XM Group Review 2025: A Trusted Broker for Forex & CFD Trading

XM

Cyprus

Cyprus

-

Minimum Deposit $5

-

Withdrawal Fee $0

-

Leverage 1000:1

-

Spread From 0.6

-

Minimum Order 0.01

-

Forex Available

-

Crypto Unavailable

-

Stock Available

-

Indices Available

Licenses

Cyprus Market Making (MM)

Cyprus Market Making (MM)

Australia Retail Forex License

Australia Retail Forex License

UAE Financial Services License

UAE Financial Services License

Belize Financial Services License

Belize Financial Services License

Softwares & Platforms

Customer Support

+35725252710

(English)

+35725252710

(English)

Supported language: Arabic, Chinese (Simplified), English, French, German, Italian, Spanish

Social Media

Summary

XM is a well-regulated and client-focused forex and CFD broker, licensed by top-tier authorities like CySEC, ASIC, and the FCA. It offers competitive spreads, flexible leverage, and multiple account types for traders of all levels. With 24/5 multilingual customer support, extensive educational resources, and a loyalty program, XM enhances the trading experience. High-volume traders benefit from free VPS hosting, though the platform is restricted in certain regions like the U.S. and Canada.

- Strong regulatory compliance with licenses from top-tier authorities

- Comprehensive customer support is available 24/5 in multiple languages

- Extensive educational resources, including webinars and tutorials

- Wide range of account types catering to different trading levels

- Competitive spreads and flexible leverage options

- Diverse array of tradable assets across various markets

- XM Loyalty Program rewards active traders with cashback and bonuses

- Free VPS hosting for high-volume traders

- User-friendly trading platforms, including MT4 and MT5

- Regular promotions and contests for traders

- Geographical restrictions in some countries with strict regulations

- Limited range of tradable instruments compared to some competitors

- Higher minimum deposit for XM Ultra Low accounts ($50)

- No fixed spreads available; all accounts have variable spreads

- Inactivity fees charged after 90 days of no trading activity

- Limited social trading features compared to some other brokers

- No guaranteed stop-loss orders available

- Doesn't offer direct stock trading (only CFDs) outside of XM Global

- The minimum withdrawal amount of $5 may not suit all traders

- Maximum leverage may be lower than some competitors in certain regions

Overview

Established in 2009, XM Group has grown into a globally recognized online broker, serving over 10 million clients worldwide. Regulated by top-tier authorities such as CySEC, ASIC, DFSA, and FSCA across its entities, XM prioritizes trust, security, and client satisfaction.

XM offers a diverse array of tradable instruments, including 50+ forex pairs, stock CFDs, commodities, and cryptocurrencies (subject to regional restrictions). With competitive spreads starting from 0.8 pips on Ultra Low accounts and leverage up to 1000:1 (region-specific), XM caters to traders of all experience levels.

The broker's commitment to education is evident through its comprehensive offering of daily webinars, video tutorials, Tradepedia courses, XM TV, and in-depth market analysis. These multilingual resources empower traders to make informed decisions and refine their strategies.

XM's 24/5 customer support, available in 30+ languages via live chat, email, and phone, ensures prompt assistance whenever needed. The intuitive MetaTrader 4/5 platforms and proprietary mobile apps provide a seamless trading experience across devices.

With a proven track record and multiple industry awards, such as "Best FX Broker" at the World Finance Forex Awards 2023, XM has established itself as a reliable and client-centric broker. Visit their official website to explore account types, promotions, and more.

While XM's low minimum deposit and educational resources make it an attractive choice, prospective clients should carefully consider their risk tolerance and trading goals. As with any financial decision, thorough research and due diligence are essential.

For more information, visit their official website atxm.com

XM Overview Table

| Aspect | Details |

|---|---|

| Regulation | CySEC (120/10), ASIC, DFSA (F003484), FSCA (49976) |

| Minimum Deposit | $5 |

| Leverage | Up to 1000:1 (region-specific) |

| Instruments | 50+ Forex pairs, CFDs (stocks, commodities, cryptos), Metals |

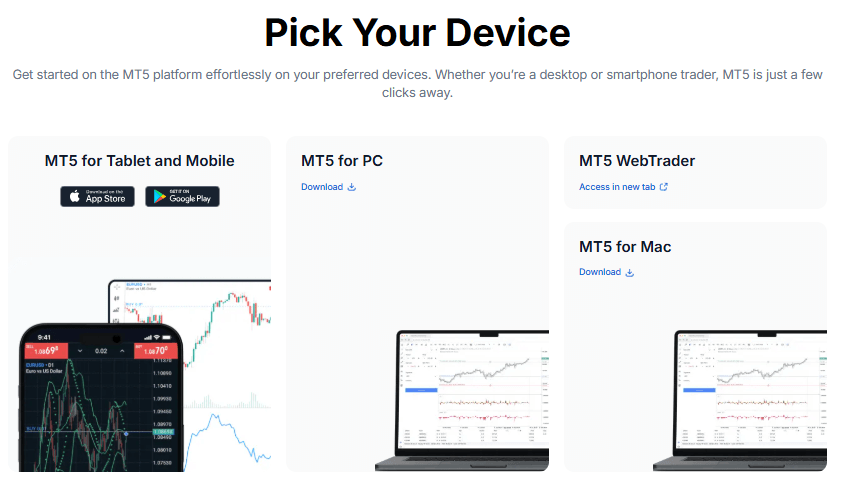

| Platforms | MetaTrader 4/5, XM mobile app |

| Education | Daily webinars, video tutorials, Tradepedia courses, market analysis |

| Customer Support | 24/5, 30+ languages, live chat, email, phone |

| Key Features | Low spreads, copy trading, forex signals, VPS hosting |

Facts List

- XM Group was founded in 2009 and has since expanded to serve over 10 million clients globally.

- The broker is regulated by respected authorities, including CySEC (120/10) in Europe and ASIC in Australia.

- XM offers competitive spreads starting from 0.8 pips on Ultra Low accounts.

- Traders can access leverage up to 1000:1, depending on regional regulations.

- XM provides a diverse range of instruments, including 50+ forex pairs, CFDs on stocks, commodities, and cryptocurrencies (subject to regional availability).

- The MetaTrader 4 and 5 platforms are available, along with user-friendly XM mobile apps for iOS and Android devices.

- XM's extensive educational resources include daily webinars, video tutorials, Tradepedia courses, and thorough market analysis.

- Clients can access 24/5 multilingual customer support via live chat, email, and phone.

- Additional features like copy trading, forex signals, and VPS hosting cater to various trading needs.

- XM has received industry recognition, such as "Best FX Broker" at the World Finance Forex Awards 2023.

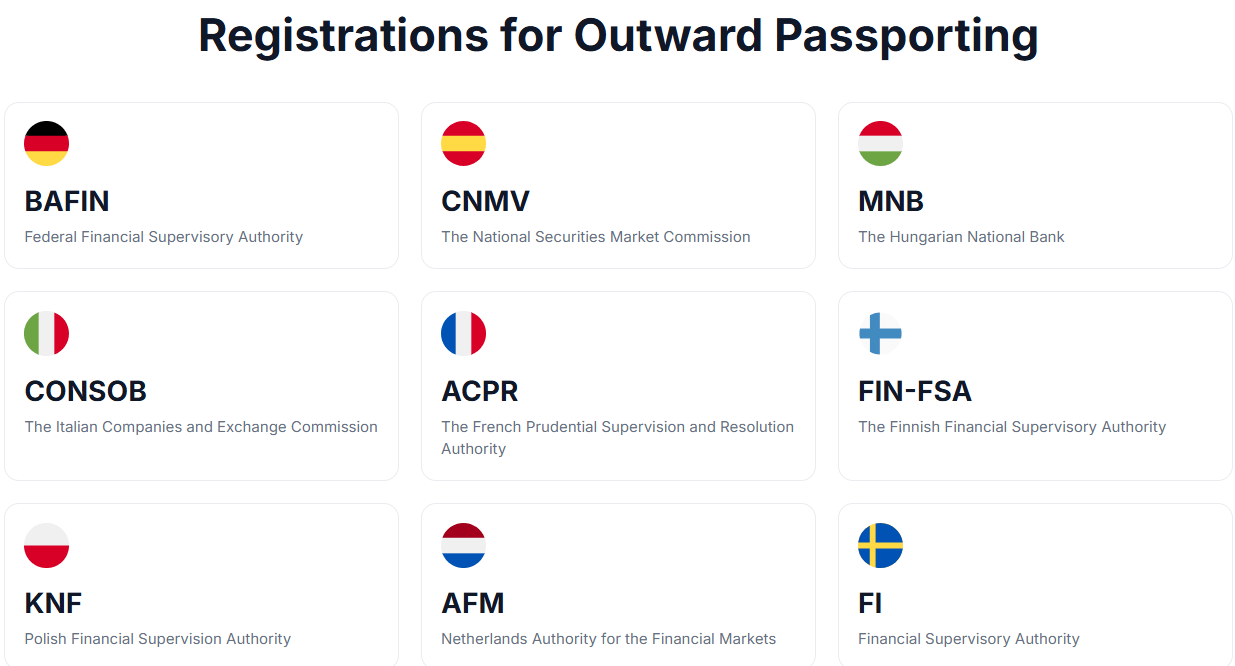

XM Licenses and Regulatory

XM Group operates under a robust regulatory framework, holding licenses from multiple respected authorities worldwide. This commitment to compliance instills trust and ensures client protection.

Regulations table

| Regulator | License Number/Authorization | Entity |

|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | License number: 120/10 | Trading Point of Financial Instruments Ltd (Cyprus) |

| Australian Securities and Investments Commission (ASIC) | Authorized and regulated in Australia | Trading Point of Financial Instruments Pty Ltd (Australia) |

| Dubai Financial Services Authority (DFSA) | License number: F003484 | Trading Point MENA Limited (UAE) |

| Financial Services Commission (FSC), Belize | License number: 000261/309 | XM Global Limited (Belize) |

| South Africa Financial Sector Conduct Authority (FSCA) | Authorized as a Financial Service Provider (FSP) with authorization number 49976 | XM ZA (Pty) Ltd (South Africa) |

The importance of multiple regulatory licenses cannot be overstated. It demonstrates XM's commitment to operating transparently and adhering to strict financial regulations across jurisdictions. This regulatory diversity also allows XM to serve clients from various regions while maintaining compliance with local laws.

Compared to industry standards, XM Group's regulatory profile is solid. The broker's licenses from CySEC and ASIC place it among the more reputable firms in the sector. However, prospective clients should be aware that the level of protection may vary depending on the specific entity they choose to trade with.

Trading Instruments

XM Group offers a diverse array of tradable assets, catering to the varied needs and preferences of its global client base. With over 1,500 instruments across multiple asset classes, XM provides traders with ample opportunities to diversify their portfolios and capitalize on market movements.

Tradable Assets

| Trading Instruments | Details |

|---|---|

| Forex | 55+ currency pairs, including majors, minors, and exotics |

| CFDs on Stocks | 1,200+ CFDs on global company shares |

| CFDs on Commodities | Precious metals, energies, and agricultural products |

| CFDs on Indices | Popular stock indices from around the world |

| CFDs on Cryptocurrencies | Bitcoin, Ethereum, Litecoin, and Ripple (subject to regional availability) |

| Shares | Direct share trading in US, UK, and German markets (available through XM Global) |

Compared to industry standards, XM's tradable assets are comprehensive and competitive. The broker's range of instruments is on par with or exceeds many of its peers, positioning XM as a versatile choice for traders seeking exposure to various markets.

Trading Platforms

XM Group offers a range of platforms to cater to the diverse needs and preferences of its clients. By providing access to both industry-standard and proprietary platforms, XM ensures that traders can choose the tools that best suit their trading style and expertise level.

| Feature | MT4 | MT5 | WebTrader | Mobile Apps |

|---|---|---|---|---|

| Charting Tools | Advanced | Advanced | Basic | Advanced |

| Technical Indicators | 30+ | 38+ | Basic | 30+ |

| Automated Trading (EAs) | Yes | Yes | No | Yes |

| Hedging | No | Yes | No | No |

| Order Types | Market, Limit, Stop | Market, Limit, Stop | Market, Limit | Market, Limit, Stop |

| Customizable Interface | Yes | Yes | No | Yes |

| Web-Based | No | No | Yes | No |

| Mobile Apps | iOS, Android | iOS, Android | No | iOS, Android |

The stability and reliability of XM's trading platforms are crucial for ensuring a smooth and satisfactory trading experience. XM invests in robust infrastructure and advanced technology to minimize downtime and ensure that its platforms can handle high trading volumes and market volatility. The broker also provides regular updates and enhancements to its platforms, ensuring that clients have access to the latest tools and features.

XM's platforms cater to a wide range of trading strategies and styles. The advanced charting tools and technical indicators available on MT4 and MT5 enable traders to perform in-depth market analysis and make informed trading decisions. The platforms also support various order types, including market, limit, and stop orders, allowing traders to manage their risk effectively.

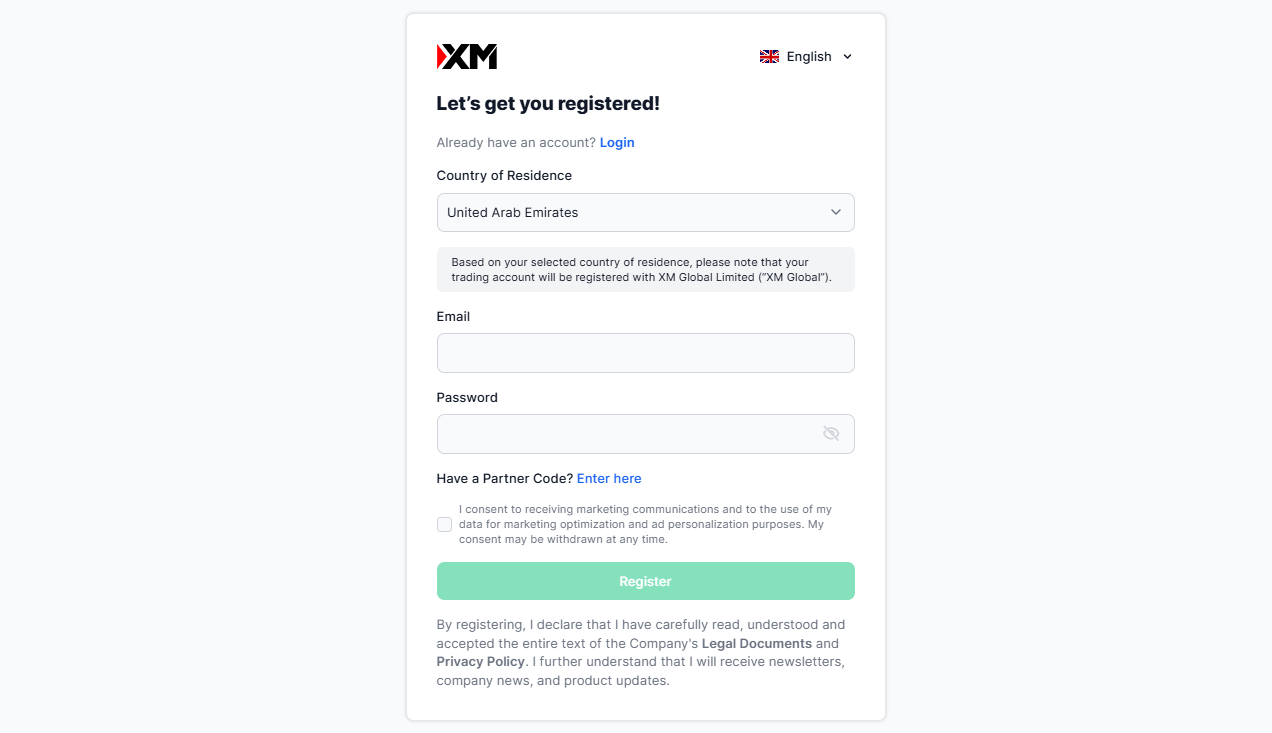

XM How to Open an Account: A Step-by-Step Guide

Opening an account with XM Group is a straightforward and user-friendly process. By following these simple steps, you can start trading with XM in no time.

Step 1: Visit the XM website and click on the "Open an Account" button.

Step 2: Choose your account type (Micro, Standard, XM Ultra Low, or Shares) and select your preferred base currency.

Step 3: Fill out the registration form with your personal information, including your name, email address, phone number, and country of residence. Ensure that all information provided is accurate and up-to-date.

Step 4: Choose your leverage and account type (for XM Global clients).

Step 5: Submit proof of identity and proof of residence. Acceptable documents for proof of identity include a valid passport or government-issued ID card. For proof of residence, you can provide a utility bill, bank statement, or other official document showing your current address. These documents are required to comply with anti-money laundering (AML) and know-your-customer (KYC) regulations.

Step 6: Wait for XM to verify your account. This process typically takes 24-48 hours, but in some cases, it may take up to 5 business days.

Step 7: Once your account is verified, log in to the Members Area and select "Fund My Account" to make your initial deposit. XM accepts various payment methods, including credit/debit cards, bank wire transfers, e-wallets (such as Skrill and Neteller), and more. The minimum deposit amounts are as follows:

- $5 for Micro and Standard accounts

- $50 for XM Ultra Low accounts

- $10,000 for Shares accounts

Step 8: Download and install the trading platform of your choice (MT4, MT5, or WebTrader) or access the XM mobile trading apps for iOS or Android devices.

Step 9: Start trading!

XM offers several unique features to streamline the account opening process. For example, the broker provides a "Live" button on the registration form, allowing you to connect with a customer support representative in real-time if you have any questions or concerns. Additionally, XM offers a fast and efficient account verification process, with most accounts being approved within 24 hours.

It's important to note that, while XM strives to make the account opening process as simple as possible, the broker is committed to complying with all relevant regulations and ensuring the security of its clients' funds and personal information. As such, XM may request additional documentation or information in some cases to ensure compliance with AML and KYC requirements.

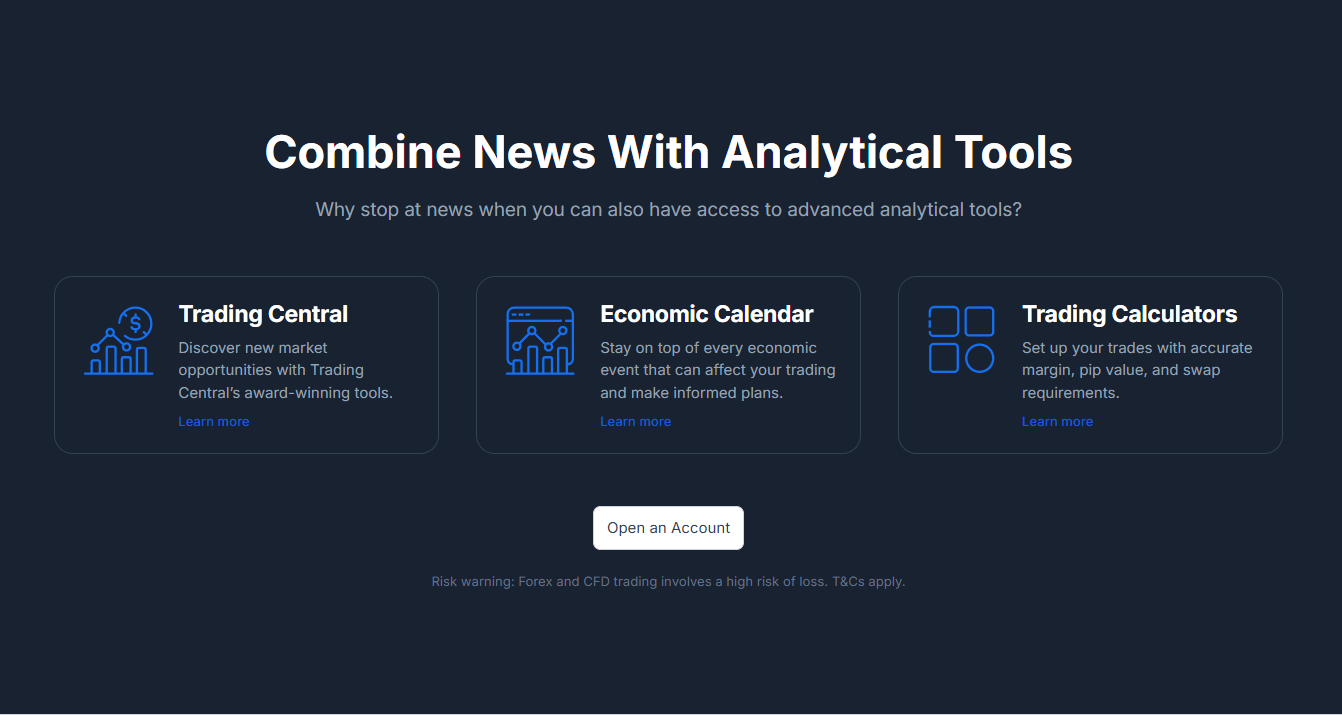

Charts and Analysis

XM Group offers a comprehensive suite of educational trading resources and tools designed to support traders of all skill levels. By providing access to a wide range of materials, XM empowers its clients to enhance their trading knowledge, refine their strategies, and make informed decisions in the markets.

| Trading Tools & Resources | Details |

|---|---|

| Charts and Technical Analysis Tools | Advanced charting capabilities with multiple chart types, timeframes, and technical indicators on MT4 and MT5. Customizable templates can be created and saved. |

| Economic Calendar | Real-time calendar tracking key market events like central bank announcements, economic data releases, and political events, with expected impact and historical data. |

| Webinars and Seminars | A wide range of live and on-demand educational webinars and seminars for both beginners and advanced traders, available in multiple languages. |

| XM Market Research and Analysis | Daily market commentary, technical and fundamental analysis from XM's in-house experts. Available in articles, videos, and podcasts across multiple platforms. |

| Educational Articles and Guides | A library of educational articles and guides to help traders learn about trading fundamentals, market trends, and risk management strategies. |

| XM for Beginners | A dedicated beginner’s section with a step-by-step guide on how to open an account, use trading platforms, place trades, and understand risk management. |

Evaluating XM's educational resources against industry standards reveals a broker committed to empowering its clients with knowledge and tools for success. The breadth and depth of XM's offerings are comparable to, and in some cases exceed, those provided by other leading brokers. The combination of live webinars, on-demand content, and written materials caters to various learning styles and preferences.

XM's investment in developing and maintaining these resources demonstrates a strong commitment to client education and support. By providing a diverse array of educational materials, XM enables traders to continuously expand their knowledge and adapt to changing market conditions.

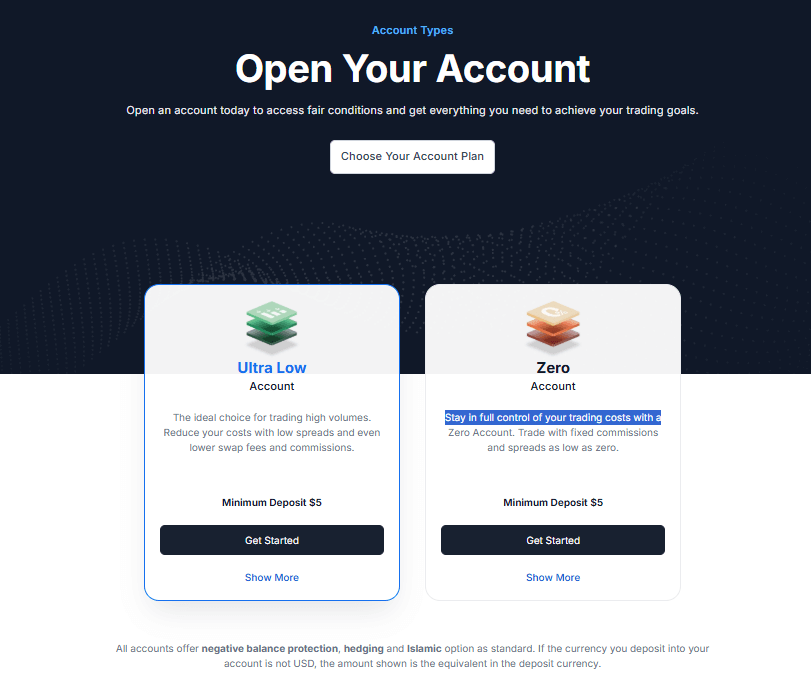

XM Account Types

XM Group offers a diverse range of trading account types designed to cater to the unique needs and preferences of its global client base. By providing multiple account options, XM account diversion ensures that traders can select the account that best aligns with their trading style, experience level, and financial objectives.

| Feature | Micro | Standard | XM Ultra Low | Shares |

|---|---|---|---|---|

| Min. Deposit | $5 | $5 | $50 | $10,000 |

| Leverage | Up to 1:1000 | Up to 1:1000 | Up to 1:888 | 1:1 |

| Spreads | From 1 pip | From 1 pip | From 0.6 pips | N/A |

| Commission | No | No | No | From $0.1/share |

| Min. Trade Size | 0.01 lots | 0.01 lots | 0.01 lots | 1 share |

| Instruments | 55+ forex pairs, CFDs | 55+ forex pairs, CFDs | 55+ forex pairs, CFDs | Stocks |

| Islamic Account | Yes | Yes | No | No |

| Demo Account | Yes | Yes | Yes | No |

Evaluating XM's account types reveals a broker committed to providing flexibility and customization to its clients. The low minimum deposit requirements for the Micro and Standard Accounts make XM accessible to a wide range of traders, while the XM Ultra Low Account caters to those seeking the most competitive spreads.

The availability of a Shares Account sets XM apart from many competitors, allowing traders to invest in and own real stocks. Furthermore, the provision of a free demo account and swap-free Islamic accounts demonstrates XM's commitment to inclusivity and accommodating diverse trading needs.

Compared to industry standards, XM's account types are competitive and well-structured. The broker strikes a balance between offering variety and maintaining simplicity, ensuring that traders can easily select the account that best suits their requirements.

Negative Balance Protection

- Automatic Stop-Out: XM’s platform automatically closes positions when the account equity drops below 50% of the required margin, preventing further losses.

- Margin Call Alerts: Traders receive alerts when their equity falls below the margin requirement, giving them an opportunity to manage their positions before reaching a negative balance.

- No Debit Balances: If a trader’s account balance turns negative, XM absorbs the loss and resets the account to zero. Clients are not held liable for debit balances.

While negative balance protection is a safeguard, XM emphasizes the importance of proper risk management. Traders should still monitor their positions, use appropriate leverage, and maintain sufficient margin.

XM’s policy ensures that traders' losses are limited to the funds available in their accounts, providing peace of mind and supporting responsible trading.

XM Deposits and Withdrawals

XM Group offers a wide range of convenient deposit and withdrawal methods to cater to the diverse needs of its global client base. The broker understands the importance of smooth and secure transactions, ensuring that traders can easily fund their accounts and access their profits.Here is a brief of their trading costs:

Deposit Methods

| Deposit Method | Processing Time | Minimum Deposit | Notes |

|---|---|---|---|

| Credit/Debit Cards (Visa, Mastercard, Maestro) | Instant processing | From $5 | No deposit fees from XM, but payment provider fees may apply. |

| Bank Wire Transfer | 2-5 business days | Varies by account type | No deposit fees from XM, but bank fees may apply. |

| Electronic Payment Methods (Skrill, Neteller, UnionPay, iDeal, Sofort) | Instant processing | From $5 | No deposit fees from XM, but payment provider fees may apply. |

| Cryptocurrencies (Bitcoin, Ethereum, Litecoin, Dash, Ripple) | Instant processing | Varies by account type | No deposit fees from XM, but blockchain network fees may apply. |

Withdrawal Methods

| Withdrawal Method | Processing Time | Minimum Withdrawal | Notes |

|---|---|---|---|

| Credit/Debit Cards (Visa, Mastercard, Maestro) | 2-5 business days | $5 | No withdrawal fees from XM, but payment provider fees may apply. |

| Bank Wire Transfer | 2-5 business days | $5 | No withdrawal fees from XM, but bank fees may apply. |

| Electronic Payment Methods (Skrill, Neteller, UnionPay, iDeal, Sofort) | Instant processing | $5 | No withdrawal fees from XM, but payment provider fees may apply. |

| Cryptocurrencies (Bitcoin, Ethereum, Litecoin, Dash, Ripple) | Instant processing | $5 | No withdrawal fees from XM, but blockchain network fees may apply. |

Verification Requirements

To comply with international anti-money laundering (AML) and know-your-customer (KYC) regulations, XM requires clients to verify their accounts before processing withdrawals. This involves submitting proof of identity (e.g., government-issued ID, passport) and proof of residence (e.g., utility bill, bank statement). The verification process is straightforward and can be completed online, with most documents being reviewed within 24 hours.Unique Deposit and Withdrawal Features

XM stands out from competitors by offering a wide range of payment methods, including support for various cryptocurrencies. This allows traders to fund their accounts and withdraw profits using their preferred digital assets, providing added flexibility and convenience. Additionally, XM's fast processing times and lack of deposit or withdrawal fees make it an attractive choice for traders seeking efficient and cost-effective transaction solutions. The broker's commitment to security and regulatory compliance further enhances client confidence in their deposit and withdrawal processes.Support Service for Customer

In the fast-paced world of online trading, reliable customer support is crucial for a positive trading experience. Traders need access to knowledgeable and responsive support teams to address their queries, resolve technical issues, and provide guidance when needed. XM Group understands the importance of excellent customer support and offers a range of channels and resources to assist traders.

Support Channels

XM provides multiple ways for traders to reach out for assistance:| Support Channel | Availability | Response Time | Details |

|---|---|---|---|

| Live Chat | 24/5 | 1-2 minutes | Connect with support in real-time directly from the website or trading platform. |

| 24/5 | 24 hours | Send inquiries to support@xm.com for prompt assistance. | |

| Phone | 24/5 (over 30 countries) | Immediate | Local phone support in over 30 countries; main line: +357 25 252 710. |

| Callback Service | 24/5 | Within chosen timeframe | Request a callback by filling out a form with your contact number and preferred time. |

| Social Media | 24/5 | Varies | Reach out through Facebook, Twitter, and LinkedIn for support or updates. |

Support Languages

XM offers customer support in over 30 languages, including English, Spanish, French, German, Italian, Arabic, Chinese, Japanese, and Russian.

Support Hours

XM's support is available 24 hours a day, 5 days a week (Monday to Friday), ensuring global coverage for traders across all time zones.

Educational Resources and FAQs

In addition to personalized support, XM offers a comprehensive Help Center and FAQ section on its website. These resources provide answers to common questions related to account management, trading platforms, financial instruments, and more. The Help Center also features step-by-step guides and video tutorials to assist traders in navigating the platform and resolving basic issues independently. XM's commitment to customer support extends beyond troubleshooting and technical assistance. The broker's support team is knowledgeable about trading and can provide guidance on platform features, risk management, and market analysis. This value-added support empowers traders to make informed decisions and maximize their trading potential.Prohibited Countries

XM Group operates in a highly regulated industry and must comply with various international laws and regulations. As a result, the broker is prohibited from providing services to residents of certain countries and regions. These restrictions are based on factors such as local regulatory requirements, licensing limitations, and geopolitical considerations.

Prohibited Countries List:

- United States of America, Canada, Israel, Iran

Consequences of Trading from Prohibited Countries:

Attempting to trade with XM Group from a prohibited country may result in the following consequences:

-Account closure: If XM Group discovers that a client is residing in a prohibited country, the broker reserves the right to close the account immediately.

-Funds forfeiture: In some cases, clients from prohibited countries may forfeit their account balances and any profits earned.

-Legal action: Knowingly attempting to circumvent regional restrictions may lead to legal consequences, depending on the jurisdiction and severity of the violation.

It is crucial for traders to ensure they are eligible to open an account with XM Group based on their country of residence. The broker implements strict verification processes to identify and prevent access from prohibited countries.

For the most up-to-date information on prohibited countries and any changes to XM Group's policies, visit the official XM website.

Special Offers for Customers

XM Group provides a range of special promotions and offers designed to attract new traders and reward existing clients for their loyalty. These offers can help traders maximize their trading potential and enhance their overall experience with the broker.

| Offer/Program | Details | Requirements |

|---|---|---|

| XM Zero Account | Commission-based account with tighter spreads and lower fees. Suitable for high-volume traders. | Minimum deposit: $100; Leverage: up to 888:1 |

| Loyalty Program | Earn XM Points (XMP) for each trade, redeemable for trading bonus credit. | Four tiers: Executive, Gold, Diamond, Elite (higher tiers earn more points) |

| Refer a Friend | Earn bonus credit by referring new clients to XM. Both the referrer and referred trader receive bonuses. | Referral bonus: $25 to $200, depending on account type and trading volume |

| 100% Welcome Bonus | New clients of XM Global can receive a 100% bonus on their first deposit. | Minimum deposit: Varies; Maximum bonus: $5,000; 30x trading volume requirement |

| XM Webinars and Seminars | Free educational webinars and seminars covering market analysis, trading strategies, and platform tutorials. | Open to all traders; Participation can lead to prize draws and competitions |

Terms and Conditions

It is important for traders to carefully review the terms and conditions associated with each special offer. Some promotions may have specific requirements, such as minimum deposit amounts, trading volume thresholds, or time limitations. Traders should ensure they fully understand and comply with these conditions to avoid any potential issues with bonus eligibility or withdrawals.

Comparison to Competitors

XM Group's special offers are competitive within the industry, particularly the XM Zero Account and the comprehensive loyalty program. The variety of promotions caters to different types of traders, from novices to high-volume professionals. However, it is always advisable to compare offers from multiple brokers to find the most suitable promotions based on individual trading needs and preferences.

Conclusion

After conducting a thorough review of XM Group's services, offerings, and reputation, I can confidently say that they have established themselves as a reliable and trustworthy broker in the online trading industry.

One of the key factors that sets XM Group apart is their commitment to regulatory compliance. With licenses from top-tier authorities such as CySEC, ASIC, and the FCA, they demonstrate a strong dedication to operating transparently and adhering to strict financial regulations. This multi-jurisdictional oversight provides traders with an added layer of protection and peace of mind.

XM Group's customer support is another area where they excel. With a multilingual support team available 24/5 through various channels, including live chat, email, and phone, traders can easily access assistance whenever they need it. The comprehensive educational resources, including webinars, tutorials, and market analysis, further highlight XM Group's commitment to empowering traders with the knowledge and tools they need to succeed.

The broker's wide range of account types caters to traders of all levels, from beginners to experienced professionals. With competitive spreads, flexible leverage options, and a diverse array of tradable assets, XM Group provides a well-rounded offering that suits various trading strategies and preferences. The inclusion of unique features like the XM Loyalty Program and free VPS hosting for high-volume traders demonstrates their dedication to rewarding and supporting their clients.They also provide well-known trading platforms like MetaTrader 4 and MetaTrader 5 and a vast range of trading instruments to satisfy the needs of traders at all levels.

While XM Group has a strong overall reputation, it's important to note that they do have some geographical restrictions, particularly in countries with strict regulatory environments like the United States and Canada. Traders from these regions will need to look for alternative brokers that are properly licensed to operate in their jurisdiction.

In conclusion, XM Group has proven itself to be a dependable and client-centric broker that prioritizes security, transparency, and user support. Their robust regulatory framework, comprehensive educational resources, and competitive trading conditions make them a compelling choice for traders seeking a reliable partner in their online trading journey. As with any financial decision, it's crucial to conduct thorough research and consider individual trading needs and risk tolerance before choosing a broker.

Overall, it is fair to say that XM is a good choice in Forex industry.

Our broker reviews quick-view grid makes side-by-side comparisons easy.

Looking for tier-one liquidity? Scan the FxPro review.