Whether you’re a beginner trying to grasp the basics or a seasoned trader managing complex strategies, these calculators will help you make informed and precise trading decisions. Each tool is designed to simplify the mathematical complexities of trading so you can focus on strategy and execution.

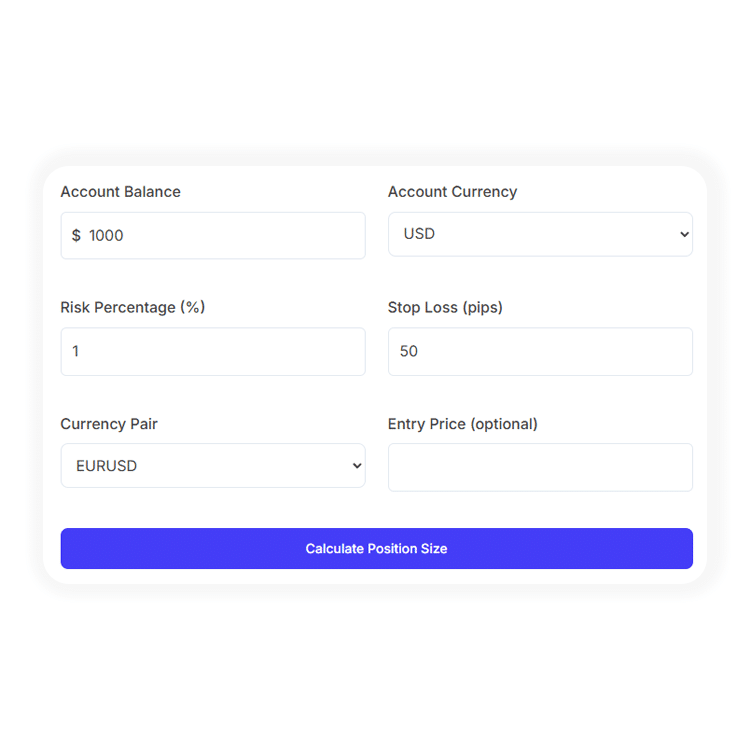

Calculate Perfect Position Sizes

The Position Size Calculator helps you determine how much of a currency pair you should trade based on your account size and risk appetite. It’s the first step in building a solid risk management foundation.

What it is

Calculates the ideal trade size in lots based on your risk percentage, account balance, and stop-loss level.

Why it's important

Prevents overexposure and ensures consistent risk per trade, which is vital for long-term profitability.

How it works

You enter your account balance, how much of it you’re willing to risk (usually 1-2%), and your stop-loss in pips. The tool then outputs

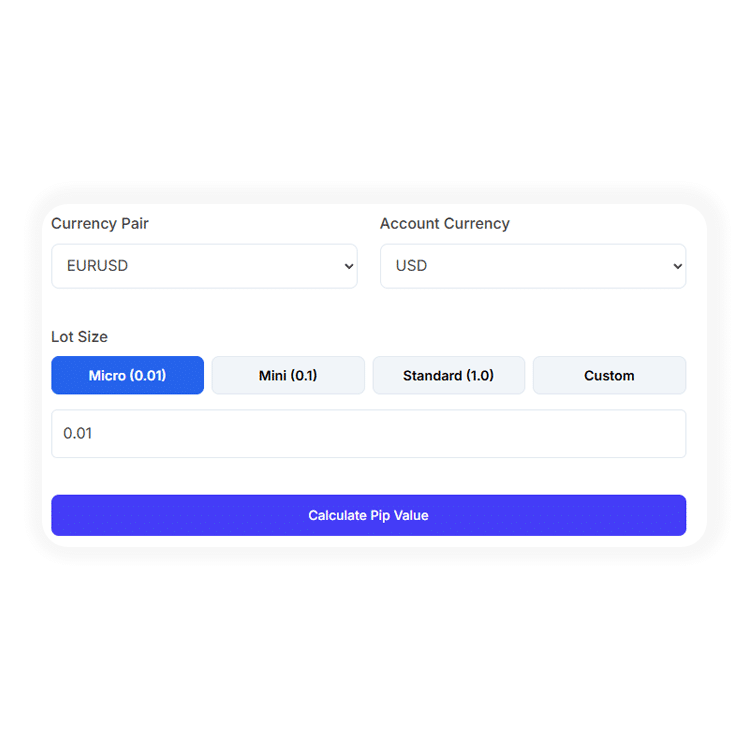

Know Your Pip Values

A “pip” might seem like a small thing, but it’s a crucial unit of measurement in forex. The Pip Value Calculator helps quantify these seemingly minor price movements into actual dollar amounts.

What it is

Determines the monetary value of each pip movement for any currency pair and trade size.

Why it's important

Essential for setting realistic stop-loss and take-profit levels and understanding potential profit or loss.

How it works

You provide the currency pair, lot size, and account currency. The tool calculates the pip value based on current market conditions.

How it helps you

Enhances clarity in trade planning by allowing precise calculations of potential gains or losses.

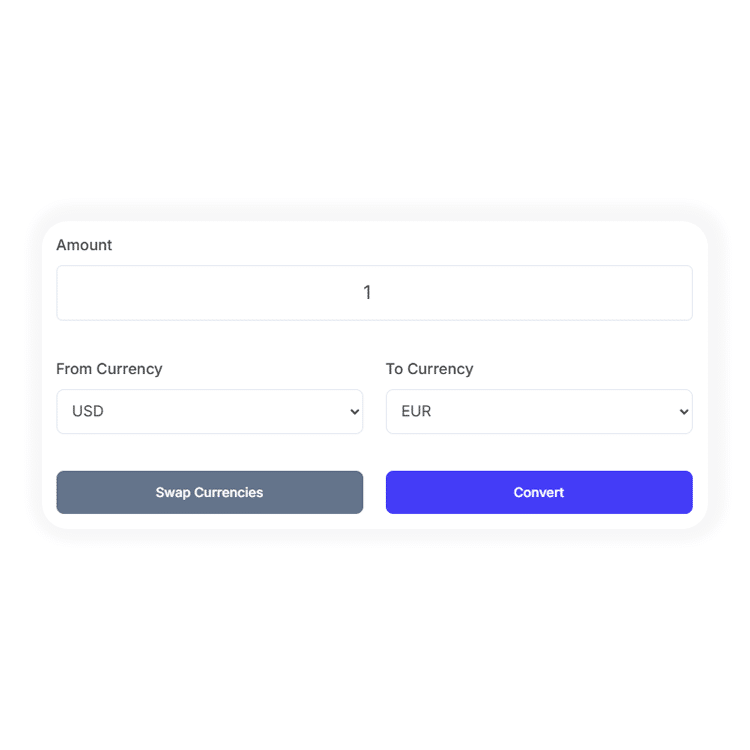

Real-Time Currency Conversion

Whether you’re comparing assets across currencies or preparing for international investments, this tool quickly converts currencies at real-time rates.

What it is

Converts any amount from one currency to another using live exchange rates.

Why it's important

Essential for traders and investors working with accounts in multiple currencies.

How it works

Choose the source and target currencies, input the amount, and the tool instantly shows the converted amount.

How it helps you

Saves time and ensures accuracy when evaluating or executing trades in different currencies.

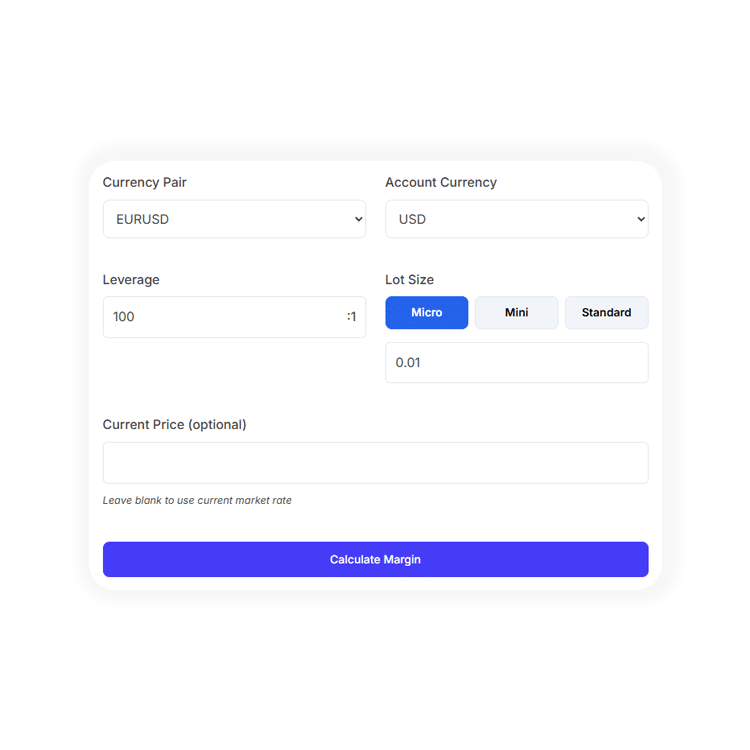

Calculate Required Margin

Know Your Margin: Before placing a trade, you must understand how much margin is required. This calculator ensures you’re never caught off guard by unexpected capital requirements.

What it is

Calculates the amount of margin needed to open and maintain a trading position.

Why it's important

Ensures you have sufficient funds in your account to cover potential losses and maintain open positions.

How it works

Input your leverage, trade size, and currency pair. The calculator tells you how much margin will be used.

How it helps you

Prevents margin calls and helps you manage account equity efficiently.

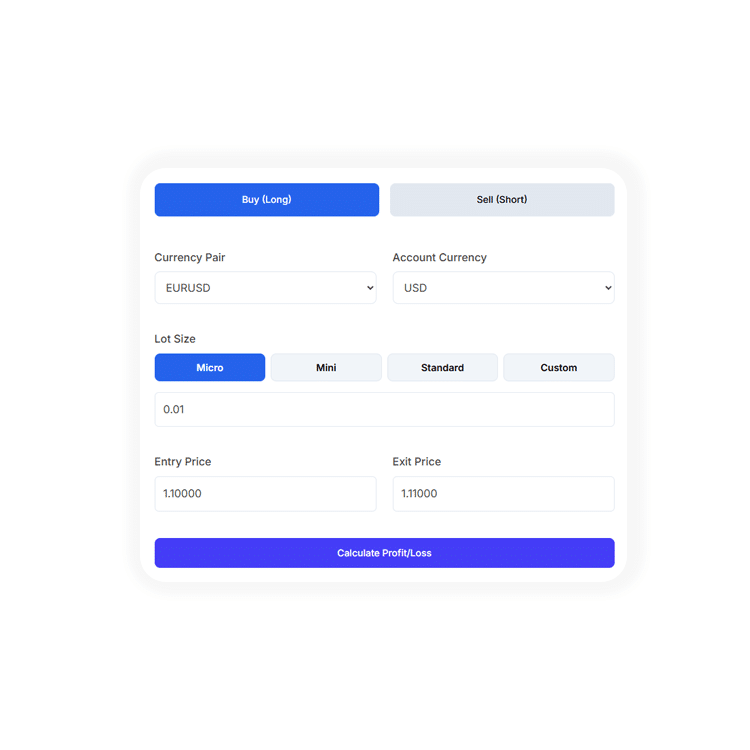

Profit & Loss Calculator

Calculate Profit & Loss

This tool allows you to visualize your trade before placing it. Know your potential profit or loss to make smarter decisions every time.

What it is

Calculates the potential profit or loss from a trade based on entry, exit, and trade size.

Why it's important

Helps assess risk-reward ratios and makes you aware of what’s at stake before entering a trade.

How it works

Enter the entry price, exit price, lot size, and currency pair. The tool will display your potential outcome.

How it helps you

Increases trading discipline and planning accuracy, leading to more consistent results.

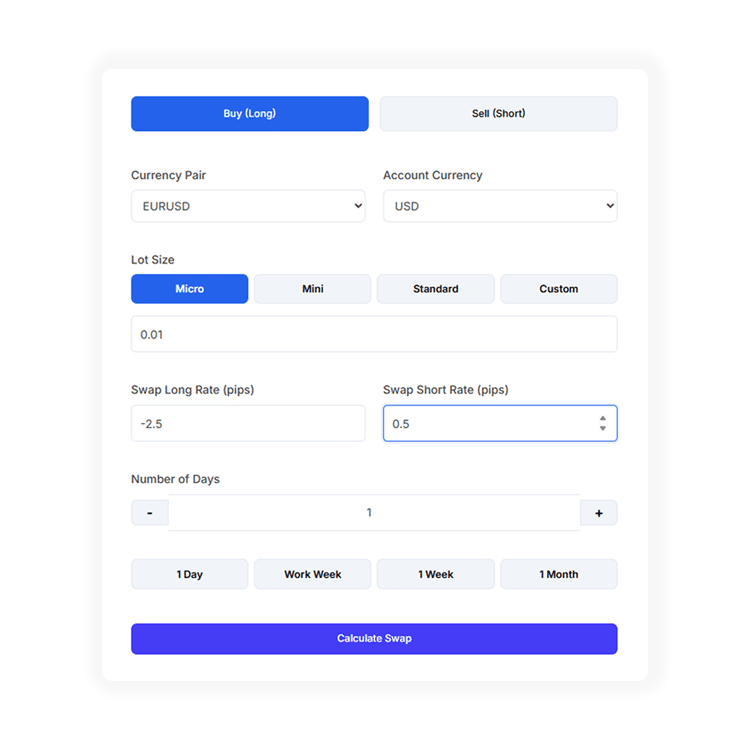

Swap Calculator

Calculate Overnight Costs

If you hold positions overnight, you may earn or pay interest. This calculator helps you estimate these costs or earnings.

What it is

Calculates the swap fee (or rollover interest) charged for holding a position overnight.

Why it's important

Swap charges can impact profitability, especially for long-term trades or scalping strategies.

How it works

Input the currency pair, trade size, and duration. The tool provides the estimated interest cost or gain.

How it helps you

Helps forecast overnight fees and plan trades more strategically around swap rates.