawal processing times

Overview

Windsor Brokers is a leading European investment firm that has been providing online trading services to retail and corporate clients worldwide since 1988. Headquartered in Limassol, Cyprus, the company is licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC) and authorised to operate in all EU member states. Windsor Brokers offers over 200 assets, including forex, CFDs on commodities, indices, shares, ETFs, bonds, and more, through the popular MT4 and MT5 trading platforms.

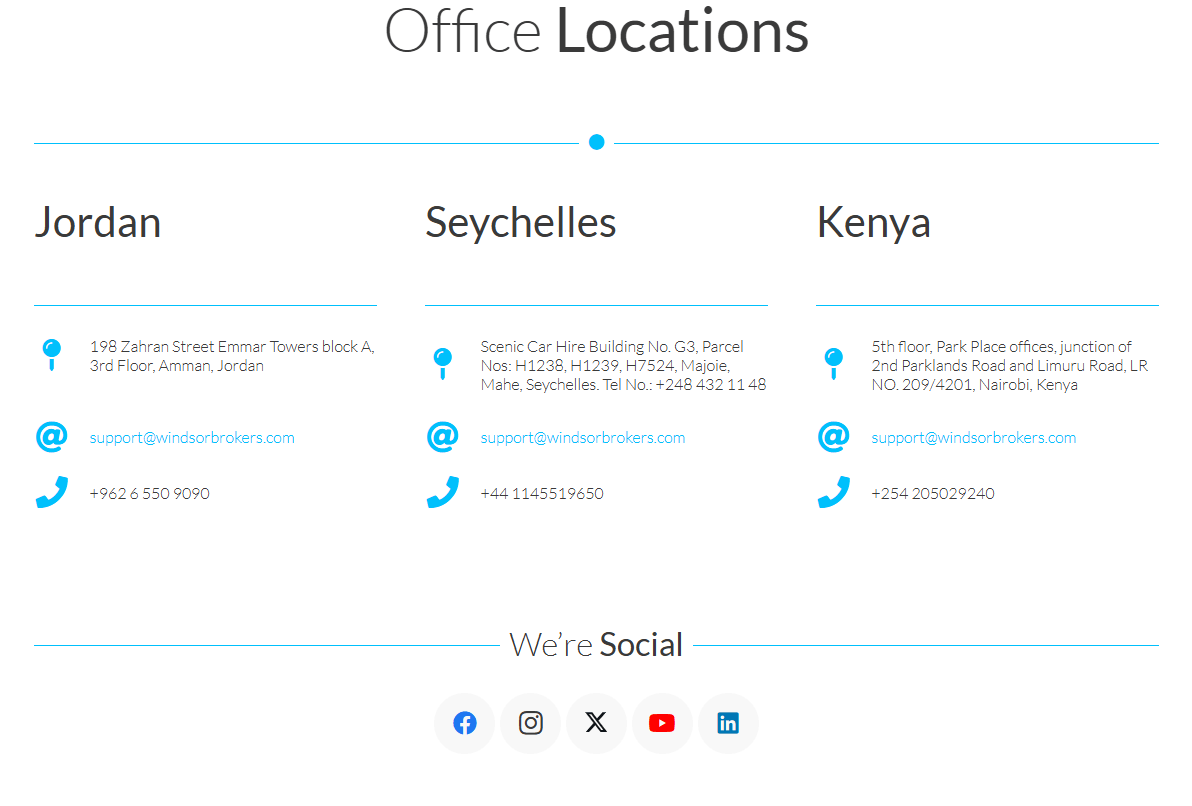

With a strong presence in over 80 countries and additional offices in Belize, Jordan, and Seychelles, Windsor Brokers has established itself as a reliable and trusted broker in the industry. The company maintains a high capital adequacy ratio of 59%, one of the highest among forex brokers globally, providing increased security for clients' funds. Throughout its history, Windsor Brokers has received international recognition for its innovative products, services, partnership programs, and excellence in customer support.

Overview Table

| Attribute | Details |

|---|---|

| Founded | 1988 |

| Headquarters | Limassol, Cyprus |

| Regulation | CySEC (Cyprus), FSA (Seychelles), IFSC (Belize), JSC (Jordan) |

| Trading Instruments | Forex, CFDs (commodities, indices, shares, ETFs), bonds, options, mutual funds, warrants |

| Trading Platforms | MT4 & MT5 (desktop, web, mobile) |

| Minimum Deposit | $50 |

| Maximum Leverage | 1:30 (EU clients), 1:1000 (professional and non-EU clients) |

| Customer Support | Email, phone, live chat |

| Educational Resources | Video library, glossary, ebook library |

Facts List

- Windsor Brokers was founded in 1988 and is headquartered in Limassol, Cyprus.

- The company is licensed and regulated by CySEC (Cyprus), FSA (Seychelles), IFSC (Belize), and JSC (Jordan).

- Windsor Brokers offers over 200 assets for trading.

- Clients can trade forex, CFDs on commodities, indices, shares, ETFs, bonds, options, mutual funds, and warrants.

- The company provides the popular MT4 & MT5 trading platforms for desktop, web, and mobile devices.

- Windsor Brokers maintains a high capital adequacy ratio of 59%, ensuring enhanced security for clients' funds.

- The minimum deposit required to open an account is $50.

- Maximum leverage is 1:30 for EU clients and 1:1000 for professional and non-EU clients.

- Windsor Brokers offers customer support via email, phone, and live chat.

- Educational resources include a video library, trading glossary, and ebook library to help clients improve their trading skills and knowledge.

Windsor Brokers Licenses and Regulatory

Windsor Brokers operates under a robust regulatory framework, holding licenses from multiple respected authorities globally. The company's primary regulator is the Cyprus Securities and Exchange Commission (CySEC), which has authorised Windsor Brokers to provide investment services across all EU member states. This adherence to the stringent rules of MiFID (Markets in Financial Instruments Directive) ensures a high level of investor protection and transparency in the company's operations.

In addition to CySEC, Windsor Brokers is licensed by the Financial Services Authority (FSA) in Seychelles, the International Financial Services Commission (IFSC) in Belize, and the Jordan Securities Commission (JSC). This multi-jurisdictional regulation demonstrates Windsor Brokers' commitment to maintaining the highest standards of compliance and integrity in its services.

The significance of multiple regulatory licenses lies in the enhanced security and trust it provides to clients. Each regulator imposes strict requirements related to capital adequacy, segregation of client funds, reporting, and fair business practices. By subjecting itself to the oversight of these respected authorities, Windsor Brokers offers its clients an additional layer of protection and peace of mind.

Compared to industry standards, Windsor Brokers stands out with its robust regulatory framework and commitment to compliance. Many brokers in the online trading space operate with a single license or, in some cases, without proper regulation. Windsor Brokers' multiple licenses from reputable regulators across different jurisdictions set it apart, showcasing its dedication to maintaining a safe and transparent trading environment for its clients.

For more information on Windsor Brokers' regulatory compliance and licenses, visit the Regulation section of their official website.

Regulations List

- Cyprus Securities and Exchange Commission (CySEC) – License No. 030/04

- Financial Services Authority (FSA), Seychelles – License No. SD072

- International Financial Services Commission (IFSC), Belize – License No. 137226

- Jordan Securities Commission (JSC) – License No. 18/01855/1/3

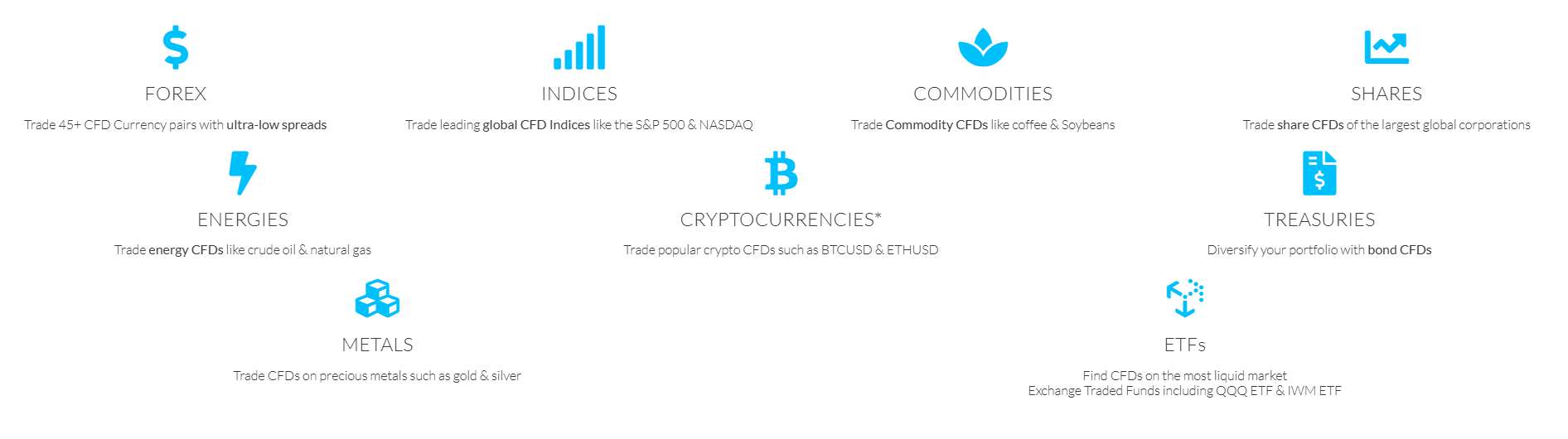

Trading Instruments

Windsor Brokers offers a wide range of tradable assets, providing clients with ample opportunities to diversify their portfolios and take advantage of various market conditions. With over 200 assets available, the broker caters to the needs of both retail and corporate clients worldwide.

| Instrument Type | Available Instruments | Key Features |

|---|---|---|

| Forex | EUR/USD, GBP/USD, USD/JPY, USD/CHF, and more | Competitive spreads from 0.2 pips. |

| CFDs | Commodities, Indices, Shares, ETFs | Speculate on price movements without owning the underlying assets. |

| Commodities | Gold, Silver, Oil, and more | Trade popular commodities via CFDs. |

| Indices | S&P 500, FTSE 100, DAX, Nikkei 225, and others | CFDs on major global stock market indices. |

| Shares | CFDs on individual company stocks from global exchanges | Trade company stocks via CFDs. |

| ETFs | CFDs on Exchange Traded Funds (ETFs) | Access a basket of securities through CFDs. |

| Futures and Options | Futures and options contracts on various underlying assets | Hedge or speculate on future price movements. |

| Bonds | Government and corporate bonds | Diversify portfolios with fixed-income securities through CFDs. |

The extensive range of tradable assets offered by Windsor Brokers reflects the broker's adaptability to market trends and its commitment to catering to the diverse needs of its clients. By providing a wide array of instruments across multiple asset classes, Windsor Brokers enables investors to build flexible and well-diversified portfolios, which is crucial for managing risk and seizing opportunities in different market conditions.

Compared to industry standards, Windsor Brokers stands out with its comprehensive offering of over 200 assets. Many brokers in the online trading space focus on a limited number of asset classes or offer a narrower selection within each category. Windsor Brokers' extensive range of tradable assets positions it as a versatile and adaptable broker that can cater to the needs of a wide variety of traders and investors.

Trading Platforms

How to Trade: Windsor Brokers offers its clients a comprehensive suite of trading platforms, including the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5), as well as the innovative Windsor Brokers App. These platforms are designed to cater to the diverse needs of traders at all levels, from beginners to experienced professionals.

MetaTrader 4 (MT4)

MT4 is a user-friendly and reliable trading platform that has become an industry standard. Windsor Brokers' MT4 platform comes equipped with a wide range of features and tools to enhance your trading experience, including:

- 38 built-in technical indicators

- 44 graphical objects

- 21 dynamic timeframes

- One-click trading

- Expert Advisor functionality for automated trading

- Multi-account management

The MT4 platform is available for desktop, web, and mobile devices (iOS and Android), allowing you to trade on the go and never miss a market opportunity.

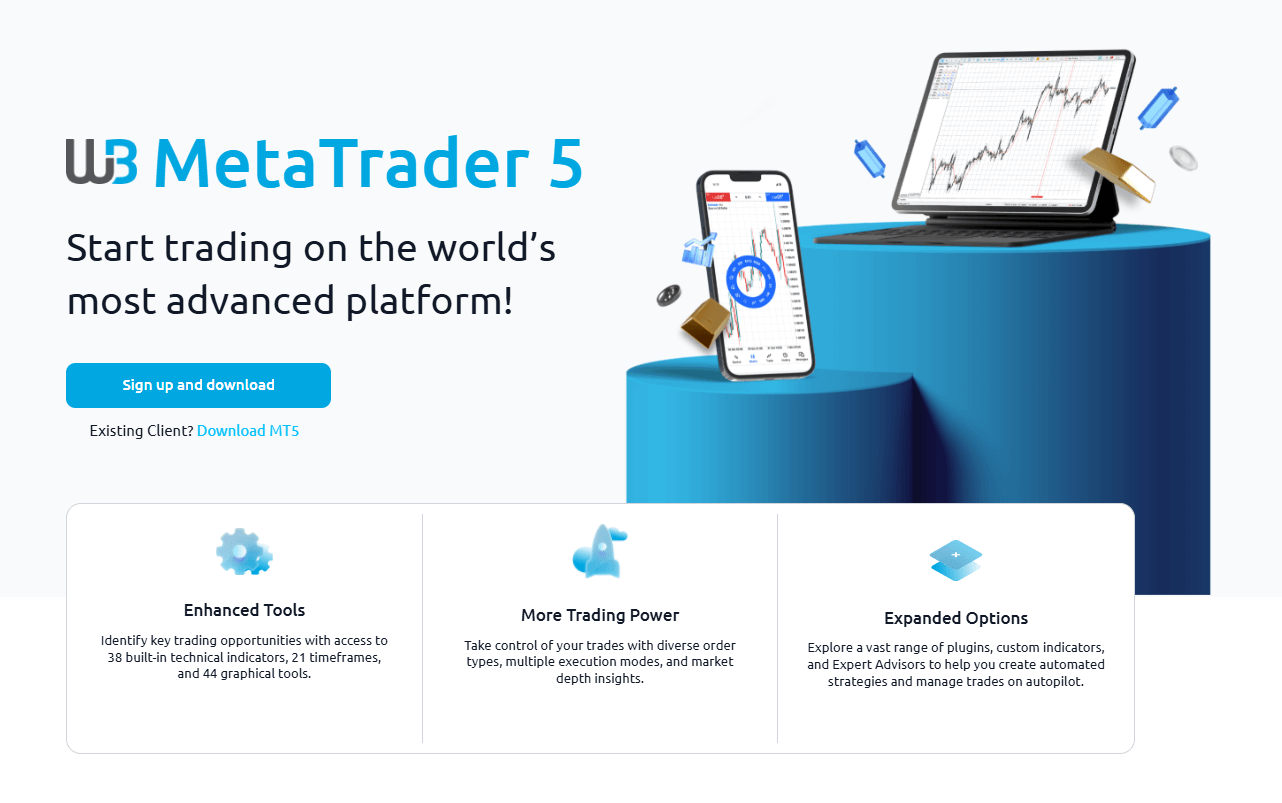

MetaTrader 5 (MT5)

For traders seeking even more advanced features and capabilities, Windsor Brokers offers the cutting-edge MT5 platform. Building upon the strengths of MT4, MT5 takes your trading to the next level with:

- Enhanced tools for identifying key trading opportunities

- Expanded options for controlling your trades, including diverse order types and multiple execution modes

- Access to over 200 trading instruments across various asset classes, including forex, spot metals, shares, cryptocurrencies, treasuries, ETFs, indices, commodities, and energies

- Improved speed, functionality, and algorithmic efficiency

- A vast range of plugins, custom indicators, and Expert Advisors for creating automated strategies and managing trades on autopilot

Like MT4, the MT5 platform is accessible via desktop, web, and mobile apps, ensuring a seamless trading experience across all devices.

Windsor Brokers App

In addition to MT4 and MT5, Windsor Brokers has developed its own proprietary mobile app, designed to provide clients with a seamless and intuitive trading experience on the go. The Windsor Brokers App offers a range of features, including:

- Account management: Control your funds and receive important account notifications

- Deposit and withdrawal: Easily manage your funds with a range of popular payment providers

- Direct access to the MT4 platform: Trade directly from the app with just a few taps

- Favorites: Save and focus on your preferred trading instruments

- Customizable push notifications: Stay informed about market updates and key events

- Performance analytics: Assess your trades and gain insights into your trading performance

- Market news and analysis: Access the latest news, exclusive insights, and market sentiments from Windsor Brokers' analysts

By offering a comprehensive suite of trading platforms, including MT4, MT5, and the Windsor Brokers App, the broker demonstrates its commitment to providing clients with stable, reliable, and feature-rich trading solutions that cater to their individual needs and preferences. These platforms empower traders to implement effective strategies, make informed decisions, and take full control of their trading journey.

Trading Platforms Comparison Table

| Feature | MT4 | MT5 | Windsor App |

|---|---|---|---|

| Built-in technical indicators | 38 | 38 | No |

| Graphical objects | 44 | 44 | No |

| Dynamic timeframes | 21 | 21 | No |

| One-click trading | Yes | Yes | Yes |

| Expert Advisor functionality | Yes | Yes | No |

| Multi-account management | Yes | Yes | Yes |

| Economic calendar | No | Yes | No |

| Unlimited charts | Yes | Yes | No |

| Order types | 4 | 6 | No |

| Execution modes | 3 | 4 | No |

| Tradable assets | 50+ | 200+ | No |

| Algorithmic efficiency | Good | Enhanced | No |

| Plugins/custom indicators | Available | Extended | No |

| Account management | No | No | Yes |

| Deposit and withdrawal | No | No | Yes |

| Performance analytics | No | No | Yes |

| Market news & analysis | No | No | Yes |

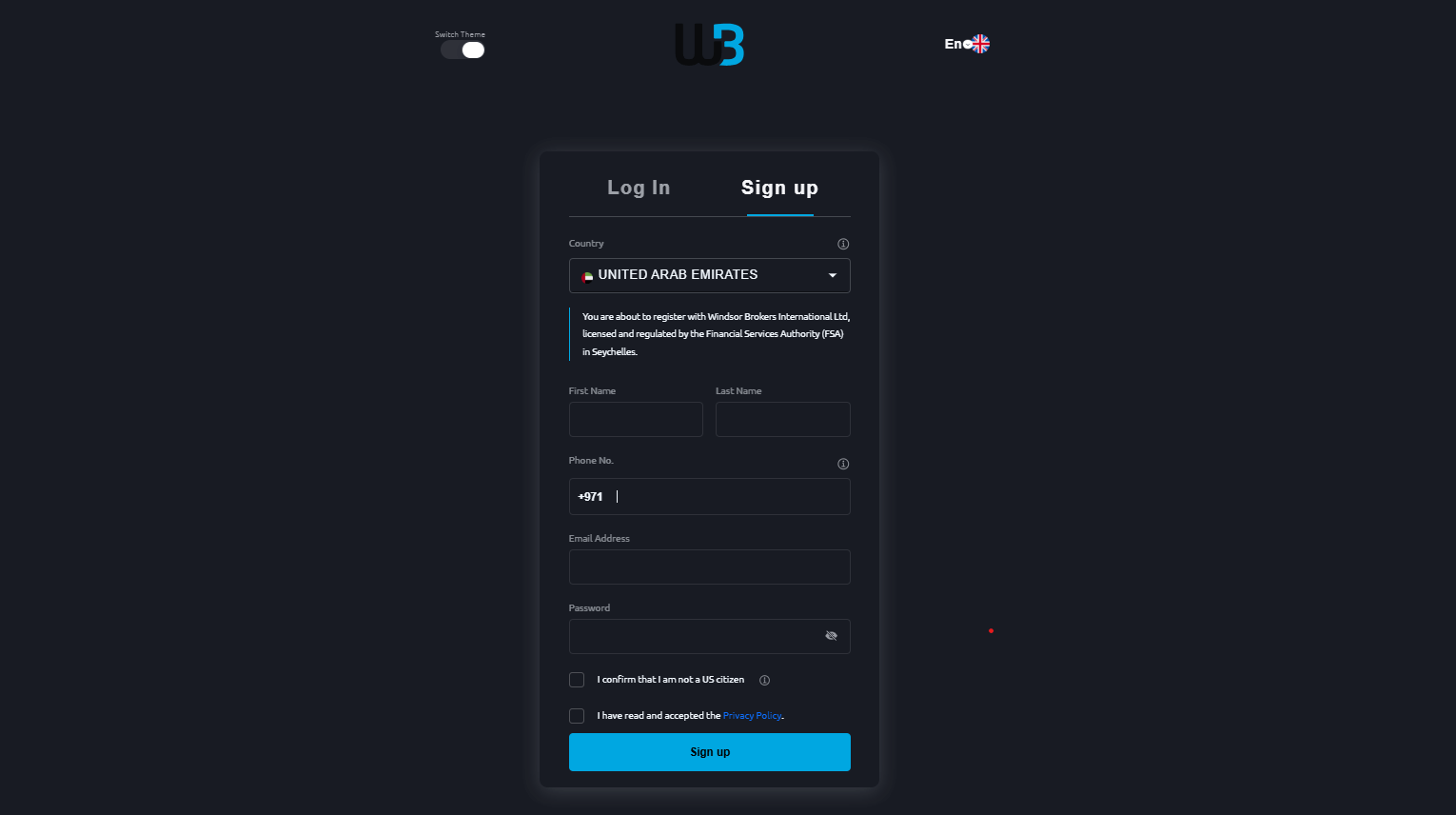

Windsor Brokers How to Open an Account: A Step-by-Step Guide

Opening an account with Windsor Brokers is a straightforward process that can be completed online in a few simple steps. Here's a guide to help you get started:

Step 1: Visit the Windsor Brokers website Go to the official Windsor Brokers website en.windsorbrokers.com and click on the "Open an Account" button located in the top right corner of the homepage.

Step 2: Choose your account type Select the type of account you wish to open from the available options, such as Prime, Zero, or VIP Zero. Each account type has different features and trading conditions, so choose the one that best suits your needs and trading style.

Step 3: Fill out the registration form Complete the online registration form with your personal details, including your full name, email address, phone number, country of residence, and preferred currency. You will also need to create a secure password for your account.

Step 4: Verify your identity To comply with regulatory requirements and prevent fraud, Windsor Brokers requires clients to verify their identity. You will need to upload a valid government-issued ID, such as a passport or driver's license, and a proof of residence, such as a utility bill or bank statement, dated within the last three months.

Step 5: Fund your account Once your account is verified, you can fund it using one of the accepted payment methods, which include credit/debit cards, bank wire transfers, and various e-wallets like Skrill, Neteller, and WebMoney. The minimum deposit required to open an account with Windsor Brokers is $50.

Step 6: Start trading After your account is funded, you can download and install the MetaTrader 4 (MT4) or MetaTrader 5 (MT5) trading platforms or access the web-based platform to start trading. Familiarise yourself with the platform's features and tools, and make sure to understand the risks involved in trading before placing your first trade.

Windsor Brokers offers a user-friendly account opening process, with a simple online registration form and quick account verification. The broker's client support team is available 24/5 to assist you with any questions or issues you may encounter during the account opening process.

Charts and Analysis

Windsor Brokers offers a comprehensive suite of educational trading resources and tools to help clients enhance their trading knowledge and skills. These resources cater to traders of all levels, from beginners to experienced professionals.

Trading Platform Tools: The MetaTrader 4 & 5 platforms provided by Windsor Brokers comes equipped with a wide range of built-in charting tools and technical indicators. Traders can access multiple chart types, timeframes, and customisable templates to analyse market trends and price movements. The platform also supports the use of Expert Advisors (EAs) for automated trading and backtesting strategies.

However, some leading competitors in the industry may offer more extensive educational programs, such as structured courses, one-on-one mentoring, and live trading rooms. While Windsor Brokers' educational resources are well-rounded, there may be room for further expansion and depth in certain areas.

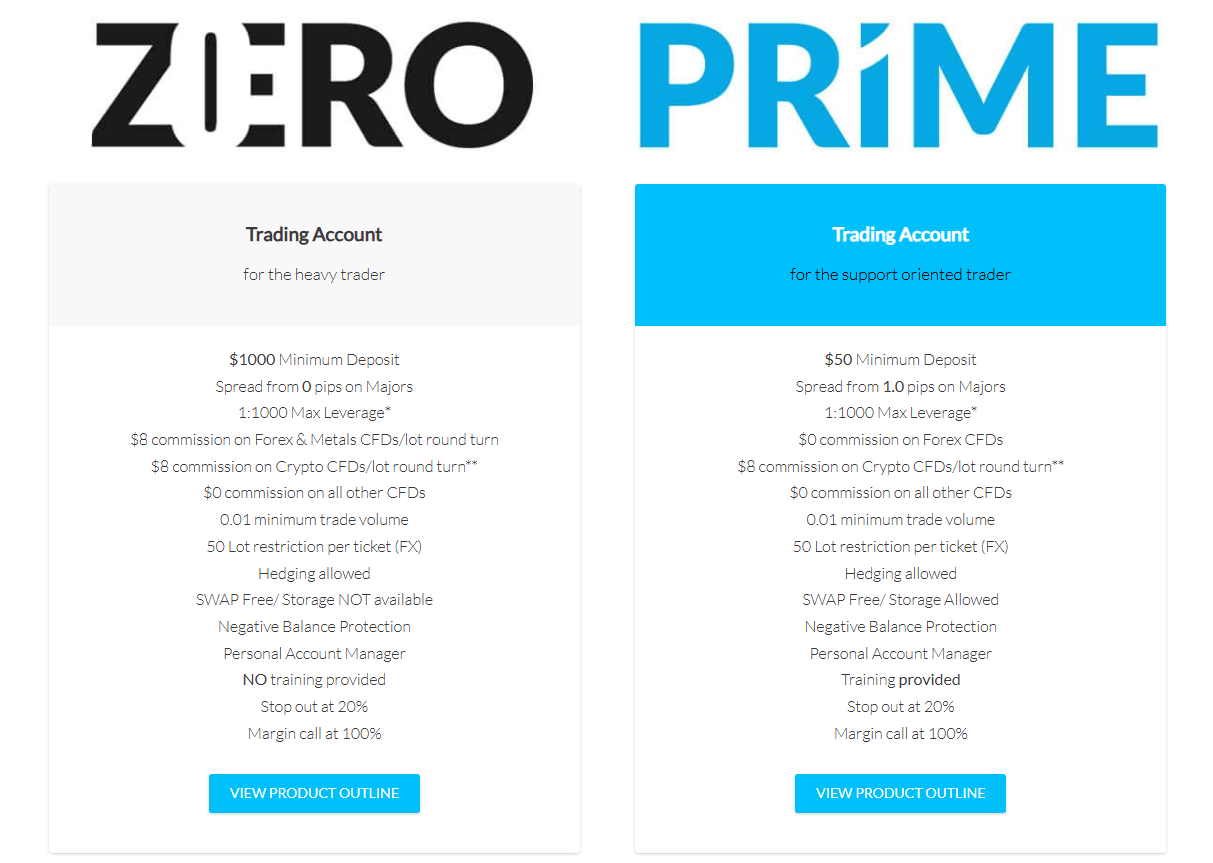

Windsor Brokers Account Types

Windsor Brokers offers three main account types designed to cater to the diverse needs and preferences of traders: Prime, Zero, and VIP Zero. Each account type comes with unique features and trading conditions, allowing clients to select the one that best suits their trading style and goals.

Prime Account

The Prime account is Windsor Brokers' most popular account type, offering competitive spreads and a range of trading instruments. Key features include:

- Minimum deposit: $50

- Maximum leverage: 1:30 for EU clients, 1:1000 for non-EU clients

- Spread: From 1.5 pips

- Commission: No additional commission

- Tradable assets: Forex, CFDs on commodities, indices, shares, and more

Zero Account

The Zero account is designed for more experienced traders seeking tighter spreads and lower trading costs. Key features include:

- Minimum deposit: $1,000

- Maximum leverage: 1:30 for EU clients, 1:1000 for non-EU clients

- Spread: From 0.0 pips

- Commission: $8 per standard lot round turn

- Tradable assets: Forex, CFDs on commodities, indices, shares, and more

VIP Zero Account

The VIP Zero account is tailored for high-volume traders and institutional clients, offering the most competitive trading conditions. Key features include:

- Minimum deposit: $25,000

- Maximum leverage: 1:30 for EU clients, 1:1000 for non-EU clients

- Spread: From 0.0 pips

- Commission: $5 per standard lot round turn

- Tradable assets: Forex, CFDs on commodities, indices, shares, and more

- Dedicated account manager and priority support

Demo Account

In addition to the live trading accounts, Windsor Brokers offers a demo account that allows clients to practise trading in a risk-free environment using virtual funds. The demo account mirrors the trading conditions of the real accounts, providing a realistic experience for clients to test strategies and familiarise themselves with the trading platform.

Windsor Brokers' range of account types demonstrates the broker's commitment to catering to the diverse needs of traders. By offering accounts with varying minimum deposits, spreads, and commissions, the broker ensures that clients can select an account type that best aligns with their trading style, experience level, and financial goals.

Account Types Comparison Table

| Feature | Prime | Zero | VIP Zero |

|---|---|---|---|

| Minimum Deposit | $50 | $1,000 | $25,000 |

| Maximum Leverage (EU) | 1:30 | 1:30 | 1:30 |

| Maximum Leverage (Non-EU) | 1:1000 | 1:1000 | 1:1000 |

| Spread (From) | 1.0 pips | 0.0 pips | 0.0 pips |

| Commission (Per Lot) | $8 | $8 | $5 |

| Tradable Assets | Forex, CFDs | Forex, CFDs | Forex, CFDs |

| Account Manager | No | No | Yes |

| Demo Account | Yes | Yes | Yes |

Negative Balance Protection

Windsor Brokers' negative balance protection policy applies to all trading accounts, regardless of the account type or the trading platform used. However, traders should be aware that this protection may not cover all situations, such as cases of market manipulation, insider trading, or other forms of misconduct. Additionally, negative balance protection may not apply to certain types of trading instruments or market conditions, such as during periods of extreme market volatility or in the event of a force majeure. Traders are encouraged to review Windsor Brokers' terms and conditions carefully to fully understand the scope and limitations of the negative balance protection policy. By offering negative balance protection, Windsor Brokers demonstrates its commitment to safeguarding clients' funds and promoting responsible trading practices. This feature provides traders with peace of mind, knowing that their potential losses are limited to the funds they have invested, even in the face of adverse market conditions.

Windsor Brokers Deposits and Withdrawals

Windsor Brokers offers a range of secure and convenient deposit and withdrawal options to facilitate smooth transactions for its clients. The broker understands the importance of efficient fund management and strives to provide a seamless experience for both deposits and withdrawals.

Deposit Methods

Clients can fund their trading accounts using the following methods:| Payment Method | Processing Time | Fees |

|---|---|---|

| Credit/Debit Cards (Visa, Mastercard) | Instant | 3% fee |

| Bank Wire Transfer | 1–5 business days | Varies by bank |

| Skrill | Instant | 3% fee |

| Neteller | Instant | 3% fee |

| WebMoney | Instant | 0.8% fee |

Withdrawal Methods

Traders can withdraw funds from their accounts using the same methods available for deposits:| Payment Method | Processing Time | Fees |

|---|---|---|

| Credit/Debit Cards (Visa, Mastercard) | 1–5 business days | $3 per transaction |

| Bank Wire Transfer | 1–5 business days | Varies by bank |

| Skrill | 1–5 business days | $3 per transaction |

| Neteller | 1–5 business days | $3 per transaction |

| WebMoney | 1–5 business days | 0.8% fee |

Support Service for Customer

In the fast-paced world of online trading, reliable customer support is crucial for a positive trading experience. Traders often require assistance with account management, platform troubleshooting, or general enquiries, and a responsive support team can make all the difference. Windsor Brokers recognises the importance of providing excellent customer support and offers multiple channels for traders to reach out for help.

Support Channels

Clients can contact Windsor Brokers' customer support team through the following channels:- Live Chat: Available 24/5 on the broker's website

- Email: support@windsorbrokers.eu

- Phone: +357 25 500 700

- Social Media: Facebook, Twitter, Instagram, LinkedIn

- Live Chat: 1-2 minutes

- Email: 1-2 hours

- Phone: Immediate response during working hours

Customer Support Comparison Table

| Feature | Details |

|---|---|

| Support Channels | Live Chat, Email, Phone, Social Media |

| Support Languages | English, Spanish, Arabic, Chinese, and more |

| Support Hours | 24/5 (Monday to Friday) |

| Average Response Time – Live Chat | 1–2 minutes |

| Average Response Time – Email | 1–2 hours |

| Average Response Time – Phone | Immediate response during working hours |

| Dedicated Account Managers | Yes (VIP Zero accounts) |

Prohibited Countries

Windsor Brokers is an international broker that aims to provide its services to a wide range of clients globally. However, due to various regulatory requirements, licensing restrictions, and geopolitical factors, the broker is prohibited from operating or offering its services in certain countries and regions.

These restrictions are put in place to ensure compliance with local laws and regulations, as well as to protect the interests of both the broker and its clients. Operating in a prohibited country could result in legal consequences for the broker and potential risks for clients, such as difficulty in accessing funds or lack of regulatory protection.

Windsor Brokers is currently not allowed to provide services to residents of the following countries:

- United States of America (USA)

- Belgium

- Japan

Residents of these countries are prohibited from opening an account or trading with Windsor Brokers. The broker implements strict measures to identify and prevent clients from prohibited countries from accessing its services, such as IP address checks and identity verification procedures.

It's important to note that attempting to trade with Windsor Brokers from a prohibited country by providing false information or using a VPN to mask your location could result in the termination of your account and potential legal consequences.

If you are unsure whether your country of residence is allowed to trade with Windsor Brokers, it is recommended to contact the broker's customer support team for clarification before attempting to open an account.

For the most up-to-date information on prohibited countries and any changes to Windsor Brokers' service availability, please refer to the "Terms and Conditions" or "Legal Documents" section of their official website.

Prohibited Countries List:

- Windsor Brokers is allowed to operate in all regions worldwide, except for the USA, Belgium, and Japan.

Special Offers for Customers

- At present, Windsor Brokers does not offer any special promotions, bonuses, or loyalty programs.

Conclusion

After conducting a thorough review of Windsor Brokers, I believe they are a reliable and trustworthy broker that offers a solid trading experience for both beginner and experienced traders.

One of the key strengths of Windsor Brokers is their strong regulatory compliance. They are licensed and regulated by reputable authorities such as CySEC, FSA, IFSC, and JSC across multiple jurisdictions. This demonstrates their commitment to operating transparently and adhering to strict financial regulations designed to protect clients' interests.

In terms of trading offerings, Windsor Brokers provides a diverse range of tradable assets, including forex, CFDs on commodities, indices, shares, ETFs, futures, options, and more. This allows traders to diversify their portfolios and take advantage of various market opportunities. The broker's competitive spreads, fast execution speeds, and the availability of the industry-standard MT4 & MT5 trading platforms further enhance the overall trading experience.

Windsor Brokers also excels in customer support, offering 24/5 multilingual assistance through various channels such as live chat, email, phone, and social media. Their knowledgeable and responsive support team is a valuable resource for traders seeking guidance or resolving issues.

While Windsor Brokers does not currently offer any special promotions or bonuses, I believe this reflects their focus on providing a fair and transparent trading environment for all clients, regardless of account size or trading volume. The broker's negative balance protection policy and commitment to client fund segregation provide additional peace of mind for traders.

One potential drawback is that Windsor Brokers is not available to residents of certain countries, including the USA, Belgium, and Japan, due to regulatory restrictions. However, this limitation is clearly communicated, and the broker takes steps to prevent traders from restricted regions from opening accounts.

Overall, I consider Windsor Brokers to be a reliable and reputable broker that prioritises client satisfaction, regulatory compliance, and a comprehensive trading experience. Their extensive range of tradable assets, competitive trading conditions, and robust customer support make them a strong choice for traders seeking a trusted partner in their trading journey.

Find zero-commission picks in the no-fee broker index.

Compare fee structures in the ROInvesting review.