INFINOX Review: Top CFD Broker with Versatile Trading Accounts

Infinox

United Kingdom

United Kingdom

-

Minimum Deposit $1

-

Withdrawal Fee $0

-

Leverage 1000:1

-

Spread From 0.2

-

Minimum Order 0.01

-

Forex Available

-

Crypto Unavailable

-

Stock Unavailable

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Forex & CFD Brokerage License

Forex & CFD Brokerage License

Broker-Dealer License

Broker-Dealer License

Softwares & Platforms

Customer Support

()

()

Supported language: English

Social Media

Summary

INFINOX is a globally recognized forex and CFD broker, established in 2009 and headquartered in London. Regulated by the UK's Financial Conduct Authority (FCA), the Financial Services Commission (FSC) of Mauritius, and the Securities Commission of The Bahamas (SCB), INFINOX ensures a secure trading environment with segregated client funds and negative balance protection. Traders have access to a wide range of instruments, including forex, commodities, indices, equities, and futures, through platforms like MetaTrader 4, MetaTrader 5, and the IX Social copy trading app. With competitive spreads, leverage up to 1:1000, and a minimum deposit of just $1, INFINOX caters to both novice and experienced traders. The broker also offers comprehensive educational resources and 24/5 multilingual customer supportu

- Multi-jurisdictional regulation (FCA, FSC, SCB)

- Wide range of tradable assets (900+ instruments)

- Low minimum deposit ($1)

- High leverage (up to 1:1000)

- Advanced trading platforms (MT4, MT5, IX Social)

- Competitive spreads and commission options

- Negative balance protection

- Segregated client funds

- 24/5 customer support

- Educational resources and market analysis

- Limited educational offering compared to some leading brokers

- No support for cTrader platform

- Inactivity fees apply after 3 months

- No social trading on MT4/MT5 (only available on IX Social)

- Some payment methods may incur fees

- Withdrawal processing time could be improved

- No US clients accepted

- VPS services not available for all account types

- Limited selection of cryptocurrencies

- Website can be difficult to navigate in some sections

Overview

Established in 2009, INFINOX is a multi-regulated online broker enabling traders worldwide to access financial markets. With a strong presence in key global regions, INFINOX offers competitive trading conditions, advanced platforms, and a wide range of tradable instruments.

The broker holds licenses from the Financial Conduct Authority (FCA) in the United Kingdom, the Financial Services Commission (FSC) in Mauritius, and the Securities Commission of The Bahamas (SCB). By prioritising client security and adhering to strict regulatory standards, INFINOX has built a reputation as a trustworthy and reliable broker.

For more details, visit their official website at www.infinox.com.

Overview Table

| Feature | Details |

|---|---|

| Year Established | 2009 |

| Headquarters | London, United Kingdom |

| Regulation | FCA (UK), FSC (Mauritius), SCB (Bahamas) |

| Tradable Assets | Forex, Indices, Commodities, Equities (CFD), Futures (CFD) |

| Trading Platforms | MT4, MT5, IX Social |

| Minimum Deposit | $1 |

| Leverage | Up to 1:1000 |

| Customer Support | 24/5 via live chat, email, phone |

Facts list

- INFINOX was founded in 2009 and has over a decade of experience in the online trading industry.

- The broker is regulated by top-tier authorities, including the FCA, FSC and SCB.

- INFINOX offers a diverse range of tradable assets, with 900+ instruments across forex, indices, commodities, equities (CFD), and futures (CFD).

- Clients can choose between the popular MT4 and MT5 trading platforms, as well as INFINOX's proprietary social trading app, IX Social.

- The minimum deposit to open an account with INFINOX is just $1, making it accessible to a wide range of traders.

- INFINOX provides leverage up to 1:1000, allowing traders to amplify their market exposure.

- The broker offers both STP and ECN account types, catering to different trading styles and preferences.

- INFINOX's educational resources include webinars, tutorials, and market analysis to support traders' growth and development.

- Customer support is available 24/5 through multiple channels, including live chat, email, and phone.

- INFINOX is committed to client fund security, with segregated accounts and negative balance protection.

Infinox Licenses and Regulatory

INFINOX operates under the regulatory oversight of multiple respected authorities worldwide, ensuring a high level of client protection and financial security.

The broker's primary licenses include:

-

Financial Conduct Authority (FCA) in the United Kingdom

-

Financial Services Commission (FSC) in Mauritius

-

Securities Commission of The Bahamas (SCB)

These regulatory bodies impose strict requirements on INFINOX, such as maintaining segregated client funds, providing negative balance protection, and adhering to best execution practices. The multi-jurisdictional regulation demonstrates INFINOX's commitment to transparency, integrity, and client safety, instilling confidence in traders who choose to partner with the broker.

Regulations List

- Financial Conduct Authority (FCA), United Kingdom

- Financial Services Commission (FSC), Mauritius

- Securities Commission of The Bahamas (SCB)

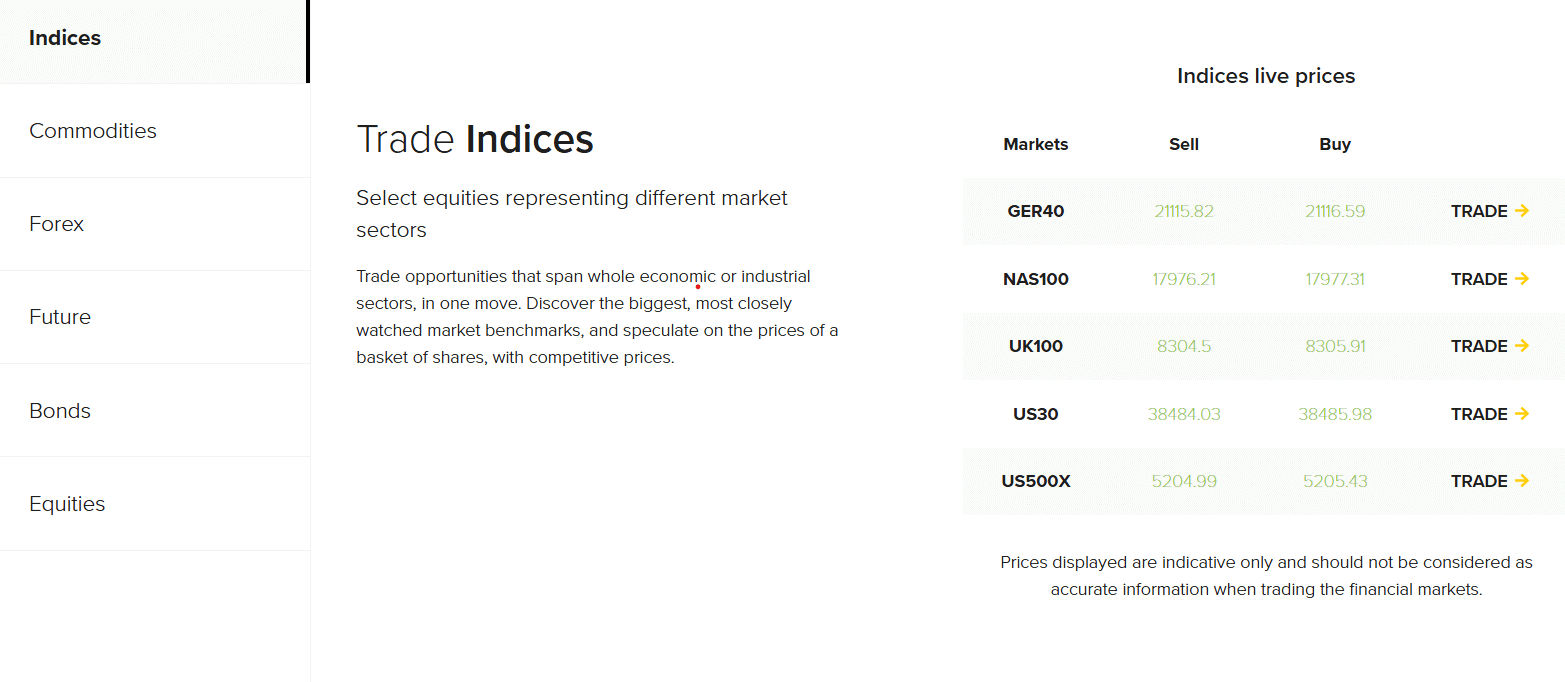

Trading Instruments

INFINOX offers an extensive selection of tradable assets, providing traders with ample opportunities to diversify their portfolios and capitalise on market movements.

The broker's 900+ instruments span across key financial markets, including:

| Asset Class | Details |

|---|---|

| Forex | 49 currency pairs, including majors, minors, and exotics |

| Indices | 10 global stock indices |

| Commodities | 14 markets, including gold, silver, and oil |

| Equities (CFD) | CFDs on 750 international stocks |

| Futures (CFD) | CFDs on a range of futures contracts |

For more detailed information on INFINOX's tradable assets, including specific instruments and spreads, please visit their official website.

Trading Platforms

INFINOX provides traders with access to industry-leading trading platforms, ensuring a seamless and efficient trading experience.

The available platforms include:

MetaTrader 4 (MT4)

The classic MT4 platform offers a user-friendly interface, advanced charting tools, and a wide range of technical indicators.

MetaTrader 5 (MT5)

MT5 builds upon the success of MT4, offering additional features such as expanded timeframes, a built-in economic calendar, and advanced order types.

IX Social

INFINOX's proprietary social trading app allows users to auto-copy trades from a selection of top global traders, making it easy for beginners to learn from experienced professionals.

All platforms are accessible via desktop, web, and mobile devices, providing traders with the flexibility to manage their positions on the go. INFINOX's trading platforms also support automated trading through expert advisors (EAs) and algorithmic strategies, empowering traders to implement their preferred trading style.

Trading Platforms Comparison Table

| Feature | MT4 | MT5 | IX Social |

|---|---|---|---|

| Customizable Layout | Yes | Yes | Yes |

| Technical Indicators | Yes | Yes | No |

| Timeframes | Yes | Yes | No |

| Automated Trading | Yes | Yes | Yes (Copy Trading) |

| Mobile App | Yes | Yes | Yes |

| Web-based Version | Yes | Yes | Yes |

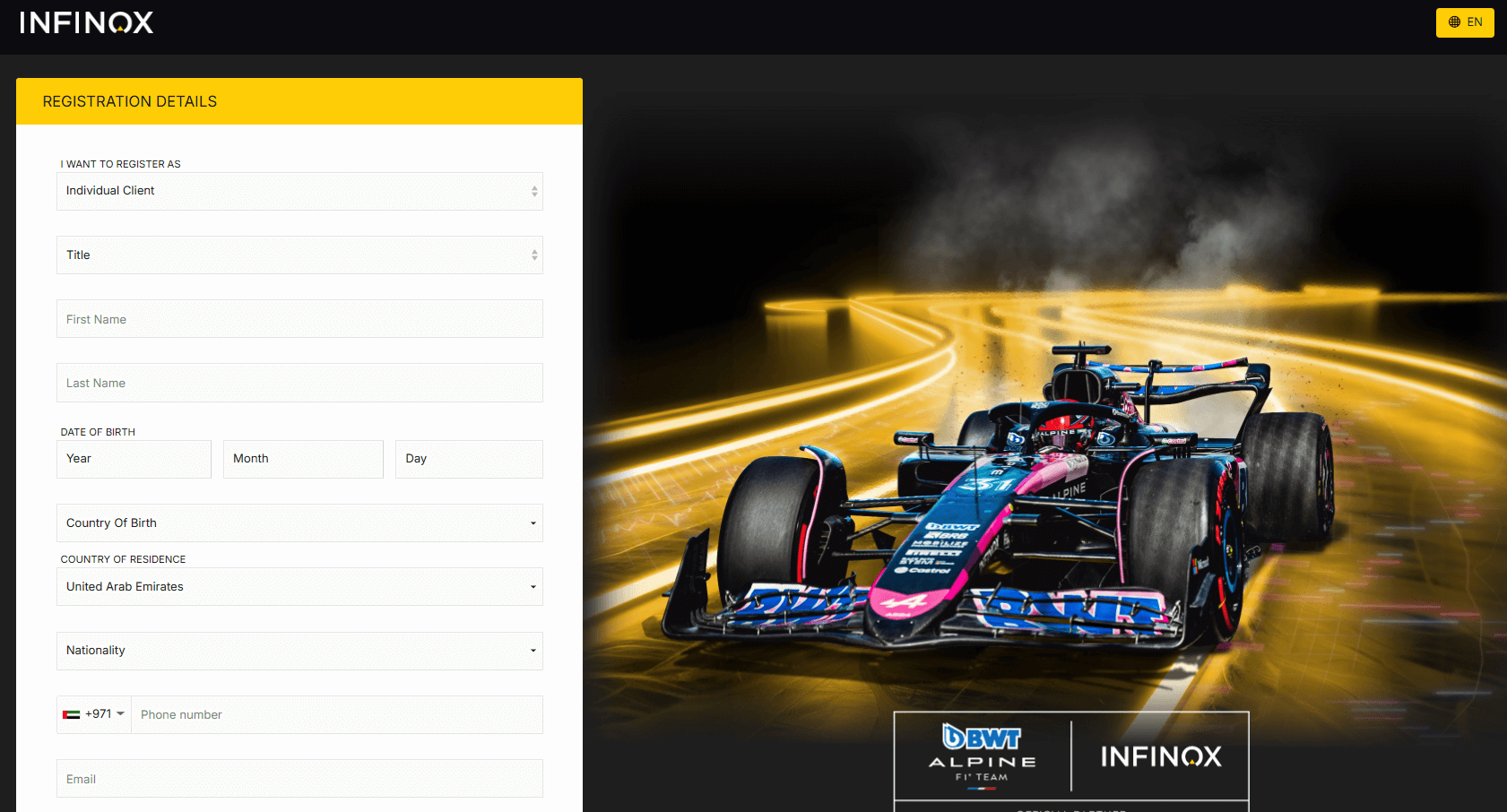

Infinox How to Open an Account: A Step-by-Step Guide

Opening an account with INFINOX is a straightforward process that can be completed entirely online.

Follow these steps to get started:

- Visit the INFINOX website and click on the "Open Live Account" button.

- Fill in the registration form with your personal details, including name, email address, and phone number.

- Choose your preferred account type (STP or ECN) and trading platform (MT4, MT5, or IX Social).

- Complete the account verification process by submitting proof of identity and proof of residence documents.

- Fund your account using one of the available payment methods, such as credit/debit card, bank transfer, or e-wallets.

INFINOX accepts the following account base currencies: USD, EUR, GBP, and AUD. The minimum deposit required to start trading is just $1, making it accessible for traders with various account sizes.

Charts and Analysis

INFINOX equips traders with a comprehensive suite of charting tools and analysis resources to help them make informed trading decisions.

Key features include:

| Feature | Details |

|---|---|

| Advanced Charting | Access a wide range of chart types, technical indicators, and drawing tools within MT4 and MT5 |

| Trading Signals | Receive real-time trading signals from expert analysts and automated algorithms |

| Economic Calendar | Stay informed with scheduled economic events and data releases impacting the markets |

| Market News and Analysis | Get timely market updates, news articles, and in-depth analysis reports |

| Webinars & Educational Materials | Participate in live webinars and access a library of educational resources hosted by experts |

Infinox Account Types

INFINOX offers two primary account types to cater to different trading styles and preferences:

- STP Account:

- Minimum deposit: $1

- Spreads from 0.9 pips

- No commissions

- Leverage up to 1:1000

- ECN Account:

- Minimum deposit: $1

- Spreads from 0.2 pips

- Commission: $7 per standard lot (round turn)

- Leverage up to 1:1000

Both account types provide access to the same range of tradable assets and trading platforms. INFINOX also offers demo accounts for traders who wish to practise trading strategies in a risk-free environment.

Account Types Comparison Table

| Feature | STP Account | ECN Account |

|---|---|---|

| Minimum Deposit | $1 | $1 |

| Spreads | From 0.9 pips | From 0.2 pips |

| Commissions | None | $7 per standard lot |

| Leverage | Up to 1:1000 | Up to 1:1000 |

| Tradable Assets | 900+ | 900+ |

| Platforms | MT4, MT5, IX Social | MT4, MT5, IX Social |

Negative Balance Protection

INFINOX provides negative balance protection to all clients, ensuring that traders cannot lose more than their account balance. This protection is a critical risk management feature that safeguards traders from potential losses exceeding their deposits. In the event of extreme market volatility or unexpected gaps, negative balance protection automatically closes out positions when the account equity reaches zero, preventing the account from falling into a negative balance. This feature provides peace of mind for traders, allowing them to manage their risk more effectively.

Infinox Deposits and Withdrawals

INFINOX supports a variety of convenient payment methods for deposits and withdrawals, including:

Deposit Methods

| Deposit Method | Details | Minimum Deposit |

|---|---|---|

| Credit/Debit Cards | Visa, Mastercard | $1 |

| Bank Wire Transfer | Standard international bank transfers | $1 |

| E-wallets | Skrill, Neteller | $1 |

Withdrawal Methods

| Withdrawal Method | Details | Processing Time |

|---|---|---|

| Credit/Debit Cards | Visa, Mastercard, no fees | 1-3 business days |

| Bank Wire Transfer | No fees | 2-5 business days |

| E-wallets | Skrill, Neteller, no fees | 1-2 business days |

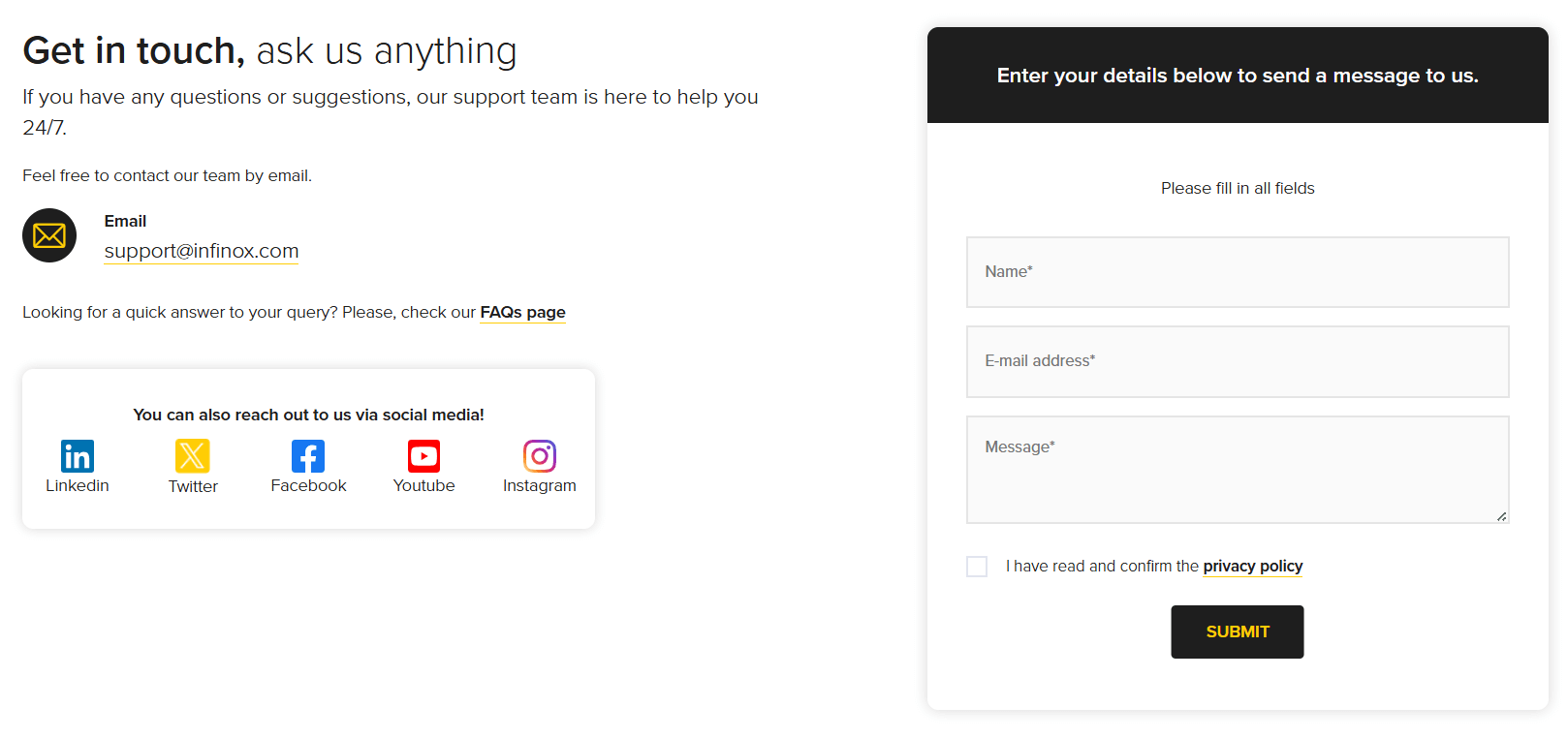

Support Service for Customer

INFINOX provides 24/5 customer support to assist traders with any questions or concerns they may have. The support team can be reached through the following channels:

- Live chat: Available on the INFINOX website

- Email: support@infinox.com

- Phone: +44 203 713 4490

- Social media: Facebook, Twitter, Instagram, LinkedIn

The multilingual support team is knowledgeable and responsive, aiming to provide timely assistance to all clients.

The multilingual support team is knowledgeable and responsive, aiming to provide timely assistance to all clients.

Customer Support Comparison Table

| Support Channel | Details |

|---|---|

| Live Chat | Available 24/5 |

| Available 24/5 | |

| Phone | Available 24/5 |

| Social Media | Available 24/5 |

| Support Languages | 15+ Languages |

| Support Hours | 24/5 |

| Average Response Time | 1-2 hours |

Prohibited Countries

INFINOX is unable to provide its services to residents of certain countries due to regulatory restrictions or company policies. The list of prohibited countries includes:

- United States

- Canada

- Japan

- Australia

- New Zealand

- Belgium

Traders from these countries cannot open an account with INFINOX. For a complete and up-to-date list of prohibited countries, please refer to the broker's official website.

Prohibited Countries List INFINOX is allowed to operate in all regions except:

United States, Canada, Japan, Australia, New Zealand

Special Offers for Customers

INFINOX occasionally provides special promotions and offers to both new and existing clients.

Some of the current promotions include:

- Welcome Bonus: New clients can receive a bonus of up to 15% on their first deposit, subject to terms and conditions.

- Refer-a-Friend: Existing clients can earn $500 for each friend they refer to INFINOX who opens and funds a live trading account.

- Trading Competitions: Participate in trading competitions for a chance to win cash prizes and other rewards.

Conclusion

Having thoroughly reviewed INFINOX, I believe they are a reliable and trustworthy broker that prioritises client satisfaction and security. INFINOX's multi-jurisdictional regulation, competitive trading conditions, and advanced platforms make them a solid choice for traders of all experience levels.

One of INFINOX's key strengths is their commitment to providing a safe trading environment. With licenses from the FCA, FSC, and SCB, the broker adheres to strict regulatory standards, ensuring client funds are segregated and protected. Additionally, negative balance protection offers an extra layer of risk management for traders.

INFINOX's diverse range of tradable assets is another compelling feature, allowing traders to access over 900 instruments across forex, indices, commodities, equities, and futures markets. The low minimum deposit requirement and high leverage options cater to various trading strategies and account sizes.

The broker's support for the popular MT4 and MT5 platforms, along with their proprietary IX Social trading app, demonstrates their dedication to offering cutting-edge trading technology. Traders can benefit from advanced charting tools, automated trading capabilities, and copy trading functionality.

While INFINOX provides a solid educational resource library, there is room for improvement compared to some other leading brokers. Expanding their offering with more in-depth courses, webinars, and market analysis could further enhance the trading experience.

Overall, I believe INFINOX is a reputable and well-rounded broker that offers a compelling proposition for traders seeking a secure and feature-rich trading environment. Their multi-jurisdictional regulation, competitive trading conditions, and innovative platforms make them a strong contender in the online trading space.