easyMarkets Review 2025: Pros, Cons & Key Features of This Trusted Broker

easyMarkets

Cyprus

Cyprus

-

Minimum Deposit $25

-

Withdrawal Fee $0

-

Leverage 400:1

-

Spread From 0.8

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Unavailable

-

Indices Unavailable

Licenses

Cyprus Market Making (MM)

Cyprus Market Making (MM)

South Africa Retail Forex License

South Africa Retail Forex License

Japan Forex Trading License

Japan Forex Trading License

Australia Retail Forex License

Australia Retail Forex License

Forex & CFD Brokerage License

Forex & CFD Brokerage License

Softwares & Platforms

Customer Support

+35725828899

(English)

+35725828899

(English)

Supported language: Chinese (Simplified), English, French, German, Italian, Spanish

Social Media

Summary

EasyMarkets is a trusted, globally regulated broker offering fixed spreads, intuitive platforms, and innovative risk management tools. Traders can access forex, commodities, indices, cryptocurrencies, and shares via its proprietary web platform, MetaTrader 4, MetaTrader 5, and TradingView. Standout features like dealCancellation, Freeze Rate, and negative balance protection provide enhanced control over trades. With strong educational resources and 24/5 customer support, it’s ideal for both beginners and experienced traders. While it delivers a seamless trading experience, its asset selection is smaller than some top competitors.

- Well-regulated by top-tier authorities like ASIC and CySEC

- Long-standing reputation since 2001

- Competitive spreads and trading conditions

- Unique risk management tools like dealCancellation and Freeze Rate

- Supports popular platforms MT4, MT5 and TradingView

- Responsive multilingual customer support

- Solid educational resources for beginners

- Research tools keep traders informed on market updates

- Promotions and loyalty programs can enhance returns

- Trading competitions and partnerships add diversity

- Prohibited from offering services in several countries

- VIP account requires high $10,000 minimum deposit

- Limited range of tradable assets compared to some brokers

- Web platform could use a modern design upgrade

- Educational content not as extensive as industry leaders

- No 24/7 customer support available

- Bonus and promotional offers have strict terms and conditions

- Potential fees or limited support for some deposit/withdrawal methods

- Lack of advanced tools for expert traders

- No social trading or copy trading available

Overview

easyMarkets is an online broker founded in 2001 that provides trading services for forex, CFDs, options, metals, commodities, indices, shares, and cryptocurrencies. Headquartered in Cyprus and regulated by top-tier authorities including ASIC, CySEC, and the FSC, easyMarkets has established a global presence with clients in over 150 countries.

easyMarkets stands out for its innovative trading features such as dealCancellation, Freeze Rate, and guaranteed stop loss and take profit. It offers both its own user-friendly web and mobile platforms as well as the industry-standard MetaTrader 4 and 5. Clients can access a wide selection of 230+ tradable instruments with competitive spreads and leverage up to 1:400.

The broker has won several awards over the years including "Best Trading Platform" at the 2021 Forex Expo Dubai and "Most Transparent Broker" at the 2020 Forex Traders Summit. It provides extensive educational resources and in-depth market analysis to support clients' trading journeys.

While generally well-regarded, potential drawbacks include higher spreads on the MT4/5 platforms, limited cryptocurrency options compared to some competitors, and no 24/7 customer support. Nonetheless, easyMarkets offers a solid, well-regulated trading environment catering to both beginners and more experienced traders.

For more details, please visit the official easyMarkets website at easymarkets.com.

easyMarkets Overview Table

| Attribute | Details |

|---|---|

| Headquarters | Limassol, Cyprus |

| Founded | 2001 |

| Regulator(s) | ASIC, CySEC, FSC BVI, FSCA, FSA Seychelles |

| Trust Score (Source: Traders Union) | 6.51/10 |

| Minimum Deposit | $25 |

| Instruments | Forex, CFDs, Options, Metals, Commodities, Indices, Shares, Cryptocurrencies |

| Platforms | easyMarkets Web & Mobile, TradingView, MT4, MT5 |

| Spreads | From 0.8 pips (EUR/USD) |

| Leverage | Up to 1:400 |

| Deposit/Withdrawal | Bank transfer, credit/debit card, e-wallets (fees may apply from payment providers) |

| Customer Support | 24/5 via phone, email, live chat |

easyMarkets Facts List

- easyMarkets was founded in 2001 and is headquartered in Limassol, Cyprus.

- The broker is regulated by top-tier financial authorities including ASIC (Australia), CySEC (Cyprus), and the FSC (British Virgin Islands).

- easyMarkets offers a wide range of 230+ tradable instruments across forex, CFDs, options, metals, commodities, indices, shares, and cryptocurrencies.

- Clients can trade on easyMarkets' own user-friendly web and mobile platforms, the popular MetaTrader 4 and 5 software, or directly via TradingView charts.

- Innovative trading tools unique to easyMarkets include dealCancellation (undo losing trades), Freeze Rate (eliminate slippage), and guaranteed stop loss and take profit orders.

- Spreads start from a competitive 0.8 pips on the EUR/USD, though they are higher on the MT4/5 platforms compared to the proprietary platform. Maximum leverage is 1:400.

- The minimum deposit requirement is just $25, making it accessible to traders with smaller accounts. Deposits and withdrawals are available via bank transfer, credit/debit cards, and e-wallets.

- easyMarkets provides extensive educational content including articles, videos, eBooks, webinars, tutorials, and a forex trading course. Its in-depth market analysis features Trading Central signals.

- Customer support is available 24/5 via phone, email, and live chat. The website is available in 12 languages including English, Arabic, German, Spanish, and Chinese.

- easyMarkets has operated for over 20 years and serves clients in more than 150 countries worldwide. It has won multiple industry awards over the years for its platform and services.

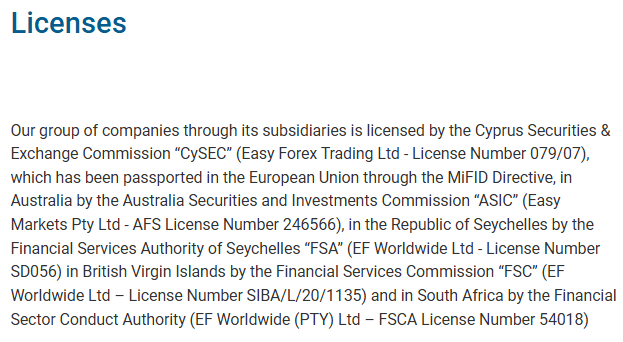

easyMarkets Licenses and Regulatory

easyMarkets operates under a robust regulatory framework, holding licenses from several respected financial authorities worldwide. This multi-jurisdictional approach to regulation provides an enhanced level of security and trust for clients.

| Regulator | Entity Name | License Number |

|---|---|---|

| Australian Securities and Investment Commission (ASIC) | Easy Markets Pty Ltd | 246566 |

| Cyprus Securities and Exchange Commission (CySEC) | Easy Forex Trading Ltd | 079/07 |

| Financial Services Commission (FSC) - British Virgin Islands | EF Worldwide Ltd | SIBA/L/20/1135 |

| Financial Sector Conduct Authority (FSCA) - South Africa | EF Worldwide (PTY) Ltd | 54018 |

| Financial Services Authority (FSA) - Seychelles | EF Worldwide Ltd | SD056 |

In terms of industry standards, easyMarkets' regulatory profile is on par with many of its peers. Most reputable brokers in the forex and CFD space hold licenses from at least one, if not multiple, well-respected regulators. However, the combination of ASIC and CySEC licensing does set easyMarkets apart from some competitors and provides a strong foundation of regulatory compliance.

Trading Instruments

easyMarkets offers a wide range of tradable assets across multiple categories, providing traders with diverse opportunities to invest and speculate in the financial markets. The broker's extensive portfolio includes over 230 instruments, catering to various trading styles and risk appetites.

| Instrument Type | Details |

|---|---|

| Forex | 63 currency pairs (majors, minors, exotics); competitive spreads from 0.8 pips |

| Share CFDs | 63 stocks (e.g., Apple, Amazon, Facebook, Netflix); below the industry average of 100-500 |

| Index CFDs | 14 indices (e.g., S&P 500, NASDAQ, FTSE 100, DAX 30); above the typical 5-10 indices offered by most brokers |

| Cryptocurrency CFDs | 20+ cryptocurrencies (e.g., Bitcoin, Ethereum, Litecoin, Ripple); competitive compared to the industry standard of 10-20 |

| Commodities & Metals | 31 markets, including gold, silver, oil, natural gas, wheat, corn; more extensive than the average 5-10 commodities |

| Metals Denominations | Available in multiple currency denominations for flexibility |

| Vanilla Options | 26 options contracts on major forex pairs & metals; significantly higher than the industry average of 5-10 |

| Futures Contracts | 12 contracts on indices like S&P 500, NASDAQ, Dow Jones; within the industry norm of 10-20 |

The diversity of tradable assets offered by easyMarkets is a significant advantage for traders. It allows for the construction of versatile portfolios and the implementation of various trading strategies. The broker's offerings cater to both short-term speculators and long-term investors, with instruments suitable for different market conditions and risk profiles.

Trading Platforms

easyMarkets provides clients with a range of trading platforms to suit different preferences and needs. Whether you're a beginner or an experienced trader, the broker offers user-friendly and feature-rich options to facilitate your trading experience.

Proprietary Platform

easyMarkets' proprietary web-based platform is designed for simplicity and ease of use. It features a clean, intuitive interface that allows traders to access all the necessary tools and functionalities from a single screen. The platform includes advanced charting powered by TradingView, with over 90 technical indicators and drawing tools for in-depth market analysis.

One of the standout features of easyMarkets' proprietary platform is the dealCancellation tool, which allows traders to "undo" losing trades within 60 minutes for a small fee. This innovative risk management tool provides an extra layer of protection and flexibility. Other notable features include Freeze Rate (locking in a preferred rate), partial closing of positions, and guaranteed stop loss and take profit orders.

The proprietary platform is accessible via web browsers on desktop and mobile devices, providing seamless cross-platform trading. easyMarkets also offers a dedicated mobile app for iOS and Android, enabling traders to monitor and manage their positions on the go.

MetaTrader 4 and 5

For traders who prefer the familiarity and advanced features of MetaTrader, easyMarkets offers both MT4 and MT5 platforms. These industry-standard platforms are known for their reliability, fast execution speeds, and wide range of technical analysis tools.

MT4 and MT5 support automated trading through Expert Advisors (EAs), allowing traders to implement algorithmic strategies and trading bots. The platforms also feature a large community of users who share custom indicators, EAs, and trading scripts, providing an ecosystem for collaboration and learning.

While MT4 is the more widely used version, MT5 offers additional features such as depth of market (DOM), built-in economic calendar, and expanded timeframes. Both platforms are available for desktop, web, and mobile, providing flexibility for traders.

easyMarkets' MT4 and MT5 offerings include a choice of fixed or variable spreads and leverage up to 1:400, depending on the account type and instrument. The broker provides a range of trading accounts with different minimum deposit requirements to cater to various budgets.

Integration with TradingView

In addition to its proprietary platform and MetaTrader, easyMarkets offers integration with TradingView, a popular web-based charting and social trading platform. This integration allows traders to access TradingView's advanced charting tools and social features while executing trades through their easyMarkets account.

TradingView is known for its extensive library of indicators, drawing tools, and customizable charts. It also supports a large community of traders who share ideas, analysis, and trading strategies, fostering a collaborative learning environment.

Trading Platforms Comparison Table

| Feature | easyMarkets Web Platform | easyMarkets Mobile App | MetaTrader 4 (MT4) | MetaTrader 5 (MT5) | TradingView Integration |

|---|---|---|---|---|---|

| User Interface | Clean, intuitive | User-friendly | Customizable | Customizable | Advanced charting |

| Charting | TradingView powered, 90+ indicators | Basic charting | 30+ built-in indicators | 38+ built-in indicators | 100+ indicators, drawing tools |

| Automated Trading | No | No | Yes (Expert Advisors) | Yes (Expert Advisors) | No |

| Order Types | Market, limit, stop, guaranteed stop loss, take profit | Market, limit, stop, guaranteed stop loss, take profit | Market, limit, stop, trailing stop, OCO | Market, limit, stop, trailing stop, OCO | N/A |

| Risk Management Tools | dealCancellation, Freeze Rate | dealCancellation, Freeze Rate | Stop loss, take profit | Stop loss, take profit | N/A |

| Social Trading | No | No | Copy Trading Signals | Copy Trading Signals | Ideas, scripts, strategies |

| Availability | Web, mobile | iOS, Android | Desktop, web, mobile | Desktop, web, mobile | Web |

| Unique Features | Partial closing, guaranteed stop loss | Partial closing, guaranteed stop loss | Customizable EAs, large community | Depth of Market, economic calendar | Advanced charting, social features |

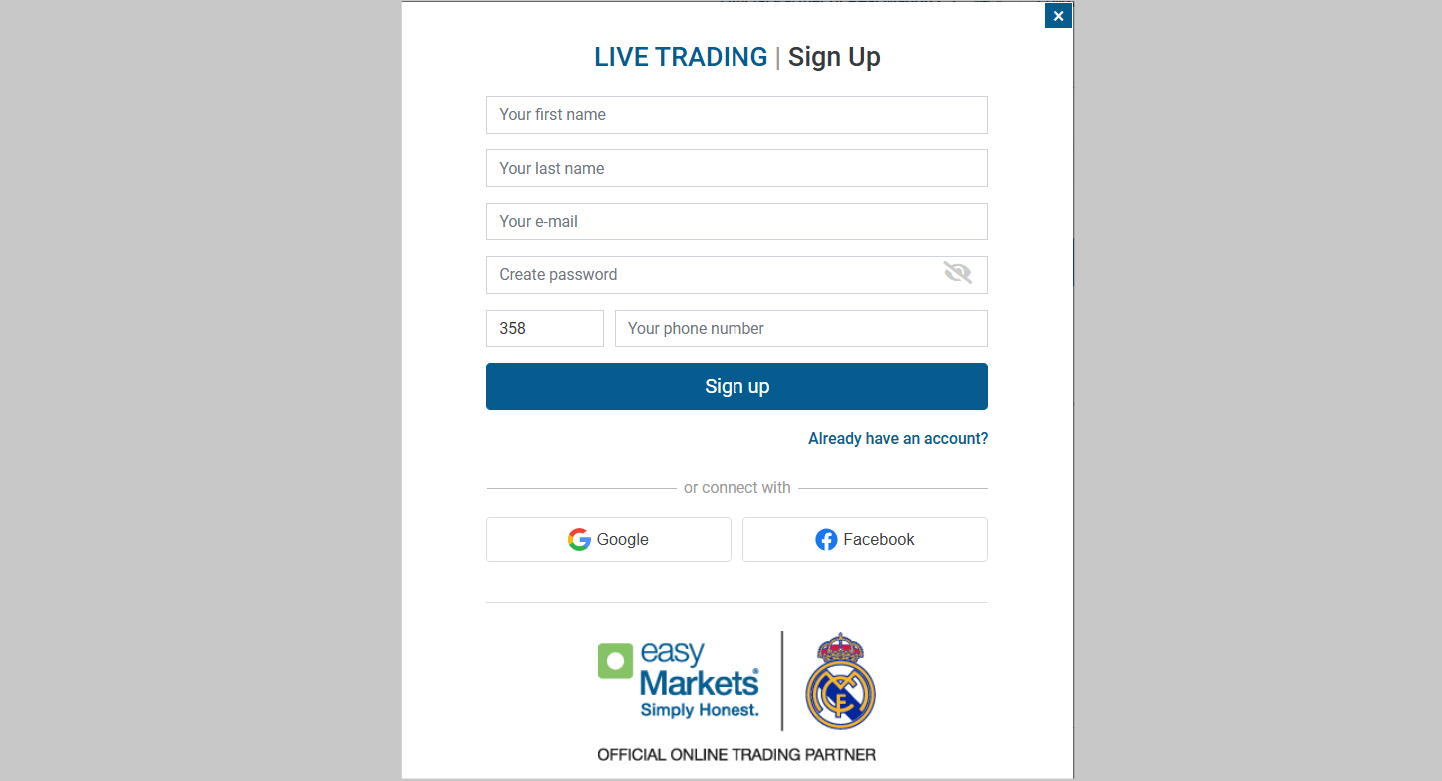

easyMarkets How to Open an Account: A Step-by-Step Guide

Opening an account with easyMarkets is a straightforward process designed to get you started trading as quickly and efficiently as possible. Whether you're a new or experienced trader, the broker's streamlined registration and verification procedures ensure a smooth onboarding experience.

Requirements

To open an account with easyMarkets, you'll need to meet the following requirements:

- Minimum age of 18 years old

- Valid government-issued identification document (e.g., passport, driver's license, or national ID card)

- Proof of residence (e.g., utility bill or bank statement)

- Minimum deposit of $25 (or equivalent in other currencies)

Account Types

easyMarkets offers three main account types to suit different trading styles and preferences:

- Standard Account: Minimum deposit of $25, fixed spreads from 0.8 pips, leverage up to 1:400

- Premium Account: Minimum deposit of $2,000, tighter spreads, dedicated account manager

- VIP Account: Minimum deposit of $10,000, exclusive trading conditions, personalized support

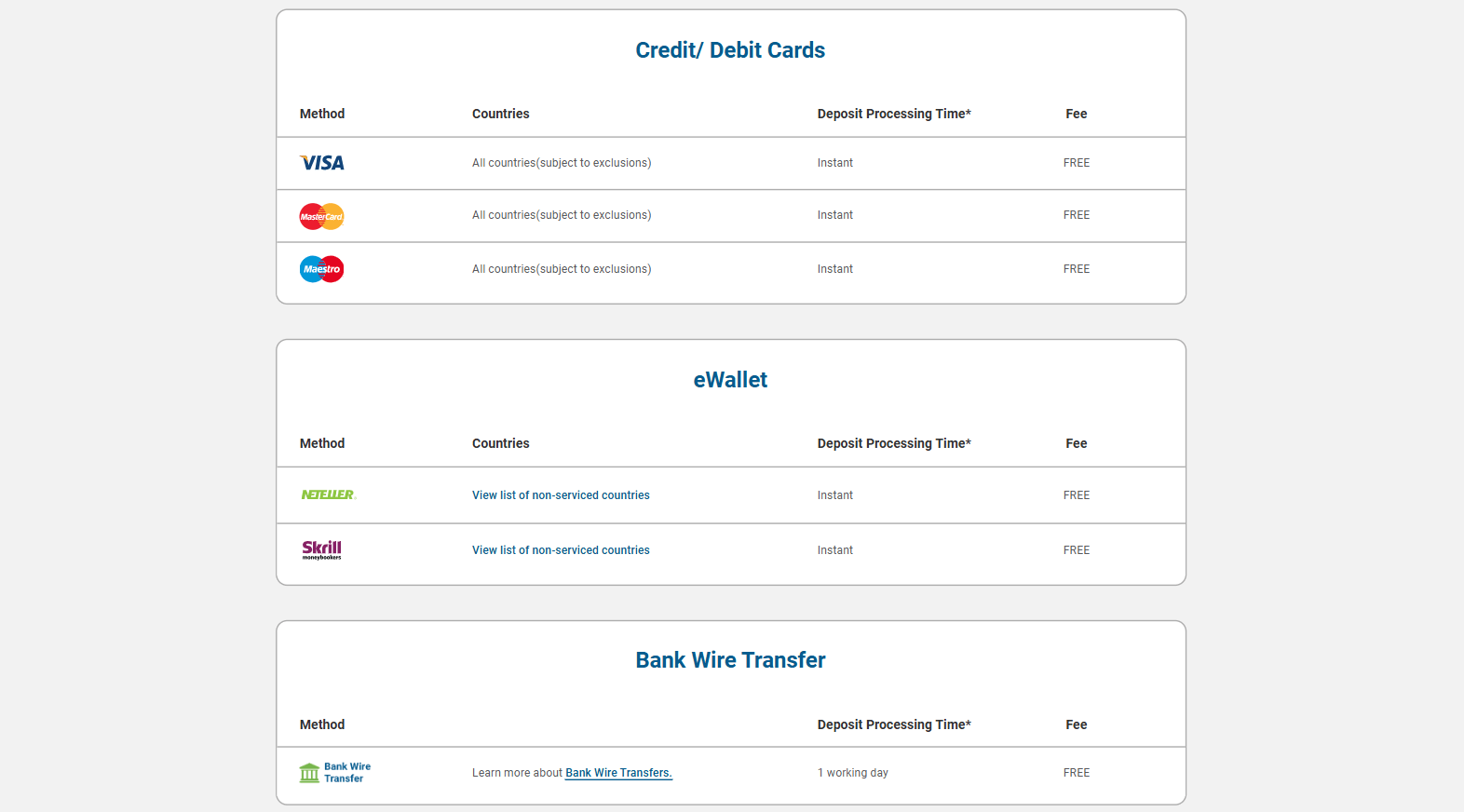

Payment Methods

easyMarkets accepts various payment methods for depositing funds into your trading account:

- Credit/debit cards (Visa, Mastercard): Instant processing

- Bank wire transfer: 1-3 business days processing time

- e-Wallets (Skrill, Neteller): Instant processing

- Local bank transfers: Processing time varies by country

Account Registration

To register for an account with easyMarkets, follow these simple steps:

- Visit the official easyMarkets website.

- Click on the "Open Account" button in the top right corner of the homepage

- Select your account type (Standard, Premium, or VIP) and click "Next"

- Fill in your personal details, including name, email address, phone number, and country of residence

- Create a secure password for your account

- Accept the terms and conditions and click "Create Account"

- Verify your email address by clicking on the link sent to your registered email

- Log in to your newly created account and complete your profile by providing additional information, such as your address, date of birth, and employment status

- Upload your identification documents and proof of residence for account verification

- Once your account is verified, make your initial deposit using one of the available payment methods

- Start trading using easyMarkets' web platform, mobile app, or MetaTrader 4/5

easyMarkets' user-friendly account opening process is designed to get you up and running quickly. The broker's support team is available 24/5 to assist you with any questions or issues you may encounter during the registration process.

Charts and Analysis

easyMarkets provides a comprehensive suite of educational resources and trading tools designed to support traders of all skill levels. From beginners just starting their trading journey to experienced investors seeking to refine their strategies, the broker offers a wealth of materials to enhance knowledge and inform decision-making.

| Feature | Details |

|---|---|

| Trading Central | Provides technical analysis and market insights through easyMarkets' proprietary platform |

| Analysis Coverage | Forex, indices, commodities, stocks |

| Trading Insights | Clear entry/exit points, target prices, stop-loss levels |

| Charting Tools | Powered by TradingView with 90+ technical indicators, drawing tools, customizable layouts |

| Chart Types & Timeframes | Candlestick, line, bar charts; timeframes from 1 minute to monthly intervals |

| Economic Calendar | Displays upcoming economic events, expected market impact, and past results |

| Market Analysis & Insights | Daily market updates, weekly outlooks, and in-depth trading articles |

| Content Series | - "Market News": Daily updates on key events - "Week Ahead": Preview of major economic releases - "Intraday Analytics": Real-time market commentary - "Market Research": In-depth articles on strategies and trends |

| Availability of Insights | Accessible on easyMarkets' website, email, and mobile app notifications |

| Educational Courses & Webinars | Online courses covering technical analysis, fundamentals, risk management, and trading psychology |

| Learning Format | Lessons with quizzes, exercises, and certificates upon completion |

| Webinars | Led by industry experts, covering market outlooks, strategies, tutorials, and Q&A sessions |

Comparison to Industry Standards: easyMarkets' educational offering is comprehensive and well-rounded, comparing favorably to industry standards. The broker's partnership with Trading Central sets it apart from many competitors, providing clients with expert insights and actionable trading ideas.

easyMarkets Account Types

easyMarkets offers a range of trading account types designed to cater to the diverse needs and preferences of traders at various stages of their trading journey. Whether you're a beginner just starting out or an experienced trader seeking advanced features and competitive trading conditions, easyMarkets has an account type to suit your requirements.

| Account Type | Minimum Deposit | Spreads | Leverage | Platforms | Key Features |

|---|---|---|---|---|---|

| Standard Account | $25 | Fixed spreads from 0.8 pips (major forex pairs) | Up to 1:400 | easyMarkets Web & Mobile | - Free guaranteed stop loss & take profit - Negative balance protection - Ideal for beginners |

| Premium Account | $2,000 | Tighter spreads from 0.5 pips | Up to 1:400 | easyMarkets Web & Mobile, MT4, TradingView | - Dedicated account manager - Exclusive market analysis & insights - Suitable for experienced traders |

| VIP Account | $10,000 | Spreads from 0.3 pips | Up to 1:400 | easyMarkets Web & Mobile, MT4, TradingView | - Senior account manager - Priority withdrawals & higher limits - VIP event invitations - Custom trading conditions |

| Demo Account | $0 (Virtual Funds) | N/A | N/A | easyMarkets Web & Mobile | - $10,000 virtual balance - Real-time market data - Unlimited validity - Risk-free practice environment |

The demo account is an excellent tool for both new and experienced traders looking to refine their skills, test new strategies, or explore easyMarkets' platforms before committing to a live account.

Importance of Multiple Account Types: By offering multiple account types, easyMarkets caters to the diverse needs and preferences of its clients, ensuring that traders at different stages of their journey can find an account that suits their requirements and goals.

Negative Balance Protection

Recognizing the importance of safeguarding its clients from risk of losing money rapidly, easyMarkets offers negative balance protection as a standard feature across all trading accounts. This policy ensures that traders cannot lose more than their account balance, even in extreme market conditions. Here's how easyMarkets' negative balance protection works:

- Automatic Position Closure: If a trader's account balance falls below the required margin level to maintain open positions, easyMarkets' trading system will automatically close the positions to prevent further losses. This process is known as a margin call and helps limit the potential for negative balances.

- No Debt Obligation: In the event that market volatility or other factors cause a trader's account balance to fall into negative territory, easyMarkets will absorb the negative balance and reset the account to zero. Traders will not be required to pay back any negative balance, providing peace of mind and limiting their maximum risk to the funds in their account.

- Transparency and Fairness: easyMarkets applies its negative balance protection policy consistently across all clients and account types, ensuring a level playing field and promoting transparency in its risk management practices.

easyMarkets Deposits and Withdrawals

Efficient and secure deposit and withdrawal processes are crucial aspects of a smooth trading experience. easyMarkets understands the importance of providing its clients with a range of convenient payment options while ensuring the safety and timely processing of transactions.

Deposit Options

easyMarkets offers a variety of deposit methods to cater to the preferences and needs of its global client base. These include:| Payment Method | Processing Time | Minimum Deposit | Additional Details | Fees |

|---|---|---|---|---|

| Credit/Debit Cards | Instant | $50 | Supports Visa, Mastercard, and Maestro; maximum deposit depends on account type and jurisdiction | No fees from easyMarkets (payment provider fees may apply) |

| Bank Wire Transfer | 1-3 business days | $100 | Allows for larger deposit amounts compared to other methods | No fees from easyMarkets (bank fees may apply) |

| e-Wallets | Instant | $50 | Supports Skrill, Neteller, FasaPay, and WebMoney | No fees from easyMarkets (payment provider fees may apply) |

| Local Payment Methods | Varies by provider | Varies | Includes UnionPay (China), Sofort (Europe), and Bpay (Australia) | No fees from easyMarkets (provider fees may apply) |

Withdrawal Options

easyMarkets offers several withdrawal methods, ensuring that traders can access their funds quickly and securely. These include:| Withdrawal Method | Processing Time | Minimum Withdrawal | Additional Details | Fees |

|---|---|---|---|---|

| Credit/Debit Cards | 1-3 business days | $20 | Supports Visa, Mastercard, and Maestro | No fees from easyMarkets (payment provider fees may apply) |

| Bank Wire Transfer | 1-5 business days | $50 | Processing time depends on the bank's policies | No fees from easyMarkets (bank fees may apply) |

| e-Wallets | Within 24 hours | $20 | Supports Skrill, Neteller, FasaPay, and WebMoney | No fees from easyMarkets (payment provider fees may apply) |

Verification and Security

To comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, easyMarkets requires traders to verify their accounts before processing withdrawals. This process typically involves submitting proof of identity and address, such as a government-issued ID and a recent utility bill or bank statement. easyMarkets employs advanced security measures to protect clients' funds and personal information. These include SSL encryption, segregated client funds, and regular security audits.Unique Features

One of the standout features of easyMarkets' payment options is the support for a wide range of local payment methods. By offering country-specific options such as UnionPay, Sofort, and Bpay, easyMarkets ensures that traders can deposit funds using familiar and convenient methods in their local currencies. Additionally, easyMarkets' commitment to not charging any deposit or withdrawal fees sets it apart from competitors who may impose such charges. This transparency and cost-effectiveness are valuable benefits for traders looking to maximize their trading capital. Comparison to Industry Standards easyMarkets' deposit and withdrawal options align with industry standards, offering a comprehensive range of payment methods to cater to the diverse needs of its global client base. The broker's support for instant deposits via credit/debit cards and e-wallets, as well as the option for larger deposits via bank wire transfer, mirrors the offerings of many reputable brokers.

Support Service for Customer

easyMarkets understands the importance of providing its clients with top-notch customer support, ensuring that traders can access the help they need when they need it. The broker offers a range of support channels and a knowledgeable, multilingual support team to cater to the diverse needs of its global client base.

Support Channels

easyMarkets provides several convenient ways for traders to reach out for assistance:| Support Method | Availability | Details | Response Time |

|---|---|---|---|

| Live Chat | 24/5 | Instant support via the easyMarkets website | 1-2 minutes |

| 24/5 | Send inquiries to support@easymarkets.com | Within 24 hours | |

| Phone | 24/5 | Country-specific contact numbers available on the website | Immediate |

| Social Media | 24/5 | Support via Facebook, Twitter, and Instagram | Varies |

| Support Hours | 24/5 | Multi-language support available | Based on trader's time zone |

Prohibited Countries

easyMarkets is a global broker that aims to provide trading services to clients worldwide. However, due to various regulatory restrictions, licensing requirements, and geopolitical factors, easyMarkets is prohibited from operating or offering its services in certain countries and regions.

The primary reason behind these restrictions is compliance with local laws and regulations. Many countries have specific rules governing the provision of financial services, including online trading. To legally operate in these jurisdictions, brokers like easyMarkets must obtain the necessary licenses and adhere to strict regulatory requirements. In some cases, the regulatory environment may be too complex or restrictive, making it unfeasible for easyMarkets to offer its services.

Additionally, geopolitical factors such as international sanctions, political instability, or economic embargoes can also impact a broker's ability to operate in specific regions. easyMarkets must comply with these international restrictions to avoid potential legal consequences and maintain its reputation as a responsible financial services provider.

It is crucial for potential clients to be aware of these restrictions before attempting to open an account with easyMarkets. Trading from a prohibited country may result in the violation of local laws, leading to legal repercussions, financial losses, and the potential freezing or closure of trading accounts.

To help readers quickly identify whether they are eligible to trade with easyMarkets, here is a comprehensive list of prohibited countries, organized by region:

Africa:

- Algeria

- Sudan

- South Sudan

Asia:

- Afghanistan

- Iran

- Iraq

- North Korea

- Syria

- Yemen

Europe:

- Belarus

- Bosnia and Herzegovina

- Crimea Region

- Russia

North America:

- Canada

- United States of America

Special Offers for Customers

easyMarkets provides a range of special promotions and offers designed to attract new clients and reward existing traders for their loyalty. These offers can help traders maximize their potential returns and enhance their overall trading experience. However, it is essential to carefully review the terms and conditions associated with each promotion to ensure eligibility and understand any limitations or requirements.

| Offer Type | Details |

|---|---|

| Sign-up Bonus | New clients may receive a bonus based on their first deposit. Example: 50% bonus on deposits up to $2,000. |

| Bonus Conditions | Includes minimum deposit requirements, trading volume thresholds, and time limits. |

| Loyalty Program | Rewards traders based on trading volume or frequency, offering perks like reduced spreads, faster withdrawals, and exclusive promotions. |

| Trading Competitions | Clients can compete for prizes or cash rewards based on performance criteria (e.g., highest percentage return, trading specific instruments). |

| Competition Benefits & Risks | Opportunity to win prizes while testing trading skills, but requires careful risk management. |

| Partnerships & Third-Party Offers | Collaborations with trading education platforms, market analysis providers, and tool developers. Offers may include discounts, free trials, or premium content. |

| Considerations for Third-Party Offers | Traders should evaluate the relevance, quality, and potential costs of these services before using them. |

Conclusion

Throughout this comprehensive review, I have thoroughly examined various aspects of easyMarkets' operations, evaluating their safety, reliability, and overall reputation as an online broker. By analyzing factors such as regulatory compliance, geographical reach, customer support, variety of trading instruments, trading platforms, and special offers, I have gained valuable insights into their trustworthiness and suitability for different types of traders.

One of the key findings is easyMarkets' strong commitment to regulatory compliance. They are overseen by top-tier regulators like ASIC and CySEC, which enforce strict guidelines to protect clients' interests. This regulatory oversight, combined with their long-standing history since 2001, provides a solid foundation of trust and stability.

However, it's important to note that easyMarkets is prohibited from offering services in certain countries due to licensing restrictions and geopolitical factors. Traders from regions like the USA, Canada, and parts of Africa and Asia may not be able to open an account with them. It's crucial to check the latest information on prohibited countries before considering easyMarkets as your broker.

In terms of trading conditions, easyMarkets offers a competitive environment with tight spreads, multiple account types, and a diverse range of tradable assets. Their unique features like dealCancellation and Freeze Rate demonstrate a commitment to innovation and risk management. The broker's support for popular platforms like MT4, MT5, and TradingView caters to the preferences of different traders.

Customer support is another area where easyMarkets shines, providing prompt and knowledgeable assistance through various channels. The availability of multiple languages and an extensive FAQ section enhances the user experience. However, the lack of 24/7 support may be a drawback for some traders.

easyMarkets' educational resources, while not the most comprehensive in the industry, offer a solid foundation for beginners. The trading academy, video tutorials, and ebooks provide valuable insights into market analysis and trading strategies. The broker's research tools, including daily market updates and an economic calendar, keep traders informed about the latest developments.

Special offers like sign-up bonuses and loyalty programs can enhance traders' potential returns, but it's essential to carefully review the terms and conditions. Trading competitions and third-party partnerships add an element of excitement and diversity to the trading experience.