Forex.com Review 2025: A Pro Trading Platform for Forex & CFD Trading

Forex.com

United States

United States

-

Minimum Deposit $100

-

Withdrawal Fee $0

-

Leverage 30:1

-

Spread From 0.2

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Cyprus Market Making (MM)

Cyprus Market Making (MM)

Japan Forex Trading License

Japan Forex Trading License

Australia Retail Forex License

Australia Retail Forex License

US Retail Forex License

US Retail Forex License

US Commodity Trading License

US Commodity Trading License

IIROC Investment Dealer

IIROC Investment Dealer

Softwares & Platforms

Customer Support

+18773673946

(English)

+18773673946

(English)

Supported language: Chinese (Simplified), English, Russian, Spanish

Social Media

Summary

Forex.com is a globally recognized broker offering a wide range of trading instruments, including forex, commodities, indices, and cryptocurrencies. Known for its robust platforms like MT4, MT5, and its proprietary Web Trader and Advanced Trading Platform, Forex.com caters to both beginners and professional traders. It provides competitive spreads, strong regulatory oversight, and access to comprehensive market analysis and educational resources. With multiple funding options, mobile trading apps, and dedicated customer support, Forex.com delivers a reliable and well-rounded trading experience.

- Well-regulated broker with licenses from top-tier authorities like FCA, CFTC, and ASIC

- Publicly-traded parent company ensures transparency and oversight

- Advanced proprietary trading platforms and support for MetaTrader 4 and 5

- Wide range of tradable assets, including 80+ currency pairs and CFDs

- Competitive spreads, flexible leverage options, and low minimum deposit requirements

- Responsive customer support available 24/5 through multiple channels

- Solid foundation of educational resources, including webinars and tutorials

- Special offers and promotions, including a 20% deposit bonus and VIP client program

- Strong reputation as a reliable and trustworthy broker

- Commitment to client satisfaction and user-focused trading environment

- Educational offerings could be expanded to cover more advanced topics

- Reports of longer customer support wait times during high market volatility

- Limited cryptocurrency CFD offerings compared to some competitors

- No negative balance protection for U.S. clients

- High balance requirements for earning interest on unused margin

- Inactivity fee charged after 12 months of no trading activity

- U.S. clients limited to forex trading only, while CFDs available elsewhere

- No guaranteed stop-loss orders for U.S. traders

- VIP program requirements may be high for some traders

- Promotions and bonuses subject to specific terms and conditions

Overview

Established in 2004 by Gain Capital, Forex.com is an online retail foreign exchange broker serving over 450,000 customers across 21 countries. In 2020, Gain Capital was acquired by StoneX Group Inc., a NASDAQ-listed company with a market capitalisation of nearly $2.5 billion as of 2023.

Forex.com operates under several regulated entities globally, adhering to strict licensing requirements from top-tier regulators such as the Financial Conduct Authority (FCA) in the UK, the Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA) in the US, the Australian Securities and Investments Commission (ASIC) in Australia, and the Financial Services Agency (FSA) in Japan.

The broker offers a wide range of currency pairs and CFDs, though product availability varies by country due to regulatory differences. US clients can trade over 80 forex pairs, while clients in other jurisdictions like the UK also have access to CFDs on indices, commodities, cryptocurrencies, and more.

Forex.com provides multiple trading platforms, including its own proprietary web, desktop, and mobile platforms, as well as popular third-party platforms like MetaTrader 4 and 5. The broker is known for its competitive pricing, robust trade execution, extensive market research, and educational resources.

In 2021, Forex.com acquired Performance Analytics, an AI-based behavioural analysis tool designed to help traders identify strengths and weaknesses in their trading habits. This acquisition demonstrates the broker's commitment to empowering clients with innovative tools and insights.

Overview Table

| Forex.com | Details |

|---|---|

| Established | 2004 |

| Parent Company | StoneX Group Inc. (NASDAQ: SNEX) |

| Headquarters | New York City, United States |

| Global Presence | 21 countries |

| Employees | 4,300+ (as part of StoneX Group) |

| Clients | 450,000+ |

| Regulation | FCA (UK), CFTC/NFA (US), ASIC (Australia), FSA (Japan), and more |

| Product Offerings | Forex, CFDs (indices, commodities, stocks, bonds, cryptos)* (*Availability varies by country) |

| Minimum Deposit | $100 |

| Trading Platforms | Forex.com Web Trader, Desktop Platform, Mobile Apps, MetaTrader 4/5 |

| Key Features | Competitive pricing, robust trade execution, market research, educational resources, Performance Analytics |

Facts List

- Forex.com is a well-established online forex and CFD broker, operating since 2004.

- The broker is a subsidiary of StoneX Group Inc., a publicly traded company on NASDAQ.

- Forex.com serves over 450,000 clients across 21 countries worldwide.

- The broker is regulated by top-tier financial authorities, including the FCA, CFTC/NFA, ASIC, and FSA.

- Product offerings include 80+ forex pairs for US clients and additional CFDs in other jurisdictions.

- Forex.com provides multiple trading platforms, including proprietary web, desktop, and mobile apps, as well as MetaTrader 4/5.

- The minimum deposit requirement is $100, making it accessible to a wide range of traders.

- Forex.com is known for its competitive pricing, with spreads as low as 1 pip on a Spread-only account and 0 pips + commission on a RAW Pricing account.

- The broker offers extensive market research and educational resources to help clients make informed trading decisions.

- In 2021, Forex.com acquired Performance Analytics, an AI-based tool designed to analyse and improve trading performance.

Forex.com Licenses and Regulatory

Forex.com operates under a robust regulatory framework, holding licenses from several top-tier financial authorities worldwide. This extensive oversight ensures that the broker adheres to strict industry standards, providing a secure and transparent trading environment for its clients.

The broker's primary regulator is the Financial Conduct Authority (FCA) in the United Kingdom, which is known for its stringent regulations and consumer protection measures. Forex.com's UK entity, StoneX Financial Ltd, is authorised and regulated by the FCA under registration number 446717. This license ensures that the broker complies with the FCA's rules on client fund segregation, capital requirements, and regular auditing.

In the United States, Forex.com is registered with the Commodity Futures Trading Commission (CFTC) as a Futures Commission Merchant (FCM) and Retail Foreign Exchange Dealer (RFED). The broker is also a member of the National Futures Association (NFA), the self-regulatory organisation for the US derivatives industry. These registrations ensure that Forex.com adheres to the CFTC's and NFA's rules on fair trading practices, client protection, and market integrity.

Other notable regulatory licenses held by Forex.com include:

- Australian Securities and Investments Commission (ASIC) - Australia

- Financial Services Agency (FSA) - Japan

- Investment Industry Regulatory Organization of Canada (IIROC) - Canada

- Cyprus Securities and Exchange Commission (CySEC) – European Union

- Cayman Islands Monetary Authority (CIMA) - Cayman Islands

These multiple licenses demonstrate Forex.com's commitment to operating in a compliant and transparent manner across various jurisdictions. By submitting to regular audits and maintaining strict financial reporting standards, the broker instills trust and confidence in its clients.

It's worth noting that the level of client protection may vary depending on the jurisdiction. For example, clients of StoneX Financial Ltd (UK) are covered by the Financial Services Compensation Scheme (FSCS), which provides up to £85,000 in compensation if the broker becomes insolvent. However, US clients do not have access to such a compensation scheme.

Despite some differences in client protection, Forex.com's overall regulatory standing is solid and on par with industry standards. The broker's long history of operation and its association with a publicly traded parent company (StoneX Group Inc.) further enhance its credibility and stability.

When choosing a forex broker, it's crucial for traders to consider the regulatory environment and the level of protection offered. Forex.com's extensive regulatory licenses and compliance with industry standards make it a reliable choice for traders seeking a secure and transparent trading experience.

Regulations List

- Financial Conduct Authority (FCA) – United Kingdom

- Commodity Futures Trading Commission (CFTC) - United States

- National Futures Association (NFA) – United States

- Australian Securities and Investments Commission (ASIC) - Australia

- Financial Services Agency (FSA) - Japan

- Investment Industry Regulatory Organization of Canada (IIROC) - Canada

- Cyprus Securities and Exchange Commission (CySEC) – European Union

- Cayman Islands Monetary Authority (CIMA) - Cayman Islands

Trading Instruments

Forex.com offers a diverse range of tradable assets, catering to the varied needs and preferences of traders worldwide. The broker's extensive portfolio includes forex, commodities, indices, and cryptocurrencies, among others. However, it's essential to note that the availability of specific assets may vary depending on the client's jurisdiction and the regulatory environment.

| Asset Class | Description |

|---|---|

| Forex | Access to 80+ currency pairs, including major, minor, and exotic pairs. Competitive spreads starting from 1 pip (Spread-only) or 0 pips + commission (RAW Pricing). |

| Commodities | Trade gold, silver, crude oil, natural gas, and agricultural products like coffee, corn, and wheat. |

| Indices | CFDs on global indices such as the S&P 500, NASDAQ 100, FTSE 100, DAX 30, and Nikkei 225 for broad market exposure. |

| Cryptocurrencies | Trade Bitcoin, Ethereum, Litecoin, and Ripple against USD. Availability varies by jurisdiction due to regulations. |

| Bonds | Speculate on government bond CFDs, including US Treasury Notes, UK Gilts, and European Bunds. |

| Stocks | Access global stocks via CFDs from major exchanges like NYSE, NASDAQ, and LSE, with opportunities to trade both rising and falling markets. |

While Forex.com's asset offerings are extensive, it's crucial for traders to understand that not all assets may be available in their specific region. The broker adheres to the regulatory requirements of each jurisdiction, which may result in certain restrictions on tradable assets.

For a comprehensive and up-to-date list of all tradable assets offered by Forex.com, visit their official website at [insert link here]. The website provides detailed information on the specific instruments available, including spreads, margin requirements, and trading hours.

Forex.com's diverse range of tradable assets is a testament to the broker's commitment to providing traders with ample opportunities to explore various markets and build well-rounded portfolios. By offering a mix of traditional and emerging asset classes, Forex.com caters to the evolving needs of traders in an increasingly dynamic financial landscape.

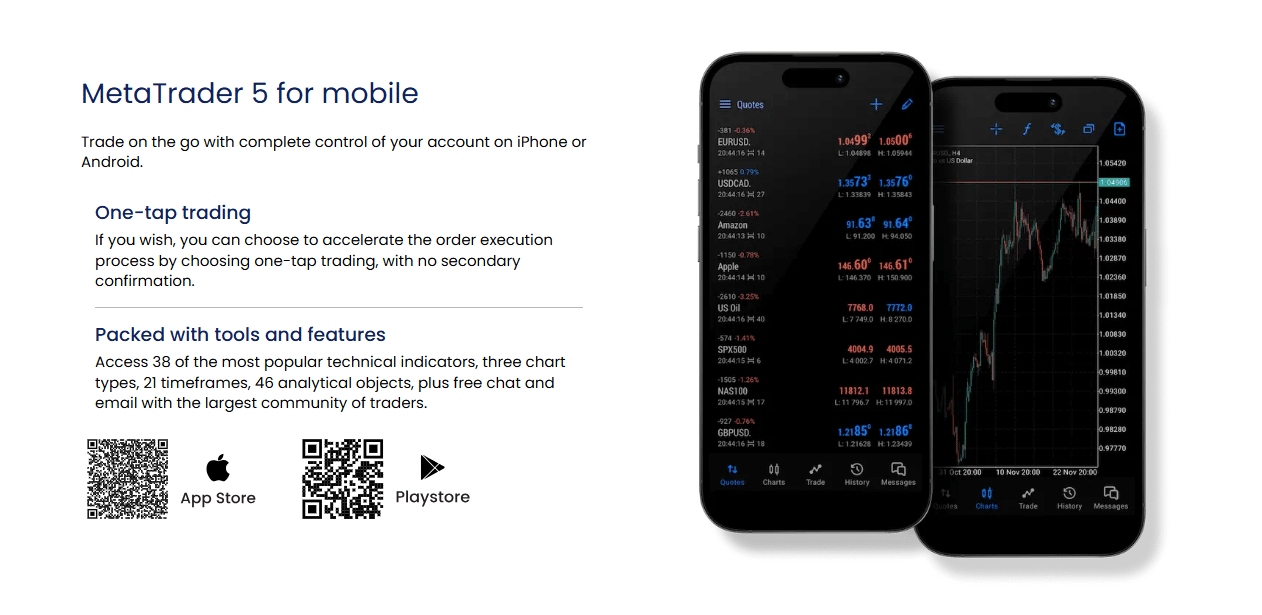

Trading Platforms

Forex.com offers a range of trading platforms to cater to the diverse needs and preferences of its clients. The broker provides access to both industry-standard platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) and its own proprietary trading software. Clients can choose to trade via desktop applications, web-based platforms, or mobile apps, ensuring flexibility and convenience.

MetaTrader Platforms MT4 and MT5 are widely used trading platforms known for their reliability, advanced charting capabilities, and extensive customisation options. Forex.com offers both platforms, allowing traders to benefit from a familiar interface and a wide range of technical indicators and trading tools.

MT4 is particularly popular among forex traders due to its user-friendly interface, automated trading features, and the ability to use expert advisors (EAs) for algorithmic trading. MT5, the newer version of the platform, offers additional features such as an expanded range of timeframes, more technical indicators, and the ability to trade a wider variety of assets.

Proprietary Platforms In addition to the MetaTrader platforms, Forex.com provides its own proprietary trading software. The broker's web-based platform, Forex.com Web Trader, offers a streamlined trading experience with advanced charting, real-time news and analysis, and risk management tools. The platform is accessible through web browsers, eliminating the need for software installation.

For desktop users, Forex.com offers the Advanced Trading Platform, which provides a comprehensive suite of trading tools, customisable layouts, and advanced order types. The platform includes features such as performance analytics, market sentiment indicators, and integrated research and news.

Mobile Trading Forex.com understands the importance of mobile trading in today's fast-paced market environment. The broker offers mobile apps for both iOS and Android devices, allowing traders to access their accounts, execute trades, and monitor positions on the go.

The Forex.com mobile app provides a user-friendly interface with essential features such as real-time quotes, interactive charts, and secure account management. Traders can also use the mobile app to receive price alerts, stay informed with market news and analysis, and manage their watchlists.

No matter which platform traders choose, Forex.com ensures a stable and reliable trading experience. The broker's platforms are designed to facilitate efficient trade execution and provide the tools necessary for informed decision-making.

Platform Comparison table

| Platform | MT4 | MT5 | Web Trader | Advanced

Trading Platform |

Mobile App |

|---|---|---|---|---|---|

| Ease of Use | 8/10 | 8/10 | 9/10 | 6/10 | 9/10 |

| Charting | 8/10 | 9/10 | 8/10 | 8/10 | 6/10 |

| Indicators | 8/10 | 9/10 | 8/10 | 8/10 | 6/10 |

| Automated Trading | 10/10 | 10/10 | 0/10 | 0/10 | 0/10 |

| Customization | 8/10 | 8/10 | 6/10 | 8/10 | 4/10 |

| Order Types | 8/10 | 9/10 | 8/10 | 9/10 | 8/10 |

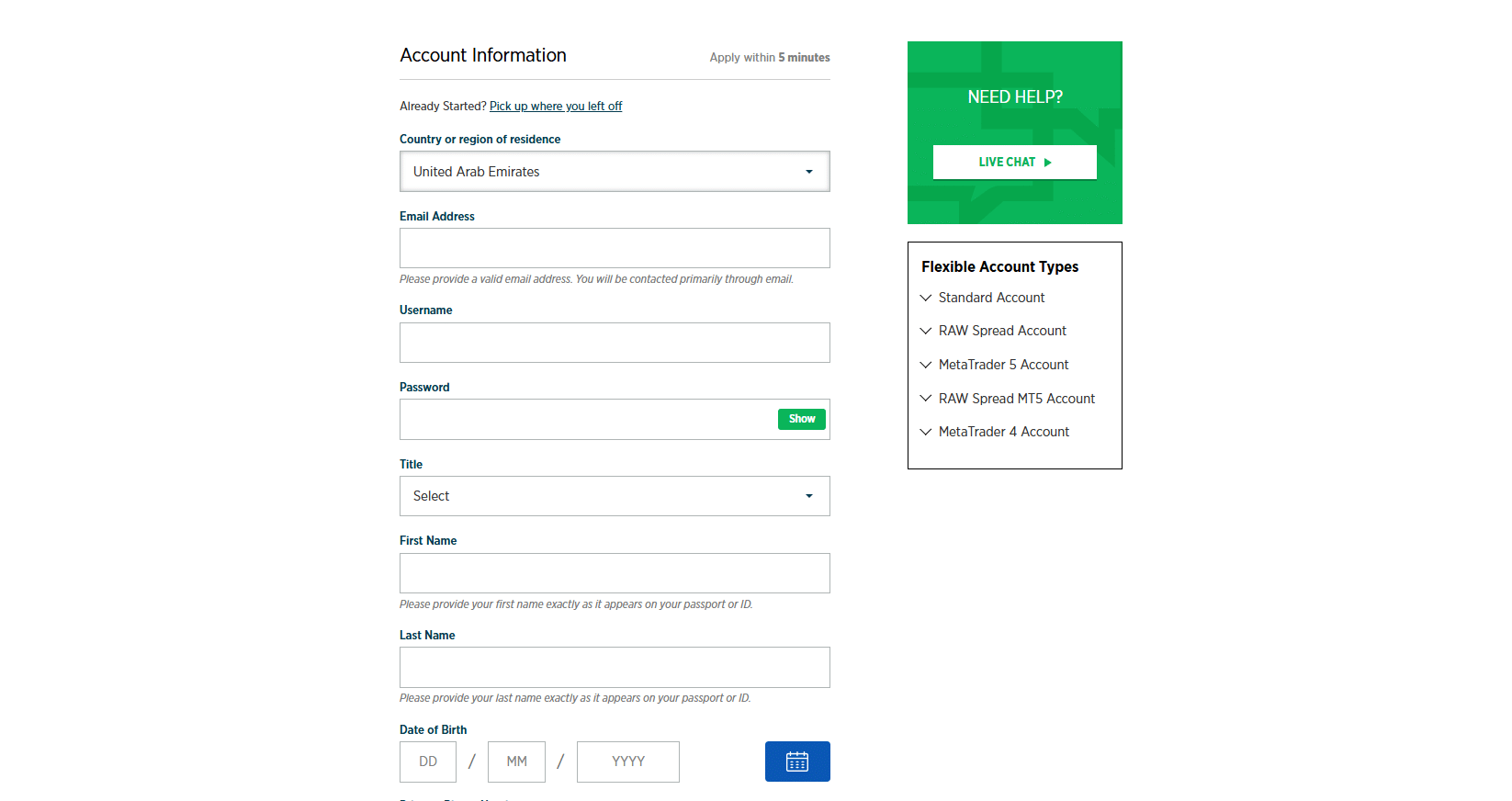

Forex.com How to Open an Account: A Step-by-Step Guide

Opening an account with Forex.com is a straightforward and user-friendly process. The broker has streamlined the account registration procedure to ensure that clients can start trading as quickly as possible. This section will guide you through the steps required to open an account and highlight the key requirements and features of the process.

Step 1: Visit the Forex.com website To begin the account opening process, visit the official Forex.com website. Click on the "Open an Account" button, which is prominently displayed on the homepage.

Step 2: Choose your account type Forex.com offers three main account types: Standard, Commission, and STP Pro. Select the account type that best suits your trading needs and preferences. You can compare the features and benefits of each account type on the Forex.com website.

Step 3: Provide personal information Fill out the online application form with your personal details, including your full name, date of birth, address, and contact information. Ensure that all information provided is accurate and up-to-date.

Step 4: Verify your identity and residency To comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, Forex.com requires clients to submit proof of identity and residency. You'll need to upload a valid government-issued ID, such as a passport or driver's license, and a recent utility bill or bank statement as proof of address.

Step 5: Choose your trading platform Select your preferred trading platform from the options provided by Forex.com. You can choose between the MetaTrader 4 (MT4), MetaTrader 5 (MT5), or the broker's proprietary platforms, such as the Web Trader or Advanced Trading Platform.

Step 6: Fund your account Once your account is approved, you can fund it using one of the available payment methods. Forex.com accepts various funding options, including bank wire transfers, credit/debit cards, and e-wallets like Skrill and Neteller. The minimum deposit requirement is $100, which is relatively low compared to some other brokers.

Step 7: Start trading After your account is funded, you can download and install your chosen trading platform and start trading. Forex.com provides a range of educational resources and tools to help you navigate the markets and make informed trading decisions.

To open an account with Forex.com, you'll need to meet the following requirements:

- Be at least 18 years old (or the legal age of majority in your country of residence)

- Provide a valid government-issued ID and proof of residency

- Have a valid email address and phone number

- Meet the minimum deposit requirement of $100

Processing Times Forex.com aims to process account applications as quickly as possible. In most cases, accounts are approved within 1-2 business days, provided that all required documentation is submitted and verified. Funding your account via credit/debit card or e-wallet is usually instant, while bank wire transfers may take 2-5 business days to clear.

By offering a streamlined account opening process, competitive minimum deposit requirements, and a range of funding options, Forex.com ensures that clients can start trading with ease. The broker's commitment to regulatory compliance and customer due diligence helps maintain a secure and trustworthy trading environment.

Charts and Analysis

Forex.com provides a comprehensive suite of educational resources and trading tools to support its clients in their trading journey. These resources are designed to cater to traders of all skill levels, from beginners to experienced professionals, and cover a wide range of topics related to forex and CFD trading.

| Category | Features |

|---|---|

| Market Analysis | - Daily Market Reports: Covers key events, economic releases, and their impact. - Technical Analysis: Insights on major currency pairs, commodities, and indices. - Market News & Events: Real-time updates and an economic calendar. |

| Educational Resources | - Webinars: Live and recorded sessions on trading strategies, risk management, and platform tutorials. - Video Tutorials: Short guides on forex trading, platform navigation, and tools. - eBooks & Guides: Downloadable PDFs covering trading concepts and strategies. - Glossary: Definitions of essential trading terms. |

| Trading Tools | - Advanced Charting: Multi-timeframe charts with 80+ indicators. - Trading Signals: Actionable insights based on technical analysis. - Position Size Calculator: Helps determine trade sizes based on risk tolerance. - Forex Volatility Calculator: Assesses historical volatility for risk evaluation. |

Comparison to Industry Standards Forex.com's educational resources and trading tools are competitive within the industry, offering a well-rounded suite of materials and features to support traders' growth and success. The broker's commitment to providing high-quality market analysis, diverse educational content, and advanced trading tools demonstrates its dedication to empowering its clients.

While some brokers may offer more extensive educational programs or specialised trading tools, Forex.com's offerings are comprehensive and cater to the needs of most traders. The broker's in-house market analysis team and regular webinars provide valuable insights and learning opportunities, setting it apart from competitors that rely solely on third-party content.

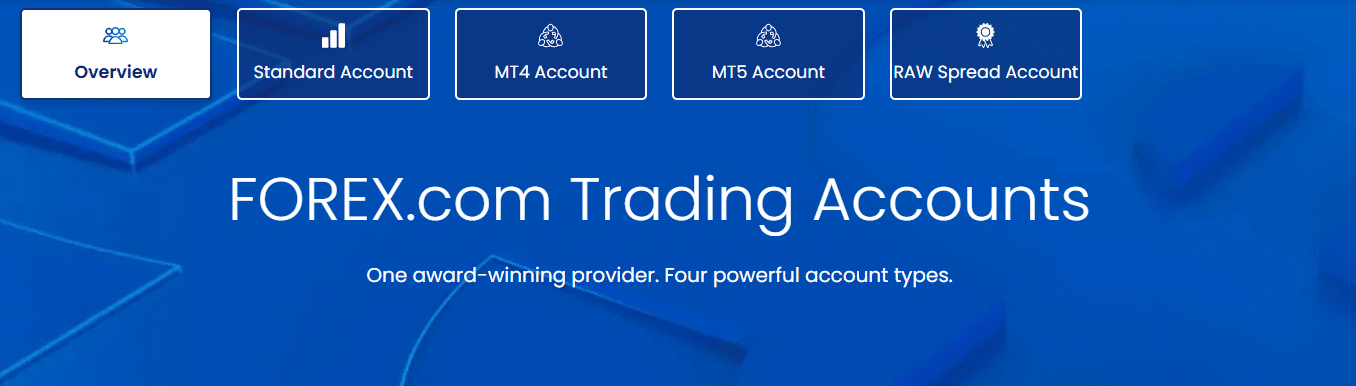

Forex.com Account Types

Forex.com offers a range of trading account types to cater to the diverse needs and preferences of its clients. Whether you're a beginner or an experienced trader, the broker has an account type that suits your trading style and goals. In this section, we'll provide an in-depth look at the characteristics of each account type and help you determine which one is the best fit for you.

Standard Account

The Standard Account is Forex.com's most popular account type, suitable for both new and experienced traders. It offers competitive spreads, starting from 1 pip on major currency pairs, and provides access to a wide range of trading instruments, including forex, indices, commodities, and cryptocurrencies. Key features of the Standard Account include:

- Minimum deposit: $100

- Leverage up to 50:1 for U.S. clients, up to 30:1 for U.K. and E.U. clients

- No commissions on trades

- Access to Forex.com's proprietary trading platforms and MetaTrader 4 (MT4)

- Free demo account available

RAW Spread Account

The RAW Spread Account is designed for active traders who prefer lower spreads in exchange for a fixed commission per trade. This account type offers spreads starting from 0.0 pips on major currency pairs, making it an attractive option for those who trade frequently or with larger volumes. Key features of the RAW Spread Account include:

- Minimum deposit: $100

- Leverage up to 50:1 for U.S. clients, up to 30:1 for U.K. and E.U. clients

- Commission of $5 per 100,000 units traded (per side)

- Access to Forex.com's proprietary trading platforms and MT4

- Free demo account available

MetaTrader Account

The MetaTrader Account is designed for traders who prefer the advanced tools and automation capabilities of the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. This account offers competitive spreads with no commissions, making it a great choice for traders who rely on MetaTrader’s powerful charting and Expert Advisors (EAs).

-

Minimum Deposit: $100

-

Spreads: Starting from 1 pip on major forex pairs

- Leverage: U.S. clients: Up to 50:1, U.K./E.U. clients: Up to 30:1

-

Commission: No commission (costs included in the spread)

-

Platforms Available: MetaTrader 4 – Ideal for forex traders and algorithmic trading, MetaTrader 5 – Enhanced features, more asset classes, and improved execution

Demo Account

Forex.com offers a free demo account that allows traders to practise trading strategies and familiarise themselves with the broker's trading platforms without risking real money. The demo account comes with virtual funds and provides access to live market data, enabling traders to experience real trading conditions. Demo accounts are available for all the Standard, RAW Spread Account and MetaTrader Account types.

Account Comparison Table

| Account Type | Standard Account | RAW Spread Account | MetaTrader Account |

|---|---|---|---|

| Minimum Deposit | $100 | $100 | $100 |

| Spreads | From 1 pip | From 0.2 pips | From 1 pip |

| Leverage | U.S.: Up to 50:1 U.K./E.U.: Up to 30:1 |

U.S.: Up to 50:1 U.K./E.U.: Up to 30:1 |

U.S.: Up to 50:1 U.K./E.U.: Up to 30:1 |

| Commission | None | $5 per 100,000 units (per side) | None |

| Platforms Available | Forex.com Platform, MT4 | Forex.com Platform, MT4 | MetaTrader 4 (MT4), MetaTrader 5 (MT5) |

| Trading Instruments | Forex, indices, commodities, cryptocurrencies | Forex, indices, commodities, cryptocurrencies | Forex, indices, commodities, cryptocurrencies |

| Automated Trading | No | No | Yes (EAs supported) |

| Hedging & Scalping | Allowed (except U.S.) | Allowed (except U.S.) | MT5 allows hedging (restricted in U.S.) |

| Market Execution | Yes | Yes | Yes |

| Demo Account | Yes | Yes | Yes |

Negative Balance Protection

Negative balance protection is a crucial risk management feature that ensures a trader's losses cannot exceed their account balance. In volatile market conditions, particularly when trading with leverage, it's possible for a trader's positions to move rapidly against them, potentially resulting in losses that surpass their available funds. This scenario could lead to a negative account balance, where the trader owes money to the broker. Forex.com offers negative balance protection to its clients in the U.K. and European Union, providing an additional layer of security and peace of mind. This means that if a trader's account balance falls below zero due to trading losses, Forex.com will absorb the negative balance, effectively limiting the trader's maximum loss to the funds in their account. However, it's important to note that Forex.com's negative balance protection policy does not extend to all jurisdictions. Clients trading under the U.S. entity, for example, are not covered by negative balance protection. In such cases, traders are responsible for any negative balances that may occur in their accounts.

Forex.com Deposits and Withdrawals

Forex.com offers a range of convenient deposit and withdrawal options to cater to the needs of its global client base. The broker understands the importance of efficient and secure transactions, ensuring that traders can fund their accounts and access their profits with ease. In this section, we'll provide a detailed overview of the deposit and withdrawal methods available at Forex.com, along with any associated fees, processing times, and policies.

Deposit Methods

| Deposit Method | Minimum Deposit | Maximum Deposit | Processing Time | Fees |

|---|---|---|---|---|

| Bank Wire Transfer | $50 | No limit | 1-3 business days | No deposit fees (banks may charge) |

| Credit/Debit Card (Visa, Mastercard) | $50 | $10,000 per transaction | Instant | No deposit fees |

| Skrill | $50 | $10,000 per transaction | Instant | No deposit fees (Skrill may charge) |

| Neteller | $50 | $10,000 per transaction | Instant | No deposit fees (Neteller may charge) |

| PayPal (available in certain countries) | $50 | $10,000 per transaction | Instant | No deposit fees (PayPal may charge) |

Withdrawal Methods

| Withdrawal Method | Minimum Withdrawal | Maximum Withdrawal | Processing Time | Fees |

|---|---|---|---|---|

| Bank Wire Transfer | $100 | No limit | 1-3 business days | No withdrawal fees (banks may charge) |

| Credit/Debit Card (Visa, Mastercard) | $50 | $25,000 per transaction | 3-5 business days | No withdrawal fees |

| Skrill | $50 | No limit | 1-2 business days | No withdrawal fees (Skrill may charge) |

| Neteller | $50 | No limit | 1-2 business days | No withdrawal fees (Neteller may charge) |

| PayPal (available in certain countries) | $50 | No limit | 1-2 business days | No withdrawal fees (PayPal may charge) |

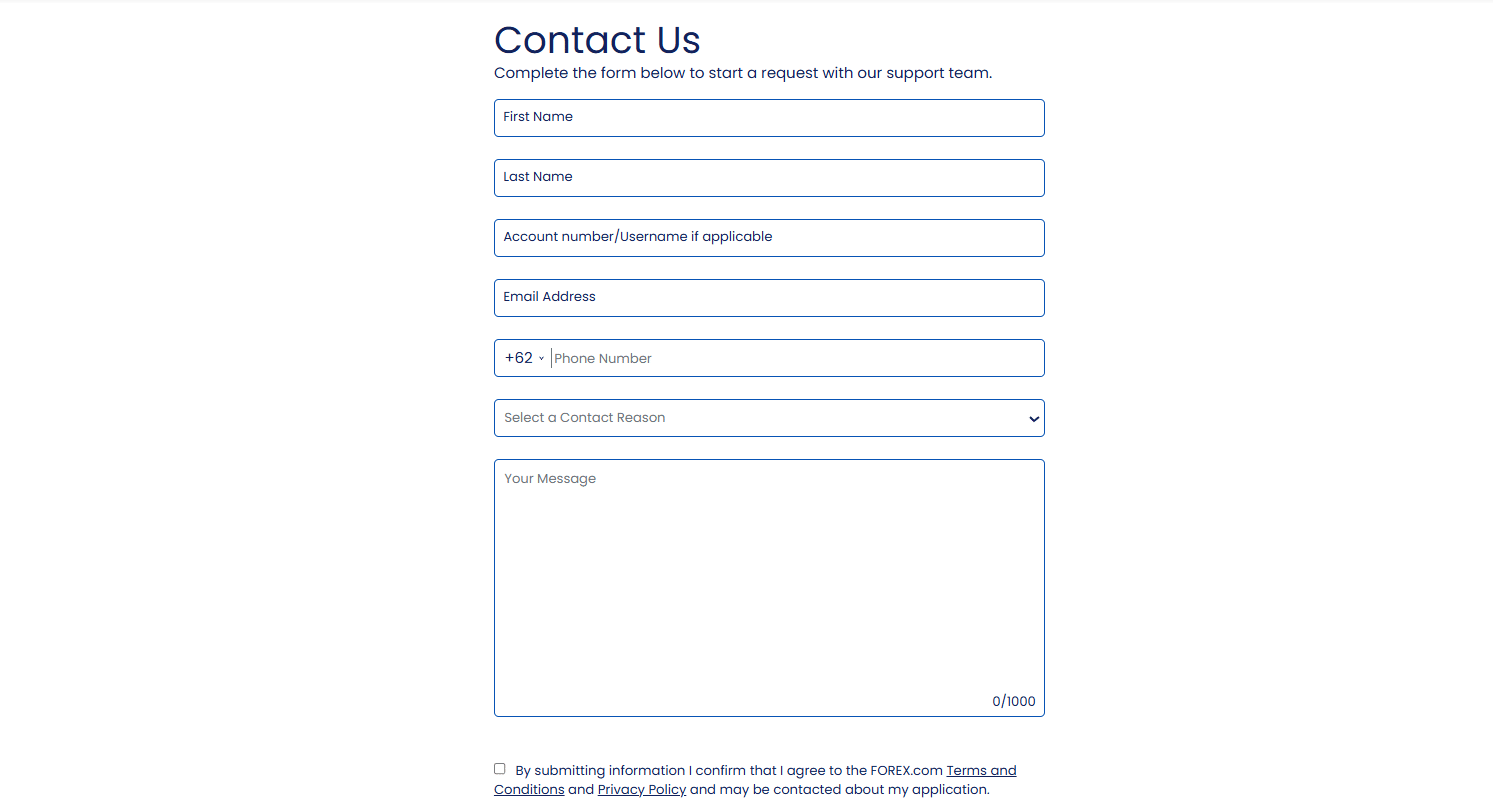

Support Service for Customer

In the fast-paced world of online trading, reliable customer support is crucial for a positive trading experience. Traders need to know that they can quickly reach out for assistance whenever they encounter issues or have questions about the platform, their account, or trading in general. Forex.com understands the importance of providing excellent customer support and offers multiple channels through which traders can get in touch with their support team.

Support Channels

-

Live Chat: Available 24/5 via the Forex.com website with an average response time of 1-2 minutes.

-

Email: Enquiries can be sent to support@forex.com, with responses typically within 1-2 hours.

-

Phone: Multilingual support in 8 languages, with country-specific phone numbers and a 1-3 minute response time.

-

Social Media: Support available via Twitter, Facebook, and LinkedIn, with an average response time of 1-2 hours.

Customer Support Comparison Table

| Support Feature | Forex.com | Industry Average |

|---|---|---|

| Support Hours | 24/5 | 24/5 |

| Live Chat | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Social Media | Yes | Yes |

| Multilingual | 8 languages | 5-10 languages |

Prohibited Countries

Due to various regulatory requirements, licensing restrictions, and geopolitical factors, Forex.com is not permitted to offer its services in certain countries and regions. It is essential for traders to be aware of these restrictions to avoid any potential legal consequences or risks associated with attempting to trade with Forex.com from a prohibited jurisdiction.

Reasons for Restrictions The primary reasons behind Forex.com's country restrictions include:

- Local Regulations: Some countries have strict regulations governing online trading and foreign exchange services. These regulations may require brokers to obtain specific licenses or meet certain criteria to operate legally within their jurisdiction.

- Licensing Requirements: Forex.com holds licenses from several top-tier regulatory bodies, such as the FCA (UK), CFTC (US), and ASIC (Australia). However, the broker may not have the necessary licenses to operate in every country.

- Geopolitical Factors: Political instability, economic sanctions, or other geopolitical factors may prevent Forex.com from offering its services in certain regions.

Prohibited Countries List

- Afghanistan

- Belarus

- Burundi

- Canada (Quebec only)

- Central African Republic

- Chad

- Congo

- Crimea

- Cuba

- Eritrea

- Guinea-Bissau

- Iran

- Iraq

- Lebanon

- Libya

- Mali

- New Zealand

- North Korea

- Somalia

- South Sudan

- Sudan

- Syria

- Turkey

- Turkmenistan

- Venezuela

- Yemen

Consequences of Trading from Prohibited Countries Attempting to trade with Forex.com from a prohibited country may result in legal consequences, account termination, and the forfeiture of any funds held in the trading account. Traders are solely responsible for ensuring compliance with local laws and regulations related to online trading.

To avoid any potential issues, traders should carefully review the list of prohibited countries and verify that they are eligible to open an account with Forex.com before attempting to register or trade. If a trader's country of residence is on the prohibited list, they should seek alternative brokers that are properly licensed and authorised to operate within their jurisdiction.

It is important to note that the list of prohibited countries may change over time due to evolving regulations, geopolitical developments, or changes in Forex.com's licensing arrangements. Traders are encouraged to regularly check the broker's website or contact customer support for the most up-to-date information on country restrictions.

Forex.com's commitment to complying with international regulations and maintaining a transparent approach to country restrictions demonstrates the broker's dedication to operating ethically and responsibly. By clearly outlining the prohibited countries and the reasons behind these restrictions, Forex.com helps traders make informed decisions and avoid potential legal or financial risks.

Special Offers for Customers

Forex.com offers a range of special promotions and incentives designed to attract new clients and reward existing traders for their loyalty. While these offers can provide additional value and enhance the trading experience, it's essential for traders to carefully review the terms and conditions associated with each promotion to ensure they understand the requirements and limitations.

| Promotion | Details | Requirements | Availability |

|---|---|---|---|

| 20% Deposit Bonus | Get a 20% bonus on your first deposit, up to $2,500. | Minimum deposit: $100 , the bonus must be traded 30 times before withdrawal. | New clients, expires [date]. |

| Refer-a-Friend Program | Earn $50 for every referred friend who opens an account and trades. | Referred person must meet minimum trading volume requirements. | Existing clients, ongoing. |

| VIP Client Program | Get a dedicated account manager, priority support, and exclusive events. | Minimum monthly trading volume: $50M or minimum account balance: $25,000. | High-volume traders, ongoing. |

| Trading Education Sponsorship | Access Trading Central’s market insights and discounted membership fees. | Available to all clients. | Limited-time promotion. |

While special offers can provide additional value, they should not be the sole factor in choosing a broker. Traders should prioritise factors such as regulatory compliance, trading platform quality, customer support, and overall trustworthiness when selecting a broker.

Forex.com's special offers are designed to cater to a range of traders, from new entrants to high-volume professionals. The 20% deposit bonus and refer-a-friend program can help traders boost their trading capital, while the VIP client program offers exclusive benefits for high-volume clients.

Conclusion

Throughout this comprehensive review, I have delved into various aspects of Forex.com's operations, evaluating their safety, reliability, and overall reputation as an online broker. By examining factors such as regulatory compliance, trading platforms, customer support, and special offers, I have gained a thorough understanding of Forex.com's strengths and potential areas for improvement.

One of the most significant findings is Forex.com's commitment to regulatory compliance and client safety. As a subsidiary of StoneX Group Inc., a publicly traded company, Forex.com is subject to strict oversight and transparency requirements. They hold licenses from top-tier regulatory bodies such as the FCA, CFTC, and ASIC, ensuring that they adhere to the highest standards of financial regulation and client protection. This regulatory framework provides traders with peace of mind, knowing that their funds are secure and that Forex.com operates in a transparent and trustworthy manner.

Another key aspect that sets Forex.com apart is their advanced trading platforms and tools. The broker offers a range of proprietary platforms, as well as support for popular third-party software like MetaTrader 4 and 5. These platforms cater to traders of all skill levels, providing intuitive interfaces, advanced charting capabilities, and a wealth of technical indicators and analysis tools. Forex.com's commitment to technological innovation is evident in their continuous development and enhancement of their trading platforms, ensuring that traders have access to the latest features and functionalities.

In terms of customer support, Forex.com demonstrates a strong commitment to client satisfaction. They offer multiple channels for support, including live chat, email, phone, and social media, with a knowledgeable and responsive support team available 24/5. The broker also provides an extensive library of educational resources, including webinars, video tutorials, and market analysis, empowering traders to improve their skills and make informed trading decisions.

Forex.com's wide range of account types and tradable assets caters to the diverse needs of traders, from beginners to experienced professionals. With competitive spreads, flexible leverage options, and low minimum deposit requirements, Forex.com ensures that traders can access the markets on their own terms. The broker's offerings include over 80 currency pairs, as well as CFDs on indices, commodities, and cryptocurrencies, providing ample opportunities for portfolio diversification.

While Forex.com does not offer the most extensive selection of special offers or promotions compared to some competitors, they do provide a range of incentives for both new and existing clients. The 20% deposit bonus and refer-a-friend program can help traders boost their trading capital, while the VIP client program offers exclusive benefits for high-volume traders.

One area where Forex.com could improve is in its educational offerings. While the broker provides a solid foundation of educational resources, there is room for expansion and deeper exploration of advanced trading concepts and strategies. Additionally, while Forex.com's customer support is generally responsive and helpful, there have been some reports of longer wait times during periods of high market volatility.

Despite these minor drawbacks, Forex.com's overall reputation as a reliable and trustworthy broker remains strong. Their commitment to regulatory compliance, advanced trading platforms, and client support has earned them a loyal following among traders worldwide.

In conclusion, Forex.com stands out as a reputable and reliable choice for traders seeking a safe, transparent, and user-focused trading environment. With their strong regulatory framework, advanced trading tools, and commitment to client satisfaction, Forex.com is well-positioned to meet the needs of both novice and experienced traders. While no broker is perfect, Forex.com's strengths far outweigh any potential weaknesses, making them a solid contender in the competitive world of online trading.