EC Markets Review 2025: Competitive Spreads, Top-Tier Regulation | Forex Broker

EC Markets

United Kingdom

United Kingdom

-

Minimum Deposit $100

-

Withdrawal Fee $0

-

Leverage 400:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Unavailable

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

South Africa Retail Forex License

South Africa Retail Forex License

Japan Forex Trading License

Japan Forex Trading License

Australia Retail Forex License

Australia Retail Forex License

Austria Financial Services License

Austria Financial Services License

Forex & CFD Brokerage License

Forex & CFD Brokerage License

Softwares & Platforms

Customer Support

+442484224099

(English)

+442484224099

(English)

Supported language: Chinese (Simplified), English, Spanish

Social Media

Summary

EC Markets is a globally regulated online trading broker offering access to forex, commodities, indices, and shares. The broker provides competitive trading conditions, including low spreads, fast execution speeds, and access to industry-leading platforms such as MetaTrader 4 and MetaTrader 5. With a strong regulatory framework and a client-focused approach, EC Markets caters to both retail and institutional traders seeking a reliable and efficient trading environment.

- Strong multi-jurisdictional regulation (FCA, ASIC, FSA, FSC, FMA, FSCA)

- Competitive spreads from 0.0 pips on ECN and PRO accounts

- MetaTrader 4 and MetaTrader 5 platforms available

- Wide range of tradable instruments (Forex, Metals, Energies, Indices, Crypto CFDs)

- Fast execution speeds and flexible leverage up to 1:500

- 24/5 multilingual customer support via live chat, email, and phone

- Low minimum deposit of $10

- Multiple account types (Standard, ECN, PRO) for different trading styles

- Negative balance protection and segregated client funds for added security

- Quick withdrawal processing within 2 hours during business days

- Educational resources could be more comprehensive.

- No 24/7 customer support

- Prohibited from offering services in certain countries (US, Canada, EU)

- No proprietary trading platform, only MT4/MT5

- Limited promotion of special offers or bonuses

- Maximum leverage and instrument availability may vary by jurisdiction.

- Overnight/weekend swap fees charged on some positions

- No guaranteed stop-loss orders available

- Cryptocurrency CFDs not available to UK traders

- Inactivity fees applied after 90 days of no trading activity

Overview

EC Markets is a globally recognized multi-asset broker, established in 2012, offering access to over 100 financial instruments across forex, precious metals, crude oil, indices, and cryptocurrency CFDs. With a strong presence in the UK, Australia, Seychelles, Mauritius, New Zealand, and South Africa, EC Markets operates under the regulatory oversight of the FCA, ASIC, FSA, FSC, FMA, and FSCA respectively, ensuring a secure and transparent trading environment for its clients.

The broker provides competitive trading conditions, with fast execution speeds, tight spreads starting from 0.0 pips, and leverage up to 500:1. EC Markets caters to both novice and professional traders, offering seamless, robust solutions tailored to diverse trading objectives through its user-friendly MetaTrader 4 and MetaTrader 5 platforms.

Clients can choose from various account types, including Standard, ECN, and PRO accounts, each designed to accommodate different trading strategies and preferences. EC Markets supports multiple funding options and processes withdrawals efficiently, with most requests handled within 2 hours during business days.

For more details on EC Markets' services, regulatory licenses, trading conditions, and account types, visit their official website at ecmarkets.com.

While EC Markets strives to provide a secure and transparent trading environment, it is essential for traders to conduct thorough research and consider their individual trading goals, risk tolerance, and regulatory requirements before engaging with any broker. As with any financial decision, it is crucial to exercise caution and seek professional advice when necessary.

Overview Table

| Category | Details |

|---|---|

| Established | 2012 |

| Regulation | FCA (UK), ASIC (Australia), FSA (Seychelles), FSC (Mauritius), FMA (New Zealand), FSCA (South Africa) |

| Instruments | Forex, Precious Metals, Crude Oil, Indices, Cryptocurrency CFDs |

| Platforms | MetaTrader 4, MetaTrader 5 (Desktop, Web, Mobile) |

| Account Types | Standard, ECN, PRO |

| Minimum Deposit | $10 |

| Spreads | Starting from 0.0 pips (ECN and PRO accounts) |

| Commissions | $3 per lot per side (ECN account) |

| Leverage | Up to 500:1 |

| Funding Options | Bank Transfer, Credit/Debit Cards, E-wallets (Skrill, Neteller), Regional Payment Processors (UnionPay, FasaPay, ViettelPay) |

| Withdrawal Processing | Within 2 hours during business days |

| Customer Support | 24/5 via Live Chat, Email, Phone |

| Education | Articles, Video Tutorials, Forex Glossary, Market Analysis (Limited) |

| Unique Features | Fast execution speeds, Multiple regulatory licenses, Competitive spreads, High leverage, Efficient funding and withdrawal, Trading Central partnership |

Facts List

- EC Markets is regulated by multiple top-tier financial authorities, including the FCA, ASIC, FSA, FSC, FMA, and FSCA.

- The broker offers access to over 100 tradable instruments, including forex, precious metals, crude oil, indices, and cryptocurrency CFDs.

- Clients can trade on the industry-leading MetaTrader 4 and MetaTrader 5 platforms, available on desktop, web, and mobile devices.

- Spreads start from 0.0 pips on ECN and PRO accounts, with a low commission of $3 per lot per side on ECN accounts.

- EC Markets provides leverage up to 500:1, allowing traders to maximize their trading potential.

- The broker processes withdrawals within 2 hours during business days, ensuring efficient access to funds.

- Multiple funding options are available, including bank transfers, credit/debit cards, e-wallets, and regional payment processors.

- EC Markets offers 24/5 customer support via live chat, email, and phone, providing assistance to traders.

- The broker has partnered with Trading Central to offer advanced market analysis and trading ideas to its clients.

- EC Markets operates globally, with a strong presence in the UK, Australia, Seychelles, Mauritius, New Zealand, and South Africa.

EC Markets Licenses and Regulatory

EC Markets operates under a robust regulatory framework, holding licenses from multiple respected financial authorities worldwide. This multi-jurisdictional oversight ensures that the broker adheres to strict compliance standards, prioritizing the security of client funds and fostering trust among its users.

The broker's primary regulatory licenses include:

| Regulatory Authority | Country | Entity Name | Registration/License Number |

|---|---|---|---|

| Financial Conduct Authority (FCA) | United Kingdom | EC Markets Group Ltd | 571881 |

| Australian Securities and Investments Commission (ASIC) | Australia | EC Markets Financial Limited | AFSL No. 414198 |

| Financial Services Authority (FSA) | Seychelles | EC Markets Limited | License No. SD009 |

| Financial Services Commission (FSC) | Mauritius | EC Markets Limited | License No. GB2100130 |

| Financial Markets Authority (FMA) | New Zealand | EC Markets Financial Limited | FSPR No. FSP197465 |

| Financial Sector Conduct Authority (FSCA) | South Africa | EC Markets Financial Limited | License No. 51886 |

The FCA and ASIC, in particular, are widely regarded as two of the most stringent and respected regulatory bodies in the financial industry. Their oversight ensures that EC Markets adheres to high standards of transparency, fair dealing, and client asset protection. Brokers regulated by these authorities must maintain segregated client funds, submit regular financial reports, and follow strict guidelines on marketing and advertising.

Holding multiple regulatory licenses demonstrates EC Markets' commitment to operating transparently and ethically across different jurisdictions. This not only enhances the broker's credibility but also provides clients with an additional layer of protection and recourse in case of any disputes or concerns.

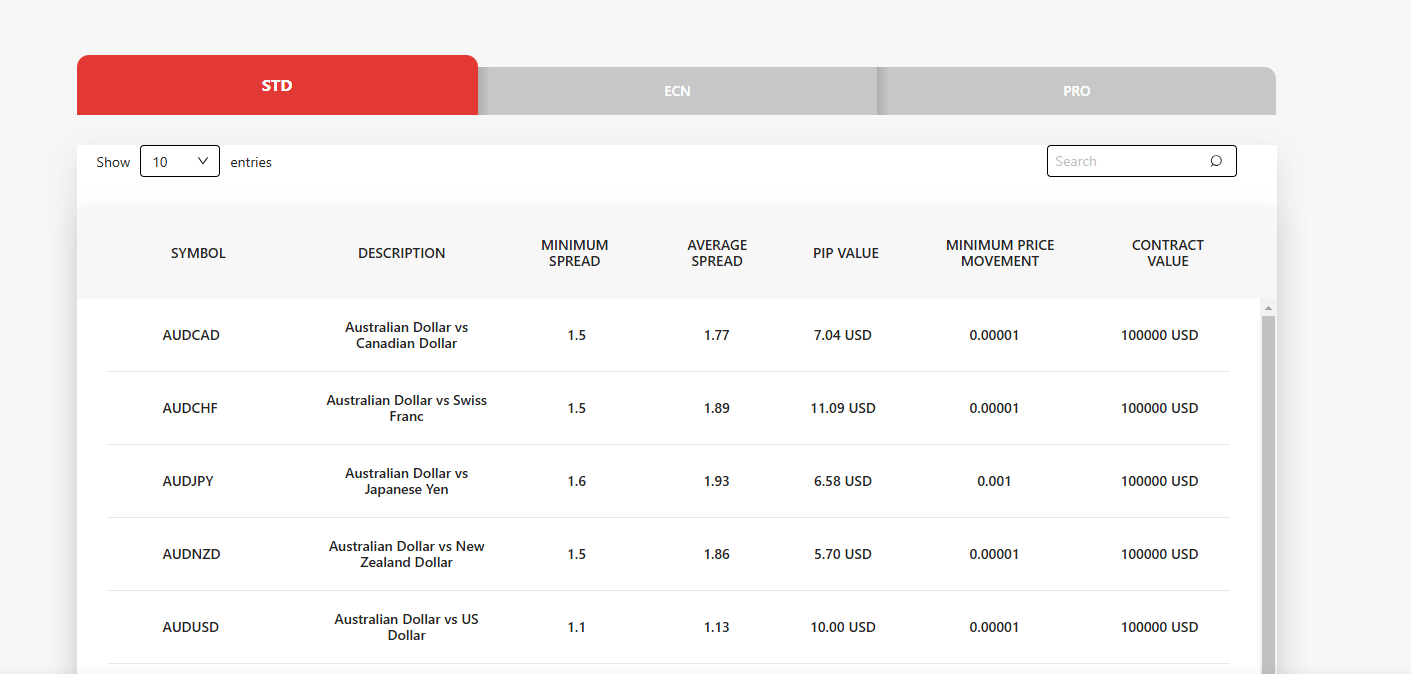

Trading Instruments

EC Markets offers a diverse range of tradable assets, catering to the varied needs and preferences of traders worldwide. With over 100 financial instruments available, the broker provides access to popular markets such as forex, precious metals, crude oil, indices, and cryptocurrency CFDs. This comprehensive selection allows traders to diversify their portfolios and capitalize on opportunities across multiple asset classes.

| Asset Class | Instruments Offered | Spreads (Starting From) | Notes |

|---|---|---|---|

| Forex | EUR/USD, GBP/USD, USD/JPY, USD/CHF, AUD/USD, NZD/USD, USD/CAD, EUR/GBP, EUR/JPY, GBP/JPY, CHF/JPY, GBP/CAD, EUR/AUD, EUR/CHF, USD/SEK, USD/SGD, USD/HKD, USD/NOK, USD/DKK, USD/ZAR, USD/MXN | 0.1 pips (ECN), 1.0 pips (Standard) | Major, minor, and exotic pairs available |

| Precious Metals | Gold (XAU/USD), Silver (XAG/USD) | 0.46 pips (Gold), 3.1 pips (Silver) | Safe-haven assets |

| Crude Oil | Brent Crude, WTI Crude | 0.08 pips | Volatile market |

| Indices | S&P 500, FTSE 100, DAX 30, Nikkei 225 | Competitive | Tracks major global markets |

| Cryptocurrency CFDs | Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP) | Competitive | Not available to UK traders due to regulations |

The diversity of tradable assets offered by EC Markets is a testament to the broker's commitment to meeting the evolving needs of its clients. By providing access to a wide range of markets, EC Markets empowers traders to pursue their individual strategies and adapt to changing market conditions. This extensive asset selection also positions EC Markets competitively within the industry, as many brokers offer a more limited range of trading instruments.

Trading Platforms

EC Markets provides clients with access to the widely-used MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, ensuring a seamless and reliable trading experience. These platforms are renowned for their user-friendly interface, advanced charting tools, and extensive customization options, making them the preferred choice for both novice and experienced traders alike.

MetaTrader 4 (MT4)

MT4 is a highly popular platform known for its stability and ease of use. Key features include:

- Customizable charts with 9 timeframes and multiple chart types

- 30+ built-in technical indicators and analytical tools

- One-click trading and real-time quotes

- Expert Advisors (EAs) for automated trading

- Customizable alerts and push notifications

- Available on desktop, web, and mobile (iOS and Android)

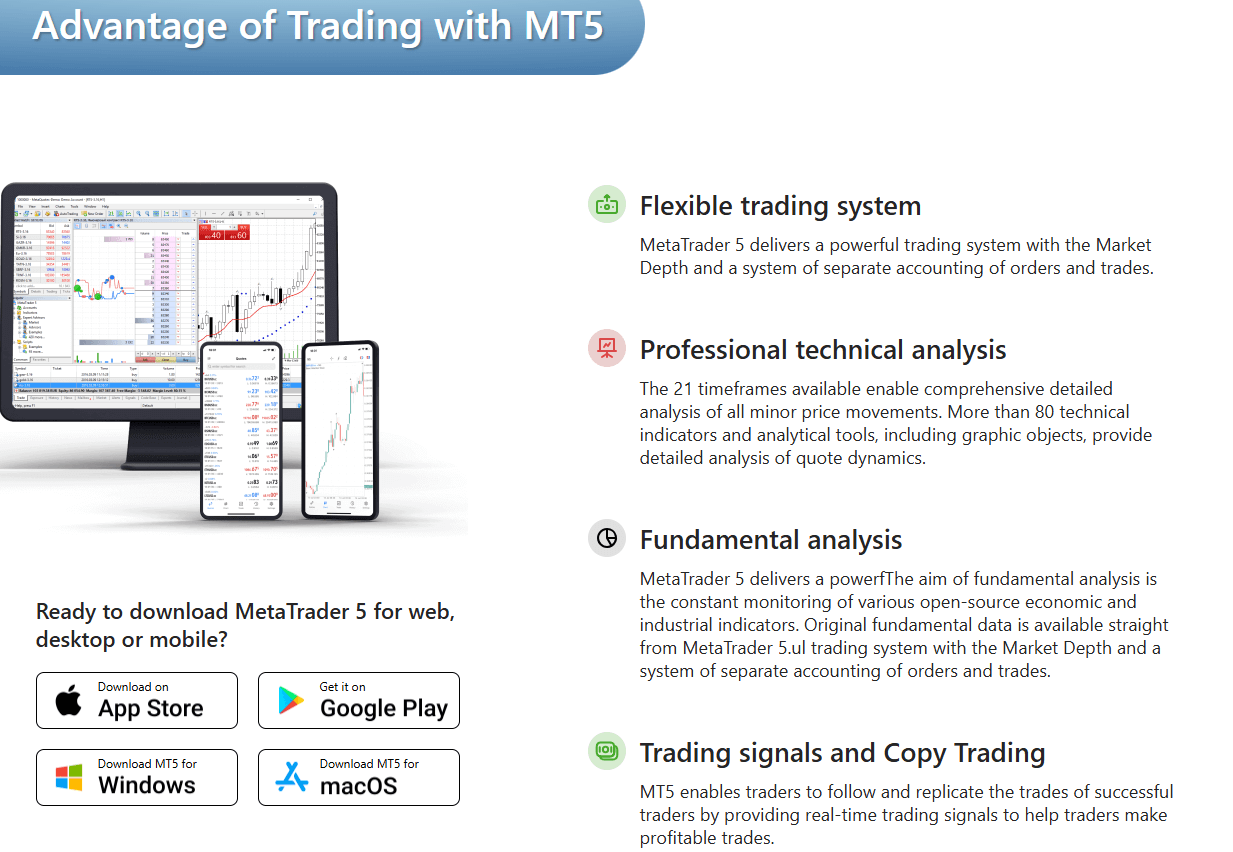

MetaTrader 5 (MT5)

MT5 builds upon the success of MT4, offering additional features and enhanced functionality. Notable features include:

- Advanced charting with 21 timeframes and 44 graphical objects

- 38 built-in technical indicators and 22 analytical objects

- Depth of Market (DOM) for real-time market depth analysis

- Multi-threaded strategy tester for optimizing EAs

- Fundamental analysis tools, including an economic calendar and news feed

- Available on desktop, web, and mobile (iOS and Android)

Both MT4 and MT5 support automated trading through EAs, allowing traders to implement complex strategies and manage their positions even when away from their trading screens. This feature is particularly beneficial for those employing algorithmic trading or requiring around-the-clock market monitoring.

Trading Platforms Comparison Table

| Feature | MetaTrader 4 (MT4) | MetaTrader 5 (MT5) |

|---|---|---|

| Charting Timeframes | 9 | 21 |

| Technical Indicators | 30+ | 38 |

| Graphical Objects | 31 | 44 |

| Automated Trading (EAs) | Yes | Yes |

| Multi-threaded Strategy Tester | No | Yes |

| Depth of Market (DOM) | No | Yes |

| Economic Calendar | No | Yes |

| News Feed | No | Yes |

| Desktop Platform | Yes | Yes |

| Web Platform | Yes | Yes |

| Mobile Apps (iOS & Android) | Yes | Yes |

EC Markets How to Open an Account: A Step-by-Step Guide

Opening an account with EC Markets is a straightforward process that can be completed entirely online. Follow these step-by-step instructions to get started:

Step 1: Visit the EC Markets Website

Go to the official EC Markets website and click on the "Open an Account" button in the top right corner of the page.

Step 2: Choose Your Account Type

Select the account type that best suits your trading needs and experience level. EC Markets offers three main account types:

- Standard Account: Spreads from 1.0 pips, no commissions

- ECN Account: Spreads from 0.0 pips, $3 commission per lot per side

- PRO Account: Spreads from 0.0 pips, no commissions

Step 3: Complete the Registration Form

Fill out the online registration form with your personal information, including your full name, email address, phone number, country of residence, and date of birth. You will also need to create a secure password for your account.

Step 4: Verify Your Identity

To comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, EC Markets requires all clients to verify their identity before trading. Upload a valid government-issued ID, such as a passport or driver's license, and proof of address, such as a utility bill or bank statement.

Step 5: Fund Your Account

Once your account is verified, you can make your initial deposit using one of the accepted payment methods:

- Bank Transfer

- Credit/Debit Cards

- E-wallets (Skrill, Neteller)

- Regional Payment Processors (UnionPay, FasaPay, ViettelPay)

The minimum deposit required to open an account with EC Markets is $10.

Step 6: Download and Install the Trading Platform

Choose your preferred trading platform (MetaTrader 4 or MetaTrader 5) and download the software from the EC Markets website. Install the platform on your device and log in using your account credentials.

Step 7: Start Trading

After funding your account and installing the trading platform, you can start trading the various financial instruments offered by EC Markets, such as forex, precious metals, crude oil, indices, and cryptocurrency CFDs.

EC Markets' streamlined account opening process ensures that clients can start trading quickly and efficiently. The broker's low minimum deposit requirement of $10 makes it accessible to a wide range of traders, while the multiple payment options cater to clients from different regions.

Charts and Analysis

EC Markets recognizes the importance of providing traders with a comprehensive suite of educational resources and tools to enhance their trading knowledge and skills. While the broker offers some basic learning materials, the depth and breadth of these resources are somewhat limited compared to industry leaders in this area.

| Feature | Description |

|---|---|

| Market Analysis | Provides daily market reviews and weekly outlooks on various financial instruments, offering insights into market trends and trading opportunities. |

| Forex Glossary | A reference guide for common forex terms and concepts, useful for beginners learning industry jargon. |

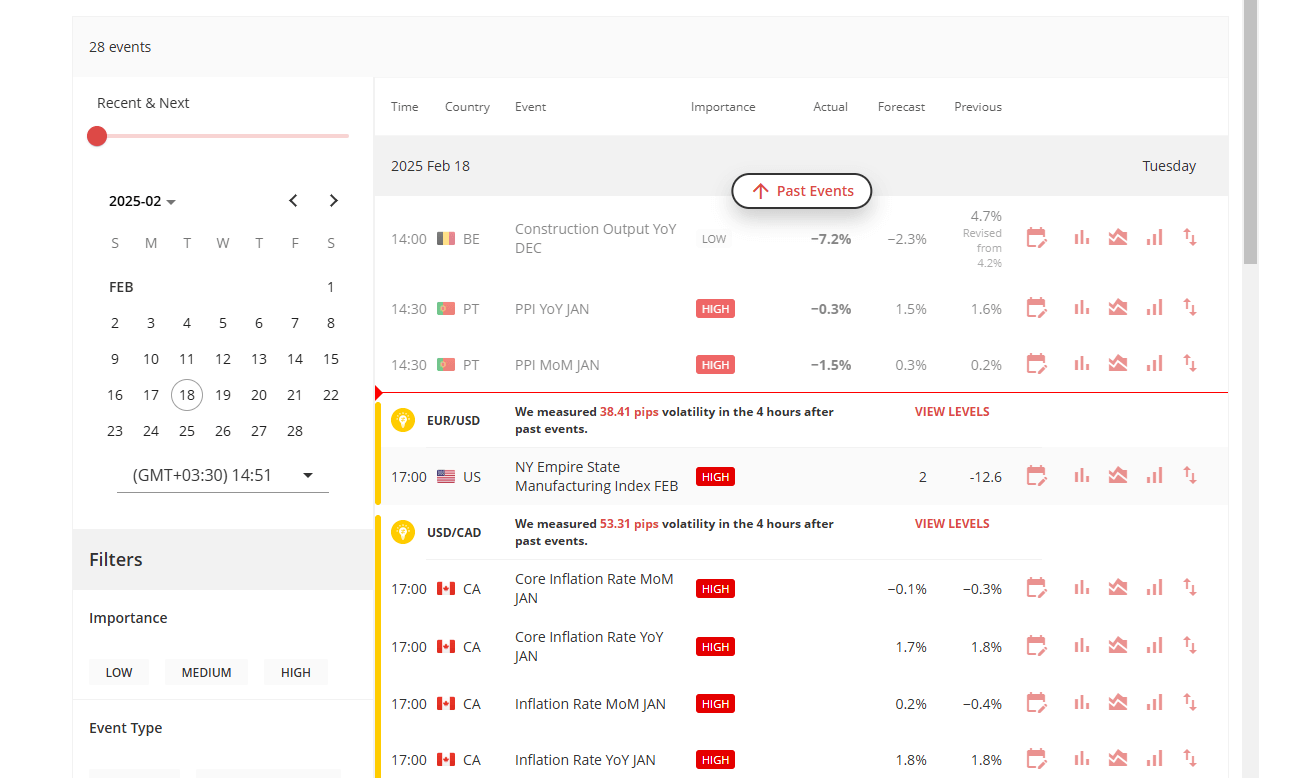

| Economic Calendar | Displays upcoming financial events and data releases to help traders stay informed and plan their trading strategies. |

While these resources provide some value to traders, EC Markets' educational offering falls short of the comprehensive libraries and academies maintained by some of its competitors. Many leading brokers invest heavily in developing extensive educational content, including in-depth articles, video tutorials, webinars, and interactive courses catering to traders of all skill levels.

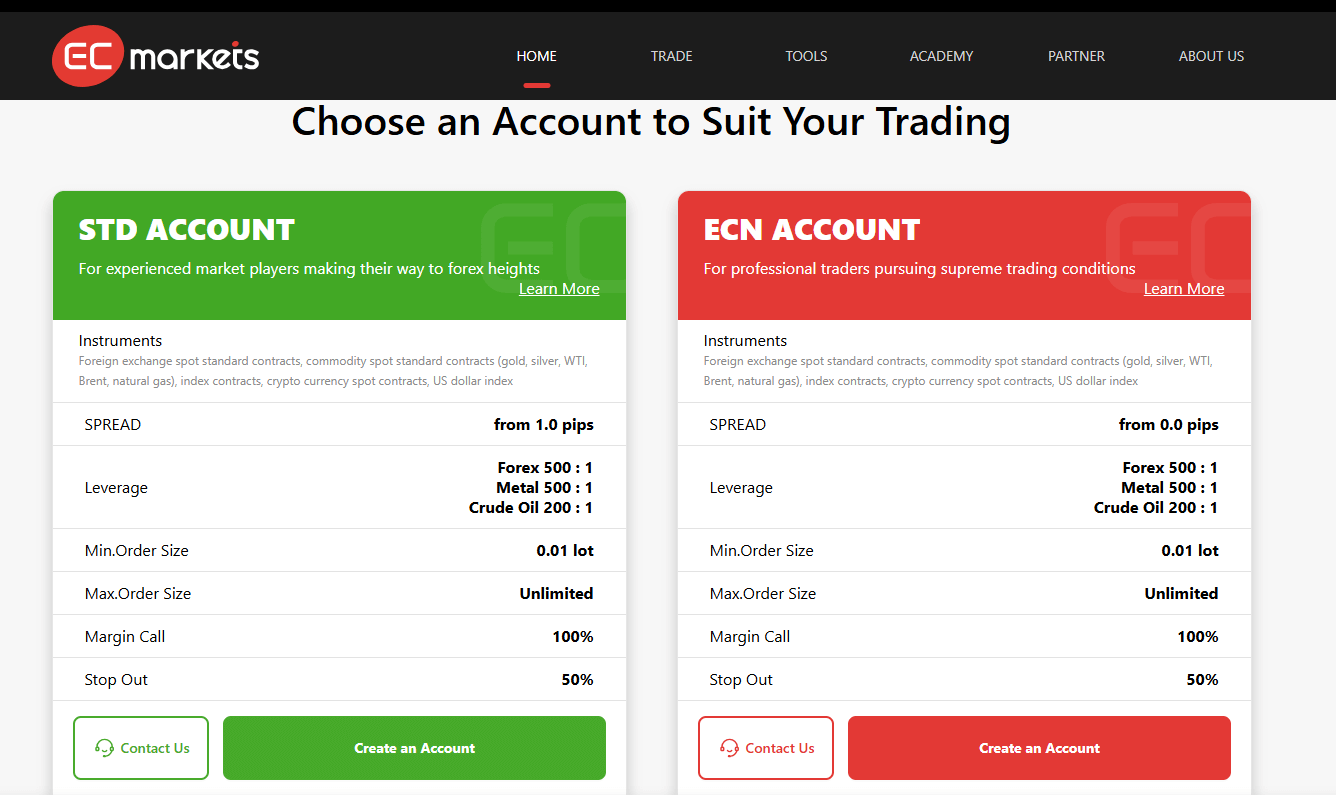

EC Markets Account Types

EC Markets offers a range of trading account types designed to cater to the diverse needs and preferences of traders at various levels of experience and with different trading styles. By providing multiple account options, the broker ensures that clients can select an account that aligns with their specific requirements and goals.

Standard Account

The Standard Account is suitable for traders of all levels, offering competitive spreads starting from 1.0 pips and no commission fees. Key features include:

- Minimum deposit: $10

- Leverage up to 500:1

- Spread from 1.0 pips

- No commission

- Minimum trade size: 0.01 lots

- Maximum trade size: Unlimited

- Margin call: 100%

- Stop out level: 50%

ECN Account

The ECN Account is designed for more experienced traders seeking tighter spreads and faster execution speeds. This account type offers spreads starting from 0.0 pips and a commission of $3 per lot per side. Other features include:

- Minimum deposit: $10

- Leverage up to 500:1

- Spread from 0.0 pips

- Commission: $3 per lot per side

- Minimum trade size: 0.01 lots

- Maximum trade size: Unlimited

- Margin call: 100%

- Stop out level: 50%

PRO Account

The PRO Account is tailored for professional traders and institutions looking for premium trading conditions and higher liquidity. This account type offers spreads starting from 0.0 pips and no commission fees. Additional features include:

- Minimum deposit: $10

- Leverage up to 500:1

- Spread from 0.0 pips

- No commission

- Minimum trade size: 0.01 lots

- Maximum trade size: Unlimited

- Margin call: 100%

- Stop out level: 50%

Demo Account

For traders who wish to practice trading strategies and familiarize themselves with the trading platforms, EC Markets offers a Demo Account. This account type provides access to virtual funds and real-time market conditions, allowing traders to gain experience without risking real money.

By offering multiple account types with varying spreads, commissions, and trading conditions, EC Markets demonstrates its commitment to accommodating the diverse needs of its clientele. The low minimum deposit requirement of $10 across all account types makes trading accessible to a wide range of investors, while the high leverage of up to 500:1 allows traders to maximize their potential returns.

Account Types Comparison Table

| Feature | Standard Account | ECN Account | PRO Account |

|---|---|---|---|

| Minimum Deposit | $10 | $10 | $10 |

| Leverage | Up to 500:1 | Up to 500:1 | Up to 500:1 |

| Spread | From 1.0 pips | From 0.0 pips | From 0.0 pips |

| Commission | No | $3 per lot per side | No |

| Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| Maximum Trade Size | Unlimited | Unlimited | Unlimited |

| Margin Call | 100% | 100% | 100% |

| Stop Out Level | 50% | 50% | 50% |

| Demo Account | Yes | Yes | Yes |

Negative Balance Protection

EC Markets' negative balance protection policy ensures that clients' losses are limited to the funds available in their trading account. Under this policy, if a trader's account balance falls into negative territory, EC Markets will absorb the loss and reset the account balance to zero. This means that traders can never lose more than their initial deposit, providing peace of mind and allowing them to manage their risk more effectively. It is essential to note that negative balance protection does not prevent losses within the limits of a trader's available funds. Traders should still employ responsible risk management techniques, such as setting appropriate stop-loss orders and maintaining adequate margin levels, to avoid excessive losses. To benefit from EC Markets' negative balance protection, clients must adhere to the broker's terms and conditions. This includes ensuring that all trades are executed through the provided trading platforms and that no unauthorized or abusive trading practices are employed.

EC Markets Deposits and Withdrawals

Deposits and Withdrawals

EC Markets offers a range of convenient deposit and withdrawal options to cater to the diverse needs of its global clientele. The broker aims to provide a seamless and secure funding experience, ensuring that traders can quickly and efficiently manage their account balances.Deposit Methods

EC Markets accepts the following deposit methods:| Payment Method | Minimum Deposit | Maximum Deposit | Processing Time | Fees |

|---|---|---|---|---|

| Bank Transfer | $10 | No limit | Up to 5 business days | No fees from EC Markets (banks may charge) |

| Credit/Debit Cards (Visa, Mastercard) | $10 | Varies by card type/issuer | Instant | No fees from EC Markets |

| E-wallets (Skrill, Neteller) | $10 | Varies by e-wallet provider | Instant | No fees from EC Markets (e-wallet provider may charge) |

| Regional Payment Processors (UnionPay, FasaPay, ViettelPay) | $10 | Varies by payment processor | Instant | No fees from EC Markets (payment processor may charge) |

Withdrawal Methods

EC Markets offers the following withdrawal methods:| Payment Method | Minimum Withdrawal | Maximum Withdrawal | Processing Time | Fees |

|---|---|---|---|---|

| Bank Transfer | $10 | No limit | Up to 5 business days | No fees from EC Markets (banks may charge) |

| Credit/Debit Cards (Visa, Mastercard) | $10 | Varies by card type/issuer | Up to 5 business days | No fees from EC Markets |

| E-wallets (Skrill, Neteller) | $10 | Varies by e-wallet provider | Up to 2 hours (business days) | No fees from EC Markets (e-wallet provider may charge) |

| Regional Payment Processors (UnionPay, FasaPay, ViettelPay) | $10 | Varies by payment processor | Up to 2 hours (business days) | No fees from EC Markets (payment processor may charge) |

Support Service for Customer

In the fast-paced world of online trading, reliable customer support is crucial for a positive trading experience. Traders need to know that they can quickly and efficiently resolve any issues or concerns that may arise, whether they are related to account management, technical difficulties, or trading queries.

| Support Channel | Availability | Contact Details | Response Time | Supported Languages |

|---|---|---|---|---|

| Live Chat | 24/5 | Available on the EC Markets website | Immediate | English |

| 24/5 | support@ecmarkets.com | Within 24 hours | English, Spanish, Chinese | |

| Phone | 24/5 | +248 422 4099 | Immediate | English |

| Social Media | 24/5 | Facebook, Twitter, Instagram, LinkedIn | Within 24 hours | English |

Prohibited Countries

Due to various regulatory requirements, licensing restrictions, and geopolitical factors, EC Markets is prohibited from offering its services in certain countries and regions. It is essential for traders to be aware of these restrictions to avoid any potential legal consequences or risks associated with attempting to trade with EC Markets from a prohibited jurisdiction.

The primary reasons behind these restrictions include:

- Local Regulations: Some countries have strict regulations governing the provision of financial services, including online trading. These regulations may require brokers to obtain specific licenses or adhere to certain requirements before offering their services to residents of those countries.

- Licensing Limitations: EC Markets holds licenses from several respected regulatory bodies, such as the FCA, ASIC, FSA, FSC, FMA, and FSCA. However, these licenses may not cover all jurisdictions, limiting the broker's ability to operate in certain regions.

- Geopolitical Factors: Political instability, economic sanctions, or other geopolitical factors may prevent EC Markets from offering its services in specific countries or regions.

EC Markets is prohibited from providing its services in the following regions:

- United States

- Canada

- European Union (including the United Kingdom)

- Japan

- North Korea

- Iran

- Syria

- Cuba

- Sudan

- Crimea

Traders from these prohibited countries should not attempt to open an account or trade with EC Markets, as doing so may violate local laws and regulations. Attempting to circumvent these restrictions by providing false information or using a VPN may result in legal consequences and the termination of the trading account.

Special Offers for Customers

At the time of writing this article and reviewing EC Markets, they do not have any Special Offers or Bonuses. You can check their website for latest updates.

Conclusion

As I approach the end of this comprehensive review of EC Markets, I want to consolidate my findings and insights to provide you with a cohesive summary of their safety, reliability, and overall reputation as a broker.

Throughout my analysis, I have found that EC Markets demonstrates a strong commitment to regulatory compliance, holding licenses from multiple respected authorities such as the FCA, ASIC, FSA, FSC, FMA, and FSCA. This multi-jurisdictional oversight ensures that they adhere to strict standards of transparency, security, and fair dealing, providing a high level of protection for their clients' funds and interests.

EC Markets offers a solid range of tradable assets, including forex, precious metals, energies, indices, and cryptocurrency CFDs, catering to diverse trading preferences. Their competitive spreads, starting from 0.0 pips on ECN and PRO accounts, coupled with fast execution speeds and flexible leverage up to 500:1, create an attractive trading environment for both novice and experienced traders alike.

The broker's decision to provide the industry-leading MetaTrader 4 and MetaTrader 5 platforms demonstrates their commitment to offering reliable, feature-rich trading solutions. These platforms, combined with EC Markets' multilingual customer support, available 24/5 through live chat, email, and phone, ensure that traders can access the tools and assistance they need to navigate the markets effectively.

While EC Markets could further enhance its educational resources and extend customer support to 24/7 availability, the broker's overall offering remains competitive and well-suited to traders seeking a reputable, well-regulated partner.

It's important to note that EC Markets is prohibited from providing services in certain countries and regions, such as the United States, Canada, and the European Union (including the United Kingdom), due to regulatory restrictions. Traders should always ensure they are eligible to trade with EC Markets based on their country of residence to avoid any potential legal issues.

In conclusion, I believe that EC Markets is a reliable and trustworthy broker that prioritizes the safety and satisfaction of its clients. Their strong regulatory standing, wide range of tradable assets, competitive trading conditions, and user-friendly platforms make them a compelling choice for traders seeking a secure and supportive trading environment.

As with any financial decision, it's essential to conduct thorough research and consider individual trading needs and risk tolerance before choosing a broker. However, based on my analysis, I can confidently recommend EC Markets as a reputable and dependable option for those looking to participate in the exciting world of online trading.