FP Markets Review 2025: A Reliable Forex and CFD Broker for All Traders

FP markets

Australia

Australia

-

Minimum Deposit $100

-

Withdrawal Fee $0

-

Leverage 500:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

Cyprus Market Making (MM)

Cyprus Market Making (MM)

Australia Retail Forex License

Australia Retail Forex License

Softwares & Platforms

Customer Support

+35725056926

(English)

+35725056926

(English)

Supported language: Arabic, Chinese (Simplified), English, German, Spanish

Social Media

Summary

FP Markets is a globally trusted Forex and CFD broker, regulated by ASIC and CySEC. Established in 2005, it offers a wide range of trading instruments, including forex, commodities, indices, shares, and crypto. With powerful platforms like MT4, MT5, and cTrader, traders benefit from tight spreads, fast execution, and advanced tools like Autochartist and Trading Central. Known for award-winning service and innovation, FP Markets provides a secure and seamless trading experience for both beginners and professionals.

- Well-regulated by top-tier authorities like ASIC and CySEC

- Wide range of tradable assets across multiple markets

- Advanced trading platforms with powerful tools and insights

- Competitive spreads and fast execution speeds

- Variety of account types for different trading styles

- Comprehensive educational resources for trader development

- Responsive 24/7 multilingual customer support

- User-friendly trading environment and client-centric approach

- Diverse deposit and withdrawal options with no fees

- Negative balance protection for enhanced trader security

- Minimum deposit of $100 may be higher than some competitors

- No current promotions or bonus offers for new clients

- Educational resources could be more structured and organized

- Limited advanced trading tools compared to some brokers

- Iress platform is more suited to experienced share traders

- Prohibited in several countries, including the USA and Japan

- Potential fees from third-party payment providers

- Some trading instruments have higher spreads than others

- Inactivity fees may apply after 12 months of no trading

- Does not offer traditional investment products like stocks or bonds

Overview

FP Markets is a leading online forex and CFD broker, established in 2005 in Sydney, Australia. With a strong presence in the Asia-Pacific region and a growing global reach, FP Markets has earned a reputation for providing traders with competitive pricing, fast execution speeds, and a wide range of trading instruments. The broker is regulated by top-tier authorities, including the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC), ensuring a secure and transparent trading environment.

According to the official FP Markets website, they currently offer 80+ Forex pairs, 17 commodities, 19 indices, and 11 cryptocurrencies. The broker provides a choice of advanced trading platforms, such as MetaTrader 4, MetaTrader 5, and Iress, catering to the diverse needs of both beginner and experienced traders. FP Markets has been recognized for its excellence, receiving multiple awards from respected industry publications, such as the "Best Global Value Broker" and "Best Forex Trading Experience" at the Global Forex Awards 2021.

Traders can choose from two account types: Standard and Raw. The Standard account offers competitive spreads starting from 1.0 pips, while the Raw account provides even tighter spreads from 0.0 pips and a low commission of $3.50 per lot per side. FP Markets supports a variety of deposit and withdrawal methods, including bank transfers, credit/debit cards, and e-wallets, with no deposit fees and fast processing times.

The broker's educational resources include webinars, video tutorials, and a comprehensive trading academy, helping traders improve their skills and knowledge. FP Markets also offers a free demo account, allowing potential clients to test their strategies in a risk-free environment. With a strong focus on customer support, the broker provides 24/5 multilingual assistance via live chat, email, and telephone.

For more detailed information about FP Markets' services, visit their official website at www.fpmarkets.com.

Overview Table

| Characteristic | Details |

|---|---|

| Broker Name | FP Markets |

| Year Established | 2005 |

| Headquarters | Sydney, Australia |

| Regulation | ASIC, CySEC |

| Tradable Instruments | Forex, Indices, Commodities, Stocks, Cryptocurrencies |

| Number of Instruments | 10,000+ |

| Trading Platforms | MetaTrader 4, MetaTrader 5, Iress |

| Minimum Deposit | $100 |

| Account Types | Standard, Raw |

| Maximum Leverage | 1:500 |

| Spreads | From 0.0 pips (Raw account) |

| Commission (Raw Account) | $3.50 per lot per side |

| Education | Webinars, Video Tutorials, Trading Academy |

| Customer Support | 24/5 via Live Chat, Email, Telephone |

| Demo Account | Yes |

Facts List

- FP Markets was founded in 2005 and is headquartered in Sydney, Australia.

- The broker is regulated by the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC).

- FP Markets offers access to over 10,000 tradable instruments across multiple asset classes, including forex, indices, commodities, stocks, and cryptocurrencies.

- Traders can choose from industry-standard platforms such as MetaTrader 4, MetaTrader 5, and Iress.

- FP Markets provides two account types: Standard and Raw, catering to different trading preferences and styles.

- The Raw account offers tight spreads from 0.0 pips and a competitive commission of $3.50 per lot per side.

- The minimum deposit required to open an account with FP Markets is $100.

- FP Markets supports various deposit and withdrawal methods, including bank transfers, credit/debit cards, and e-wallets, with no deposit fees.

- The broker offers a range of educational resources, including webinars, video tutorials, and a comprehensive trading academy to help traders enhance their skills.

- FP Markets provides 24/5 multilingual customer support via live chat, email, and telephone, ensuring prompt assistance for traders.

FP markets Licenses and Regulatory

FP Markets operates under a robust regulatory framework, ensuring a secure and transparent trading environment for its clients. The broker holds licenses from top-tier regulatory bodies, demonstrating its commitment to maintaining high industry standards and protecting the interests of its clients.

| Regulatory Authority | Entity Name | License Number | Jurisdiction |

|---|---|---|---|

| Australian Securities and Investments Commission (ASIC) | FP Markets | 286354 | Australia |

| Cyprus Securities and Exchange Commission (CySEC) | FP Markets | 371/18 | European Economic Area (EEA) |

Having multiple regulatory licenses is a testament to FP Markets' commitment to operating at the highest industry standards. It demonstrates the broker's dedication to transparency, security, and client protection. Regulated brokers are required to maintain sufficient capital reserves, segregate client funds from the broker's operating funds, and provide regular financial reports to their respective regulatory bodies.

Compared to industry standards, FP Markets stands out as a well-regulated broker, holding licenses from two highly respected regulatory authorities. This dual regulation provides clients with increased peace of mind, knowing that their funds are secure and that the broker adheres to strict guidelines in its operations.

Trading Instruments

FP Markets offers a wide range of tradable assets, catering to the diverse needs and preferences of traders worldwide. With over 10,000 instruments available, the broker provides ample opportunities for traders to diversify their portfolios and take advantage of various market conditions. FP Markets' extensive offering spans multiple asset classes, including forex, indices, commodities, stocks, and cryptocurrencies.

| Asset Class | Details |

|---|---|

| Forex | Over 60 currency pairs, including majors, minors, and exotics. Raw account spreads start from 0.0 pips on major pairs like EUR/USD and USD/JPY. |

| Indices | Global stock indices such as S&P 500, NASDAQ, Dow Jones, FTSE 100, DAX 30, and ASX 200. Competitive spreads and leverage options are available. |

| Commodities | Includes precious metals (gold, silver) and energy products (oil, natural gas). Provides portfolio diversification and hedging opportunities. |

| Stocks | Access to over 10,000 global stocks from various sectors and geographies. Competitive pricing and leverage options for short- and long-term trading. |

| Cryptocurrencies | Major digital assets include Bitcoin, Ethereum, Litecoin, and Ripple. Trading is available without a digital wallet, with competitive spreads and leverage. |

Compared to industry standards, FP Markets stands out for its wide range of tradable assets, particularly in the forex and stock categories. The broker's competitive pricing and leverage options further enhance its appeal to traders seeking cost-effective access to global markets.

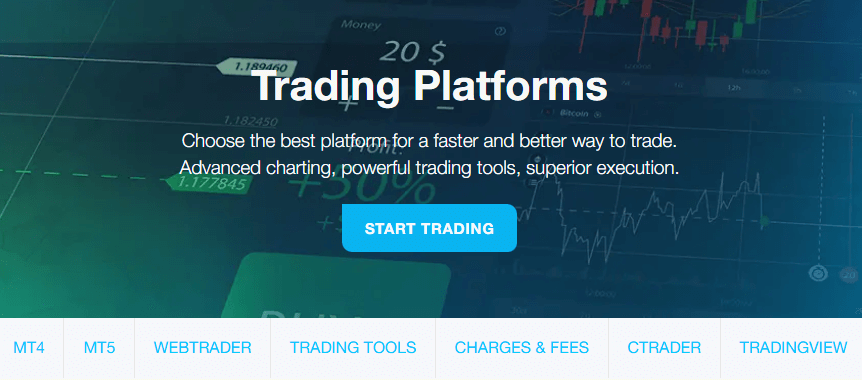

Trading Platforms

FP Markets offers its clients a range of powerful trading platforms, catering to various trading styles and preferences. The broker provides access to industry-standard platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), as well as the versatile Iress platform.

| Platform | Key Features | Availability |

|---|---|---|

| MetaTrader 4 (MT4) | User-friendly interface, advanced charting, one-click trading, automated trading via Expert Advisors (EAs), customizable alerts. | Desktop, Web, Mobile (iOS & Android) |

| MetaTrader 5 (MT5) | Enhanced features over MT4, improved backtesting, built-in economic calendar, multi-asset trading. | Desktop, Web, Mobile (iOS & Android) |

| Iress | Advanced charting tools, real-time market data, comprehensive risk management, ideal for trading shares & exchange-traded products. | Iress Trader & Iress ViewPoint (Desktop & Web) |

| Web Trading | Web-based versions of MT4, MT5, and Iress, offering full platform functionalities without the need for installation. | Accessible via any web browser |

| Mobile Trading | Mobile apps for MT4 & MT5, allowing full account management and trade execution. | Available on iOS & Android |

FP Markets' range of trading platforms caters to the diverse needs of its clients, offering stability, advanced features, and user-friendly interfaces. The broker's commitment to providing industry-standard platforms like MT4 and MT5 ensures that traders can access a wide range of trading tools, indicators, and automated trading capabilities.

The availability of web-based and mobile trading platforms further enhances the accessibility and flexibility of FP Markets' trading environment, allowing traders to stay connected to the markets and manage their positions from anywhere, at any time.

In comparison to industry standards, FP Markets' platform offering is comprehensive and competitive, providing traders with the tools and resources necessary to implement their trading strategies effectively. The broker's platforms are regularly updated to maintain stability, security, and compatibility with the latest market technologies.

Trading Platforms Comparison Table

| Feature | MT4 | MT5 | Iress Trader | Iress ViewPoint |

|---|---|---|---|---|

| One-click Trading | ✓ | ✓ | ✓ | ✓ |

| Automated Trading | ✓ | ✓ | ✗ | ✗ |

| Customizable Charts | ✓ | ✓ | ✓ | ✓ |

| Technical Indicators | 30+ | 38+ | 50+ | 100+ |

| Timeframes | 9 | 21 | 10 | 15 |

| Market Depth | ✓ | ✓ | ✓ | ✓ |

| Mobile App | ✓ | ✓ | ✗ | ✓ |

| Web Platform | ✓ | ✓ | ✓ | ✓ |

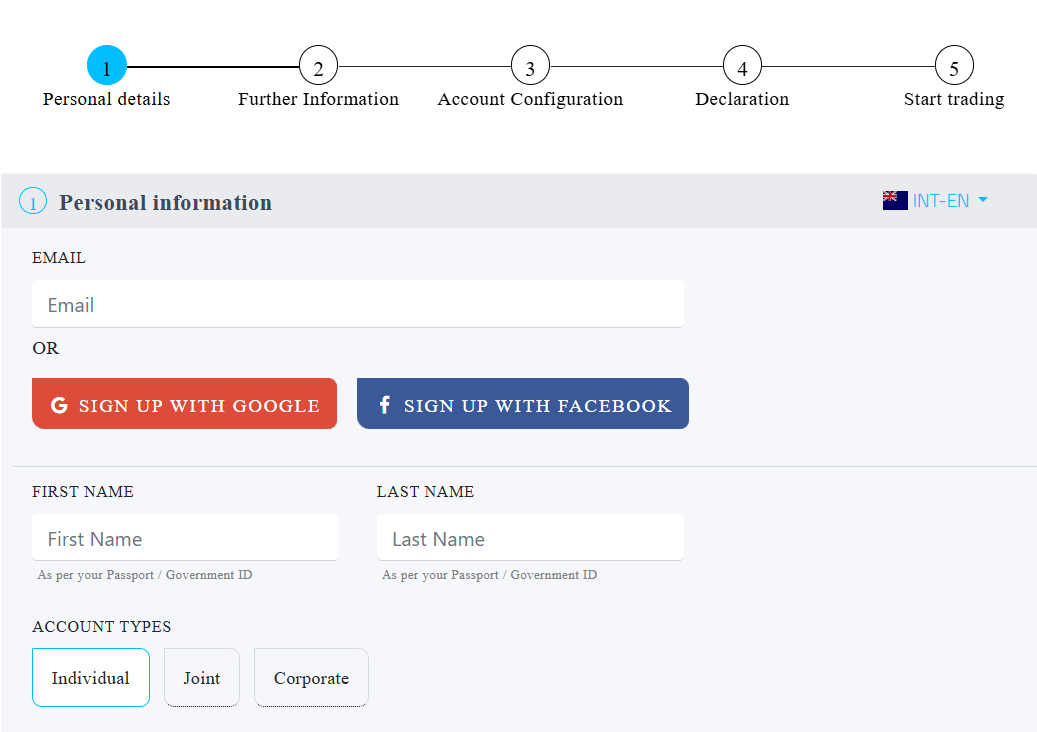

FP markets How to Open an Account: A Step-by-Step Guide

Opening an account with FP Markets is a simple and straightforward process, designed to get traders started quickly and efficiently. To begin trading with FP Markets, follow these steps:

Step 1: Visit the FP Markets website and click on the "Open Live Account" button.

Step 2: Choose your preferred account type (Standard or Raw) and select your trading platform (MetaTrader 4, MetaTrader 5, or Iress).

Step 3: Fill out the registration form with your personal information, including your full name, email address, phone number, and country of residence. You will also need to create a secure password for your account.

Step 4: Provide proof of identity and proof of residence. Acceptable documents for proof of identity include a valid passport, driver's license, or national ID card. For proof of residence, you can submit a recent utility bill, bank statement, or any other official document that shows your current address. These documents are required to comply with anti-money laundering (AML) and know-your-customer (KYC) regulations.

Step 5: Choose your preferred deposit method and fund your account. FP Markets accepts various payment methods, including credit/debit cards, bank wire transfers, and e-wallets such as Skrill and Neteller. The minimum deposit required to open an account with FP Markets is $100 or its equivalent in your account currency.

Step 6: Once your account is funded, you can download and install your chosen trading platform (MetaTrader 4, MetaTrader 5, or Iress) and start trading.

FP Markets offers a quick and user-friendly account opening process, with most applications being approved within 24 hours, subject to the successful completion of the required documentation. The broker's support team is available 24/5 to assist with any issues or questions that may arise during the account opening process.

It is important to note that FP Markets operates in accordance with strict regulatory requirements and may request additional documentation to verify your identity and ensure compliance with AML/KYC regulations.

Charts and Analysis

FP Markets provides a comprehensive suite of educational trading resources and tools designed to support traders of all skill levels. These resources aim to enhance traders' knowledge, improve their trading strategies, and keep them informed about the latest market developments.

| Category | Details |

|---|---|

| Trading Academy | Offers structured educational materials, including articles, tutorials, and videos, covering both basic and advanced trading concepts. Suitable for traders of all experience levels. |

| Webinars | Regular live sessions conducted by industry experts covering market analysis, strategies, and platform tutorials. Recorded versions are available on demand. |

| E-Books & Guides | Downloadable resources covering topics such as risk management, technical analysis, and trading psychology to help traders refine their skills. |

| Market News & Analysis | Daily market updates, news articles, and technical analysis reports provided by in-house analysts, covering forex, stocks, indices, and commodities. |

| Economic Calendar | Highlights important market-moving events like central bank meetings, economic data releases, and geopolitical developments, helping traders anticipate volatility. |

| Trading Tools | Includes currency calculators, margin calculators, and pip calculators to assist traders in managing their positions and risk effectively. Integrated into the trading platforms. |

Compared to industry standards, FP Markets' educational resources and tools are comprehensive and well-developed. The broker's commitment to providing a diverse range of educational materials sets it apart from many of its competitors. By offering resources suitable for traders of all skill levels, FP Markets demonstrates its dedication to supporting the growth and success of its clients.

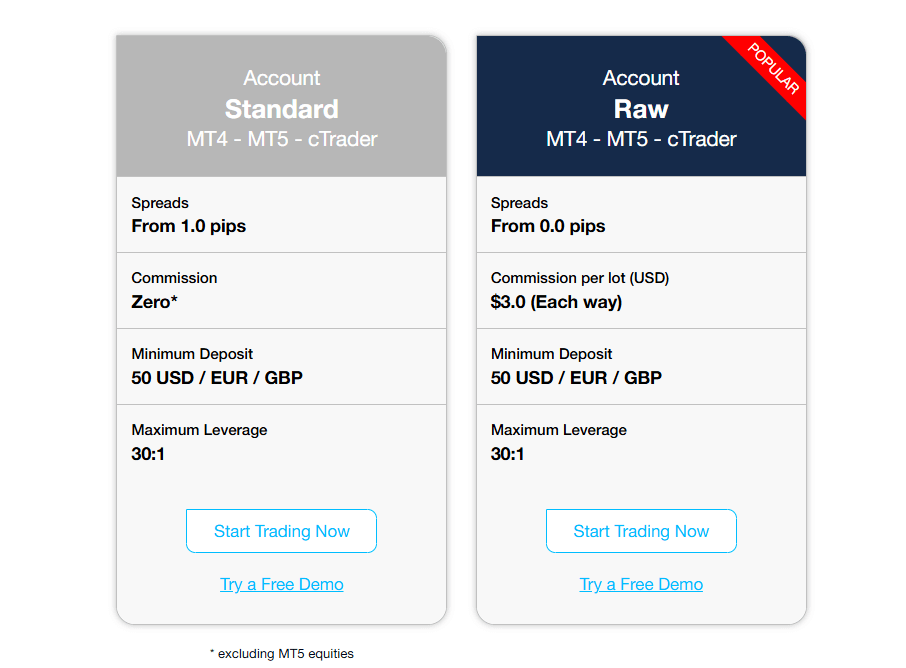

FP markets Account Types

FP Markets offers a variety of trading account types to cater to the diverse needs of traders, from beginners to experienced professionals. The broker's account types are designed to provide flexibility, competitive trading conditions, and access to a wide range of markets.

| Account Type | Spreads | Commission | Features |

|---|---|---|---|

| Standard Account | From 1.0 pips | No commission | Simple pricing structure, suitable for traders looking to minimize costs. Access to forex, indices, commodities, and cryptocurrencies. |

| Raw Account | From 0.0 pips | $3.50 per lot per side | Designed for experienced traders, offering tight spreads and faster execution speeds. Best for scalpers and high-frequency traders. |

| Islamic Account | From 1.0 pips (Standard) / From 0.0 pips (Raw) | No swap fees (swap-free) | Sharia-compliant, no overnight interest charges. Available in both Standard and Raw account types. |

| Demo Account | Simulated market conditions | No commission | Risk-free trading with virtual funds, unlimited access for practice and strategy testing. |

The range of account types offered by FP Markets demonstrates the broker's commitment to accommodating the diverse requirements of its clientele. By providing multiple account options, FP Markets ensures that traders can select the account type that aligns with their trading style, experience level, and risk tolerance.

Compared to industry standards, FP Markets' account types are competitive and offer a balanced mix of pricing options and trading features. The Standard Account's low spreads and the Raw Account's commission-based structure provide traders with the flexibility to choose the pricing model that best suits their needs. Additionally, the availability of Islamic accounts and a Demo account further enhances the broker's appeal to a wide range of traders.

Account Types Comparison Table

| Feature | Standard Account | Raw Account | Islamic Account |

|---|---|---|---|

| Minimum Deposit | $100 | $100 | $100 |

| Spreads | From 1.0 pips | From 0.0 pips | Same as Standard/Raw |

| Commissions | No | $3.50 per side | Same as Standard/Raw |

| Leverage | Up to 1:500 | Up to 1:500 | Up to 1:500 |

| Swap-Free | No | No | Yes |

| Tradable Instruments | 50+ | 50+ | 50+ |

| Platform Compatibility | MT4, MT5, Iress | MT4, MT5, Iress | MT4, MT5, Iress |

Negative Balance Protection

FP Markets offers negative balance protection to all its clients, regardless of the account type or trading platform they use. This policy ensures that traders cannot lose more than their account balance, even in the event of extreme market volatility or unexpected price gaps. If a trader's account balance reaches zero, FP Markets will absorb any additional losses, preventing the account from going into negative territory. It is important to note that while negative balance protection provides a layer of security, it should not be seen as a substitute for proper risk management. Traders should still employ sound risk management strategies, such as setting appropriate stop-loss orders and managing their leverage responsibly. Negative balance protection should be viewed as a last line of defense, providing peace of mind and limiting potential losses in unforeseen circumstances. FP Markets' commitment to providing negative balance protection demonstrates the broker's dedication to safeguarding its clients' funds and promoting responsible trading practices. By offering this protection, FP Markets aims to create a secure trading environment where traders can focus on their strategies without worrying about the risk of incurring debts beyond their account balance. Traders should be aware that while negative balance protection is a valuable feature, it may not cover all potential losses in every situation. It is essential to thoroughly review FP Markets' terms and conditions to understand the specific circumstances under which negative balance protection applies and any limitations or exceptions to the policy.

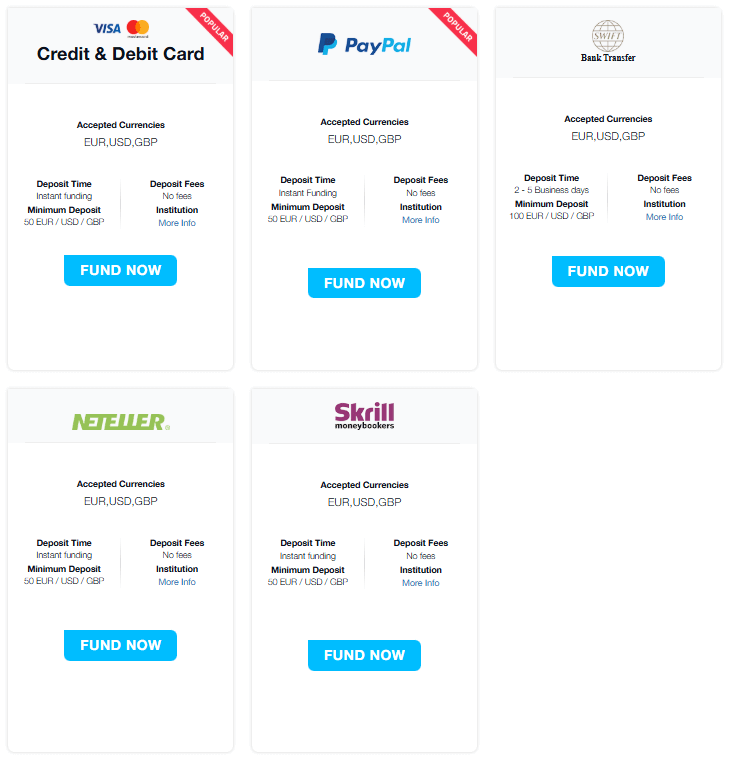

FP markets Deposits and Withdrawals

FP Markets offers a wide range of deposit and withdrawal options to cater to the needs of its diverse client base. The broker aims to provide a seamless and secure funding experience, ensuring that traders can easily manage their accounts and access their funds when needed.

Deposit Methods

FP Markets accepts several deposit methods:

| Payment Method | Processing Time | Deposit Fees | Minimum Deposit | Notes |

|---|---|---|---|---|

| Credit/Debit Cards (Visa, Mastercard) | Instant | No fees | $100 | Convenient and fast funding option. |

| Bank Wire Transfer | 1-3 business days | No fees (banks may charge a transfer fee) | $100 | Traditional bank transfer method. |

| Electronic Wallets (Skrill, Neteller, PayPal) | Instant | No fees from FP Markets (provider fees may apply) | $100 | Fast digital payment option. |

| Local Bank Transfers (Australia only—POLi, PayID) | Instant | No fees | $100 | Available for Australian clients. |

| BPAY (Australia only) | 1-2 business days | No fees | $100 | A local Australian payment option. |

Withdrawal Methods

FP Markets processes withdrawal requests promptly, with most requests being completed within 1-2 business days. Available withdrawal methods:

| Payment Method | Withdrawal Fees | Notes |

|---|---|---|

| Credit/Debit Cards (Visa, Mastercard) | No fees from FP Markets (card issuers may charge a small fee) | Fast and convenient withdrawal method. |

| Bank Wire Transfer | No fees for withdrawals above $50; a $20 fee applies for withdrawals below $50 | Traditional bank transfer method. |

| Electronic Wallets (Skrill, Neteller, PayPal) | No fees from FP Markets (e-wallet providers may charge a small fee) | Fast digital payment option. |

| Local Bank Transfers (Australia only) | No fees | Available for Australian clients. |

Traders must submit a withdrawal request through their Client Portal, specifying the desired withdrawal method and amount. FP Markets may require additional verification documents to process withdrawals, in compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations.

It is important to note that traders can only withdraw funds using the same method they used for depositing, up to the amount of their initial deposit. Any profits exceeding the initial deposit amount can be withdrawn using an alternative method.

FP Markets' diverse range of deposit and withdrawal options, combined with its no-fee policy and fast processing times, sets it apart from many competitors. The broker's commitment to providing a seamless funding experience demonstrates its focus on client satisfaction and ease of use.

Traders should be aware that while FP Markets does not charge fees for most deposit and withdrawal methods, third-party providers (such as banks or e-wallet services) may impose their own charges. It is essential to review the terms and conditions of these providers to understand any potential costs associated with funding your trading account.

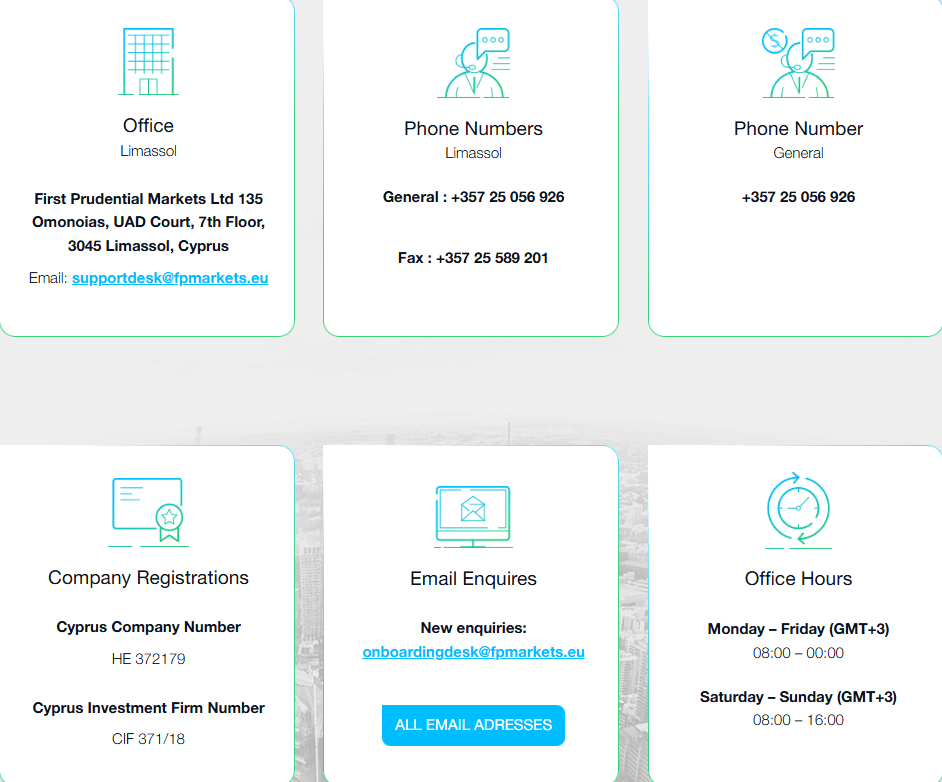

Support Service for Customer

In the fast-paced world of online trading, reliable customer support is crucial for a positive trading experience. Traders often require assistance with account-related queries, technical issues, or general guidance, and a responsive support team can make all the difference. FP Markets understands the importance of providing excellent customer support and offers a range of channels through which traders can reach out for help.

| Support Channel | Availability | Details |

|---|---|---|

| Live Chat | 24/7 | Real-time assistance via the FP Markets website. Ideal for urgent queries. |

| Email Support | 24/5 | Contact: support@fpmarkets.com. Response time within 24 hours. Suitable for less urgent inquiries and record-keeping. |

| Phone Support | 24/5 (Monday-Friday) | International phone numbers available: Australia: +61 2 8252 6800 United Kingdom: +44 20 3318 8265 Cyprus: +357 2504 0418 China: +86 400 842 0168 |

| Social Media | Varies | Available on Facebook, Twitter, LinkedIn for general inquiries and updates. |

| Multi-Language Support | Yes | Available in English, Spanish, Portuguese, French, German, Italian, Dutch, Thai, Indonesian, Vietnamese, and Chinese. |

Compared to industry standards, FP Markets' customer support offerings are comprehensive and competitive. The broker's 24/7 live chat service, multi-language support, and various contact options set it apart from many competitors, providing traders with a superior support experience.

Compared to industry standards, FP Markets' customer support offerings are comprehensive and competitive. The broker's 24/7 live chat service, multi-language support, and various contact options set it apart from many competitors, providing traders with a superior support experience.

Prohibited Countries

In the global landscape of online trading, it is essential for brokers to comply with international regulations and licensing requirements. As a result, some brokers may be restricted from operating or providing services in certain countries or regions. FP Markets, like many other international brokers, has a list of prohibited countries where it cannot offer its trading services.

The primary reasons behind these restrictions include:

- Local Regulations: Some countries have strict regulations governing the provision of online trading services. These regulations may require brokers to obtain specific licenses or adhere to particular guidelines to operate legally within their jurisdiction.

- Licensing Requirements: Brokers may choose not to operate in certain countries due to the complexity or cost of obtaining the necessary licenses. Each country has its own set of requirements, and meeting these criteria can be time-consuming and expensive.

- Geopolitical Factors: Political instability, economic sanctions, or other geopolitical factors may make it difficult or impossible for brokers to offer services in certain regions. Brokers must comply with international laws and regulations to avoid potential legal consequences.

FP Markets is prohibited from offering its services to residents of the following countries:

- United States

- Canada

- Japan

- New Zealand

- Brazil

- Democratic People's Republic of Korea (DPRK)

- Iran

- Cuba

- Sudan

- Syria

It is important for traders to be aware of these restrictions and ensure that they are eligible to open an account with FP Markets before attempting to do so. Attempting to trade with FP Markets from a prohibited country may result in the suspension or termination of the trading account and potential legal consequences.

Traders should also note that this list of prohibited countries is subject to change based on evolving regulations and geopolitical factors. It is advisable to check FP Markets' official website or contact their customer support team for the most up-to-date information regarding country-specific restrictions.

Special Offers for Customers

FP Markets occasionally provides special promotions and offers to both new and existing traders, enhancing the overall trading experience and providing additional value to its clients. These offers may include sign-up bonuses, loyalty programs, trading competitions, and partnerships with third-party service providers. However, at the time of writing this review, FP Markets does not have any active special offers or promotions.

It is important to note that the availability and terms of special offers can change over time, depending on market conditions, regulatory requirements, and the broker's marketing strategies. Traders should regularly check FP Markets' official website or contact their customer support team for the most up-to-date information regarding any ongoing or upcoming promotions.

When evaluating special offers from any broker, traders should carefully review the associated terms and conditions to fully understand the requirements and potential limitations. Some common terms to look out for include:

- Minimum Deposit Requirements: Some promotions may require traders to deposit a minimum amount to qualify for the offer.

- Trading Volume Thresholds: Bonuses or rewards may be contingent upon meeting specific trading volume requirements within a given timeframe.

- Time Limitations: Special offers may have an expiration date or a limited time period during which traders can take advantage of the promotion.

- Withdrawal Restrictions: In some cases, bonuses or rewards may be subject to withdrawal restrictions or require a certain level of trading activity before they can be withdrawn.

While special offers can provide additional value to traders, it is crucial to evaluate them in the context of the broker's overall offering, including its trading conditions, platform stability, and customer support. Traders should not base their decision to open an account with a broker solely on the availability of promotions but rather consider the full range of services and benefits provided.

Conclusion

Throughout this comprehensive review, I have delved into various aspects of FP Markets' operations, examining their regulatory compliance, geographical jurisdictions, trading platforms, account types, customer support, and more. Drawing upon these findings, I can confidently conclude that FP Markets is a safe, reliable, and reputable broker that prioritizes the needs of its clients. FP Markets delivers a unique experience to forex brokers with low trading costs

One of the standout features of FP Markets is their commitment to regulatory compliance. They are overseen by top-tier regulatory bodies such as ASIC and CySEC, ensuring a high level of financial security and transparency. This robust regulatory framework instills confidence in traders, knowing that their funds are protected and that the broker adheres to strict industry standards.

FP Markets' global presence and wide range of tradable assets make them an attractive choice for traders of all levels. They offer competitive spreads, fast execution speeds, and a variety of account types to cater to different trading styles and preferences. The broker's advanced trading platforms, including MetaTrader 4, MetaTrader 5, and Iress, provide users with powerful tools and insights to make informed trading decisions.

Customer support is another area where FP Markets excels. They offer 24/7 multilingual support through various channels, ensuring that clients can access assistance whenever they need it. The broker's extensive educational resources, including webinars, tutorials, and market analysis, demonstrate their commitment to empowering traders with the knowledge and skills needed to succeed.

While FP Markets may not always have active special offers or promotions, their overall trading environment, competitive pricing, and dedication to client satisfaction more than compensate for this. The broker's user-friendly platforms, wide range of deposit and withdrawal options, and negative balance protection further enhance their appeal.

In conclusion, FP Markets has established itself as a trustworthy and reliable broker that prioritizes the safety and success of its clients. Their strong regulatory compliance, advanced trading platforms, and commitment to education and support make them a compelling choice for traders seeking a secure and transparent trading environment. Whether you are a novice or an experienced trader, FP Markets offers the tools, resources, and expertise to help you achieve your trading goals.