DB Investing Broker Review: Regulated Forex Trading Under FSA Oversight

DB Investing

United Arab Emirates

United Arab Emirates

-

Minimum Deposit $50

-

Withdrawal Fee $varies

-

Leverage 1000:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

Japan Forex Trading License

Japan Forex Trading License

Securities Brokerage License

Securities Brokerage License

Softwares & Platforms

Customer Support

+97144268730

(English)

+97144268730

(English)

Supported language: English, German, Portuguese, Indonesian, Arabic, Italian, Tamil

Social Media

Summary

DB Investing is a multi-regulated Forex and CFD broker established in 2018, with its main office in Dubai and additional branches across six countries. It offers STP/ECN execution with access to global markets, including forex, stocks, commodities, and crypto. Traders benefit from high leverage up to 1:1000, spreads from 0.0 pips, and social trading features via platforms like MT5 and ZuluTrade. While regulated by the FSA (Seychelles) and UAE’s SCA, its offshore license may be considered less stringent than top-tier regulators. The broker supports both beginner and experienced traders with various account types and educational tools.

- Wide range of tradable assets across multiple markets

- Competitive spreads from 0 pips and low commissions

- High leverage up to 1:1000

- MetaTrader 5 platform with advanced tools and mobile app

- Proprietary Sirix WebTrader for flexible browser-based trading

- Social trading available via ZuluTrade integration

- Diverse account types for beginner to professional clients

- Low minimum deposit of $50 for standard accounts

- Regulated by FSA Seychelles and UAE SCA

- Educational resources and market analysis tools

- Offshore regulation with less oversight than top-tier authorities

- Limited to OTC markets, no exchange-traded securities

- Reported issues with withdrawal delays by some users

- High minimum deposits of $5000 for premium accounts

- Not available to residents of the US, UK, EU, and Canada

- Potential conflict of interest as a market maker

- Limited transparency on financial information and executive team

- Restrictions on scalping and hedging in trading terms

- Bonuses come with high volume requirements

- Lack of investor protection schemes like FSCS/SIPC

Overview

DB Investing is a global Forex and CFD broker that was established in 2018. With headquarters in Dubai, UAE and additional offices in Seychelles, Cyprus, Nigeria, Egypt, Malta, and Saudi Arabia, they provide traders worldwide with access to over-the-counter (OTC) markets. As an STP (Straight Through Processing) and ECN (Electronic Communication Network) broker, DB Investing enables trading in various assets including currencies, stocks, commodities, indices, metals and cryptocurrencies.

The broker offers competitive features like high leverage up to 1:1000, social trading, multi-account management, low spreads from 0 pips, and fast execution speeds. They cater to both beginner and experienced traders with a user-friendly MT5 platform and educational resources.

While DB Investing is licensed by the Financial Services Authority (FSA) of Seychelles and the UAE's Securities and Commodities Authority (SCA), it's important to note that Seychelles is an offshore jurisdiction with more relaxed regulations compared to major regulators like the FCA or ASIC.

Overview Table

| Feature | Details |

|---|---|

| Foundation Year | 2018 |

| Headquarters | Dubai, UAE |

| Regulation | FSA Seychelles (SD053), SCA UAE (20200000197) |

| Trading Instruments | Forex, Stocks, Commodities, Indices, Metals, Crypto |

| Platforms | MetaTrader 5, Sirix WebTrader, ZuluTrade |

| Min. Deposit | $50 - $5,000 (depending on account type) |

| Max. Leverage | 1:1000 |

| Spreads | From 0.0 pips |

| Commission | $0-$4 per lot per side |

| Education | Ebooks, Webinars, Tutorials, Market News |

| Customer Support | Live Chat, Email, WhatsApp, Facebook, Telegram |

Facts List

- Founded in 2018

- Headquarters in Dubai, UAE with 6 other global offices

- Regulated by the FSA of Seychelles (license SD053) and UAE SCA (license 20200000197)

- Offers leveraged trading on Forex, stocks, indices, commodities, metals, cryptocurrencies

- Leverage up to 1:1000

- Minimum deposit of $50-$5000 depending on account type

- Spreads from 0.0 pips

- Commission from $0 to $4 per lot per side

- Trading platforms: MetaTrader 5, Sirix WebTrader, social trading via ZuluTrade

- Multiple account types for retail and Islamic traders

DB Investing Licenses and Regulatory

One of the most critical factors to consider when choosing a Forex broker is their regulatory status and compliance with industry standards. Here's what we found regarding DB Investing's regulations:

DB Investing Licenses

- Financial Services Authority (FSA) of Seychelles—License SD053

- Securities and Commodities Authority (SCA) of the United Arab Emirates—License 20200000197

As mentioned, DB Investing is authorised and regulated by the Seychelles FSA. Established in 2013, the FSA oversees the non-bank financial services sector and ensures brokers adhere to compliance requirements.

However, it's crucial to note that Seychelles is an offshore jurisdiction, often preferred by brokers for its relatively relaxed regulations and lower operating costs. While FSA regulation provides some oversight, it's not as stringent or reputable as licenses from major regulators like the FCA, ASIC, or CYSEC which prioritise investor protection.

DB Investing is also licensed by the UAE's SCA under category 5 for arranging and advising. The SCA aims to develop the legislative structure and regulatory framework relating to the securities sector.

To their credit, DB Investing does provide additional safety measures like negative balance protection to prevent client losses exceeding deposits and mandatory KYC verification.

However, the absence of licensing from tier-1 regulators, the offshore nature of the Seychelles FSA, and some negative user feedback alleging issues with withdrawals are concerns to be aware of when deciding to trade with DB Investing. Traders must weigh the potential benefits against the risks.

Trading Instruments

DB Investing offers a wide range of trading instruments, giving clients access to diverse markets:

| Asset Class | Description |

|---|---|

| Forex | Major, minor, and exotic currency pairs (e.g., EUR/USD, USD/TRY, GBP/JPY) |

| Stocks | CFDs on global company shares listed on major stock exchanges |

| Indices | CFDs on top global indices like S&P 500, NASDAQ, DAX 40, NIKKEI 225, and more |

| Commodities | Trade energy products (oil, natural gas) and agricultural commodities (e.g., wheat, coffee) |

| Metals | Spot trading on gold (XAU), silver (XAG), platinum, palladium, and copper |

| Cryptocurrencies | Trade popular digital assets like Bitcoin, Ethereum, Litecoin, and Ripple |

DB Investing also provides CFDs on ETFs, bonds, and real stocks from regional MENA markets. The extensive asset offering caters to various trading strategies and goals.

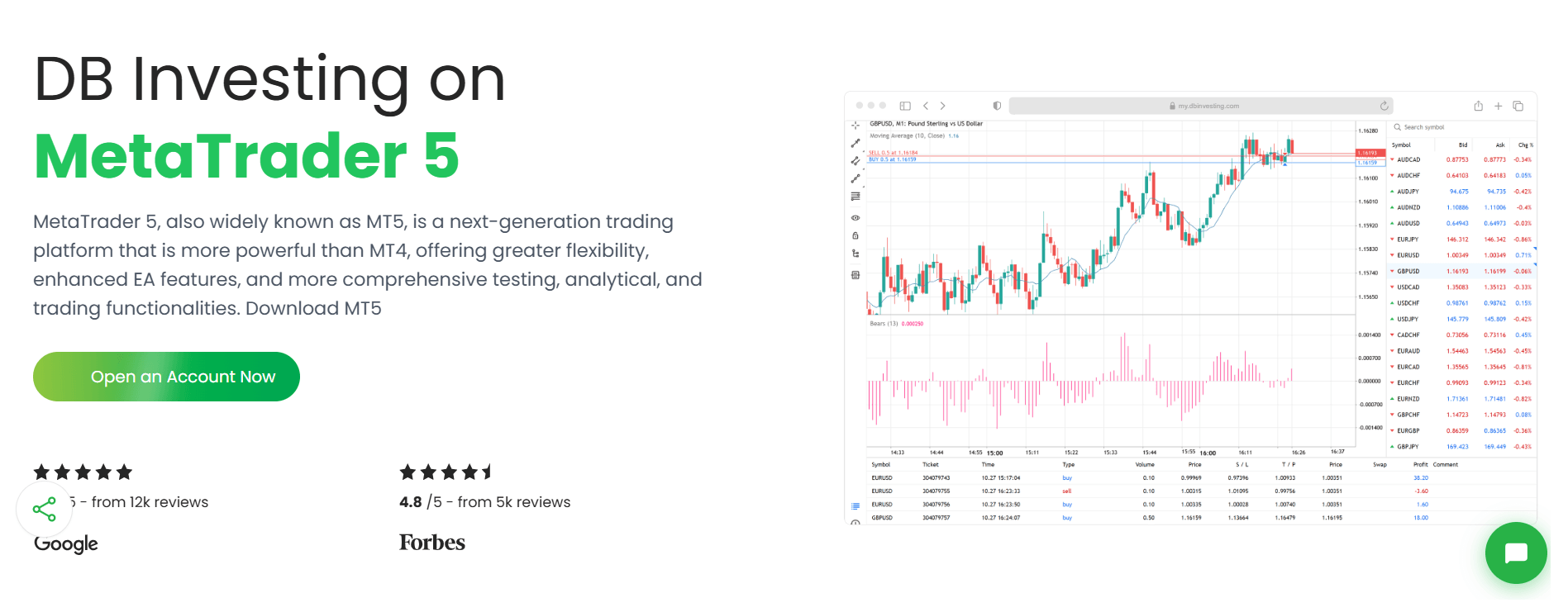

Trading Platforms

DB Investing supports the industry-standard MetaTrader 5 (MT5) platform, known for its advanced charting, technical indicators, and algorithmic trading tools. The broker also offers their proprietary Sirix WebTrader for web-based trading.

Trading Platforms

- MetaTrader 5 (MT5) desktop, web, and mobile

- Sirix WebTrader on web browsers

- Social trading via ZuluTrade

MT5 provides a powerful and flexible trading experience with features like:

- 21 timeframes

- 38 built-in indicators

- 44 graphic objects

- Multi-threaded strategy tester

- Upgraded MQL5 language

Sirix WebTrader is a professional web-based platform offering one-click trading, advanced order types, risk management tools, and customisable layouts.

Copy trading is available through ZuluTrade for those who prefer to automate their strategies or follow expert traders.

Trading Platforms Comparison

| Feature | MT5 | Sirix WebTrader |

|---|---|---|

| Execution | Market, Instant | Market |

| Analysis | 38 Indicators | Advanced tools |

| Customization | Extensive | Flexible layouts |

| Algorithmic | MQL5 | Supported |

| Mobile App | iOS, Android | n/a |

| Social Trading | ZuluTrade | n/a |

DB Investing How to Open an Account: A Step-by-Step Guide

To start trading with DB Investing, follow these steps:

- Visit the DB Investing website and click "Open an Account"

- Fill out the registration form with personal details

- Choose your account type and base currency

- Verify your identity by uploading documents

- Make a deposit using available payment methods

- Download or access the trading platform and start trading

Requirements include a minimum deposit of $50-$5000, depending on account type, proof of identity and residence documents. Deposits can be made via credit card, e-wallets, or bank transfer.

Account verification is usually processed within 24 hours. Once the account is active, traders can login to MT5 or WebTrader with their credentials and begin executing trades.

Charts and Analysis

DB Investing provides a suite of tools and resources for market analysis to help inform trading decisions:

| Resource Type | Description |

|---|---|

| Live Webinars & Seminars | Interactive sessions covering trading strategies, market analysis, and platform tutorials |

| Ebooks & Tutorial Videos | Step-by-step guides for beginners to advanced traders; covers platforms and trading concepts |

| DB Market News | Real-time news and insights on major market movements and tradable assets |

| Trading Academy | Structured educational content designed to improve trader knowledge and skills |

| Economic Calendar | Key global data releases and central bank event schedules |

| Currency Converter | Tool to convert between global currencies quickly and accurately |

| ATP Calculators | Includes profit, margin, pip, and position size calculators |

| Signal Center | Community-driven trade ideas and analysis from experienced traders |

| FlexTV | On-demand video content featuring expert commentary, news, and analysis |

The broker offers both live sessions and recorded webinars covering strategies, market trends, and platform usage. Ebooks provide in-depth trading guides for beginner to advanced levels.

Their market news covers key developments and events across all tradable assets. The economic calendar highlights global data releases and central bank announcements.

For technical insights, DB Investing provides FX calculators, currency converters, a Signals Center for community trade ideas, and FlexTV for news and analysis videos.

The diversity of resources caters to the knowledge levels and learning preferences of different types of traders.

DB Investing Account Types

DB Investing offers 5 account types with varying features and minimum deposits:

- STP: Starts from $50, 1 pip spreads, 1:1000 leverage, no commission

- RAW: Starts from $5000, 0 pips, $4/side commission, 1:1000 leverage

- PRO: Starts from 5000, 0.3 pips, 5000, $ commission, 1:1000 leverage

- Islamic: $50 minimum, 1 pip spreads, no commission, 1:1000 leverage

- Islamic+: $5000 minimum, 0 pips, no commission, 1:1000 leverage

All accounts are available on the MT5 platform and allow a minimum trade size of 0.01 lots. Islamic accounts are swap-free, complying with Sharia law.

Account Types Comparison Table

| Feature | STP | RAW | PRO | Islamic | Islamic+ |

|---|---|---|---|---|---|

| Min. Deposit | $50 | $5,000 | $5,000 | $50 | $5,000 |

| Leverage | 1:1000 | 1:1000 | 1:1000 | 1:1000 | 1:1000 |

| Spreads | 1 pip | 0 pips | 0.3 pips | 1 pip | 0 pips |

| Commission | No | $4/lot | $1.50/lot | No | No |

| Swap-Free | No | No | No | Yes | Yes |

| Min. Trade | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 |

| Currencies | USD,EUR | USD,EUR | USD,EUR | USD,EUR | USD,EUR |

Negative Balance Protection

Protection DB Investing offers all clients negative balance protection, meaning traders cannot lose more than their account balance. This policy helps manage risk by preventing accounts from falling into a negative equity state due to extreme market volatility or abnormal trading conditions. If a trader's balance hits $0 or below, the broker will zero out the account to prevent further losses. It's an important safeguard, especially when using high leverage. However, negative balance protection doesn't cover losses incurred before hitting a zero balance. Proper risk management, such as setting stop-losses and controlling position sizing, is still essential for preserving capital.

DB Investing Deposits and Withdrawals

DB Investing supports the following payment methods for deposits and withdrawals:

Deposit Methods

| Method | Available Options | Minimum Deposit | Processing Time | Fees Charged |

|---|---|---|---|---|

| Credit/Debit Card | Visa, Mastercard | $50 | Instant to a few minutes | No broker fees (third-party may apply) |

| E-wallets | Fasapay, Jeton, Perfect Money | $50 | Instant to a few minutes | No broker fees (third-party may apply) |

| Bank Wire Transfer | – | $50 | 1–3 business days | No broker fees (third-party may apply) |

| Cryptocurrency | Bitcoin | $50 | Depends on network speed | No broker fees (third-party may apply) |

Withdrawal Methods

| Method | Availability | Minimum Withdrawal | Processing Time by Broker | Arrival Time to Account | Fees Charged |

|---|---|---|---|---|---|

| Bank Wire Transfer | Yes | $100 | Same business day (before 12:00 server time) | 3–5 business days | No broker fees (third-party may apply) |

| Same as Deposit Method | Yes (if method allows withdrawals) | $100 | Same business day (before 12:00 server time) | 3–5 business days (varies) | No broker fees (third-party may apply) |

Support Service for Customer

DB Investing provides multiple channels for customer support:

- 24/7 Live Chat on website

- Phone support: +971 4 526 8750

- Email: support@dbinvesting.com

- Social Media – Telegram, Facebook, Instagram, YouTube, LinkedIn

Customer Support Comparison

| Channel | Availability | Response Time |

|---|---|---|

| Live Chat | 24/7 | <5 minutes |

| Phone | 24/5 | <5 minutes (avg. wait) |

| 24/7 (responses in 24 hrs) | Within 24 hours | |

| Social Media | 24/7 | Varies by platform |

| FAQ | 24/7 | Instant |

Prohibited Countries

DB Investing does not accept clients from the following regions:

Prohibited Regions

- United States

- European Union

- United Kingdom

- Canada

- Countries restricted by the Financial Action Task Force (FATF)

Special Offers for Customers

DB Investing provides several promotions for clients:

Special Promotions

- Welcome Bonus: 100% match on first deposits up to $500.

- Cashback Rebate – Up to $1000 per quarter

- DB Rewards program – Points earned on paid trading commissions

- Profit Bonus – Claim up to $300 bonus on net profit

- Affiliate Contest – Earn cash prizes for referrals

The Welcome Bonus has a 45-day expiry and a 10x volume trading requirement. Cashback rebates depend on total trading volume per quarter. The DB Rewards program allows points to be redeemed for cash or other exclusive privileges.

Note that bonuses cannot be withdrawn directly and are subject to the broker's terms and conditions. Certain promotions may not be available to clients in all countries.

Conclusion

To conclude this deep dive into DB Investing, I believe they offer an appealing proposition for traders seeking a wide range of assets, account types, competitive pricing and an advanced yet user-friendly MetaTrader 5 platform. The addition of a proprietary WebTrader and social trading expand the options for market access.

DB Investing has taken steps to provide a secure trading environment through Seychelles FSA regulation, negative balance protection, and KYC procedures. The broker appears committed to client education, offering diverse resources for market analysis and skill building.

However, it's crucial to acknowledge the limitations and risks. As an offshore broker, DB Investing is not subject to the same stringent oversight as those licensed by top-tier regulators like the FCA or ASIC.

They also restrict clients from key regions like the US, UK, and EU, which may raise a flag for some traders. The reports of withdrawal issues, while not necessarily widespread, are still concerning. High leverage, while potentially beneficial, also amplifies the risk of rapid losses.

Overall, DB Investing seems to be a legitimate broker with some standing in the retail Forex market. Given their spread of features, they could make a reasonable choice for both beginners and experienced traders. But it's critical to make an informed choice based on individual preferences, risk tolerance and validating the broker's current conditions and credibility.

As with any financial service, traders should always operate with caution, use proper risk management, and never invest more than they can afford to lose. Thoroughly compare multiple brokers and stay informed through research to find the most suitable and trustworthy fit for your trading needs.