eToro Review 2025: Pros, Cons & Key Features of the Social Trading Pioneer

eToro

Cyprus

Cyprus

-

Minimum Deposit $200

-

Withdrawal Fee $5

-

Leverage 30.1

-

Spread From 0.99

-

Minimum Order 0.1

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Cyprus Market Making (MM)

Cyprus Market Making (MM)

South Africa Retail Forex License

South Africa Retail Forex License

Australia Retail Forex License

Australia Retail Forex License

Softwares & Platforms

Customer Support

+18882718365

(English)

+18882718365

(English)

+35722030622

(English)

+35722030622

(English)

Supported language: English, French, German, Italian, Spanish

Social Media

Summary

eToro, a multi-asset online broker founded in 2007 in Tel Aviv, has established itself as a leading platform for social trading and investing. With over 30 million registered users across more than 140 countries, eToro offers a wide range of financial instruments, including stocks, ETFs, commodities, currencies, and cryptocurrencies. The company has received numerous awards for its innovative features, such as the "Best Social Trading Platform" at the Fintech Breakthrough Awards (2022) and the "Most Innovative Blockchain Company" at the UK Forex Awards (2019).

- Well-regulated by top-tier financial authorities like FCA, CySEC, and ASIC

- User-friendly web and mobile trading platforms suitable for all skill levels

- Innovative social trading features like CopyTrader and Smart Portfolios

- Wide range of tradable assets, including stocks, ETFs, forex, commodities, and crypto

- Commission-free stock and ETF trading in most countries

- Negative balance protection for retail clients to limit losses

- Comprehensive educational resources and responsive customer support

- Attractive promotions and loyalty rewards for active traders

- Easy account opening process with low minimum deposits for most countries

- Transparent and secure trading environment with a strong focus on client satisfaction

- Higher spreads on some asset classes compared to competitors.

- Limited range of advanced trading tools and platform customization options.

- Cryptocurrency trading incurs a 1% flat fee per trade.

- High minimum deposit requirements for certain countries (up to $10,000).

- No MetaTrader 4/5 integration or support for automated trading strategies.

- Inactivity fee of $10 per month after one year of no login activity.

- Withdrawal fee of $5 per transaction.

- Limited choice of base currencies (USD, EUR, GBP) depending on client's location.

- Services not available in some countries due to regulatory restrictions.

- Social trading carries additional risks and may not be suitable for all investors.

Overview

eToro's user-friendly web and mobile platforms cater to both beginner and experienced traders, providing a seamless trading experience, educational resources, and unique social features like CopyTrader and Smart Portfolios. The broker is regulated by top-tier financial authorities, including the FCA (UK), FSCA (South Africa), CySEC (Cyprus), and ASIC (Australia), ensuring a secure trading environment. However, potential clients should be aware of the risks associated with trading complex instruments like CFDs and cryptocurrencies. For more information, visit eToro.com.

eToro Overview Table

| Category | Details |

| Founded | 2007 |

| Headquarters | Tel Aviv, Israel |

| Regulation | FCA (UK), CySEC (Cyprus), ASIC (Australia), FinCEN (USA) |

| Minimum Deposit | $10-$10,000 (varies by country) |

| Trading Platforms | Web, Mobile (iOS & Android) |

| Assets Offered | Stocks, ETFs, Forex, CFDs, Crypto, Commodities |

| Copy Trading | Yes (CopyTrader) |

| Demo Account | Yes |

| Educational Resources | eToro Academy (articles, videos, webinars) |

| Customer Support | Email, Live Chat, Help Center |

eToro Licenses and Regulatory

eToro Regulations

eToro operates under a robust regulatory framework, holding licenses from several respected financial authorities worldwide.

eToro's primary regulatory licenses include:

- Financial Conduct Authority (FCA) in the United Kingdom

- Cyprus Securities and Exchange Commission (CySEC) in Cyprus

- Australian Securities and Investments Commission (ASIC) in Australia

- Financial Sector Conduct Authority (FSCA) in South Africa

Having multiple regulatory licenses is significant and offers several advantages for eToro's clients. It provides an extra layer of protection and reassurance, as the broker must adhere to the rules and guidelines set forth by each regulator. In the unlikely event of eToro's insolvency, clients may be eligible for compensation schemes, such as the Financial Services Compensation Scheme (FSCS) in the UK, which covers up to £85,000 per client.

For more information on eToro's regulatory measures and licenses, readers can visit the broker's official website at www.etoro.com.

| Regulatory Authority | Country | Key Details |

|---|---|---|

| Financial Conduct Authority (FCA) | United Kingdom | Regulates eToro in the UK, offering client protection and adherence to strict financial standards. |

| Cyprus Securities and Exchange Commission (CySEC) | Cyprus | Regulates eToro in Cyprus, providing oversight and investor protection under EU law. |

| Australian Securities and Investments Commission (ASIC) | Australia | Oversees eToro in Australia, ensuring compliance with local financial regulations. |

| Financial Sector Conduct Authority (FSCA) | South Africa | Regulates eToro in South Africa, ensuring adherence to local financial rules. |

Trading Instruments

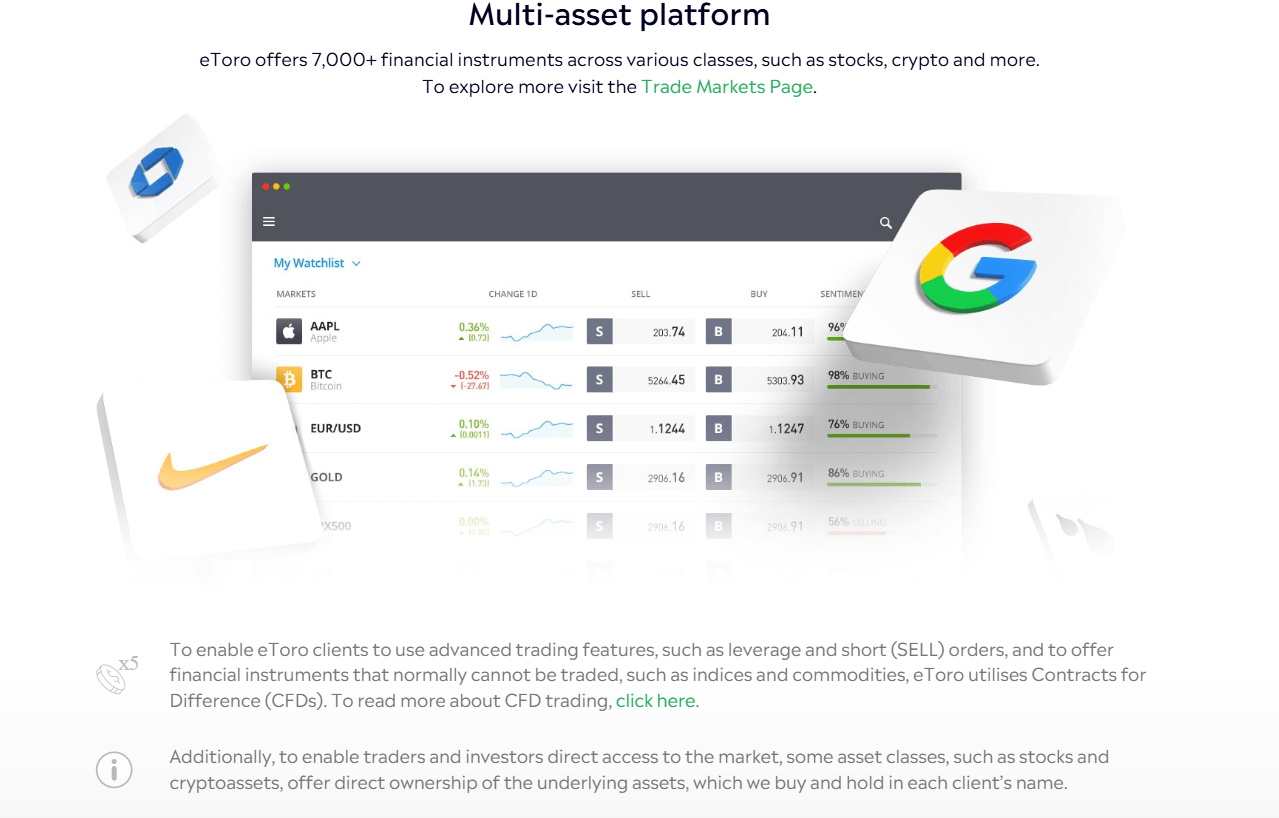

eToro offers a wide range of tradable assets, providing investors with ample opportunities to diversify their portfolios and capitalize on various market conditions.

Stocks and ETFs

eToro provides commission-free trading on a vast array of stocks and ETFs from major exchanges worldwide. Clients can invest in fractional shares, enabling them to build portfolios with smaller capital outlays. The stock offering covers numerous sectors and regions, from well-established blue-chip companies to emerging market opportunities. With over 2,000 stocks and 250 ETFs available, eToro's selection is comprehensive and accommodates a broad range of investment strategies.

Forex

The broker offers access to a diverse range of currency pairs, including majors, minors, and exotics. With competitive spreads starting from 1 pip on major pairs like EUR/USD and leverage up to 30:1, eToro caters to both short-term traders and long-term investors in the forex market. The platform's user-friendly interface and advanced charting tools make it accessible for traders of all skill levels.

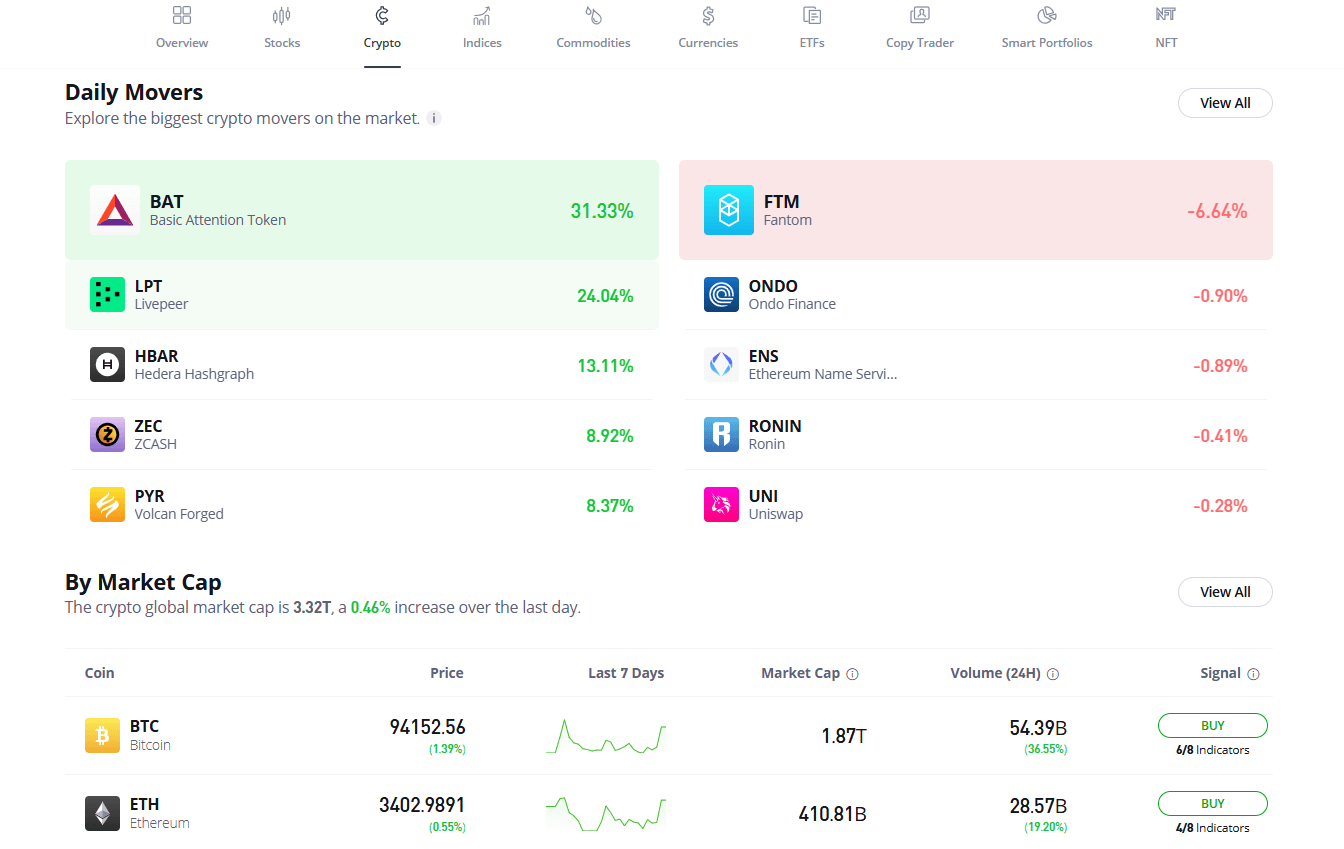

Cryptocurrencies

eToro has established itself as a leader in the cryptocurrency trading space, offering one of the most extensive selections of digital assets among multi-asset brokers. Clients can trade and invest in more than 120 cryptocurrencies, including popular choices like Bitcoin, Ethereum, and Ripple, as well as lesser-known altcoins. With a 1% flat fee on crypto trades and the ability to copy successful crypto traders, eToro has become a go-to platform for those looking to gain exposure to this dynamic market.

Commodities and Indices

Traders can access a variety of commodities, including precious metals like gold and silver, as well as energy products like oil and natural gas. eToro offers competitive spreads on these assets, with 45 pips on gold and 5 pips on crude oil. Additionally, the platform provides trading on over 30 major global indices, such as the S&P 500, FTSE 100, and DAX 30, allowing investors to gain exposure to entire markets through a single instrument.

Copy Trading

eToro's innovative CopyTrader feature sets it apart from many competitors. This unique offering allows clients to automatically allocate funds to replicate the trades of successful investors. By providing access to a vast pool of experienced traders and their strategies, eToro enables novice investors to benefit from the expertise of seasoned market participants. The CopyTrader feature has been a significant draw for many users, contributing to eToro's growth and popularity.

| Asset Class | Key Details |

|---|---|

| Stocks and ETFs | - Commission-free trading on over 2,000 stocks and 250 ETFs from global exchanges. - Fractional shares allow smaller investments. - Covers multiple sectors and regions, from blue-chip to emerging markets. |

| Forex | - Access to a wide range of currency pairs, including majors, minors, and exotics. - Competitive spreads starting from 1 pip on major pairs (e.g., EUR/USD). - Leverage up to 30:1. |

| Cryptocurrencies | - Over 120 cryptocurrencies, including Bitcoin, Ethereum, and Ripple. - 1% flat fee on crypto trades. - Ability to copy successful crypto traders. |

| Commodities | - Includes precious metals (gold, silver) and energy products (oil, natural gas). - Competitive spreads: 45 pips on gold, 5 pips on crude oil. |

| Indices | - Trading on over 30 major global indices, such as S&P 500, FTSE 100, and DAX 30. - Gain exposure to entire markets with a single instrument. |

| Copy Trading | - CopyTrader feature allows clients to replicate successful investors’ trades automatically. - Provides access to experienced traders’ strategies. |

Trading Platforms

Web-based Platform

eToro's web-based platform is accessible through any modern browser, providing clients with a seamless trading experience without the need for additional software installations. The platform boasts a clean, intuitive interface that allows users to easily navigate between markets, view real-time price updates, and execute trades with just a few clicks. The web platform also integrates eToro's social trading features, enabling clients to interact with other traders, share ideas, and copy successful strategies.

Mobile Trading Apps

For traders on the go, eToro offers mobile apps for both iOS and Android devices. The mobile applications provide full access to the broker's trading features, allowing clients to monitor their portfolios, execute trades, and manage their accounts from anywhere, at any time. The apps also incorporate eToro's social trading functionalities, ensuring that clients can stay connected with the trading community and make informed decisions based on the insights and strategies shared by other traders.

CopyTrader

eToro's proprietary CopyTrader feature is a standout offering that sets the broker apart from many of its competitors. This innovative tool allows clients to automatically copy the trades of successful investors, enabling them to benefit from the expertise of more experienced traders without the need for constant market analysis and manual trade execution. CopyTrader has been a significant draw for many of eToro's clients, particularly those who are new to trading or lack the time to actively manage their portfolios.

Smart Portfolios

In addition to CopyTrader, eToro offers Smart Portfolios, which are professionally managed thematic investment portfolios designed to help clients diversify their holdings and gain exposure to specific market sectors or trends. These portfolios are created and managed by eToro's investment committee, combining human expertise with advanced algorithms to optimize asset allocation and risk management. Smart Portfolios provide an accessible way for clients to invest in pre-built, diversified portfolios that align with their investment goals and risk preferences.

While eToro does not offer popular third-party platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5), the broker's proprietary platforms are designed to meet the needs of most traders. The platforms provide a range of advanced charting tools and indicators, real-time market updates, and a user-friendly interface that facilitates smooth navigation and trade execution.

| Feature | Web Platform | Mobile Apps (iOS & Android) | CopyTrader | Smart Portfolios |

| Availability | Yes | Yes | Yes | Yes |

| Charting Tools | Yes | Yes | N/A | N/A |

| Indicators | Yes | Yes | N/A | N/A |

| Real-time Prices | Yes | Yes | N/A | Yes |

| Social Trading | Yes | Yes | Yes | No |

| Automated Trading | No | No | Yes | Yes |

| Thematic Investing | No | No | No | Yes |

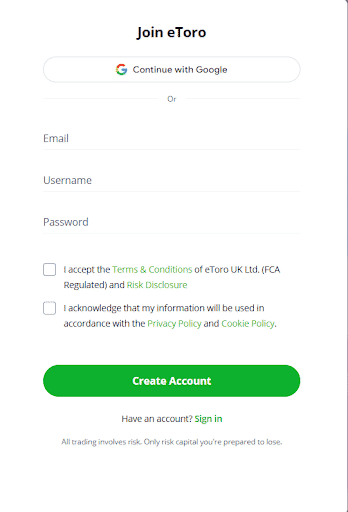

eToro How to Open an Account: A Step-by-Step Guide

Step 1: Visit eToro's website. Begin by visiting eToro's official website at etoro.com. Click on the "Sign Up" button located at the top right corner of the homepage.

Step 2: Complete the registration form. Fill out the registration form with your personal information, including your name, email address, and desired password. You can also choose to sign up using your Facebook or Google account, which will pre-fill some of the required information.

Step 3: Verify your email address After submitting the registration form, you'll receive an email from eToro containing a verification link. Click on the link to verify your email address and activate your account.

Step 4: Complete your profile Once your account is activated, log in to your eToro account and complete your profile by providing additional personal information, such as your date of birth, phone number, and address.

Step 5: Verify your identity To comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, eToro requires clients to verify their identity. Upload a copy of your government-issued ID, such as a passport or driver's license, and a proof of address, such as a utility bill or bank statement.

Step 6: Fund your account After your identity is verified, you can fund your account using one of eToro's accepted payment methods. These include credit/debit cards, bank transfers, and various e-wallets like PayPal, Skrill, and Neteller. The minimum deposit amount varies depending on your location, ranging from $50 to $10,000.

Step 7: Start trading Once your account is funded, you can begin trading on eToro's platform. Browse the available markets, analyze price charts, and execute trades using the broker's user-friendly interface.

eToro's account opening process is designed to be quick and easy, with most clients able to start trading within 1-2 business days of completing the registration form. The broker's customer support team is available to assist with any questions or issues that may arise during the account opening process

Charts and Analysis

eToro provides a comprehensive suite of trading resources and educational tools designed to support clients in their trading journey. These resources cater to traders of all skill levels, from beginners seeking to understand the basics of trading to experienced investors looking to refine their strategies and stay informed about market developments.

| Resource/Tool | Key Details |

|---|---|

| Charting Tools | - Advanced charting capabilities available on the web and mobile apps. - Customizable charts: candlestick, line, and bar charts. - Access to over 100 built-in technical indicators, such as moving averages, Bollinger Bands, and MACD. |

| Economic Calendar | - Displays key market events, news releases, and economic indicators that may affect markets. - Automatically updated, filterable by currency, importance level, and event type. |

| Market News and Analysis | - Daily updates and expert insights via the eToro blog and in-platform real-time news feed. - Aggregates trusted financial media sources to keep clients informed of market developments. |

| Webinars and Educational Videos | - Regular webinars led by experienced traders and analysts, covering a variety of trading topics. - Educational videos available on-demand via eToro’s YouTube channel and platform. |

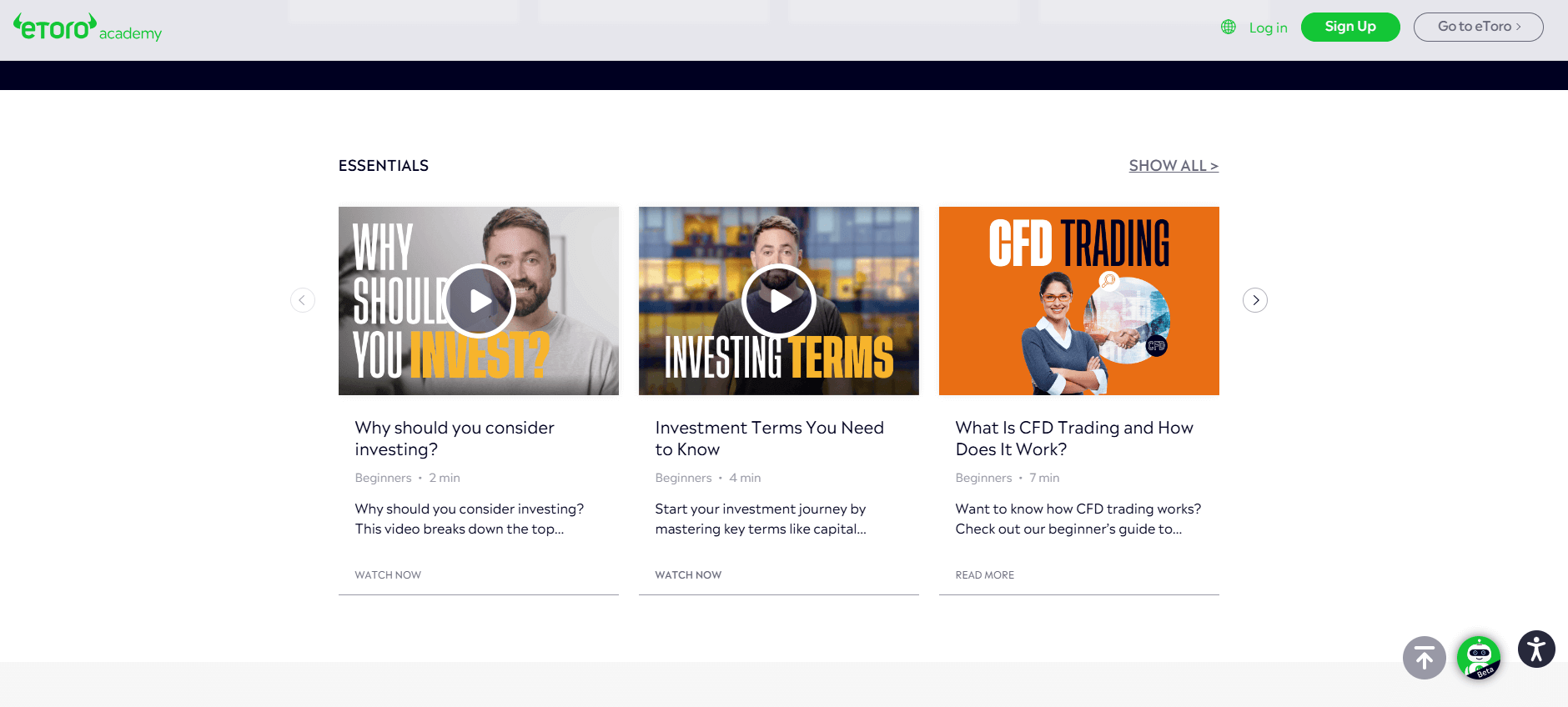

| eToro Academy | - A comprehensive online learning resource with structured courses for all skill levels. - Topics include trading basics, market analysis, risk management, and platform usage. - Quizzes and certifications available to track progress and achievements. |

eToro Account Types

eToro offers a streamlined approach to trading accounts, providing a single account type that caters to the needs of most traders.

Standard Trading Account

A versatile account for all traders, offering full access to eToro's platform, assets, and social trading features, with competitive spreads and leverage up to 1:30 for retail clients.

| Feature | Details |

|---|---|

| Minimum Deposit | Ranges from $50 to $10,000, depending on the client’s country of residence. |

| Spreads | 1 pip on forex pairs, 0.09% on stocks. |

| Leverage | Up to 1:30 for retail clients, up to 1:400 for professional clients. |

| Platform Access | Access to eToro’s web-based platform and mobile apps. |

| Payment Methods | Wide range of options for deposits and withdrawals (e.g., bank transfer, credit card, e-wallets). |

| Negative Balance Protection | Available for retail clients. |

| Social Trading Features | Access to CopyTrader and Smart Portfolios for social trading and portfolio management. |

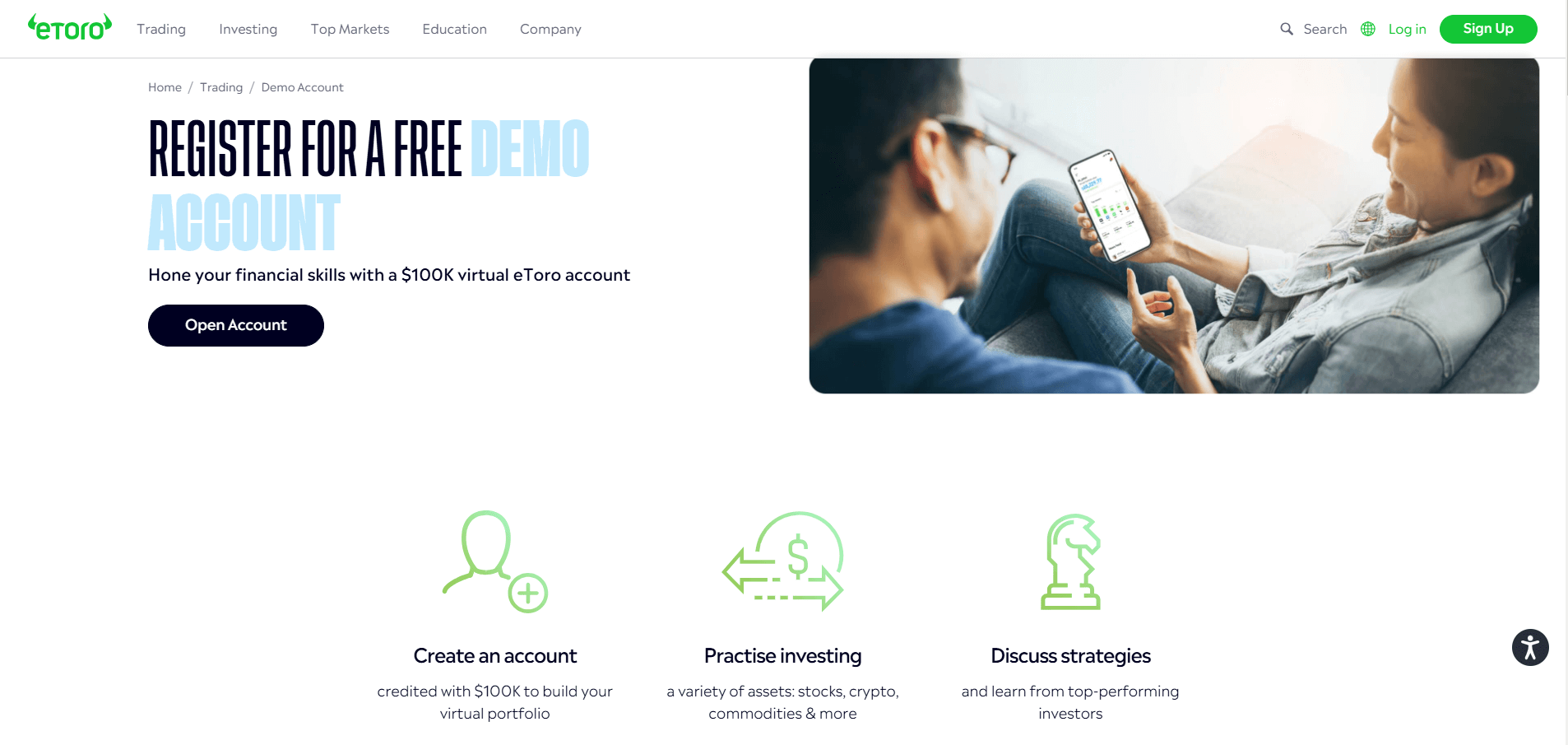

Demo Account:

A risk-free account funded with virtual currency, ideal for practicing and testing strategies before trading with real money.

| Feature | Details |

|---|---|

| Purpose | Allows clients to practice risk-free trading with virtual currency. |

| Access | Full access to the eToro platform and features, mirroring the live account. |

| Testing Strategies | Test and refine trading strategies without financial risk. |

| Learning Tool | Familiarize with the platform and gain confidence before committing real funds. |

Professional Account:

Designed for experienced traders meeting specific criteria, offering higher leverage (up to 1:400) and advanced tools for more sophisticated trading strategies.

| Eligibility Criteria | Details |

|---|---|

| 1. Transaction Volume | Must have completed 10 significant transactions per quarter over the last 4 quarters. |

| 2. Portfolio Size | A portfolio (cash + financial instruments) exceeding €500,000. |

| 3. Professional Experience | Must have 1 year of financial sector experience in a professional role requiring financial knowledge. |

| Feature | Details |

|---|---|

| Leverage | Up to 1:400 for professional accounts, higher than the retail limit. |

| Additional Tools | Access to reduced margin close-out levels and advanced trading resources. |

eToro Account Types Comparison Table

| Feature | Standard Account | Demo Account | Professional Account |

| Minimum Deposit | $50 - $10,000* | N/A | $50 - $10,000* |

| Leverage (Forex) | Up to 1:30 | Up to 1:30 | Up to 1:400 |

| Leverage (Stocks) | Up to 1:5 | Up to 1:5 | Up to 1:10 |

| Tradable Assets | Full access | Full access | Full access |

| Trading Platform | Web, Mobile | Web, Mobile | Web, Mobile |

| Social Trading | Yes | Yes | Yes |

| Negative Balance Protection | Yes | N/A | No |

| Margin Close-Out Level | 50% | N/A | 15% |

Negative Balance Protection

While negative balance protection provides a safety net for traders, it should not be relied upon as a primary risk management strategy. Traders should still implement proper risk management techniques, such as setting appropriate stop-loss orders, managing position sizes, and maintaining a balanced portfolio to minimize potential losses. eToro encourages clients to familiarize themselves with the risks associated with trading and to always trade responsibly. The broker provides educational resources, risk management tools, and account management features to help clients make informed trading decisions and manage their risk exposure effectively. In summary, eToro's negative balance protection policy demonstrates the broker's commitment to safeguarding clients' funds and promoting a secure trading environment. By absorbing negative balances for retail clients, eToro ensures that traders' losses are limited to their deposited funds, providing peace of mind and mitigating the risk of unexpected financial obligations. However, traders should still exercise caution, employ sound risk management practices, and never trade beyond their means to ensure a sustainable and responsible trading experience.

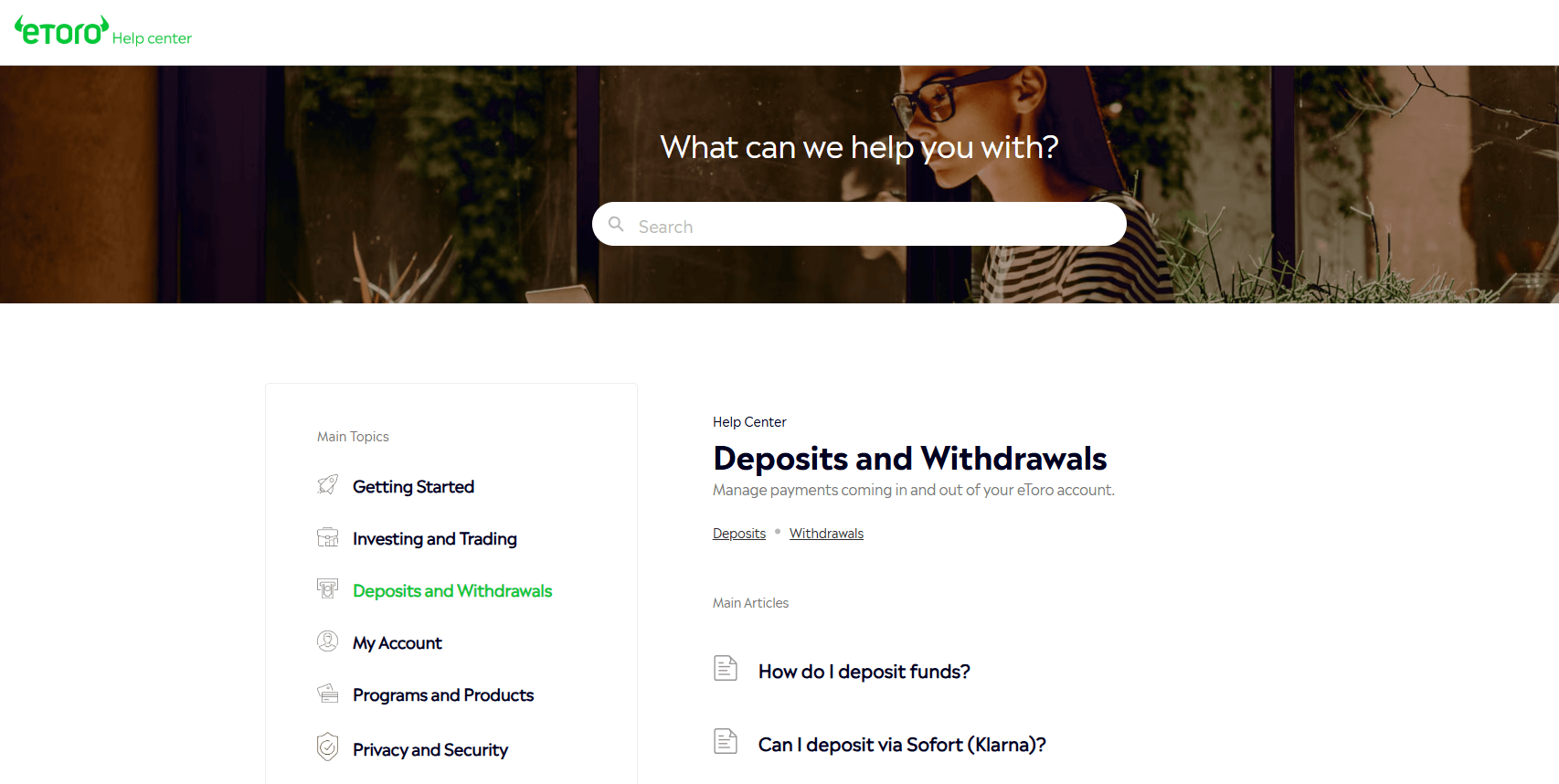

eToro Deposits and Withdrawals

Deposit Methods

eToro accepts the following deposit methods:| Payment Method | Details |

|---|---|

| Credit/Debit Cards | Visa, Mastercard, Diners Club, Maestro |

| Bank Transfer | Domestic and International transfers |

| e-Wallets | PayPal, Skrill, Neteller, WebMoney, Yandex |

| Rapid Transfer | Fast payment processing method |

| Online Banking | Trustly, POLi, Klarna |

| Local Payment Methods | Sofort, GiroPay, iDEAL |

| Minimum Deposit | Ranges from $50 to $10,000 depending on country and payment method |

| Processing Time | Instant for credit/debit cards and e-wallets, 3-7 business days for bank transfers |

| Deposit Fees | No fees charged by eToro, but payment providers may charge their own fees |

Withdrawal Methods

eToro supports the following withdrawal methods:| Payment Method | Details |

|---|---|

| Bank Transfer | Domestic and International transfers |

| Credit/Debit Cards | Visa, Mastercard, Diners Club, Maestro |

| e-Wallets | PayPal, Skrill, Neteller |

| Minimum Withdrawal | $30 |

| Withdrawal Fee | $5 flat fee per withdrawal |

| Processing Time | 1-2 business days, plus 3-8 business days for funds to reach the account |

Verification and Security

To comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, eToro requires clients to verify their identity before processing withdrawals. Clients must provide a valid government-issued ID, proof of address, and, in some cases, additional documentation to confirm the ownership of the funding source. eToro employs state-of-the-art security measures to protect clients' funds and personal information. The broker uses SSL encryption, two-factor authentication, and segregated client accounts to ensure the safety of funds and data.Unique Features

One of the unique features of eToro's deposit and withdrawal system is the ability to fund an account using a wide range of local payment methods, making it convenient for clients in different countries to deposit funds using their preferred payment provider.Support Service for Customer

eToro understands the importance of providing timely assistance to its clients, offering multiple channels through which traders can reach out for help and guidance.

Support Channels

eToro offers the following customer support channels:- Live Chat: Available within the trading platform, live chat allows clients to connect with a support representative in real time for immediate assistance.

- Email: Clients can send their inquiries to eToro's support team via email and expect a response within 24-48 hours.

- Phone: eToro provides a dedicated phone support line for clients who prefer to speak with a representative directly.

- Social Media: Traders can reach out to eToro's support team through their official social media channels, such as Twitter and Facebook.

- Help Center: eToro's comprehensive Help Center offers a wide range of articles, tutorials, and FAQs that address common issues and provide step-by-step guidance.

Support Languages

eToro's customer support is available in multiple languages to cater to its global client base, including:- English

- German

- French

- Spanish

- Italian

- Russian

- Arabic

- Chinese

Availability and Response Times

eToro's customer support team is available Monday to Friday, 24 hours a day. The broker aims to provide prompt assistance to all clients, with the following target response times:- Live Chat: Immediate response during market hours

- Email: 24-48 hours

- Phone: Immediate response during market hours

- Social Media: 24-48 hours

eToro Customer Support Comparison Table

| Feature | eToro |

|---|---|

| Support Channels | Live Chat, Email, Phone, Social Media, Help Center |

| Support Languages | English, German, French, Spanish, Italian, Russian, Arabic, Chinese |

| Availability | Monday to Friday, 24 hours a day |

| Live Chat Response Time | Immediate (during market hours) |

| Email Response Time | 24-48 hours |

| Phone Response Time | Immediate (during market hours) |

| Social Media Response Time | 24-48 hours |

| Country-Specific Support | Available for select countries |

Prohibited Countries

As a globally regulated broker, eToro adheres to the laws and regulations of the countries in which it operates. Due to various legal restrictions, licensing requirements, and geopolitical factors, eToro is prohibited from providing services to residents of certain countries.

Reasons for Restrictions

The primary reasons behind these restrictions include:

- Local Regulations: Some countries have strict regulations governing online trading and foreign exchange, requiring brokers to obtain specific licenses or comply with particular requirements. If eToro does not meet these requirements or chooses not to pursue the necessary licenses, it may be prohibited from operating in those countries.

- Geopolitical Factors: Political instability, economic sanctions, or international trade restrictions can also prevent eToro from offering services in certain regions. These factors may make it difficult or impossible for the broker to conduct business in a compliant manner.

- Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) Laws: eToro must comply with strict AML and CTF regulations to prevent financial crimes and maintain the integrity of its platform. Some countries may have insufficient AML/CTF frameworks, making it challenging for eToro to operate in compliance with global standards.

Prohibited Countries List

As of 2023, eToro is prohibited from providing services to residents of the following countries:

Afghanistan, Albania, Bahamas, Barbados, Belarus, Burundi, Cambodia, Cayman Islands, Chad, Congo Republic, Cuba, Democratic Republic of the Congo, Eritrea, Ghana, Guinea, Guinea Bissau, Haiti, Iran, Iraq, Jamaica, Lebanon, Libya, Mali, Myanmar, Nicaragua, Niger, Nigeria, North Korea, Pakistan, Panama, Samoa, Serbia, Somalia, South Sudan, Sudan, Syria, Trinidad and Tobago, Tunisia, Uganda, Venezuela, Yemen, Zimbabwe

Consequences of Trading from Prohibited Countries

Attempting to trade with eToro from a prohibited country may result in severe consequences, including:

- Account Termination: If eToro discovers that a client is residing in a prohibited country, the broker may immediately terminate their account and liquidate any open positions.

- Funds Seizure: In some cases, funds deposited from prohibited countries may be subject to seizure or freezing, as they may be considered in violation of international sanctions or AML/CTF laws.

- Legal Action: Clients who knowingly attempt to circumvent eToro's restrictions and trade from prohibited countries may face legal action, fines, or other penalties.

- Africa, Asia, the Caribbean, Europe, the Middle East, Oceania, South America

Special Offers for Customers

eToro offers a range of special promotions and incentives designed to attract new clients and reward existing traders for their loyalty. These offers can provide additional value and enhance the overall trading experience on the platform.

| Feature | Details |

|---|---|

| Sign-Up Bonus | New clients may receive a bonus (e.g., $50) for depositing a minimum amount (e.g., $500) and meeting trading requirements within 30 days. Bonus terms vary by location and promotion. |

| Refer-a-Friend Program | Existing clients can earn rewards by inviting others to join. Both the referring client and the new client may receive bonuses, with terms varying by region. |

| Trading Competitions | Periodic competitions focus on specific assets (e.g., cryptocurrencies or stocks) and reward top performers with cash bonuses, perks, or merchandise. |

| Club Tiers and Benefits | eToro’s Club Program includes five tiers: Silver, Gold, Platinum, Platinum+, and Diamond, with increasing perks like spread rebates, account managers, and exclusive events. |

| Third-Party Partnerships | Collaborations with external firms may provide clients with exclusive market research, trading insights, or additional tools to enhance their trading decisions. |

Conclusion

Throughout this comprehensive review, I have extensively analyzed various aspects of eToro's operations, including their regulatory compliance, geographical reach, trading platforms, asset offerings, customer support, and promotional incentives. By consolidating these findings, I aim to provide a cohesive assessment of eToro's safety, reliability, and overall reputation as an online broker.

One of the most striking aspects of eToro is their commitment to regulatory compliance and client protection. They are authorized and regulated by top-tier financial authorities such as the FCA, CySEC, and ASIC, which subject them to strict oversight and ensure that they adhere to industry best practices. This multi-jurisdictional regulation provides a robust framework for safeguarding clients' funds and interests.

In terms of trading platforms and tools, eToro offers a user-friendly and intuitive experience that caters to both novice and experienced traders. Their proprietary web-based platform and mobile apps provide a seamless trading environment, equipped with advanced charting capabilities, risk management tools, and social trading features like CopyTrader and Smart Portfolios. These innovative offerings set eToro apart from many of their competitors.

eToro's extensive range of tradable assets is another compelling factor, allowing clients to diversify their portfolios and seize opportunities across multiple markets. With commission-free stock and ETF trading, competitive spreads on forex and commodities, and an impressive selection of cryptocurrencies, eToro provides a versatile and cost-effective trading environment.

Customer support is a crucial aspect of any brokerage, and eToro has demonstrated a strong commitment to providing timely and efficient assistance to their clients. With multiple support channels, including live chat, email, phone, and a comprehensive Help Center, traders can access the guidance they need to navigate the platform and resolve any issues that may arise.

While eToro's promotions and incentives may not be the most extensive in the industry, they do offer a range of attractive benefits, such as sign-up bonuses, a refer-a-friend program, trading competitions, and tiered loyalty rewards. These initiatives provide added value to clients and enhance the overall trading experience.

It is worth noting that eToro does have some limitations, such as higher spreads on certain asset classes compared to some competitors and a relatively high minimum deposit requirement for certain countries. Additionally, their services are not available in all regions, so potential clients should verify their eligibility before attempting to open an account.

Overall, I believe that eToro is a reliable and trustworthy broker that prioritizes client satisfaction and regulatory compliance. Their user-friendly platforms, wide range of tradable assets, and innovative social trading features make them an attractive choice for both beginner and experienced traders. While there may be some areas where other brokers excel, eToro's comprehensive offering and commitment to transparency and security make them a strong contender in the online brokerage space.

As with any financial decision, it is crucial for individuals to conduct their own research, assess their trading goals and risk tolerance, and carefully review the terms and conditions before choosing a broker. However, based on the findings of this review, I believe that eToro is a reputable and well-rounded choice for those seeking a secure and feature-rich trading environment.