XS Broker Review 2025: Pros, Cons, and Key Features | Scam or Legit ?

XS

Australia

Australia

-

Withdrawal Fee $varies

-

Leverage 2000:1

-

Spread From 0.1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Unavailable

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Cyprus Market Making (MM)

Cyprus Market Making (MM)

Australia Retail Forex License

Australia Retail Forex License

Softwares & Platforms

Customer Support

Supported language: English, Arabic

Social Media

Summary

XS is a multi-regulated broker founded in 2010, headquartered in Australia, and licensed by FSA, ASIC, and CySEC. It offers a wide range of instruments like forex, shares, commodities, and crypto, with spreads starting from 0.1 pips. Traders can access the popular MT4, MT5, web, and mobile platforms with a $0 minimum deposit and leverage up to 1:2000. While XS provides strong trading options and 24/7 support, minor concerns exist regarding its CySEC-regulated entity.

- Multi-regulated broker with licenses from FSA, ASIC, and CySEC

- Wide range of tradable assets across forex, shares, indices, and more

- Competitive spreads starting from 0.1 pips on Elite account

- Flexible leverage options up to 1:2000, depending on entity and asset

- Multiple account types catering to different trading levels and styles

- User-friendly trading platforms, including MT4, MT5, web, and mobile

- Comprehensive educational resources and trading tools

- 24/7 customer support via live chat, email, and social media

- Negative balance protection for all clients

- Convenient deposit and withdrawal methods with no internal fees

- CySEC-regulated entity flagged as "suspicious clone" by the regulator

- Limited educational resources compared to some competitors

- Potential variations in trading conditions and asset offerings between entities

- No direct phone support for customer service

- Relatively new broker with limited track record

- Leverage and trading conditions may vary by entity and jurisdiction

- Withdrawal processing times of up to 24 hours, subject to approval

- No current promotions or bonuses advertised on the website

- Some negative user reviews regarding withdrawal delays and platform issues

Overview

XS is a multi-regulated online broker established in 2010, offering trading services globally. Headquartered in Australia, XS operates under the regulatory oversight of the Financial Services Authority (FSA) in Seychelles, the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC), though its CySEC-regulated entity has raised some regulatory flags.

XS provides access to a wide range of tradable instruments, including forex, shares, indices, metals, commodities, and cryptocurrencies. The broker offers several account types tailored to different trading styles and experience levels, with competitive spreads starting from 0.1 pips. Clients can trade using the popular MetaTrader 4 and MetaTrader 5 platforms, as well as a web-based platform and mobile app.

For more details on XS's offerings, visit their official website at xs.com.

Overview Table

| Feature | Details |

|---|---|

| Broker Name | XS |

| Founded | 2010 |

| Headquarters | Australia |

| Regulation | FSA (Seychelles), ASIC (Australia), CySEC (Cyprus) |

| Min. Deposit | $0 |

| Max. Leverage | Up to 1:2000 |

| Instruments | Forex, Shares, Indices, Metals, Commodities, Crypto |

| Platforms | MT4, MT5, Web, Mobile |

Facts List

- XS is a multi-regulated broker with licenses from FSA, ASIC, and CySEC.

- The broker offers a wide range of tradable instruments across multiple asset classes.

- Clients can choose from several account types with competitive spreads from 0.1 pips.

- XS provides the popular MetaTrader 4 and MetaTrader 5 trading platforms.

- Traders can also access a web-based platform and mobile trading app.

- The minimum deposit to open an account is $0.

- Maximum leverage of up to 1:2000 is available, varying by instrument and entity.

- XS supports multiple deposit and withdrawal methods, including bank transfers and e-wallets.

- The broker offers 24/7 customer support via live chat, email, and social media.

- Some concerns have been raised about the regulatory status of XS's CySEC entity.

XS Licenses and Regulatory

XS operates under the regulatory purview of three major financial authorities:

- The Financial Services Authority (FSA) in Seychelles

- The Australian Securities and Investments Commission (ASIC)

- The Cyprus Securities and Exchange Commission (CySEC)

Holding multiple licenses from reputable regulatory bodies provides an added layer of security and trust for clients. These regulators enforce strict guidelines to ensure fair and transparent trading practices, as well as the segregation and protection of client funds.

Licenses List

- FSA Seychelles: Retail Forex License (License No. SD089)

- ASIC Australia: Institution Forex License (License No. 374409)

- CySEC Cyprus: STP License (License No. 412/22)

Trading Instruments

XS offers a comprehensive range of tradable instruments, allowing clients to diversify their portfolios and take advantage of various market opportunities.

The broker's asset offerings include:

| Asset Class | Description |

|---|---|

| Forex | A wide selection of currency pairs, including majors, minors, and exotics. |

| Shares | Access to global shares, including popular U.S. stocks like Apple, Microsoft, and Amazon. |

| Indices | Trading opportunities on major indices worldwide like S&P 500 and FTSE 100. |

| Metals | Precious metals trading, including gold and silver, with competitive spreads. |

| Commodities | Energy products such as crude oil and natural gas, plus agricultural commodities. |

| Crypto | Popular cryptocurrencies like Bitcoin, Ethereum, and Ripple. |

Trading Platforms

Trading Platforms: XS offers a range of powerful trading platforms to suit the needs and preferences of different types of traders. The broker provides access to the industry-leading MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, as well as a web-based trading platform and mobile trading apps for iOS and Android devices.

MetaTrader 4 (MT4)

MT4 is one of the most popular trading platforms in the world, known for its user-friendly interface, advanced charting capabilities, and extensive range of technical indicators and tools.

XS's MT4 platform offers the following key features:

- Customizable charts with 9 timeframes and over 50 built-in indicators

- 3 chart types (bar, candlestick, and line) and 24 graphical objects for analysis

- One-click trading and advanced order types, including pending orders and trailing stops

- Automated trading with Expert Advisors (EAs) and MQL4 programming language

- Strategy Tester for backtesting and optimizing trading strategies

- Alerts and notifications for price levels, technical indicators, and account activity

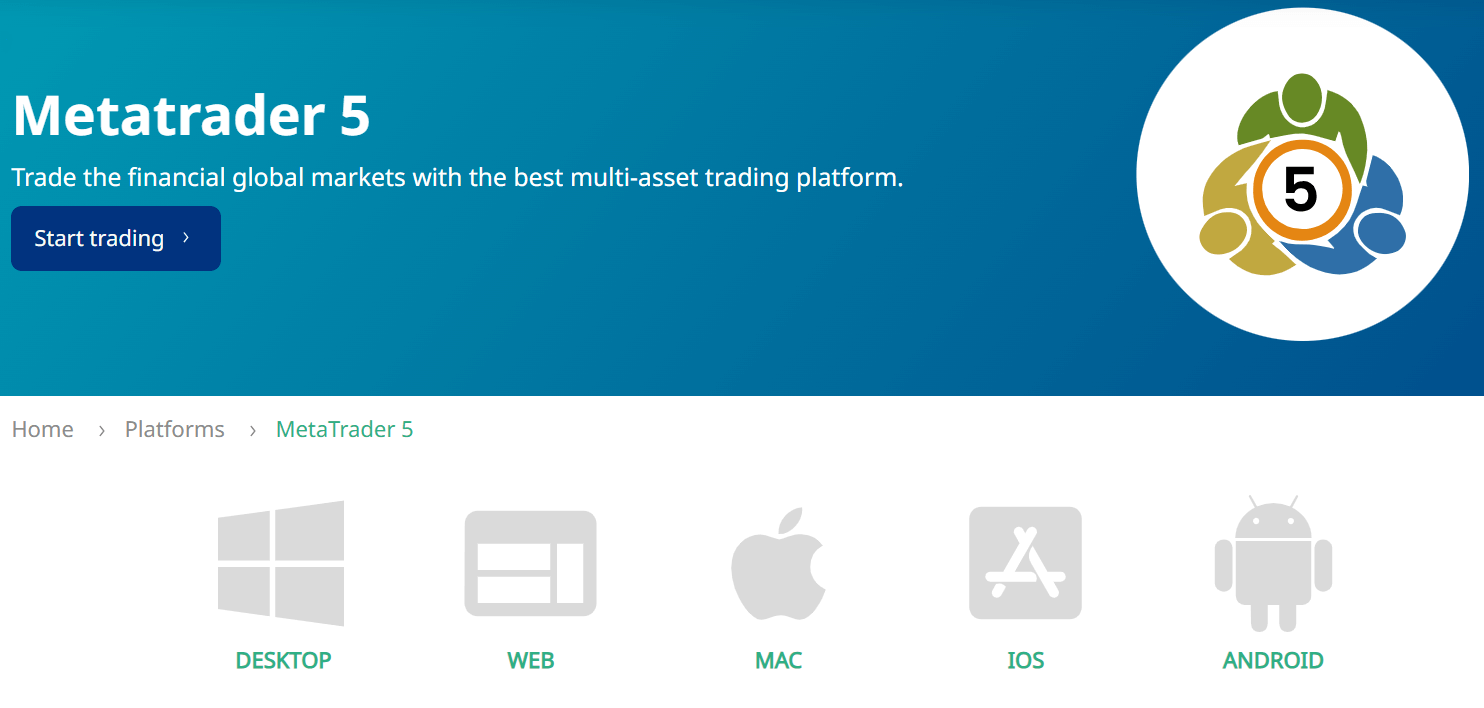

MetaTrader 5 (MT5)

MT5 is the successor to MT4, offering enhanced features and functionality for multi-asset trading. XS's MT5 platform includes all the features of MT4, plus additional tools and capabilities, such as:

- 21 timeframes and 38 technical indicators for in-depth market analysis

- Advanced charting with 44 graphical objects and additional chart types

- Depth of Market (DOM) for monitoring market liquidity and order flow

- Improved backtesting and optimization tools for Expert Advisors

- Built-in economic calendar and market news feed

- Hedging and netting options for flexible position management

Web Trading Platform

For traders who prefer to access their accounts and trade directly from a web browser, XS provides a web-based trading platform.

The web platform offers essential trading features and tools, including:

- Real-time quotes and interactive charts with multiple timeframes

- Over 30 technical indicators and drawing tools for analysis

- One-click trading and basic order types

- Account management and reporting tools

- Compatible with modern web browsers on desktop and mobile devices

Mobile Trading Apps

XS offers mobile trading apps for both iOS and Android devices, allowing traders to access their accounts, monitor markets, and place trades on the go.

The mobile apps provide a streamlined trading experience with key features, such as:

- Real-time quotes and interactive charts with multiple timeframes

- Over 30 technical indicators and drawing tools for analysis

- One-click trading and basic order types

- Account management and reporting tools

- Alerts and notifications for price levels and account activity

- Secure login and two-factor authentication for enhanced security

All of XS's trading platforms are designed to provide traders with a seamless and efficient trading experience, with features and tools tailored to their needs and expertise levels. The platforms are regularly updated to ensure optimal performance, security, and compatibility with the latest market requirements.

Trading Platforms Comparison Table

| Feature | MT4 | MT5 | Web Trader | Mobile App |

|---|---|---|---|---|

| One-click trading | Yes | Yes | Yes | Yes |

| Customizable charts | Yes | Yes | Yes | Yes |

| Technical indicators | 30+ | 38+ | 30+ | 30+ |

| Drawing tools | 24+ | 44+ | Yes | Yes |

| Automated trading (EAs) | Yes | Yes | No | No |

| Algorithmic trading | Yes | Yes | No | No |

| Market depth | No | Yes | No | No |

| Web browser access | No | No | Yes | No |

| Mobile app (iOS/Android) | No | No | No | Yes |

| Integrated news feed | Yes | Yes | Yes | Yes |

| Multi-language support | Yes | Yes | Yes | Yes |

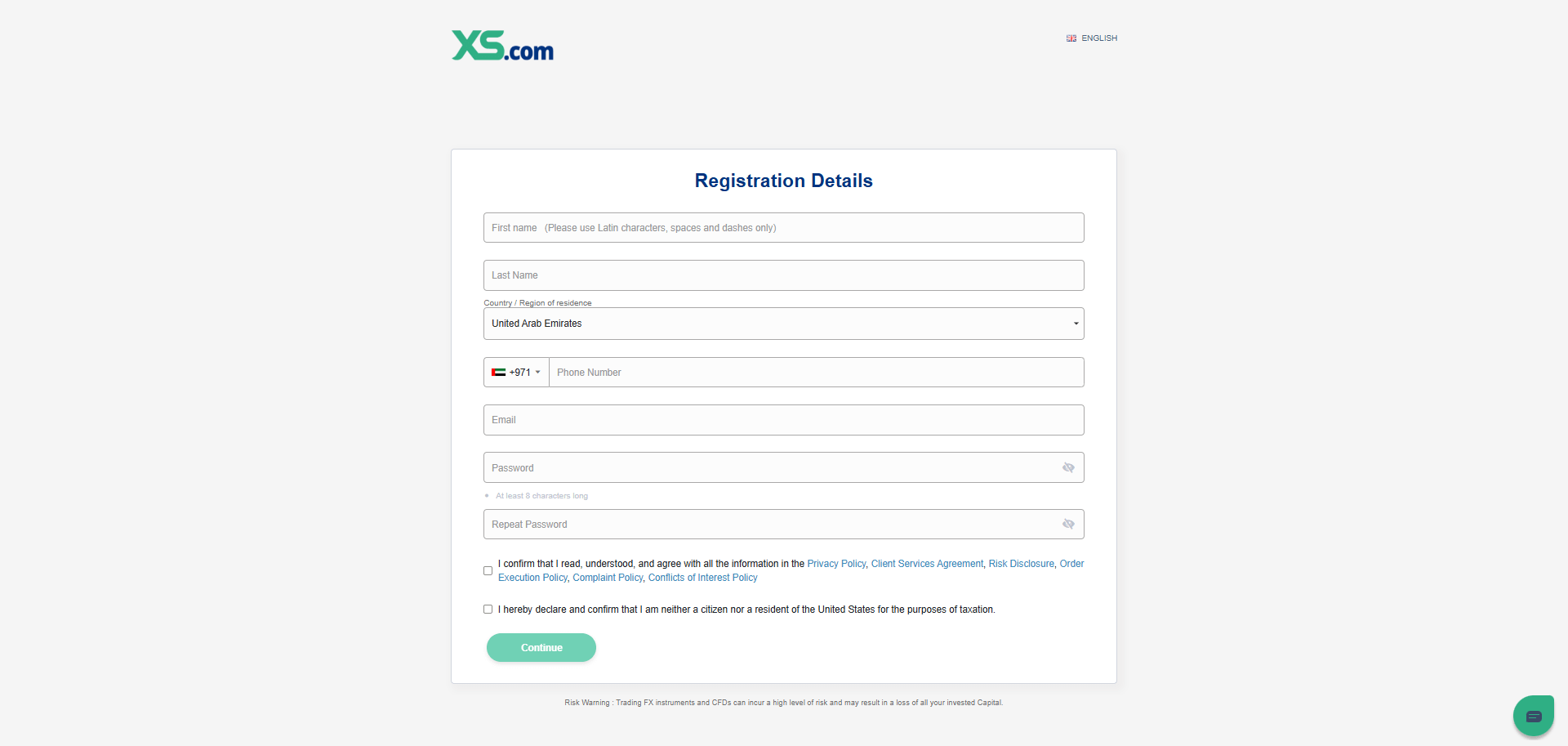

XS How to Open an Account: A Step-by-Step Guide

Opening an account with XS is a straightforward process that can be completed online in a few simple steps:

- Visit the XS website and click on the "Open Account" or "Register" button.

- Fill out the registration form with your personal details, including:

- First and last name

- Email address

- Phone number

- Country of residence

- Date of birth

- Select your preferred account type (Cent, Micro, Standard, Pro, or Elite) and base currency (USD, EUR, or GBP).

- Choose your leverage and other account settings, such as platform (MT4 or MT5) and trading experience.

- Read and agree to the broker's terms and conditions, privacy policy, and risk disclosure statement.

- Submit your registration form and wait for a confirmation email from XS.

- Log in to your newly created account using the credentials provided in the confirmation email.

- Complete the account verification process by uploading the required documents:

- Proof of identity: A valid government-issued ID, such as a passport or driver's license

- Proof of address: A recent utility bill, bank statement, or other official document showing your current address

- Once your account is verified, you can fund it using one of the available deposit methods, such as bank wire transfer, credit/debit card, or e-wallet.

- Download and install the trading platform of your choice (MT4 or MT5) and log in using your account credentials.

The account opening process typically takes less than 24 hours, subject to successful completion of the verification procedure. XS's customer support team is available 24/7 to assist with any questions or issues that may arise during the account opening process.

Charts and Analysis

XS provides traders with a comprehensive suite of tools and resources to support their market analysis and trading decisions.

The broker's offerings include:

| Feature Category | Details |

|---|---|

| Advanced Charting | - Interactive, customizable charts with multiple timeframes (9 on MT4, 21 on MT5) - 50+ technical indicators (moving averages, oscillators, volatility indicators) - Advanced drawing tools (trendlines, Fibonacci, channels) - Multiple chart types (candlestick, bar, line) - Save, load, and share custom templates - Real-time and historical price data for backtesting |

| Market Insights | - Real-time news and analysis from Reuters, MarketWatch - Economic calendar with customizable alerts - Instrument specifications (trading hours, margin, contracts) - Market sentiment indicators and trading signals - Daily and weekly market reports |

| Technical Analysis Tools | - Trend tools (moving averages, MACD, ADX) - Oscillators and momentum indicators (RSI, Stochastic, CCI) - Volatility indicators (Bollinger Bands, ATR) - Customizable settings and parameters - Ability to create/save custom indicators with MQL4/MQL5 |

| Fundamental Analysis Resources | - Central bank decisions and monetary policy updates - Key economic data releases (GDP, inflation, employment) - Earnings reports and financials for stocks and indices - Geopolitical news impacting sentiment - Expert analysis and commentary |

| Educational Resources | - Video tutorials on platforms, technical analysis, strategies - Regular webinars by analysts and traders - Articles, e-books, trading guides (beginner to advanced) - Glossary of trading terms - Interactive courses and quizzes |

These resources are designed to cater to traders of all experience levels, from beginners seeking to learn the basics of trading to advanced traders looking to refine their strategies and stay informed about market developments.

XS's advanced charting capabilities, particularly on the MetaTrader platforms (MT4 and MT5), provide traders with a powerful toolkit for technical analysis and strategy development. The wide range of built-in indicators, drawing tools, and customization options enable traders to analyze price action, identify trends and patterns, and make informed trading decisions.

The broker's commitment to providing timely market insights, including real-time news, analysis, and an economic calendar, ensures that traders can stay up-to-date with key developments that may impact their trading activities. The combination of technical and fundamental analysis resources allows traders to form a comprehensive view of the markets and adapt their strategies accordingly.

XS Account Types

XS offers a range of account types to cater to the needs of different traders, from beginners to experienced professionals.

The main account types include:

Cent Account

- Designed for novice traders who want to start with minimal investment

- Minimum deposit: No minimum deposit required

- Leverage: Up to 1:2000

- Spreads: From 1.1 pips

- Commissions: No commissions

- Tradable assets: Forex, Metals

- Platform: MT5

Micro Account

- Suitable for beginner traders with smaller account balances

- Minimum deposit: No minimum deposit required

- Leverage: Up to 1:2000

- Spreads: From 1.1 pips

- Commissions: No commissions

- Tradable assets: Forex, Metals, Energies, Indices

- Platform: MT5

Standard Account

- The most popular account type, suitable for a wide range of traders

- Minimum deposit: No minimum deposit required

- Leverage: Up to 1:2000

- Spreads: From 1.1 pips

- Commissions: No commissions

- Tradable assets: Forex, Shares, Metals, Energies, Indices, Cryptocurrencies, Futures

- Platforms: MT4, MT5

Pro Account

- Designed for experienced traders seeking lower spreads and advanced trading features

- Minimum deposit: $500

- Leverage: Up to 1:2000

- Spreads: From 0.7 pips

- Commissions: No commissions

- Tradable assets: Forex, Shares, Metals, Energies, Indices, Cryptocurrencies, Futures

- Platforms: MT4, MT5

Elite (Raw) Account

- Tailored for professional and high-volume traders seeking the most competitive trading conditions

- Minimum deposit: $500

- Leverage: Up to 1:2000

- Spreads: From 0.1 pips

- Commissions: $3 per lot per round turn

- Tradable assets: Forex, Metals, Energies, Indices, Cryptocurrencies, Futures

- Platforms: MT4, MT5

In addition to these main account types, XS also offers swap-free accounts for traders who prefer to avoid overnight interest charges due to religious or other reasons. Demo accounts are available for all account types, allowing traders to practice strategies and familiarize themselves with the trading platforms using virtual funds.

Account Types Comparison Table

| Feature | Cent | Micro | Standard | Pro | Elite |

|---|---|---|---|---|---|

| Min. Deposit | $0 | $0 | $0 | $500 | $500 |

| Leverage | 1:2000 | 1:2000 | 1:2000 | 1:2000 | 1:2000 |

| Spreads From | 1.1 | 1.1 | 1.1 | 0.7 | 0.1 |

| Commission | No | No | No | No | $3/lot |

| Lot Size | 0.01 | 0.01 | 0.01–100 | 0.01–100 | 0.01–100 |

| Assets | FX, Metals | FX, Metals, Energies, Indices | FX, Shares, Metals, Energies, Indices, Crypto, Futures | FX, Shares, Metals, Energies, Indices, Crypto, Futures | FX, Metals, Energies, Indices, Crypto, Futures |

| Platforms | MT5 | MT5 | MT4, MT5 | MT4, MT5 | MT4, MT5 |

| Swap-Free | Yes | Yes | Yes | Yes | Yes |

| Demo Account | Yes | Yes | Yes | Yes | Yes |

Negative Balance Protection

XS offers negative balance protection to all clients, ensuring that traders cannot lose more than their account balance. This means that in the event of extreme market volatility or unexpected gaps, clients' accounts will not fall into a negative equity state. Negative balance protection is an important risk management tool that helps limit potential losses, especially for leveraged trading. XS's commitment to this policy demonstrates their focus on client protection and fair trading practices. However, it is crucial to note that negative balance protection does not absolve traders from the responsibility of managing their risk properly. Employing sound risk management techniques, such as setting appropriate stop-loss orders and maintaining reasonable position sizes, is still essential for successful trading.

XS Deposits and Withdrawals

XS supports a variety of convenient deposit and withdrawal methods to cater to clients' preferences:

Deposit Methods

| Deposit Method | Minimum Amount | Maximum Amount | Processing Time | Currencies |

|---|---|---|---|---|

| Bank Wire Transfer | $300 | Unlimited | 1–7 business days | EUR, USD |

| Credit/Debit Card (Visa, Mastercard) | $50 | $5,000 | Instant | EUR, USD |

| Skrill | $15 | $15,000 or equivalent | Instant | EUR, USD |

| Neteller | $15 | $15,000 or equivalent | Instant | EUR, USD |

| Klarna | $15 | $5,000 | 1 business day | EUR, GBP, PLN, CZK |

| Giropay | $15 | $5,000 | 1 business day | EUR |

Withdrawal Methods

| Withdrawal Method | Minimum Amount | Maximum Amount | Processing Time | Currencies |

|---|---|---|---|---|

| Bank Wire Transfer | $200 | Unlimited | 1 business day | EUR, USD, GBP |

| Credit/Debit Card (Visa, Mastercard) | $50 | $5,000 | Instant | EUR, USD, GBP |

| Skrill | $50 | $50,000 or equivalent | 1 business day | EUR, USD, GBP |

| Neteller | $50 | $2,500 or equivalent | Instant | EUR, USD, GBP |

Support Service for Customer

XS provides 24/7 customer support via multiple channels to ensure that clients can receive prompt assistance whenever needed.

- Live Chat: Available 24/7 on the website and trading platforms

- Email: support@xs.com for general inquiries and assistance

- Call Back: Submit a request from the "Contact Us" section on the website

- FAQs: Find answers to common questions in the comprehensive FAQs section

Customer Support Comparison Table

| Channel | Availability | Languages | Expected Response Time |

|---|---|---|---|

| Live Chat | 24/7 | English | 1–3 minutes |

| 24/7 | English | 1–8 hours | |

| Call Back Request | 24/7 | English | 1–8 hours |

| FAQs | 24/7 | English | Self-service |

| Social Media | Business hours | English | 4–8 hours |

Prohibited Countries

Due to regulatory restrictions and local laws, XS is unable to provide services to residents of certain countries and regions.

These prohibited countries include:

- USA

- Iran

- North Korea

Traders from these countries cannot open an account or access XS's trading services. Attempting to do so may result in account termination and funds being returned to the original source.

It is essential for clients to ensure they are eligible to trade with XS based on their country of residence before registering an account. For the most up-to-date list of prohibited countries, please refer to the "Terms and Conditions" section on XS's website.

Special Offers for Customers

At the time of writing, XS is not promoting any specific special offers or bonuses. However, the broker occasionally runs promotional campaigns and contests for both new and existing clients. These may include:

| Promotion Type | Description |

|---|---|

| Deposit Bonuses | Receive a percentage bonus on your initial or subsequent deposits, subject to trading volume requirements. |

| Cashback Offers | Get a portion of your trading costs refunded based on your trading activity. |

| Trading Competitions | Participate in live trading contests and win prizes for top performance. |

| Loyalty Programs | Earn points for your trading activity and redeem them for various rewards. |

To stay informed about the latest promotions and offers, visit the "Promotions" section on XS's website or subscribe to their email newsletter.

Please note that all bonus and promotional offers come with specific terms and conditions, such as minimum deposit amounts, trading volume requirements, and time limits. Be sure to read and understand these conditions carefully before participating in any promotion.

Conclusion

After thoroughly reviewing XS's offerings and services, I believe that the broker is a solid choice for traders seeking a multi-regulated platform with a wide range of tradable assets. XS's commitment to providing a user-friendly and efficient trading environment is evident in their choice of trading platforms, which include the popular MT4 and MT5 alongside a web-based platform and mobile app. The broker's competitive spreads, starting from 0.0 pips on the Elite account, and flexible leverage options up to 1:2000 cater to various trading strategies and risk preferences.

XS's multiple account types, ranging from Cent and Micro accounts for beginners to Pro and Elite accounts for experienced traders, ensure that there is a suitable option for every level of trading expertise. The broker's educational resources, including video tutorials, webinars, and trading guides, provide valuable support for traders looking to enhance their skills and knowledge.

However, it is essential to note that XS's regulatory status raises some concerns, particularly with regard to its CySEC-regulated entity, which has been flagged as a "suspicious clone." While the broker holds licenses from reputable authorities such as FSA and ASIC, traders should exercise caution and conduct thorough due diligence before committing funds.

Overall, XS appears to be a legitimate and well-rounded broker that offers a competitive trading environment, a wide range of assets, and user-friendly platforms. The broker's 24/7 customer support and commitment to negative balance protection demonstrate a focus on client satisfaction and security.

As with any broker, it is crucial for traders to carefully consider their individual needs and risk tolerance before opening an account. Responsible money management and a solid understanding of the markets are key to a successful trading experience.