HYCM Review 2025: Pros and Cons, and Key Features for Traders

HYCM

United Kingdom

United Kingdom

-

Minimum Deposit $20

-

Withdrawal Fee $0

-

Leverage 500:1

-

Spread From 0.1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

UAE Financial Services License

UAE Financial Services License

Softwares & Platforms

Customer Support

+442073309021

(English)

+442073309021

(English)

Supported language: Arabic, Chinese (Simplified), Russian

Social Media

Summary

HYCM is a well-established forex and CFD broker with over 40 years of experience, regulated by FCA, CySEC, and CIMA. It offers a wide range of tradable assets, including forex, stocks, indices, commodities, and cryptocurrencies. Traders can choose from Fixed, Classic, and Raw accounts, with spreads starting from 0.1 pips. HYCM supports MetaTrader 4 and MetaTrader 5 for a seamless trading experience. The minimum deposit is $20, with leverage up to 1:500. Customer support is available 24/5 via live chat, email, and phone.

- HYCM is regulated by top-tier authorities, including the FCA, DFSA, and CIMA, ensuring a secure trading environment.

- The broker offers a wide range of tradable assets, such as forex, indices, commodities, stocks, and cryptocurrencies.

- Competitive spreads and fast order execution enhance the trading experience.

- Negative balance protection mitigates the risk of losses exceeding account balances.

- HYCM provides user-friendly trading platforms, including MT4, MT5, and the proprietary HYCM Trader app.

- The broker offers comprehensive educational resources, such as webinars, tutorials, and market analysis.

- Multilingual customer support is available 24/5 through various channels.

- HYCM caters to different trading styles with a variety of account types.

- Attractive promotional offers, including welcome bonuses and trading competitions, are available.

- With over 40 years of experience, HYCM is an established brand in the financial markets.

- HYCM recently renounced its CySEC licence, meaning it no longer accepts clients from the European Union.

- The broker's CIMA-regulated entity in the Cayman Islands may not provide the same level of protection as other top-tier regulators.

- HYCM's customer support is not available on weekends, which may be inconvenient for some traders.

- The broker's educational resources, while comprehensive, may not be as extensive as those offered by some industry leaders.

- HYCM's range of tradable assets, although diverse, may not be as broad as some larger brokers.

- Some of the broker's promotional offers may have strict terms and conditions, such as high minimum deposit requirements or trading volume thresholds.

- HYCM's trading platforms, while user-friendly, may lack certain advanced features or customisation options.

- The broker's research and analysis, although informative, may not be as in-depth as some competitors.

- HYCM's account opening process, while generally straightforward, may require more extensive documentation for verification purposes.

- The broker's website, although informative, may not be as intuitive or easy to navigate as some other industry leaders.

Overview

HYCM (Henyep Capital Markets) is a well-established and globally recognised forex and CFD broker that has been providing financial services since 1977. As part of the Henyep Group, an international conglomerate with a strong presence in financial services, property, education, and charity, HYCM has built a solid reputation for reliability and professionalism over its 40+ years in operation.

Regulated by top-tier financial authorities such as the Financial Conduct Authority (FCA) in the UK, the Dubai Financial Services Authority (DFSA) in Dubai, and the Cayman Islands Monetary Authority (CIMA), HYCM prioritises the safety and security of its clients' funds. The broker offers a diverse range of over 300 trading instruments, including forex, indices, commodities, stocks, and cryptocurrencies, catering to the needs of both novice and experienced traders.

HYCM's commitment to excellence has earned it numerous industry awards, such as the "Best Forex Broker" title from World Finance in 2019 and the "Best Mobile Trading Platform" recognition in 2017. The broker provides a choice of account types, competitive spreads starting from 0.1 pips, fast order execution, and support for popular trading platforms like MetaTrader 4 and MetaTrader 5.

While HYCM offers a comprehensive suite of educational resources and tools, it's essential for traders to understand the potential risks associated with leveraged trading and to exercise caution when investing in complex financial instruments like CFDs. For more information about HYCM's services, regulation, and risk disclosure, visit their official website at hycm.com.

Overview Table

| Feature | Details |

|---|---|

| Broker Name | HYCM (Henyep Capital Markets) |

| Established | 1977 |

| Regulator(s) | FCA (UK), DFSA (Dubai), CIMA (Cayman Islands) |

| Headquarters | London, United Kingdom |

| Instruments | Forex, Indices, Commodities, Stocks, Cryptocurrencies |

| Platforms | MetaTrader 4, MetaTrader 5, HYCM Mobile |

| Account Types | Fixed, Classic, Raw |

| Minimum Deposit | $20 |

| Leverage | Up to 1:500 (depending on jurisdiction and instrument) |

| Spreads | Starting from 0.1 pips on Raw accounts |

| Unique Features | Negative balance protection, Expert Advisors |

Facts List

- HYCM is part of the Henyep Group, a global conglomerate with over 40 years of experience in the financial industry.

- The broker is regulated by top-tier authorities, including the FCA, DFSA, and CIMA, ensuring a high level of client protection.

- HYCM offers a wide range of over 300 trading instruments across forex, indices, commodities, stocks, and cryptocurrencies.

- Clients can choose from three main account types – Fixed, Classic, and Raw – to suit their trading style and preferences.

- HYCM provides competitive spreads, with Raw accounts offering spreads as low as 0.1 pips.

- The broker supports popular trading platforms, including MetaTrader 4, MetaTrader 5, and a proprietary mobile app.

- HYCM offers negative balance protection to safeguard clients from losses exceeding their account balance.

- The minimum deposit requirement of $20 makes HYCM accessible to a wide range of traders.

- HYCM provides a comprehensive suite of educational resources, including webinars, tutorials, and market analysis.

- The broker has earned multiple industry awards, recognising its excellence in services and innovation.

HYCM Licenses and Regulatory

HYCM operates under a robust regulatory framework, holding licenses from multiple respected financial authorities worldwide. This comprehensive oversight ensures that the broker adheres to strict industry standards, prioritising the security of client funds and maintaining transparent, fair, and ethical business practices.

The broker's primary regulatory licenses include:

- The Financial Conduct Authority (FCA) in the United Kingdom (Reference number: 186171)

- The Dubai Financial Services Authority (DFSA) in Dubai (Reference number: F000048)

- The Cayman Islands Monetary Authority (CIMA) (Reference number: 1442313)

These licences demonstrate HYCM's commitment to operating in a compliant manner and providing a secure trading environment for its clients. The FCA, known for its stringent regulations, ensures that HYCM follows strict rules regarding client fund segregation, risk disclosure, and the prevention of financial crimes such as money laundering and fraud.

The DFSA licence further reinforces HYCM's credibility, as the Dubai regulator is recognised for its high standards and rigorous oversight of financial service providers. The CIMA licence, while not as well-known as the FCA or DFSA, still provides an additional layer of regulation and supervision.

It's important to note that HYCM recently renounced its Cyprus Securities and Exchange Commission (CySEC) licence in June 2024. As a result, the broker no longer accepts clients from the European Union under the CySEC-regulated entity. However, HYCM's other licences, particularly the FCA licence, continue to provide a high level of protection for clients from other regions.

When compared to industry standards, HYCM's regulatory framework is on par with many well-respected brokers. The multiple licences demonstrate the broker's dedication to maintaining a high level of compliance and transparency. However, traders should always be aware of the potential risks associated with trading leveraged products such as forex and CFDs, regardless of the broker's regulatory status.

Regulations List

- Financial Conduct Authority (FCA), United Kingdom – Reference number: 186171

- Dubai Financial Services Authority (DFSA), Dubai – Reference number: F000048

- Cayman Islands Monetary Authority (CIMA) - Reference number: 1442313

- Note: HYCM renounced its Cyprus Securities and Exchange Commission (CySEC) license in June 2024

Trading Instruments

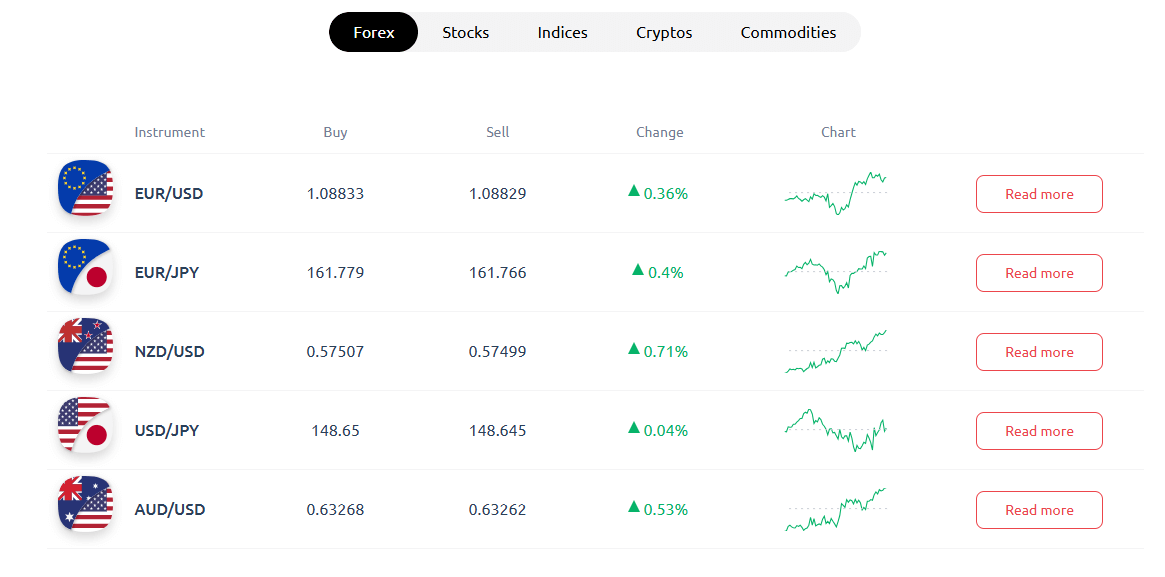

HYCM offers a diverse range of tradable assets, providing investors with ample opportunities to diversify their portfolios and capitalise on various market conditions. With over 300 instruments across multiple asset classes, the broker caters to the needs of both novice and experienced traders seeking exposure to global financial markets.

| Asset Class | Key Details |

|---|---|

| Forex | Access to a wide selection of forex pairs including majors, minors, and exotics. Competitive spreads, with prices starting from 0.1 pips on EUR/USD for Raw account holders, enabling various trading strategies from scalping to position trading. |

| Indices and Commodities | A comprehensive range of CFDs on global stock indices (e.g., S&P 500, NASDAQ, FTSE 100, DAX 30) and commodities (e.g., gold, silver, oil, natural gas) with leveraged access to potentially magnify returns while maintaining portfolio balance. |

| Stocks and ETFs | The HYCM Invest platform allows trading in individual stocks and ETFs, including fractional shares of popular companies, enabling investors to build diversified equity portfolios without substantial capital requirements. |

| Cryptocurrencies | Offers cryptocurrency CFDs on major digital assets such as Bitcoin, Ethereum, Litecoin, and Ripple. Note that these offerings may be limited or unavailable in certain jurisdictions due to regulatory restrictions. |

While HYCM's asset selection is extensive and diverse, it's essential for traders to thoroughly research the markets they wish to trade and understand the unique risks and characteristics associated with each asset class. Leveraged trading carries a high level of risk, and losses can exceed initial deposits.

Trading Platforms

Trading Platforms HYCM offers a range of trading platforms to cater to the diverse needs and preferences of its clients. The broker provides access to the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, as well as its proprietary mobile trading app, HYCM Trader.

MetaTrader 4 (MT4)

MT4 is a popular choice among traders due to its user-friendly interface, extensive charting tools, and automated trading capabilities. HYCM's MT4 platform supports various order types, including market, Limit, and Stop orders, as well as one-cancels-the-other (OCO) orders. Traders can also access a wide range of technical indicators and customisable charts to analyse market trends and make informed trading decisions.

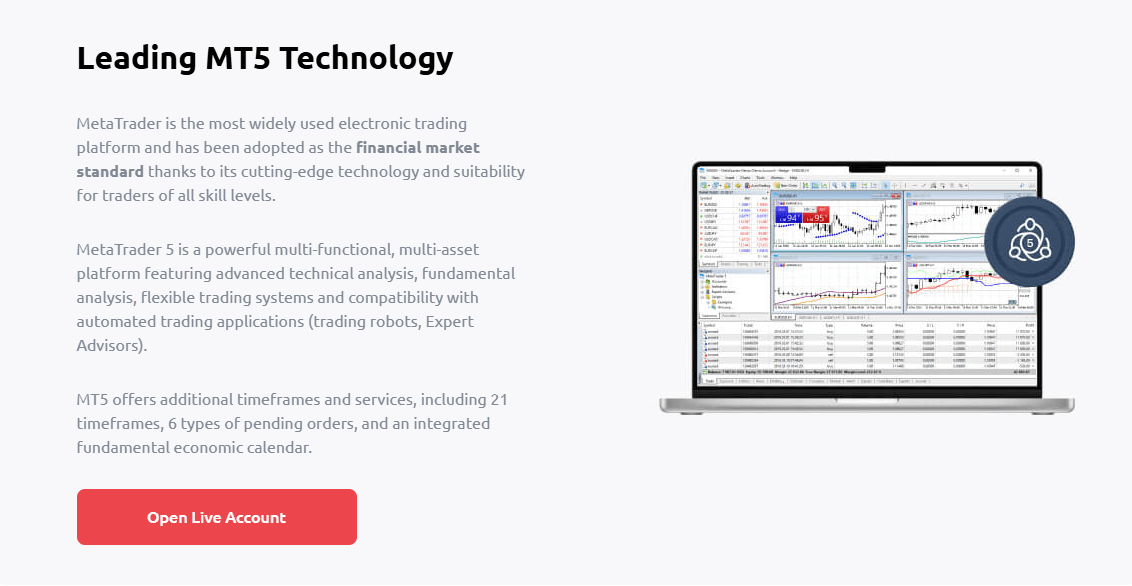

MetaTrader 5 (MT5)

For traders seeking more advanced features, HYCM provides the MT5 platform. MT5 builds upon the capabilities of MT4, offering additional timeframes, a built-in economic calendar, and a greater number of technical indicators. The platform also supports more advanced order types, such as Buy Stop Limit and Sell Stop Limit orders, giving traders greater control over their positions.

HYCM Trader

HYCM Trader is the broker's proprietary mobile trading app, designed to provide clients with a seamless and intuitive trading experience on the go. The app offers full trading functionality, allowing users to place and manage trades, access real-time charts, and view their account balances and transaction history. HYCM Trader also includes a range of risk management tools, such as Stop Loss and Take Profit orders, to help traders protect their positions.

Web Trading

For traders who prefer not to download additional software, HYCM offers web-based versions of both MT4 and MT5. These web platforms provide the same features and functionality as their desktop counterparts, accessible through a web browser.

Trading Bots and Automated Trading

HYCM's MT4 and MT5 platforms support the use of Expert Advisors (EAs), which are trading bots that can automate trading strategies based on predefined rules and algorithms. This feature is particularly useful for traders who wish to implement consistent trading strategies or take advantage of market opportunities around the clock.

By offering a combination of industry-standard platforms and a proprietary mobile app, HYCM ensures that its clients have access to the tools they need to trade effectively and efficiently. The broker's platforms are stable, reliable, and regularly updated to meet the evolving needs of traders in an ever-changing market environment.

Trading Platforms Comparison Table

| Feature | MT4 | MT5 | HYCM Trader |

|---|---|---|---|

| Order Types | Market, Limit, Stop, OCO | Market, Limit, Stop, OCO, Buy Stop Limit, Sell Stop Limit | Market, Limit, Stop |

| Charts | 9 timeframes | 21 timeframes | Real-time charts |

| Technical Indicators | 30+ | 80+ | Basic indicators |

| Automated Trading | Yes (EAs) | Yes (EAs) | No |

| Web Platform | Yes | Yes | No |

| Mobile App | Third-party | Third-party | Yes (proprietary) |

| Customizable Interface | Yes | Yes | Limited |

HYCM How to Open an Account: A Step-by-Step Guide

Opening an account with HYCM is a straightforward process that can be completed entirely online. The broker has streamlined the application procedure to ensure that clients can start trading quickly and easily. Here's a step-by-step guide on how to open an account with HYCM:

Account Requirements

Before you begin the account opening process, ensure that you meet the following requirements:

- Minimum age: 18 years old

- Minimum deposit: $20 (may vary depending on account type and jurisdiction)

- Valid government-issued identification document (e.g., passport, driver's license, or national ID card)

- Proof of residence (e.g., utility bill or bank statement dated within the last 3 months)

Account Registration

- Visit the HYCM website at hycm.com and click on the "Open an Account" button.

- Select your preferred account type (Fixed, Classic, or Raw) and base currency (USD, EUR, GBP, or others).

- Fill in your personal information, including your full name, date of birth, country of residence, and contact details.

- Provide your employment and financial information, such as your occupation, annual income, and trading experience.

- Choose your preferred trading platform (MT4, MT5, or HYCM Trader) and account leverage (subject to regulatory restrictions).

- Review and accept the broker's terms and conditions, risk disclosure statement, and privacy policy.

- Submit your application and wait for HYCM to review and approve your account. This process typically takes 1-2 business days.

Account Verification

To comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, HYCM requires clients to verify their identity and address before funding their accounts. Follow these steps to complete the verification process:

- Log in to your HYCM client area.

- Upload a clear, coloured copy of your valid government-issued identification document.

- Upload a proof of residence document, such as a utility bill or bank statement, dated within the last 3 months.

- Wait for HYCM to review and approve your documents. This process usually takes 1-2 business days.

Funding Your Account

Once your account has been approved and verified, you can fund it using one of the following payment methods:

- Bank wire transfer

- Credit/debit card (Visa, Mastercard)

- E-wallets (Skrill, Neteller, PayTrust, ZOTAPAY, fasapay, Lipi)

- Cryptocurrencies (Bitcoin, Ethereum, Tether)

The minimum deposit amount is $20, and most payment methods are processed instantly, allowing you to start trading immediately.

By following these simple steps and providing the required information and documents, you can open an account with HYCM and begin trading in the global financial markets.

Charts and Analysis

| Resource | Key Details |

|---|---|

| Market Analysis | Regular articles, videos, and webinars by HYCM's research team covering forex, indices, commodities, and cryptocurrencies. Offers insights on market trends, economic events, and trading opportunities. |

| Economic Calendar | Integrated into trading platforms; lists global economic releases, central bank meetings, and political events with their expected market impact to help traders anticipate volatility. |

| Trading Central | Partnership with Trading Central provides automated technical analysis and trading recommendations via tools like Analyst Views and Technical Insights, offering actionable trading ideas. |

| Webinars & Educational Videos | HYCM Academy offers a wide range of live and recorded webinars and video tutorials covering basic to advanced trading concepts, strategies, and market updates; content is also available on HYCM's YouTube channel. |

| eBooks & Guides | Downloadable resources providing in-depth insights into trading strategies, risk management, and market analysis, ideal for self-paced learning and deeper exploration of specific topics. |

Investing in a diverse array of educational resources demonstrates HYCM's commitment to supporting its clients' trading journeys. By offering a mix of market analysis, trading tools, and educational content, the broker empowers traders to make informed decisions and continuously improve their skills.

HYCM Account Types

HYCM offers a range of trading account types designed to cater to the diverse needs and preferences of its clients. By providing multiple account options, the broker ensures that traders can select the most suitable account based on their trading style, experience level, and capital.

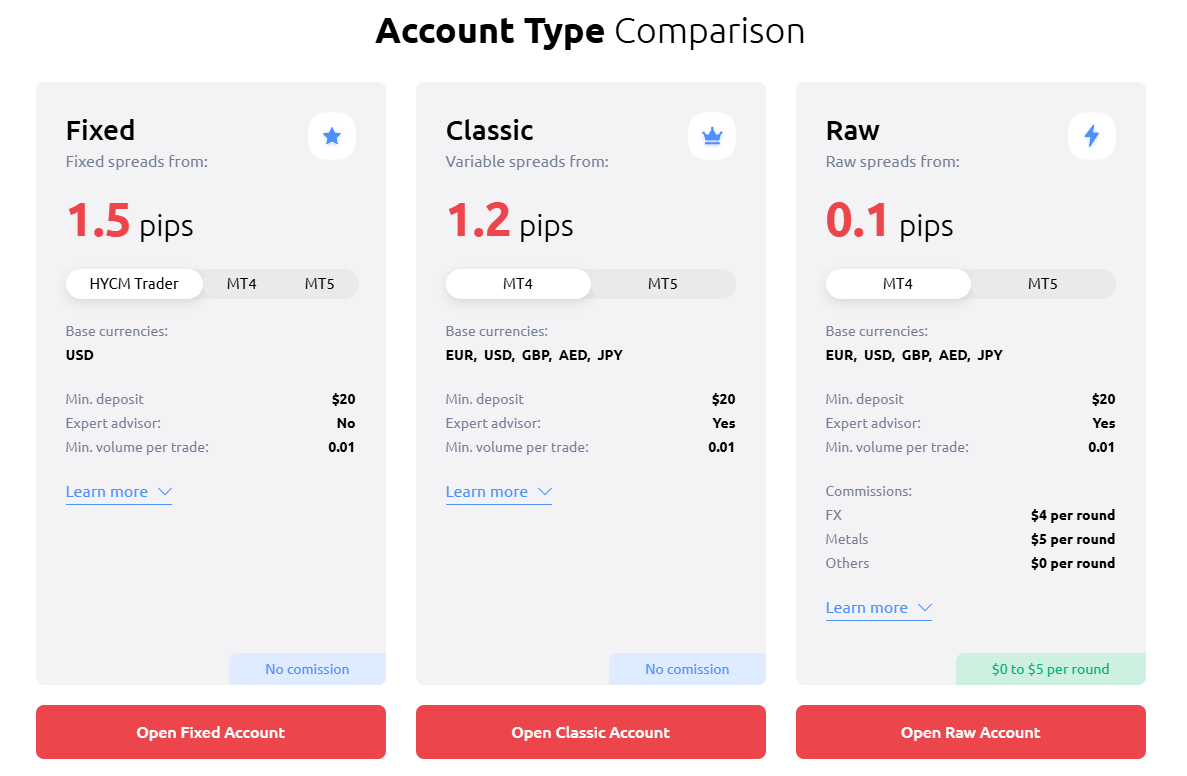

Fixed Account

The Fixed Account is ideal for traders who prefer stable and predictable trading costs. With fixed spreads starting from 1.5 pips, this account type offers a consistent trading environment. The minimum deposit requirement for a Fixed Account is $20, making it accessible to a wide range of traders. Clients can trade micro-lots (0.01) and enjoy leverage of up to 1:500, depending on the jurisdiction and asset class.

Classic Account

HYCM's Classic Account is designed for traders who seek a balance between competitive costs and flexibility. This account type features variable spreads starting from 1.2 pips, allowing traders to take advantage of market conditions. Like the Fixed Account, the Classic Account requires a minimum deposit of $20 and offers micro-lot trading and leverage of up to 1:500, subject to regulatory restrictions.

Raw Account

The Raw Account caters to experienced traders who demand the tightest spreads and fastest execution. With raw spreads starting from 0.1 pips, this account type offers the most competitive pricing. However, it does incur a commission of $4 per round turn. The minimum deposit for a Raw Account is also $20, and traders can access leverage of up to 1:500, depending on the jurisdiction and asset class.

Demo Account

For traders who wish to practise their strategies or familiarise themselves with the trading platforms, HYCM provides a Demo Account. This account type offers a risk-free environment with virtual funds, allowing traders to test their skills and gain confidence before transitioning to a live account. Demo Accounts mirror the trading conditions of live accounts, including spreads, leverage, and asset selection.

Islamic Account

HYCM offers Islamic Accounts that comply with Sharia law, which prohibits the accrual of interest. Also known as swap-free accounts, Islamic Accounts do not incur overnight interest charges on open positions. Instead, a small administrative fee is applied to positions held open overnight. Islamic Accounts are available for both Fixed and Classic account types.

By offering a diverse range of account types, HYCM demonstrates its commitment to catering to the unique requirements of its clientele. Whether you are a novice trader seeking stability or an experienced trader looking for the most competitive pricing, HYCM has an account type that aligns with your trading goals.

Account Types Comparison Table

| Feature | Fixed | Classic | Raw |

|---|---|---|---|

| Spread | Fixed (from 1.5 pips) | Variable (from 1.2 pips) | Raw (from 0.1 pips) |

| Commission | No | No | $4 per round turn |

| Minimum Deposit | $20 | $20 | $20 |

| Leverage | Up to 1:500* | Up to 1:500* | Up to 1:500* |

| Trading Instruments | 300+ | 300+ | 300+ |

| Platform | MT4, MT5, HYCM Trader | MT4, MT5, HYCM Trader | MT4, MT5, HYCM Trader |

| Islamic Account | Available | Available | Not Available |

*Leverage restrictions apply based on jurisdiction and asset class.

| Feature | Demo | Islamic |

|---|---|---|

| Spread | Same as live account | Same as chosen account type |

| Commission | No | No |

| Minimum Deposit | N/A | Same as chosen account type |

| Leverage | Same as live account | Same as chosen account type |

| Trading Instruments | Same as live account | Same as chosen account type |

| Platform | MT4, MT5, HYCM Trader | MT4, MT5, HYCM Trader |

| Virtual Funds | Yes | No |

Negative Balance Protection

Negative balance protection is a crucial risk management feature offered by HYCM to safeguard traders from losing more than their account balance. In the fast-paced world of online trading, market volatility and unexpected events can sometimes result in significant losses, potentially exceeding the funds available in a trader's account. This scenario is known as a negative balance, where the account balance drops below zero. HYCM understands the importance of protecting its clients from such situations and has implemented a robust negative balance protection policy. This policy ensures that traders cannot lose more than the total funds in their trading account, even in extreme market conditions. How Does Negative Balance Protection Work? Negative balance protection acts as a safety net for traders, automatically closing out losing positions when the account balance reaches zero. This prevents the account from going into a negative balance, effectively limiting the trader's liability to the funds available in their account. For example, suppose a trader has a $1,000 balance in their HYCM trading account. If a sudden market movement causes their open positions to incur losses exceeding $1,000, negative balance protection will kick in, closing out the positions and preventing the account balance from dropping below zero. In this scenario, the trader would lose their $1,000 account balance but would not be liable for any additional losses. HYCM's Commitment to Client Protection HYCM's negative balance protection policy applies to all retail clients, regardless of the account type or trading platform they use. This comprehensive coverage demonstrates the broker's commitment to prioritizing client protection and managing risk effectively. It is important to note that while negative balance protection provides a significant level of risk mitigation, it does not eliminate the potential for losses altogether. Traders should still exercise caution and employ sound risk management strategies, such as setting appropriate stop-loss orders and managing their leverage responsibly. By offering negative balance protection, HYCM provides traders with peace of mind, knowing that their potential losses are limited to the funds in their account. This feature is particularly valuable for novice traders who may be more susceptible to unexpected market movements and less experienced in managing risk.

HYCM Deposits and Withdrawals

HYCM offers a range of convenient deposit and withdrawal options to cater to the diverse needs of its global client base. The broker understands the importance of efficient and secure transactions, ensuring that traders can easily fund their accounts and access their profits.

Deposit Methods

HYCM accepts the following deposit methods:| Payment Method | Processing Time | Fees | Additional Details |

|---|---|---|---|

| Bank Wire Transfer | 3–5 business days | No deposit fees by HYCM (bank fees may apply) | Secure and reliable for larger deposits; funds are deposited directly from the trader’s bank account. |

| Credit/Debit Cards | Instant | No deposit fees by HYCM (issuer fees may apply) | Accepts Visa and Mastercard; ideal for quick funding to start trading immediately. |

| E-wallets | Usually within 24 hours | No deposit fees by HYCM | Supports Skrill, Neteller, PayTrust, ZOTAPAY, Fasapay, and Lipi; offers fast and secure transactions. |

| Cryptocurrencies | Varies (typically fast, depending on blockchain confirmations) | No deposit fees by HYCM | Accepts Bitcoin, Ethereum, and Tether; provides an option for digital currency deposits and increased anonymity. |

Withdrawal Options

| Parameter | Details |

|---|---|

| Withdrawal Options | Same as deposit options (e.g., Bank Wire Transfer, Credit/Debit Cards, E-wallets, Cryptocurrencies) |

| Withdrawal Request | Submit via the client portal |

| Processing Time | Within 24 hours (subject to account verification and regulatory requirements) |

| Method Requirement | Withdrawals must be made using the same method/account as the initial deposit; if unavailable, additional documentation may be required |

| Withdrawal Fees | No fees charged by HYCM (payment provider or bank fees may apply) |

| Minimum Withdrawal Amount | $50 |

| Maximum Withdrawal Amount | Depends on the chosen withdrawal method and the trader's account balance |

Account Verification

To comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, HYCM requires traders to verify their accounts before processing withdrawals. This process involves submitting proof of identity and proof of address, which may include documents such as a passport, driver's licence, utility bill, or bank statement. HYCM's account verification process is designed to protect traders' funds and prevent fraudulent activities. The broker strives to complete the verification process promptly, ensuring that traders can access their funds without undue delaysSupport Service for Customer

In the fast-paced world of online trading, reliable customer support is crucial for a positive trading experience. Traders often require assistance with account-related queries, technical issues, or general trading guidance. HYCM understands the importance of providing prompt and efficient customer support to ensure that traders can navigate the markets with confidence.

Support Channels

HYCM offers a range of customer support channels to cater to the diverse preferences of its global client base:- Live Chat: Traders can access instant support through the live chat feature on the HYCM website. This option is ideal for quick queries and real-time assistance.

- Email: For less urgent enquiries or detailed requests, traders can send an email to support@hycm.com. The customer support team aims to respond to all emails within 24 hours.

- Phone: HYCM provides a dedicated phone support line (+44 208 816 7812) for traders who prefer to speak directly with a customer support representative. This option is available during the broker's standard support hours.

- Social Media: Traders can also reach out to HYCM's customer support team through popular social media platforms, such as Facebook, Twitter, and LinkedIn. The broker maintains an active presence on these platforms, providing timely responses to enquiries and updates on market developments.

Multilingual Support

To cater to its international client base, HYCM offers customer support in multiple languages, including English, Arabic, Spanish, Italian, French, German, Dutch, Polish, and Russian. This ensures that traders can communicate effectively with the support team and receive assistance in their preferred language.Support Hours and Response Times

HYCM's customer support team is available from Monday to Friday, 24 hours a day. This extensive coverage ensures that traders can access support regardless of their time zone or trading hours. The broker aims to provide prompt responses to all enquiries, with live chat and phone support offering the fastest response times. For email enquiries, HYCM strives to respond within 24 hours, although response times may vary depending on the complexity of the request and the volume of enquiries received. The broker prioritises maintaining high standards of customer support and continuously seeks to improve its response times and service quality.Additional Resources

In addition to its dedicated customer support team, HYCM provides a comprehensive FAQ section on its website, addressing common queries related to account management, trading platforms, and general trading topics. The broker also offers an extensive library of educational materials, including video tutorials, webinars, and trading guides, to help traders enhance their knowledge and skills.Customer Support Comparison Table

| Feature | HYCM |

|---|---|

| Live Chat | Yes |

| Email Support | support@hycm.com |

| Phone Support | +44 208 816 7812 |

| Social Media Support | Yes (Facebook, Twitter, LinkedIn) |

| Support Languages | English, Arabic, Spanish, Italian, French, German, Dutch, Polish, Russian |

| Support Hours | Monday to Friday, 24 hours a day |

| Average Response Time | Live Chat & Phone: Instant <br> Email: Within 24 hours |

| FAQ Section | Yes |

| Educational Resources | Yes (Video Tutorials, Webinars, Trading Guides) |

Prohibited Countries

HYCM is a globally regulated broker that strives to provide its services to traders worldwide. However, due to varying legal and regulatory requirements, as well as geopolitical factors, the broker is prohibited from operating in certain countries and regions.

These restrictions are put in place to ensure that HYCM remains compliant with international laws and regulations governing the provision of financial services. Operating in prohibited countries could expose the broker and its clients to legal and financial risks.

Prohibited Regions and Countries

HYCM is currently unable to provide its services to residents of the following countries and regions:

- United States of America (USA)

- Canada

- European Union (EU) countries – Belgium, France, Spain, Cyprus

- Japan

- Sudan

- Syria

- North Korea

- Iran

- Cuba

It is important to note that this list is subject to change based on evolving regulatory landscapes and geopolitical developments. Traders are advised to regularly check the HYCM website for the most up-to-date information on prohibited countries.

Consequences of Trading from Prohibited Countries

Attempting to trade with HYCM from a prohibited country may result in legal and financial consequences for both the trader and the broker. HYCM reserves the right to immediately close any accounts opened by traders residing in prohibited countries, and any funds deposited may be subject to seizure or forfeiture.

Special Offers for Customers

HYCM offers a range of special promotions and bonuses designed to enhance the trading experience for both new and existing clients. These offers provide traders with additional opportunities to boost their trading capital, gain educational resources, and participate in exciting competitions.

Current Promotions As of March 2025, HYCM is offering the following special promotions:

| Promotion | Benefits | Terms/Requirements |

|---|---|---|

| 50% Welcome Bonus | Receive a 50% bonus on your first deposit, up to a maximum of $5,000. | Minimum deposit of $20; required trading volume must be completed within 30 days. |

| Refer-a-Friend Program | Earn a $250 bonus for each friend referred to HYCM. | Referred friend must open a live trading account, deposit at least $500, and meet specified trading volume requirements within 60 days. |

| Trading Masters Competition | Opportunity to win a share of a $10,000 prize pool through a monthly competition. | Must register for the competition and achieve the highest percentage of profitable trades during the contest period. |

| VPS Hosting Discount | Receive a 20% discount on VPS hosting services. | Offered in partnership with a VPS provider; ideal for traders using automated strategies or needing a stable, reliable trading environment. |

Terms and Conditions

It is essential for traders to carefully review the terms and conditions associated with each special offer before participating. Some key factors to consider include:

- Minimum deposit requirements

- Trading volume thresholds

- Time limitations for meeting bonus requirements

- Restrictions on bonus withdrawals

- Eligibility criteria for specific account types or trading instruments

Traders should also be aware that bonuses and promotions may impact their account leverage and margin requirements. It is crucial to manage risk effectively and not rely solely on bonus funds for trading activities.

Conclusion

Throughout this comprehensive review, I have thoroughly examined HYCM's operations, regulatory compliance, trading offerings, and customer support. After analysing various aspects of their business, I can confidently conclude that HYCM is a trustworthy and reliable broker that prioritises the safety and satisfaction of its clients.

One of the key factors that sets HYCM apart is their strong regulatory framework. With licences from top-tier authorities such as the FCA, DFSA, and CIMA, HYCM demonstrates a commitment to operating transparently and adhering to strict financial guidelines. This regulatory oversight provides traders with peace of mind, knowing that their funds are secure and their interests are protected.

HYCM's wide range of tradable assets, which includes forex, indices, commodities, stocks, and cryptocurrencies, caters to the diverse needs of both novice and experienced traders. The broker's competitive spreads, fast order execution, and negative balance protection further enhance the trading experience, allowing clients to focus on their strategies without worrying about unexpected losses.

The broker's user-friendly trading platforms, which include MT4, MT5, and the proprietary HYCM Trader app, ensure that clients can access the markets efficiently and effectively. These platforms are complemented by a comprehensive suite of educational resources, including webinars, tutorials, and market analysis, empowering traders to make informed decisions and continuously improve their skills.

HYCM's commitment to providing excellent customer support is evident in their multilingual support team, available 24/5 through various channels such as live chat, email, and phone. The broker's extensive educational resources and prompt assistance demonstrate their dedication to fostering a positive trading environment for their clients.

While HYCM offers an impressive range of features and services, it is essential for traders to carefully consider their individual needs and preferences when choosing a broker. Factors such as account types, trading instruments, and promotional offers may vary in importance depending on a trader's goals and experience level.