IC Markets Review 2025: Pros, Cons & Key Features

IC Markets

Australia

Australia

-

Minimum Deposit $200

-

Withdrawal Fee $0

-

Leverage 1:500

-

Spread From 0.1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Unavailable

-

Stock Unavailable

-

Indices Unavailable

Licenses

Cyprus Market Making (MM)

Cyprus Market Making (MM)

Japan Forex Trading License

Japan Forex Trading License

Australia Retail Forex License

Australia Retail Forex License

Softwares & Platforms

Customer Support

+61280144280

(English)

+61280144280

(English)

Supported language: Arabic, Chinese (Simplified), English, German, Indonesian, Italian, Spanish, Thai, Vietnamese

Social Media

Summary

IC Markets is a leading global forex and CFD broker founded in 2009 and headquartered in Sydney, Australia. As a pioneer in the online trading industry, IC Markets has built a strong reputation for providing traders worldwide with competitive spreads, fast execution speeds, and a wide range of tradable instruments

- Strong regulatory compliance with top-tier authorities like ASIC and CySEC

- Wide range of over 2,200 tradable instruments across multiple asset classes

- Competitive spreads starting from 0.0 pips and low commissions

- Fast and reliable trade execution with servers at Equinix NY4 and LD5

- Supports popular platforms including MetaTrader 4, MetaTrader 5, cTrader, and TradingView.

- Offers raw spread, standard, and Islamic account types to suit different trading styles

- Provides 24/7 multilingual customer support via live chat, email, and phone.

- Extensive educational resources, including webinars, guides, and video tutorials

- Offers occasional promotions and loyalty programs for added value

- Negative balance protection for European clients under CySEC regulation

- Limited range of funding methods compared to some competitors

- $200 minimum deposit may be higher than some other brokers

- Inactivity fees are charged after 12 months of no trading activity.

- No standalone mobile app; mobile trading only available through third-party platforms

- Restricted leverage for European traders under ESMA rules

- Does not accept clients from the US, Canada, and some other countries.

- No direct phone support for general inquiries; callback service only

- Educational content could be more comprehensive and beginner-friendly.

- Promotional offers and rebates are not available to all clients globally.

- Maximum leverage of 1:500 may be considered high-risk for inexperienced traders.

Overview

Regulated by top-tier authorities such as the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC), as well as the Financial Services Authority (FSA) of Seychelles, IC Markets offers a secure and transparent trading environment. The broker has received numerous industry awards, including "Best MT4 Broker" and "Best MT5 Broker" at the 2020 Global Forex Awards.

With a presence in over 200 countries and a diverse offering of more than 65 currency pairs, indices, commodities, futures, bonds, and cryptocurrencies, IC Markets caters to the needs of both novice and experienced traders. The broker provides access to popular trading platforms such as MetaTrader 4, MetaTrader 5, cTrader, and TradingView, enabling clients to trade using their preferred tools and strategies.

IC Markets' commitment to delivering exceptional service is evident through its 24/7 multilingual customer support, competitive pricing, and advanced technology infrastructure. The broker's servers are located at the Equinix NY4 and LD5 data centers, ensuring fast and reliable trade execution with an average speed of 40 milliseconds.

For more detailed information about IC Markets' products, services, and trading conditions, visit their official website at icmarkets.com.

IC Markets: Overview Table

| Category | Information | Details |

| Headquarters | Sydney, Australia | Founded in 2007 |

| Regulation | ASIC, CySEC, FSA | Tier-1 and Tier-3 regulators |

| Trading Platforms | MetaTrader 4, MetaTrader 5, cTrader, TradingView | Desktop, web, and mobile versions |

| Minimum Deposit | $200 | Applies to all account types |

| Leverage | Up to 1:500 | Varies by jurisdiction and instrument |

| Instruments | Forex, CFDs, Commodities, Indices, Futures, Bonds, Cryptocurrencies | Over 2,200 tradable instruments |

| Spreads | From 0.0 pips | Raw ECN spreads on cTrader and MetaTrader |

| Commissions | $3.0 - $3.5 per standard lot | Depends on account type and platform |

| Execution | ECN, STP | Average speed of 40 ms |

| Customer Support | 24/7 multilingual support | Live chat, email, phone |

IC Markets Licenses and Regulatory

IC Markets operates under a robust regulatory framework, holding licenses from multiple respected authorities worldwide. The broker's primary regulator is the Australian Securities and Investments Commission (ASIC), which oversees its headquarters in Sydney, Australia. ASIC is known for its strict regulatory standards and commitment to protecting investors, ensuring that IC Markets adheres to stringent operational and financial requirements.

In addition to ASIC, IC Markets is regulated by the Cyprus Securities and Exchange Commission (CySEC) for its European operations. CySEC is a highly regarded regulatory body that enforces the Markets in Financial Instruments Directive (MiFID) across the European Union. This license enables IC Markets to offer its services to clients throughout Europe while complying with the region's comprehensive regulatory framework.

Furthermore, IC Markets holds a license from the Financial Services Authority (FSA) of Seychelles, which allows the broker to serve clients in regions not covered by its ASIC and CySEC licenses. Although the FSA is considered a less strict regulator compared to ASIC and CySEC, it still requires brokers to maintain certain standards of operation and client protection.

The multiple regulatory licenses held by IC Markets demonstrate the broker's commitment to operating transparently and ethically across different jurisdictions. By submitting to the oversight of these regulators, IC Markets provides clients with an enhanced level of security and trust, as the broker must adhere to each authority's rules and regulations designed to protect investors' interests.

Compared to industry standards, IC Markets' regulatory standing is solid, with licenses from two top-tier regulators (ASIC and CySEC) and one lower-tier regulator (FSA). This combination of licenses allows the broker to serve a global client base while maintaining a high level of regulatory compliance. Traders can take comfort in knowing that IC Markets is subject to regular audits, reporting requirements, and oversight by these reputable authorities.

| Regulator | Region | Details |

|---|---|---|

| Australian Securities and Investments Commission (ASIC) | Australia | Oversees IC Markets' headquarters in Sydney; enforces strict operational and financial requirements. |

| Cyprus Securities and Exchange Commission (CySEC) | Europe | Regulates European operations under MiFID; ensures compliance across the European Union. |

| Financial Services Authority (FSA) | Seychelles | Covers regions outside ASIC and CySEC jurisdictions; enforces basic operational and client protection standards. |

Trading Instruments

IC Markets offers a comprehensive range of tradable assets, catering to the diverse needs and preferences of traders worldwide. With over 2,200 instruments across multiple asset classes, the broker provides ample opportunities for portfolio diversification and exposure to global financial markets.

| Asset Class | Details | Key Features |

|---|---|---|

| Forex | Extensive selection of major, minor, and exotic pairs. | Spreads from 0.0 pips, popular pairs like EUR/USD, USD/JPY; leverage up to 1:500. |

| CFDs on Indices, Commodities, and Futures | Wide range of CFDs on global indices, commodities, and futures. | Major indices like S&P 500, FTSE 100, DAX 30; commodities like gold, silver, oil; leverage up to 1:200. |

| Share CFDs | Over 2,100 share CFDs from global stock exchanges. | Diversification across sectors and geographies. |

| Cryptocurrencies | CFDs on major digital assets like Bitcoin, Ethereum, Litecoin, Ripple. | Leverage up to 1:200; no need for digital wallets. |

| Bonds | CFDs on government bonds from the UK, US, Japan, and other major economies. | Alternative to fixed-income investments; leverage and flexible contract sizes. |

| Total Instruments | Over 2,200 instruments across multiple asset classes. | Comprehensive offering for portfolio diversification. |

Trading Platforms

IC Markets offers a range of powerful trading platforms to cater to the diverse needs and preferences of its clients. Whether you're a novice trader or an experienced professional, the broker provides access to industry-leading software that facilitates seamless trading across multiple asset classes.

MetaTrader 4 (MT4)

MetaTrader 4 is one of the most popular trading platforms in the world, known for its user-friendly interface, advanced charting capabilities, and extensive range of technical indicators. IC Markets offers the MT4 platform for desktop, web, and mobile devices (iOS and Android), allowing traders to access their accounts and execute trades from anywhere at any time.

MT4 supports automated trading through Expert Advisors (EAs), enabling traders to implement complex strategies and algorithms without constant manual intervention. The platform also features a built-in scripting language (MQL4) that allows users to develop custom indicators and trading systems.

MetaTrader 5 (MT5)

IC Markets also supports the MetaTrader 5 platform, which is the successor to MT4. MT5 offers enhanced functionality, including more advanced charting tools, additional timeframes, and an expanded range of order types. Like MT4, MT5 is available for desktop, web, and mobile devices, providing traders with flexibility and convenience.

MT5 also supports automated trading through EAs and features the MQL5 programming language for custom indicator and strategy development. Additionally, the platform offers access to a broader range of markets, including stocks and futures, making it an attractive choice for diversified traders.

cTrader

For traders seeking a powerful and customizable platform, IC Markets offers cTrader. This platform boasts advanced charting tools, fast order execution, and deep liquidity from multiple sources. cTrader is available for desktop, web, and mobile devices, ensuring that traders can stay connected to the markets at all times.

One of cTrader's standout features is its support for algorithmic trading through cBots. Traders can develop and backtest their strategies using the platform's built-in programming language (C#) or take advantage of the cTrader Automate service to convert trading ideas into executable code without writing it themselves.

TradingView

IC Markets has recently integrated TradingView, a popular web-based charting and analysis platform, into its offering. TradingView provides a user-friendly interface, advanced charting tools, and a vast library of user-generated indicators and strategies. The platform also supports social trading, allowing users to share ideas and insights with the TradingView community.

By offering TradingView, IC Markets enables traders to access a powerful and flexible platform directly from their web browser without the need for any software installation.

| Feature | MetaTrader 4 (MT4) | MetaTrader 5 (MT5) | cTrader | TradingView |

| Charting Tools | Advanced | Advanced | Advanced | Advanced |

| Technical Indicators | 50+ | 80+ | 70+ | 100+ |

| Timeframes | 9 | 21 | 9 | 12 |

| Order Types | 4 | 6 | 4 | 4 |

| Automated Trading | Yes (EAs) | Yes (EAs) | Yes (cBots) | Yes (Pine Script) |

| Customization | Moderate | Moderate | High | High |

| Web-based Version | Yes | Yes | Yes | Yes |

| Mobile Apps | iOS, Android | iOS, Android | iOS, Android | - |

| Social Trading | - | - | - | Yes |

| User-Friendliness | High | High | High | Very High |

IC Markets How to Open an Account: A Step-by-Step Guide

Opening an account with IC Markets is a straightforward process that can be completed entirely online. Follow these simple steps to get started:

Step 1: Visit the IC Markets website. Go to icmarkets.com and click on the "Open Live Account" button in the top right corner of the homepage.

Step 2: Choose your account type. Select the account type that best suits your trading needs. IC Markets offers three main account types: Raw Spread, cTrader Raw, and Standard. Consider factors such as the trading platform, spread, and commission structure when making your choice.

Step 3: Provide personal information Fill in the required personal information, including your full name, date of birth, country of residence, and contact details. Ensure that all information provided is accurate and up-to-date.

Step 4: Complete the questionnaire. Answer a series of questions regarding your trading experience, financial knowledge, and risk tolerance. This step helps IC Markets assess the suitability of their products and services for your individual needs.

Step 5: Verify your identity and residence. Upload proof of identity (e.g., passport, national ID card, or driver's license) and proof of residence (e.g., utility bill or bank statement). These documents are required to comply with anti-money laundering (AML) and know-your-customer (KYC) regulations.

Step 6: Fund your account Choose from a variety of payment methods to fund your account. IC Markets accepts bank wire transfers, credit/debit cards, and e-wallets such as Skrill, Neteller, and PayPal. The minimum deposit requirement is $200 for all account types.

Step 7: Start trading Once your account is funded, you can download the trading platform of your choice (MT4, MT5, cTrader, or access TradingView through your web browser) and start trading. Make sure to familiarize yourself with the platform's features and functionalities before placing any real trades.

Charts and Analysis

IC Markets provides a comprehensive suite of educational resources and tools designed to support traders at all levels of experience. From interactive charts and advanced analysis tools to economic calendars and market insights, the broker offers a wealth of information to help clients make informed trading decisions

| Feature | Details | Key Benefits |

|---|---|---|

| Trading Platforms | MetaTrader 4, MetaTrader 5, cTrader, TradingView. | Built-in charting and analysis tools; customizable charts with multiple timeframes and technical indicators. |

| Economic Calendar | Comprehensive overview of upcoming economic events and data releases. | Filter by event type, currency, and importance to plan trading activities effectively. |

| Market Analysis | Daily market overviews, technical analysis, and trading ideas across asset classes. | Delivered through articles, video updates, and live webinars. |

| Educational Webinars | Live webinars covering financial markets, strategies, and risk management in multiple languages. | Interactive sessions for all levels of traders. |

| Trading Guides and eBooks | Downloadable guides and eBooks on topics like technical/fundamental analysis, trading psychology, and risk management. | Self-paced learning resources for all experience levels. |

| Forex Blog | Regular blog updates featuring market news, trade ideas, and educational content. | Insights and commentary to stay informed and ahead of market trends. |

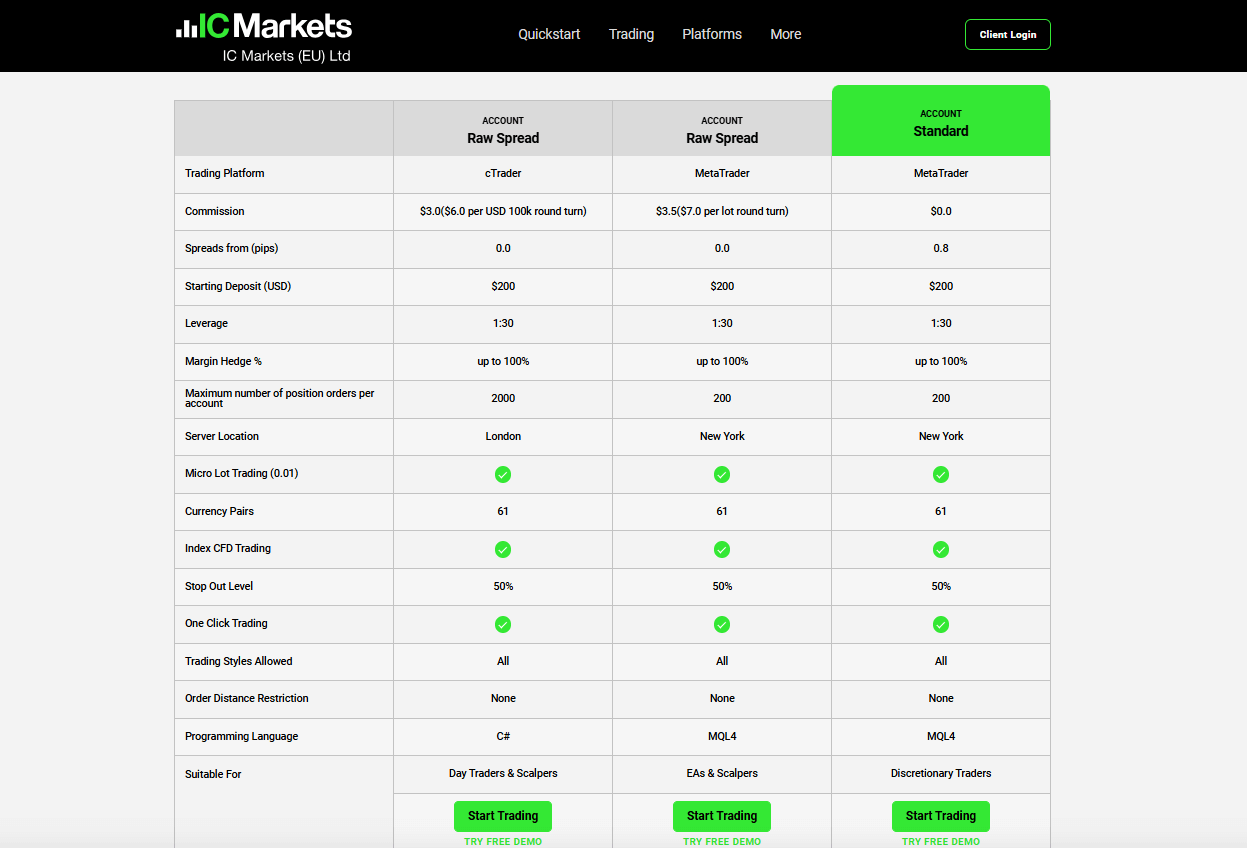

IC Markets Account Types

IC Markets offers a range of trading account types designed to cater to the diverse needs and preferences of traders at all levels.

| Account Type | Spreads | Commission | Minimum Deposit | Leverage | Platforms | Key Features |

|---|---|---|---|---|---|---|

| Raw Spread Account | From 0.0 pips | $3.50 per standard lot (round turn) | $200 | Up to 1:500 | MetaTrader 4, MetaTrader 5 | Cost-effective, ultra-tight spreads, fast execution. |

| cTrader Raw Account | From 0.0 pips | $3.00 per standard lot (round turn) | $200 | Up to 1:500 | cTrader | Advanced features exclusive to cTrader. |

| Standard Account | From 1.0 pips | No commissions | $200 | Up to 1:500 | MetaTrader 4, MetaTrader 5 | Commission-free, beginner-friendly pricing structure. |

| Islamic Account | Depends on account type | Varies by account type | $200 | Up to 1:500 | All platforms | Swap-free accounts compliant with Sharia law. |

| Demo Account | Simulated spreads | No commissions | N/A | N/A | All platforms | Unlimited access, same conditions as live accounts for practice trading. |

By offering a diverse range of account types, IC Markets demonstrates its commitment to meeting the needs of a wide spectrum of traders. The broker's account options cater to different trading styles, risk appetites, and budgets, ensuring that clients can find an account that aligns with their individual requirements. For more detailed information about IC Markets' account types, visit their official website at www.icmarkets.com.

| Feature | Raw Spread | cTrader Raw | Standard |

|---|---|---|---|

| Minimum Deposit | $200 | $200 | $200 |

| Spreads | From 0.0 pips | From 0.0 pips | From 1.0 pips |

| Commissions | $3.50 per lot | $3.00 per lot | No |

| Leverage | Up to 1:500 | Up to 1:500 | Up to 1:500 |

| Platforms | MT4, MT5 | cTrader | MT4, MT5 |

| Islamic Account | Available | Available | Available |

| Demo Account | Available | Available | Available |

Negative Balance Protection

IC Markets' Negative Balance Protection Policy: IC Markets offers negative balance protection to all its clients, regardless of the account type or trading platform they use. This policy applies to both retail and professional clients, ensuring that their account balance never falls below zero. It is important to note that negative balance protection does not eliminate the risk of losses; it only limits the potential losses to the funds available in the trader's account. Traders are still responsible for managing their risk effectively and using appropriate risk management tools, such as stop-loss orders and proper position sizing. In the event that negative balance protection is triggered, IC Markets will reset the account balance to zero, absorbing any negative balance. Traders can then continue trading with their remaining funds or deposit additional funds to resume trading.

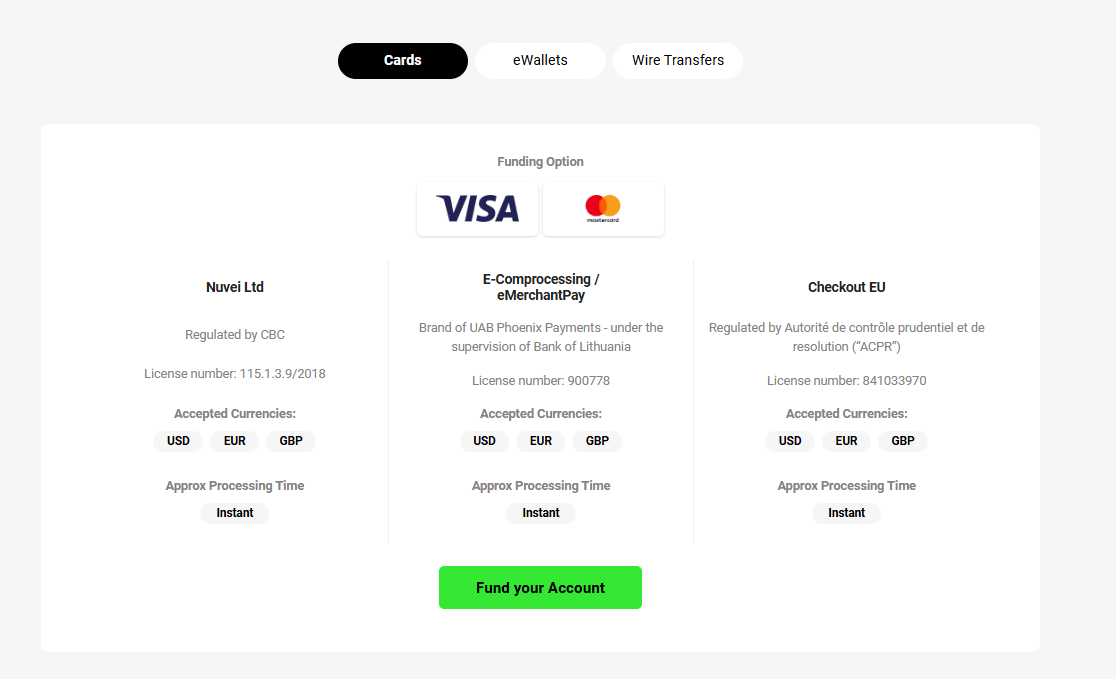

IC Markets Deposits and Withdrawals

Efficient and secure deposit and withdrawal processes are essential for a smooth trading experience. IC Markets offers a wide range of payment methods to cater to the diverse needs of its global client base, ensuring that traders can easily manage their funds. Deposit Methods IC Markets accepts the following deposit methods:

| Payment Method | Processing Time | Fees | Details |

|---|---|---|---|

| Credit/Debit Cards | Instant | No fees | Visa and MasterCard accepted. |

| Bank Wire Transfer | Varies by bank | No fees charged by IC Markets | Direct deposit from your bank account. |

| Electronic Payment Systems | Instant | Fees vary by provider | Supports PayPal, Skrill, Neteller, UnionPay, FasaPay, POLI, Klarna, and Rapidpay. |

| Broker-to-Broker Transfer | Varies by sending broker | Depends on sending broker | Transfer funds directly from another broker. |

The minimum deposit amount for all account types is $200 or the equivalent in your account currency.

Withdrawal Methods IC Markets offers the following withdrawal methods:

The minimum deposit amount for all account types is $200 or the equivalent in your account currency.

Withdrawal Methods IC Markets offers the following withdrawal methods:

| Withdrawal Method | Details | Processing Time | Fees |

|---|---|---|---|

| Credit/Debit Cards | Withdraw to Visa or MasterCard | 3-5 business days | No fees charged by IC Markets |

| Bank Wire Transfer | Transfer to your bank account | Varies depending on the bank | $20 AUD for international transfers outside Australia |

| Electronic Payment Systems | Withdraw to supported e-wallets and payment systems (e.g., PayPal, Skrill, Neteller, UnionPay, FasaPay, POLI, Klarna, Rapidpay) | Generally instant | Vary depending on the payment provider |

Deposit and Withdrawal Policies: To ensure the security of clients' funds and comply with regulatory requirements, IC Markets has implemented several policies:

| Category | Details |

|---|---|

| Account Verification | IC Markets requires clients to verify their identity and address by submitting a valid government-issued ID and proof of residence to process withdrawal requests. |

| Withdrawal Processing Time | Withdrawal requests are typically processed within 24 hours, but actual times vary depending on the payment method and the time of the request. |

| Withdrawal to Original Deposit Method | Withdrawals may need to be processed using the same payment method as the original deposit to prevent money laundering and ensure fund security. |

| Withdrawal Fees | IC Markets doesn’t charge fees for most methods. However, some payment providers may impose their own fees, which clients should confirm with their provider. |

Support Service for Customer

In the fast-paced world of online trading, reliable customer support is crucial for a positive trading experience. Traders need to know that they can quickly and easily reach out for assistance whenever they encounter issues or have questions. Support Channels IC Markets provides the following customer support channels:

| Support Channel | Details |

|---|---|

| Live Chat | Available 24/7 on the IC Markets website for instant support with real-time connections to support representatives. |

| Dedicated email addresses for different inquiries: - General Support: support@icmarkets.com - Account Inquiries: accounts@icmarkets.com - Technical Support: support@icmarkets.com | |

| Phone | Local and international phone numbers are available to ensure traders can contact support from anywhere in the world. |

| Social Media | Connect on platforms like Facebook, Twitter, and LinkedIn. Best for staying updated on news, promotions, and resources (not suitable for account-specific inquiries). |

- Support Languages and Localized Contact Details: IC Markets offers customer support in 10 languages, catering to its diverse global client base. Traders can access support in English, Spanish, German, French, Italian, Vietnamese, Thai, Arabic, Chinese, and Bahasa Indonesia. The broker also provides country-specific contact details, ensuring that traders can easily reach out using local phone numbers.

- Support Hours and Response Times: IC Markets' customer support is available 24/7, ensuring that traders can access assistance at any time, regardless of their location or time zone. The broker aims to provide prompt and efficient support, with live chat inquiries typically answered within a few minutes. Email response times may vary depending on the complexity of the inquiry, but IC Markets strives to respond to all emails within 24 hours.

- Knowledgebase and FAQs: In addition to its dedicated customer support channels, IC Markets offers a comprehensive knowledgebase and FAQ section on its website. The knowledgebase covers a wide range of topics, including account management, trading platforms, deposit and withdrawal procedures, and technical issues. Traders can access the knowledgebase 24/7 and find answers to common questions, saving time and effort.

- Commitment to Client Satisfaction: IC Markets' commitment to providing excellent customer support demonstrates its dedication to client satisfaction. The broker understands that responsive, knowledgeable, and friendly support is essential for building long-lasting relationships with traders. By offering multiple support channels, 24/7 availability, and multilingual assistance, IC Markets ensures that traders can get the help they need, when they need it.

Customer Support Comparison Table

| Feature | IC Markets |

| Support Channels | Live Chat, Email, Phone, Social Media |

| Support Languages | English, Spanish, German, French, Italian, Vietnamese, Thai, Arabic, Chinese, Bahasa Indonesia |

| Live Chat Hours | 24/7 |

| Email Response Time | Within 24 hours |

| Phone Support | Local and international numbers |

| Knowledgebase/FAQs | Comprehensive, covers various topics |

Prohibited Countries

As a globally regulated broker, IC Markets adheres to strict compliance standards and respects the laws and regulations of each jurisdiction in which it operates. While the broker aims to provide its services to traders worldwide, there are certain countries and regions where IC Markets is not allowed to operate or accept clients due to legal restrictions, regulatory limitations, or geopolitical factors.

Reasons for Restrictions: There are several reasons why IC Markets may be prohibited from operating in certain countries, including:

- Local Regulations: Some countries have strict regulations governing online trading and foreign exchange services. These regulations may require brokers to obtain specific licenses or meet certain requirements before they can legally operate within the jurisdiction.

- Licensing Requirements: Each country has its own set of licensing requirements for financial service providers. If IC Markets does not hold the necessary licenses in a particular jurisdiction, it may be prohibited from accepting clients from that country.

- Geopolitical Factors: Political instability, economic sanctions, or other geopolitical factors may prevent IC Markets from operating in certain regions or countries.

Prohibited Countries List: IC Markets is currently unable to provide services to residents of the following countries:

- United States

- Canada

- Japan

- New Zealand

Consequences of Trading from a Prohibited Country Attempting to trade with IC Markets from a prohibited country may result in severe consequences, including:

- Account Termination: If IC Markets discovers that a client is trading from a prohibited country, the broker reserves the right to immediately terminate the account without prior notice.

- Funds Forfeiture: In some cases, clients from prohibited countries may forfeit their account balances and any profits generated from trading.

- Legal Action: Depending on the jurisdiction and the severity of the violation, clients who attempt to trade from a prohibited country may face legal action or penalties.

It is the responsibility of each trader to ensure that they comply with their local laws and regulations before opening an account with IC Markets or any other broker.

Special Offers for Customers

IC Markets offers a range of special promotions and incentives designed to enhance traders' experiences and provide additional value. While the specific offers may vary over time, the broker consistently seeks to reward both new and existing clients with competitive deals and partnerships.

| Promotion | Details |

|---|---|

| Trading Bonuses for New Clients | Bonuses offered to new clients who meet specific deposit and trading volume requirements. Example: Deposit at least $500 and trade 5 standard lots within 30 days to receive a $200 bonus. |

| Loyalty Program | Rewards active traders with lower spreads, cashback, and exclusive event invitations based on trading volume. Example: Trade 50+ standard lots/month to receive a 10% spread discount + 5% cashback. |

| Trading Competitions | Regular competitions with prizes like cash rewards, gadgets, or experiences. Entry often requires a minimum deposit or trading volume. Example: Join the $50,000 "Market Masters" competition by depositing $1,000 and trading instruments over 6 weeks. Top 10 performers share the prize pool. |

| Third-Party Partnerships | Partnerships provide exclusive discounts or free trials for services like VPS hosting, market analysis tools, or education platforms. Example: Get 50% off your first 3 months of VPS hosting. |

Terms and Conditions: It is essential for traders to carefully review the terms and conditions associated with each special offer. Some common requirements include:

- Minimum deposit amounts to qualify for bonuses or promotions

- Specific trading volume thresholds to unlock benefits or withdraw bonus funds

- Time limits on bonus validity or promotion periods

- Restricted trading instruments or styles (e.g., hedging may not count toward volume requirements)

Traders should also be aware that some offers may be subject to change or withdrawal at IC Markets' discretion. Always check the broker's official website for the most up-to-date information on current promotions and their associated terms and conditions.

Stay Informed To stay informed about the latest special offers and promotions from IC Markets, traders can:

- Regularly visit the broker's website and check the "Promotions" section.

- Subscribe to IC Markets' newsletter to receive updates directly to their email inbox.

- Follow IC Markets on social media platforms like Facebook, Twitter, and LinkedIn.

Conclusion

Throughout this comprehensive review, I have thoroughly examined various aspects of IC Markets' operations, from their regulatory compliance and geographical reach to their trading platforms, account types, and customer support. By consolidating these findings, I aim to provide a cohesive evaluation of IC Markets' safety, reliability, and overall reputation as a broker.

One of the most critical factors when assessing a broker is their regulatory compliance. IC Markets demonstrates a strong commitment to operating within the boundaries of the law, holding licenses from tier-1 regulators such as ASIC and CySEC, as well as the FSA in Seychelles. This multi-jurisdictional regulation ensures that IC Markets adheres to strict financial guidelines and maintains transparency in its dealings with clients.

In terms of trading offerings, IC Markets excels in providing a diverse range of tradable assets, including forex, indices, commodities, stocks, and cryptocurrencies. The broker's competitive spreads, low commissions, and fast execution speeds cater to the needs of both novice and experienced traders. The availability of multiple account types, including raw spread and Islamic accounts, further demonstrates IC Markets' adaptability to different trading styles and preferences.

IC Markets' choice of trading platforms is another area where they shine. By offering the industry-standard MetaTrader 4 and 5 and the innovative cTrader and TradingView platforms, the broker ensures that traders have access to a wide range of tools and features for analysis, execution, and automated trading. The availability of these platforms across desktop, web, and mobile devices provides traders with the flexibility to manage their accounts and trades on the go.

Customer support is an essential aspect of any brokerage, and IC Markets has made significant efforts to provide reliable and efficient assistance to its clients. With 24/7 live chat, email support, and a comprehensive knowledge base, traders can easily access the help they need. The broker's multilingual support team and localized contact options further demonstrate their commitment to serving a global clientele.

While IC Markets occasionally offers special promotions and incentives, such as trading bonuses and loyalty programs, it is essential for traders to carefully review the terms and conditions associated with these offers. The broker maintains transparency by clearly outlining the requirements and limitations of each promotion on their website.

Based on my analysis, I believe that IC Markets is a trustworthy and dependable broker that prioritizes the safety and satisfaction of its clients. Their strong regulatory compliance, wide range of trading instruments, advanced platforms, and dedicated customer support make them a compelling choice for traders of all levels.

However, as with any financial decision, it is crucial for individuals to conduct their own research and consider their unique trading needs and risk tolerance before choosing a broker. Prospective clients should thoroughly review IC Markets' terms and conditions, as well as the legal documentation associated with their chosen account type and jurisdiction.

In conclusion, IC Markets has established itself as a reputable and reliable broker in the highly competitive online trading industry. Their commitment to providing a secure, transparent, and user-focused trading environment, combined with their extensive range of offerings and support services, makes them a strong contender for traders seeking a comprehensive and trustworthy brokerage partner.