Module 5: Managing Leverage and Avoiding Overtrading

Introduction: The Art of Controlled Trading

Leverage is one of the most powerful tools in forex trading, allowing you to control larger positions with a relatively small amount of capital. However, it’s also a double-edged sword—while it can amplify profits, it can just as easily magnify losses. Similarly, overtrading—making too many trades due to overconfidence or emotional triggers—can quickly deplete your account.

This module will teach you:

- How to use leverage responsibly.

- The risks associated with overtrading and how to avoid it.

- Practical techniques for maintaining disciplined trading habits.

What is Leverage in Trading?

Definition

Leverage is a mechanism that allows traders to control larger positions than their capital would otherwise permit by borrowing funds from their broker.

How Leverage Works

- Example: With 100:1 leverage, you can control a $100,000 position with just $1,000 in your trading account.

Leverage and Margin

- Margin: The amount of money required in your account to open and maintain a leveraged position.

- Example: At 100:1 leverage, the margin requirement for a $100,000 trade would be $1,000.

The Benefits and Risks of Leverage

Benefits:

- Amplifies Potential Profits: Small price movements can yield significant returns.

- Example: A 1% move on a $10,000 position results in a $100 profit, but with 100:1 leverage, that same move yields $1,000 on a $100 margin.

- Increases Market Accessibility: Allows traders with smaller accounts to participate in the forex market.

Risks:

- Magnifies Losses: Just as it increases profits, leverage also increases losses.

- Example: A 1% loss on a $10,000 position results in a $1,000 loss if leveraged 100:1.

- Can Lead to Margin Calls: If your losses exceed your margin, your broker may close your position to prevent further losses.

How to Use Leverage Responsibly

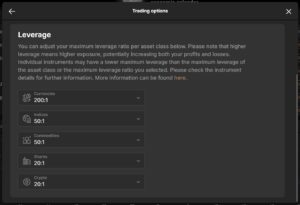

1. Understand Your Risk Tolerance

- Only use leverage levels you’re comfortable with.

- For beginners, start with lower leverage (e.g., 10:1 or 20:1) to reduce risk.

2. Combine Leverage with Position Sizing

- Use the position sizing formula to ensure trades align with your account size and risk tolerance.

- Example:

- Account balance: $10,000.

- Risk per trade: 1% ($100).

- Leverage: 50:1.

- Trade size: $50,000.

3. Set Tight Risk Controls

- Always use stop-loss orders to limit potential losses.

- Example: If you’re trading a $50,000 position, set a stop-loss at a level that ensures your risk doesn’t exceed $100.

What is Overtrading?

Definition

Overtrading occurs when traders open too many positions, often due to emotional triggers such as greed, fear, or frustration.

Signs of Overtrading:

- Excessive Trade Volume:

- Placing multiple trades in a single day without proper analysis.

- Depleting Capital Rapidly:

- Experiencing frequent losses due to impulsive decisions.

- Emotional Decision-Making:

- Trading to “chase” losses or capitalize on perceived opportunities without strategy.

Why Overtrading is Dangerous

1. Increased Risk of Losses

- Frequent trades increase transaction costs (e.g., spreads, commissions), eroding profits.

2. Emotional Burnout

- Overtrading often leads to stress and fatigue, which impair decision-making.

3. Loss of Discipline

- Trading excessively often means ignoring your plan, increasing the likelihood of mistakes.

How to Avoid Overtrading

1. Follow a Trading Plan

- Define your daily or weekly trade limits (e.g., maximum of 3 trades per day).

2. Stick to High-Probability Setups

- Only trade when your strategy signals a clear opportunity.

- Example: Enter a trade only when your risk-reward ratio is at least 1:2.

3. Take Breaks

- Avoid continuously monitoring the market to prevent emotional reactions.

4. Keep a Trading Journal

- Record each trade, including your reasoning and emotions, to identify patterns of overtrading.

Practical Example: Managing Leverage and Avoiding Overtrading

Scenario 1: Calculating a Leveraged Position

- Account Balance: $5,000

- Leverage: 50:1

- Position Size: $50,000 (1 standard lot).

- Risk: 1% ($50).

- Stop-Loss: 20 pips.

With proper leverage and a stop-loss in place, your risk is capped at $50, even with a $50,000 position.

Scenario 2: Setting Trade Limits

- Define a daily trade cap:

- Maximum trades: 3.

- Minimum risk-reward ratio: 1:2.

- Outcome:

- You avoid emotional trading and focus on quality setups.

Key Takeaways

- Leverage is a powerful tool, but it must be used responsibly to avoid magnified losses.

- Always combine leverage with proper position sizing and stop-loss levels.

- Overtrading is a common pitfall; avoid it by following a trading plan and maintaining discipline.

- Breaks, trading journals, and strict limits on trades can help prevent impulsive decisions.

Practical Exercise

- Calculate Leverage:

- Use your account size and risk tolerance to calculate an appropriate leverage level for a $10,000 trade.

- Simulate Trades:

- On a demo account, practice using different leverage levels and observe their impact on your risk and profit.

- Journal Your Trades:

- Record 5 simulated trades, noting whether emotions influenced your decisions.

What’s Next?

In the next module, Backtesting and Refining Risk Management Strategies, you’ll learn how to test your strategies in historical markets to optimize your approach and refine your risk management.