Cryptorocket Review 2025: A Legit Forex Broker for Market Traders

Cryptorocket

Saint Vincent and the Grenadines

Saint Vincent and the Grenadines

-

Minimum Deposit $10

-

Withdrawal Fee $varies

-

Leverage 500:1

-

Spread From 0.1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

Softwares & Platforms

Customer Support

()

()

Supported language: Arabic, English, Russian, Spanish

Social Media

Summary

CryptoRocket was an unregulated forex and CFD broker based in St. Vincent and the Grenadines, offering trading on platforms like MetaTrader 4. It provided access to various instruments, including forex, cryptocurrencies, stocks, and commodities, with leverage up to 1:500 and a low minimum deposit requirement. However, the broker faced multiple warnings from regulators such as Spain's CNMV and Canada's BCSC for operating without proper authorization. In October 2024, CryptoRocket ceased all operations, citing a challenging commercial landscape. Due to its unregulated status and regulatory warnings, traders are advised to exercise caution when dealing with such brokers.

- Low $10 minimum deposit

- Tight spreads from 0.1 pips

- MT4 for desktop, web and mobile

- 35 cryptos for trading

- Leverage up to 500:1

- Negative balance protection

- Bitcoin funding & withdrawal

- 24/5 support in 4 languages

- Free VPS

- Bonuses & rebates for extra trading capital

- NO REGULATION – Not licensed by any government authority

- No investor protections – clients at high risk

- Does not accept clients from US, Canada, EU, Australia & other countries

- No proprietary platform

- Limited research & education

- High bonus turnover requirements (30-50x)

- Support not 24/7

- Mandatory USD conversion on deposits

- Limited funding methods

- No weekend customer service

Overview

Cryptorocket is an online broker founded in 2018 and based in St. Vincent and the Grenadines. While this broker specialises in cryptocurrencies, it also offers trading in 55 forex pairs, 64 stocks, 11 indices and several commodities.

Some notable features of Cryptorocket include:

- Low minimum deposit of just $10

- Leverage up to 500:1

- Tight spreads from 0.1 pips

- Fast order execution speeds

- 24/7 customer support via live chat, email and callback

However, a major drawback is that Cryptorocket is not regulated by any jurisdiction. This lack of regulatory oversight is a significant red flag in terms of the safety and security of client funds. The broker is also not transparent about its ownership structure.

For more details on Cryptorocket's offerings, visit https://www.cryptorocket.com/.

Overview Table

| Type of Broker | Online CFDs/Forex Broker |

|---|---|

| Founded | 2018 |

| Headquarters | St Vincent and the Grenadines |

| Regulation | Unregulated |

| Tradable Assets | 55 Forex pairs, 35 Cryptos, 64 Stocks, 11 Indices, Commodities |

| Platforms | MT4, WebTrader, Mobile apps |

| Minimum Deposit | $10 |

| Leverage | Up to 500:1 |

| Spreads | From 0.1 pips |

| Commissions | $6 per lot |

| Funding Methods | Credit/debit card, wire transfer, Bitcoin |

| Withdrawals | Credit/debit card, wire transfer, Bitcoin |

Facts list

- Founded in 2018 and based in St Vincent and the Grenadines

- Unregulated broker – not licensed by any authority

- Offers trading on 55 forex pairs, 35 cryptocurrencies, 64 stocks, 11 indices and commodities

- Low minimum deposit requirement of just $10

- High maximum leverage of 500:1

- Tight spreads starting from 0.1 pips

- Charges commissions of $6 per standard lot traded

- Provides the MT4 platform for desktop, web and mobile trading

- Supports credit/debit card, wire transfer and Bitcoin for deposits and withdrawals

- Offers 24/7 customer support via live chat, email and callback

Cryptorocket Licenses and Regulatory

Cryptorocket is not regulated by any financial authority. The broker is registered in St Vincent and the Grenadines, a jurisdiction known for its lax regulations. This means Cryptorocket can operate with very little oversight or accountability.

The lack of regulation is very concerning from a safety standpoint. With no governing body supervising Cryptorocket's activities, there are no guarantees that client funds are being properly segregated or that the broker is maintaining adequate capital. If Cryptorocket were to become insolvent, traders may have little recourse for recovering their money.

Reputable brokers will hold one or more licenses from respected regulators like the FCA, ASIC or CySEC. These agencies require brokers to submit regular reports, maintain minimum capital levels and comply with strict client protection rules. Cryptorocket does not appear to adhere to any such standards.

While Cryptorocket states that client funds are held in segregated accounts, this claim cannot be independently verified. The lack of transparency about the broker's banking relationships and corporate structure is also troubling.

Ultimately, trading with an unregulated broker like Cryptorocket entails significantly more risk compared to using a licensed, reputable broker. Traders should be aware that they may have little protection or recourse if issues arise with deposits or withdrawals. Caution is strongly advised.

Regulations List

- Not licensed or regulated by any authority

Trading Instruments

Cryptorocket offers a broad selection of tradable instruments across multiple asset classes:

| Market | Instruments | Key Details |

|---|---|---|

| Forex | 55 currency pairs (majors, minors, exotics) | Tight spreads from 0.1 pips on EUR/USD |

| Cryptocurrencies | 35 crypto pairs (Bitcoin, Ethereum, Litecoin, Ripple, Dash, etc.) | Trade crypto/fiat pairs and crypto/crypto pairs |

| Stocks | 64 share CFDs (US, UK, European companies) | Includes Apple, Facebook, Google, Tesla |

| Indices | 11 global index CFDs | Includes S&P 500, NASDAQ 100, FTSE 100, DAX 30 |

| Commodities | Precious metals (gold, silver), Energies (crude oil, natural gas) | Popular commodities for trading |

The range of markets is fairly standard compared to most online brokers. The selection covers the most heavily traded instruments in each category.

One potential downside is the broker's focus on CFDs. These derivative products may not be available to traders in all countries due to regulatory restrictions. Muslim traders also cannot trade CFDs as they do not comply with Islamic law.

Trading Platforms

Cryptorocket provides the popular MetaTrader 4 (MT4) platform for trading.

MT4 is available for:

Desktop

- Windows PC

- Mac OS

Web Browser

- Accessible without any downloads or installation

- Supports Chrome, Firefox, Safari and other browsers

Mobile

- iPhone

- Android

Key features of MT4 include:

- Fast trade execution with one-click trading

- Real-time quotes and charts

- Customizable technical analysis with 50+ indicators and drawing tools

- Algo trading compatible using Expert Advisors (EAs)

- Secure login with 128-bit encryption

MT4 is the industry-standard platform trusted by millions of traders worldwide. It is feature-rich and highly customisable to suit different trading styles.

The main drawback of MT4 is that it can have a steep learning curve for beginners. The user interface is quite complex with numerous options and settings to configure. Cryptorocket does not appear to offer its own proprietary web platform so traders are limited to just MT4.

Cryptorocket also does not support the newer MetaTrader 5 (MT5) platform currently. Many brokers now offer both MT4 and MT5 to give traders a choice.

Trading Platform Comparison

| Feature | MT4 Desktop | MT4 WebTrader | MT4 Mobile |

|---|---|---|---|

| 1-click trading | Yes | Yes | Yes |

| Customizable layout | Yes | Yes | Limited |

| Technical analysis | 50+ indicators, 30+ drawing tools | 30+ indicators, 24 drawing tools | 30+ indicators, 24 drawing tools |

| Real-time quotes | Yes | Yes | Yes |

| Alerts and notifications | Yes | Yes | Yes |

| Trade history | Yes | Yes | Yes |

| News feed | Yes | Yes | Yes |

| Algo trading | Yes | No | No |

| Hedging | Yes | Yes | Yes |

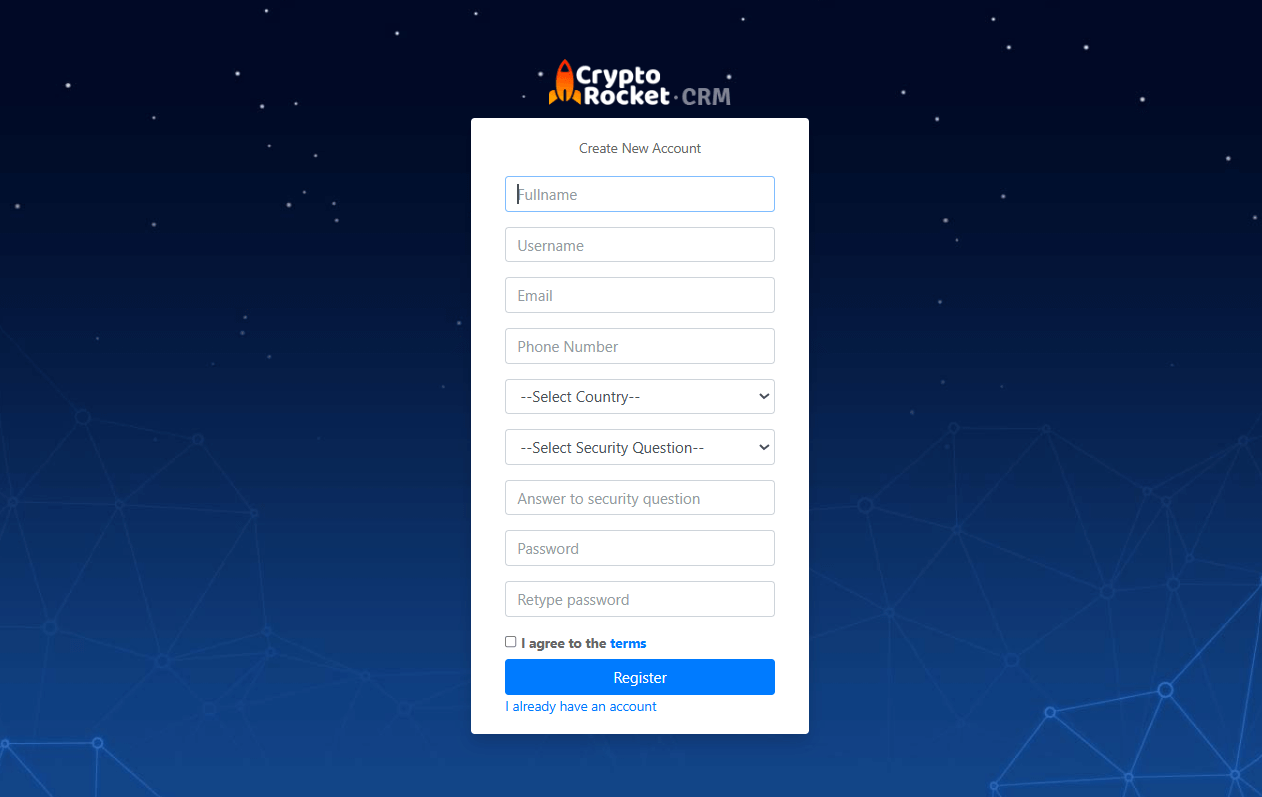

Cryptorocket How to Open an Account: A Step-by-Step Guide

To open an account with Cryptorocket:

- Go to https://www.cryptorocket.com/ and click "Open Account"

- Enter your name, email, phone number and country of residence

- Choose your account currency (USD or BTC) and leverage

- Accept the terms & conditions and click "Register"

- Verify your email address

- Log in to Cryptorocket Client Portal

- Submit proof of ID (e.g. passport) and proof of residence (e.g. utility bill)

- Wait 1-2 days for your documents to be reviewed and approved

- Make a deposit using credit card, wire transfer or BTC to start trading

The account opening process is quick and straightforward. Most accounts are approved within 1 business day.

The minimum deposit is $10 for credit card payments. This is one of the lowest minimum deposits in the industry. There is no minimum deposit for wire transfers or BTC transactions.

Cryptorocket does not charge any account opening or maintenance fees. Deposits and withdrawals are also free.

One thing to note is that Cryptorocket will convert all deposits to USD upon receipt. Withdrawals are only processed in USD (for credit card and wire transfer) or BTC. This may not be ideal for non-US clients.

Charts and Analysis

Cryptorocket provides access to a variety of trading tools and resources:

| Feature | Details |

|---|---|

| Charts | - Real-time price charts for all tradable instruments - Timeframes from 1 minute to 1 month - 50+ technical indicators (e.g., moving averages, MACD, RSI) - 30+ drawing tools (e.g., trendlines, Fibonacci retracements, Gann Lines) - Ability to trade directly from charts |

| Market Analysis | - Daily market reviews covering major forex, commodity, and stock index markets - Weekly trading ideas and technical set-ups - Fundamental analysis reports on high-impact news releases - Real-time news feed from top-tier sources (e.g., Reuters) |

| Economic Calendar | - Coverage of key economic data releases from 40+ countries - Includes previous, forecast, and actual figures for each event - Automatic chart updates when data is released - Personal calendar for saving important events |

| Sentiment | - Real-time long/short positioning data for major forex pairs - Data sourced from Cryptorocket client trades - Helps gauge current market sentiment and potential trend reversals |

| Calculators | - Pip calculator for determining pip values and stop loss/take profit levels - Margin calculator for required margin based on volume and leverage - Currency converter for quick exchange rate calculations |

All of these tools are free to use for Cryptorocket clients. The selection is comparable to what's offered by other leading brokers.

However, some key resources are missing. There are no webinars, video tutorials or in-person seminars for beginners. The broker does not appear to have a full trading course or structured educational curriculum.

The analysis and research are also quite limited compared to larger brokers. There are no detailed forecasts, trade ideas or strategy guides provided.

Overall, while Cryptorocket covers the basics, their offering falls short of the best brokers in this area. Traders can find more comprehensive education and powerful trading tools with other providers.

Cryptorocket Account Types

Cryptorocket offers one main account type, the Standard Account:

Standard Account

- Minimum deposit: $10

- Spreads from 0.1 pips

- Commissions: $6 per lot

- Leverage up to 500:1

- Tradable assets: 55 FX pairs, 35 cryptos, 64 stocks, 11 indices, commodities

- Platform: MT4

- min. trade size: 0.01 lots

- Max. trade size: 100 lots

- Scalping allowed

- Hedging allowed

- Free VPS hosting

The Standard Account has a very competitive cost structure with tight spreads and low commissions. It provides good flexibility for all common forex strategies like day trading, scalping and position trading. The high leverage and low minimum trade size also make the account very accessible.

Demo Account

- $10,000 virtual money

- Real market conditions

- Valid for 30 days

- Can be extended on request

The Demo Account is ideal for beginners who want to practice trading risk-free. It can also be useful for testing strategies and EAs before committing real money.

Islamic Account

- Swap-free

- No other differences vs Standard Account

Overall, Cryptorocket's account lineup is quite basic. The lack of a higher-tier account with lower spreads or VIP perks is a drawback for high-volume traders.

Many competitors offer a wider variety including Raw ECN, Zero Spread, VIP, Professional and Islamic account types. These often have lower trading costs, added benefits or specialised features for different trading styles.

Account Types Comparison

| Feature | Standard | Demo | Islamic |

|---|---|---|---|

| Minimum deposit | $10 | n/a | $10 |

| Spreads from | 0.1 pips | 0.1 pips | 0.1 pips |

| Commissions | $6/lot | n/a | $6/lot |

| Leverage up to | 500:1 | 500:1 | 500:1 |

| Tradable assets | 55 FX, 35 cryptos, 64 stocks, 11 indices, commodities | 55 FX, 35 cryptos, 64 stocks, 11 indices, commodities | 55 FX, 35 cryptos, 64 stocks, 11 indices, commodities |

| Platform | MT4 | MT4 | MT4 |

| Min. trade size | 0.01 lots | 0.01 lots | 0.01 lots |

| Max. trade size | 100 lots | 100 lots | 100 lots |

| Scalping allowed | Yes | Yes | Yes |

| Hedging allowed | Yes | Yes | Yes |

| Swap free | No | No | Yes |

| Free VPS | Yes | No | Yes |

Negative Balance Protection

Cryptorocket offers negative balance protection on all trading accounts. This means that clients cannot lose more than their account balance. Negative balance protection can come into effect during extreme market volatility. If a client's usable margin falls to zero and their open positions cannot be closed at the initial requested price, Cryptorocket will absorb the negative balance. For example, say a trader has an account balance of $1,000 and opens a large EUR/USD position using the maximum available leverage. Due to a major news shock, their position is closed at a loss of $1,200. Without negative balance protection, the client would owe Cryptorocket $200. With this protection in place, Cryptorocket will reset the account balance to zero. The trader will not owe money to the broker. It's an important risk management tool, especially for clients using high leverage. All accounts have negative balance protection enabled by default.

Cryptorocket Deposits and Withdrawals

Cryptorocket supports the following payment methods:

Deposit Method

| Deposit Method | Fees | Processing Time | Minimum Deposit | Additional Notes |

|---|---|---|---|---|

| Credit/Debit Card (Visa, Mastercard) | No fees from Cryptorocket (check with card provider) | Instant | $10 | Instant deposit, Visa and Mastercard accepted |

| Wire Transfer | No fees from Cryptorocket (check with bank) | 2-5 business days | $10 | Deposit may take 2-5 days based on the bank's processing time |

| Bitcoin Transfer | No fees from Cryptorocket (check with provider) | Instant | $10 | Fast and convenient method for BTC deposits |

Withdrawal Method

| Withdrawal Method | Fees | Processing Time | Minimum Withdrawal | Additional Notes |

|---|---|---|---|---|

| Credit/Debit Card | No fees from Cryptorocket (check with card provider) | Within 1 business day | $10 | Faster processing for withdrawals to credit/debit cards |

| Wire Transfer | No fees from Cryptorocket (check with bank) | 2-5 business days | $10 | Withdrawal processing time may vary based on the bank |

| Bitcoin Transfer | No fees from Cryptorocket (check with provider) | 2-5 business days | $10 | Fast but may depend on blockchain network conditions |

Support Service for Customer

Cryptorocket offers 24/5 customer support from 9:00am Monday to 6:00pm Friday GMT+3. The support channels are:

- Accessible from any page on cryptorocket.com

- Instant connection to a support agent

- Wait times under 1 minute

- Good for simple queries

- support@cryptorocket.com

- Typical reply time from 30 minutes to 6 hours

- Submit callback request on cryptorocket.com/contact-us

- Specify convenient time to receive call

- Agent will call client's provided phone number

- Share screen with support agent for technical troubleshooting

- Accessed via live chat or scheduled in advance

- Facebook: https://www.facebook.com/CryptoRocketFX

- Twitter: https://twitter.com/cryptorocket4

- English

- Russian

- Spanish

- Arabic

Customer Support Comparison

| Channel | Availability | Languages |

|---|---|---|

| Live chat | 24/5, <1 min wait time | EN, RU, ES, AR |

| 30 min - 6 hr response | EN, RU, ES, AR | |

| Phone callback | 24/5, scheduled in advance | EN, RU, ES, AR |

| Remote assistance | 24/5, via live chat or scheduled | EN |

Prohibited Countries

Cryptorocket does not accept clients from the following countries:

- United States

- Canada

- Japan

- Australia

- Belgium

- Israel

- Palestine

- Panama

- Ghana

- Yemen

- North Korea

- Iran

- South Sudan

- Sudan

- Syria

The United States prohibits CFD and forex trading via the Dodd-Frank Act. Brokers must obtain a special license from US regulators to accept American clients, which Cryptorocket does not have.

The other countries have similar laws that prohibit CFD and OTC derivatives trading to retail clients. Cryptorocket has likely chosen not to obtain the necessary licenses in these jurisdictions.

Non-compliance can result in severe fines and legal consequences for brokers. Some prohibited countries like Iran and North Korea are also subject to international sanctions.

Note that this list can change from time to time depending on regulations. Always check with Cryptorocket for the latest banned countries before attempting to open an account.

Special Offers for Customers

Cryptorocket has the following promotions for clients:

50% Deposit Bonus:

- Get a 50% bonus on your first deposit

- Minimum deposit $100 to qualify

- Bonus funds can be used for trading but cannot be withdrawn

- 30x turnover required to withdraw bonus profits

- Offer valid for first 30 days after account opening

Cash Rebates:

- Up to $6 per lot rebate on trades

- Earn up to 20% of spread back in cash

- Rebate credited to account balance at end of each trading day

- No turnover requirements or withdrawal restrictions

While these offers can provide extra trading capital, they come with strings attached. The high turnover requirements make it difficult to actually withdraw any profits from the bonuses.

In our experience, the deal terms tend to favour the broker. Most traders are better off not accepting bonus funds.

The cash rebates offer is more straightforward, but the rebates are quite small relative to the total trading costs. Cryptorocket's spreads and commissions are in line with industry averages, so the rebates do not make it a more affordable broker overall.

Conclusion

After carefully reviewing Cryptorocket across key areas like regulation, trading conditions, platforms, research and more, I'm quite cautious about recommending this broker.

The biggest red flag is Cryptorocket's lack of licensing and oversight. As an unregulated broker, Cryptorocket is not held to the same standards as authorised firms in major jurisdictions like the US, UK or Australia. Client protections are minimal and there's little recourse if the broker violates its obligations. It's unclear who actually owns and operates Cryptorocket, which is another concerning sign.

That said, Cryptorocket does a few things well. The account minimum is just $10, making it accessible to beginners. Spreads start from 0.1 pips, which is competitive with other STP brokers. All clients can trade on the industry-leading MT4 platform with leverage up to 500:1.

Cryptorocket offers 24/5 multilingual support, though the communication channels and response times are just average. The education and research are also limited compared to the best brokers.

So while there are some bright spots, it's hard to look past Cryptorocket's regulatory issues. I believe traders are better off with a fully licensed broker that provides greater transparency and client protection. Established brands like IG, OANDA, Saxo Bank and XTB offer competitive pricing, professional platforms and helpful resources without the same level of risk.

If you do decide to trade with Cryptorocket, start with a small amount of risk capital. Thoroughly test the broker's execution and service quality before depositing more money. Keep in mind that you're unlikely to receive much help from regulators if you encounter problems with deposits, withdrawals or trade execution.

In summary, Cryptorocket has some appealing features on the surface but too many concerns under the hood to earn a strong endorsement. Traders shouldn't be lured in by the flashy offers – the lack of proper regulation is a major risk factor. Consider your alternatives carefully before opening an account.