Capital.com Review 2025: Trading Made Easy with TradingView Integration

Capital.com

United Kingdom

United Kingdom

-

Minimum Deposit $20

-

Withdrawal Fee $varies

-

Leverage 500:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Cyprus Market Making (MM)

Cyprus Market Making (MM)

Australia Retail Forex License

Australia Retail Forex License

Securities Brokerage License

Securities Brokerage License

Broker-Dealer License

Broker-Dealer License

Softwares & Platforms

Customer Support

+35725123646

(English)

+35725123646

(English)

Supported language: English, French, German, Spanish

Social Media

Summary

Capital.com is a global fintech company headquartered in London, United Kingdom, offering a user-friendly trading platform with a wide range of assets, including forex, stocks, commodities, and cryptocurrencies. The broker provides advanced trading tools, TradingView integration, and competitive spreads to enhance the trading experience. Capital.com is regulated in multiple jurisdictions, ensuring security and compliance for traders. It also offers educational resources, market analysis, and a demo account to support both beginner and experienced traders.

- Strong regulatory compliance with licenses from FCA, CySEC, ASIC, and NBRB

- Wide range of over 3,000 tradable markets, including forex, stocks, indices, commodities, and cryptocurrencies

- User-friendly trading platforms for web, mobile, and MetaTrader 4

- Extensive educational resources, including webinars, tutorials, and market analysis

- 24/7 multilingual customer support via live chat, email, and phone

- Competitive spreads and low minimum deposit requirements

- Negative balance protection and demo account for risk management

- Transparent fee structure with no hidden charges

- Suitable for traders of all levels, from beginners to experienced professionals

- Proven track record of reliability and reputation in the online trading industry

- No current sign-up bonuses or loyalty programs

- Not available to residents of the United States and some other countries

- Limited range of deposit and withdrawal options compared to some competitors

- No direct phone number for customer support

- Educational resources, while extensive, may not be as comprehensive as some industry leaders

- Lack of advanced trading tools and platforms, such as cTrader or NinjaTrader

- No managed account options for hands-off investors

- Cryptocurrency trading not available for Capital.com UK retail customers

- Inactivity fees apply to some account types (e.g., SCB and CySEC accounts)

- High leverage can amplify potential losses for inexperienced traders

Overview

Capital.com, a leading online broker established in 2016, has rapidly emerged as a prominent player in the global trading landscape. With a strong presence in Europe, the UK, the Middle East, and Australia, Capital.com offers a wide range of financial instruments, including CFDs on forex, stocks, indices, commodities, and cryptocurrencies. The company's commitment to innovation, user-centric design, and educational resources has earned it numerous accolades, such as the "Best Trading App" award from the Good Money Guide in 2023 and the "Best CFD Provider" title from the Online Money Awards in the same year. Capital.com's swift rise to success is evidenced by its ranking as the fastest-growing company in the Middle East in the 2024 Deloitte Technology Fast 50.

At the heart of Capital.com's offering is its intuitive, award-winning trading platform, which caters to both novice and experienced traders. The broker provides access to over 3,000 markets, enabling clients to diversify their portfolios and seize opportunities across various asset classes. With a strong focus on transparency, competitive pricing, and robust regulatory compliance, Capital.com has garnered the trust of over 710,000 traders worldwide, who have collectively traded more than $1 trillion on the platform as of 2024.

While Capital.com's innovative solutions and educational resources empower traders to make informed decisions, it is essential to acknowledge the inherent risks associated with CFD trading. As with any form of leveraged trading, individuals should carefully consider their risk tolerance and financial capacity before engaging in such activities. For more information about Capital.com's services, fees, and regulatory status, readers are encouraged to visit the broker's official website (capital.com).

Overview Table

| Aspect | Details |

|---|---|

| Headquarters | London, UK |

| Established | 2016 |

| Regulation | FCA (UK), CySEC (Cyprus), ASIC (Australia), SCB (Bahamas), SCA (UAE) |

| Trading Platforms | Proprietary web and mobile apps, MetaTrader 4 |

| Markets Offered | 3,000+ CFDs on forex, stocks, indices, commodities, cryptocurrencies |

| Minimum Deposit | $20 |

| Commissions | Zero (other fees apply) |

| Customer Support | 24/7 multilingual support via live chat, email |

| Educational Resources | Guides, videos, webinars, glossary, demo account |

Facts List

- Capital.com is one of the fastest-growing brokers, ranked #1 in the Middle East by the 2024 Deloitte Technology Fast 50.

- The broker serves over 710,000 clients globally, with more than 110,000 active traders monthly.

- Capital.com offers 3,000+ tradable markets across forex, stocks, indices, commodities, and cryptocurrencies.

- Clients have traded over $1 trillion on the Capital.com platform as of 2024.

- The company provides 24/7 multilingual customer support via live chat and email.

- Capital.com is regulated by top-tier authorities such as the FCA, CySEC, ASIC, SCB, and SCA.

- The broker offers competitive spreads, zero commissions (other fees apply), and low minimum deposits starting at $20.

- Capital.com provides a comprehensive suite of educational resources, including guides, videos, webinars, and a demo account.

- The proprietary trading platform features over 100 technical indicators and advanced charting tools.

- Capital.com employs segregated client accounts and robust fraud prevention measures to safeguard funds and personal information.a

Capital.com Licenses and Regulatory

Capital.com operates within a robust regulatory framework, holding licenses from multiple top-tier financial authorities worldwide. This multi-jurisdictional approach to regulation demonstrates the broker's commitment to maintaining the highest standards of client protection, transparency, and operational integrity.

One of Capital.com's primary licenses is from the Financial Conduct Authority (FCA) in the United Kingdom. The FCA is renowned for its stringent oversight and consumer protection measures, ensuring that regulated firms adhere to strict codes of conduct and maintain segregated client funds. Capital.com's FCA license (number: 793714) is a testament to its compliance with these rigorous standards, instilling confidence in clients who value the security and stability associated with a well-regulated broker.

In addition to its FCA license, Capital.com holds authorisations from the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), the Securities Commission of The Bahamas (SCB), and the Financial Services Regulatory Authority (SCA) in the United Arab Emirates. Each of these regulatory bodies has its own set of rules and requirements, focusing on areas such as client onboarding, risk disclosure, and the handling of client funds.

By maintaining licenses from multiple respected regulators, Capital.com demonstrates its dedication to operating transparently and ethically across various jurisdictions. This not only enhances the broker's credibility but also provides clients with an extra layer of protection, as they can seek recourse through the relevant regulatory channels in case of any disputes or concerns.

Moreover, Capital.com's adherence to industry best practices and its proactive approach to regulatory compliance set it apart from less scrupulous operators in the online trading space. The broker's commitment to maintaining a secure and trustworthy trading environment is further evidenced by its use of segregated client accounts, robust data protection measures, and regular audits by independent third parties.

In summary, Capital.com's multi-faceted regulatory framework, which includes licenses from the FCA, ASIC, CySEC, SCB, and SCA, underscores the broker's dedication to upholding the highest standards of client protection and regulatory compliance. By prioritising transparency, security, and ethical conduct, Capital.com has established itself as a reliable and reputable choice for traders seeking a well-regulated and trustworthy broker.

Regulations List

- Financial Conduct Authority (FCA), United Kingdom – Licence No. 793714

- Australian Securities and Investments Commission (ASIC), Australia - AFSL No. 513393

- Cyprus Securities and Exchange Commission (CySEC), Cyprus – Licence No. 319/17

- Securities Commission of The Bahamas (SCB), The Bahamas – Licence No. SIA-F265

- Financial Services Regulatory Authority (SCA), United Arab Emirates (UAE) – Licence No. 190005

Trading Instruments

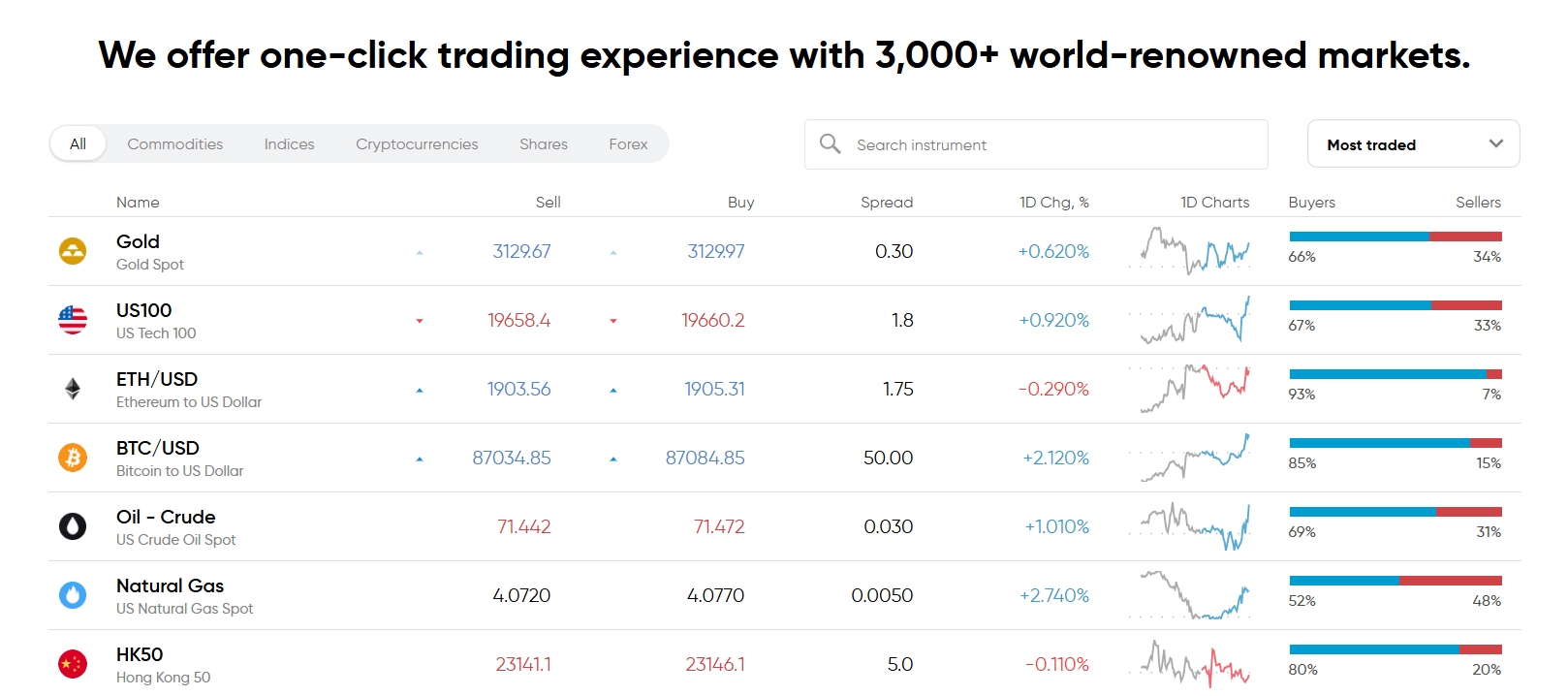

Capital.com offers an extensive range of tradable assets, providing investors with a diverse selection of instruments across multiple markets. With over 3,000 CFDs available, the broker caters to the needs of both novice and experienced traders seeking exposure to various asset classes.

| Asset Class | Description |

|---|---|

| Forex | Offers a wide range of currency pairs, including major, minor, and exotic pairs. Competitive spreads and leveraged trading options help traders capitalise on market movements. Advanced charting tools and real-time data support informed decision-making. |

| Stocks & Indices | Provides access to global stocks and indices through CFDs. Covers major exchanges like NYSE, NASDAQ, LSE, and HKEX. Traders can diversify holdings and benefit from market fluctuations with competitive spreads and leverage. |

| Commodities | Includes CFDs on precious metals (gold, silver), energy (crude oil, natural gas), and agricultural products (wheat, coffee). Offers competitive spreads and high liquidity for speculative or hedging strategies. |

| Cryptocurrencies | Features cryptocurrency CFDs on major assets like Bitcoin, Ethereum, and Litecoin, as well as emerging altcoins. Enables long and short trading on volatile markets with an intuitive platform and educational resources. cryptocurrency trading is not available for retail customers in the UK. |

By offering a diverse array of tradable assets, Capital.com empowers investors to construct well-rounded portfolios that align with their risk appetite and financial goals. The broker's commitment to providing a comprehensive trading experience is evident in the depth and breadth of its CFD offerings, which span multiple asset classes and global markets.

For a detailed breakdown of the specific instruments available within each asset class, along with their respective spreads and trading conditions, readers are encouraged to visit Capital.com's official website. The platform's transparency and user-centric approach ensure that clients have access to the information they need to make informed trading decisions.

Trading Platforms

Capital.com offers a range of trading platforms to cater to the diverse needs and preferences of its clients. The broker understands the importance of providing stable, reliable, and feature-rich platforms that facilitate seamless trading experiences and support well-informed decision-making.

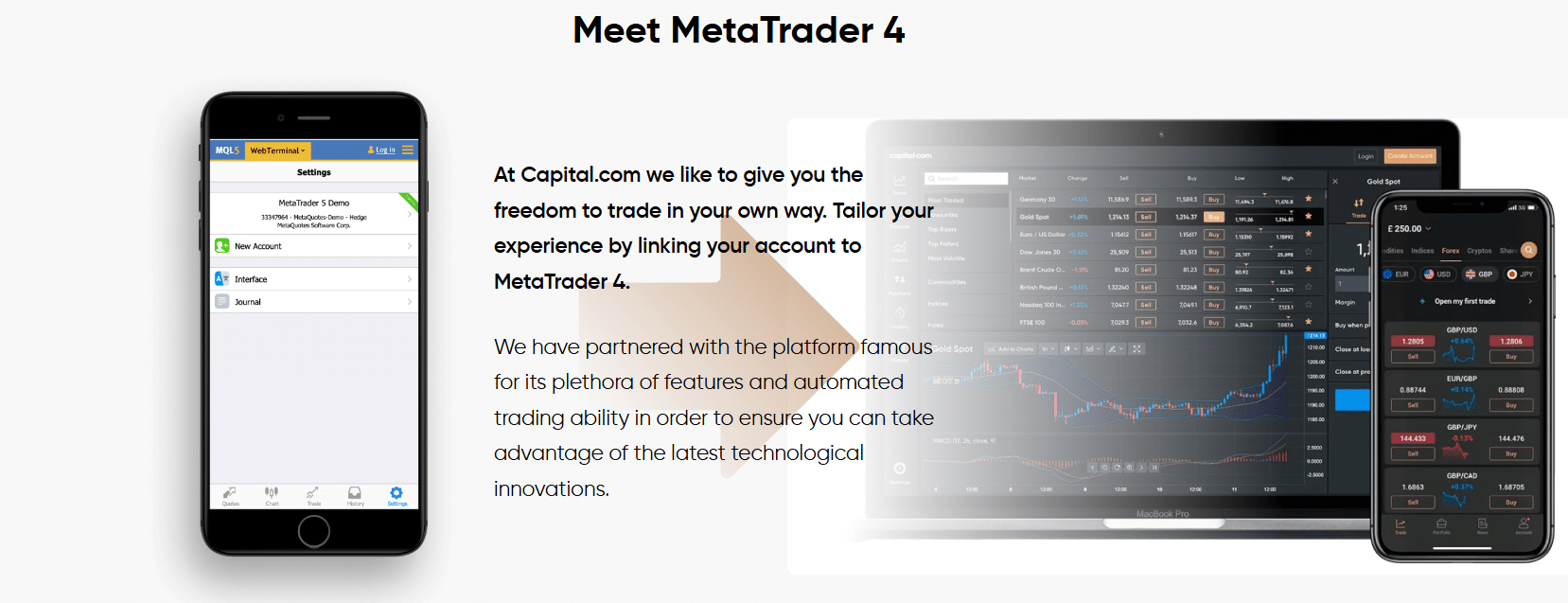

MetaTrader 4 (MT4)

Capital.com provides access to the widely used MetaTrader 4 platform, which has long been a staple in the online trading industry. MT4 offers a user-friendly interface, advanced charting capabilities, and a wide range of technical indicators and trading tools. The platform supports automated trading through expert advisors (EAs) and allows for customisation using the MQL4 programming language. MT4's popularity ensures that traders can access a vast library of third-party tools and resources to enhance their trading strategies.

TradingView

Capital.com has integrated TradingView, a powerful web-based charting and analysis platform, into its offering. TradingView provides a comprehensive suite of technical indicators, drawing tools, and customisable charts, enabling traders to perform in-depth market analysis and identify potential trading opportunities. The platform's social features allow users to collaborate with other traders, share ideas, and learn from experienced professionals. TradingView's user-friendly interface and extensive functionalities make it an attractive choice for both novice and advanced traders.

Web and Mobile Platforms

In addition to MT4 and TradingView, Capital.com has developed its own proprietary web and mobile trading platforms. These platforms are designed to offer a seamless and intuitive trading experience, with a focus on simplicity and ease of use. The web platform allows traders to access their accounts and trade directly through their web browsers, without the need for any software installations. The mobile apps, available for both iOS and Android devices, provide traders with the flexibility to manage their positions and monitor markets on the go.

Capital.com's proprietary platforms come equipped with a range of features designed to support informed decision-making and effective risk management. These include real-time market data, customisable watchlists, price alerts, and a variety of order types. The platforms also offer educational resources, such as market analysis and trading guides, to help clients expand their knowledge and refine their strategies.

By offering a diverse range of trading platforms, Capital.com ensures that its clients have the tools they need to trade effectively and confidently. Whether traders prefer the familiarity of MT4, the advanced features of TradingView, or the simplicity of the broker's proprietary platforms, Capital.com has a solution to suit their needs. The broker's commitment to providing cutting-edge technology and user-centric platforms sets it apart in the competitive online trading landscape.

Trading Platforms Comparison Table

| Feature | MT4 | TradingView | Proprietary Web | Proprietary Mobile |

|---|---|---|---|---|

| Charting | Yes | Yes | Yes | Yes |

| Technical Indicators | Yes | Yes | Yes | Yes |

| Automated Trading | Yes | No | No | No |

| Customization | Yes | Yes | No | No |

| Social Trading | No | Yes | No | No |

| Web-based | No | Yes | Yes | No |

| Mobile Apps | Yes | Yes | No | Yes |

| Educational Resources | No | Yes | Yes | Yes |

Capital.com How to Open an Account: A Step-by-Step Guide

Opening an account with Capital.com is a straightforward process designed to be user-friendly and efficient. The broker has streamlined the application procedure to ensure that clients can start trading as quickly as possible, without compromising on security or regulatory compliance.

Step 1: Visit Capital.com's website and click on the "Join Now" or "Sign Up" button.

Step 2: Fill out the registration form with your personal information, including your full name, email address, and phone number. You will also need to create a secure password for your account.

Step 3: Verify your email address by clicking on the link sent to your registered email.

Step 4: Once your email is verified, you will be prompted to provide additional information to complete your profile. This includes details such as your date of birth, residential address, and nationality.

Step 5: Answer a series of questions designed to assess your trading knowledge and experience. This step is part of Capital.com's client onboarding process and helps the broker ensure that its services are appropriate for your level of expertise.

Step 6: Upload the required identification documents for account verification. This typically includes a government-issued ID (such as a passport or driver's license) and a proof of address (such as a utility bill or bank statement). Capital.com uses advanced technology to verify these documents quickly, often within minutes.

Step 7: Choose your preferred account type and base currency. Capital.com offers both Retail and Professional accounts, with different features and requirements.

Step 8: Make your initial deposit using one of the accepted payment methods. Capital.com supports a wide range of options, including credit/debit cards, bank transfers, and e-wallets. The minimum deposit amount varies depending on the payment method, but can be as low as $20 for some options.

Step 9: Once your deposit is processed, you can start trading on Capital.com's platforms. The broker offers access to MetaTrader 4, TradingView, and its proprietary web and mobile platforms.

Throughout the account opening process, Capital.com provides clear instructions and support to ensure that clients can complete the application smoothly. The broker's customer service team is available 24/7 to assist with any questions or issues that may arise.

By offering a streamlined and user-friendly account opening process, Capital.com demonstrates its commitment to accessibility and customer-centricity. The broker's quick verification procedures and low minimum deposit requirements make it an attractive choice for traders looking to start their online trading journey with a reputable and regulated provider.

Charts and Analysis

Capital.com is committed to empowering its clients with a comprehensive suite of educational resources and trading tools. The broker recognises the importance of continuous learning and skill development in the dynamic world of online trading and has invested significantly in creating a robust educational ecosystem.

| Feature | Description |

|---|---|

| Interactive Charts | Offers advanced charting tools with customisable options like candlestick, line, and bar charts. Supports multiple indicators and drawing tools. Available on both web and mobile platforms. |

| Technical Analysis Tools | Provides a variety of indicators such as moving averages, RSI, Bollinger Bands, Fibonacci retracements, and Elliott Wave analysis. Integrated with TradingView for additional tools and user-generated scripts. |

| Fundamental Analysis Resources | Includes an economic calendar for tracking market events, regular news updates, and geopolitical insights to aid trading decisions. |

| Educational Content | Features webinars, video tutorials, and structured courses covering beginner to advanced trading topics. Live webinars allow real-time interaction with market experts. |

| Blogs and Market Insights | Maintains a blog with market analysis, trading ideas, and educational content, written by expert analysts and guest contributors. Covers trends, risk management, and trading psychology. |

The broker also offers a market insights section on its website, which includes daily market briefings, economic data analysis, and commentary on key financial events. These resources help traders stay informed about the factors driving market movements and potential trading opportunities.

Compared to industry standards, Capital.com's educational resources and trading tools are comprehensive and well-developed. The broker's commitment to education sets it apart from competitors who may offer more limited resources. By providing a diverse range of tools and content, Capital.com empowers its clients to make informed trading decisions and continuously improve their skills.

Capital.com Account Types

Capital.com offers a range of trading account types designed to cater to the diverse needs and preferences of its clients. By providing multiple account options, the broker ensures that traders can select the most suitable account based on their trading style, experience level, and financial goals.

Standard Account

The Standard account is Capital.com's most popular offering, suitable for both novice and experienced traders. This account type offers competitive spreads, starting from 0.6 pips on major currency pairs, and leverage of up to 1:30 for retail clients. The minimum deposit requirement for a Standard account is just $20, making it accessible to a wide range of traders. Standard account holders have access to all of Capital.com's tradable assets, including forex, stocks, indices, commodities, and cryptocurrencies.

Plus Account

The Plus account is designed for more experienced traders who seek additional benefits and enhanced trading conditions. This account type offers tighter spreads compared to the Standard account, starting from 0.1 pips on major currency pairs. Plus account holders also enjoy lower overnight financing rates, which can be particularly advantageous for traders who hold positions for extended periods. The minimum deposit requirement for a Plus account is $3,000, reflecting the higher level of commitment and trading volume expected from these clients.

Professional Account

Capital.com's Professional account is tailored to meet the needs of experienced traders who qualify as professional clients under the European Securities and Markets Authority (ESMA) regulations. Professional account holders have access to higher leverage of up to 1:500, which can significantly amplify potential returns (and losses). This account type also offers even tighter spreads compared to the Plus account, providing more favourable trading conditions. To qualify for a Professional account, traders must meet certain criteria, such as having a portfolio value of at least €500,000 and relevant trading experience.

Islamic Account

The Islamic account, also known as a swap-free account, is designed to cater to the needs of Muslim traders who adhere to Sharia law. This account type does not incur overnight interest charges (swaps), ensuring compliance with the Islamic prohibition on earning or paying interest. Instead of swaps, Islamic account holders may be subject to alternative fees, such as wider spreads or fixed commissions. All other features and trading conditions are similar to the Standard account.

Demo Account

Capital.com offers a demo account that allows traders to practise their strategies and familiarise themselves with the platform in a risk-free environment. The demo account provides access to all of Capital.com's tradable assets and features, with virtual funds that mirror real market conditions. This account type is an invaluable tool for both beginners looking to gain experience and seasoned traders testing new strategies.

By offering a diverse range of account types, Capital.com demonstrates its commitment to accommodating the unique requirements of its clientele. The broker's account options cater to traders with varying levels of experience, trading styles, and religious beliefs, ensuring that each client can find an account that aligns with their needs.

Account Types Comparison Table

| Feature | Standard | Plus | Professional | Islamic | Demo |

|---|---|---|---|---|---|

| Min. Deposit | $20 | $3,000 | €500,000 | $20 | N/A |

| Spreads (EUR/USD) | From 0.6 | From 0.1 | From 0.0 | From 1.0 | From 0.6 |

| Leverage | Up to 1:30 | Up to 1:30 | Up to 1:500 | Up to 1:30 | Up to 1:30 |

| Overnight Fees | Yes | Lower | Lower | No | No |

| Tradable Assets | All | All | All | All | All |

| Negative Balance Protection | Yes | Yes | No | Yes | N/A |

Negative Balance Protection

Negative balance protection is an essential feature for retail traders, providing a safety net against unexpected market volatility and limiting potential losses to the funds deposited in the trading account. Capital.com's negative balance protection policy demonstrates the broker's commitment to managing risk and safeguarding its clients' funds. However, traders should be aware that negative balance protection does not replace the need for effective risk management and disciplined trading practices. By combining negative balance protection with a well-defined trading plan and appropriate risk management tools, traders can navigate the markets with greater confidence and control.

Capital.com Deposits and Withdrawals

Capital.com offers a wide range of convenient deposit and withdrawal options, ensuring that traders can manage their funds efficiently and securely. The broker understands the importance of seamless transactions and strives to provide a smooth and user-friendly experience for its clients.

Deposit Methods

| Deposit Method | Providers | Minimum Deposit | Processing Time | Fees |

|---|---|---|---|---|

| Credit/Debit Cards | Visa, Mastercard, Maestro | $20 (or equivalent) | Instant | No fees (provider fees may apply) |

| Bank Transfer | - | Varies (check website) | Several business days | No fees (provider fees may apply) |

| E-wallets | Apple Pay, Giropay, iDEAL, Neteller, PayPal, Skrill, SOFORT, Trustly | $20 (or equivalent) | Instant | No fees (provider fees may apply) |

Withdrawal Methods

| Withdrawal Method | Providers | Minimum Withdrawal | Processing Time | Fees |

|---|---|---|---|---|

| Credit/Debit Cards | Visa, Mastercard, Maestro | $10 (or equivalent) | Within 24 hours (provider processing times may vary) | No fees |

| Bank Transfer | - | $10 (or equivalent) | Within 24 hours (may take longer depending on the bank) | No fees |

| E-wallets | Neteller, PayPal, Skrill, Trustly | $10 (or equivalent) | Within 24 hours (instant in some cases) | No fees |

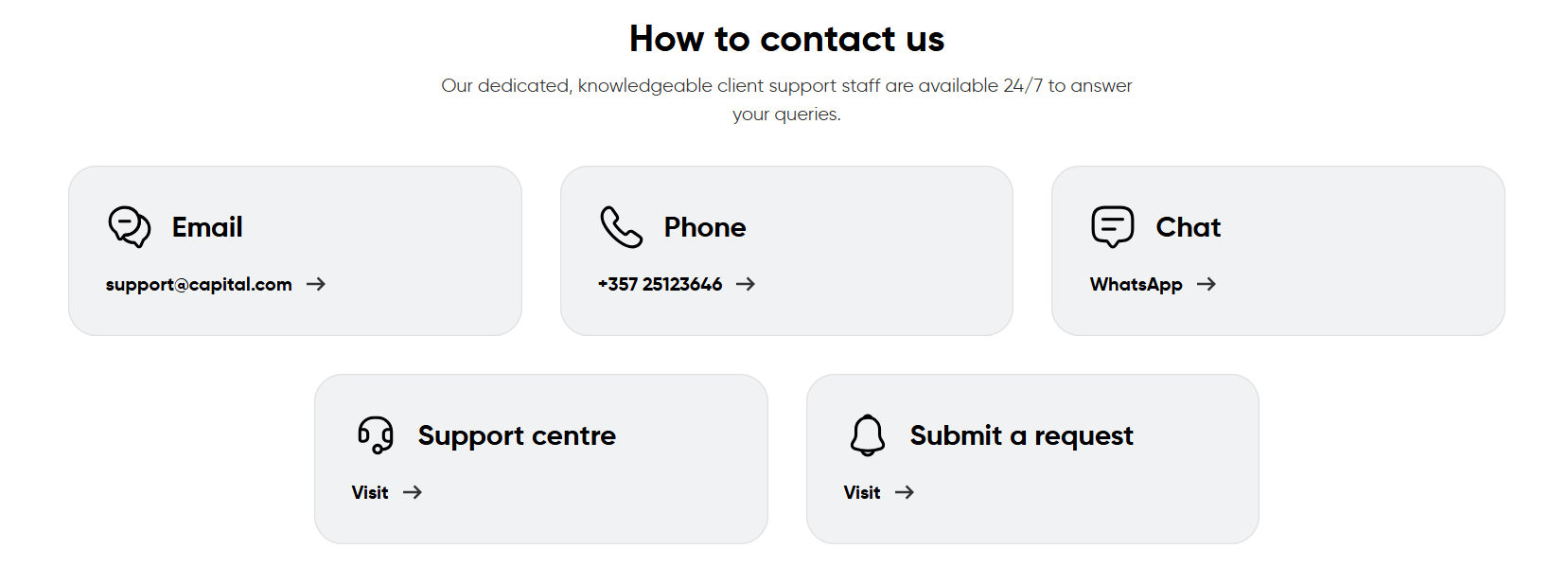

Support Service for Customer

In the fast-paced world of online trading, reliable customer support is essential for a positive trading experience. Capital.com recognises the importance of providing prompt, knowledgeable, and friendly assistance to its clients, ensuring that they can navigate the platform and market conditions with confidence.

- Live Chat: Traders can access 24/7 live chat support directly through the Capital.com website or trading platform. This channel provides instant assistance for general enquiries, technical issues, and account-related questions.

- Email: Clients can send detailed enquiries or requests to Capital.com's support team via email. The broker aims to respond to all email enquiries within 24 hours, with most responses provided within a few hours.

- Phone Support: Capital.com offers phone support during business hours, with local numbers available for clients in different regions. This channel is ideal for more complex issues or when traders prefer to speak with a support representative directly.

- Social Media: Traders can reach out to Capital.com's support team through their official social media channels, such as Facebook, Twitter, and Instagram. While social media enquiries may have longer response times compared to other channels, they provide an alternative means of communication.

Customer Support Comparison Table

| Feature | Capital.com |

|---|---|

| 24/7 Support | Yes |

| Live Chat | Yes |

| Email Support | Yes |

| Phone Support | Yes |

| Social Media Support | Yes |

| Languages | English, Spanish, French, German, Italian, Polish, Portuguese, Romanian, Russian, Swedish, Turkish |

| Response Time (Live Chat) | < 5 minutes |

| Response Time (Email) | < 24 hours |

Prohibited Countries

Capital.com is committed to providing its services in compliance with international regulations and local laws. As a result, the broker is restricted from operating or offering its services in certain countries and regions. These restrictions are based on factors such as local regulatory requirements, licensing constraints, and geopolitical considerations.

Reasons for Restrictions

- Regulatory Compliance: Each country has its own set of financial regulations and licensing requirements for brokers. If Capital.com does not hold the necessary licenses or meet the regulatory standards in a particular jurisdiction, it is prohibited from offering its services there.

- Geopolitical Factors: Political instability, economic sanctions, or international trade restrictions may prevent Capital.com from operating in certain regions. The broker must adhere to international laws and avoid engaging in activities that could violate global sanctions or pose risks to its clients and operations.

- Legal and Financial Risks: Operating in countries with unclear or unfavourable legal frameworks can expose Capital.com to potential legal disputes or financial losses. The broker prioritises the protection of its clients' funds and the stability of its operations and therefore avoids jurisdictions with high legal and financial risks.

Consequences of Trading from Prohibited Countries

- Account Suspension or Termination: If Capital.com identifies that a client is trading from a prohibited jurisdiction, the broker reserves the right to suspend or terminate the client's account immediately. This can result in the loss of access to the trading platform and any open positions.

- Legal Action: Trading with Capital.com from a prohibited country may violate local laws and regulations. Clients who engage in such activities may face legal consequences, including fines, penalties, or even criminal charges, depending on the jurisdiction.

- Loss of Funds: In some cases, clients who trade from prohibited countries may face difficulties in withdrawing their funds or may have their assets frozen due to regulatory or legal issues. Capital.com strongly advises against attempting to circumvent its restrictions, as it can lead to financial losses and legal complications.

Prohibited Countries List

United States, Canada, Cuba, Iran, Syria, North Korea, Sudan, Japan, Rwanda, Burundi, Bangladesh, Haiti, Myanmar, Yemen, Singapore, Lao PDR, Nicaragua, Pakistan, Panama, Congo (DRC), Paraguay

It is essential for traders to review the list of prohibited countries and ensure that they are not residing in or accessing Capital.com's services from any of these jurisdictions. For the most up-to-date information on prohibited countries and any changes to Capital.com's services, traders should regularly check the broker's official website and terms and conditions.

Special Offers for Customers

Capital.com offers

-

Refer-a-Friend Program: Clients can earn up to $250 every three months by referring friends who deposit at least $200 and complete a minimum of three trades.

-

Rebate Program for Active Traders: High-volume traders may qualify for monthly cash rebates based on their trading volumes across various asset classes. For example, forex traders with monthly volumes over $150 million can receive a 20% rebate on spreads.

Capital.com does not offer traditional deposit bonuses or trading incentives to retail traders, in line with regulatory standards.

Conclusion

After conducting a thorough review of Capital.com, I can confidently say that they have established themselves as a reliable and trustworthy broker in the online trading industry. Throughout my analysis, I have been impressed by their commitment to regulatory compliance, user-centric approach, and dedication to providing a comprehensive trading experience.

One of the key factors that sets Capital.com apart is their strong regulatory framework. With licenses from top-tier authorities such as the FCA, CySEC, ASIC, and NBRB, they demonstrate a commitment to operating transparently and adhering to strict financial regulations. This provides traders with peace of mind, knowing that their funds and personal information are protected by robust security measures and segregated client accounts.

Capital.com's user-friendly trading platforms and wide range of tradable assets make them an attractive choice for both novice and experienced traders. The broker offers access to over 3,000 markets, including forex, stocks, indices, commodities, and cryptocurrencies, providing ample opportunities for portfolio diversification. Their integration of advanced charting tools and risk management features, such as negative balance protection, further enhances the trading experience.

I was particularly impressed by Capital.com's extensive educational resources and commitment to supporting their clients' growth as traders. The broker offers a wide array of educational materials, including webinars, tutorials, and market analysis, which cater to different learning styles and skill levels. The availability of a demo account allows traders to practise and refine their strategies in a risk-free environment before committing real funds.

Capital.com's customer support is another area where they excel. With 24/7 multilingual support via live chat, email, and phone, traders can access assistance whenever they need it. The prompt response times and knowledgeable support staff ensure that clients' enquiries and concerns are addressed efficiently and effectively.

While Capital.com may not currently offer sign-up bonuses or loyalty programs, they make up for it with competitive spreads, low minimum deposit requirements, and a transparent fee structure. The broker's focus on providing value through its core services and features, rather than relying on short-term promotions, demonstrates their long-term commitment to their clients' success.

In conclusion, Capital.com has proven itself to be a reliable and reputable broker that prioritises the needs of its clients. With a strong regulatory foundation, diverse trading opportunities, user-friendly platforms, and comprehensive educational resources, they provide a well-rounded trading experience suitable for traders of all levels. As with any broker, it's essential for traders to carefully consider their individual trading goals and risk tolerance before making a decision. However, based on my analysis, I believe that Capital.com is a strong contender for those seeking a trustworthy and supportive trading partner.