FBS Review 2025: A Comprehensive Look at This Forex Broker

FBS

Belize

Belize

-

Minimum Deposit $5

-

Withdrawal Fee $1

-

Leverage 3000:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Unavailable

-

Indices Available

Licenses

Cyprus Market Making (MM)

Cyprus Market Making (MM)

South Africa Retail Forex License

South Africa Retail Forex License

Australia Retail Forex License

Australia Retail Forex License

Belize Financial Services License

Belize Financial Services License

Softwares & Platforms

Customer Support

+50125313540

(English)

+50125313540

(English)

Supported language: Chinese (Simplified), English, Indonesian, Spanish

Social Media

Summary

FBS is a globally recognized forex and CFD broker, founded in 2009 and regulated by CySEC, ASIC, FSCA, and IFSC. It offers a wide range of trading instruments, including forex, metals, indices, stocks, and cryptocurrencies, with leverage up to 1:3000 and spreads starting from 0 pips. The broker supports multiple account types, including Micro, Standard, Zero Spread, and ECN accounts, catering to traders of all levels. FBS provides MT4, MT5, and its proprietary FBS Trader app, along with extensive educational resources, trading tools, and 24/7 customer support. Additionally, it offers attractive bonuses, cashback programs, and trading contests to enhance the trading experience.

- Well-regulated by top-tier authorities CySEC and ASIC

- Wide range of account types for beginners and experienced traders

- Low minimum deposit requirements starting from $5 to $100

- Diverse selection of tradable assets including forex, metals, energies, indices, and stocks

- User-friendly trading platforms: MetaTrader 4, MetaTrader 5, and FBS Trader app

- Extensive educational resources: webinars, video tutorials, and guides

- 24/7 multilingual customer support via live chat, email, and phone

- Attractive promotions and loyalty programs for clients

- Negative balance protection to limit potential losses

- Competitive spreads and trading conditions

- Not available to traders in the USA, Canada, and a few other countries

- Limited range of cryptocurrencies compared to some competitors

- Charges inactivity fees after 90 days of no trading activity

- No support for automated trading systems on FBS Trader app

- Smaller selection of trading tools compared to some larger brokers

- Occasional requotes and slippage reported during high volatility

- Limited research and market analysis compared to industry leaders

- Some withdrawal methods may take up to 5 business days

- High leverage can increase risk of losses for inexperienced traders

- Non-leveraged long-term investing options are not available

Overview

Established in 2009, FBS is an international online forex and CFD broker that has gained popularity among traders worldwide. With a presence in over 150 countries and more than 23 million registered traders, FBS has become a prominent player in the online trading industry. The broker has received numerous awards and recognitions, including "Best Forex Broker Asia" at the Global Banking & Finance Awards and "Best Customer Service Broker Asia" at the International Business Magazine Awards.

FBS offers a wide range of tradable instruments, including over 75 currency pairs, metals, energies, indices, and shares, catering to the diverse needs of traders. The broker provides competitive trading conditions, such as low spreads starting from 0 pips, high leverage up to 1:3000, and fast execution speeds. FBS is known for its user-friendly trading platforms, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5), as well as its proprietary FBS Trader app for mobile trading.

One of the key advantages of FBS is its commitment to education and support. The broker offers an extensive library of educational materials, including video tutorials, webinars, and trading guides, suitable for both beginners and experienced traders. FBS also provides 24/7 multilingual customer support via live chat, email, and phone, ensuring that traders can access assistance whenever they need it.

While FBS has gained a solid reputation in the industry, it's essential for traders to consider the potential risks associated with online trading, such as market volatility and the possibility of financial losses. As with any financial decision, it's crucial to conduct thorough research, understand the risks involved, and only invest what you can afford to lose.

Overview Table

| Feature | Details |

|---|---|

| Broker Name | FBS |

| Year Founded | 2009 |

| Headquarters | Belize City, Belize |

| Regulation | CySEC, ASIC, FSCA, IFSC |

| Number of Traders | Over 23 million |

| Countries Served | Over 150 |

| Minimum Deposit | $5 |

| Maximum Leverage | 1:3000 |

| Trading Platforms | MT4, MT5, FBS Trader app |

| Customer Support | 24/7 via live chat, email, and phone |

| Education & Research | Video tutorials, webinars, trading guides |

Facts List

- FBS was established in 2009 and has since expanded its presence to over 150 countries worldwide.

- The broker has more than 23 million registered traders, demonstrating its popularity and market reach.

- FBS is regulated by reputable authorities, including CySEC (Cyprus), ASIC (Australia), FSCA (South Africa), and IFSC (Belize).

- Traders can access over 75 currency pairs, as well as metals, energies, indices, and shares, providing a diverse range of trading opportunities.

- FBS offers competitive trading conditions, with low spreads starting from 0 pips and leverage up to 1:3000.

- The broker supports popular trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary FBS Trader app for mobile trading.

- FBS provides an extensive library of educational materials, such as video tutorials, webinars, and trading guides, catering to both beginners and experienced traders.

- Traders can access 24/7 multilingual customer support via live chat, email, and phone, ensuring prompt assistance whenever needed.

- The minimum deposit required to open an account with FBS is just $5, making it accessible to a wide range of traders.

- Despite its reputation, traders should be aware of the potential risks associated with online trading and carefully consider their investment decisions.

FBS Licenses and Regulatory

FBS operates under the regulatory oversight of several reputable financial authorities worldwide, ensuring a high level of compliance with industry standards and providing a secure trading environment for its clients.

The primary regulatory entities supervising FBS include:

- The Cyprus Securities and Exchange Commission (CySEC) – FBS's European entity, Tradestone Ltd, is authorised and regulated by CySEC under license number 331/17. CySEC is known for its strict regulatory framework, which is harmonised with the European Union's Markets in Financial Instruments Directive (MiFID). This license allows FBS to offer its services to clients across the European Economic Area (EEA).

- The Australian Securities and Investments Commission (ASIC) – FBS's Australian entity, FBS AU Pty Ltd, is regulated by ASIC under license number 426359. ASIC is a well-respected regulatory body that oversees financial services providers in Australia, ensuring they adhere to high standards of conduct and investor protection.

- The Financial Sector Conduct Authority (FSCA) of South Africa – FBS's South African entity, FBS SA (Pty) Ltd, is authorised by the FSCA under license number 51931. The FSCA is responsible for regulating financial services providers in South Africa, promoting fair treatment of customers and ensuring the integrity of the financial markets.

- The International Financial Services Commission (IFSC) of Belize – FBS's global entity, FBS Markets Inc., is licensed by the IFSC under license number IFSC/60/254/TS/21. While the IFSC is not considered a top-tier regulator, it still provides oversight and requires brokers to adhere to certain standards of operation.

The fact that FBS holds multiple licenses from respected regulatory bodies is a testament to its commitment to compliance and providing a secure trading environment for its clients. These licenses help ensure that FBS operates transparently, maintains segregated client funds, and adheres to strict financial reporting requirements.

Moreover, FBS's regulatory status provides clients with access to various investor protection schemes, such as the Investor Compensation Fund (ICF) in Cyprus, which offers compensation of up to €20,000 per client in the event of broker insolvency.

It's essential for traders to choose a well-regulated broker like FBS, as it offers greater peace of mind and reduces the risk of fraud or malpractice. However, it's important to note that even with robust regulation, trading forex and CFDs still carries inherent risks due to the nature of the financial markets. Traders should always exercise caution and never invest more than they can afford to lose.

Regulations List

- Cyprus Securities and Exchange Commission (CySEC) – Licence number 331/17

- Australian Securities and Investments Commission (ASIC) – Licence number 426359

- Financial Sector Conduct Authority (FSCA) of South Africa – Licence number 51931

- International Financial Services Commission (IFSC) of Belize – Licence number IFSC/60/254/TS/21

Trading Instruments

FBS offers a diverse range of tradable assets, catering to the varied preferences and risk appetites of traders worldwide. With over 75 currency pairs, as well as CFDs on metals, energies, indices, and shares, FBS provides ample opportunities for traders to diversify their portfolios and capitalise on market movements.

| Asset Class | Details |

|---|---|

| Forex | Major, minor, and exotic currency pairs with spreads from 0 pips. Popular pairs include EUR/USD, GBP/USD, USD/JPY, and USD/CHF. |

| Metals & Energies | CFDs on gold (XAU/USD), silver (XAG/USD), crude oil (WTI & Brent), and natural gas (NG). |

| Indices | CFDs on global indices like S&P 500, NASDAQ 100, Dow Jones 30, FTSE 100, DAX 30, and Nikkei 225. |

| Shares | CFDs on U.S., European, and Asian stocks, including Apple, Amazon, Facebook, Google, and Microsoft. |

| Cryptocurrencies | CFDs on Bitcoin, Ethereum, and other digital assets without the need for ownership or storage. |

FBS's wide array of tradable assets is a testament to its commitment to providing a comprehensive trading experience for its clients. By offering access to multiple markets and instruments, FBS empowers traders to diversify their portfolios, manage risk more effectively, and seize opportunities across various sectors and geographies.

Moreover, FBS's competitive spreads and deep liquidity across its asset classes ensure that traders can execute their strategies efficiently and cost-effectively. The broker's ability to offer such a diverse range of tradable assets also demonstrates its adaptability to evolving market trends and its responsiveness to the changing needs of its client base.

In terms of trading conditions for each asset class, FBS provides detailed information on spreads, margins, and other specifications on its official website. Traders are encouraged to visit the "Trading Instruments" section on the FBS website to explore the full range of assets available and their respective trading conditions.

Trading Platforms

FBS offers a range of trading platforms to cater to the diverse needs and preferences of its clients. Whether you're a beginner or an experienced trader, you'll find a platform that suits your trading style and expertise level.

MetaTrader 4 (MT4)

MT4 is one of the most popular trading platforms in the world, known for its user-friendly interface, advanced charting tools, and extensive customization options. FBS clients can access MT4 through desktop, web, and mobile applications, ensuring seamless trading across devices.

Key features of the MT4 platform include:

- 30+ technical indicators and analytical tools

- Multiple order types, including market, limit, and stop orders

- One-click trading and trading directly from charts

- Automated trading through Expert Advisors (EAs)

- Customizable alerts and notifications

MetaTrader 5 (MT5)

MT5 is the successor to MT4, offering enhanced functionality and advanced trading features. Like MT4, FBS clients can access MT5 through desktop, web, and mobile applications.

Notable features of the MT5 platform include:

- 38+ technical indicators and 44 graphical objects

- 21 timeframes for analysis and trading

- Depth of Market (DOM) for enhanced market transparency

- Built-in economic calendar and market news

- Algorithmic trading through Expert Advisors (EAs)

FBS Trader App

FBS Trader App In addition to MT4 and MT5, FBS offers its proprietary mobile trading app, FBS Trader. This app is designed to provide a streamlined and user-friendly trading experience on the go.

Features of the FBS Trader app include:

- Intuitive and easy-to-use interface

- Real-time quotes and charts for various instruments

- Instant deposit and withdrawal options

- Secure trading with biometric authentication

- Access to FBS's educational resources and market analysis

Web Trading

Web Trading For traders who prefer to trade directly from their web browsers, FBS offers web-based versions of both MT4 and MT5. These web platforms provide the same functionality as their desktop counterparts, without the need for any software installation.

By offering multiple trading platforms, FBS ensures that its clients have the flexibility to choose the tools that best align with their trading needs and preferences. The availability of popular platforms like MT4 and MT5 is particularly advantageous, as traders can leverage the vast ecosystem of third-party tools, indicators, and EAs built around these platforms.

Trading Platforms Comparison Table

| Feature | MT4 | MT5 | FBS Trader App | Web Trading |

|---|---|---|---|---|

| Desktop | Yes | Yes | No | No |

| Web | Yes | Yes | No | Yes (MT4 & MT5) |

| Mobile | Yes | Yes | Yes (iOS & Android) | No |

| Technical Indicators | 30+ | 38+ | Basic | Same as desktop |

| Order Types | Market, Limit, Stop | Market, Limit, Stop | Market, Limit, Stop | Same as desktop |

| One-Click Trading | Yes | Yes | Yes | Yes |

| Automated Trading (EAs) | Yes | Yes | No | Same as desktop |

| Customization Options | High | High | Limited | Same as desktop |

FBS How to Open an Account: A Step-by-Step Guide

Opening an account with FBS is a simple and straightforward process that can be completed entirely online. Follow these step-by-step instructions to get started:

Step 1: Visit the FBS website Go to the official FBS website at fbs.com and click on the "Open an Account" button in the top right corner of the homepage.

Step 2: Choose your account type Select the type of account you wish to open from the available options, such as Micro, Standard, Zero Spread, or ECN. Consider factors such as minimum deposit requirements, leverage, and trading instruments when making your decision.

Step 3: Provide personal information Fill in the registration form with your personal details, including your full name, date of birth, country of residence, phone number, and email address. Ensure that all information provided is accurate and up-to-date.

Step 4: Choose trading platform Select your preferred trading platform from the options provided, such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5), and specify your desired account base currency (USD, EUR, etc.).

Step 5: Agree to terms and conditions Read and agree to FBS's terms and conditions, privacy policy, and other relevant legal documents by checking the appropriate boxes.

Step 6: Verify your email and phone number Upon submitting the registration form, you will receive a verification code via email and SMS. Enter these codes in the designated fields to confirm your email address and phone number.

Step 7: Fund your account Once your account is verified, log in to your FBS Personal Area and navigate to the "Deposit" section. Choose your preferred payment method, such as credit/debit card, e-wallet, or bank transfer, and follow the instructions to fund your account. FBS offers a low minimum deposit requirement of just $5 for Micro accounts.

Step 8: Start trading After your deposit is processed, you can download and install your chosen trading platform (MT4 or MT5) from the FBS website. Log in to the platform using the credentials provided in your FBS Personal Area and start trading.

To ensure a smooth account opening process, make sure to have the following documents and information readily available:

- Valid government-issued ID (e.g., passport, driver's license, or national ID card)

- Proof of residence (e.g., utility bill or bank statement)

- Payment method details (e.g., credit card, e-wallet, or bank account information)

FBS may require additional documentation as part of its account verification process, depending on your country of residence and chosen account type. The broker strives to complete account verification within 24 hours of receiving all necessary documents.

One of the advantages of opening an account with FBS is its user-friendly and streamlined application process. The broker has optimised its registration form to minimise the time and effort required from potential clients, while still ensuring compliance with regulatory requirements.

Charts and Analysis

FBS offers a comprehensive suite of educational trading resources and tools to help clients enhance their trading knowledge and skills. These resources cater to traders of all levels, from beginners to experienced professionals, and cover a wide range of topics related to forex, CFDs, and financial markets.

| Feature | Description |

|---|---|

| Market Analysis | Daily insights on forex, commodities, indices, and stocks with technical and fundamental analysis. Available on the website, app, and email. |

| Webinars | Live sessions on trading strategies, risk management, and market analysis. Free access with Q&A. Past webinars are available on demand. |

| Video Tutorials | Step-by-step trading videos covering platforms, chart patterns, and indicators. Available on the FBS website and YouTube. |

| E-books & Guides | Downloadable materials on trading strategies, risk management, and analysis. Free for FBS clients. |

| Trading Glossary | A comprehensive list of trading terms with definitions and examples. Helpful for both beginners and advanced traders. |

| Economic Calendar | Real-time updates on economic events, customisable by currency, country, and event type. Available on the website and app. |

| Trader’s Calculator | Tool for calculating margin, pip values, and risk/reward ratios. Supports multiple account types. Accessible via the website and app. |

FBS's commitment to providing a diverse range of educational resources sets it apart from many of its competitors. By offering a mix of market analysis, webinars, video tutorials, e-books, and trading tools, FBS caters to the learning preferences and needs of a wide range of clients. The broker's educational content is well-structured, informative, and regularly updated, demonstrating its dedication to supporting clients in their trading journeys.

Compared to industry standards, FBS's educational offerings are comprehensive and of high quality. The broker's investment in developing and maintaining these resources is evident, and clients can benefit greatly from leveraging these tools to enhance their trading knowledge and skills.

FBS Account Types

FBS offers a diverse range of trading account types to cater to the varying needs and preferences of traders at different levels of experience and with different trading styles. The broker provides four main account types: Micro, Standard, Zero Spread, and ECN.

Micro Account

The Micro account is designed for novice traders who are just starting their trading journey. Key features include:

- Low minimum deposit of just $5

- Flexible leverage options up to 1:3000

- Tight spreads starting from 1 pip

- Access to a wide range of trading instruments, including forex and metals

Standard Account

The Standard account is suitable for traders with some experience and higher trading volumes. It offers:

- Minimum deposit of $100

- Leverage up to 1:3000

- Competitive floating spreads from 0.5 pips

- No commissions on trades

- Access to a wide range of trading instruments, including forex, metals, energies, indices, and stocks

Zero Spread Account

The Zero Spread account is ideal for active traders who prioritize low trading costs. Features include:

- Minimum deposit of $500

- Leverage up to 1:3000

- Zero spreads on major forex pairs

- Low commission of $20 per lot traded

- Access to forex and metal instruments

ECN Account

The ECN account is designed for experienced traders who demand the best possible trading conditions. It provides:

- Minimum deposit of $1000

- Leverage up to 1:500

- Ultra-tight spreads from 0.1 pips

- Low commission of $6 per lot traded

- Direct market access and fast execution speeds

- Access to a wide range of forex instruments

Demo Account

In addition to the live trading accounts, FBS also offers a demo account that allows traders to practice trading strategies and familiarize themselves with the trading platforms without risking real money. Demo accounts are available for all account types and come with virtual funds that can be topped up as needed.

FBS's wide range of account types is a testament to the broker's commitment to catering to the diverse needs of its clients. By offering accounts with different minimum deposit requirements, leverage options, and trading conditions, FBS ensures that traders can find an account that aligns with their trading style, risk tolerance, and financial goals.

Account Types Comparison Table

| Feature | Micro | Standard | Zero Spread | ECN |

|---|---|---|---|---|

| Minimum Deposit | $5 | $100 | $500 | $1000 |

| Leverage | Up to 1:3000 | Up to 1:3000 | Up to 1:3000 | Up to 1:500 |

| Spread | From 1 pip | From 0.5 pips | 0 pips | From 0.1 pips |

| Commission | No | No | $20 per lot | $6 per lot |

| Instruments | Forex, Metals | Forex, Metals, Energies, Indices, Stocks | Forex, Metals | Forex |

Negative Balance Protection

Negative balance protection is a crucial risk management feature that ensures traders cannot lose more money than they have in their trading account. This protection is particularly important in the context of leveraged trading, where market volatility and unexpected events can cause significant losses that exceed a trader's account balance. In the absence of negative balance protection, a trader's account balance could potentially turn negative if their losses surpass their available funds. This situation could arise due to several factors, such as:

- Highly volatile market conditions leading to sudden price gaps

- Insufficient margin to maintain open positions

- Delayed or failed execution of stop-loss orders

- Trading with excessive leverage

- Setting appropriate stop-loss orders

- Managing leverage responsibly

- Maintaining sufficient margin in the account

- Staying informed about market news and events

FBS Deposits and Withdrawals

FBS offers a wide range of convenient deposit and withdrawal options to cater to the needs of its diverse client base. The broker supports various payment methods, including credit/debit cards, e-wallets, and bank transfers, making it easy for traders to fund their accounts and withdraw their profits.

Deposit Methods

| Method | Processing Time | Minimum Deposit | Fees |

|---|---|---|---|

| Credit/Debit Cards (Visa, Mastercard) | Instant | Varies by account type (from $5) | No |

| E-wallets (Skrill, Neteller, FasaPay, Perfect Money, Payeer) | Instant | Varies by account type (from $5) | No |

| Bank Transfer | 3-5 business days | Varies by account type (from $5) | No (but banks may charge) |

| Cryptocurrency (Bitcoin, Ethereum, Litecoin, Bitcoin Cash, Ripple) | Instant | Varies by account type (from $5) | No |

Withdrawal Methods

| Method | Processing Time | Minimum Withdrawal | Fees |

|---|---|---|---|

| Credit/Debit Cards (Visa, Mastercard) | Up to 24 hours | $1 | No (but card issuers may charge) |

| E-wallets (Skrill, Neteller, FasaPay, Perfect Money, Payeer) | Up to 24 hours | $1 | No |

| Bank Transfer | 3-5 business days | $1 | No (but banks may charge) |

| Cryptocurrency (Bitcoin, Ethereum, Litecoin, Bitcoin Cash, Ripple) | Up to 24 hours | $1 | No |

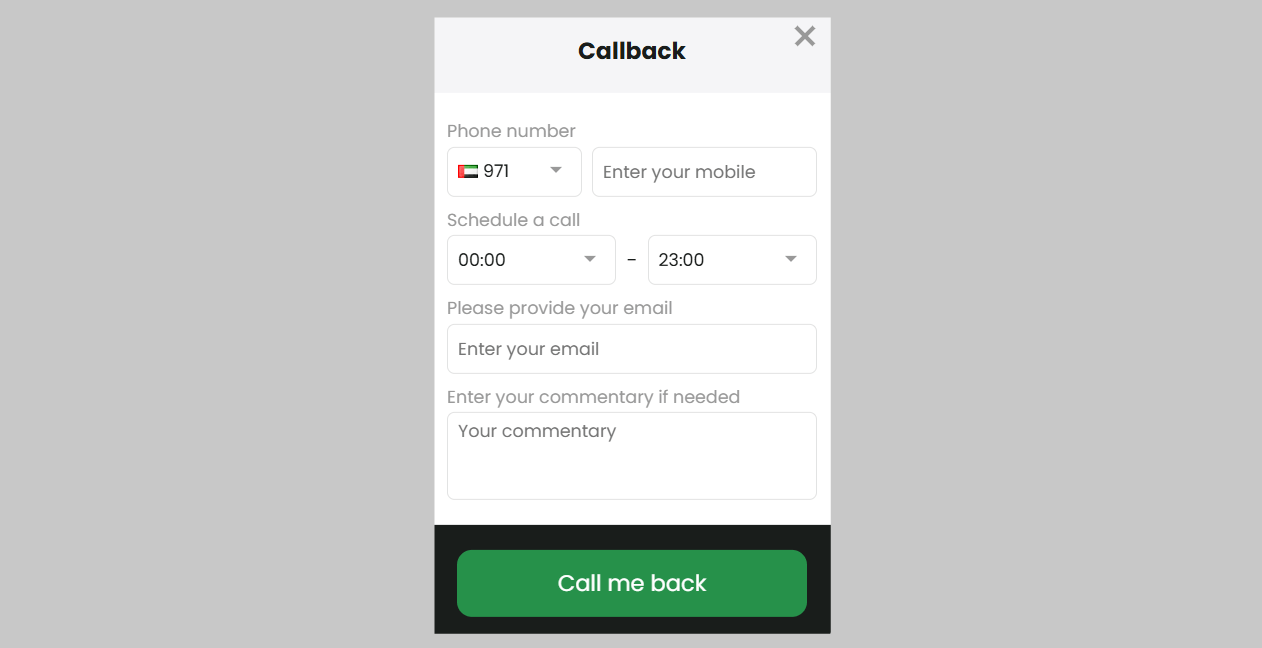

Support Service for Customer

In the fast-paced world of online trading, reliable customer support is crucial to ensuring a positive trading experience. Traders may encounter various issues or have questions that require prompt assistance, and a broker's ability to provide efficient and helpful support can make a significant difference in a trader's success and satisfaction.

- Live Chat: Available 24/7 directly through the FBS website or trading platform

- Email: support@fbs.com

- Phone: +357 25 123 345 (Monday to Friday, 9:00 AM - 6:00 PM GMT+2)

- Social Media: Facebook, Twitter, Instagram, Telegram, and WhatsApp

Customer Support Comparison Table

| Feature | Details |

|---|---|

| Languages Supported | 20 |

| Live Chat | 24/7 |

| Email Support | support@fbs.com |

| Phone Support | +357 25 123 345 |

| Phone Support Hours | Monday to Friday, 9:00 AM - 6:00 PM GMT+2 |

| Social Media Support | Facebook, Twitter, Instagram, Telegram, WhatsApp |

| FAQ/Knowledge Base | Comprehensive and well-organized |

Prohibited Countries

Due to various factors such as local regulations, licensing requirements, and geopolitical considerations, FBS is prohibited from providing services to residents of certain countries. It is essential for traders to be aware of these restrictions to avoid any potential legal consequences or risks associated with attempting to trade with FBS from a prohibited jurisdiction.

FBS is not allowed to open accounts or provide trading services to residents of the following countries:

- United States of America

- Canada

- Japan

- Australia

- New Zealand

- United Kingdom

- Israel

- Iran

- North Korea

- Sudan

- Syria

- Cuba

- Belgium

The primary reason behind these restrictions is the strict regulatory environment in these countries. For example, in the United States, the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) impose stringent requirements on forex brokers, including registration, capital requirements, and compliance with various consumer protection laws. FBS, being an offshore broker, may not meet these requirements and, therefore, cannot legally serve U.S. clients.

Similarly, other countries on the prohibited list have their own regulatory bodies and legal frameworks that FBS must comply with to operate legally. In some cases, such as Iran and North Korea, international sanctions and geopolitical tensions also play a role in the broker's decision not to provide services.

It is crucial for traders to understand that attempting to circumvent these restrictions by providing false information or using virtual private networks (VPNs) to mask their location can lead to severe consequences, including account termination, forfeiture of funds, and potential legal action.

Traders should always check with their local regulatory authorities and seek legal advice before engaging in online trading activities to ensure compliance with applicable laws and regulations.

FBS is committed to operating transparently and in compliance with international regulations. By clearly stating the prohibited countries on its website and in its terms and conditions, the broker demonstrates its commitment to ethical business practices and protecting its clients' interests.

For traders who reside in countries where FBS is allowed to operate, the broker offers a wide range of trading instruments, competitive trading conditions, and robust trading platforms. FBS is continually working on expanding its services to new regions while ensuring compliance with local regulations and maintaining a high standard of service for its clients.

Regions where FBS is allowed to operate

Europe (excluding Belgium and the United Kingdom), Asia (excluding Japan and Singapore), Africa, South America

Special Offers for Customers

FBS provides a range of special promotions and offers designed to attract new clients and reward existing traders for their loyalty. These offers can help traders maximise their trading potential and enjoy additional benefits while trading with FBS.

| Program | Description |

|---|---|

| Deposit Bonus | Up to 100% bonus on deposits, credited to the account. Bonus funds can be used for trading but require meeting trading volume conditions before withdrawal. |

| Cashback Program | Traders receive cash rebates based on trading volume and account type. Cashback is credited daily and helps reduce trading costs. |

| Loyalty Program | Traders earn loyalty points based on trading activity, progressing through different tiers to unlock higher cashback rates, bonuses, VIP perks, and exclusive support. |

| Trading Contests | Regular competitions where traders compete based on trading volume, profitability, or other metrics, with cash prizes, bonuses, and luxury items. Open to all clients. |

| Refer-a-Friend | Traders earn a cash bonus for referring new clients who meet deposit and trading volume requirements. Both the referrer and the referred trader benefit. |

It is essential for traders to carefully review the terms and conditions of each special offer before participating, as there may be specific requirements or limitations that apply. FBS strives to provide transparent and fair promotional offers that comply with regulatory guidelines and prioritise the interests of its clients.

Conclusion

After conducting a thorough review of FBS, I can confidently say that they have established themselves as a reliable and trustworthy broker in the online trading industry. Throughout my analysis, I have found that FBS consistently prioritises the safety, security, and satisfaction of their clients, making them a compelling choice for traders of all levels.

One of the most impressive aspects of FBS is their commitment to regulatory compliance. They hold licenses from top-tier regulatory bodies such as CySEC and ASIC, ensuring that they adhere to strict guidelines and maintain transparency in their operations. This level of oversight provides clients with peace of mind, knowing that their funds and personal information are protected.

FBS's wide range of account types and tradable assets is another standout feature. They offer accounts suitable for both beginner and experienced traders, with low minimum deposit requirements and competitive trading conditions. The variety of instruments available, including forex, metals, energies, indices, and stocks, allows traders to diversify their portfolios and pursue their preferred trading strategies.

In terms of trading platforms, FBS excels by offering the industry-standard MetaTrader 4 and MetaTrader 5, along with their proprietary FBS Trader app. These platforms provide a user-friendly interface, advanced charting tools, and a wide range of technical indicators, empowering traders to make informed decisions and execute trades seamlessly.

FBS's dedication to education and support is commendable. They offer an extensive library of educational resources, including webinars, video tutorials, and trading guides, catering to traders of all skill levels. The 24/7 multilingual customer support via live chat, email, and phone ensures that clients can always reach out for assistance whenever they need it.

Another aspect that sets FBS apart is their commitment to rewarding client loyalty through various promotions and bonus programs. From generous deposit bonuses to cashback offers and trading contests, FBS provides traders with ample opportunities to maximise their trading potential and enjoy additional benefits.

While FBS has demonstrated its reliability and trustworthiness, it is important to remember that trading always carries inherent risks. Traders should exercise caution, practice risk management, and never invest more than they can afford to lose. FBS provides the tools and resources to facilitate informed trading decisions, but ultimately, the responsibility lies with the individual trader.

In conclusion, based on my comprehensive review, I believe that FBS is a reliable and reputable broker that prioritises the interests of its clients. Their strong regulatory compliance, diverse trading offerings, advanced platforms, educational resources, and client-centric approach make them a solid choice for traders seeking a trustworthy partner in their trading journey.