Grand Capital Review: Trade and Invest with a Versatile Global Broker

Grand Capital

Saint Vincent and the Grenadines

Saint Vincent and the Grenadines

-

Minimum Deposit $10

-

Withdrawal Fee $varies

-

Leverage 500:1

-

Spread From 0.4

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

Softwares & Platforms

Customer Support

+2484422900

(English)

+2484422900

(English)

Supported language: English

Social Media

Summary

Grand Capital is an international forex and CFD broker established in 2006, offering access to over 330 trading instruments, including forex, cryptocurrencies, stocks, indices, and commodities . The broker provides various account types—Standard, ECN Prime, Micro, Crypto, and Swap-Free—with minimum deposits starting from $10 . Clients can trade on MetaTrader 4, MetaTrader 5, and WebTrader platforms, with leverage up to 1:500 depending on the account type .

- Wide selection of tradable assets

- Multiple account types to cater to different trading preferences

- Supports popular trading platforms like MT4, MT5, and WebTrader

- Offers educational resources and market analysis

- Provides customer support through various channels

- Attractive promotions and bonuses for traders

- Offers a demo account for practice trading

- Allows various deposit and withdrawal methods

- Provides negative balance protection

- Offers both automated trading and copy trading options

- Lacks proper regulation, raising concerns about safety and security of funds

- Has an "Unauthorized" status with the NFA in the United States

- Operates with a "No Sharing" license, indicating a lack of transparency

- Does not accept traders from the United States and Japan

- Some account types require high minimum deposits

- Has limited regulatory oversight compared to other brokers

- The company's regulatory status may deter some traders

- Relatively high spreads on certain account types

- Commissions apply on several account types, increasing trading costs

- Limited information regarding the company's financial standing and management

Overview

Grand Capital is an online broker that has been providing trading services since 2006. With a presence in over 144 countries and more than 2,700 partners, Grand Capital has established itself as a stable and globally recognised company. The broker offers a wide range of financial instruments, including forex, cryptocurrencies, stocks, indices, metals, commodities, and CFDs, catering to the diverse needs of traders worldwide.

Grand Capital's commitment to providing top-notch trading services has earned them several prestigious awards, such as "Best Binary Options Broker" from TradingEXPRO Awards 2017 and "Best Forex Broker Central and Eastern Europe 2020" from International Business Magazine. For more detailed information about the company, visit their official website.

Overview table

| Aspect | Information |

|---|---|

| Registered Country/Area | Saint Vincent and the Grenadines |

| Founded Year | 2006 |

| Company Name | Grand Capital Ltd |

| Regulation | No Regulation |

| Minimum Deposit | $10 for Micro Account, $100 for Standard, MT5, Swap Free, and Crypto Accounts, $500 for ECN Prime Account |

| Maximum Leverage | Up to 1:500 for Standard, Swap Free, and Micro Accounts, Up to 1:100 for ECN Prime and MT5 accounts, Up to 1:10 for Crypto Account |

| Spreads | Starting from 0.4 pips for commission-free accounts, Commissions apply on certain account types |

| Trading Platforms | MetaTrader 4 (MT4), MetaTrader 5 (MT5), WebTrader |

| Tradable Assets | Forex, Cryptocurrencies, Stocks, Indices, Spot Metals, Energies, ETFs, CFDs on Soft Commodities, Grains, Bonds, and Meats |

| Account Types | Standard Account, MT5 Account, Micro Account, ECN Prime Account, Swap Free Account, Crypto Account |

| Demo Account | Available with virtual funds of $10,000 USD for 30 days |

| Islamic Account | Available on Standard and Extended Swap-free accounts |

| Customer Support | Email, Phone, Chat Service, Callback Request, Regional YouTube Channels |

| Payment Methods | Bank Wire Transfer, Credit Cards, Debit Cards, Neteller, Skrill, Bitcoin, Help2Pay, Ethereum, FasaPay, Ripple, Perfect Money, and more |

Facts list

- Grand Capital offers over 500 assets across 11 classes for trading.

- The broker provides multiple account types to cater to different trader needs and preferences.

- Grand Capital supports popular trading platforms like MT4, MT5, and WebTrader.

- Spreads start from as low as 0.4 pips on commission-free accounts.

- The broker offers a copy trading service for investors to follow successful traders' strategies.

- Grand Capital provides investment portfolios for balanced exposure to stocks, indices, and metals.

- Educational resources include charts, analysis tools, economic calendars, webinars, and more.

- The broker accepts various payment methods for deposits and withdrawals.

- Clients can reach customer support via email, phone, chat, and callback requests.

- Grand Capital offers special promotions and bonuses for traders and partners.

Grand Capital Licenses and Regulatory

Grand Capital operates without proper regulation, which is a significant concern for traders. While the broker claims to have a Common Financial Service License, the license type is listed as "No Sharing", and there is a lack of comprehensive information about the regulatory agency and the effective dates of the license.

The National Futures Association (NFA) in the United States is mentioned as the regulatory body, with Grand Capital Ltd listed under license number 0540363. However, the official regulatory status is stated as "unauthorised", and the broker is noted to exceed the business scope regulated by the NFA.

It's crucial for traders to exercise caution and carefully consider the risks associated with engaging with an unregulated broker like Grand Capital. The absence of proper regulatory oversight raises concerns about the safety and security of client funds and the overall transparency of the broker's operations.

Trading Instruments

Grand Capital offers a diverse range of tradable assets, providing traders with ample opportunities to invest in various financial markets.

The broker's offerings include:

| Asset Class | Details |

|---|---|

| Forex | 50+ currency pairs, including majors like EUR/USD and GBP/USD |

| Cryptocurrencies | 60+ crypto pairs, including BTC, ETH, and altcoins |

| Stocks | US, European, and Russian company stocks |

| Indices | 12 global indices, including NASDAQ, FTSE 100 |

| Spot Metals | Gold, Silver |

| Energies | Crude Oil (WTI, Brent), Natural Gas |

| ETFs | 7 ETFs, including QQQ |

| Other CFDs | Soft commodities (coffee, sugar), grains (corn, wheat), bonds, meats |

Additionally, Grand Capital provides binary options trading on their separate website, GC Option, covering more than 30 assets, including currency pairs, futures, and metals.

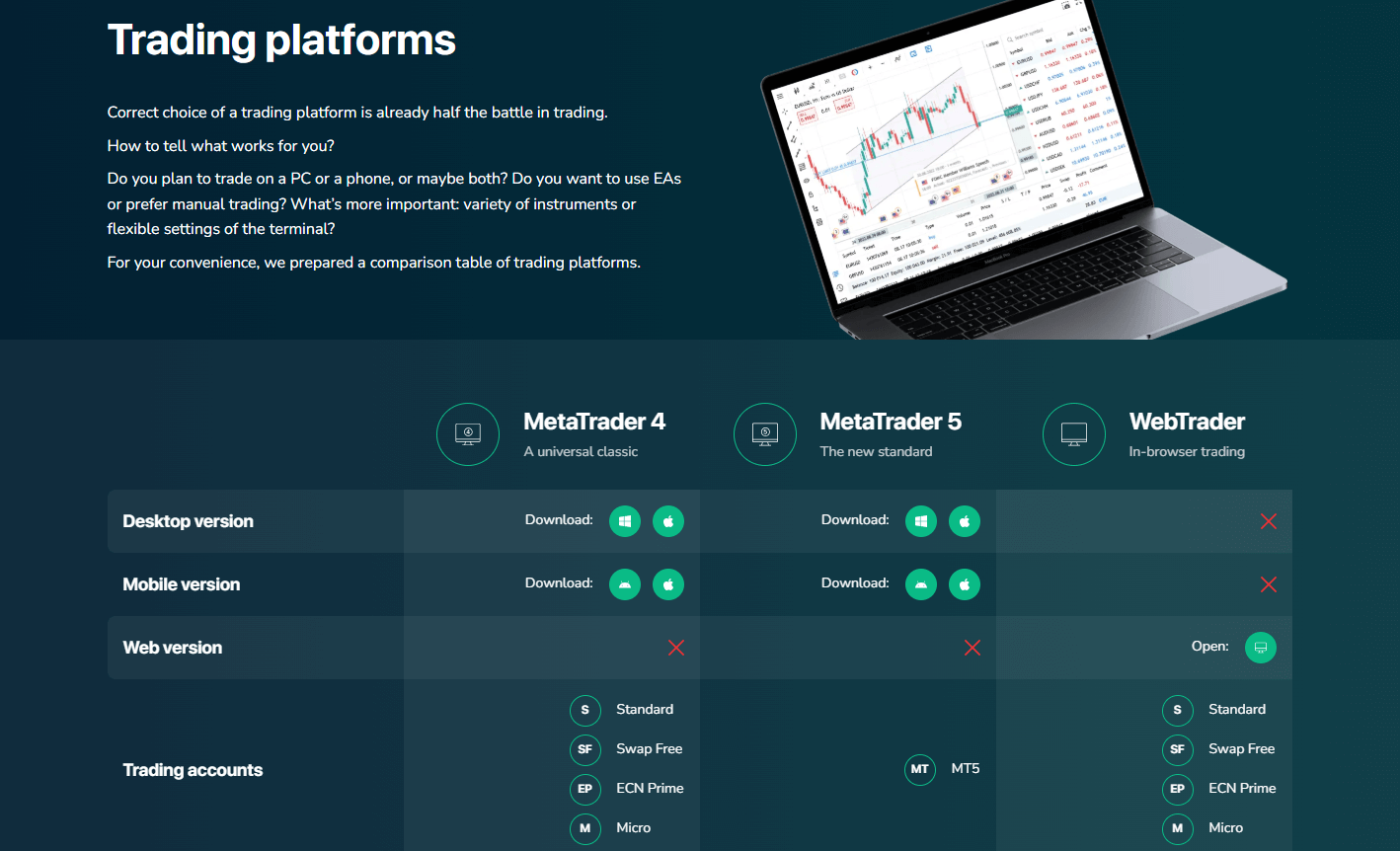

Trading Platforms

Grand Capital offers several trading platforms to accommodate the diverse needs and preferences of traders:

MetaTrader 4 (MT4) and MetaTrader 4 Mobile

MT4 is a widely recognised and popular trading platform, offering a comprehensive set of features and tools for efficient trading. Traders can access over 330 instruments, including currency pairs, spot metals, CFDs, stocks, indices, and futures. The platform is compatible with iOS and Android devices, enabling mobile trading. MT4 also supports user indicators and expert advisors for customised trading strategies.

MetaTrader 5 (MT5) and MetaTrader 5 Mobile

MT5 is the next generation of the MT4 platform, offering enhanced trading capabilities and access to a broader range of financial instruments. It is considered a preferred terminal for professional traders.

WebTrader

Grand Capital's WebTrader is an online trading terminal accessible through web browsers, allowing traders to trade directly without software installation. It provides access to professional analytical tools, such as indicators and charts.

These platforms offer features like real-time quotes, order execution, technical analysis tools, and risk management options. Traders can choose the platform that best suits their trading style and needs.

comparison of Grand Capital's trading platforms

| Feature | MT4 | MT5 | WebTrader |

|---|---|---|---|

| Desktop Version | Yes | Yes | No |

| Web Version | No | No | Yes |

| Mobile App | Yes | Yes | No |

| Number of Assets | 330+ | 400+ | - |

| Automated Trading | Yes | Yes | No |

| Indicators | Yes | Yes | Yes |

| Economic Calendar | Yes | Yes | - |

| News Feed Integration | Yes | Yes | - |

| Multi-Language Support | Yes | Yes | - |

Grand Capital How to Open an Account: A Step-by-Step Guide

To open an account with Grand Capital, follow these steps:

- Visit the Grand Capital website and click on the "Open an Account" or "Sign Up/Register" button.

- Fill in the required personal information in the registration form, including your name, email address, phone number, country of residence, and any other requested details.

- After completing the registration, you will receive a verification email. Follow the instructions in the email to verify your account and gain access to the trading platform.

- Once your account is verified, log in to your Grand Capital account to start trading.

Grand Capital accepts various payment methods for account funding, such as bank wire transfers, credit/debit cards, e-wallets (Neteller, Skrill, Perfect Money), and cryptocurrencies (Bitcoin, Ethereum, Ripple). The minimum deposit requirements range from $10 to $500, depending on the account type.

Charts and Analysis

Grand Capital provides a range of educational resources and tools to support traders in their market analysis and decision-making process. These include:

| Feature | Description |

|---|---|

| Charts | Advanced charting tools with customizable indicators and drawing options |

| Analysis Tools | Technical analysis suite for spotting trends and trade opportunities |

| Economic Calendar | Tracks key global economic events and data releases |

| Webinars | Live educational sessions by expert analysts on trading topics and strategies |

| Downloadable PDFs | Guides and tutorials on trading concepts and platform use |

| Market News Updates | Real-time updates and insights on major financial market movements |

| Blogs | Articles on strategies, market analysis, and trading insights |

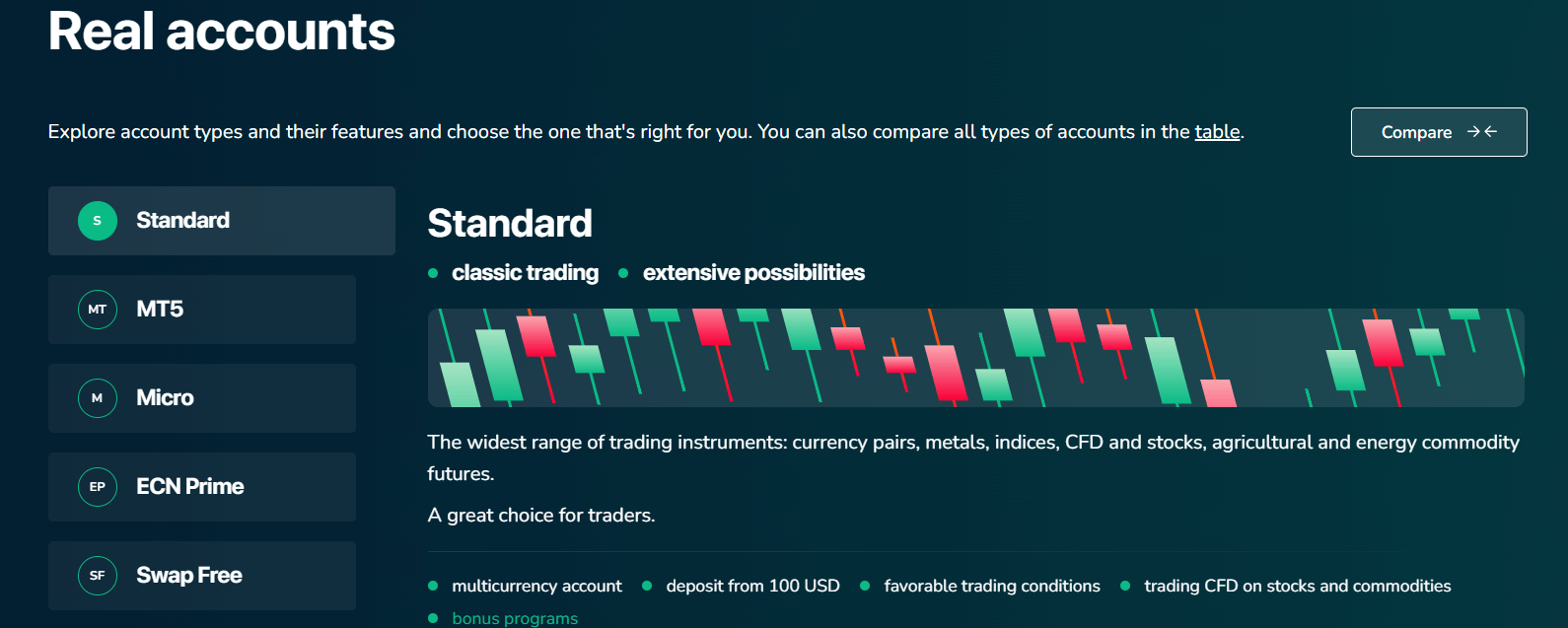

Grand Capital Account Types

Grand Capital offers a variety of account types to cater to the different needs and preferences of traders:

- Standard Account: A popular choice for traders interested in a wide range of assets, particularly in the forex market. It requires a minimum deposit of $100 and offers the option to choose from eight different currencies as the account currency.

- MT5 Account: Designed for algorithmic trading, the MT5 account is ideal for traders who prefer automated trading strategies. It requires a minimum deposit of $100 and operates on the MetaTrader 5 (MT5) platform.

- Micro Account: Tailored for beginners who want to start with smaller trade sizes and lower risk. It offers access to 66 popular instruments and requires a minimum deposit of $10.

- ECN Prime Account: Best suited for seasoned traders and scalpers who prioritise low spreads and fast execution. It requires a minimum deposit of $500 and provides an environment conducive to high-frequency trading.

- Swap Free Account: Designed for Muslim traders, the Swap Free account eliminates overnight fees, making it compliant with Islamic finance principles. It requires a minimum deposit of $100 and offers trading without any interest charges.

- Crypto Account: Specifically designed for trading cryptocurrencies. It provides access to 68 different cryptocurrencies and comes with the added benefit of an analyst to assist traders. The minimum deposit for this account type is $100.

comparison table of Grand Capital's account types

| Feature | Standard | MT5 | Micro | ECN Prime | Swap Free | Crypto |

|---|---|---|---|---|---|---|

| Minimum Deposit | $100 | $100 | $10 | $500 | $100 | $100 |

| Leverage | 1:500 | 1:100 | 1:500 | 1:100 | 1:500 | 1:10 |

| Spread | From 0.4 | From 0.4 | From 0.4 | From 0.4 | From 0.4 | - |

| Commission | No | $5-$10 | No | $5-$7 | No | 0.5% |

| Trading Instruments | 500+ | 400+ | 66 | - | - | 68 Cryptos |

| Platform | MT4 | MT5 | MT4 | MT4 | MT4 | MT4 |

| Swap Free | No | No | No | No | Yes | - |

Negative Balance Protection

Negative balance protection is a risk management feature that prevents a trader's account balance from falling below zero. In the event of extreme market volatility or unexpected market gaps, negative balance protection ensures that traders do not lose more than their account balance. Grand Capital offers negative balance protection to its clients, safeguarding their funds and limiting potential losses. This means that even if a trader's account balance reaches zero, they will not owe any additional money to the broker. It's essential to understand that while negative balance protection provides a safety net, it does not eliminate the risk of losing the funds invested in the account. Traders should still exercise caution and implement proper risk management strategies when trading.

Grand Capital Deposits and Withdrawals

Grand Capital supports a wide range of deposit and withdrawal methods to facilitate convenient funding and withdrawal of trading accounts. Here are the available options:

Deposit Methods

| Deposit Method | Options | Minimum Deposit | Processing Time |

|---|---|---|---|

| Bank Wire Transfer | International bank transfers | $10 (Micro), $100–$500 (others) | 1–5 business days |

| Credit/Debit Cards | Visa, Mastercard | $10 (Micro), $100–$500 (others) | Instant |

| E-wallets | Neteller, Skrill, Perfect Money, FasaPay | $10 (Micro), $100–$500 (others) | Instant |

| Cryptocurrencies | Bitcoin (BTC), Ethereum (ETH), Ripple (XRP) | $10 (Micro), $100–$500 (others) | Instant |

| Other Methods | Help2Pay, WebMoney, QIWI, UnionPay | $10 (Micro), $100–$500 (others) | Instant |

Withdrawal Methods

| Withdrawal Method | Options | Processing Time | Fees |

|---|---|---|---|

| Bank Wire Transfer | International bank transfers | Up to 7 business days | May apply depending on bank |

| Credit/Debit Cards | Visa, Mastercard | 1–5 business days | No fees |

| E-wallets | Neteller, Skrill, Perfect Money, FasaPay | 1–5 business days | Small fees may apply |

| Cryptocurrencies | Bitcoin (BTC), Ethereum (ETH), Ripple (XRP) | 1–5 business days | No fees |

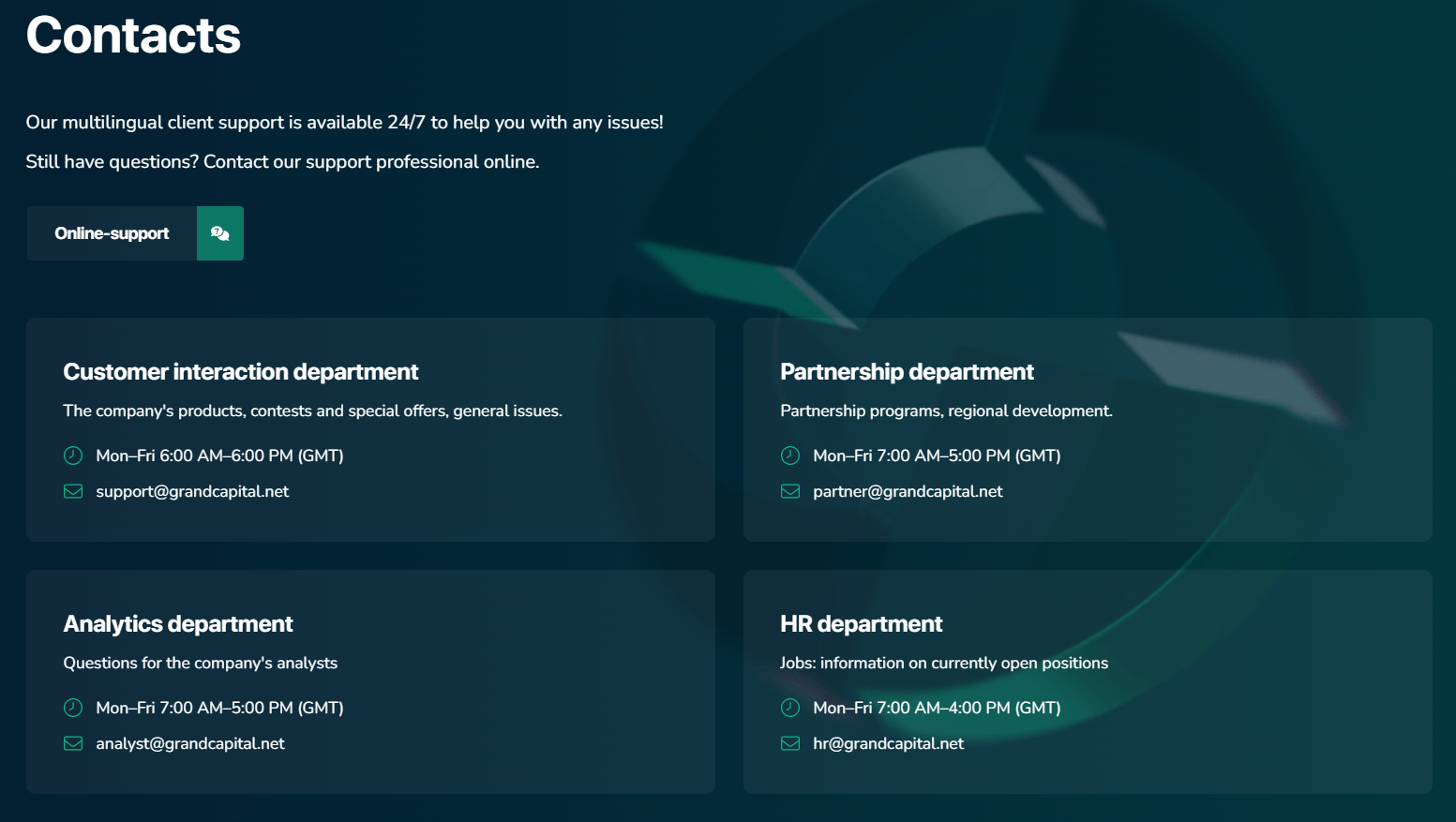

Support Service for Customer

Grand Capital provides various customer support channels to assist traders with their enquiries and concerns:

- Email: info@grandcapital.net

- Phone: +1 646 8447187

- Live Chat: Available on the Grand Capital website

- Callback Request: Traders can request a callback from the support team

- Regional YouTube Channels: Access to region-specific support and information

comparison table of Grand Capital's customer support

| Support Channel | Availability |

|---|---|

| 24/5 | |

| Phone | 24/5 |

| Live Chat | 24/5 |

| Callback Request | 24/5 |

| YouTube Channels | Varies by region |

Prohibited Countries

Grand Capital has restrictions on providing services to traders from certain countries and regions due to local regulations, licensing requirements, or geopolitical factors. The broker does not accept clients from the following countries:

- United States

- Japan

Traders from these prohibited countries are not allowed to open an account or access Grand Capital's trading services. Attempting to trade with Grand Capital from a prohibited country may result in legal consequences and the termination of the trading account.

Special Offers for Customers

Grand Capital offers various promotions and bonuses to attract and retain traders.

Some of the current special offers include:

- Sign-Up Bonus: Traders can receive a 40% bonus on their initial deposit, which can be renewed every six months by depositing 10% of the initial sum.

- Trading Bonus: Traders can receive a 40% bonus on their initial deposit, with $3 credited to their account for each lot closed. The bonus can be withdrawn after meeting specific trading volume requirements.

- Trading Contests: Grand Capital organises trading competitions that offer attractive prizes to top-performing traders.

- Partnership Program: Affiliates can earn up to 50% of the company's profit or up to $25 per lot traded by referred clients.

It's crucial to review the terms and conditions associated with each bonus and promotion, as there may be specific requirements, such as minimum deposit amounts, trading volume thresholds, or time limitations.

Conclusion

After conducting a thorough review of Grand Capital, I have mixed feelings about recommending them as a broker. While they offer a wide range of tradable assets, multiple account types, and attractive promotions, their lack of proper regulation is a significant concern.

Grand Capital's global presence and years of operation suggest a level of stability, but the absence of clear regulatory oversight raises questions about the safety and security of client funds. The broker's "No Sharing" license and "Unauthorised" status with the National Futures Association (NFA) in the United States are red flags that cannot be ignored.

On the positive side, Grand Capital provides a diverse selection of trading platforms, including the popular MetaTrader 4 and MetaTrader 5, along with a web-based platform. The broker offers a wide range of educational resources, such as webinars, tutorials, and market analysis, to support traders in their learning and decision-making process.

The variety of account types caters to different trading styles and preferences, with options suitable for beginners and experienced traders alike. The availability of a demo account allows potential clients to test the platforms and practise trading strategies without risking real money.

Grand Capital's customer support is accessible through multiple channels, including email, phone, live chat, and callback requests. The broker also maintains regional YouTube channels to provide localised support and information.

However, the lack of proper regulation overshadows these positive aspects. Traders should be cautious and thoroughly assess the potential risks before deciding to trade with Grand Capital. It is advisable to seek out regulated brokers that offer similar features and benefits but with the added security of regulatory oversight.

While Grand Capital may appeal to some traders with its extensive range of assets, competitive trading conditions, and attractive promotions, the absence of a strong regulatory framework makes it difficult for me to recommend them wholeheartedly. Traders should prioritise the safety and security of their funds and carefully consider the implications of trading with an unregulated broker.