Anzo Capital Review 2025: Is This Forex and CFD Broker Legit?

Anzo Capital

Belize

Belize

-

Minimum Deposit $100

-

Withdrawal Fee $varies

-

Leverage 1000:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Unavailable

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Belize Financial Services License

Belize Financial Services License

Softwares & Platforms

Customer Support

+5012232928

(English)

+5012232928

(English)

Supported language: Chinese (Simplified), English, Spanish

Social Media

Summary

Anzo Capital is a globally recognized forex and CFD broker established in 2015, offering over 100 trading instruments, including forex, commodities, indices, and stocks. The broker provides access to the popular MetaTrader 4 and MetaTrader 5 platforms, catering to both novice and experienced traders. Anzo Capital is regulated by the Financial Services Commission (FSC) of Belize and has been acknowledged for its commitment to client fund security and trading excellence. In 2025, it was honored with the "Most Trusted Forex Broker" award by BrokersView in Singapore and the "Best Trading Speed" award by Fastbull in Vietnam . With competitive trading conditions, including high leverage options and tight spreads, Anzo Capital continues to be a preferred choice for traders worldwide.

- Offers access to popular MetaTrader 4 and MetaTrader 5 trading platforms.

- Provides competitive trading conditions, including tight spreads and high leverage.

- Offers STP and ECN account types to cater to different trading styles.

- Supports a range of payment methods for deposits and withdrawals.

- Provides negative balance protection to limit potential losses.

- Primarily regulated by the IFSC of Belize, which has a less stringent regulatory framework.

- Numerous user complaints and negative reviews regarding withdrawal issues and account closures.

- Limited educational resources and market analysis compared to industry leaders.

- Restricted from operating in several countries, including the US, UK, and EU.

- Lack of transparency regarding the broker's ownership and management structure.

Overview

Anzo Capital is an online forex and CFD broker established in 2015, with its headquarters located in Belize City, Belize. The broker has expanded its presence to serve clients globally, particularly focusing on the Asian market. Anzo Capital offers access to over 100 trading instruments, including forex pairs, CFDs on indices, commodities, precious metals, and cryptocurrencies.

Traders can access the popular MetaTrader 4 and MetaTrader 5 platforms through Anzo Capital, available on desktop, web, and mobile devices. The broker provides competitive trading conditions, such as tight spreads, high leverage up to 1:1000, and fast execution through STP and ECN account types.

Anzo Capital Limited is regulated by the International Financial Services Commission (IFSC) of Belize under license number IFSC/60/482/TS/19. The broker also claims authorisation from the Financial Conduct Authority (FCA) in the United Kingdom and the Financial Services Authority in St. Vincent and the Grenadines. However, potential clients should verify the extent of protection offered by these regulatory affiliations.

While Anzo Capital has received some industry recognition, such as the "Best Broker of the Year 2023" award at the Mindanao Traders Expo, user reviews regarding the broker's services are mixed. Some traders praise the competitive trading conditions and customer support, while others report issues with slippage, withdrawals, and unexpected account closures.

For more details on Anzo Capital's offerings, prospective clients can visit the broker's official website at anzocapital.com. As with any financial decision, thorough due diligence and careful consideration of one's trading goals and risk tolerance are essential before engaging with a broker.

Overview Table

| Aspect | Details |

|---|---|

| Foundation Year | 2015 |

| Headquarters | Belize City, Belize |

| Regulation | IFSC Belize (License No. IFSC/60/482/TS/19) |

| Trading Platforms | MetaTrader 4, MetaTrader 5 |

| Instruments | Forex, CFDs (Indices, Commodities, Metals, Cryptocurrencies) |

| Account Types | STP, ECN |

| Minimum Deposit | $100 (STP), $500 (ECN) |

| Maximum Leverage | 1:1000 |

| Spread | From 0.0 pips (ECN) |

| Commission | $4 per lot (ECN) |

| Payment Methods | Bank Wire, Credit/Debit Cards, E-wallets, Cryptocurrencies |

Facts List

- Anzo Capital was founded in 2015 and is headquartered in Belize City, Belize.

- The broker offers over 100 trading instruments, including forex, indices, commodities, metals, and cryptocurrencies.

- Anzo Capital provides access to the MetaTrader 4 and MetaTrader 5 platforms on desktop, web, and mobile devices.

- The broker is regulated by the International Financial Services Commission (IFSC) of Belize under license number IFSC/60/482/TS/19.

- Anzo Capital offers STP and ECN account types with a minimum deposit of $100 and $500, respectively.

- Maximum leverage offered by the broker is 1:1000, depending on the asset and account type.

- Spreads start from 0.0 pips on the ECN account, with a commission of $4 per lot.

- The broker supports various payment methods, including bank wire transfers, credit/debit cards, e-wallets, and cryptocurrencies.

- Anzo Capital has received the "Best Broker of the Year 2023" award at the Mindanao Traders Expo.

- User reviews of Anzo Capital are mixed, with some praising the trading conditions and support, while others report issues with slippage, withdrawals, and account closures.

Anzo Capital Licenses and Regulatory

Anzo Capital Limited operates under the regulatory oversight of the International Financial Services Commission (IFSC) of Belize. The broker holds a license from the IFSC with the number IFSC/60/482/TS/19, which authorises it to provide forex and CFD trading services to clients globally.

While Anzo Capital claims to be authorised by the Financial Conduct Authority (FCA) in the United Kingdom and the Financial Services Authority in St. Vincent and the Grenadines, the extent and implications of these authorisations remain unclear. Potential clients should exercise caution and verify the level of protection offered by these additional regulatory affiliations.

The IFSC is known for its relatively lenient regulatory framework compared to more stringent authorities such as the FCA, the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC). Brokers operating under the IFSC's jurisdiction may not be subject to the same level of oversight and client protection measures as those regulated by top-tier authorities.

The lack of a strong regulatory presence can raise concerns about the safety of client funds, the reliability of trading conditions, and the broker's overall accountability. Traders should be aware that in the event of a dispute or financial loss, recourse options may be limited when dealing with an offshore-regulated broker like Anzo Capital.

In contrast, brokers regulated by reputable authorities such as the FCA, ASIC, or CySEC are required to adhere to strict guidelines designed to protect clients' interests. These measures include maintaining segregated client funds, providing negative balance protection, and participating in investor compensation schemes.

While Anzo Capital's IFSC regulation allows it to offer services to a wide range of clients, traders should carefully consider their risk tolerance and preferences before choosing a broker. Those prioritising a high level of regulatory protection may opt for brokers licensed by top-tier authorities, even if it means potentially higher costs or fewer trading options.

As with any financial decision, thorough due diligence is essential before engaging with a broker. Traders should review the broker's regulatory status, client feedback, and terms of service to make an informed choice that aligns with their individual needs and expectations.

Regulations List

- International Financial Services Commission (IFSC) of Belize:

- License Number: IFSC/60/482/TS/19

- Authorizes Anzo Capital Limited to provide forex and CFD trading services

- Financial Conduct Authority (FCA) in the United Kingdom:

- Anzo Capital claims authorization, but the extent and implications are unclear

- Traders should verify the level of protection offered by this affiliation

- Financial Services Authority in St. Vincent and the Grenadines:

- Anzo Capital claims authorization, but the extent and implications are unclear

- Traders should verify the level of protection offered by this affiliation

Trading Instruments

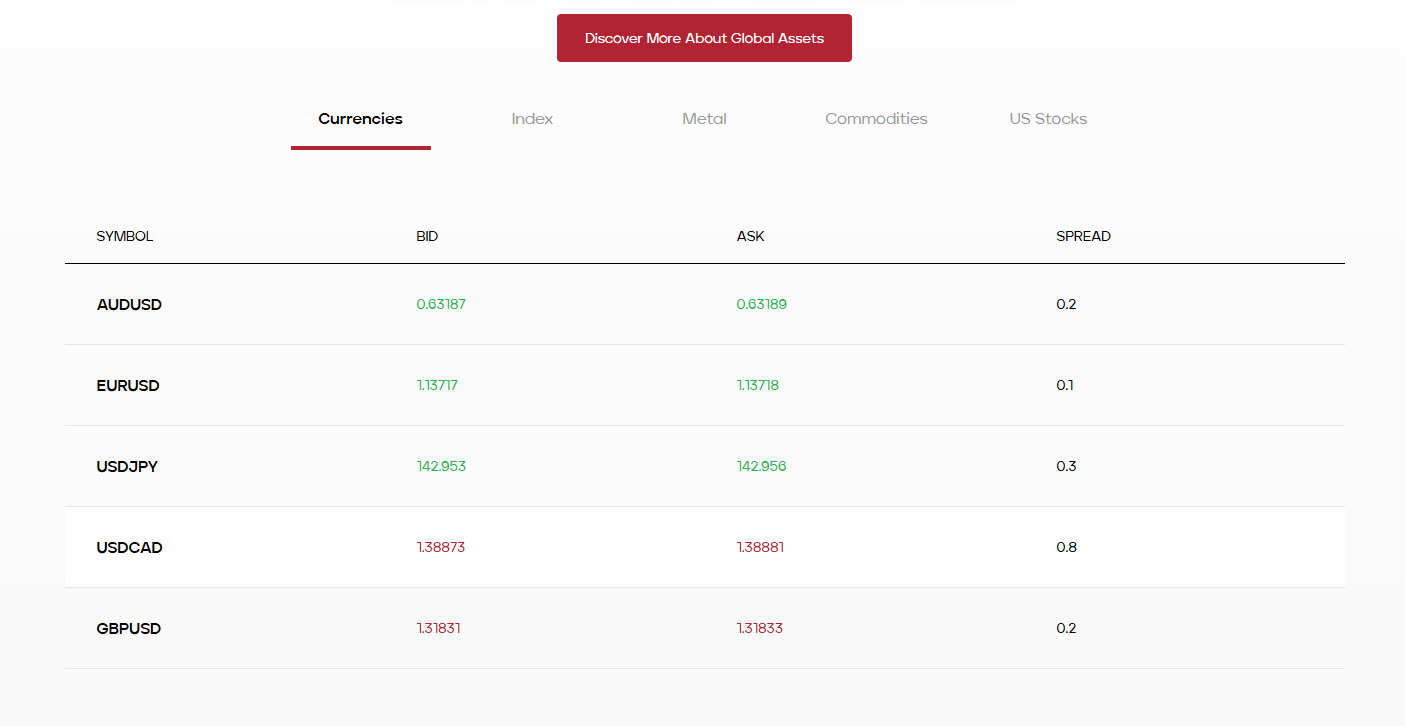

Anzo Capital provides traders with access to a diverse range of tradable assets, allowing them to build a comprehensive portfolio tailored to their individual preferences and risk tolerance. The broker offers over 100 trading instruments across various asset classes, empowering clients to seize opportunities in different market conditions.

| Asset Class | Examples | Features |

|---|---|---|

| Forex Pairs | EUR/USD, GBP/USD, USD/JPY, USD/CHF, exotics | Wide selection (majors, minors, exotics), competitive spreads, cost-effective strategy support |

| CFDs on Indices | S&P 500, NASDAQ 100, FTSE 100, DAX 30, ASX 200 | Leverage available, speculate on market sectors, no need to own underlying assets |

| Commodities & Metals | Gold, Silver, Crude Oil, Natural Gas | Portfolio diversification, hedge against inflation, flexible contract sizes |

| Cryptocurrencies (CFDs) | Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP) | High volatility, speculative trading, potential high returns, regulatory uncertainty risks |

The breadth and depth of Anzo Capital's tradable assets demonstrate the broker's commitment to catering to the diverse needs of its client base. By providing a comprehensive range of instruments across multiple asset classes, Anzo Capital empowers traders to pursue their unique strategies and adapt to evolving market conditions.

Having a diverse portfolio of tradable assets not only enhances flexibility for investors but also reflects positively on the broker's ability to stay attuned to market trends and client demands. Anzo Capital's asset offerings are competitive within the industry, allowing the broker to attract and retain a broad spectrum of traders.

Trading Platforms

Anzo Capital offers its clients access to the renowned MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, which are widely recognised as industry standards in the forex and CFD trading world. These platforms are designed to cater to both novice and experienced traders, providing a user-friendly interface, advanced charting tools, and a wide range of technical indicators.

MetaTrader 4 (MT4)

MT4 is a popular choice among traders due to its intuitive interface, customisable charts, and extensive library of trading indicators and Expert Advisors (EAs). The platform supports automated trading, allowing clients to develop and deploy their own trading bots or utilise pre-built strategies. MT4 is accessible through desktop, web, and mobile applications, enabling traders to monitor and manage their positions on the go.

MetaTrader 5 (MT5)

MT5 is the successor to MT4, offering enhanced features and functionality. In addition to forex and CFD trading, MT5 supports stocks, futures, and options trading, making it a versatile platform for diversified trading strategies. The platform provides advanced charting tools, a built-in economic calendar, and a comprehensive backtesting environment for developing and optimising trading strategies.

Web-based Trading

Anzo Capital's web-based trading platform allows clients to access their trading accounts and execute trades directly through a web browser, without the need to install any software. This feature is particularly convenient for traders who prefer not to download additional applications or who frequently access their accounts from different devices. Mobile Trading Apps For traders who value mobility and flexibility, Anzo Capital offers mobile trading apps for both MT4 and MT5. These apps, available on iOS and Android devices, provide a streamlined interface for monitoring markets, executing trades, and managing positions while on the move. The mobile apps offer a range of features, including real-time quotes, customisable charts, and push notifications for important market events.

Mobile Trading Apps

For traders who value mobility and flexibility, Anzo Capital offers mobile trading apps for both MT4 and MT5. These apps, available on iOS and Android devices, provide a streamlined interface for monitoring markets, executing trades, and managing positions while on the move. The mobile apps offer a range of features, including real-time quotes, customizable charts, and push notifications for important market events.

The stability and reliability of Anzo Capital's trading platforms are critical for ensuring a smooth and satisfactory trading experience. The broker's choice to offer MT4 and MT5, which are known for their robustness and popularity, demonstrates a commitment to meeting clients' expectations and facilitating their trading activities.

By providing a range of trading platforms and access methods, Anzo Capital caters to the diverse needs and preferences of its client base. Whether traders prefer the familiarity of MT4, the advanced features of MT5, or the convenience of web-based and mobile trading, Anzo Capital's technological offerings are well-positioned to meet current market demands and support effective trading strategies.

Trading Platforms Comparison Table

| Feature | MT4 | MT5 |

|---|---|---|

| Forex trading | Yes | Yes |

| CFD trading | Yes | Yes |

| Stocks trading | No | Yes |

| Futures trading | No | Yes |

| Options trading | No | Yes |

| Automated trading (EAs) | Yes | Yes |

| Customizable charts | Yes | Yes |

| Technical indicators | 30+ | 38+ |

| Economic calendar | No | Yes |

| Backtesting environment | Basic | Advanced |

| Web-based access | Yes | Yes |

| Mobile apps (iOS/Android) | Yes | Yes |

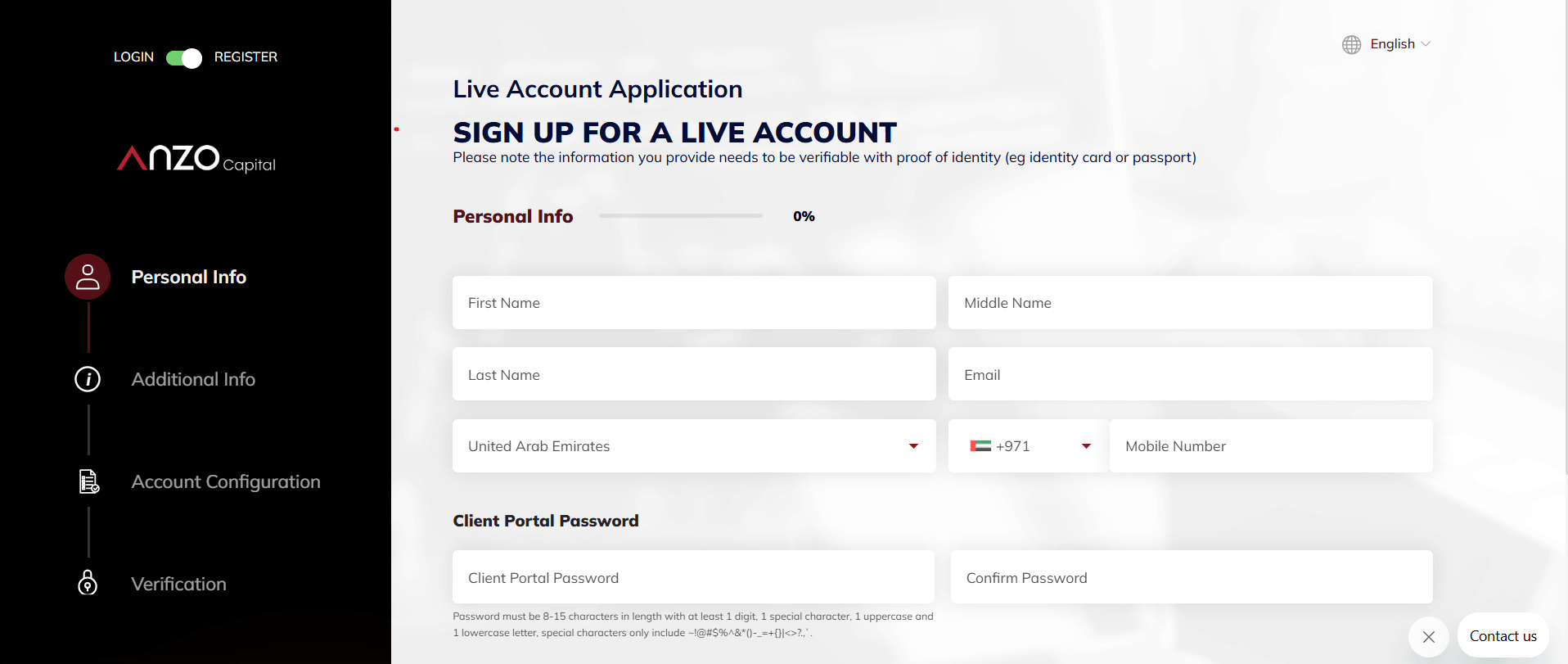

Anzo Capital How to Open an Account: A Step-by-Step Guide

Opening an account with Anzo Capital is a straightforward process designed to get traders started on their investment journey as quickly and efficiently as possible. To begin trading with Anzo Capital, follow these simple steps:

Step 1: Registration Visit Anzo Capital's official website at anzocapital.com and click on the "Open an Account" button. Fill out the registration form with your personal information, including your full name, email address, phone number, and country of residence. Choose your preferred account type (STP or ECN) and base currency.

Step 2: Account Verification To comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, Anzo Capital requires clients to verify their identity and address. Submit a valid government-issued ID, such as a passport or driver's license, and a proof of address, such as a utility bill or bank statement, dated within the last three months.

Step 3: Funding Your Account Once your account is verified, you can fund it using one of the available payment methods. Anzo Capital accepts deposits via bank wire transfer, credit/debit cards, and various e-wallets, including Skrill, Neteller, and Sticpay. The minimum deposit requirement is $100 for STP accounts and $500 for ECN accounts.

Step 4: Download and Install Trading Platform Choose your preferred trading platform (MetaTrader 4 or MetaTrader 5) and download the appropriate software from Anzo Capital's website. Install the platform on your device and log in using the credentials provided by the broker.

Step 5: Start Trading After logging in to your trading platform, you can start exploring the available markets and instruments. Familiarise yourself with the platform's features, such as charting tools and order types. When you're ready, you can begin placing trades and implementing your strategies.

Anzo Capital's account opening process is designed to be user-friendly and efficient, allowing traders to start their investment journey with minimal hassle. The broker's client support team is available 24/5 to assist with any questions or issues that may arise during the account opening process.

It is essential to note that while Anzo Capital strives to make the account opening process as smooth as possible, traders should carefully consider their investment goals, risk tolerance, and the broker's regulatory status before committing funds. As with any financial decision, thorough research and due diligence are crucial for making informed choices.

Charts and Analysis

Anzo Capital provides its clients with a range of educational trading resources and tools to support their learning and development in the forex and CFD markets. While the broker's educational offerings are not as extensive as some of its competitors, it does offer a selection of materials designed to cater to traders of varying skill levels and needs.

| Resource | Description | Remarks |

|---|---|---|

| Trading Platforms | MetaTrader 4 (MT4) and MetaTrader 5 (MT5) | Built-in charting tools, over 50 indicators, supports custom indicators and trading scripts |

| Economic Calendar | Displays upcoming financial events and economic data releases | Basic in functionality; may lack depth compared to more advanced calendars offered elsewhere |

| Educational Articles | Covers topics like technical/fundamental analysis and risk management | Useful for beginners but limited in scope and depth |

| Market Analysis | Occasional market insights and trading commentary | Not updated frequently; traders may need external resources for real-time, in-depth analysis |

Anzo Capital's educational resources demonstrate the broker's effort to support its clients' trading knowledge and skills development. However, the relatively limited scope of these offerings may not be sufficient for traders seeking extensive educational content and tools.

In contrast, many industry-leading brokers invest heavily in developing comprehensive educational programs, including webinars, video tutorials, e-books, and interactive courses. These resources cater to traders of all skill levels and provide a more immersive and structured learning experience.

While Anzo Capital's educational resources may be beneficial for some traders, those seeking a more robust educational support system may need to consider other brokers or supplement their learning with third-party resources.

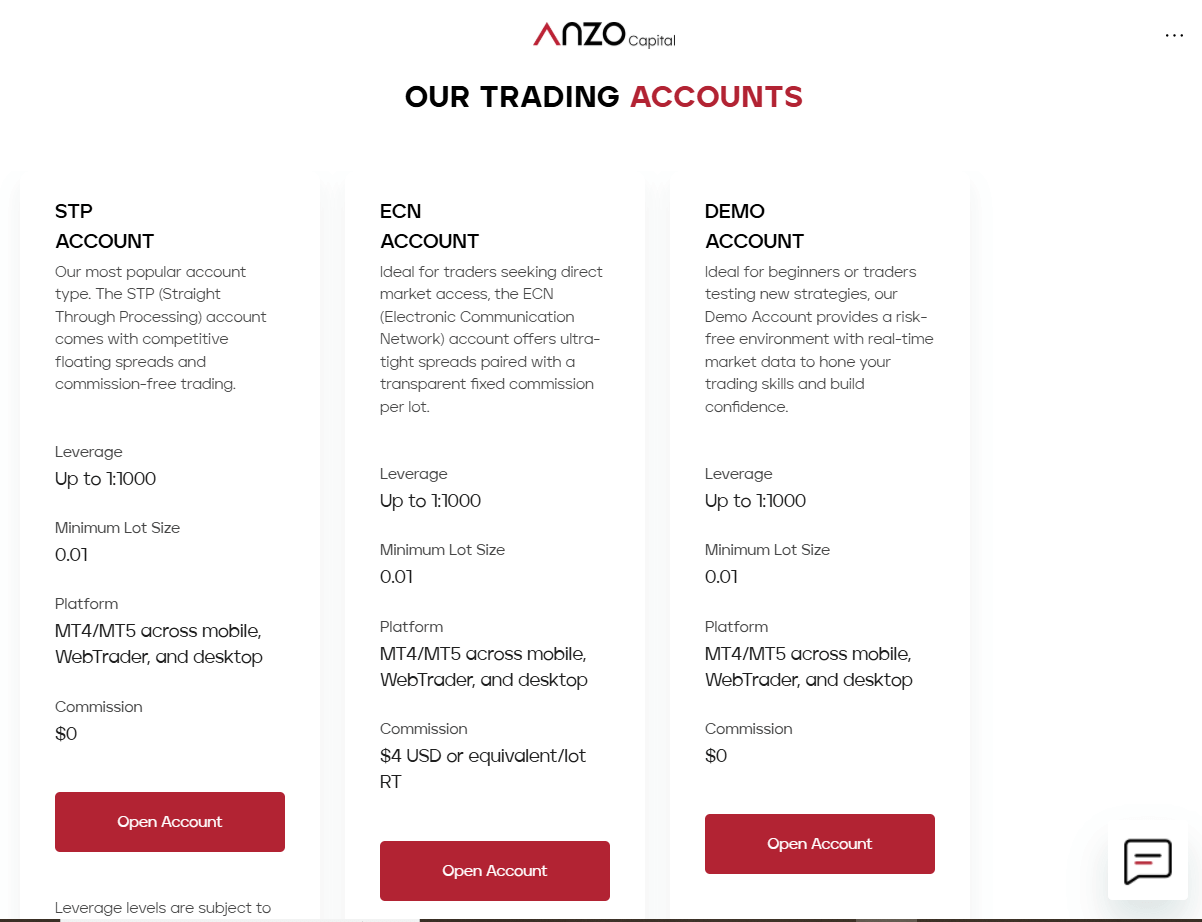

Anzo Capital Account Types

Anzo Capital offers two main types of trading accounts designed to cater to the diverse needs and preferences of its clients: STP (Straight-Through Processing) and ECN (Electronic Communication Network) accounts. Both account types provide access to a wide range of trading instruments, including forex pairs, CFDs on indices, commodities, precious metals, and cryptocurrencies.

STP Account

The STP account is suitable for traders who prefer a more straightforward trading experience without dealing with commission fees. This account type offers competitive spreads starting from 1.3 pips, with no additional commissions charged. The minimum deposit requirement for an STP account is $100, making it accessible to a wide range of traders, including beginners. The maximum leverage available for STP accounts is 1:1000, allowing traders to potentially amplify their returns while also increasing risk exposure.

ECN Account

The ECN account is designed for more experienced traders who prioritise tight spreads and faster execution speeds. This account type offers raw spreads starting from 0.0 pips, providing traders with more favourable trading conditions. However, ECN accounts come with a commission fee of $4 per standard lot traded (round trip), which is added to the spread. The minimum deposit requirement for an ECN account is $500, reflecting the more advanced nature of this account type. ECN accounts offer a higher maximum leverage of up to 1:1000, catering to traders who employ more aggressive trading strategies.

Demo Account

In addition to the live trading accounts, Anzo Capital provides a demo account option, allowing traders to practise their strategies and familiarise themselves with the trading platforms in a risk-free environment. The demo account is funded with virtual currency and offers the same trading conditions as the live accounts, enabling traders to test their skills and gain confidence before committing real funds.

Anzo Capital's range of account types demonstrates the broker's commitment to accommodating the diverse needs of its client base. By offering both STP and ECN accounts, as well as a demo account, Anzo Capital provides traders with the flexibility to choose an account that aligns with their trading style, experience level, and risk tolerance.

However, it is essential for traders to carefully consider their individual needs and goals when selecting an account type. While the higher leverage offered by Anzo Capital may be attractive to some traders, it is crucial to understand the increased risk associated with leveraged trading and to employ appropriate risk management strategies.

Account Types Comparison Table

| Feature | STP Account | ECN Account |

|---|---|---|

| Minimum Deposit | $100 | $500 |

| Spreads | From 1.3 pips | From 0.0 pips |

| Commissions | No | $4 per lot |

| Maximum Leverage | 1:1000 | 1:1000 |

| Trading Instruments | Forex, CFDs | Forex, CFDs |

| Suitable for | Beginners | Experienced |

| Demo Account Available | Yes | Yes |

Negative Balance Protection

Anzo Capital recognizes the importance of protecting its clients from such scenarios and offers negative balance protection as a standard feature across all account types. This means that if a trader's account balance falls below zero due to trading losses, Anzo Capital will absorb the negative balance and reset the account to zero. Traders will not be required to pay back the negative balance, providing peace of mind and limiting their maximum potential loss to the funds in their trading account. It is essential to note that while negative balance protection is an important risk management tool, it should not be relied upon as a substitute for proper risk management practices. Traders should still employ appropriate strategies, such as setting stop-loss orders, managing position sizes, and maintaining a healthy risk-to-reward ratio, to control their exposure to potential losses. To benefit from Anzo Capital's negative balance protection, traders must ensure that they comply with the broker's terms and conditions. This includes adhering to the broker's trading policies and not engaging in any abusive or manipulative trading practices that may void the negative balance protection. Traders should also be aware that negative balance protection may not apply in certain exceptional circumstances, such as in the event of a market gap or a technical issue with the trading platform. It is crucial to thoroughly review Anzo Capital's terms and conditions related to negative balance protection to fully understand the scope and limitations of this feature.

Anzo Capital Deposits and Withdrawals

Anzo Capital offers a range of deposit and withdrawal options to facilitate convenient and secure transactions for its clients. The broker aims to provide a seamless funding experience, enabling traders to focus on their trading activities without unnecessary delays or complications.

Deposit Methods

| Category | Method/Details | Processing Time | Remarks |

|---|---|---|---|

| Bank Wire Transfer | Direct bank account transfer | 2–5 business days | Ideal for large deposits; delays possible due to intermediary banks |

| Credit/Debit Cards | Visa, Mastercard | Instant | Convenient and fast; suitable for small to medium deposits |

| E-wallets | Skrill, Neteller, Sticpay | Instant | Fast, easy-to-use, and widely accepted |

| Cryptocurrencies | Bitcoin, Ethereum, Tether | Depends on network confirmation | Offers privacy and decentralization |

| Minimum Deposit | STP: $100 ECN: $500 | — | Varies by account type |

| Withdrawal Methods | Same as deposits (Bank, Cards, E-wallets, Crypto) | 24-hour internal processing | External delays possible depending on method and location |

Withdrawal Methods

| Methods | Minimum Withdrawal | Processing Time (Anzo) |

|---|---|---|

| Bank Wire Transfer | $100 | Within 24 hours |

| Credit/Debit Cards (Visa, Mastercard) | $50 | Within 24 hours |

| E-wallets (Skrill, Neteller, Sticpay) | $100 | Within 24 hours |

| Cryptocurrencies (Bitcoin, Ethereum, Tether) | $50 | Within 24 hours |

Support Service for Customer

In the fast-paced world of online trading, reliable customer support is essential for a positive trading experience. Traders often require assistance with account-related queries, technical issues, or general guidance, and a responsive support team can make all the difference. Anzo Capital recognises the importance of providing efficient and helpful customer support to its clients.

- Live Chat: Traders can access the live chat feature on Anzo Capital's website for instant support. This is often the quickest way to get help with minor queries or issues.

- Email Support: Clients can send their enquiries to Anzo Capital's support email address. The support team aims to respond to all emails within 24 hours.

- Phone Support: Anzo Capital provides phone support for traders who prefer to discuss their concerns directly with a support representative.

- Social Media: Traders can also reach out to Anzo Capital through its official social media channels, such as Facebook and Twitter, for general enquiries and updates.

Customer Support Comparison Table

| Feature | Anzo Capital |

|---|---|

| Live Chat | Yes |

| Email Support | Yes |

| Phone Support | Yes |

| Social Media Support | Yes (Facebook and Twitter) |

| Support Languages | English, Chinese, Spanish, others |

| Support Hours | 24/5 (Monday to Friday) |

| Average Response Time | Varies by channel and inquiry complexity |

Prohibited Countries

Anzo Capital, like many other international forex and CFD brokers, is subject to various regulations and licensing requirements that restrict its ability to provide services in certain countries and regions. These restrictions are put in place by local authorities to protect consumers, prevent financial crimes, and ensure fair market practices.

One of the most notable restrictions is the United States' Commodity Futures Trading Commission (CFTC) regulation, which prohibits Anzo Capital from accepting clients from the United States. This is due to the strict regulatory environment in the U.S., which requires brokers to obtain specific licenses and adhere to stringent rules when offering trading services to U.S. citizens.

In addition to the United States, Anzo Capital is prohibited from operating or providing services in several other countries and regions, including:

- Canada

- European Union countries

- Japan

- Australia

- New Zealand

- Brazil

- Iran

These restrictions are based on various factors, such as local licensing requirements, anti-money laundering (AML) regulations, and geopolitical considerations. For example, Japan has a highly regulated forex market, requiring brokers to obtain a specific license from the Financial Services Agency (FSA) to operate legally. Similarly, the European Union has implemented the Markets in Financial Instruments Directive (MiFID) and the Markets in Financial Instruments Regulation (MiFIR), which impose strict requirements on brokers offering services to EU residents.

It is crucial for traders to be aware of these restrictions and to ensure that they are not residing in a prohibited country before attempting to open an account with Anzo Capital. Attempting to trade with Anzo Capital from a prohibited country may result in the termination of the trading account and potential legal consequences.

Traders should always verify their eligibility to trade with Anzo Capital by reviewing the broker's terms and conditions and contacting the customer support team for clarification if needed. It is also essential to keep abreast of any changes in regulations that may affect their ability to trade with Anzo Capital or any other broker.

Prohibited Countries List

- Anzo Capital is prohibited from operating or providing services in the United States, Canada, European Union countries, Japan, Australia, New Zealand, Brazil, Iran.

Special Offers for Customers

Anzo Capital currently offers a 20% Credit Bonus promotion, which provides traders with additional trading power and the opportunity to convert the bonus into a cash balance.

To qualify for the 20% Credit Bonus, traders need to follow these simple steps:

- Open a real trading account with Anzo Capital (for new clients) or log in to their existing account.

- Make a minimum net deposit of $500.

- Apply for the 20% Credit Bonus through their Account Manager.

- Once the trading requirements are met, apply for the Cash Balance Conversion.

The 20% Credit Bonus offers several benefits:

- Leverage: The credit bonus can be used to open higher-volume positions and diversify risks.

- Convertibility: The bonus is 100% convertible to cash balance upon meeting the trading requirements of $2 per lot.

- Maximum Bonus: Each trading account can claim a credit bonus of up to $10,000.

Traders should be aware of the following terms and conditions:

- Residents of Australia, New Zealand, the UK, China Mainland, and Taiwan are excluded from this promotion.

- Withdrawals are allowed during the promotion period, but a 20% deduction will be applied to the existing credit bonus for each withdrawal or internal transfer.

- Traders can use multiple trading accounts to apply for the 20% Credit Bonus, with a maximum credit bonus of $10,000 per account.

- Participation in other promotions is allowed, provided that the eligibility requirements for each individual promotion are met.

In addition to the 20% Credit Bonus, Anzo Capital is also running a Trading Competition with over $200,000 in rewards and prizes. The competition is divided into two groups: the Pride Team and the Voyage Team, each with a minimum deposit requirement of $500.

The Trading Competition offers the following prizes:

- Ultimate Awards: Cash prizes ranging from $1,000 to $58,888 for the top 10 performers in each team.

- Weekly Prizes: $100 and $50 per week for the highest profit rate and trading volume in the Pride Team and Voyage Team, respectively.

The Trading Competition details are as follows

- Registration Date: 26 February 2025 - 2 June 2025

- Trading Period: 3 March 2025 - 15 June 2025

- Accepted Trading Technology: MT4 or MT5, including Expert Advisors (EAs)

These promotions demonstrate Anzo Capital's commitment to providing traders with attractive incentives and the opportunity to maximise their trading potential. However, traders should carefully review the terms and conditions and ensure that they fully understand the requirements and limitations associated with each offer before participating.

Conclusion

After conducting a thorough review of Anzo Capital, I have found that while the broker offers some attractive features, there are also significant concerns regarding their regulatory status and overall trustworthiness.

On the positive side, Anzo Capital provides access to the popular MetaTrader 4 and MetaTrader 5 platforms, which are well regarded in the industry for their reliability and advanced trading tools. The broker offers competitive trading conditions, including tight spreads and high leverage, which may appeal to experienced traders looking to maximise their potential returns.

However, I have serious reservations about Anzo Capital's regulatory compliance. The broker is primarily regulated by the International Financial Services Commission (IFSC) of Belize, which is known for its relatively lax oversight compared to more reputable regulatory bodies such as the FCA, ASIC, or CySEC. This lack of strong regulation raises concerns about the level of protection and recourse available to clients in case of disputes or financial losses.

Furthermore, there have been numerous user complaints and negative reviews regarding Anzo Capital's practices, particularly concerning issues with withdrawals and unexpected account closures. These reports, combined with the broker's offshore regulatory status, suggest that traders should exercise extreme caution when considering whether to entrust their funds to Anzo Capital.

While Anzo Capital does offer some educational resources and customer support, these offerings are relatively limited compared to those provided by leading industry brokers. The absence of robust educational materials and market analysis may be a drawback for beginner traders seeking to develop their skills and knowledge.

In conclusion, based on my analysis, I cannot confidently recommend Anzo Capital as a reliable and trustworthy broker. The potential benefits of their competitive trading conditions are overshadowed by the serious concerns surrounding their regulatory compliance and the numerous user complaints. Traders prioritising safety and security would be better served by choosing a broker with a strong regulatory framework and a solid reputation in the industry.

As with any financial decision, it is crucial for traders to conduct their own thorough research and due diligence before committing funds to any broker. Careful consideration of one's trading goals, risk tolerance, and the broker's regulatory status should be at the forefront of the decision-making process.