HF Markets Review 2025: Uncovering the Pros and Cons, and Key Features

HF Markets

Cyprus

Cyprus

-

Withdrawal Fee $varies

-

Leverage 1:2000

-

Minimum Order 0.01

-

Forex Available

-

Crypto Unavailable

-

Stock Available

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Cyprus Market Making (MM)

Cyprus Market Making (MM)

Japan Forex Trading License

Japan Forex Trading License

UAE Financial Services License

UAE Financial Services License

Softwares & Platforms

Customer Support

+576023896018

(Spanish)

+576023896018

(Spanish)

+525588527276

(Spanish)

+525588527276

(Spanish)

+86 4001200742

(Chinese (Simplified))

+86 4001200742

(Chinese (Simplified))

+91 0008009190406

(Icelandic)

+91 0008009190406

(Icelandic)

+6625060095

(Thai)

+6625060095

(Thai)

+63284651240

(Filipino)

+63284651240

(Filipino)

+97143184711

(Arabic)

+97143184711

(Arabic)

Supported language: Arabic, Bulgarian, Chinese (Simplified), Croatian, Czech, English, Filipino, French, German, Hungarian, Indonesian, Italian, Japanese, Korean, Malay, Persian, Polish, Portuguese, Romanian, Russian, Slovak, Spanish, Thai, Turkish, Vietnamese

Social Media

Summary

HF Markets offers a variety of account types with flexible deposit requirements starting at $0. The broker is regulated by CySEC, the FCA, and other reputable authorities, ensuring a secure trading environment. Clients can access a wide range of instruments, including forex, commodities, and indices, on platforms like MetaTrader 4, MetaTrader 5, and WebTrader. HF Markets provides competitive spreads, high leverage options, and a robust support system, making it a popular choice for both beginner and experienced traders.

- Well-regulated by reputable authorities (CySEC, FCA, DFSA, FSA)

- Wide range of trading instruments (forex, commodities, indices, stocks, cryptos)

- Multiple account types catering to different trader needs

- Competitive spreads and fees

- Advanced trading platforms (MT4, MT5, HFM Trading App)

- Limited availability in certain countries due to regulations

- No dedicated "Contact Us" page on the website

- Some promotions have complex terms and conditions

- Limited cryptocurrency offerings compared to forex

- Customer support not available 24/7

Overview

HFM, formerly known as HotForex, is a well-established and award-winning forex and CFD broker that has been serving clients worldwide since its founding in 2010. With its headquarters in Cyprus and offices in South Africa, United Arab Emirates, and St. Vincent and the Grenadines, HFM has built a strong global presence. The broker is regulated by multiple respected authorities, including the Cyprus Securities and Exchange Commission (CySEC), the Financial Conduct Authority (FCA) in the UK, the Dubai Financial Services Authority (DFSA), and the Financial Services Authority (FSA) of Seychelles.

HFM's commitment to providing excellent trading conditions and customer support has earned it over 60 industry awards throughout its years of operation. The broker offers a wide range of over 1,200 trading instruments, including forex, metals, energies, indices, stocks, commodities, cryptocurrencies, bonds, and ETFs. Clients can access these markets through the popular MetaTrader 4 and MetaTrader 5 platforms, as well as the broker's proprietary HFM Trading App, available for both iOS and Android devices.

With a variety of account types catering to different trading styles and experience levels, competitive spreads starting from 0 pips, and leverage of up to 1:2000, HFM provides a well-rounded offering for traders of all backgrounds. The broker's educational resources, which include webinars, tutorials, and market analysis, further support clients in their trading journey. For more details on HFM's services and offerings, visit their official website at www.hfm.com.

As with any financial investment, it's important to consider the potential risks involved in trading leveraged products like CFDs and forex. Traders should always conduct thorough research, understand the risks, and develop a solid risk management strategy before investing. HFM's high-leverage offerings can amplify both gains and losses, so traders should exercise caution and never invest more than they can afford to lose. For more information visit HFM.com.

Overview Table

| Broker | HFM (formerly HotForex) |

|---|---|

| Founded | 2010 |

| Headquarters | Cyprus |

| Regulation | CySEC, FCA, DFSA, FSA |

| Trading Instruments | 1,200+ (Forex, Metals, Energies, Indices, Stocks, Commodities, Cryptocurrencies, Bonds, ETFs) |

| Platforms | MetaTrader 4, MetaTrader 5, HFM Trading App (iOS & Android) |

| Account Types | Cent, Premium, Zero ,Pro |

| Minimum Deposit | $0 , $100 (Pro Account) |

| Maximum Leverage | 1:2000 |

| Spreads | From 0 pips |

| Education | Webinars, Tutorials, Market Analysis |

Facts List

- HFM was founded in 2010 and has over a decade of experience in the forex and CFD trading industry.

- The broker is regulated by top-tier authorities, including CySEC, FCA, DFSA, and FSA, ensuring a secure trading environment.

- HFM offers over 1,200 trading instruments across various asset classes, providing diverse opportunities for traders.

- Clients can access markets through MetaTrader 4, MetaTrader 5, and HFM's proprietary mobile trading app.

- HFM has earned more than 60 industry awards since its inception, recognising its excellence in service and innovation.

- The broker provides competitive trading conditions with spreads starting from 0 pips and leverage up to 1:2000.

- Multiple account types cater to different trading styles and experience levels, with low minimum deposits starting at $0.

- HFM offers a comprehensive suite of educational resources, including webinars, tutorials, and market analysis.

- The broker has a strong global presence with offices in Cyprus, South Africa, United Arab Emirates, and St. Vincent and the Grenadines.

- HFM supports over 27 languages and has more than 200 employees worldwide, ensuring accessible and responsive customer support.

HF Markets Licenses and Regulatory

HFM, a global forex and CFD broker, operates under the oversight of multiple respected regulatory authorities worldwide. This comprehensive regulatory framework plays a crucial role in ensuring the safety and security of clients' funds, as well as maintaining the integrity and transparency of the broker's operations.

One of the primary regulators overseeing HFM is the Cyprus Securities and Exchange Commission (CySEC). As a CySEC-regulated broker, HFM must adhere to strict guidelines set forth by the regulator, including regular audits, financial reporting, and the segregation of client funds from the company's operating capital. CySEC is a well-respected regulatory body in the European Union, and its supervision provides an additional layer of protection for HFM's clients.

In the United Kingdom, HFM is regulated by the Financial Conduct Authority (FCA), which is known for its stringent rules and regulations. FCA-regulated brokers must comply with various consumer protection measures, such as the Financial Services Compensation Scheme (FSCS), which covers client losses up to £85,000 in the event of broker insolvency. The FCA also requires brokers to maintain a certain level of capital adequacy and submit regular financial reports.

HFM's Dubai entity is regulated by the Dubai Financial Services Authority (DFSA), which oversees financial services firms operating within the Dubai International Financial Centre (DIFC). The DFSA has a strong reputation for maintaining high regulatory standards and ensuring that firms operate in a fair, transparent, and efficient manner.

For its offshore operations, HFM is regulated by the Financial Services Authority (FSA) of Seychelles. While offshore regulators may have less stringent requirements compared to their onshore counterparts, the FSA still provides a level of oversight and requires brokers to adhere to specific guidelines to maintain their licences.

The importance of multiple regulatory licenses cannot be overstated, as it demonstrates a broker's commitment to operating transparently and adhering to industry best practices. By submitting to the oversight of several regulatory bodies, HFM has taken steps to ensure the safety and security of its clients' funds and maintain a high level of trust and credibility within the trading community.

Regulations List

- Cyprus Securities and Exchange Commission (CySEC) – Licence No. 183/12

- Financial Conduct Authority (FCA) - License No. 801701

- Dubai Financial Services Authority (DFSA) – Licence No. F004885

- Financial Services Authority (FSA) of Seychelles – Licence No. SD015

Trading Instruments

HFM offers a diverse range of tradable assets, providing traders with ample opportunities to diversify their portfolios and capitalise on various market conditions. With over 1,200 instruments available, HFM caters to the needs of both novice and experienced traders seeking exposure to multiple asset classes.

| Trading Instruments | Details |

|---|---|

| Forex | Access to major, minor, and exotic currency pairs, including EUR/USD, GBP/USD, and USD/JPY. Competitive spreads starting from 0.2 pips. |

| Metals and Energies | Trade CFDs on precious metals like gold and silver, as well as energy products such as crude oil and natural gas. No physical ownership required. |

| Indices and Stocks | Speculate on global indices like the S&P 500, NASDAQ, FTSE 100, and DAX 30, as well as individual stock CFDs from major companies like Apple, Amazon, and Facebook. |

| Cryptocurrencies | Trade cryptocurrency CFDs, including Bitcoin, Ethereum, Litecoin, and Ripple, without owning the underlying assets. |

| Bonds and ETFs | Gain exposure to government bonds and popular ETFs through CFDs, allowing for portfolio diversification and access to fixed-income markets. |

The broad range of tradable assets offered by HFM is a testament to the broker's commitment to meeting the diverse needs of its clients. By providing access to multiple markets and instruments, HFM empowers traders to create well-rounded portfolios and take advantage of opportunities across various asset classes. This extensive offering also demonstrates HFM's adaptability to evolving market trends and its ability to cater to the preferences of a wide spectrum of traders.

Trading Platforms

HFM offers a comprehensive suite of trading platforms to cater to the diverse needs and preferences of its clients. These platforms include the widely used MetaTrader 4 (MT4) and MetaTrader 5 (MT5), as well as a proprietary mobile trading app, providing traders with flexibility and convenience in accessing the financial markets.

MetaTrader 4 (MT4)

MT4 is a popular trading platform known for its user-friendly interface, advanced charting tools, and extensive range of technical indicators. HFM's MT4 platform is available for desktop (Windows and Mac), web, and mobile devices (iOS and Android). This versatility enables traders to access their accounts and manage their positions seamlessly across multiple devices.

One of the key advantages of MT4 is its support for automated trading through Expert Advisors (EAs). Traders can develop, test, and deploy custom trading algorithms, allowing them to automate their strategies and take advantage of market opportunities around the clock. Additionally, MT4 offers a wide range of built-in indicators and drawing tools, empowering traders to perform in-depth technical analysis and make informed trading decisions.

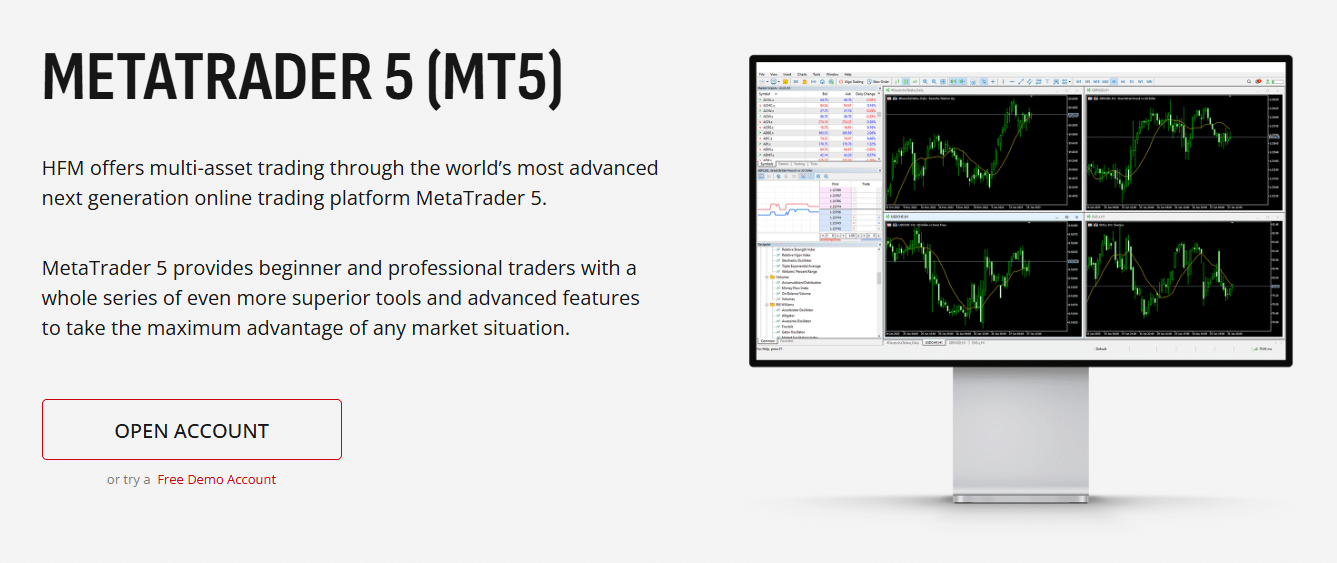

MetaTrader 5 (MT5)

MT5 is the successor to MT4, offering enhanced features and functionalities. Like MT4, HFM's MT5 platform is available for desktop, web, and mobile devices, ensuring a seamless trading experience across platforms. MT5 expands on the capabilities of MT4, providing advanced charting tools, a greater number of timeframes, and a more extensive selection of technical indicators.

One notable feature of MT5 is its multi-asset trading functionality. In addition to forex, traders can access a wide range of financial instruments, including stocks, indices, commodities, and cryptocurrencies, all from a single platform. This multi-asset capability allows traders to diversify their portfolios and take advantage of opportunities across various markets.

HFM Mobile Trading App

For traders who prioritise mobility and on-the-go access to the markets, HFM offers its own proprietary mobile trading app. Available for both iOS and Android devices, the HFM Trading App provides a user-friendly and intuitive interface, enabling traders to monitor their accounts, analyse markets, and execute trades seamlessly from their smartphones or tablets.

The HFM Trading App offers a range of features designed to enhance the mobile trading experience. These include real-time quotes, interactive charts, multiple order types, and push notifications for important account and market updates. The app also integrates with HFM's educational resources, providing traders with access to market analysis, webinars, and tutorials directly from their mobile devices.

Web Trading

In addition to the desktop and mobile platforms, HFM offers web-based trading through the MetaTrader WebTrader. This browser-based platform allows traders to access their accounts and trade the markets without the need to download or install any software. The WebTrader provides a streamlined and user-friendly interface, making it convenient for traders to manage their positions and monitor the markets from any device with an internet connection.

By offering a diverse range of trading platforms, HFM ensures that its clients can choose the most suitable option based on their individual needs, preferences, and trading styles. The availability of popular platforms like MT4 and MT5, along with the proprietary mobile app and web-based trading, demonstrates HFM's commitment to providing a comprehensive and flexible trading experience.

Trading Platforms Comparison Table

| Feature | MT4 | MT5 | HFM Trading App | MetaTrader WebTrader |

|---|---|---|---|---|

| Availability | Desktop, Web, Mobile | Desktop, Web, Mobile | iOS, Android | Web |

| Automated Trading (EAs) | Yes | Yes | No | No |

| Multi-Asset Trading | Limited | Yes | Yes | Limited |

| Technical Indicators | 30+ | 38+ | 20+ | 30+ |

| Timeframes | 9 | 21 | 9 | 9 |

| Order Types | Market, Pending | Market, Pending | Market, Pending | Market, Pending |

| Customizable Interface | Yes | Yes | Limited | Limited |

| Real-Time Quotes | Yes | Yes | Yes | Yes |

| Push Notifications | No | No | Yes | No |

| Built-in News | Yes | Yes | Yes | No |

| Trading Signals | Yes | Yes | No | No |

HF Markets How to Open an Account: A Step-by-Step Guide

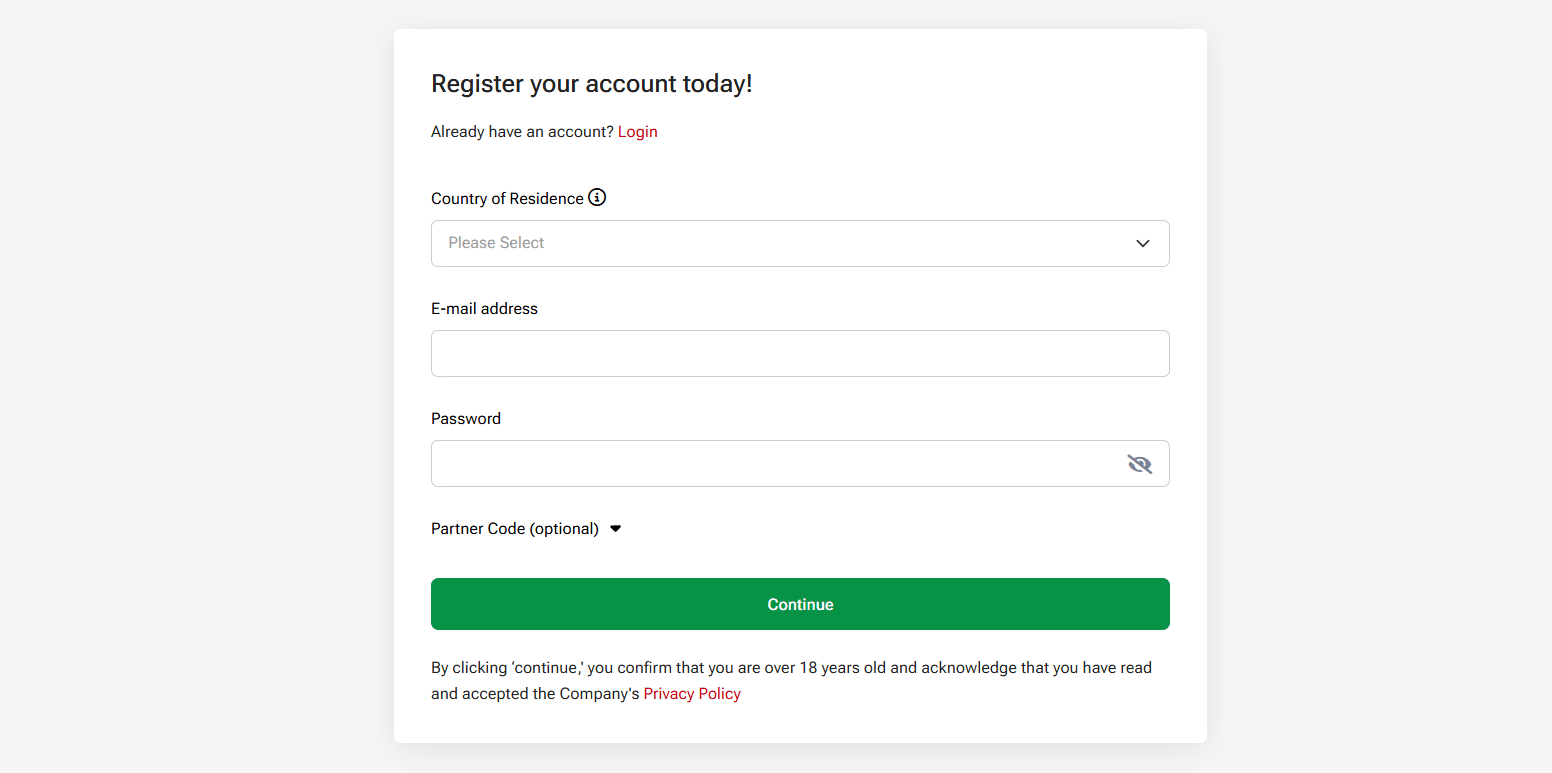

Opening an account with HFM is a straightforward process designed to be user-friendly and efficient. Follow these simple steps to get started on your trading journey with HFM:

Step 1: Visit the HFM website www.hfm.com and click on the "Open an Account" button located at the top right corner of the homepage.

Step 2: Choose the type of account you wish to open. HFM offers several account types, including Cent, Premium, Zero , and Pro. Select the one that best suits your trading needs and experience level.

Step 3: Fill out the registration form with your personal information, including your name, email address, country of residence, and phone number. Ensure that all information provided is accurate and up-to-date.

Step 4: Create a secure password for your account and select your preferred account currency. HFM offers a wide range of base currencies, including USD, EUR, GBP, and more.

Step 5: Accept the terms and conditions and submit your registration form. HFM will send a verification email to the address provided.

Step 6: Click on the verification link in the email to confirm your account registration. This step is essential for activating your account and proceeding with the next stages.

Step 7: Once your account is verified, log in to your HFM Client Area using your registered email address and password.

Step 8: To comply with regulatory requirements and ensure the security of your account, you will need to complete the account verification process by submitting proof of identity and proof of residence. Accepted documents include government-issued ID, passport, utility bills, and bank statements.

Step 9: Upload the required documents in the Client Area. HFM's verification team will review your submission and confirm your account verification status within 1-2 business days.

Step 10: After your account is fully verified, you can proceed to fund your account. HFM offers a variety of payment methods, including credit/debit cards, bank wire transfers, and e-wallets like Skrill and Neteller. Choose your preferred method and follow the instructions to make your deposit.

Step 11: Once your funds are credited to your trading account, you can download the trading platform of your choice (MetaTrader 4, MetaTrader 5, or HFM Trading App) and start trading.

It's important to note that the minimum deposit required to open an account with HFM varies depending on the account type chosen:

- Cent Account: $0

- Crypto CFD Account: $0

- Zero Account: $0 / €0

- Pro Account: $100 / €100

- Premium Account: $0 / €0

Charts and Analysis

HFM is committed to providing its clients with a comprehensive suite of educational resources and tools to enhance their trading knowledge and skills. The broker understands the importance of continuous learning in the dynamic world of financial markets and has invested significant efforts in developing a diverse range of resources to cater to traders of all levels.

| Educational Resources & Tools | Description |

|---|---|

| Trading Classes & Educational Videos | A series of videos and classes covering fundamental and technical analysis, risk management, trading psychology, and market dynamics. Led by industry experts. |

| Training Courses & Forex Education | A structured learning approach with a dedicated Forex Education Centre offering interactive courses, quizzes, and practical exercises from basic to advanced strategies. |

| Webinars & Events | Live webinars hosted by market experts, providing insights on market trends, risk management, and trading techniques. Exclusive in-person events for networking and expert insights. |

| Economic Calendar & Earnings Calendar | Real-time updates on key economic events (central bank meetings, GDP releases, employment reports) and corporate earnings reports to help traders anticipate market movements. |

| Trading Tools & Calculators | Includes margin calculators, pip calculators, and risk management calculators to help traders make informed decisions and manage risk effectively. |

When compared to industry standards, HFM's educational resources and tools stand out for their depth, diversity, and quality. The broker's commitment to providing a well-rounded educational experience sets it apart from competitors who may offer limited or superficial resources. HFM's investment in developing comprehensive educational content demonstrates its dedication to empowering traders and helping them succeed in the markets.

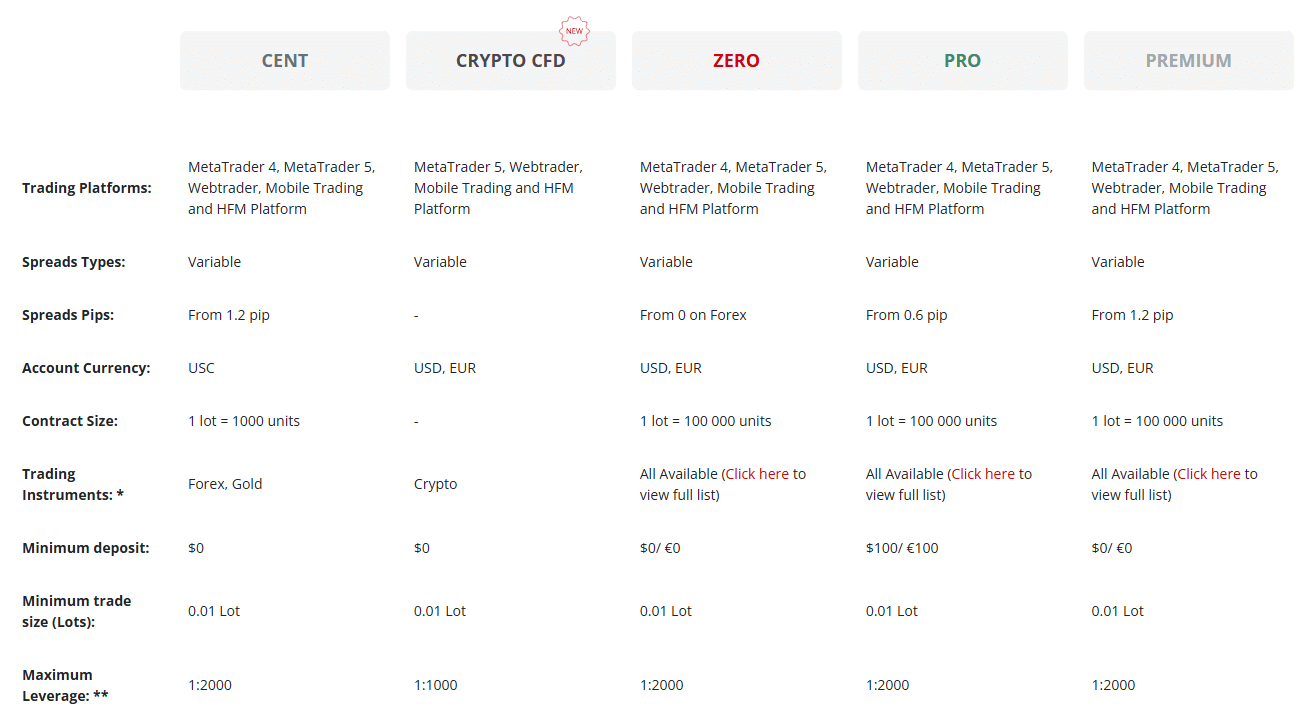

HF Markets Account Types

HFM offers a diverse range of trading account types tailored to meet the unique needs and preferences of its clients. By providing multiple account options, the broker ensures that traders can select the most suitable account based on their trading style, experience level, and financial goals. Let's take a closer look at the key features and characteristics of each account type:

Cent Account

The Cent Account is designed for traders who want to start with smaller trade sizes and lower risk. This account type allows trading in micro-lots, making it ideal for beginners.

- Minimum deposit: $0

- Spreads: From 1.2 pips

- Maximum leverage: 1:2000

- Minimum trade size: 0.01 lot

- Trading instruments: Forex, Gold

- Platforms: MetaTrader 4, MetaTrader 5, WebTrader, Mobile Trading, HFM Platform

Crypto CFD Account

The Crypto CFD Account is tailored for traders interested in cryptocurrency trading, offering access to a wide range of crypto assets.

- Minimum deposit: $0

- Spreads: Variable

- Maximum leverage: 1:1000

- Minimum trade size: 0.01 lot

- Trading instruments: Crypto

- Platforms: MetaTrader 5, WebTrader, Mobile Trading, HFM Platform

Zero Account

The Zero Account is ideal for traders seeking raw spreads with no markups, making it a great choice for scalpers and algorithmic traders.

- Minimum deposit: $0 / €0

- Spreads: From 0.0 pips on Forex

- Maximum leverage: 1:2000

- Minimum trade size: 0.01 lot

- Trading instruments: All available (Click here to view full list)

- Platforms: MetaTrader 4, MetaTrader 5, WebTrader, Mobile Trading, HFM Platform

Pro Account

The Pro Account is suitable for experienced traders who require better trading conditions with tighter spreads and flexible trade sizes.

- Minimum deposit: $100 / €100

- Spreads: From 0.6 pips

- Maximum leverage: 1:2000

- Minimum trade size: 0.01 lot

- Trading instruments: All available (Click here to view full list)

- Platforms: MetaTrader 4, MetaTrader 5, WebTrader, Mobile Trading, HFM Platform

Premium Account

The Premium Account offers a balance of competitive spreads and high leverage, catering to a broad range of traders.

-

- Minimum deposit: $0 / €0

- Spreads: From 1.2 pips

- Maximum leverage: 1:2000

- Minimum trade size: 0.01 lot

- Trading instruments: All available (Click here to view full list)

- Platforms: MetaTrader 4, MetaTrader 5, WebTrader, Mobile Trading, HFM Platform

Demo Account

In addition to the live trading accounts, HFM offers a demo account that allows traders to practice their strategies and familiarise themselves with the trading platforms in a risk-free environment. The demo account provides access to live market conditions and features virtual funds, enabling traders to test their skills and gain confidence before transitioning to live trading.

HFM's range of account types demonstrates the broker's commitment to catering to the diverse needs of its clientele. By offering accounts with varying minimum deposits, leverage options, spreads, and commission structures, HFM ensures that traders can find an account that aligns with their trading style, risk tolerance, and financial goals.

Moreover, the availability of a demo account allows potential clients to explore the broker's offerings and trading platforms without risking real funds. This feature is particularly valuable for beginners who are just starting their trading journey and need to gain practical experience before committing capital.

Account Types Comparison Table

| Account Type | Cent | Crypto CFD | Zero | Pro | Premium |

|---|---|---|---|---|---|

| Trading Platforms | MetaTrader 4, MetaTrader 5, WebTrader, Mobile Trading, HFM Platform | MetaTrader 5, WebTrader, Mobile Trading, HFM Platform | MetaTrader 4, MetaTrader 5, WebTrader, Mobile Trading, HFM Platform | MetaTrader 4, MetaTrader 5, WebTrader, Mobile Trading, HFM Platform | MetaTrader 4, MetaTrader 5, WebTrader, Mobile Trading, HFM Platform |

| Spreads Types | Variable | Variable | Variable | Variable | Variable |

| Spreads Pips | From 1.2 pips | - | From 0.0 on Forex | From 0.6 pips | From 1.2 pips |

| Account Currency | USC | USD, EUR | USD, EUR | USD, EUR | USD, EUR |

| Contract Size | 1 lot = 1000 units | - | 1 lot = 100,000 units | 1 lot = 100,000 units | 1 lot = 100,000 units |

| Trading Instruments | Forex, Gold | Crypto | All Available (Click here to view full list) | All Available (Click here to view full list) | All Available (Click here to view full list) |

| Minimum Deposit | $0 | $0 | $0 / €0 | $100 / €100 | $0 / €0 |

| Minimum Trade Size (Lots) | 0.01 Lot | 0.01 Lot | 0.01 Lot | 0.01 Lot | 0.01 Lot |

| Maximum Leverage | 1:2000 | 1:1000 | 1:2000 | 1:2000 | 1:2000 |

Negative Balance Protection

Negative balance protection is a crucial risk management feature that ensures traders cannot lose more money than they have in their trading account. This protection is particularly important in the context of leveraged trading, where rapid market movements can potentially lead to losses exceeding a trader's account balance. In the fast-paced world of online trading, unexpected events such as market gaps, flash crashes, or extreme volatility can cause significant price fluctuations. These sudden changes can result in substantial losses, particularly for traders using high leverage. In some cases, the losses may even exceed the funds available in a trader's account, resulting in a negative balance. Negative balance protection acts as a safety net in such scenarios. When a broker offers negative balance protection, they effectively absorb any losses that exceed a trader's account balance. This means that even if a trader's account balance drops below zero due to extreme market conditions, they will not be required to pay additional funds to cover the negative balance. HFM recognises the importance of negative balance protection and is committed to safeguarding its clients' funds. The broker offers negative balance protection to all its clients, ensuring that traders cannot lose more than their account balance. This policy applies to all trading accounts, regardless of the account type or the trading platform used. By offering negative balance protection, HFM demonstrates its dedication to responsible risk management and client protection. Traders can engage in the markets with greater peace of mind, knowing that their potential losses are limited to the funds they have invested in their account. It is important to note that while negative balance protection provides a valuable safety net, it should not be seen as a substitute for proper risk management. Traders should still employ sound risk management strategies, such as setting appropriate stop-loss levels, managing position sizes, and maintaining a healthy risk-to-reward ratio. In addition to negative balance protection, HFM employs several other measures to ensure the safety and security of client funds. These include segregating client funds from the company's operating capital, holding client funds with reputable banks, and implementing robust security protocols to protect sensitive financial information.

HF Markets Deposits and Withdrawals

Deposits Methods

| Method | Minimum Deposit | Maximum Deposit | Processing Time | Fees |

|---|---|---|---|---|

| Bank Transfers | $100 | Unlimited | 2 to 7 business days | No fees for deposits over $100 |

| Credit/Debit Cards (VISA, Mastercard) | $5 | $10,000 | Up to 10 minutes | No fees |

| E-Wallets (Skrill, Neteller, FasaPay, WebMoney, Perfect Money) | Varies by provider (e.g., $5 for Skrill, $30 for FasaPay) | Varies by provider (e.g., $5,000 for Skrill, $10,000 for Neteller) | Instant or up to 10 minutes | No fees |

| Cryptocurrencies (via BitPay) | $10 | $10,000 | Up to 10 minutes | No fees |

Withdrawal Methods

| Method | Minimum Withdrawal | Processing Time | Fees |

|---|---|---|---|

| Bank Transfers | $100 | 2 to 10 business days | No internal fees; intermediary banks may apply charges |

| Credit/Debit Cards (VISA, Mastercard) | $5 | 2 to 10 business days | No fees |

| E-Wallets (Skrill, Neteller, FasaPay, WebMoney, Perfect Money) | Varies by provider (e.g., $5 for Skrill, $10 for FasaPay) | Instant or up to 24 hours | No fees |

| Cryptocurrencies (via BitPay) | $5 | Up to 24 hours | 1% fee |

Support Service for Customer

In the fast-paced world of online trading, reliable customer support is a crucial aspect of a positive trading experience. Traders often require assistance with account-related queries, technical issues, or general guidance, and a responsive support team can make a significant difference in their overall satisfaction with a broker.

- Live Chat: HFM's website features a live chat option, allowing traders to connect with a support representative in real-time. This is often the quickest way to receive immediate assistance for urgent matters.

- Email Support: Traders can send their enquiries or concerns via email to support@hfm.com. The support team aims to respond to all emails within 24 hours, ensuring that traders receive timely assistance.

- Phone Support: HFM provides a dedicated phone support line for traders who prefer to discuss their queries over the phone. The main support number is +44-2030978571, with additional country-specific numbers available on the broker's website.

- Social Media: Traders can also reach out to HFM's customer support team through their official social media channels, such as Facebook, Twitter, and LinkedIn. The support team monitors these channels regularly and aims to provide prompt responses to enquiries.

Customer Support Comparison Table

| Criteria | HFM Customer Support |

|---|---|

| Support Channels | Live Chat, Email, Phone, Social Media |

| Support Languages | English, Spanish, German, French, Italian, Arabic, and more |

| Support Hours | 24/5 (Monday to Friday) |

| Live Chat Response Time | Within minutes |

| Email Response Time | Within 24 hours |

| Phone Support | Yes (+44-2030978571) |

| Dedicated Contact Page | No (contact information in website footer) |

Prohibited Countries

In the global landscape of online trading, it is crucial for traders to be aware of the countries and regions where a broker is not allowed to operate or provide services. These restrictions can arise due to various factors, such as local regulations, licensing requirements, or geopolitical considerations. HFM, like many international brokers, is subject to such restrictions and is prohibited from offering its services in certain jurisdictions.

The primary reason behind these restrictions is regulatory compliance. Each country has its own set of laws and regulations governing the provision of financial services, including online trading. These regulations are designed to protect consumers, maintain market integrity, and prevent financial crimes such as money laundering and terrorist financing. Brokers must obtain the necessary licences and approvals from local regulatory bodies to legally operate within a specific jurisdiction.

In some cases, geopolitical factors such as economic sanctions, trade embargoes, or political instability may also lead to restrictions on a broker's ability to offer services in certain countries. These restrictions are often imposed by international organisations or governments to address specific geopolitical concerns or to maintain global security.

HFM is prohibited from providing its services to residents of the following countries:

- Afghanistan, Algeria, Belgium, British Columbia (Canada), British Virgin Islands, Burundi, Central African Republic, Democratic Republic of the Congo, Eritrea, France, Guinea, Guinea-Bissau, Haiti, Iran, Iraq, Israel, Ivory Coast, Lebanon, Liberia, Libya, Myanmar, New Brunswick (Canada), Newfoundland and Labrador (Canada), North Korea, Ontario (Canada), Pakistan, Quebec (Canada), Saskatchewan (Canada), Sierra Leone, Somalia, South Sudan, Sudan, Syria, Trinidad and Tobago, Tunisia, United States of America, Vanuatu, Yemen, and Zimbabwe.

Special Offers for Customers

HFM provides a range of special offers and promotions designed to enhance the trading experience for both new and existing clients. These offers include deposit bonuses, loyalty programs, trading competitions, and more. By taking advantage of these promotions, traders can potentially boost their trading capital, earn rewards, and benefit from exclusive features.

- HFM Deposit Bonus Offerings HFM offers several deposit bonus promotions that can help traders increase their trading capital. These bonuses are automatically applied to eligible deposits and come with specific terms and conditions. Some of the current deposit bonus offerings include:

- 50% balance increase for deposits of $50 or more

- Daily cash rebates of USD 2 per lot for deposits of USD 10 or more

- Increased account leverage for deposits over USD 50

- Relaxed time limits for completing volume requirements

Traders should carefully review the specific terms and conditions associated with each deposit bonus, such as minimum deposit amounts, trading volume requirements, and any applicable time limits.

- HFM Trading Rewards Loyalty Program The HFM Trading Rewards Loyalty Program allows traders to earn HFM Bars for every trade they execute. These HFM Bars can be accumulated and later exchanged for cash or trading services. The program features four levels (Red, Silver, Gold, and Platinum), with each level offering progressively higher rewards based on the number of active trading days and volume.

- HFM Contests HFM regularly hosts trading contests and competitions, giving traders the opportunity to showcase their skills and win attractive prizes. Some of the popular contests include:

- The Traders Awards

- Demo Contests

- Festive Contests

These contests often feature cash prizes, trading services, and other rewards for top-performing traders. Participants can compete against each other in a simulated or live trading environment, depending on the specific contest rules.

- HFM Funding HFM offers free and secure account funding options for its clients. Traders can deposit funds into their trading accounts without incurring any additional fees or charges. HFM even covers the fees charged by banks on the broker's side for wire transfers, ensuring that clients' deposits are credited to their trading accounts in full.

- HFM Merchandise As a token of appreciation for its loyal clients and partners, HFM offers an exclusive range of branded merchandise, including clothing and accessories. These items are not for sale but are instead provided as gifts to valued clients and partners who meet certain criteria.

The special offers and promotions available at HFM cater to a wide range of traders, from beginners to experienced professionals. By offering deposit bonuses, loyalty rewards, and engaging contests, HFM aims to provide added value and enhance the overall trading experience for its clients.

However, traders should always carefully review the terms and conditions associated with each offer to fully understand the requirements and any potential limitations. It is essential to consider these promotions as potential added benefits rather than the primary reason for choosing a broker.

Conclusion

As I near the end of this comprehensive review of HFM, I find myself with a clearer understanding of their position as a broker in the competitive landscape of online trading. Throughout this article, I have delved into various aspects of HFM's operations, from their regulatory compliance and global presence to their customer support and special offers. By consolidating these findings, I aim to provide a cohesive summary that addresses HFM's safety, reliability, and overall reputation.

One of the standout aspects of HFM is their commitment to regulatory compliance. They are overseen by multiple well-respected regulatory bodies, including CySEC, FCA, DFSA, and FSA. This level of regulation provides a strong foundation for trust and security, as it demonstrates HFM's adherence to strict guidelines and their dedication to maintaining a transparent and fair trading environment.

In terms of geographical reach, HFM has established a significant global presence, with offices in Cyprus, South Africa, and the United Arab Emirates, as well as offshore entities in St. Vincent and the Grenadines. This widespread presence allows them to cater to a diverse clientele while maintaining a localised approach to customer support and service.

Speaking of customer support, HFM offers a range of channels for traders to seek assistance, including live chat, email, phone, and social media. While the absence of a dedicated "Contact Us" page on their website may be a minor inconvenience, the availability of multiple support options and their commitment to providing prompt and helpful responses demonstrate their focus on client satisfaction.

HFM's offering of special promotions and bonuses adds an extra layer of value for traders. From deposit bonuses and loyalty programs to trading competitions and merchandise, these offers can enhance the overall trading experience and provide additional incentives for clients to engage with the broker. However, as with any promotional offer, traders should carefully review the terms and conditions to ensure they fully understand the requirements and limitations.

In conclusion, based on the analysis conducted throughout this review, I believe that HFM presents itself as a reliable and trustworthy broker. Their strong regulatory compliance, global presence, comprehensive customer support, and attractive special offers combine to create a compelling proposition for traders seeking a dependable partner in their online trading journey.

As with any financial decision, it is essential for traders to conduct their own due diligence and consider their individual needs and goals when choosing a broker. However, the insights gleaned from this review suggest that HFM is well-positioned to provide a secure, transparent, and user-focused trading environment for a wide range of clients.