City Index Review 2025: A Trusted Broker with a Wide Range of Markets

City Index Group

United Kingdom

United Kingdom

-

Minimum Deposit $100

-

Withdrawal Fee $Varies

-

Leverage 400:1

-

Spread From 0.5

-

Minimum Order 0.01

-

Forex Available

-

Crypto Unavailable

-

Stock Unavailable

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Australia Retail Forex License

Australia Retail Forex License

Singapore Financial Services License

Singapore Financial Services License

Softwares & Platforms

Customer Support

+61289169000

(English)

+61289169000

(English)

+6568269988

(English)

+6568269988

(English)

Supported language: Arabic, Chinese (Simplified), English, German, Polish, Spanish

Social Media

Summary

City Index Group is a leading global provider of online trading services, specializing in spread betting, CFD trading, and forex. Founded in 1983, the company offers advanced trading platforms, market insights, and competitive pricing to retail and institutional clients. It is part of StoneX Group Inc., a Fortune 100 company, ensuring strong financial backing and regulatory compliance. City Index provides access to thousands of markets, including stocks, indices, commodities, and cryptocurrencies, catering to traders of all experience levels.

- Strongly regulated by top-tier authorities like FCA, ASIC, and MAS

- Wide range of over 13,500 tradable markets across multiple asset classes

- Competitive spreads and transparent pricing structure

- User-friendly proprietary Web Trader platform and MT4 integration

- Mobile trading apps and TradingView integration for seamless access

- Knowledgeable and responsive customer support via multiple channels

- Comprehensive educational resources, including webinars and guides

- Negative balance protection and segregated client funds for security

- Long-standing reputation and backing by publicly-listed StoneX Group

- Commitment to providing a reliable, high-quality trading experience

- No current promotions or bonus offers for new or existing clients

- Educational video content lags behind some industry leaders

- Lacks weekend customer support availability

- No MetaTrader 5 (MT5) support at present

- Cryptocurrency CFDs are not available to UK retail clients

- Inactivity fee charged after 12 months of no trading activity

- Limited customization options for the Web Trader platform

- No built-in copy trading or social trading features

- Minimum deposit requirement of $150 in some regions (Singapore, Australia)

- Some premium features, like Cash Rebate, are accessible only at high-volume tiers

Overview

City Index, established in 1983 in the United Kingdom as a spread betting company, has evolved into a globally recognized multi-asset brokerage that offers spread betting, forex, and CFD trading across an extensive range of markets. As a subsidiary of the NASDAQ-listed StoneX Group Inc., a Fortune 100 company with over $200 billion in annual trade volume, City Index operates under the regulatory oversight of top-tier authorities, including the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Monetary Authority of Singapore (MAS).

Serving over 400,000 retail clients worldwide, City Index provides access to more than 13,500 markets, including forex, indices, shares, commodities, bonds, and options. The broker has garnered numerous accolades for its innovative trading platforms, competitive pricing, and comprehensive educational resources. Notable awards include "Best CFD Trading Platform" at the 2023 ADVFN International Financial Awards and "Best Spread Betting Provider" at the 2023 Online Personal Wealth Awards.

City Index's offerings cater to both new and experienced traders, with a user-friendly proprietary web-based platform, advanced charting capabilities through TradingView integration, and support for the popular MetaTrader 4 (MT4) platform. The broker also provides a feature-rich mobile trading app, allowing clients to access their accounts and trade on the go. For more details on City Index's services, visit their official website at cityindex.com.

Overview Table

| Feature | Details |

|---|---|

| Founded | 1983 in the United Kingdom |

| Regulator(s) | FCA (UK), ASIC (Australia), MAS (Singapore) |

| Parent Company | StoneX Group Inc. (NASDAQ: SNEX) |

| Trading Platforms | Proprietary Web Platform, MetaTrader 4, Mobile App, TradingView Integration |

| Markets Offered | 13,500+ (Forex, Indices, Shares, Commodities, Bonds, Options) |

| Account Types | Standard, MT4, Demo, Islamic (Swap-Free), Professional |

| Minimum Deposit | £100 (UK), $150 (Australia/Singapore) |

| Customer Support | 24/5 via live chat, email, phone |

| Website | www.cityindex.com |

Facts List

- City Index was founded in 1983 and is headquartered in London, United Kingdom.

- The broker is a subsidiary of StoneX Group Inc., a NASDAQ-listed company with a market capitalization of over $1 billion.

- City Index is regulated by top-tier authorities, including the FCA (UK), ASIC (Australia), and MAS (Singapore).

- The broker offers access to more than 13,500 markets, including forex, indices, shares, commodities, bonds, and options.

- City Index provides a user-friendly proprietary web-based trading platform, as well as support for MetaTrader 4 (MT4).

- Clients can access advanced charting capabilities through TradingView integration.

- The broker offers a feature-rich mobile trading app for both iOS and Android devices.

- City Index provides competitive spreads, with EUR/USD typically starting from 0.5 pips.

- Educational resources include a comprehensive Trading Academy, webinars, and a demo account for risk-free practice.

- City Index has won numerous industry awards, including "Best CFD Trading Platform" at the 2023 ADVFN International Financial Awards and "Best Spread Betting Provider" at the 2023 Online Personal Wealth Awards.

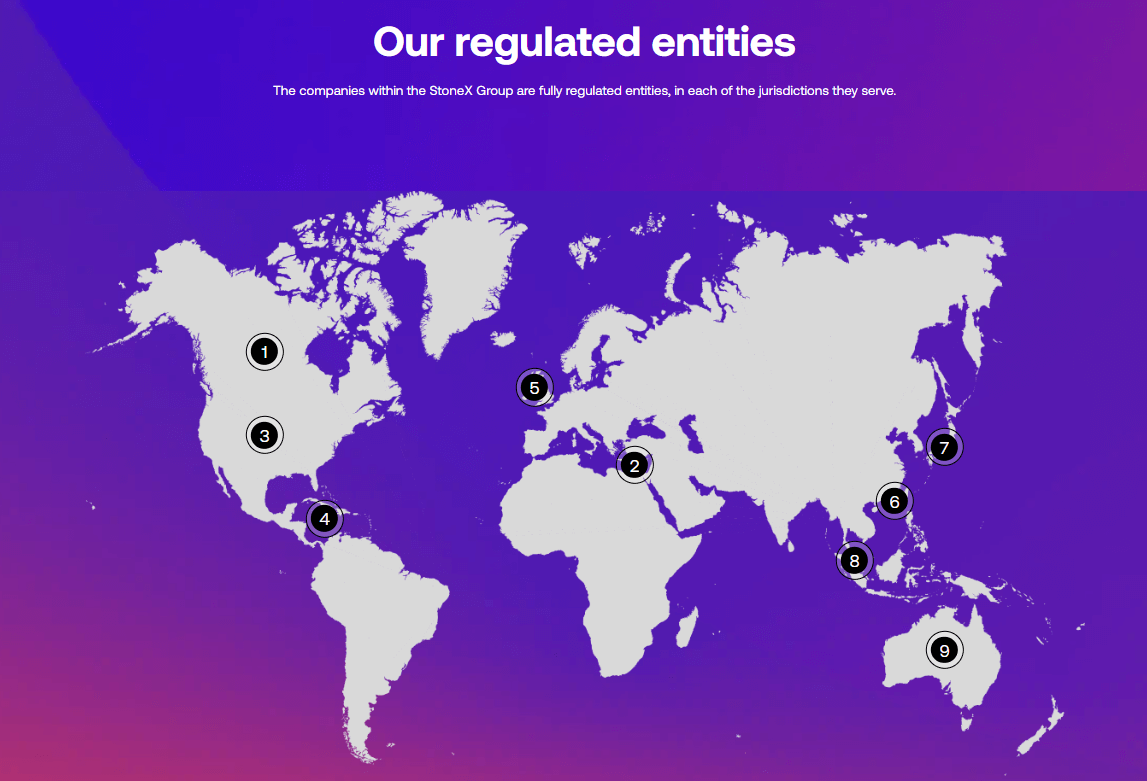

City Index Group Licenses and Regulatory

City Index operates under the regulatory oversight of multiple top-tier financial authorities, ensuring a high level of client protection and adherence to strict industry standards. The broker's primary regulator is the Financial Conduct Authority (FCA) in the United Kingdom, which is known for its robust regulatory framework and stringent oversight of financial services providers.

| Regulation & Licensing | Details |

|---|---|

| FCA License | City Index (UK) Limited holds an FCA license (Reference Number: 823316), while its parent company, StoneX Financial Ltd, also holds an FCA license (Reference Number: 446717), ensuring transparency, fair business practices, and client fund protection. |

| FCA Compliance | Under FCA regulations, City Index must segregate client funds from its own capital, maintain sufficient financial reserves, and undergo regular audits. |

| Additional Regulators | City Index is also regulated by the Australian Securities and Investments Commission (ASIC) and the Monetary Authority of Singapore (MAS), reinforcing its commitment to legal compliance and trader security. |

Multiple regulatory licenses are significant for a brokerage as they indicate a higher level of scrutiny and compliance with various regulatory standards. By subjecting itself to the oversight of several respected regulatory bodies, City Index demonstrates its commitment to maintaining the highest standards of integrity and client protection. This, in turn, fosters trust among clients and reinforces the broker's reputation within the industry.

Compared to industry standards, City Index's regulatory profile is impressive, with licenses from three top-tier regulators. This places the broker in the upper echelon of regulated brokerages and provides clients with a strong sense of security and peace of mind when trading with City Index.

Furthermore, as a subsidiary of the publicly listed StoneX Group Inc., City Index is subject to additional scrutiny and must adhere to strict financial reporting requirements, further enhancing its transparency and accountability.

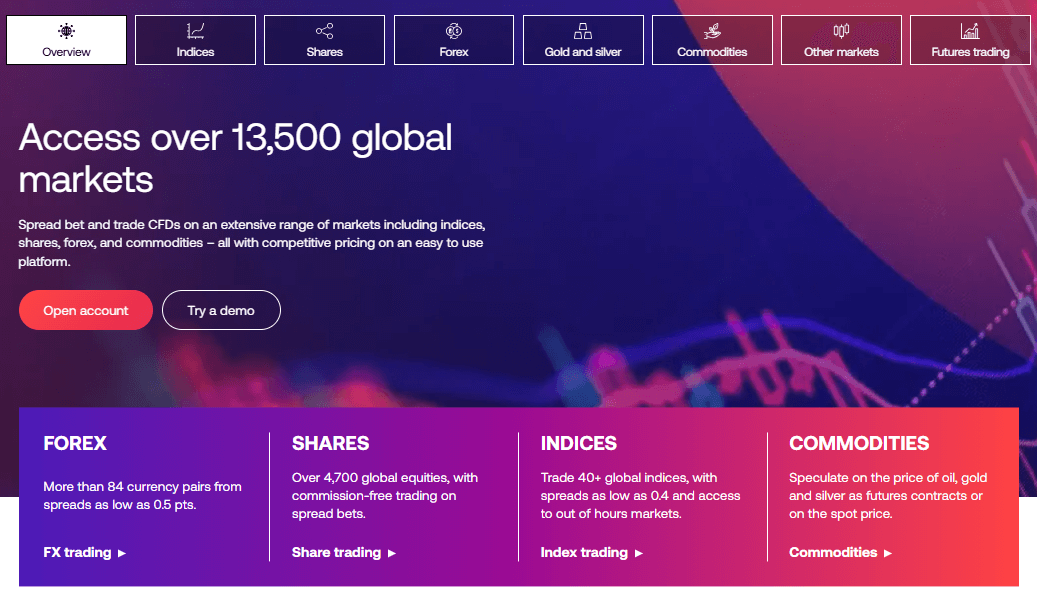

Trading Instruments

City Index offers an extensive range of tradable assets, catering to the diverse needs and preferences of traders worldwide. With over 13,500 markets available, the broker provides access to a comprehensive selection of instruments across multiple asset classes, allowing clients to build well-diversified trading portfolios.

| Asset Class | Details |

|---|---|

| Forex | Offers 84+ currency pairs, including majors, minors, and exotics. Competitive spreads starting from 0.5 pips on EUR/USD. Suitable for traders of all experience levels. |

| Indices | Access to 40+ major global indices, including S&P 500, FTSE 100, DAX, and Nikkei 225. Competitive spreads, with minimum spreads of 0.4 points on the UK 100. Extended trading hours on 70+ U.S. stocks. |

| Shares | Provides access to 6,000+ global shares from multiple exchanges and sectors. Competitive commission rates starting from 0.08% for U.K. shares. Includes IPO market participation. |

| Commodities | Over 40 commodity markets, including precious metals, energy products, and agricultural commodities. Competitive spreads on gold (0.5 points) and U.S. crude oil (1.5 points). Offers spot contracts for simplified trading. |

| Options | Trading available on indices, shares, commodities, metals, bonds, and interest rates. Used for risk management, speculation, and income generation through strategies like covered calls and put writing. |

| Thematic Indices | Includes indices focused on specific market trends and sectors, such as ESG, blockchain, and NFT giants. Enables traders to align investments with specific market themes. |

Overall, City Index's extensive range of tradable assets distinguishes the broker from many of its competitors. By offering a diverse selection of instruments across multiple asset classes, City Index provides traders with the flexibility to pursue various trading strategies and adapt to changing market conditions. The broker's competitive spreads and commissions further enhance the appeal of its offerings, making it an attractive choice for traders seeking a comprehensive and cost-effective trading experience.

Trading Platforms

City Index offers a diverse range of trading platforms to cater to the varying needs and preferences of its clients. By providing access to both industry-standard and proprietary platforms, the broker ensures that traders can choose the tools that best suit their trading style and expertise level.

| Trading Platform | Details |

|---|---|

| MetaTrader 4 (MT4) | Industry-standard platform for forex and CFD trading. Features a user-friendly interface, advanced charting, and a wide range of technical indicators. Supports automated trading through Expert Advisors (EAs). |

| Proprietary Web Trader | Web-based platform with no need for downloads. Features a customizable interface, TradingView-powered charting, performance analytics, and Trading Central research. |

| Mobile Trading Apps | Available for iOS and Android. Offers real-time quotes, advanced charting, and full trade management. Designed for seamless trading on the go. |

| TradingView Integration | Partnership with TradingView provides access to advanced charting tools, social trading features, and direct trade execution from the TradingView platform. |

By offering a diverse range of trading platforms, City Index demonstrates its commitment to providing clients with the tools they need to succeed in the markets. The combination of industry-standard platforms like MT4, proprietary platforms like Web Trader, and mobile trading apps ensures that traders can access their accounts and execute trades in a manner that suits their individual needs and preferences.

Trading Platforms Comparison Table

| Feature | MT4 | Web Trader | Mobile Apps | TradingView Integration |

|---|---|---|---|---|

| Charting | Advanced | Advanced (powered by TradingView) | Advanced | Advanced |

| Automated Trading | Yes (EAs) | No | No | No |

| Indicators & Tools | Wide range | Performance Analytics, Trading Central | Real-time quotes, charting | Extensive |

| Accessibility | Desktop, web, mobile | Web browser | iOS & Android | Web browser |

| Customization | Extensive | Customizable interface | User-friendly | Extensive |

| Social Trading | Limited | No | No | Yes |

City Index Group How to Open an Account: A Step-by-Step Guide

Opening an account with City Index is a straightforward and user-friendly process designed to help traders get started quickly and easily. Follow these simple steps to begin your trading journey with City Index:

Step 1: Visit the City Index website Navigate to the City Index website and click on the "Create Account" or "Open an Account" button, usually located in the top right corner of the homepage.

Step 2: Choose your account type Select the type of account you wish to open, such as a live trading account or a demo account. Demo accounts are an excellent way to practice trading strategies and familiarize yourself with the platform before committing real funds.

Step 3: Provide personal information Fill out the registration form with your personal details, including your name, email address, phone number, and country of residence. You will also need to create a unique username and password for your account.

Step 4: Complete the questionnaire Answer a series of questions designed to assess your trading experience, financial knowledge, and risk tolerance. This information helps City Index ensure that their services are appropriate for your needs and that you understand the risks associated with trading.

Step 5: Verify your identity and residence To comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, you will need to provide proof of identity and residency. This typically involves uploading a copy of your government-issued ID, such as a passport or driver's license, and a recent utility bill or bank statement that confirms your address.

Step 6: Choose your funding method and make a deposit Once your account is verified, select your preferred funding method from the available options, which include credit/debit cards, bank transfers, and e-wallets. Follow the instructions to make your initial deposit, keeping in mind that minimum deposit requirements may vary depending on your account type and country of residence.

Step 7: Start trading After your deposit is processed, you can access the trading platform and start exploring the markets. If you opened a demo account, you can use virtual funds to practice trading and test your strategies before transitioning to a live account.

City Index strives to make the account opening process as efficient and user-friendly as possible. The broker's website provides clear guidance and support throughout the registration process, and the client support team is available to assist with any questions or concerns.

By following these simple steps, traders can quickly and easily open an account with City Index and begin their trading journey with a reputable and well-established broker.

Charts and Analysis

City Index offers a comprehensive suite of educational resources and trading tools designed to support traders at all levels of experience. By providing access to a diverse range of materials, the broker empowers its clients to enhance their trading knowledge, develop new skills, and make informed decisions in the markets.

Interactive Charts

City Index's trading platforms feature advanced charting capabilities powered by TradingView, a leading provider of financial charts and analysis tools. Traders can access a wide range of customizable charts, including candlestick, line, bar, area, Heikin Ashi, and more, with the ability to apply various technical indicators and drawing tools. The interactive nature of these charts allows traders to analyze price action, identify trends, and make informed trading decisions based on their preferred strategies.

Technical Analysis Tools

In addition to the standard charting features, City Index provides a range of technical analysis tools to help traders evaluate market trends and potential trading opportunities. These tools include popular indicators such as moving averages, Bollinger Bands, MACD, RSI, and Fibonacci retracements, among others. Traders can customize these indicators to suit their specific needs and trading styles, enabling them to develop and refine their strategies over time.

Trading Central

City Index has partnered with Trading Central, a leading provider of market analysis and trading ideas, to offer clients access to expert insights and actionable trading opportunities. Through this integration, traders can access technical analysis reports, market commentary, and trading signals directly within the City Index platform. This feature is particularly valuable for traders who seek guidance and inspiration from experienced analysts and market professionals.

Economic Calendar

To help traders stay informed about upcoming market events and economic releases, City Index provides an economic calendar that highlights the most important news and data releases from around the world. The calendar includes information on the expected impact of each event, as well as historical data and consensus forecasts, allowing traders to anticipate potential market movements and adjust their trading strategies accordingly.

Educational Resources

City Index offers a wealth of educational resources designed to help traders improve their knowledge and skills, regardless of their experience level. These resources include:

- Trading Academy: A comprehensive online learning platform featuring courses, webinars, and tutorials covering various aspects of trading, from basic concepts to advanced strategies.

- Market Analysis: Regular market updates, news, and analysis provided by City Index's in-house experts and guest contributors, helping traders stay informed about the latest market developments and trends.

- Trading Guides: Downloadable PDFs and eBooks that cover a wide range of trading topics, including platform guides, risk management strategies, and market analysis techniques.

- Webinars: Live and recorded webinars hosted by City Index's market experts, covering a variety of trading topics and strategies, as well as platform tutorials and Q&A sessions.

By offering such a diverse range of educational resources and trading tools, City Index demonstrates its commitment to supporting its clients' trading journeys and facilitating their success in the markets. The broker's focus on education and analysis sets it apart from many competitors and ensures that traders have access to the resources they need to make informed decisions and achieve their trading goals.

City Index Group Account Types

City Index offers a range of trading account types designed to cater to the diverse needs and preferences of traders at various levels of experience and with different trading styles. By providing multiple account options, the broker ensures that clients can select the account that best suits their individual requirements and goals.

| Feature | Standard Account | MT4 Account | Demo Account |

|---|---|---|---|

| Spreads | From 0.5 pips on major forex pairs | From 0.5 pips on major forex pairs | Real-time market data |

| Commission | No commission (except for share CFDs) | No commission (except for share CFDs) | No commission |

| Minimum Deposit | £100 (or equivalent) | £100 (or equivalent) | £10,000 in virtual funds |

| Platforms | Web Trader, Mobile Apps | MetaTrader 4 (MT4) | Web Trader, MT4 |

| Automated Trading | No | Yes (Expert Advisors - EAs) | No |

| Trading Tools & Research | Trading Central, analysis tools | MT4 technical analysis, EAs | Strategy testing, risk-free practice |

| Negative Balance Protection | Yes | Yes | Not applicable |

| Time Limit | No time limit | No time limit | No expiration date |

| Best For | Traders of all levels | Traders preferring MT4 | Beginners, strategy testing |

By offering multiple account types, City Index demonstrates its commitment to providing a flexible and adaptable trading experience for its clients. The combination of competitive pricing, advanced trading platforms, and comprehensive educational resources ensures that traders can select the account type that best aligns with their needs and goals.

Negative Balance Protection

City Index's negative balance protection policy guarantees that clients will never lose more than the funds in their trading account. In the event that a trader's positions incur losses that exceed their account balance, City Index will absorb the excess loss, effectively resetting the account balance to zero. This protection applies to all trading accounts, including Standard and MT4 accounts, ensuring that all clients benefit from this essential risk management feature. It is important to note that while negative balance protection provides a safety net, it does not eliminate the risk of losing the funds deposited in the trading account. Traders should still exercise caution and employ sound risk management strategies, such as setting appropriate stop-loss orders and managing their trading positions responsibly. To be eligible for negative balance protection, traders must comply with City Index's terms and conditions, which include acting in good faith and not engaging in any abusive trading practices. The broker reserves the right to review and adjust the negative balance protection policy in cases where clients are found to be in breach of these terms. City Index's commitment to negative balance protection demonstrates the broker's dedication to client safety and risk management. By offering this policy, City Index provides traders with peace of mind, knowing that their potential losses are limited to the funds in their trading account. This focus on client protection sets City Index apart from some competitors and reinforces the broker's reputation as a reliable and trustworthy partner for online traders.

City Index Group Deposits and Withdrawals

City Index offers a range of convenient deposit and withdrawal options to ensure that traders can manage their funds easily and securely. The broker strives to provide a seamless transaction experience, with fast processing times and minimal fees, allowing traders to focus on their trading activities.

Deposit Methods

City Index accepts the following deposit methods:| Payment Method | Processing Time | Fees | Minimum Deposit |

|---|---|---|---|

| Credit/Debit Cards (Visa, Mastercard, Maestro) | Instant | No fees | Varies by country (No minimum in the UK, $150 in Australia/Singapore) |

| Bank Transfer | 1-3 business days | No fees | Varies by country (No minimum in the UK, $150 in Australia/Singapore) |

| PayPal | Instant | No fees | Varies by country (No minimum in the UK, $150 in Australia/Singapore) |

Withdrawal Methods

Traders can withdraw funds from their City Index account using the following methods:| Payment Method | Processing Time | Fees | Additional Notes |

|---|---|---|---|

| Credit/Debit Cards (Visa, Mastercard, Maestro) | 1-3 business days | No fees | Withdrawals are processed back to the original deposit method where possible. |

| Bank Transfer | 1-3 business days | No fees | Traders may need to provide additional documentation if an alternative withdrawal method is used. |

| PayPal | Instant | No fees | Must withdraw to the same PayPal account used for deposit. |

Verification Requirements

To comply with AML and know-your-customer (KYC) regulations, City Index requires traders to verify their identity and address before processing withdrawals. This involves providing a copy of a government-issued ID, such as a passport or driver's license, and a recent utility bill or bank statement confirming the trader's address. The verification process is designed to protect both the trader and the broker from fraudulent activity and ensures that funds are only withdrawn by the account holder.Processing Times

City Index aims to process all deposit and withdrawal requests as quickly as possible. Most deposits, including those made via credit/debit cards and e-wallets, are processed instantly, allowing traders to access their funds and start trading immediately. Withdrawal requests are typically processed within 1-3 business days, depending on the chosen method and the trader's account status. In some cases, additional verification checks may be required, which can slightly extend the processing time.Unique Features

City Index offers a unique deposit and withdrawal feature called "Cash Rebate," which rewards high-volume traders with cash rebates on their trading activity. The rebate is automatically credited to the trader's account and can be withdrawn or used to fund further trading. By offering a range of deposit and withdrawal options, fast processing times, and unique features like Cash Rebate, City Index demonstrates its commitment to providing a convenient and rewarding trading experience for its clients.Support Service for Customer

In the fast-paced world of online trading, reliable customer support is crucial for ensuring a positive trading experience. Traders often require assistance with account management, platform navigation, or technical issues, and the ability to access prompt and knowledgeable support can make a significant difference in their overall satisfaction with a broker. City Index recognizes the importance of providing excellent customer support and offers several channels through which traders can reach out for assistance:

- Live Chat: Traders can access instant support through the live chat feature available on the City Index website. This option is ideal for quick queries and general assistance.

- Email Support: For more detailed inquiries or less urgent matters, traders can send an email to City Index's support team. The broker aims to respond to all email inquiries within 24 hours.

- Telephone Support: City Index provides local telephone support numbers for its main markets, including the UK, Australia, and Singapore. Traders can speak directly with a support representative for immediate assistance.

- Social Media: Traders can also reach out to City Index via their official social media channels, such as Twitter and Facebook. While not the primary support channel, social media can be useful for staying updated on the latest news and promotions.

Customer Support Channels List

- Live Chat: Available 24/5

- Email Support: support@cityindex.co.uk

- Telephone Support:

- UK: +44 (0)20 7107 7979

- Australia: +61 (0)2 8916 9000

- Singapore: +65 6826 9988

- Social Media: Twitter, Facebook

- FAQs: Comprehensive self-help section on the website

| Support Channel | Availability | Languages | Target Response Time |

|---|---|---|---|

| Live Chat | 24/5 | English | < 1 minute |

| 24/5 | English | Within 24 hours | |

| Telephone | 24/5 | English | Within minutes |

| Social Media | 24/5 | English | Best effort basis |

| FAQs | 24/7 | Multilingual | Instant |

Prohibited Countries

City Index adheres to strict regulatory requirements and licensing conditions, which means that the broker is not permitted to offer its services in certain countries and regions. These restrictions are put in place to ensure compliance with local laws and to protect both the broker and its clients from potential legal and financial risks.

The primary reason behind these restrictions is the varying regulatory landscape across different jurisdictions. Some countries have specific licensing requirements or prohibit certain types of financial instruments, such as CFDs or spread betting. In other cases, local laws may impose restrictions on foreign brokers operating within their borders.

It is essential for traders to be aware of these restrictions, as attempting to access City Index's services from a prohibited country may result in account termination, funds being frozen, or legal consequences.

According to City Index's website and regulatory disclosures, the broker is not allowed to provide services to residents of the following regions:

- United States

- Canada

- New Zealand

- Japan

Please note that this list is subject to change based on evolving regulatory requirements and City Index's business decisions. It is always recommended to check the broker's official website or contact their customer support for the most up-to-date information on prohibited countries.

Traders from permitted regions, such as the United Kingdom, Australia, Singapore, and most European countries, can freely access City Index's services, subject to the broker's terms and conditions and local regulations.

If you are unsure about your eligibility to trade with City Index based on your country of residence, it is advisable to contact the broker's customer support team for clarification before attempting to open an account or engage in any trading activities.

The broker focuses on providing competitive spreads, a wide range of markets, advanced trading platforms and tools, and educational resources rather than promotional offers. This aligns with their position as an established, trustworthy broker that aims to attract traders through the quality and reliability of their services.

Special Offers for Customers

Currently, City Index does not appear to offer any special promotions or bonuses.

Conclusion

After conducting a thorough review of City Index, I can confidently say that they are a reliable and reputable broker with a strong commitment to providing a safe, transparent, and user-focused trading environment. Throughout my analysis, I have been impressed by their adherence to regulatory compliance, the breadth of their offerings, and their dedication to supporting traders of all levels.

One of the key factors that sets City Index apart is their robust regulatory framework. With licenses from top-tier authorities such as the FCA, ASIC, and MAS, they demonstrate a clear commitment to operating within the confines of the law and prioritizing the protection of their clients' funds and interests. This regulatory oversight, combined with their segregation of client funds and negative balance protection, provides traders with a high level of security and peace of mind.

City Index's wide range of tradable assets is another notable strength, with over 13,500 markets across forex, indices, shares, commodities, and more. This extensive selection allows traders to diversify their portfolios and pursue a variety of trading strategies. The broker's competitive spreads and transparent pricing further enhance the appeal of their offering, making them an attractive choice for cost-conscious traders.

In terms of trading platforms, City Index excels by offering a combination of proprietary and industry-standard options. Their Web Trader platform is user-friendly and packed with advanced features, while the MT4 integration caters to traders who prefer the familiarity and flexibility of the popular third-party platform. The availability of mobile trading apps and TradingView further demonstrates City Index's commitment to providing a seamless and accessible trading experience.

Throughout my interaction with City Index's customer support, I have found them to be knowledgeable, responsive, and dedicated to resolving queries efficiently. The availability of multiple support channels and the provision of educational resources, such as webinars, trading guides, and market analysis, showcase their commitment to empowering traders and fostering a supportive trading community.

While City Index may not currently offer promotions or bonuses, I believe this reflects their focus on providing a high-quality, reliable service rather than relying on short-term incentives. Their emphasis on building long-term relationships with traders based on the strength of their core offering is a testament to their integrity and confidence in their platform.

In conclusion, I highly recommend City Index as a trustworthy and reliable broker for traders of all levels. Their strong regulatory compliance, wide range of markets, competitive pricing, advanced trading platforms, and commitment to client support make them a compelling choice in the online trading space. Whether you are a novice trader looking to learn the ropes or an experienced investor seeking a robust platform, City Index has the tools and resources to support your trading journey.