ATFX Review 2025: Is This Global Forex & CFD Broker Safe and Legit?

ATFX

Cyprus

Cyprus

-

Minimum Deposit $100

-

Withdrawal Fee $0

-

Leverage 400:1

-

Spread From 0.6

-

Minimum Order 0.01

-

Forex Available

-

Crypto Unavailable

-

Stock Unavailable

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Cyprus Market Making (MM)

Cyprus Market Making (MM)

South Africa Retail Forex License

South Africa Retail Forex License

Australia Retail Forex License

Australia Retail Forex License

Softwares & Platforms

Customer Support

()

()

Supported language: English, French, German, Italian, Spanish

Social Media

Summary

ATFX is a globally recognized online trading broker offering a wide range of financial instruments, including forex, CFDs on indices, commodities, and shares. With competitive spreads, deep liquidity, and advanced trading tools, ATFX caters to both novice and professional traders. The broker provides robust market analysis, educational resources, and industry-leading platforms to enhance the trading experience.

- Strong regulation by top-tier authorities like FCA, CySEC, ASIC, and FSCA

- Competitive spreads starting from 0.1 pips on premium accounts

- Wide range of tradable assets, including forex, indices, commodities, and shares

- MetaTrader 4 and 5 platforms for advanced trading and analysis

- User-friendly web and mobile trading apps for flexibility

- 24/5 multilingual customer support via phone, email, and live chat

- Extensive educational resources, including webinars, ebooks, and tutorials

- Copy trading and PAMM accounts for passive investing

- Fast and easy account opening process

- Regular promotions and loyalty programs for active traders

- No cryptocurrency trading ( this may vary in different jurisdictions )

- $500 minimum deposit for live accounts may be high for some traders

- Limited range of funding methods compared to some brokers

- Inactivity fees charged after 6 months of no trading

- ECN accounts are only available with higher minimum deposits

- Some restrictions on clients from the US, Japan, and other countries

- Relatively new broker established in 2014

- No managed account services

- No 24/7 customer support outside market hours

- Bonuses and promotions are not available to all clients

Overview

ATFX, founded in 2014, is a well-established global online forex broker. As part of the AT Global Markets group, ATFX has grown its presence to serve clients in over 15 countries worldwide. The broker is authorized and regulated by several respected financial authorities, including the FCA in the UK, CySEC in Cyprus, ASIC in Australia, and the FSCA in South Africa.

ATFX has earned recognition for its services, receiving awards such as "Best Forex Customer Service" at the 2017 Entrepreneur JFEX Awards and "Best Forex MT4 Broker - MENA" at the 2022 Global Forex Awards. The broker offers a wide range of trading instruments, competitive pricing, and advanced trading platforms like MetaTrader 4 and 5.

Clients can choose from several account types designed for both retail and professional traders, with access to extensive educational resources, market research, and 24/5 multilingual customer support. More information about ATFX's offerings, regulation, and global presence can be found on their official website, atfx.com. While ATFX strives to provide a reliable trading environment, it's essential for traders to consider the potential risks associated with leveraged trading and conduct thorough due diligence before investing.

Overview Table

| Broker Name | ATFX |

|---|---|

| Founded | 2014 |

| Headquarters | London, United Kingdom |

| Regulated By | FCA (UK), CySEC (Cyprus), ASIC (Australia), FSCA (South Africa) |

| Trading Platforms | MetaTrader 4, MetaTrader 5, WebTrader, Mobile App |

| Minimum Deposit | $100 - $10,000 (depending on account type) |

| Instruments | Forex, CFDs (indices, commodities, shares) |

| Customer Support | 24/5 multilingual support via phone, email, live chat |

| Website | www.atfx.com |

Facts List

- ATFX is part of the AT Global Markets group, an international financial services provider.

- The broker is regulated by top-tier authorities like the FCA, CySEC, ASIC, and FSCA.

- ATFX offers trading in forex, indices, commodities, and CFD shares.

- Clients can choose from standard, premium, and professional account types.

- The minimum deposit ranges from $100 to $10,000 depending on the account type.

- ATFX provides the MetaTrader 4 and 5 platforms for desktop, web, and mobile trading.

- The broker offers competitive spreads starting from 0.1 pips on premium accounts.

- ATFX has won awards for its customer service and trading conditions.

- Extensive educational resources are available, including webinars, tutorials, and market analysis.

- 24/5 customer support is provided in multiple languages via phone, email, and live chat.

ATFX Licenses and Regulatory

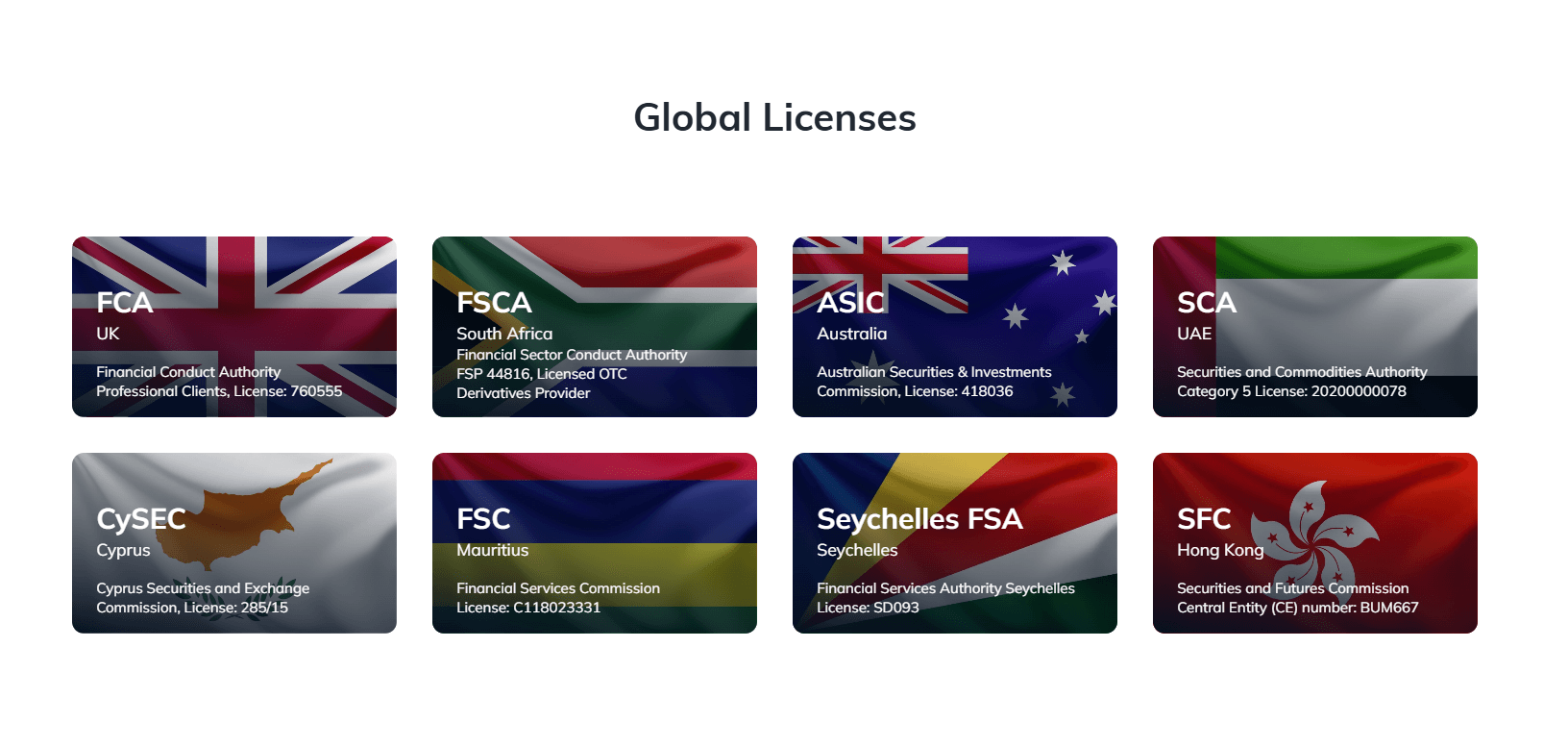

ATFX operates under a strong regulatory framework, holding licenses from several respected financial authorities worldwide. This multi-jurisdictional regulation is a testament to the broker's commitment to maintaining high standards of security, transparency, and fair trading practices.

The primary regulatory bodies overseeing ATFX's operations include:

- Financial Conduct Authority (FCA) in the United Kingdom

- Cyprus Securities and Exchange Commission (CySEC) in Cyprus

- Australian Securities and Investments Commission (ASIC) in Australia

- Financial Sector Conduct Authority (FSCA) in South Africa

These regulators are known for their stringent requirements and regular audits, ensuring that brokers adhere to strict guidelines designed to protect clients' interests. By obtaining licenses from multiple top-tier regulators, ATFX demonstrates its dedication to providing a secure and trustworthy trading environment for its clients.

One of the key benefits of trading with a well-regulated broker like ATFX is the segregation of client funds. This means that clients' money is kept separate from the broker's operational funds, reducing the risk of misappropriation and ensuring that clients can withdraw their funds at any time.

Furthermore, regulated brokers must maintain a certain level of capital adequacy to weather market volatility and ensure the stability of their operations. They are also required to implement strict anti-money laundering (AML) and know-your-customer (KYC) procedures to prevent financial crimes and maintain the integrity of the financial system.

In comparison to the industry standards, ATFX's regulatory standing is impressive. While many brokers operate with a single license or with licenses from less reputable jurisdictions, ATFX has gone the extra mile to secure multiple licenses from top-tier regulators. This sets the broker apart and provides clients with an added layer of trust and security.

It's essential for traders to verify a broker's regulatory licenses before opening an account to ensure the legitimacy and reliability of the broker. ATFX's licenses can be independently verified on the respective regulators' websites, providing clients with peace of mind and confidence in their choice of broker.

Trading Instruments

ATFX offers a diverse range of tradable assets, catering to the varying needs and preferences of traders worldwide. With over 300 instruments available, the broker provides ample opportunities for portfolio diversification and exposure to multiple markets.

In comparison to industry standards, ATFX's asset offerings are comprehensive and competitive. Many brokers focus primarily on forex, while ATFX has expanded its range to include a variety of CFDs, catering to a broader audience of traders. This diversity reflects the broker's adaptability to market trends and commitment to meeting clients' evolving needs.

| Asset Class | Description |

|---|---|

| Forex | ATFX offers a wide range of forex currency pairs, including majors, minors, and exotics. Traders can access competitive spreads and deep liquidity on popular pairs like EUR/USD, GBP/USD, and USD/JPY. Suitable for both novice and experienced traders. |

| CFDs on Indices | Traders can access global stock indices such as the S&P 500, NASDAQ 100, FTSE 100, and DAX 30. CFDs allow speculation on market performance without owning the underlying assets, offering a cost-effective way to diversify portfolios. |

| CFDs on Commodities | ATFX enables traders to speculate on commodities like gold, silver, oil, and natural gas. These assets can hedge against market volatility and inflation. Competitive spreads and flexible contract sizes are available. |

| CFDs on Shares | Traders can access shares from major exchanges like NYSE, NASDAQ, and LSE. This allows speculation on company performance without requiring large capital investments. |

Having a diverse portfolio of tradable assets is crucial for several reasons. Firstly, it allows traders to spread their risk across multiple markets and asset classes, potentially mitigating the impact of volatility in any single market. Secondly, it enables traders to take advantage of opportunities in different sectors and regions, capitalizing on global economic trends. Finally, a diverse range of assets attracts a wider client base, positioning the broker as a versatile and reliable choice for traders of all levels.

ATFX's commitment to providing a diverse range of tradable assets, combined with its competitive pricing and robust trading platforms, makes it an attractive choice for traders seeking flexibility and opportunities in multiple markets.

Trading Platforms

ATFX offers a range of powerful trading platforms to cater to the diverse needs of its clients. Whether you're a novice or an experienced trader, the broker provides user-friendly and feature-rich platforms to facilitate seamless trading experiences. Let's explore the available options:

MetaTrader 4 (MT4)

ATFX provides the industry-standard MetaTrader 4 platform, which is renowned for its reliability, speed, and advanced charting capabilities. MT4 offers a wide range of technical indicators, customizable charts, and an intuitive interface, making it an ideal choice for traders of all levels. The platform also supports automated trading through Expert Advisors (EAs), allowing clients to implement their trading strategies efficiently.

MetaTrader 5 (MT5)

For traders seeking a more advanced trading environment, ATFX offers the MetaTrader 5 platform. MT5 builds upon the success of MT4, offering additional features such as a built-in economic calendar, depth of market (DOM) functionality, and the ability to trade multiple assets from a single account. The platform also boasts enhanced backtesting capabilities and a more sophisticated programming language for developing EAs.

Web Trading Platform

ATFX's web-based trading platform provides clients with the flexibility to trade directly from their web browsers without the need to download and install any software. The web platform offers a streamlined interface, real-time quotes, and interactive charts, enabling traders to monitor markets and execute trades conveniently from any device with an internet connection.

Mobile Trading Apps

To accommodate the growing demand for mobile trading, ATFX offers dedicated mobile apps for both iOS and Android devices. The mobile apps provide a seamless trading experience on the go, allowing clients to access their accounts, monitor positions, and execute trades from their smartphones or tablets. The apps feature intuitive navigation, real-time market data, and a range of trading tools, ensuring that clients can stay connected to the markets at all times.

ATFX's commitment to providing cutting-edge trading platforms reflects the broker's dedication to meeting the evolving needs of its clients. By offering a combination of industry-standard platforms like MT4 and MT5, alongside web-based and mobile trading solutions, ATFX ensures that traders can access the markets through their preferred method, without compromising on functionality or performance.

The availability of advanced features such as trading bots, algorithmic trading, and a wide range of technical indicators empowers traders to develop and implement sophisticated trading strategies. ATFX's platforms also prioritize stability and reliability, ensuring that clients can execute trades seamlessly, even during periods of high market volatility.

In today's fast-paced trading environment, having access to robust and user-friendly trading platforms is crucial for success. ATFX's technological offerings align with current market demands and client expectations, providing traders with the tools they need to make informed decisions and capitalize on market opportunities.

Trading Platforms Comparison Table

| Feature | MetaTrader 4 (MT4) | MetaTrader 5 (MT5) | Web Trading Platform | Mobile Trading Apps |

|---|---|---|---|---|

| Charting | Advanced | Advanced | Interactive | Real-time |

| Technical Indicators | 30+ | 38+ | 20+ | 30+ |

| Timeframes | 9 | 21 | 7 | 9 |

| Automated Trading (EAs) | Yes | Yes | No | No |

| Multi-Asset Trading | No | Yes | No | No |

| Economic Calendar | No | Yes | No | Yes |

| Depth of Market (DOM) | No | Yes | No | No |

| Accessibility | Desktop, Mobile | Desktop, Mobile | Web Browser | iOS, Android |

ATFX's diverse range of trading platforms caters to the unique preferences and needs of its clients, ensuring that every trader can find a suitable platform to facilitate their trading activities. By staying at the forefront of technological advancements and offering platforms that are reliable, user-friendly, and feature-rich, ATFX positions itself as a broker that prioritizes the success and satisfaction of its clients.

ATFX How to Open an Account: A Step-by-Step Guide

Opening an account with ATFX is a straightforward process that can be completed entirely online. Follow these simple steps to get started:

Step 1: Visit the ATFX Website Go to the official ATFX website and click on the "Open an Account" button located in the top right corner of the homepage.

Step 2: Choose Your Account Type Select the type of account you wish to open from the available options, such as Standard, Edge, or Premium. Each account type has its own unique features, trading conditions, and minimum deposit requirements.

Step 3: Provide Personal Information Fill out the registration form with your personal details, including your full name, date of birth, country of residence, and contact information. Ensure that all the information provided is accurate and up-to-date.

Step 4: Complete the Questionnaire Answer a series of questions designed to assess your trading experience, financial knowledge, and risk tolerance. This step helps ATFX ensure that the products and services offered are suitable for your needs and objectives.

Step 5: Verify Your Identity To comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, you'll need to provide proof of identity and proof of residence. This typically involves uploading a copy of your government-issued ID, such as a passport or driver's license, and a recent utility bill or bank statement.

Step 6: Choose Your Funding Method Select your preferred method to fund your trading account. ATFX accepts various payment options, including credit/debit cards, bank wire transfers, and e-wallets like Skrill and Neteller. Be aware of the minimum deposit requirements for your chosen account type.

Step 7: Start Trading Once your account is fully verified and funded, you can download the trading platform of your choice, such as MetaTrader 4 or MetaTrader 5, and start trading the markets.

ATFX has streamlined the account opening process to make it as user-friendly as possible. The entire procedure can typically be completed within a matter of minutes, and the broker's dedicated customer support team is available to assist you with any questions or concerns you may have along the way.

It's important to note that the specific requirements for opening an account may vary slightly depending on your country of residence and the regulatory jurisdiction under which you'll be trading. However, ATFX provides clear guidance throughout the process to ensure that you have all the necessary information and documentation to get started.

Charts and Analysis

ATFX provides a comprehensive suite of educational resources and trading tools to support its clients in their trading journey. These resources cater to traders of all levels, from beginners to experienced professionals, helping them enhance their knowledge, refine their strategies, and make informed trading decisions. Let's explore the various offerings in detail:

| Feature | Description |

|---|---|

| Market Analysis | ATFX’s in-house market analysis team provides regular insights on market developments, trends, and trading opportunities. Clients receive daily market reports, weekly outlooks, and periodic in-depth analysis covering forex, indices, commodities, and shares. |

| Economic Calendar | A robust economic calendar keeps traders informed about high-impact events such as central bank decisions, GDP releases, and employment figures. Integrated into trading platforms for easy tracking of key events. |

| Trading Central | ATFX partners with Trading Central to provide expert research, trading ideas, and actionable signals across multiple timeframes and asset classes. Analysis is accessible directly within trading platforms for informed decision-making. |

| Autochartist | An automated technical analysis tool that scans markets 24/7, identifying patterns, trends, and potential trading opportunities. Provides visual alerts and detailed reports to help traders optimize entry and exit points. |

| Educational Resources | ATFX offers various educational materials to help traders enhance their knowledge and skills. These include: - Webinars: Live and recorded sessions by expert analysts covering beginner to advanced trading strategies. - Video Tutorials: A library of videos covering trading concepts, platform usage, and risk management. - eBooks: Downloadable guides on trading psychology, money management, and technical analysis. - Glossary: A detailed list of trading terms and definitions to help traders understand market terminology. |

Compared to industry standards, ATFX's educational resources and trading tools are extensive and well-developed. The broker's commitment to providing a diverse range of high-quality resources sets it apart from many competitors who may offer only basic educational materials.

By investing in partnerships with leading providers like Trading Central and Autochartist, ATFX demonstrates its dedication to empowering its clients with the best tools and insights available. These resources not only help traders make informed decisions but also foster a culture of continuous learning and growth.

ATFX Account Types

ATFX offers a range of trading account types designed to cater to the diverse needs and preferences of traders at various levels of experience and with different trading styles. Whether you're a beginner just starting your trading journey or an experienced professional seeking advanced features and competitive pricing, ATFX has an account type that suits your requirements. Let's explore the available options in detail:

Standard Account

The Standard Account is an excellent choice for novice traders who are new to the world of online trading. With a minimum deposit of just $500, this account type offers a cost-effective entry point into the markets. Traders can access a wide range of assets, including forex, indices, commodities, and shares, with competitive spreads starting from 1.8 pips. The Standard Account also features leverage of up to 1:400, allowing traders to amplify their potential returns while managing risk carefully.

Edge Account

For traders seeking an enhanced trading experience, the Edge Account provides a balance of competitive pricing and advanced features. With a minimum deposit of $2,500, this account type offers tighter spreads starting from 0.6 pips, reducing trading costs and potentially increasing profitability. Edge Account holders also benefit from higher leverage of up to 1:500, enabling them to take advantage of market opportunities with greater flexibility. Additionally, this account type includes access to premium educational resources and dedicated customer support.

Premium Account

The Premium Account is designed for experienced traders who demand the most competitive trading conditions and advanced features. With a minimum deposit of $10,000, this account type offers ultra-tight spreads starting from just 0.1 pips, significantly reducing trading costs and maximizing potential returns. Premium Account holders also enjoy the highest leverage of up to 1:500, allowing for greater flexibility in trading strategies. Moreover, this account type includes exclusive access to VIP events, personalized trading support, and priority withdrawal processing.

Demo Account

For traders who wish to practice their strategies, test the trading platforms, or familiarize themselves with the markets without risking real funds, ATFX offers a Demo Account. This account type provides a realistic trading environment with virtual funds, allowing traders to gain hands-on experience and build confidence before transitioning to live trading. The Demo Account features the same trading conditions and platform features as the live accounts, ensuring a seamless transition when traders are ready to invest real money.

ATFX's range of account types demonstrates the broker's commitment to accommodating the diverse needs of its clients. By offering varying minimum deposit thresholds, leverage options, and spread competitiveness, ATFX ensures that traders can select an account type that aligns with their trading goals, risk tolerance, and experience level.

The availability of a Demo Account further showcases ATFX's dedication to supporting traders' growth and development. By providing a risk-free environment to practice and refine strategies, ATFX empowers traders to build confidence and make informed decisions when transitioning to live trading.

Account Types Comparison Table

| Feature | Standard Account | Edge Account | Premium Account |

|---|---|---|---|

| Minimum Deposit | $100 | $2,500 | $10,000 |

| Spreads (from pips) | 1.8 | 0.6 | 0.1 |

| Leverage (up to) | 1:400 | 1:500 | 1:500 |

| Assets | Forex, Indices, Commodities, Shares | Forex, Indices, Commodities, Shares | Forex, Indices, Commodities, Shares |

| Educational Resources | Standard | Enhanced | Enhanced |

| Customer Support | Standard | Dedicated | VIP |

| Withdrawal Priority | Standard | Standard | Priority |

Negative Balance Protection

Negative balance protection availability may vary depending on the specific ATFX entity and the regulatory jurisdiction under which the client's account is held. Under ATFX's negative balance protection policy, if a trader's account balance falls into negative territory due to trading losses, the broker will absorb the negative balance and reset the account to zero. This means that traders can never lose more than the funds they have deposited in their ATFX trading account. It's important to note that negative balance protection does not apply to professional clients who have opted out of the retail client category. Professional clients are assumed to have a higher level of trading experience and a better understanding of the risks involved. How Does Negative Balance Protection Work in Practice? Let's consider a scenario where a trader has a $1,000 balance in their ATFX trading account. The trader opens a position in the market, and due to unexpected volatility, the position incurs a loss of $1,200. Without negative balance protection, the trader's account balance would be -$200, meaning they would owe the broker $200. However, with ATFX's negative balance protection policy in place, the broker will absorb the negative balance of $200 and reset the trader's account balance to zero. The trader's maximum loss is limited to the $1,000 they had initially deposited. It's crucial to remember that negative balance protection should not be seen as a license to take excessive risks or neglect proper risk management. Traders should always employ sound risk management strategies, such as setting appropriate stop-loss orders and managing their position sizes, to minimize potential losses.

ATFX Deposits and Withdrawals

When it comes to managing your funds in online trading, having access to secure, efficient, and flexible deposit and withdrawal options is crucial. ATFX understands the importance of seamless transactions and offers a range of payment methods to cater to the diverse needs of its global client base. Let's explore the deposit and withdrawal options available at ATFX, along with their associated policies and requirements.

Deposit Options

ATFX supports the following deposit methods:| Payment Method | Fees | Minimum Deposit |

|---|---|---|

| Credit/Debit Cards (Visa, Mastercard) | No fees | Typically $50 |

| Bank Wire Transfer | No fees | Usually $500 |

| E-wallets (Skrill, Neteller) | No fees | Typically $50 |

| Local Bank Transfers (selected countries) | Fees vary by country | Varies |

Withdrawal Options

ATFX offers the following withdrawal methods:| Payment Method | Fees | Minimum Withdrawal |

|---|---|---|

| Credit/Debit Cards (Visa, Mastercard) | No fees | $50 |

| Bank Wire Transfer | Fees may apply depending on the receiving bank | $100 |

| E-wallets (Skrill, Neteller) | No fees | $50 |

| Local Bank Transfers (selected countries) | Fees vary by country | Varies |

Verification Requirements:

To comply with international anti-money laundering (AML) and know-your-customer (KYC) regulations, ATFX requires all clients to verify their identity and address before processing any withdrawals. This verification process typically involves submitting a copy of a government-issued ID (such as a passport or driver's license) and a recent proof of address (such as a utility bill or bank statement). ATFX's verification process is designed to be straightforward and efficient, with most documents being reviewed within 1-2 business days. Once a client's account is fully verified, they can request withdrawals without any further delays.Unique Features:

One of the standout features of ATFX's deposit and withdrawal process is the broker's commitment to transparency and security. All client funds are held in segregated accounts with top-tier banks, ensuring that they are kept separate from the broker's operational funds. This segregation provides an additional layer of protection for clients' money. Moreover, ATFX employs advanced encryption technology to safeguard clients' sensitive financial information during transactions. The broker also offers 24/5 customer support to assist with any deposit or withdrawal queries, ensuring that clients can manage their funds with ease and confidence.Support Service for Customer

ATFX provides multiple ways for traders to reach out to their customer support team, ensuring that help is always just a click or call away:

| Support Channel | Description |

|---|---|

| Live Chat | ATFX's website features a real-time chat option, ideal for quick queries or urgent matters. |

| Traders can send inquiries to ATFX's support email, with responses typically within 24 hours. | |

| Phone | Local phone support is available in various countries for more in-depth discussions. |

| Social Media | ATFX monitors platforms like Facebook, Twitter, and Instagram for customer inquiries. |

- English

- Spanish

- Chinese (Mandarin & Cantonese)

- Arabic

- Russian

- Indonesian

- Malaysian

- Thai

- Vietnamese

Prohibited Countries

In the global landscape of online trading, regulatory compliance plays a crucial role in ensuring a fair and secure trading environment. As a responsible broker, ATFX adheres to the laws and regulations of the jurisdictions in which it operates. However, due to varying legal requirements, licensing restrictions, and geopolitical factors, ATFX is prohibited from providing services in certain countries and regions.

Reasons for Restrictions: The primary reasons behind ATFX's restricted operations in specific countries include:

- Local Regulations: Some countries have stringent regulations governing online trading activities. These regulations may require brokers to obtain specific licenses, comply with particular reporting standards, or adhere to certain operational guidelines. In cases where ATFX is unable to meet these requirements or deems the regulatory environment too complex, it may choose to restrict its services in those countries.

- Licensing Limitations: ATFX holds licenses from several reputable regulatory bodies, including the FCA, CySEC, ASIC, and FSCA. However, these licenses may not cover all jurisdictions globally. In countries where ATFX does not have the necessary licenses to operate legally, it is obligated to restrict its services to comply with local laws.

- Geopolitical Factors: Political instability, economic sanctions, or international trade restrictions can also impact a broker's ability to provide services in certain regions. ATFX continually monitors the global geopolitical landscape and may restrict its operations in countries subject to such factors to mitigate potential risks and ensure compliance with international laws.

List of Prohibited Countries

ATFX is currently prohibited from providing services in the following regions:

- United States

- Japan

- Canada

- North Korea

- Iran

- Cuba

- Syria

- Sudan

- Crimea

It is essential for traders to note that this list is not exhaustive and may be subject to change based on evolving regulatory requirements and geopolitical developments. Traders are encouraged to visit ATFX's official website or contact their customer support team for the most up-to-date information on prohibited countries.

Risks and Consequences: Attempting to trade with ATFX from a prohibited country can result in serious consequences. These may include:

- Account Termination: If ATFX detects that a trader is accessing its services from a prohibited country, it reserves the right to immediately terminate the trading account without prior notice. This can result in the forfeiture of any open positions and the closure of all associated trading activities.

- Legal Implications: Trading with a broker that is not licensed to operate in a specific jurisdiction may violate local laws and regulations. Traders from prohibited countries who attempt to circumvent restrictions and access ATFX's services may face legal consequences, including fines, penalties, or even criminal charges.

- Lack of Protection: Traders from prohibited countries who manage to open an account with ATFX may not be afforded the same level of protection and recourse as those from permitted jurisdictions. In the event of any disputes or issues, these traders may have limited legal options and may not be able to seek assistance from local regulatory authorities.

Special Offers for Customers

ATFX is committed to providing its clients with a rewarding and competitive trading experience. As part of this commitment, the broker offers a range of special promotions and offers designed to enhance traders' benefits and incentivize their trading activities. Let's explore the current offerings in detail.

Sign-up Bonus

New traders who open an account with ATFX can take advantage of a generous sign-up bonus. The bonus amount varies depending on the initial deposit, with higher deposits qualifying for larger bonuses. For example, traders who deposit $500 or more may be eligible for a bonus of up to 30% of their deposit amount.

To qualify for the sign-up bonus, traders must meet specific trading volume requirements within a designated period, typically 30 days from the date of deposit. The bonus funds are credited to the trader's account and can be used for trading purposes, but they cannot be withdrawn until the trading volume conditions are met.

Loyalty Program

ATFX values the loyalty of its clients and offers a tiered loyalty program to reward long-term traders. The program is based on a points system, where traders accumulate points based on their trading activity and account balance. As traders reach higher loyalty tiers, they unlock additional benefits, such as:

- Reduced trading fees

- Faster withdrawal processing

- Exclusive access to market analysis and trading insights

- Invitations to VIP events and seminars

- Dedicated account manager

The loyalty program encourages traders to maintain a consistent trading volume and rewards them for their ongoing commitment to ATFX.

Trading Competitions

Throughout the year, ATFX hosts various trading competitions that offer traders the chance to win attractive prizes, such as cash rewards, luxury vacations, or cutting-edge trading technology. These competitions typically run for a specific period and are based on trading volume, profitability, or other performance metrics.

Traders can participate in these competitions by registering through their ATFX client portal and meeting the specified trading requirements. The competitions not only provide an opportunity for traders to earn additional rewards but also foster a sense of community and friendly rivalry among ATFX's clients.

Third-Party Partnerships

ATFX collaborates with reputable third-party service providers to offer its clients exclusive discounts and benefits. These partnerships may include:

- Trading software providers: Traders can access discounted or free licenses for advanced trading tools and platforms.

- Market analysis and signal providers: ATFX clients can benefit from exclusive access to premium market research and trading signals.

- Educational resources: The broker may partner with educational institutions or trading academies to offer discounted courses and training programs to its clients.

These partnerships aim to provide ATFX traders with a competitive edge and enhance their overall trading experience.

Special Offers table

| Special Offer | Description |

|---|---|

| Sign-up Bonus | Up to 30% bonus on the initial deposit (terms and conditions apply). |

| Loyalty Program | Tiered rewards based on trading activity and account balance. |

| Trading Competitions | Chance to win cash prizes, luxury vacations, or advanced trading technology. |

| Third-Party Partnerships | Exclusive discounts and benefits from trading software providers, market analysis services, and educational resources. |

Conclusion

Throughout this comprehensive review, I have thoroughly analyzed various aspects of ATFX's operations, including their regulatory compliance, geographical reach, trading platforms, account types, customer support, and special offers. Based on my findings, I can confidently conclude that ATFX is a reliable and trustworthy broker that prioritizes the safety and satisfaction of its clients.

One of the standout features of ATFX is their strong regulatory framework. They are authorized and regulated by multiple top-tier financial authorities, such as the FCA, CySEC, ASIC, and FSCA, which ensures that they adhere to strict guidelines and maintain transparency in their operations. This regulatory oversight provides traders with peace of mind, knowing that their funds are protected and that ATFX operates with integrity.

ATFX's commitment to providing a user-friendly and inclusive trading environment is evident in their diverse range of account types and tradable assets. Whether you're a beginner or an experienced trader, ATFX offers account options tailored to your needs, with competitive spreads and flexible leverage. Their extensive selection of trading instruments, including forex, indices, commodities, and shares, allows traders to diversify their portfolios and seize opportunities in different markets.

Another area where ATFX excels is their trading platforms and tools. They offer the renowned MetaTrader 4 and MetaTrader 5 platforms, which are known for their reliability, advanced charting capabilities, and automated trading features. ATFX also provides a user-friendly web trading platform and mobile apps, ensuring that traders can access the markets and manage their positions seamlessly from any device.

In terms of customer support, ATFX has demonstrated a strong commitment to assisting their clients. They offer multiple channels for support, including live chat, email, phone, and social media, with a knowledgeable and responsive team available 24/5. ATFX also provides comprehensive educational resources, such as webinars, video tutorials, and e-books, empowering traders to enhance their skills and make informed trading decisions.

ATFX's special offers and promotions add an extra layer of value for their clients. From generous sign-up bonuses to loyalty programs and trading competitions, ATFX rewards its clients for their trust and activity. These incentives not only provide additional trading capital but also foster a sense of community and engagement among ATFX's users.

While ATFX has a few limitations, such as the lack of cryptocurrency trading and the restriction of services in certain countries, these drawbacks are outweighed by the broker's numerous strengths and the overall quality of their services.

In conclusion, ATFX has established itself as a reliable and reputable broker that prioritizes the needs of its clients. With their strong regulatory compliance, diverse trading offerings, advanced platforms, and dedicated customer support, ATFX is well-equipped to provide traders with a safe and satisfying trading experience. I recommend ATFX as a trustworthy choice for traders seeking a transparent and user-focused broker.