XTB Review 2025: A Comprehensive Look at the Trusted Forex and CFD Broker

XTB

-

Withdrawal Fee $0

-

Leverage 500:1

-

Spread From 0.5

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Unavailable

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Cyprus Market Making (MM)

Cyprus Market Making (MM)

UAE Financial Services License

UAE Financial Services License

Belize Financial Services License

Belize Financial Services License

Softwares & Platforms

Customer Support

+48222019900

(English)

+48222019900

(English)

Supported language: English, French, German, Spanish

Social Media

Summary

XTB is a well-established forex and CFD broker, known for its robust trading platform, XStation, and comprehensive educational resources. Founded in 2002, it is regulated in multiple regions, offering traders access to a wide range of assets, including forex, indices, commodities, and cryptocurrencies. XTB provides competitive spreads and leverage options, catering to both beginners and experienced traders. With strong customer support and various account types, it is a trusted choice for traders seeking a reliable, user-friendly trading experience.

- Regulated by top-tier financial authorities, ensuring a safe and transparent trading environment.

- User-friendly and feature-rich proprietary trading platform, xStation 5.

- Extensive educational resources, including Trading Academy, webinars, and market analysis.

- Competitive spreads and a wide range of tradable assets.

- No fees for most deposit and withdrawal methods.

- Responsive and knowledgeable customer support available 24/5.

- Negative balance protection and segregation of client funds for added security.

- Global presence with support for multiple languages.

- Attractive promotional offers, such as welcome bonuses and referral programs.

- Algorithmic trading capabilities and advanced charting tools.

- Limited account type options compared to some competitors.

- No support for third-party trading platforms like MetaTrader 4/5.

- Inactivity fees charged after one year of no trading activity.

- Limited customization options for the xStation 5 platform.

- No telephone support available during weekends.

- Relatively high minimum deposit for corporate accounts (£15,000).

- Some educational content may not be as comprehensive as other brokers.

- Withdrawal fees apply for amounts below the minimum withdrawal threshold.

- Margin call and stop out levels may be higher than some competitors.

- Cryptocurrency trading is limited to CFDs, with no option to trade underlying assets.

Overview

XTB (X-Trade Brokers) is a well-established online forex and CFD broker founded in 2002 in Poland. The company is publicly traded on the Warsaw Stock Exchange and regulated by top-tier financial authorities, including the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC).

With a presence in over a dozen countries across Europe, XTB serves more than 1 million active clients globally as of 2024. The broker offers trading on a wide range of financial instruments, including forex, stocks, ETFs, indices, and commodities, through its proprietary xStation 5 trading platform.

XTB has garnered recognition for its high-quality services, earning Best in Class honors for Research, Beginners, Crypto Trading, and Overall categories in the ForexBrokers.com 2025 Annual Awards. The company's commitment to providing competitive pricing, extensive educational resources, and robust trading tools has positioned it as a trusted choice for traders worldwide.

For more detailed information about XTB's offerings, visit their official website at https://www.xtb.com/.

Overview Table

| Feature | Details |

|---|---|

| Year Founded | 2002 |

| Headquarters | Poland |

| Regulated by | FCA (UK), CySEC (Cyprus), KNF (Poland) |

| Tradable Instruments | 7,184 (forex, stocks, ETFs, indices, commodities, crypto CFDs) |

| Trading Platforms | Proprietary xStation 5 (web, mobile, desktop) |

| Minimum Deposit | $0 |

| Pricing | Commission-free CFDs, low spreads from 0.5 pips |

| Education | Extensive Trading Academy with 200+ lessons |

| Customer Support | 24/5 live chat, phone, email |

| Awards | Best in Class for Research, Beginners, Crypto Trading, Overall (ForexBrokers.com 2025) |

Facts List

- XTB was founded in 2002 in Poland and is publicly traded on the Warsaw Stock Exchange.

- The broker is regulated by top-tier financial authorities, including the FCA (UK) and CySEC (Cyprus).

- XTB serves over 1 million active clients globally as of 2024.

- The company offers trading on 7,184 financial instruments, including forex, stocks, ETFs, indices, and commodities.

- XTB provides access to its proprietary xStation 5 trading platform on web, mobile, and desktop.

- The broker offers commission-free trading on CFDs and competitive spreads starting from 0.5 pips.

- XTB maintains a minimum deposit requirement of $0, making it accessible to a wide range of traders.

- The company provides an extensive educational resource called Trading Academy, which includes more than 200 lessons.

- XTB offers customer support via 24/5 live chat, phone, and email.

- In the ForexBrokers.com 2025 Annual Awards, XTB earned Best in Class honors for Research, Beginners, Crypto Trading, and Overall categories.

XTB Licenses and Regulatory

XTB operates under a robust regulatory framework, holding licenses from multiple top-tier financial authorities worldwide. The broker's primary regulators include:

- The Financial Conduct Authority (FCA) in the United Kingdom

- The Cyprus Securities and Exchange Commission (CySEC)

- The Polish Financial Supervision Authority (KNF)

These regulatory bodies oversee XTB's operations, ensuring that the company adheres to strict guidelines and maintains high standards of transparency, security, and fair trading practices. The multiple licenses demonstrate XTB's commitment to providing a safe and trustworthy trading environment for its clients.

The FCA, in particular, is known for its stringent regulations and consumer protection measures. As an FCA-regulated broker, XTB must segregate client funds from its own operating capital, maintain adequate liquidity levels, and submit regular financial reports. This oversight helps to minimize the risk of misappropriation and ensures that clients' investments are well-protected.

In addition to its primary regulators, XTB also holds licenses from several other financial authorities, including:

- The Dubai Financial Services Authority (DFSA)

- The International Financial Services Commission of Belize (IFSC)

These additional licenses allow XTB to operate legally in various jurisdictions and serve a broader client base. The company's adherence to multiple regulatory frameworks further strengthens its credibility and demonstrates its dedication to maintaining high standards of compliance and client protection.

Regulations List

- Financial Conduct Authority (FCA) - United Kingdom

- License No.: 522157

- Cyprus Securities and Exchange Commission (CySEC)

- License No.: 169/12

- Polish Financial Supervision Authority (KNF)

- License No.: DDM-M-4021-57-1/2005

- Dubai Financial Services Authority (DFSA)

- License No.: F006316

- International Financial Services Commission of Belize (IFSC)

- License No.: IFSC/60/413/TS/19

Trading Instruments

XTB offers a diverse range of tradable assets, catering to the varied needs and preferences of its clients. The broker provides access to over 7,184 financial instruments across multiple asset classes, including:

| Asset Class | Available Products / CFDs | Additional Details |

|---|---|---|

| Forex | 71 currency pairs | Tight spreads (e.g., EUR/USD typically around 1 pip); significant trading volume reflects strong client interest |

| Stocks & ETFs | Over 2,022 stock CFDs and 167 ETF CFDs; plus commission-free trading on real stocks and ETFs in certain jurisdictions (over 3,400 stocks and 1,350 ETFs available) | Allows for portfolio diversification and participation in global equity markets |

| Indices | 33 major global indices (e.g., S&P 500, NASDAQ 100, FTSE 100) | Competitive spreads with the S&P 500 typically at a 0.08 spread |

| Commodities | 27 commodity CFDs | Includes precious metals, energies, and agricultural products; suited for hedging against market volatility or speculating on price movements |

| Cryptocurrencies | 40 cryptocurrency CFDs | Provides exposure to popular cryptocurrencies (e.g., Bitcoin, Ethereum, Litecoin); note that trading is via CFDs and not on the underlying assets directly |

The breadth and depth of XTB's tradable assets demonstrate the broker's commitment to providing clients with ample opportunities to diversify their portfolios and adapt to changing market conditions. By offering a wide range of instruments across multiple asset classes, XTB enables traders to implement various strategies and manage risk effectively.

Compared to industry standards, XTB's asset offering is competitive and comprehensive. The broker's extensive range of tradable instruments positions it as a versatile choice for traders with diverse needs and preferences.

Trading Platforms

XTB offers its clients a streamlined trading experience through its proprietary trading platform, xStation 5. The platform is available as a web-based application, desktop software, and mobile app, catering to the diverse needs and preferences of traders.

xStation 5

XTB's flagship trading platform, xStation 5, is a powerful and user-friendly solution designed to meet the demands of both novice and experienced traders. The platform offers a range of advanced features, including:

- Intuitive interface with customizable layouts

- Advanced charting tools with over 30 drawing tools and 90 technical indicators

- Integrated trading signals and market sentiment data

- Real-time market news and analysis

- One-click trading and advanced order types

- Algorithmic trading tools and trading bots

xStation 5 is accessible through web browsers, dedicated desktop applications for Windows and Mac, and mobile apps for iOS and Android devices. The platform's cross-device compatibility ensures that traders can access their accounts and manage their positions seamlessly, regardless of their location or preferred device.

Mobile Trading

XTB's mobile trading apps for iOS and Android provide clients with the flexibility to trade on the go. The mobile apps offer a streamlined version of the xStation 5 platform, with key features such as real-time quotes, advanced charting, and one-click trading. The apps also provide access to account management tools, enabling traders to monitor their portfolios and manage their positions conveniently.

Algorithmic Trading

For traders interested in automated trading strategies, XTB offers support for algorithmic trading through its xStation 5 platform. Clients can create and deploy custom trading bots using the platform's built-in coding environment, which supports popular programming languages such as Python and C#. The platform also integrates with popular algorithmic trading solutions, such as MetaTrader 4's Expert Advisors (EAs).

XTB's focus on providing a powerful and user-friendly trading platform sets it apart from many of its competitors. The xStation 5 platform's advanced features, combined with its cross-device compatibility and support for algorithmic trading, cater to the needs of both novice and experienced traders.

By offering a stable and feature-rich trading environment, XTB ensures that its clients have access to the tools and resources needed to implement effective trading strategies and make informed decisions. The broker's commitment to technological excellence is evident in the continuous development and improvement of its trading platforms.

Trading Platforms Comparison Table

| Feature | xStation 5 Web | xStation 5 Desktop | xStation 5 Mobile |

|---|---|---|---|

| Charting Tools | 30+ drawing tools, 90+ indicators | 30+ drawing tools, 90+ indicators | Basic charting with indicators |

| Order Types | Market, Limit, Stop, Trailing Stop | Market, Limit, Stop, Trailing Stop | Market, Limit, Stop, Trailing Stop |

| One-Click Trading | Yes | Yes | Yes |

| Algorithmic Trading | Yes (via built-in coding environment) | Yes (via built-in coding environment) | No |

| News & Analysis | Real-time market news and analysis | Real-time market news and analysis | Real-time market news and analysis |

| Customizable Layout | Yes | Yes | Limited |

| Mobile Compatibility | Yes (mobile-optimized) | No (separate mobile app) | Yes (native mobile app) |

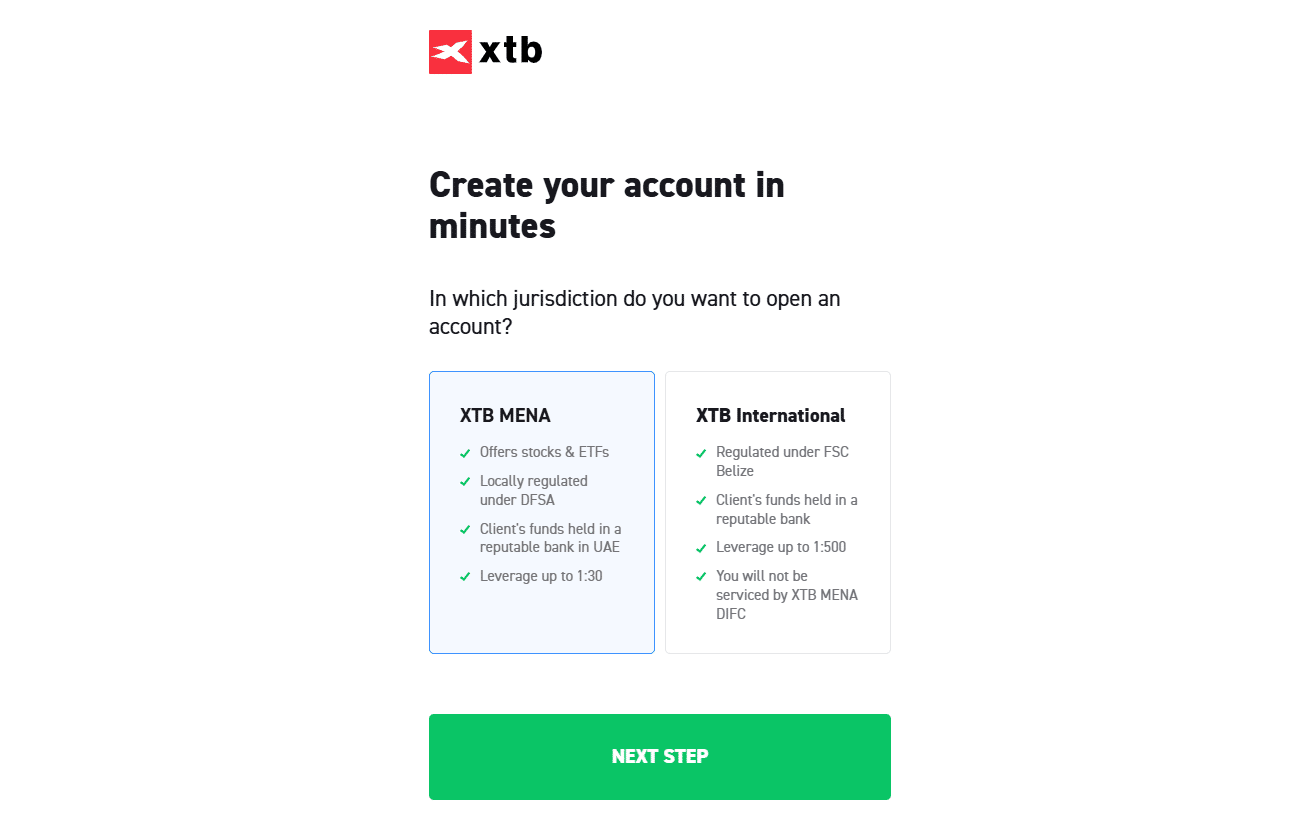

XTB How to Open an Account: A Step-by-Step Guide

Opening an account with XTB is a straightforward and user-friendly process. The broker has streamlined the application procedure to ensure that clients can start trading as quickly as possible. Here's a step-by-step guide on how to open an account with XTB:

Requirements

To open an account with XTB, you'll need to meet the following requirements:

- Be at least 18 years old

- Provide a valid government-issued ID (passport, national ID card, or driver's license)

- Provide proof of residence (utility bill, bank statement, or government-issued document)

- Have a valid email address and phone number

Account Types

XTB offers two main account types:

- Standard Account: This account type is suitable for most traders, with no minimum deposit requirement and access to all trading instruments and platform features.

- Professional Account: This account type is designed for experienced traders who meet certain criteria, such as having a substantial trading volume or working in the financial sector. Professional accounts offer higher leverage and other benefits, but clients must meet specific requirements to qualify.

Registration Process

To open an account with XTB, follow these steps:

- Visit the XTB website and click on the "Open an Account" button.

- Select your country of residence and preferred account type (Standard or Professional).

- Fill in the required personal information, including your name, email address, phone number, and date of birth.

- Provide your identification and proof of residence documents. You can upload these documents directly during the registration process or provide them later.

- Answer the questionnaire about your trading experience, financial knowledge, and risk tolerance. This information helps XTB ensure that their services are appropriate for your needs and experience level.

- Read and accept the terms and conditions, privacy policy, and other relevant documents.

- Submit your application and wait for XTB to review and approve your account. This process typically takes less than 24 hours.

Funding Your Account

Once your account is approved, you can fund it using one of the following methods:

- Bank transfer (USD, EUR, GBP)

- Credit/debit card (Visa, Mastercard)

- E-wallets (Skrill, Neteller, PayPal)

The minimum deposit amount varies depending on your chosen funding method and account currency. For most methods, there is no minimum deposit requirement. Funds are usually credited to your account instantly, except for bank transfers, which may take 1-3 business days.

Start Trading

After your account is funded, you can access the XTB trading platform (xStation 5) and start trading. The platform is available as a web-based application, desktop software, and mobile app, so you can choose the version that best suits your needs and preferences.

XTB's user-friendly account opening process, combined with its low minimum deposit requirements and wide range of funding options, makes it an attractive choice for both novice and experienced traders. The broker's commitment to streamlining the application procedure ensures that clients can start trading quickly and efficiently.

Charts and Analysis

XTB offers a comprehensive suite of educational resources and tools to help clients enhance their trading knowledge and skills. The broker's commitment to providing a well-rounded educational experience sets it apart from many competitors in the industry.

| Feature | Description | Notable Details |

|---|---|---|

| Trading Academy | A free online learning platform offering educational materials for traders at all skill levels. | Over 200 video lessons covering the basics of trading, technical and fundamental analysis, risk management, and trading psychology; includes quizzes and interactive exercises. |

| Webinars | Regular live sessions hosted by expert analysts and traders. | Cover various topics including market analysis, trading strategies, and platform tutorials; sessions allow live Q&A and are recorded for later viewing. |

| Market News & Analysis | A consistent stream of market commentary, technical analysis, and trading ideas provided through XTB's website and xStation 5 trading platform. | In-house analysts deliver daily insights across multiple asset classes, accessible via the "Market News" section or directly on the trading platform. |

| Economic Calendar | A comprehensive tool that lists upcoming market events and economic data releases. | Displays expected impact, previous and forecasted values for indicators; filters available by date, currency, and event importance, helping traders focus on relevant information. |

| Trading Tools | A suite of built-in analytical tools available on the xStation 5 trading platform. | Features advanced charting (over 30 drawing tools and 90 technical indicators), trading sentiment data, heat maps of top movers, and a stock screener to filter and analyze stocks based on various criteria. |

By offering such a diverse range of educational resources and trading tools, XTB empowers its clients to continually improve their trading knowledge and skills. The broker's commitment to education is evident in the depth and quality of its offerings, which cater to traders of all experience levels.

Compared to industry standards, XTB's educational resources and tools are comprehensive and well-developed. The broker's focus on providing a holistic learning experience, combined with its user-friendly trading platform and powerful analytical tools, makes it an attractive choice for traders seeking to enhance their skills and knowledge.

XTB Account Types

XTB offers a streamlined selection of trading account types, catering to the needs of both retail and professional traders. The broker's account offerings are designed to provide clients with competitive trading conditions and access to a wide range of financial instruments.

Standard Account

The Standard Account is XTB's primary offering for retail traders. Key features include:

- No minimum deposit requirement

- Competitive spreads starting from 0.5 pips

- Leverage up to 1:500

- Access to over 7,184 trading instruments

- Negative balance protection

This account type is suitable for both novice and experienced traders, providing a balanced mix of affordability and flexibility. The absence of a minimum deposit requirement makes it easy for traders to start with XTB, while the competitive spreads and high leverage allow for cost-effective trading and potential amplification of returns.

Professional Account

The Professional Account is designed for experienced traders who meet certain eligibility criteria, such as having a substantial trading volume or working in the financial sector. Key features include:

- Higher leverage (up to 1:500)

- Tighter spreads

- Priority customer support

- Access to professional trading tools and resources

To qualify for a Professional Account, clients must meet at least two of the following criteria:

- Have made an average of 10 transactions of significant size per quarter in the last four quarters

- Have a financial instrument portfolio (including cash deposits and financial instruments) exceeding €500,000

- Work or have worked in the financial sector for at least one year in a professional position requiring knowledge of transactions or services envisaged

The Professional Account caters to the needs of high-volume and institutional traders, offering enhanced trading conditions and exclusive resources.

Demo Account

XTB offers a free Demo Account that allows traders to practice trading strategies and familiarize themselves with the xStation 5 trading platform. The Demo Account features:

- Virtual balance of $100,000

- Access to all trading instruments

- Real-time market data

- No time limit or expiration

The Demo Account is an excellent tool for both new and experienced traders looking to test strategies, explore new markets, or learn the ins and outs of XTB's trading platform without risking real money.

By offering a focused selection of account types, XTB ensures that traders can easily choose the most suitable option for their needs and experience level. The Standard Account's accessibility and competitive conditions make it an attractive choice for the majority of retail traders, while the Professional Account caters to the demands of high-volume and institutional clients.

Account Types Comparison Table

| Feature | Standard Account | Professional Account | Demo Account |

|---|---|---|---|

| Minimum Deposit | No minimum | No minimum | N/A |

| Leverage | Up to 1:500 | Up to 1:500 | Up to 1:500 |

| Spreads | From 0.5 pips | Tighter spreads | From 0.5 pips |

| Commission | None | None | None |

| Instruments | 7,184+ | 7,184+ | 7,184+ |

| Platform | xStation 5 | xStation 5 | xStation 5 |

| Negative Balance Protection | Yes | Yes | N/A |

| Dedicated Support | Standard | Priority | Standard |

| Professional Resources | No | Yes | No |

| Real-time Market Data | Yes | Yes | Yes |

| Virtual Funds | No | No | $100,000 |

Negative Balance Protection

XTB's negative balance protection policy applies to all trading instruments and account types, ensuring that clients are protected from unexpected market events or trading errors. However, it is important to note that negative balance protection does not eliminate the risk of loss; it only limits the maximum potential loss to the funds deposited in the trading account. Traders should still exercise caution and employ sound risk management strategies, such as setting appropriate stop-loss orders and managing their position sizes, to minimize the risk of substantial losses. XTB encourages its clients to familiarize themselves with the risks associated with trading and to use the educational resources provided to develop a solid understanding of risk management principles. By offering negative balance protection, XTB demonstrates its commitment to safeguarding clients' funds and promoting responsible trading practices. This policy provides traders with an added layer of security and helps to foster a more sustainable and trustworthy trading environment.

XTB Deposits and Withdrawals

XTB offers a variety of convenient deposit and withdrawal options to its clients, ensuring a smooth and efficient funds management process. The broker's deposit and withdrawal policies are designed to prioritize security, speed, and accessibility.

Deposit Options

XTB accepts the following deposit methods:| Deposit Method | Accepted Currencies | Minimum Requirement | Processing Time | Fees |

|---|---|---|---|---|

| Bank Transfer | USD, EUR, GBP | No fixed minimum (varies by account currency) | 1–3 business days | None by XTB (provider fees may apply) |

| Credit/Debit Card | Visa, Mastercard | None | Instant | None by XTB (provider fees may apply) |

| E-wallets | Skrill, Neteller, PayPal | None | Instant | None by XTB (provider fees may apply) |

Withdrawal Options

XTB allows withdrawals via the following methods:| Withdrawal Method | Accepted Currencies | Minimum Withdrawal Amount | Processing Time | Fee for Withdrawals Above Minimum | Fee for Withdrawals Below Minimum |

|---|---|---|---|---|---|

| Bank Transfer | USD, EUR, GBP | $50 / €50 / £50 | Same business day if before 1:00 PM (CET); after 1:00 PM processed next business day; funds may take 1–3 business days to arrive | None | $20 / €20 / £20 |

| Credit/Debit Card | Visa, Mastercard | $5 / €5 / £5 | Same business day if before 1:00 PM (CET); after 1:00 PM processed next business day; usually instant once processed | None | $5 / €5 / £5 |

| E-wallets | Skrill, Neteller, PayPal | $5 / €5 / £5 | Same business day if before 1:00 PM (CET); after 1:00 PM processed next business day; usually instant once processed | None | $5 / €5 / £5 |

Verification Requirements

To comply with AML and Know Your Customer (KYC) regulations, XTB requires clients to verify their identity and address before processing withdrawals. Clients must provide the following documents:- Proof of identity: passport, national ID card, or driver's license

- Proof of address: utility bill, bank statement, or government-issued document (not older than 3 months)

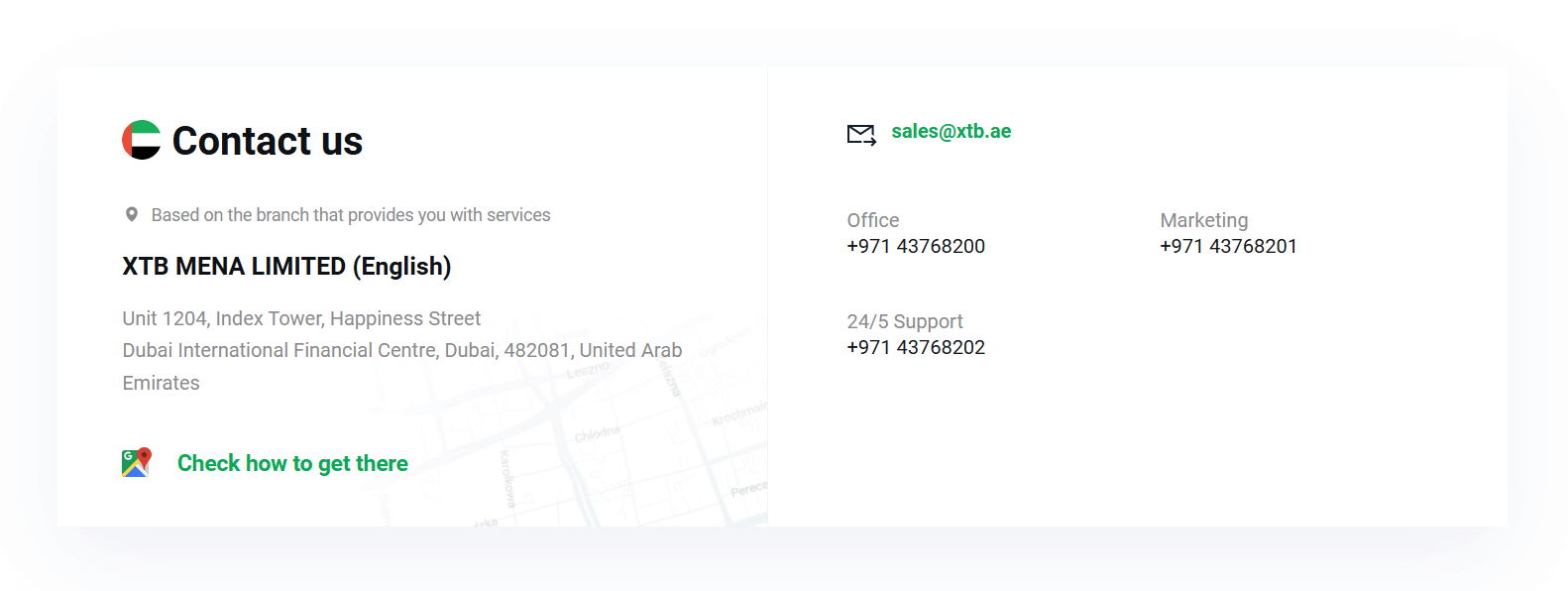

Support Service for Customer

In the fast-paced world of online trading, reliable customer support is crucial for a positive trading experience. Traders need access to knowledgeable and responsive support staff who can assist them with technical issues, account-related queries, and general trading questions.

- Live Chat: Available 24/5 (Monday to Friday) in 11 languages (English, French, German, Spanish, Italian, Polish, Portuguese, Romanian, Russian, Chinese, and Arabic).

- Email: Traders can send their inquiries to support@xtb.com or use the dedicated email addresses for specific countries, which can be found on the XTB website.

- Phone: International support can be reached via phone at + 44 203 695 3086 (24/5). Country-specific phone numbers are also available, ensuring that traders can speak to a local representative during business hours.

- Social Media: XTB maintains a presence on popular social media platforms, such as Facebook, Twitter, and LinkedIn, where traders can reach out for assistance or stay informed about the latest news and updates.

| Feature | XTB Customer Support |

|---|---|

| Live Chat | 24/5 |

| support@xtb.com, country-specific emails | |

| Phone | +44 203 695 3086 (international, 24/5), country-specific numbers |

| Social Media | Facebook, Twitter, LinkedIn |

| Languages | English, French, German, Spanish, Italian, Polish, Portuguese, Romanian, Russian, Chinese, Arabic |

| Response Time (Live Chat) | Under 2 minutes (during trading hours) |

| Response Time (Email) | 1 hour (during trading hours) |

| FAQ Section | Comprehensive self-help resource |

| Educational Resources | Video tutorials, webinars, trading guides |

Prohibited Countries

XTB is a globally recognized broker that strives to provide its services to traders worldwide. However, due to various factors such as local regulations, licensing requirements, and geopolitical considerations, the broker is prohibited from operating in certain countries and regions.

The primary reason behind these restrictions is compliance with international laws and regulations. Each country has its own set of rules governing the provision of financial services, including online trading. To operate legally in a given jurisdiction, brokers must obtain the necessary licenses and adhere to local regulatory requirements. In some cases, the regulatory environment may be too restrictive or the costs of compliance too high, making it unfeasible for XTB to offer its services.

Another factor that can influence XTB's ability to operate in certain countries is geopolitical risk. In regions experiencing political instability, economic sanctions, or conflicts, the broker may choose to suspend its services to protect its clients' interests and comply with international laws.

As of 2025, XTB is prohibited from offering its services in the following countries:

- United States

- Canada

- Japan

- North Korea

- Iran

- Syria

- Sudan

- Cuba

- Crimea region (Ukraine)

Residents of these countries are not permitted to open an account with XTB or access its trading platforms. Attempting to do so may result in the immediate termination of the trading account and potential legal consequences.

Special Offers for Customers

XTB offers a range of special promotions and incentives designed to attract new clients and reward existing traders for their loyalty. These offers can provide traders with additional value and enhance their overall trading experience. However, it is essential to carefully review the terms and conditions associated with each promotion to ensure that you understand the requirements and potential limitations.

As of April 14, 2025, XTB is offering the following special promotions:

| Promotion Name | Offer Details | Eligibility & Requirements | Additional Information |

|---|---|---|---|

| Welcome Bonus - 100% Deposit Match up to $1,000 | 100% bonus match on deposit, up to $1,000. | New clients must deposit a minimum of $250. A trading volume requirement of $25,000 must be met for every $1 bonus received within 90 days of the deposit. | Bonus funds can be used for trading but cannot be withdrawn until the volume requirement is fulfilled. |

| Flexible ISA with Boosted Interest Rate - 6.5% for 3 Months | Boosted interest rate of 6.5% on uninvested GBP funds for the first 90 days. | Open a Flexible Stocks and Shares ISA with XTB between March 1 and April 30, 2025 (UK-based clients). | After 90 days, the rate reverts to the standard interest rate of 4.5%. |

| Trading Masterclass Webinar Series - Free Access for Live Account Holders | Free access to exclusive Trading Masterclass webinars covering market analysis, trading strategies, and risk management. | Available to live account holders. Non-clients can purchase access. | Webinars are conducted throughout 2025 and feature insights from expert analysts and experienced traders. |

| Refer-a-Friend Program - Earn $100 for Each Referral | Earn a bonus of $100 for each referred friend. | The referred friend must open a live trading account and achieve a minimum trading volume of $10,000 within 30 days of account activation. | The bonus is credited to the referrer’s account and can be used for trading or withdrawn. |

When considering these special offers, it is crucial to evaluate your trading needs and objectives to determine whether they align with the promotions' requirements. Some offers may be more suitable for high-volume traders, while others may be more beneficial for long-term investors or those looking to enhance their trading knowledge.

Before participating in any special offer or promotion, make sure to read the full terms and conditions provided by XTB. Pay close attention to any minimum deposit requirements, trading volume thresholds, time limitations, and restrictions on bonus fund usage or withdrawal.

Conclusion

Throughout this comprehensive review of XTB, I have delved into various aspects of their operations, from regulatory compliance and geographical reach to trading platforms, account types, and customer support. By consolidating the findings and insights gathered, I aim to provide a cohesive summary that addresses XTB's safety, reliability, and overall reputation as a broker.

One of the most critical factors when evaluating a broker is their regulatory compliance. XTB demonstrates a strong commitment to operating within the confines of the law, holding licenses from top-tier regulators such as the FCA in the UK and CySEC in Cyprus. This adherence to strict regulatory standards instills confidence in their ability to provide a safe and transparent trading environment for clients.

XTB's global presence, with services offered in multiple languages and support for a wide range of trading instruments, further solidifies their position as a versatile and accessible broker. Their negative balance protection policy and segregation of client funds provide additional layers of security, ensuring that traders' interests are safeguarded.

The broker's proprietary trading platform, xStation 5, stands out as a user-friendly and feature-rich solution, catering to the needs of both novice and experienced traders. The platform's advanced charting tools, integrated news and analysis, and algorithmic trading capabilities demonstrate XTB's commitment to providing a comprehensive and innovative trading experience.

XTB's educational resources, including the extensive Trading Academy, webinars, and market analysis, are another area where they excel. By offering a wealth of learning materials and expert insights, XTB empowers traders to make informed decisions and continuously improve their skills.

Customer support is a crucial aspect of any brokerage, and XTB's multi-channel approach, with 24/5 availability and support in numerous languages, ensures that clients can access assistance whenever needed. The broker's prompt response times and knowledgeable support staff further contribute to a positive trading experience.

While XTB's account types are somewhat limited compared to some competitors, the broker makes up for this with competitive spreads, a wide range of tradable assets, and attractive promotional offers. The absence of fees for most deposit and withdrawal methods is another advantage, making it easy and cost-effective for traders to manage their funds.

In conclusion, XTB presents itself as a reliable, well-regulated, and client-centric broker that prioritizes the safety and satisfaction of its traders. Their combination of advanced trading tools, comprehensive educational resources, and dedicated customer support makes them a compelling choice for both beginner and experienced traders alike.

As with any financial decision, it is essential to consider your individual trading goals, risk tolerance, and preferences when choosing a broker. However, based on the findings of this review, I believe that XTB is a trustworthy and dependable option for those seeking a well-rounded and supportive trading environment.

Get a broader picture with the multi-asset broker collection.

Low-minimum deposits? Scan the TeraFX review.