Axiory Review 2025: Legit Forex & CFD Brokerroker with Competitive Conditions

Axiory

Belize

Belize

-

Minimum Deposit $10

-

Withdrawal Fee $0

-

Leverage 400:1

-

Spread From 0.2

-

Minimum Order 0.01

-

Forex Available

-

Crypto Unavailable

-

Stock Unavailable

-

Indices Available

Licenses

Belize Financial Services License

Belize Financial Services License

Global Business License

Global Business License

Softwares & Platforms

Customer Support

+2292236910

(English)

+2292236910

(English)

Supported language: Arabic, Chinese (Simplified), English, Spanish

Social Media

Summary

Axiory is a global forex and CFD broker known for its client-friendly approach, competitive spreads, and advanced trading technology. Established in 2011, it offers trading on platforms like MT4, MT5, and cTrader, catering to both beginners and experienced traders. Axiory provides multiple account types, flexible leverage, and strong regulatory oversight under the FSC of Belize. The broker is recognized for its transparency, educational resources, and efficient customer support, making it a reliable choice for traders worldwide.

- Regulated by the International Financial Services Commission of Belize (IFSC)

- Wide range of tradable instruments, including forex and CFDs

- Advanced trading platforms: MetaTrader 4, MetaTrader 5, and cTrader

- Competitive trading conditions with tight spreads and flexible leverage

- Low minimum deposit of $10

- Multiple account types catering to different trading styles

- Educational resources and market analysis to support trader development

- Fast and reliable trade execution with advanced technology

- Responsive customer support available 24/5 through multiple channels

- Commitment to transparency, security, and regulatory compliance

- Regulated by an offshore authority (IFSC), which may not provide the same level of oversight as top-tier regulators

- High leverage (up to 1:777) can amplify risks for inexperienced traders

- Limited range of funding options compared to some competitors

- No PAMM or MAM accounts for passive investing

- Customer support is not available 24/7

- No additional research tools or features beyond the standard offerings

- Educational resources may not be as comprehensive as those provided by some other brokers

- Limited customization options for trading platforms

- No guaranteed stop-loss orders

- Potential for conflicts of interest as a market maker broker

Overview

Overview Table

|

Category

|

Details

|

|---|---|

|

Broker Name

|

Axiory

|

|

Establishment Year

|

2011

|

|

Headquarters

|

Belize (No.1 Corner of Hutson Street and Marine Parade, Belize City)

|

|

Regulation

|

Financial Services Commission (Belize), Financial Services Commission (Mauritius), Financial Commission

|

|

Geographical Presence

|

Global, with offices in Belize and Dubai, serving regions like Asia and the Middle East

|

|

Trading Platforms

|

MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, MyAxiory App

|

|

Minimum Deposit

|

$10

|

|

Account Types

|

Nano, Standard, Max, Tera, Alpha; includes Islamic and demo accounts

|

|

Trading Instruments

|

Forex (60+ pairs), CFDs (stocks, indices, commodities), metals, exchange stocks, ETFs

|

|

Leverage

|

Up to 1:777 (Max account); varies by account type and instrument

|

|

Spreads

|

From 0.1 pips (Nano) to 1.8 pips (Max), variable

|

|

Commissions

|

$6/lot (Nano, Zero), none on Standard/Max; stock CFDs from 0.04 USD/share

|

|

Deposit/Withdrawal

|

Bank transfer, credit/debit cards, e-wallets (Neteller, Skrill), crypto (BTC, USDT); no fees

|

|

Customer Support

|

Live chat, email, phone; 8 hours/day, 5 days/week

|

|

Notable Recognitions

|

Award-winning customer support; recognized as a trusted broker

|

Facts List:

-

Founded in 2011: Axiory began as a forex and CFD broker in Belize, marking over a decade in the market.

-

Regulated Offshore: Overseen by financial commissions in Belize and Mauritius, plus a financial body offering compensation up to €20,000.

-

Low Entry Point: Requires just a $10 minimum deposit, perfect for beginners, with demo accounts included.

-

Diverse Instruments: Covers 60+ forex pairs, CFDs on stocks, indices, and commodities like gold and oil, plus real stocks and ETFs.

-

Platform Options: Offers MT4, MT5, and cTrader, alongside a mobile app, with tools like Autochartist for analysis.

-

Competitive Spreads: Starts at 0.1 pips on Nano accounts with $6/lot commissions; Standard accounts skip commissions but widen to 1.2 pips on EUR/USD.

-

High Leverage: Reaches up to 1:777 on the Max account, enticing for risk-takers but heightening potential losses.

-

Payment Flexibility: Handles bank transfers, cards, e-wallets like Neteller and Skrill, and cryptocurrencies like BTC and USDT, with no broker fees.

-

Safety Features: Provides negative balance protection and segregated accounts, boosting trust despite offshore oversight.

-

Global Reach, Some Limits: Operates worldwide but skips markets like the U.S., Nigeria, and Vietnam due to regulatory hurdles.

Axiory Licenses and Regulatory

| Regulatory Authority | Role/Description |

|---|---|

| Financial Services Commission (Belize) | Oversees Axiory’s forex and brokerage activities, ensuring fund segregation and AML/KYC compliance. |

| Financial Services Commission (Mauritius) | Regulates non-banking financial services, including CFDs and global operations; enforces transparency and risk management. |

| Financial Commission (International) | Provides dispute resolution and compensation up to €20,000 per claim, adding an extra layer of client protection. |

Trading Instruments

| Asset Class | Key Features | Instruments / Examples |

|---|---|---|

| Forex | - Over 60 pairs available (majors, minors, exotics) - Highly liquid market - Spreads: 0.1 pips (Nano) to 1.8 pips (Max) - Leverage up to 1:777 | - Major pairs: EUR/USD, GBP/USD - Daily global trades in the trillions |

| CFDs | - Broad range covering stocks, indices, and commodities - Competitive commissions/spreads - Speculate without owning underlying assets | - Stocks: 70+ (e.g., Apple, Tesla) with commissions from 0.04 USD per share - Indices: 10+ (e.g., S&P 500) - Commodities: Gold, silver, oil, natural gas (e.g., 0.2 pips on premium accounts) |

| Real Stocks & ETFs | - Offered via the Alpha account - No leverage (1:1) for reduced risk - Focus on long-term investment | - Real stocks such as Amazon - Broad-market ETFs (selection is more limited compared to full-service brokers) |

Trading Platforms

| Feature | MT4 | MT5 | cTrader | MyAxiory App |

|---|---|---|---|---|

| Availability | Desktop, Web, Mobile | Desktop, Web, Mobile | Desktop, Web, Mobile | Mobile Only |

| Asset Types | Forex, CFDs | Forex, CFDs, Stocks | Forex, CFDs | Account Management |

| Trading Bots | Yes (EAs) | Yes (EAs) | Yes (cBots) | No |

| Indicators | Extensive Library | Advanced Options | Wide Range | Limited Quotes |

| Execution Speed | Fast | Faster | Lightning-Fast | N/A (Support Only) |

| Leverage Support | Up to 1:777 | Up to 1:777 | Up to 1:777 | N/A |

| Spreads | From 0.1 pips | From 0.1 pips | From 0.1 pips | N/A |

| Customization | High | Very High | Moderate | Low |

| Best For | Forex Beginners | Multi-Asset Pros | Scalpers | Mobile Oversight |

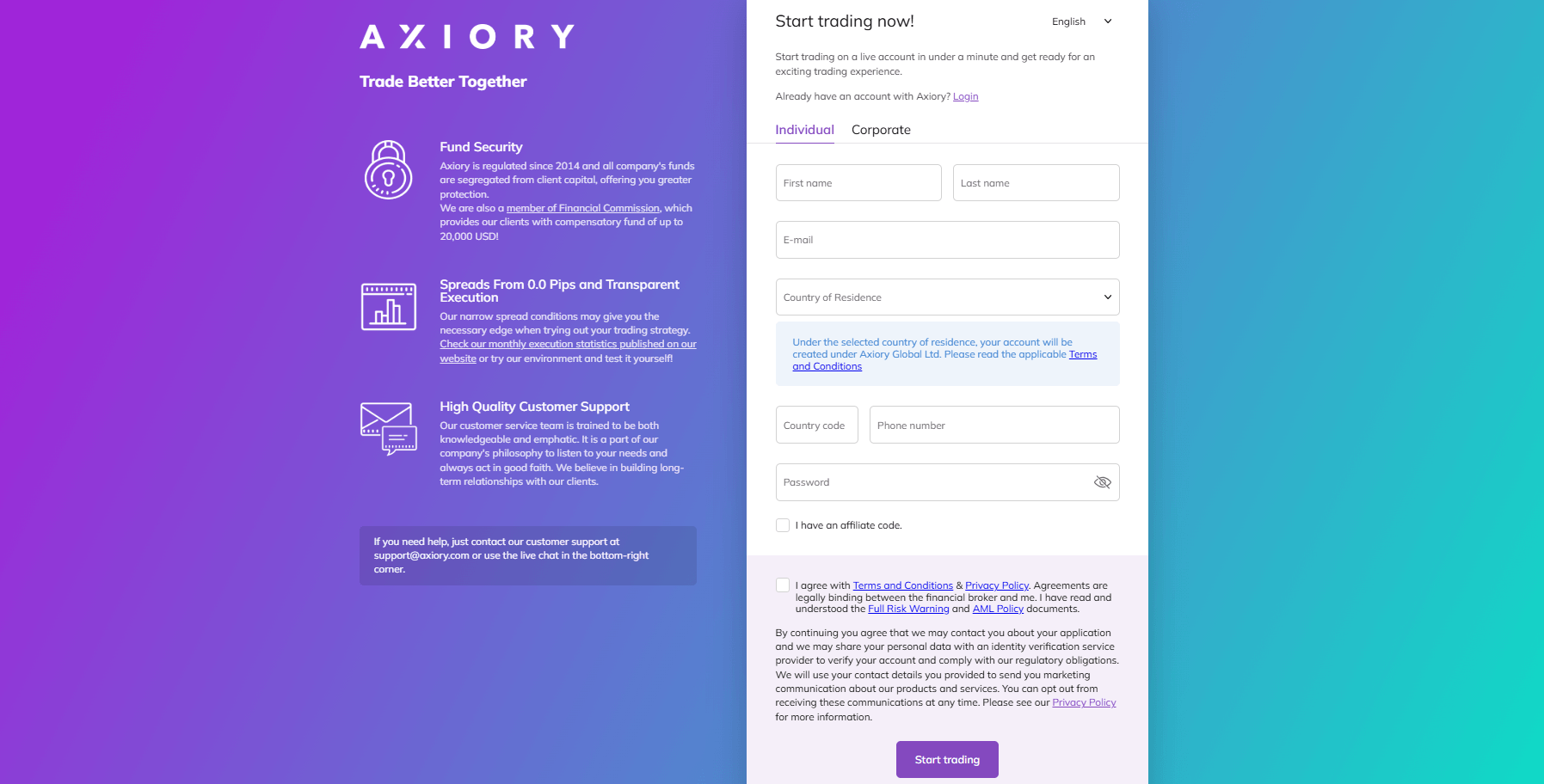

Axiory How to Open an Account: A Step-by-Step Guide

Requirements

-

Minimum Deposit: Just $10 unlocks most accounts (Nano, Standard, Max, Tera), keeping it affordable. The Alpha account for real stocks may vary slightly.

-

Identification Documents: You’ll need a valid ID (passport or national ID) and proof of address (utility bill or bank statement, less than 3 months old). These meet Axiory’s strict KYC (Know Your Customer) rules to ensure safety.

-

Personal Info: Be ready with your name, email, phone number, and financial details (like income level) to complete the form.

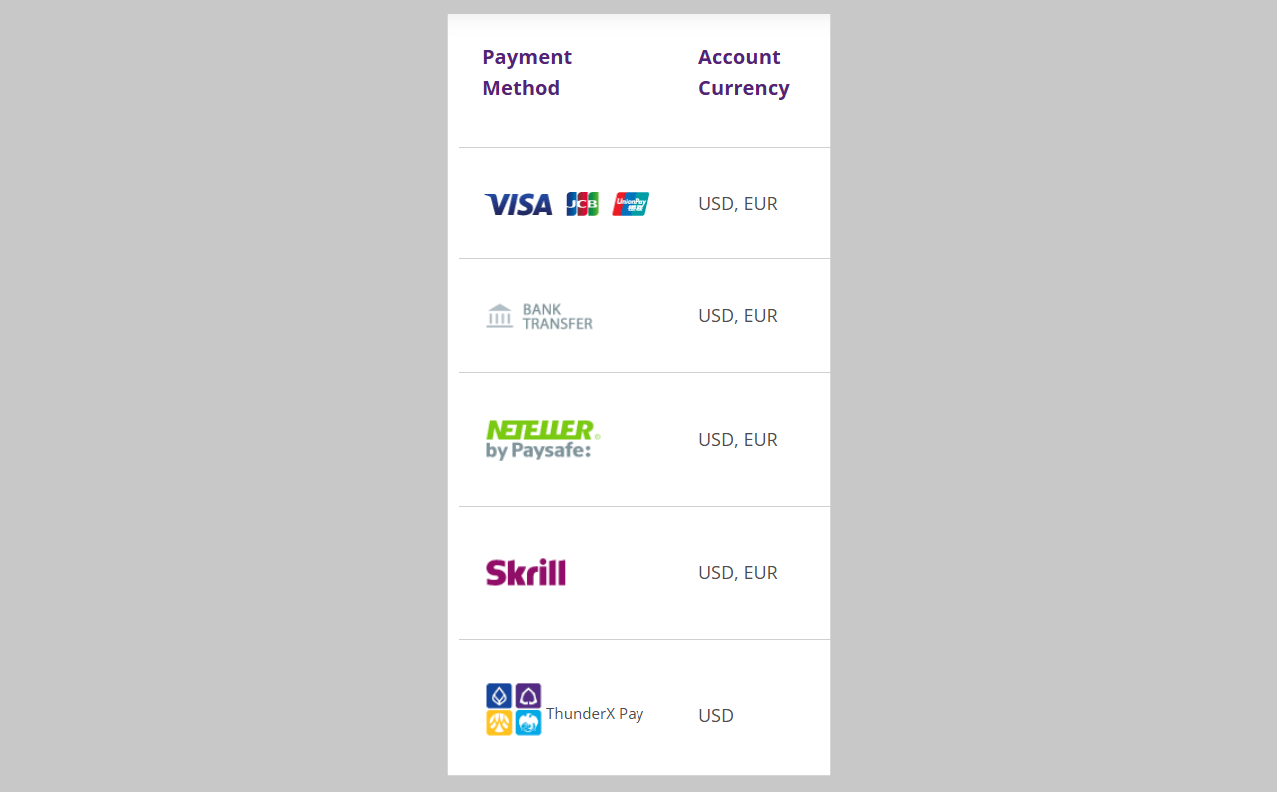

Payment Methods and Processing Times

-

Bank Transfer: Fee-free from Axiory, takes 3-10 business days depending on your bank.

-

Credit/Debit Cards: Visa or JCB, instant processing, no Axiory fees (card issuer may charge).

-

E-Wallets: Neteller, Skrill, Sticpay—processed in minutes, often instant, though providers might add fees.

-

Cryptocurrencies: BTC or USDT, typically 15 minutes after confirmation, no Axiory fees.

-

Visit the Sign-Up Page: Head to Axiory’s platform and hit “Open Account.”

-

Fill Out the Form: Enter your name, email, phone, and a strong password. It’s quick and intuitive.

-

Choose Your Account Type: Pick from Nano (tight spreads), Standard (no commissions), Max (high leverage), Tera (MT5-focused), or Alpha (real stocks). Demo accounts are free to test first.

-

Verify Your Identity: Upload your ID and proof of address. Axiory’s fast-track verification—sometimes done in minutes—uses smart tech to speed things up.

-

Fund Your Account: Log into the client zone, select “Deposit,” choose a payment method, and add at least $10. Processing varies by method—cards and e-wallets are fastest.

Charts and Analysis

| Resource | Description | Key Features | Comparative Observations |

|---|---|---|---|

| Economic Calendars | Tracks key economic events (e.g., interest rate decisions, GDP releases) | Regular updates with past, present, and forecast data; clear and accessible design | Standard tool across brokers; helps time entries, especially in high-leverage accounts (up to 1:777) |

| Webinars | Live and recorded sessions led by professionals on trading strategies | Covers topics like scalping, fundamental analysis, MT4 tools, and currency correlations | Forex-focused content gives it an edge for currency traders, though the schedule is not as voluminous as some industry giants |

| Downloadable PDFs | Concise guides ranging from basic to advanced topics | Topics include pivot points, equity in trading, consumer confidence, etc.; free downloads; part of Trading Academy | Useful for forex learners; however, the library is not as extensive as those offered by larger platforms like Investopedia |

| Market News Updates | Daily posts that keep traders informed on price movers and fundamental shifts | Timely updates; integrates with fundamental analysis for position trading | Adequate for informed trades but leaner than Bloomberg-style feeds at larger brokers |

| Blogs | Written insights on technical and fundamental analysis aimed at traders of all levels | Jargon-light content; covers topics like technical indicators and economic data | Excellent for forex focus but lacks the interactive, community-driven vibe found on platforms like TradingView |

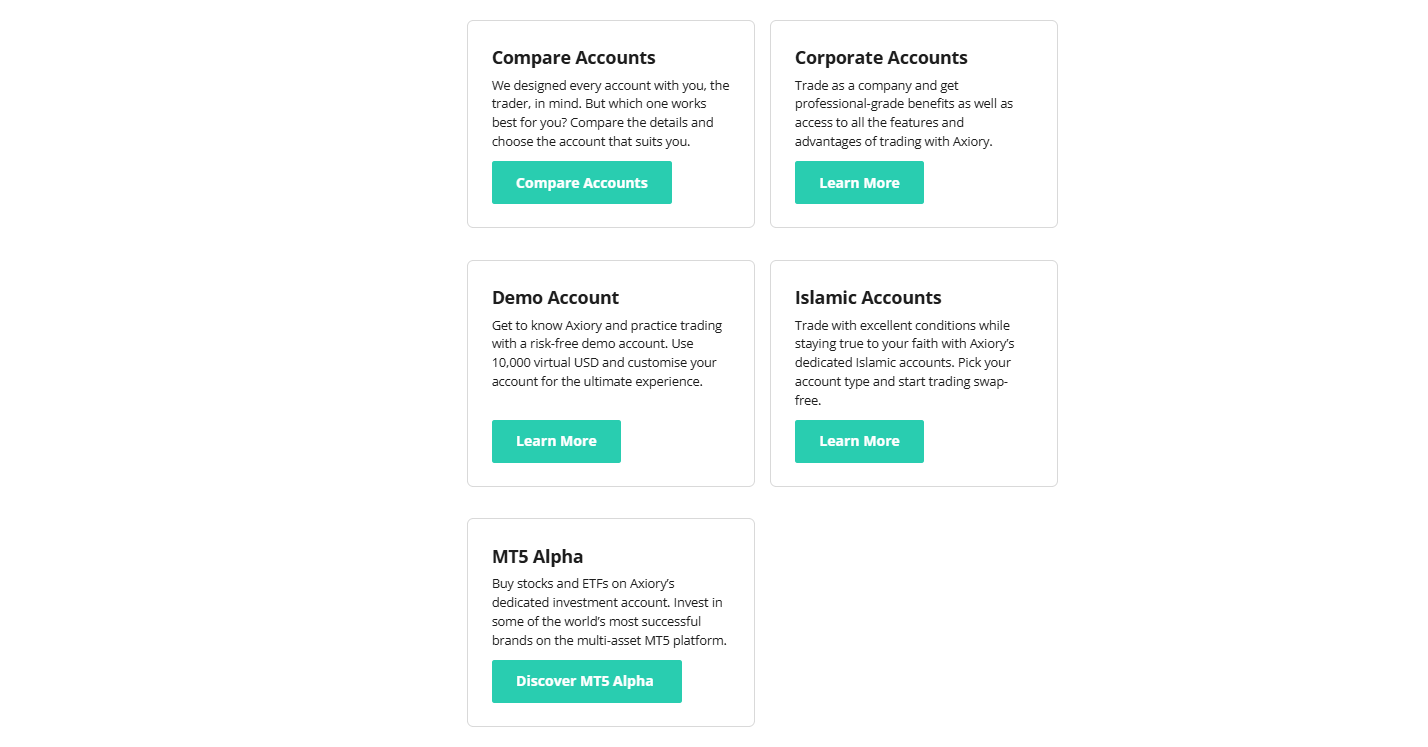

Axiory Account Types

- Nano Account:

- Target Audience: Beginners and testers

- Spreads & Fees: 0.1 pips on EUR/USD with a $6 per lot commission

- Leverage: 1:400

- Minimum Deposit: $10

- Instruments: Forex and CFDs with micro-lot flexibility (0.01 lots)

- Platforms: MT4 or cTrader

- Demo: Available for risk-free practice

- Standard Account:

- Target Audience: Everyday traders

- Spreads & Fees: 1.2 pips on EUR/USD, no commission (cost built into spreads)

- Leverage: 1:400

- Minimum Deposit: $10

- Instruments: Forex, CFDs, and indices

- Platforms: MT4 or cTrader

- Trade Size: No limits

- Demo: Available

- Max Account:

- Target Audience: Bold traders seeking high leverage

- Spreads & Fees: 1.8 pips on EUR/USD, no commission

- Leverage: Up to 1:777

- Minimum Deposit: $10

- Instruments: Forex and CFDs

- Platforms: MT4 or cTrader

- Demo: Available

- Tera Account:

- Target Audience: Tech-savvy traders who prefer advanced tools

- Spreads & Fees: 0.1 pips on EUR/USD with a $6 per lot commission

- Leverage: 1:400

- Minimum Deposit: $10

- Instruments: Forex, CFDs, and more

- Platform: MT5 (advanced features and extra timeframes)

- Demo: Available

- Alpha Account:

- Target Audience: Investors focused on real stocks and ETFs

- Leverage: 1:1 (no leverage, ensuring true ownership)

- Minimum Deposit: None (fund what you trade)

- Instruments: Real stocks and ETFs (not CFDs)

- Platform: MT5-only

- Demo: Available

Account Types Comparison Table: Axiory

|

Feature

|

Nano

|

Standard

|

Max

|

Tera

|

Alpha

|

|---|---|---|---|---|---|

|

Minimum Deposit

|

$10

|

$10

|

$10

|

$10

|

None Set

|

|

Leverage

|

Up to 1:400

|

Up to 1:400

|

Up to 1:777

|

Up to 1:400

|

1:1

|

|

Spreads (EUR/USD)

|

0.1 pips

|

1.2 pips

|

1.8 pips

|

0.1 pips

|

N/A

|

|

Commission

|

$6/lot

|

None

|

None

|

$6/lot

|

Per Share

|

|

Platform

|

MT4, cTrader

|

MT4, cTrader

|

MT4, cTrader

|

MT5

|

MT5

|

|

Assets

|

Forex, CFDs

|

Forex, CFDs

|

Forex, CFDs

|

Forex, CFDs

|

Stocks, ETFs

|

|

Demo Available

|

Yes

|

Yes

|

Yes

|

Yes

|

Yes

|

|

Trade Size

|

0.01 lots

|

0.01 lots

|

0.01 lots

|

0.01 lots

|

Varies

|

|

Best For

|

Beginners

|

All Levels

|

Risk-Takers

|

Tech Pros

|

Investors

|

Negative Balance Protection

Terms and Conditions

-

It applies to trading losses only—not fees or intentional abuse (like gaming the system with hedged accounts).

-

Extreme cases—like force majeure events (wars, crashes)—might limit coverage, though rare.

-

Clients must keep accounts funded to avoid margin calls; protection kicks in post-stop-out (20% margin level).

Axiory’s Commitment

Axiory Deposits and Withdrawals

Deposit Methods

Axiory accepts the following deposit methods:| Payment Method | Providers | Minimum Deposit | Maximum Limits | Processing Times | Fees |

|---|---|---|---|---|---|

| Bank Transfer | Bank wires | $10 (for most accounts; Alpha has no set floor) | No hard cap from Axiory; banks set their own limits | 3-10 business days | No fees from Axiory (third parties might charge conversion fees) |

| Credit/Debit Cards | Visa, JCB | $10 | Provider-specific (e.g., up to $50,000) | Deposits: Instant | No fees from Axiory (third parties might impose conversion fees) |

| E-Wallets | Neteller, Skrill, Sticpay | $10 | Provider-specific (varies, e.g., up to $50,000) | Deposits: Instant | No fees from Axiory (providers may charge their own fees) |

| Cryptocurrencies | BTC, USDT | $10 | No hard cap from Axiory; provider-dependent | Approximately 15 minutes after blockchain confirmation | No fees from Axiory |

Withdrawal Methods

Axiory accepts the following withdrawal methods:| Payment Method | Providers | Minimum Withdrawal | Maximum Limits | Processing Times | Fees |

|---|---|---|---|---|---|

| Bank Transfer | Bank wires | $10 or full balance if lower | No hard cap from Axiory; banks set their own limits | 3-10 business days | Free from Axiory (providers may charge, e.g., $15 for transfers under $200) |

| Credit/Debit Cards | Visa, JCB | $10 or full balance if lower | Provider-specific (e.g., up to $50,000) | Withdrawals: 3-10 business days | Free from Axiory (providers may impose fees) |

| E-Wallets | Neteller, Skrill, Sticpay | $10 or full balance if lower | Provider-specific (varies, e.g., up to $50,000) | Withdrawals: within 24 hours or less | Free from Axiory (providers may charge their own fees) |

| Cryptocurrencies | BTC, USDT | $10 or full balance if lower | No hard cap from Axiory; provider-dependent | Approximately 15 minutes after blockchain confirmation | Free from Axiory |

Policies and Verification

-

Verification: KYC (Know Your Customer) requires ID and proof of address upfront. Deposits need light verification; withdrawals demand full checks.

-

Same-Method Rule: Withdrawals go back to your deposit source—cards up to the deposited amount, profits via bank wire.

-

Restrictions: No third-party payments allowed—your name must match the account. Some regions (e.g., U.S.) can’t trade due to offshore regulation.

Support Service for Customer

| Support Channel | Description | Contact Info | Response Time |

|---|---|---|---|

| Live Chat | Real-time help via the platform, ideal for urgent forex/CFD issues. | Access via the Axiory website | Typically within 30 minutes |

| For in-depth queries like account verification or withdrawal delays. | General: support@axiory.com Japanese: jpsupport@axiory.com | A few hours to next business day | |

| Phone | Direct calls for pressing needs, such as payment issues during market hours. | +501 224-4632 (Belize) | Instant when lines are open |

| Social Media | Quick outreach via platforms like Facebook and Twitter for general questions. | Official social media accounts | Within a few hours |

Prohibited Countries

-

Local Regulations: Some countries—like the U.S.—demand brokers register with strict bodies (e.g., CFTC, SEC). Axiory’s Belize and Mauritius licenses don’t cut it there, barring forex and CFD services.

-

Licensing Requirements: Operating in places like the EU needs tougher credentials than Axiory’s offshore setup offers. Without them, it can’t legally handle accounts or payments.

-

Geopolitical Factors: Sanctions or tensions—say, U.S. embargoes on Iran—stop Axiory from touching restricted regions, dodging legal and financial heat.

-

North America: United States, Canada.

-

Europe: Belgium, Bulgaria, Croatia, France, Germany, Monaco.

-

Africa: Burkina Faso, Cameroon, Democratic Republic of the Congo, Haiti, Kenya, Mali, Mozambique, Namibia, Nigeria, Senegal, South Africa, South Sudan, Tanzania, Yemen.

-

Asia: Iran, Philippines, Syria, Vietnam.

-

Latin America and Caribbean: Venezuela.

-

Account Rejection: Axiory’s KYC (Know Your Customer) checks—needing ID and address—flag banned regions, blocking account setup.

-

Fund Loss: Deposits might freeze or vanish if caught mid-process; withdrawals could stall.

-

Legal Trouble: Bypassing bans (e.g., via VPN) risks penalties—local laws or Axiory’s terms could bite.

-

No Protection: Negative balance protection or support won’t apply—offshore status leaves you exposed.

Special Offers for Customers

Sign-Up Bonuses

-

Benefit: Test forex or CFDs risk-free when offered.

-

Terms: Minimum trade volume (e.g., 5 lots), time limits (30 days), no stock CFD trades.

Deposit Bonuses

-

Benefit: More leverage for forex and CFD moves.

-

Terms: $10 minimum, volume rules, expires if unused.

Loyalty Programs

-

Benefit: Potential rebates for steady forex traders.

-

Terms: Affiliate-driven, no direct Axiory tiers.

Trading Competitions

-

Benefit: None active—focus stays on trading.

-

Terms: N/A.

Partnerships with Third-Party Providers

-

Introducing Broker (IB): Refer forex traders, earn up to $10 per lot traded. No cap, just volume.

-

Affiliate Program: Share links, bag up to $1,000 per client signup with a $10 minimum deposit. Scales with referrals.

-

Company Representative: Custom deals for big players—think firms or influencers—offering tailored rebates.

-

Benefit: Steady income for forex networkers.

-

Terms: Client must trade, payouts vary by lots or signups.

Conclusion