BMFN Review 2025: Is This Established Broker Safe and Reliable?

BMFN

Vanuatu

Vanuatu

-

Minimum Deposit $50

-

Leverage 200:1

-

Spread From 1.4

-

Minimum Order 0.01

-

Forex Available

-

Crypto Unavailable

-

Stock Available

-

Indices Available

Licenses

Forex Trading License

Forex Trading License

Softwares & Platforms

Customer Support

+35924917016

(English)

+35924917016

(English)

+442033180309

(English)

+442033180309

(English)

Supported language: Arabic, English, Spanish, Thai

Social Media

Summary

BMFN (Boston Merchant Financial) is a forex and CFD broker established in 1988, headquartered in Port Vila, Vanuatu. It offers trading on MetaTrader 4 and its proprietary UniTrader platform, providing access to forex pairs, commodities, indices, and equities. The broker allows high leverage up to 1:200 with a minimum deposit of $50. While regulated by the Vanuatu Financial Services Commission (VFSC), concerns have been raised about withdrawal delays and customer support issues. Traders are advised to exercise caution and conduct thorough research before engaging with BMFN.

- Established broker operating since 1988

- Regulated by the Vanuatu Financial Services Commission (VFSC)

- Offers popular trading platforms like MetaTrader 4, UniTrader, and WebTrader

- Low minimum deposit requirement of $50

- Provides access to a decent range of tradable assets, including forex, indices, stocks, commodities, and ETFs

- Suspicious clone licenses from New Zealand's FSPR and Australia's ASIC, raising concerns about regulatory compliance

- Lack of transparency regarding operations, headquarters location, and prohibited countries

- No clear negative balance protection policy, exposing traders to potential losses exceeding deposits

- High $50 fee for bank wire withdrawals and a complex account verification process

- Basic educational resources and customer support compared to industry leaders

- No attractive deposit bonuses or loyalty programs currently offered

- Limited information about affiliate program commissions and terms

- Relatively high spreads starting from 1.4 pips

- Outdated website design and user interface

- Mixed user reviews and feedback, with some complaints about withdrawal issues and platform performance

Overview

BMFN (Boston Merchant Financial) is a global forex and CFD broker established in 1988. Headquartered in Vanuatu, BMFN is regulated by the Vanuatu Financial Services Commission (VFSC) under license number 40202. The broker provides access to over 80 tradable instruments, including forex, indices, stocks, commodities, and ETFs.

BMFN offers the popular MetaTrader 4 platform as well as its proprietary UniTrader and WebTrader platforms. Clients can choose from several account types with a minimum deposit of $50 and leverage up to 1:200. The broker supports various payment methods such as bank wire, credit/debit cards, Skrill, Neteller, and China UnionPay.

While BMFN has been operating for over three decades, some concerns have been raised regarding its regulatory status, as the licenses from New Zealand's FSPR and Australia's ASIC appear to be suspicious clones. The broker's user agreement is only available in English after registration, and the high $50 withdrawal fee along with a complicated verification process may be off-putting for some traders.

For more information about BMFN's services and offerings, interested parties can visit the broker's official website at bmfn.com. As with any financial decision, thorough research and due diligence are recommended before opening an account to ensure the broker aligns with individual trading needs and preferences.

Overview Table

| Attribute | Details |

|---|---|

| Headquarters | Vanuatu |

| Established | 1988 |

| Regulation | VFSC (Vanuatu), license #40202 |

| Suspicious Licenses | FSPR (New Zealand), ASIC (Australia) |

| Min. Deposit | $50 |

| Max. Leverage | 1:200 |

| Instruments | 80+ (Forex, Indices, Stocks, Commodities, ETFs) |

| Platforms | MetaTrader 4, UniTrader, WebTrader |

| Account Types | Demo, NDD, UniTrader, MT CFD, MT FX, MT DMA |

| Payment Methods | Bank Wire, Credit/Debit Cards, Skrill, Neteller, China UnionPay, WebMoney |

| Withdrawal Fee | $50 |

Facts list

- BMFN was established in 1988 and is headquartered in Vanuatu.

- The broker is regulated by the Vanuatu Financial Services Commission (VFSC) under license number 40202.

- BMFN offers trading on 80+ instruments, including forex, indices, stocks, commodities, and ETFs.

- Clients can access the MetaTrader 4, UniTrader, and WebTrader platforms.

- The minimum deposit to open an account is $50, with leverage up to 1:200.

- BMFN supports various payment methods, such as bank wire, credit/debit cards, Skrill, Neteller, China UnionPay, and WebMoney.

- Withdrawals are subject to a high $50 fee and may take 1-3 business days to process.

- The broker's licenses from New Zealand's FSPR and Australia's ASIC appear to be suspicious clones.

- BMFN's user agreement is only available in English after registration.

- The broker has a complicated account verification process that may be cumbersome for some traders.

BMFN Licenses and Regulatory

BMFN's regulatory status is a mixed bag, with a valid license from the Vanuatu Financial Services Commission (VFSC) but suspicious clone licenses from New Zealand's Financial Service Providers Register (FSPR) and Australia's Securities and Investments Commission (ASIC).

The broker's primary regulation comes from the VFSC under license number 40202. While Vanuatu is not considered a top-tier regulatory jurisdiction, the VFSC still provides some oversight and client protection measures. However, it's important to note that the VFSC's regulatory standards may not be as stringent as those of more reputable authorities like the FCA, CySEC, or ASIC.

BMFN's FSPR and ASIC licenses raise red flags, as they appear to be suspicious clones. The FSPR is merely a registration and does not provide any regulatory oversight, while ASIC is known for its strict regulations. The fact that BMFN claims to have these licenses but they are flagged as suspicious undermines the broker's credibility and trustworthiness.

In contrast, well-regulated brokers typically hold licenses from respected authorities and adhere to strict compliance standards, such as segregated client funds, regular audits, and transparent financial reporting. These measures ensure a higher level of client protection and trust.

Regulations List

- Vanuatu Financial Services Commission (VFSC): License number 40202

- Financial Services Providers Register (FSPR), New Zealand: Suspicious clone license

- Australian Securities and Investments Commission (ASIC): Suspicious clone license

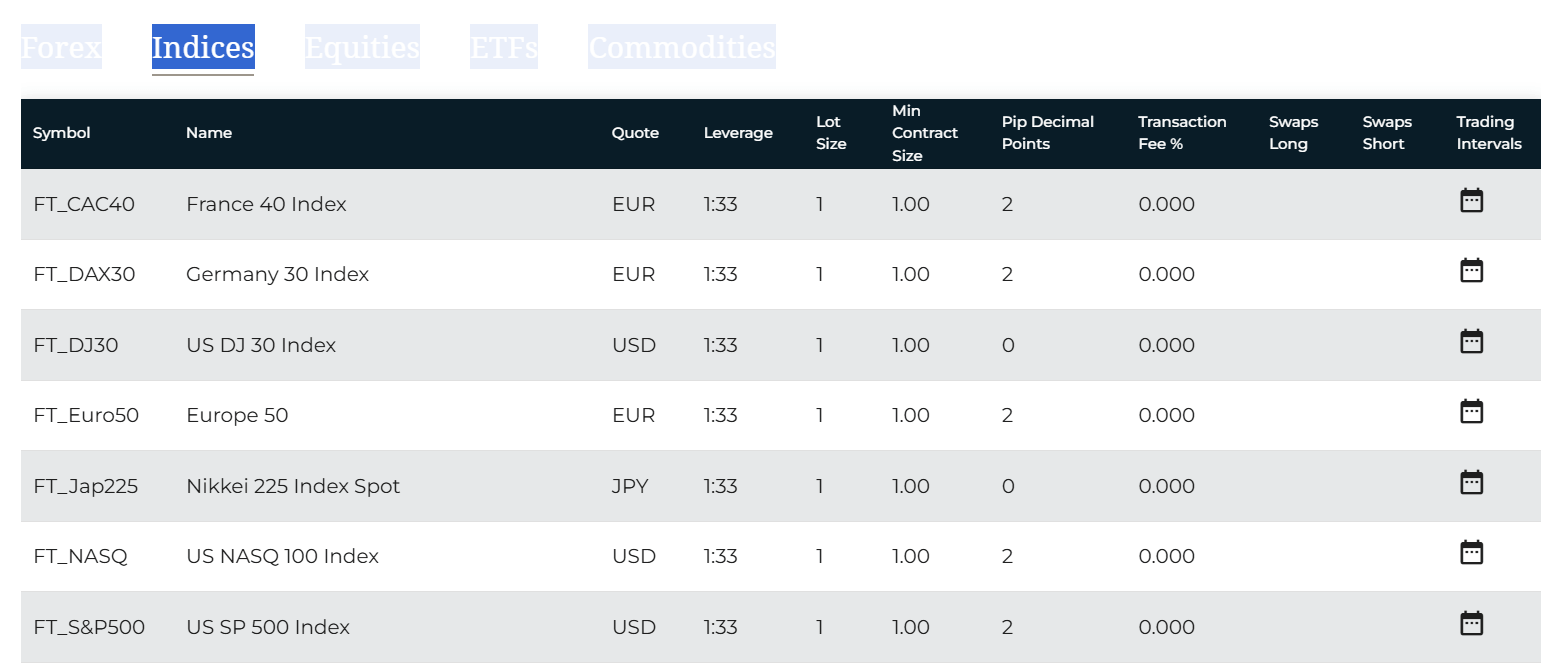

Trading Instruments

BMFN offers a diverse range of tradable assets, providing clients with access to over 80 financial instruments across various markets. While the selection may not be as extensive as some larger brokers, BMFN covers the most popular asset classes, allowing traders to diversify their portfolios and capitalize on different market opportunities.

| Instrument Category | Details |

|---|---|

| Forex | • Access to 23 currency pairs (majors, minors, exotics)• Spreads from 1.4 pips (relatively high)• No additional commissions |

| Indices & Stocks | • Trading on popular global stock indices• Access to individual stocks (selection more limited than dedicated stock brokers) |

| Commodities & ETFs | • Commodities: precious metals (gold, silver) and energy products (oil)• ETFs: exposure to various asset classes and sectors in a single instrument |

While BMFN covers the essential asset classes, the depth of offerings within each category may be limited compared to larger, more established brokers. Traders looking for a wide variety of exotic currency pairs, niche stocks, or specialized ETFs may need to look elsewhere.

However, for most retail traders, BMFN's selection of tradable assets is sufficient to build a well-rounded portfolio and take advantage of diverse market conditions. The broker's asset offerings demonstrate its adaptability to market trends and commitment to meeting the needs of its clients.

Trading Platforms

BMFN provides clients with access to several trading platforms, catering to different preferences and skill levels. The broker's platform offerings include the popular MetaTrader 4 (MT4), as well as its proprietary UniTrader and WebTrader platforms.

MetaTrader 4 (MT4)

MT4 is a widely-used trading platform known for its stability, advanced charting tools, and extensive customization options. BMFN's MT4 platform comes equipped with a range of built-in indicators and allows for the integration of custom trading bots and expert advisors (EAs). The platform is available for desktop, web, and mobile devices (iOS and Android), providing traders with the flexibility to monitor and manage their positions on the go.

UniTrader

UniTrader is BMFN's proprietary trading platform designed for simplicity and ease of use. The platform offers a user-friendly interface and features like one-click trading, advanced order types, and a built-in economic calendar. UniTrader is accessible via web browsers and mobile apps (Android only), making it a convenient choice for traders who prefer a streamlined trading experience.

WebTrader

BMFN's WebTrader platform is a browser-based solution that allows clients to trade directly from their web browser without the need for any software downloads or installations. The platform provides a simple, intuitive interface and basic trading tools, making it suitable for beginners or those who prefer a no-frills trading experience.

While BMFN's platform offerings cover the essentials, they may lack some of the advanced features and customization options found in more sophisticated trading platforms. However, the broker's selection of MT4, UniTrader, and WebTrader caters to a wide range of trading styles and preferences, ensuring that most clients can find a platform that suits their needs.

Trading Platforms Comparison Table

| Feature | MT4 | UniTrader | WebTrader |

|---|---|---|---|

| Availability | Desktop, Web, Mobile | Web, Mobile (Android) | Web |

| Customization | High | Medium | Low |

| Charting Tools | Advanced | Basic | Basic |

| Indicators | Built-in & Custom | Built-in | Built-in |

| Trading Bots | Supported | Not Supported | Not Supported |

| Order Types | Advanced | Advanced | Basic |

| One-Click Trading | Supported | Supported | Not Supported |

| Economic Calendar | Third-Party | Built-in | Not Supported |

| User Experience | Intermediate to Advanced | Beginner to Intermediate | Beginner |

BMFN How to Open an Account: A Step-by-Step Guide

Opening an account with BMFN is a relatively straightforward process, although it does involve a few more steps than some other brokers. Here's a step-by-step guide to help you get started:

Step 1: Visit the BMFN website Go to the official BMFN website at bmfn.com and click on the "Open an Account" button.

Step 2: Choose your account type Select the type of account you want to open: Individual, Corporate, or Joint. Individual accounts are for single users, Corporate accounts are for businesses, and Joint accounts are for two or more individuals.

Step 3: Fill out the registration form Provide your personal information, including your name, email address, phone number, and country of residence. You'll also need to create a password for your account.

Step 4: Verify your email BMFN will send you an email to verify your email address. Click on the verification link in the email to confirm your account.

Step 5: Complete your profile Once your email is verified, log in to your BMFN account and complete your profile by providing additional information, such as your address, date of birth, and employment details.

Step 6: Submit identification documents To comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, you'll need to submit proof of identity and proof of residence. This typically includes a government-issued ID, such as a passport or driver's license, and a utility bill or bank statement.

Step 7: Choose your trading platform Select the trading platform you want to use: MetaTrader 4, UniTrader, or WebTrader. You can access these platforms directly from the BMFN website.

Step 8: Fund your account BMFN accepts several payment methods, including bank wire transfers, credit/debit cards, and e-wallets like Skrill and Neteller. Choose your preferred method and follow the instructions to deposit funds into your account. The minimum deposit is $50.

Step 9: Start trading Once your account is funded, you can start trading on your chosen platform. Be sure to familiarize yourself with the platform's features and tools before placing any real trades.

It's important to note that BMFN's account verification process is more extensive than some other brokers, requiring users to sign an electronic form to create an electronic signature. While this adds an extra step to the process, it helps ensure the security of your account.

Charts and Analysis

BMFN provides a basic set of educational resources and tools to help clients improve their trading knowledge and skills. While the broker's offerings cover some essential areas, they may not be as comprehensive or well-developed as those provided by industry leaders.

| Resource | Details |

|---|---|

| Forex Education Center | Knowledge base with articles on trading strategies, terminology, platform features, and general forex education. Informative but lacks the depth and interactivity of advanced programs. |

| Economic Calendar | Displays upcoming market events and data releases to help plan trades. Basic version without customizable filters or alert functionality. |

| Market Analysis | Blog posts and articles offering insights into current market trends, trading opportunities, and strategies. Coverage is limited compared to some other brokers’ research. |

| Webinars & Videos | No evidence of webinars or video tutorials. Notable absence compared to leading brokers that provide regular live and on-demand educational sessions. |

While BMFN's educational resources cover some basic aspects of trading, they may not be sufficient for more advanced traders or those seeking in-depth market insights. The broker's offerings lack the diversity and depth found in the educational suites of some competitors, which often include interactive courses, quizzes, and personalized learning paths.

BMFN Account Types

BMFN offers several trading account types catering to different trader preferences and experience levels. While the broker doesn't provide a wide variety of accounts compared to some competitors, the available options cover the essential needs of most traders.

Demo Account

BMFN provides a demo account that allows prospective clients to test the broker's trading platforms and conditions without risking real money. The demo account is a great way for new traders to familiarize themselves with the markets and practice trading strategies in a risk-free environment. However, it's important to note that demo trading conditions may not always reflect real market conditions.

Live Accounts

BMFN offers the following live trading accounts:

- NDD Account The NDD (No Dealing Desk) account is BMFN's primary live trading account. It provides access to the MetaTrader 4 (MT4) platform and offers competitive spreads starting from 1.4 pips. The minimum deposit for this account is $50, making it accessible to a wide range of traders. The maximum leverage for the NDD account is 1:200.

- UniTrader Account The UniTrader account is designed for traders who prefer to use BMFN's proprietary UniTrader platform. This account offers similar trading conditions to the NDD account, with competitive spreads and a minimum deposit of $50. The UniTrader platform is known for its user-friendly interface and ease of use, making it a good choice for beginners.

- MT CFD, MT FX, and MT DMA Accounts BMFN also offers MT CFD, MT FX, and MT DMA accounts, which provide access to the MT4 platform for trading specific instruments. The MT CFD account is designed for trading Contracts for Difference (CFDs), while the MT FX account focuses on forex trading. The MT DMA account offers Direct Market Access (DMA) for trading various instruments. The trading conditions for these accounts are similar to the NDD account.

One notable aspect of BMFN's account offerings is the low minimum deposit requirement of $50 across all account types. This low barrier to entry makes it easier for new traders to start trading with real money and experience live market conditions.

Account Types Comparison Table

| Feature | Demo | NDD | UniTrader | MT CFD | MT FX | MT DMA |

|---|---|---|---|---|---|---|

| Platform | MT4, UniTrader, WebTrader | MT4 | UniTrader | MT4 | MT4 | MT4 |

| Minimum Deposit | N/A | $50 | $50 | $50 | $50 | $50 |

| Spreads | Variable | From 1.4 pips | Variable | Variable | Variable | Variable |

| Commission | N/A | No | No | No | No | No |

| Maximum Leverage | 1:200 | 1:200 | 1:200 | 1:200 | 1:200 | 1:200 |

| Instruments | Forex, CFDs, Metals | Forex, CFDs, Metals | Forex, CFDs, Metals | CFDs | Forex | Various |

| Execution | Instant | Market | Market | Market | Market | DMA |

Negative Balance Protection

Negative balance protection is an important risk management feature that ensures a trader's account balance cannot fall below zero, even in extreme market conditions that could cause significant losses. Without this protection, traders could potentially lose more money than they have deposited, leaving them in debt to the broker. Scenarios that could lead to a negative balance include:

- High market volatility, such as during major news events or economic releases

- Large, unexpected price gaps

- Overexposure to high-risk trades

- Using excessive leverage

- Technical issues or platform malfunctions

BMFN Deposits and Withdrawals

BMFN offers several deposit and withdrawal methods, providing traders with flexibility in managing their funds. However, some of the broker's policies and fees may be less favorable compared to industry standards.

Deposit Methods

BMFN accepts the following deposit methods:| Payment Method | Min. Deposit | Processing Time | Deposit Fee | Notes |

|---|---|---|---|---|

| Bank Wire Transfer | $50 | 1 business day | None (provider/bank fees may apply) | — |

| Credit/Debit Cards (Visa, Mastercard) | $50 | Instant to 1 business day | None (provider/bank fees may apply) | — |

| E‑wallets (Skrill, Neteller) | $50 | Instant | None (provider fees may apply) | — |

| China UnionPay | $50 | Instant to 1 business day | None (provider/bank fees may apply) | — |

| WebMoney | $50 | Instant | None (provider fees may apply) | — |

Withdrawal Methods

BMFN offers the same methods for withdrawals as for deposits, ensuring a seamless experience for traders. The minimum withdrawal amount is $50, and processing times vary depending on the method:| Payment Method | Min. withdrawal | Processing Time | Deposit Fee | Notes |

|---|---|---|---|---|

| Bank Wire Transfer | $50 | 1–3 business days | None (provider/bank fees may apply) | — |

| Credit/Debit Cards (Visa, Mastercard) | $50 | 1 business day | None (provider/bank fees may apply) | — |

| E‑wallets (Skrill, Neteller) | $50 | 1 business day | None (provider fees may apply) | — |

| China UnionPay | $50 | 1 business day | None (provider/bank fees may apply) | — |

| WebMoney | $50 | 1 business day | None (provider fees may apply) | — |

Verification Requirements

To comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, BMFN requires traders to verify their accounts before making a withdrawal. This process involves submitting proof of identity and proof of residence, which can be a passport, driver's license, bank statement, or utility bill. Account verification is a standard procedure among reputable brokers, but BMFN's process is more complex than some competitors. Traders must sign an electronic form to create an electronic signature, which can be time-consuming and may delay the withdrawal process.Support Service for Customer

Reliable customer support is crucial in the trading industry, as it directly impacts a trader's experience and trust in a broker. BMFN recognizes the importance of providing efficient and responsive support to its clients, offering multiple channels for traders to reach out for assistance.

Support Channels

BMFN provides the following customer support channels:- Phone Support: BMFN offers phone support through several dedicated lines for offices in various countries, including:

- UK: +44-203-318-03-09

- Canada: +1-514-667-84-70

- Bulgaria: +359-2-491-70-16

- Australia: +61-2-8805-1957

- Email Support: Traders can send their inquiries to support@bmfn.com for general assistance.

- Live Chat: BMFN offers a 24/5 live chat service on their website, allowing traders to connect with a support representative in real-time during trading hours.

- FAQ Section: The broker maintains a comprehensive FAQ section on their website, addressing common questions and concerns related to trading, accounts, platforms, and more.

Support Languages

BMFN provides customer support in English, Spanish, Thai, and Arabic, catering to a diverse international clientele.Support Hours and Response

Times BMFN's customer support operates 24 hours a day, 5 days a week, from Monday to Friday. This ensures that traders can access assistance during major trading sessions, regardless of their location or time zone. The broker aims to provide prompt and efficient support, with live chat inquiries typically addressed within a few minutes during trading hours. Email responses may take longer, depending on the complexity of the issue and the volume of inquiries received. While BMFN does not provide specific guarantees for response times, the broker strives to address all client concerns in a timely and satisfactory manner. Comparison to Industry Standards BMFN's customer support offerings are generally in line with industry standards, providing multiple channels for traders to seek assistance. The availability of phone support in several countries and the 24/5 live chat service are particularly noteworthy, as they demonstrate the broker's commitment to serving a global client base.Customer Support Comparison Table

| Feature | BMFN |

|---|---|

| Support Channels | Phone, Email, Live Chat, FAQ |

| Support Languages | English, Spanish, Thai, Arabic |

| Support Hours | 24/5 (Monday to Friday) |

| Response Times | Live Chat: Few minutes, Email: Varies |

| 24/7 Support | No |

| Specific Response Time Guarantees | No |

Prohibited Countries

Most reputable brokers clearly state the countries they are unable to serve due to legal, regulatory, or other reasons. This information is typically easily accessible on their websites or within their terms and conditions. The absence of such details from BMFN raises questions about the broker's compliance with international regulations and its commitment to transparency.

While BMFN appears to accept clients from many countries, as evidenced by its multilingual support and varied payment methods, the broker should provide a clear list of prohibited countries to help traders make informed decisions. Potential clients should be aware of the risks associated with trading with a broker that is not transparent about its operations and restrictions.

It is essential for traders to ensure they are not violating any local laws or regulations by trading with a broker that may not be authorized to operate in their jurisdiction. Trading with an unauthorized broker can lead to legal consequences and potential difficulties in depositing or withdrawing funds.

In the absence of clear information from BMFN regarding prohibited countries, traders should exercise caution and thoroughly research the broker's regulatory status and compliance with their local laws before opening an account. It may be advisable to choose a broker that is more transparent about its operations and provides a clear list of restricted countries to minimize potential risks.

Prohibited Countries List

- Information not clearly provided by BMFN

Special Offers for Customers

BMFN does not currently offer any special promotions or bonuses to its clients. The broker previously had some short-term deposit bonuses available, but these are no longer active.

However, BMFN does provide several affiliate program options for clients to potentially earn additional income by referring new customers to the broker. These programs include:

- Referral Program: Earn a percentage of the trading volume generated by new clients who sign up using your unique referral link.

- Introducing Broker: Create a simple website to attract new clients to BMFN and earn commissions based on their trading activity.

- White Label & Omnibus White Label (for legal entities): Sell BMFN's financial products and services under your own brand and earn commissions.

- Money Manager: Manage the funds of other BMFN clients and earn a percentage of their profits.

Conclusion

After conducting a thorough review of BMFN, I have mixed feelings about the broker's overall safety, reliability, and reputation. While BMFN has been operating since 1988 and offers some attractive features, there are several concerning aspects that potential clients should carefully consider before opening an account.

On the positive side, BMFN is regulated by the Vanuatu Financial Services Commission (VFSC) under license number 40202, providing some level of regulatory oversight. The broker offers a decent selection of tradable assets, including forex, indices, stocks, commodities, and ETFs, as well as popular trading platforms like MetaTrader 4 and their proprietary UniTrader and WebTrader. The low minimum deposit requirement of $50 makes BMFN accessible to a wide range of traders.

However, I have significant concerns about BMFN's regulatory compliance and transparency. The broker claims to have licenses from New Zealand's Financial Service Providers Register (FSPR) and Australia's Securities and Investments Commission (ASIC), but these appear to be suspicious clones rather than legitimate licenses. This raises red flags about BMFN's true regulatory status and commitment to operating within the boundaries of the law.

Another worrying aspect is the lack of clear information about BMFN's operations, including the physical location of their headquarters and the countries they are prohibited from serving. The absence of a negative balance protection policy is also concerning, as it exposes traders to the risk of losing more than their initial deposit. Furthermore, the high $50 fee for bank wire withdrawals and the complex account verification process involving electronic signatures may be off-putting for some traders.

While BMFN does offer some educational resources and customer support options, I find them to be relatively basic compared to industry leaders. The broker also doesn't currently provide any attractive deposit bonuses or loyalty programs, which may make them less appealing to traders who value these incentives.

In conclusion, while BMFN has some positive attributes, the numerous red flags and concerns identified in this review lead me to approach the broker with caution. The lack of transparency, questionable regulatory status, and potential risks associated with trading with BMFN make it difficult for me to wholeheartedly recommend them as a safe and reliable choice for most traders.

As with any financial decision, I strongly encourage potential clients to conduct their own thorough research, compare multiple brokers, and carefully consider their individual trading needs and risk tolerance before opening an account with BMFN or any other broker. It may be wise to prioritize brokers with solid reputations, clear regulatory compliance, and transparent operations to ensure a safer and more trustworthy trading experience.