InstaForex Review 2025 : A Trusted Forex Broker With Low Deposit, Wide Markets,and Top Platforms

InstaForex

British Virgin Islands

British Virgin Islands

-

Minimum Deposit $1

-

Withdrawal Fee $varies

-

Leverage 1000:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

Forex & CFD Brokerage License

Forex & CFD Brokerage License

Softwares & Platforms

Customer Support

()

()

Supported language: Arabic, Chinese (Simplified), English, Russian, Spanish

Social Media

Summary

InstaForex is a globally recognized forex broker offering a wide range of trading instruments, including forex, stocks, commodities, and cryptocurrencies. The broker provides multiple account types with flexible trading conditions, catering to both beginners and experienced traders. InstaForex supports popular trading platforms like MetaTrader 4 and MetaTrader 5, along with proprietary solutions. With a minimum deposit starting from $1, traders can access leverage up to 1:1000. The broker also offers various promotions and bonuses. Regulated in multiple jurisdictions, InstaForex ensures a secure trading environment for its clients.

- Low minimum deposit of $1, making it accessible for beginner traders

- Wide range of tradable instruments, including forex, stocks, indices, commodities, and cryptocurrencies

- Multiple account types to suit different trading styles and preferences

- Competitive spreads starting from 0 pips on Eurica accounts

- High leverage up to 1:1000, increasing potential returns

- Regulated by the FSC of the British Virgin Islands, providing oversight and protection

- Offers popular MT4 and MT5 platforms, as well as WebTrader and mobile apps

- Extensive educational resources, including video tutorials, webinars, and e-books

- 24/7 multi-language customer support via live chat, email, phone, and social media

- Innovative features like ForexCopy social trading and AutoChartist market analysis

- Higher spreads on some account types compared to other brokers

- Lack of top-tier regulation like FCA or ASIC

- Limited range of cryptocurrency CFDs compared to some competitors

- Inactivity fees apply after 6 months of no trading activity

- Some withdrawal methods incur fees

- Occasional reports of delays in withdrawals

- Educational resources may not be as comprehensive as some leading brokers

- WebTrader platform lacks advanced features compared to desktop versions

- High leverage can also amplify potential losses

- Not suitable for traders in certain countries due to regulatory restrictions

Overview

InstaForex is an international forex broker that has been providing online trading services since 2007. Headquartered in the British Virgin Islands, InstaForex has grown to serve over 7 million clients across 260 representative offices worldwide. The broker is regulated by the BVI Financial Services Commission (FSC) under license number SIBA/L/14/1082.

InstaForex offers a wide range of trading instruments, including over 300 forex pairs, CFDs on stocks, commodities, indices, and cryptocurrencies. The broker provides access to the popular MetaTrader 4 and MetaTrader 5 platforms, as well as mobile and web-based trading solutions. InstaForex has received numerous industry awards over the years, including "Best Forex Broker Asia" at the Global Banking & Finance Awards and "Best ECN Broker" at the European CEO Awards.

One of InstaForex's key advantages is its low minimum deposit requirement, starting from just $1 on standard accounts. This makes forex and CFD trading accessible to beginner traders and those with limited capital. InstaForex also offers micro lot trading and Islamic swap-free accounts to cater to different trading needs.

In addition to competitive spreads and high leverage up to 1:1000, InstaForex provides clients with innovative tools like the ForexCopy social trading system and PAMM multi-account management service. The broker's comprehensive educational center includes video tutorials, webinars, guides, and a demo account to help traders improve their skills.

While InstaForex has established itself as a reputable broker over the years, trading forex and CFDs still carries a high level of risk. Potential clients should educate themselves thoroughly and ensure they understand the risks involved before trading with real money.

For more details on account types, trading conditions, bonuses, and more, visit the official InstaForex website at instaforex.com.

Overview Table

| Attribute | Details |

|---|---|

| Broker | InstaForex |

| Year Founded | 2007 |

| Headquarters | British Virgin Islands |

| Clients Worldwide | Over 7 million |

| Offices Worldwide | 260 |

| Regulation | FSC BVI (license SIBA/L/14/1082) |

| Tradable Instruments | Forex, stocks CFDs, indices CFDs, commodities CFDs, crypto CFDs |

| Trading Platforms | MT4, MT5, mobile, web |

| Minimum Deposit | From $1 (standard accounts) |

| Account Funding | Instant for most methods |

| Notable Awards | "Best Forex Broker Asia" (Global Banking & Finance Awards), "Best ECN Broker" (European CEO Awards) |

Facts List

- InstaForex was founded in 2007 and has over 7 million clients worldwide.

- The broker is regulated by the British Virgin Islands Financial Services Commission (FSC).

- InstaForex offers 300+ tradable instruments including forex, CFDs on stocks, indices, commodities and cryptos.

- Minimum deposit starts from just $1 on standard trading accounts.

- Clients can trade on MT4, MT5, mobile apps and web platforms.

- InstaForex provides social trading via ForexCopy and multi-account management via PAMM.

- Leverage up to 1:1000 is available, increasing both potential profits and risks.

- The broker supports cent accounts, Islamic swap-free accounts, and offers frequent contests and bonuses.

- An extensive education center is available with tutorials, webinars, guides, analytics and demo accounts.

- InstaForex has 260 local representative offices to serve clients around the world.

InstaForex Licenses and Regulatory

InstaForex operates under the regulatory oversight of the British Virgin Islands Financial Services Commission (FSC). The broker is licensed by the FSC under registration number SIBA/L/14/1082, adhering to the Securities and Investment Business Act (SIBA) of 2010.

As an FSC-regulated broker, InstaForex must comply with strict financial standards, including maintaining segregated client funds, reporting transparency, and undergoing regular audits. The FSC license provides a level of client protection and establishes InstaForex as a legitimate broker. However, it's important to note that the BVI FSC is often considered a less strict offshore regulator compared to top-tier authorities like the FCA or ASIC.

While InstaForex does not currently hold licenses with major regulators like CySEC, FCA or ASIC, the broker still implements standard security measures like SSL encryption and negative balance protection. Client funds are held in segregated accounts at top-tier banks to ensure safety.

It's worth noting that regulatory compliance is just one factor to consider when choosing a forex broker. Traders should also evaluate a broker's reputation, trading conditions, platforms, and overall transparency. InstaForex has built a positive reputation over its 18+ years in operation, with few major regulatory issues or client complaints.

Regulations List

- British Virgin Islands Financial Services Commission (FSC) - licensed and regulated under registration number SIBA/L/14/1082

- Operates under the Securities and Investment Business Act (SIBA) of 2010

Trading Instruments

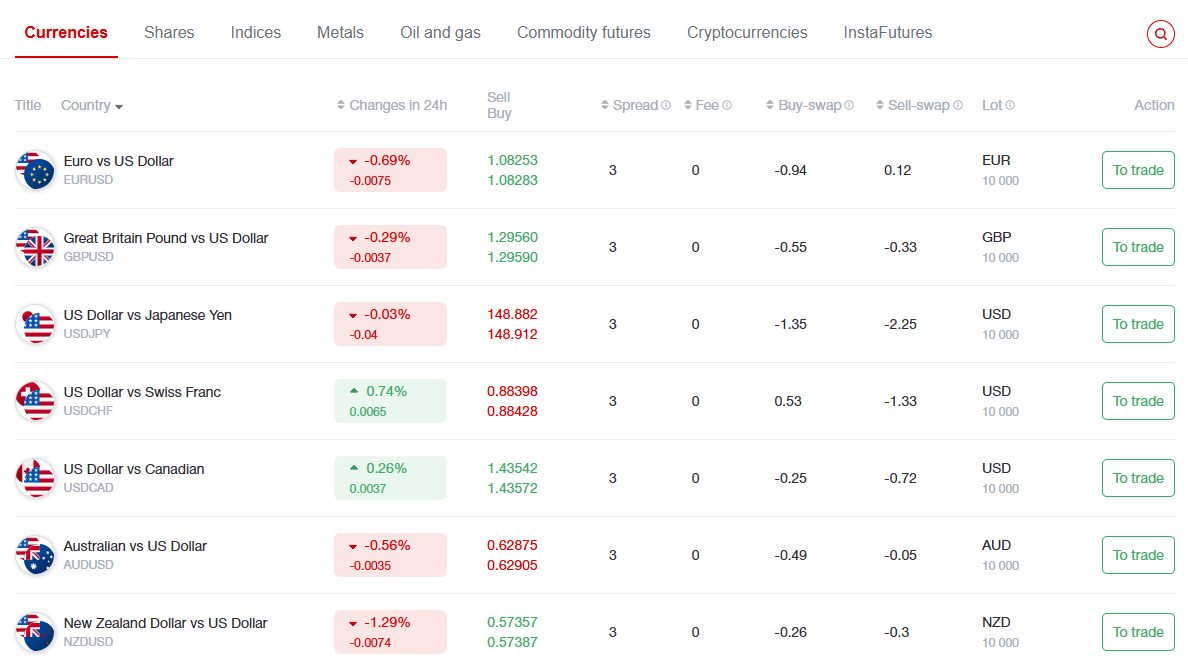

InstaForex offers a diverse selection of over 300 tradable instruments, providing traders with ample opportunities to build versatile portfolios and capitalise on various market conditions. The broker's extensive asset lineup caters to both novice and experienced traders seeking exposure to popular and niche markets.

| Asset Class | Details |

|---|---|

| Forex | Over 100 currency pairs, including majors, minors, and exotics. Competitive spreads from 0.2 pips on EUR/USD ensure cost-effective trading. |

| Stocks | Trade CFDs on 88 US and EU-based companies (e.g., Apple, Amazon, Deutsche Bank). Leverage up to 1:20 with low margin requirements. |

| Indices | Speculate on 16 index CFDs, including S&P 500, FTSE 100, DAX 30, and ASX 200, with spreads from 0.4 points. |

| Commodities | Trade 16 commodity CFDs, including precious metals (gold, silver), energies (oil, natural gas), and agricultural products (wheat, coffee, sugar). |

| Cryptocurrencies | Trade 13 digital currencies (Bitcoin, Ethereum, Litecoin, Ripple) as CFDs. Leverage up to 1:10, with spreads from 50 points on BTC/USD. |

| Futures | Speculate on 34 futures contracts across metals, energies, indices, and agricultural commodities. |

InstaForex's diverse asset selection is a testament to its commitment to meeting the evolving needs of traders worldwide. By offering a wide array of markets, the broker empowers clients to diversify their portfolios, implement dynamic trading strategies, and seize opportunities in multiple sectors.

Trading Platforms

InstaForex provides clients with a range of trading platforms to suit different preferences and needs. The broker offers the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, as well as its proprietary WebTrader and mobile apps for iOS and Android devices.

MetaTrader 4 (MT4)

MT4 is a popular choice among traders due to its user-friendly interface, advanced charting tools, and extensive customisation options. The platform supports automated trading through Expert Advisors (EAs), allowing clients to implement complex strategies and backtest them on historical data. MT4 also offers a wide range of technical indicators and graphical objects for comprehensive market analysis.

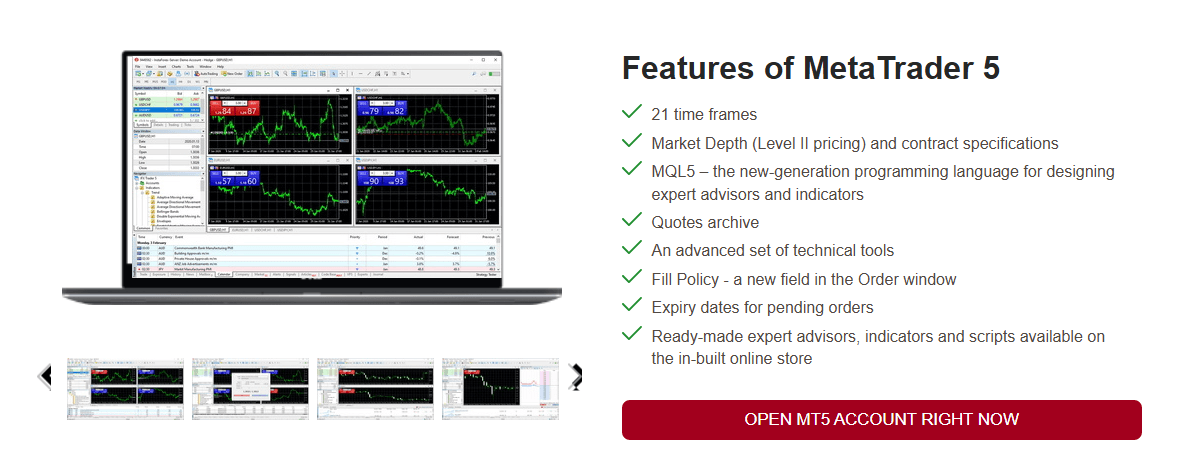

MetaTrader 5 (MT5)

MT5 is the successor to MT4, offering enhanced features and functionality. In addition to forex and CFDs, MT5 supports trading of stocks, futures, and options, making it a versatile platform for diversified trading. The platform includes an advanced Market Depth feature, a built-in economic calendar, and fundamental analysis tools.

WebTrader

For traders who prefer not to install additional software, InstaForex's WebTrader platform allows seamless trading directly from a web browser. The platform provides a streamlined interface for placing trades, managing positions, and analysing markets using interactive charts and technical indicators. WebTrader is compatible with various browsers and devices, offering flexibility and convenience.

Mobile Trading

InstaForex offers mobile trading apps for both iOS and Android devices, enabling clients to trade on the go. The apps provide a user-friendly interface for placing trades, monitoring positions, and accessing real-time market quotes. Users can also set price alerts, analyse charts with technical indicators, and manage their accounts directly from their mobile devices.

InstaForex's range of trading platforms caters to the diverse needs of modern traders, offering flexibility, reliability, and advanced features. By providing access to popular platforms like MT4 and MT5, along with a proprietary WebTrader and mobile apps, the broker ensures that clients can choose the most suitable platform for their trading style and experience level.

Trading Platforms Comparison Table

| Feature | MetaTrader 4 (MT4) | MetaTrader 5 (MT5) | WebTrader | Mobile Apps |

|---|---|---|---|---|

| Asset Classes | Forex, CFDs | Forex, CFDs, Stocks, Futures, Options | Forex, CFDs | Forex, CFDs |

| Automated Trading | Yes (Expert Advisors) | Yes (Expert Advisors) | No | No |

| Technical Indicators | 30+ | 38+ | 30+ | 30+ |

| Charting Tools | Yes | Yes | Yes | Yes |

| Customization Options | High | High | Medium | Low |

| Compatible OS | Windows, Mac, Linux | Windows, Mac, Linux | Web-based | iOS, Android |

| Real-time Quotes | Yes | Yes | Yes | Yes |

| Trade Execution | Instant, Market | Instant, Market | Instant | Instant |

InstaForex How to Open an Account: A Step-by-Step Guide

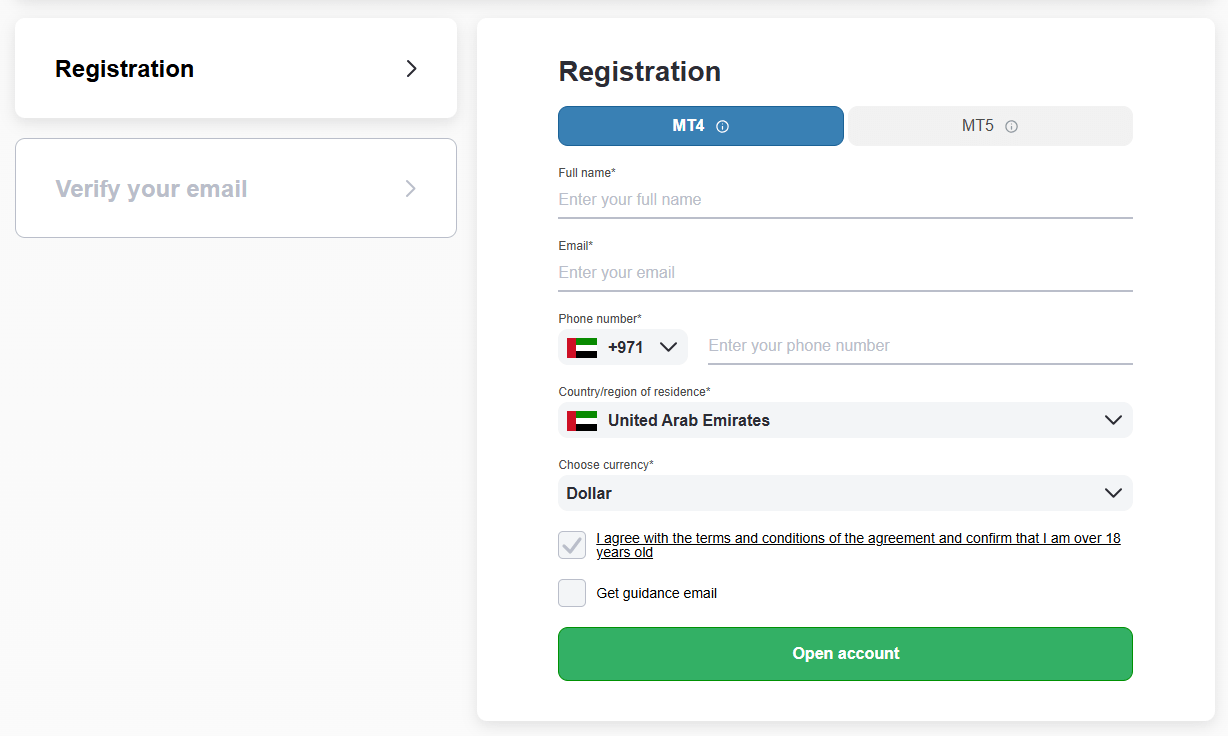

Opening an account with InstaForex is a straightforward process that can be completed online in just a few steps. The broker has streamlined the registration process to make it user-friendly and accessible to traders worldwide.

Requirements

To open an account with InstaForex, you must meet the following requirements:

- Be at least 18 years old

- Provide a valid email address

- Submit proof of identity (e.g., passport, driver's license, or national ID card)

- Submit proof of residence (e.g., utility bill, bank statement, or government-issued document)

Minimum Deposit

InstaForex has a low minimum deposit requirement, starting from just $1 for standard accounts. This makes it accessible for beginner traders and those with limited initial capital. There is no minimum deposit for the demo account.

Payment Methods

The broker accepts various payment methods for account funding, including:

- Credit/debit cards (Visa, Mastercard, Maestro)

- Bank wire transfer

- E-wallets (Skrill, Neteller, UnionPay, FasaPay, and more)

- Cryptocurrencies (Bitcoin, Litecoin, Ethereum, Tether) Processing times vary depending on the chosen payment method, with e-wallets and credit/debit cards typically offering instant deposits.

Account Opening Process List

- Visit the InstaForex website and click on the "Open an Account" button

- Select your preferred account type (e.g., Insta.Standard, Insta.Eurica, Cent.Standard, Cent.Eurica)

- Fill in the registration form with your personal details, including full name, email address, and country of residence

- Choose your trading platform (MT4 or MT5) and base currency

- Accept the terms and conditions and click "Register"

- Verify your email address by clicking on the confirmation link sent to your inbox

- Log in to your Client Cabinet using your registered credentials

- Navigate to the "Verification" section and upload the required identity and residency documents

- Once your account is verified, make your initial deposit using one of the available payment methods

- Start trading on your chosen platform using demo or real funds

Charts and Analysis

InstaForex provides a comprehensive suite of educational resources and tools to support traders in their learning journey and decision-making process. The broker offers a diverse range of materials catering to various skill levels and learning preferences.

| Feature | Details |

|---|---|

| Interactive Charts | InstaForex's MT4 and MT5 platforms include advanced charting tools with line, bar, and candlestick charts. Traders can access multiple timeframes and customisable indicators for in-depth analysis. |

| Economic Calendar | Displays upcoming economic releases, central bank meetings, and political events. Traders can filter by currency, importance, and date range to align strategies with market-moving news. |

| Market Analysis | Daily market reviews, technical and fundamental analysis across forex, commodities, indices, and cryptocurrencies. Includes real-time commentary and trading signals. |

| Educational Resources | A wide range of learning materials, including video tutorials, webinars, e-books, guides, a glossary, and an FAQ section to help traders improve their skills and strategies. |

InstaForex's commitment to providing diverse and high-quality educational resources sets it apart from many competitors. The broker's extensive range of materials caters to traders of all levels, from complete beginners to advanced professionals. By investing in these resources, InstaForex empowers its clients to make informed trading decisions and continuously improve their skills.

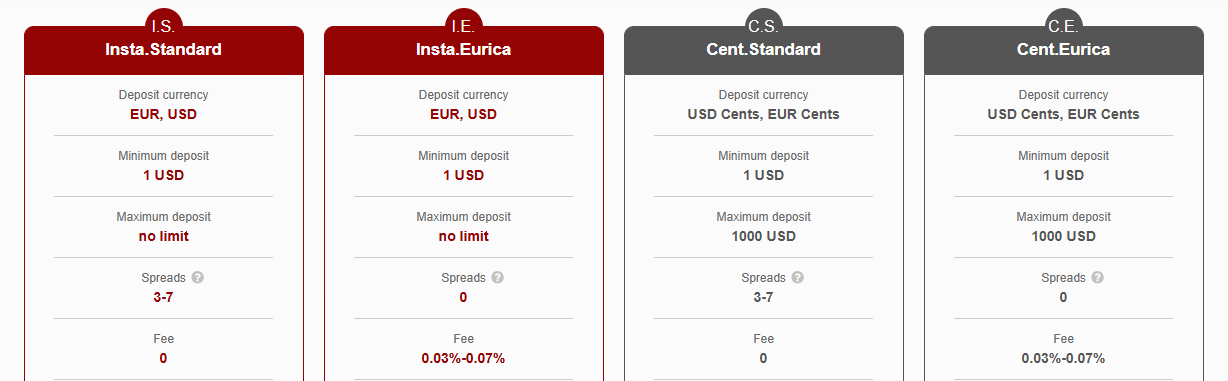

InstaForex Account Types

InstaForex offers a diverse range of trading account types to cater to the unique needs and preferences of traders at various levels of experience and investment capital. The broker provides flexibility and choice, allowing clients to select an account that best suits their trading style, risk tolerance, and financial goals.

Insta.Standard

The Insta.Standard account is a popular choice for beginner and intermediate traders. With a minimum deposit of just $1, it offers accessible entry into the world of forex and CFD trading. This account type features competitive spreads starting from 3 pips, no commissions, and a maximum leverage of 1:1000. Traders can access a wide range of trading instruments and benefit from instant execution on the MT4 and MT5 platforms.

Insta.Eurica

Designed for experienced traders seeking optimal trading conditions, the Insta.Eurica account offers zero spreads and low commissions starting from 0.03%. The minimum deposit for this account type is $1, making it an attractive option for traders looking to minimise trading costs without compromising on leverage (up to 1:1000) or execution speed. The Insta.Eurica account is available on both MT4 and MT5 platforms.

Cent.Standard

The Cent.Standard account is an excellent choice for novice traders looking to gain experience with minimal risk. This account operates in cents, allowing traders to open positions as small as 0.0001 lots (0.01 cents). With a minimum deposit of just 1 cent, traders can explore the markets and test strategies without substantial capital investment. The Cent.Standard account features spreads from 3 pips and leverage up to 1:1000.

Cent.Eurica

Similar to the Cent.Standard account, the Cent.Eurica account operates in cents but offers zero spreads and low commissions from 0.03%. This account type is suitable for beginner traders seeking cost-effective trading conditions while maintaining the ability to trade micro lots. The minimum deposit for the Cent.Eurica account is 1 cent, and leverage is available up to 1:1000.

Demo Account

For traders who want to practise trading strategies, test the platform, or familiarise themselves with the markets without risk, InstaForex offers a demo account. This account type provides access to live market conditions, real-time quotes, and a virtual balance of $10,000. Demo accounts are available on both MT4 and MT5 platforms, allowing traders to experience the full functionality of the trading environment.

InstaForex's range of account types demonstrates the broker's commitment to accommodating the diverse needs of its clientele. By offering accounts with varying minimum deposits, spread/commission structures, and lot sizes, InstaForex ensures that traders can find an account tailored to their specific requirements and financial capabilities.

| Feature | Insta.Standard | Insta.Eurica | Cent.Standard | Cent.Eurica | Demo Account |

|---|---|---|---|---|---|

| Minimum Deposit | $1 | $1 | $1 | $1 | N/A |

| Spreads | From 3 pips | Zero | From 3 pips | Zero | From 3 pips |

| Commissions | No | From 0.03% | No | From 0.03% | No |

| Leverage | Up to 1:1000 | Up to 1:1000 | Up to 1:1000 | Up to 1:1000 | Up to 1:1000 |

| Minimum Lot Size | 0.01 | 0.01 | 0.0001 | 0.0001 | 0.01 |

| Execution Type | Instant | Instant | Instant | Instant | Instant |

| Trading Platforms | MT4, MT5 | MT4, MT5 | MT4, MT5 | MT4, MT5 | MT4, MT5 |

| Tradable Instruments | Wide range | Wide range | Wide range | Wide range | Wide range |

| Virtual Balance | N/A | N/A | N/A | N/A | $10,000 |

Negative Balance Protection

InstaForex understands the importance of trust and security in the broker-client relationship. By offering negative balance protection, the broker demonstrates its commitment to safeguarding clients' funds and promoting responsible trading practices. This policy is applied automatically to all InstaForex trading accounts, without any additional terms or conditions. It is essential to note that while negative balance protection provides a safety net, it should not be relied upon as a substitute for proper risk management. Traders should always employ sound risk management strategies, such as setting appropriate stop-loss orders, managing leverage responsibly, and maintaining a well-diversified trading portfolio. In conclusion, InstaForex's negative balance protection policy is a testament to the broker's dedication to client security and risk mitigation. By ensuring that traders cannot lose more than their account balance, InstaForex provides a more secure trading environment and helps build long-term trust with its clients.

InstaForex Deposits and Withdrawals

InstaForex offers a wide range of convenient deposit and withdrawal methods to cater to the diverse needs of its global client base. The broker understands the importance of seamless transactions and strives to provide a smooth, secure, and efficient funding experience for all traders.

Deposit Methods

InstaForex accepts the following deposit methods:| Payment Method | Processing Time | Fees | Minimum Deposit |

|---|---|---|---|

| Credit/Debit Cards (Visa, Mastercard, Maestro) | Instant | No fees | $1 |

| Bank Wire Transfer | 2-5 business days | No fees | $1 |

| Electronic Payment Systems | |||

| - Skrill | Instant | No fees | $1 |

| - Neteller | Instant | No fees | $1 |

| - UnionPay | Instant | No fees | $1 |

| - FasaPay | Instant | No fees | $1 |

| - WebMoney | Instant | 0.8% fee | $1 |

| Cryptocurrencies (Bitcoin, Litecoin, Ethereum, Tether) | 1-30 minutes | No fees | $1 |

Withdrawal Methods

InstaForex supports the following withdrawal methods:| Payment Method | Processing Time | Minimum Withdrawal | Fees |

|---|---|---|---|

| Credit/Debit Cards (Visa, Mastercard, Maestro) | 1-5 business days | $1 | Free for withdrawals over $100 |

| Bank Wire Transfer | 2-5 business days | $1 | $30 |

| Electronic Payment Systems | |||

| - Skrill | Instant | $1 | 1% |

| - Neteller | Instant | $1 | 2% |

| - UnionPay | Instant | $1 | 1% |

| - FasaPay | Instant | $1 | 0.5% |

| - WebMoney | Instant | $1 | 0.8% |

| Cryptocurrencies (Bitcoin, Litecoin, Ethereum, Tether) | 1-30 minutes | $1 | No fees |

Account Verification

To ensure the security of clients' funds and comply with international anti-money laundering (AML) regulations, InstaForex requires account verification for withdrawals. Traders must submit proof of identity (e.g., passport, ID card) and proof of residence (e.g., utility bill, bank statement) before their first withdrawal request can be processed. This one-time verification process typically takes 1-3 business days.Unique Withdrawal Feature

InstaForex offers a unique "Fast Withdrawal" feature for verified clients, allowing them to receive their funds within just 1 hour. This service is available for select payment methods and is subject to certain terms and conditions. In conclusion, InstaForex provides a comprehensive range of deposit and withdrawal options, catering to the preferences of traders worldwide. With instant deposits, competitive fees, and fast withdrawal processing, the broker ensures a seamless funding experience. By prioritising security and compliance, InstaForex maintains a safe and trustworthy trading environment for its clients.Support Service for Customer

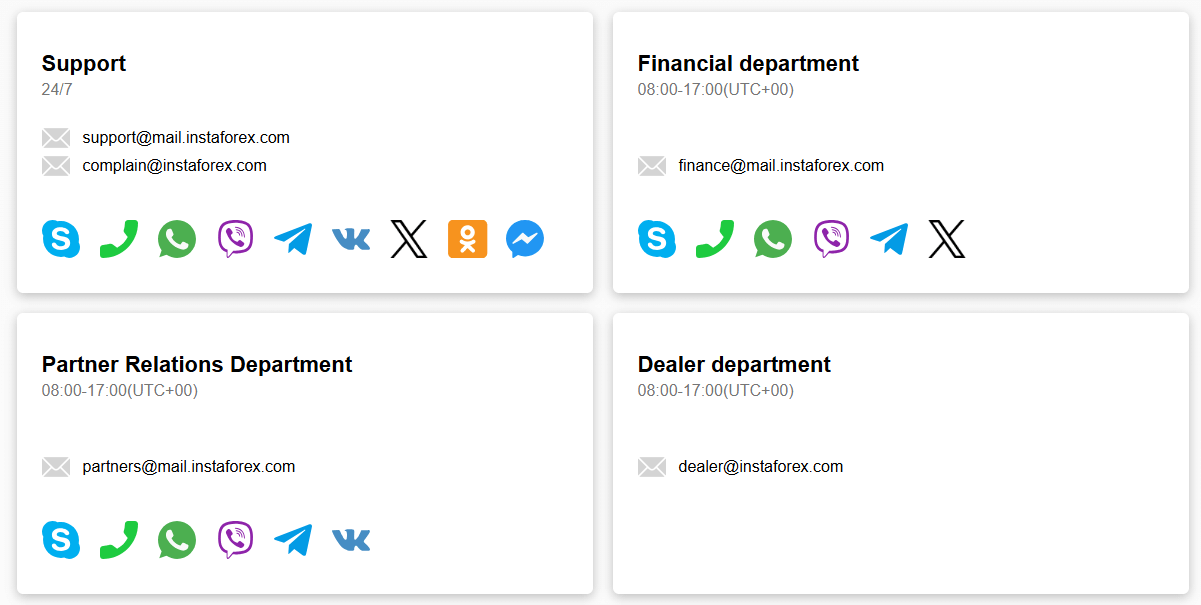

In the fast-paced world of online trading, reliable and responsive customer support is crucial for a positive trading experience. InstaForex understands the importance of providing traders with efficient assistance whenever they need it, ensuring that their queries and concerns are addressed promptly and professionally.

Support Channels

InstaForex offers a comprehensive range of customer support channels to cater to the diverse preferences and needs of its global client base:- Live Chat: Available 24/7, instant response

- Email: support@instaforex.com, typically replied within 24 hours

- Phone: Multiple country-specific numbers, available 24/5

- Social Media: Twitter, Facebook, Instagram, Telegram, WhatsApp

- Callback Request Form: Submit a request on the website, receive a call within 1 hour

Multi-Language Support

To serve its international clientele effectively, InstaForex provides customer support in 16 languages, including English, Chinese, Indonesian, Arabic, Spanish, French, German, Italian, Portuguese, Vietnamese, Korean, Malay, Thai, Gujarati, Hindi, and Urdu. This extensive language support ensures that traders from various regions can communicate comfortably and have their enquiries addressed in their preferred language.Country-Specific Contact Details

InstaForex has dedicated local phone numbers for over 50 countries, allowing traders to reach the support team without incurring international call charges. The complete list of country-specific contact details can be found on the broker's official website.Response Times and Availability

InstaForex strives to provide prompt and efficient customer support across all channels. The live chat feature is available 24/7, with instant response times, enabling traders to get real-time assistance at any time of the day. Emails are typically replied to within 24 hours, while phone support is available 24/5, ensuring that traders can speak directly with a support representative during trading hours. For social media enquiries, InstaForex aims to respond within 1-2 hours during business hours. The callback request form on the website allows traders to schedule a convenient time for a support representative to call them back, with calls usually made within 1 hour of the scheduled time.Customer Support Comparison Table

| Support Channel | Availability | Response Time | Languages |

|---|---|---|---|

| Live Chat | 24/7 | Instant | 16 |

| 24/7 | Within 24 hours | 16 | |

| Phone | 24/5 | Immediate | 16 |

| Social Media | 24/7 | 1-2 hours | 16 |

| Callback Request | 24/7 | Within 1 hour | 16 |

Prohibited Countries

InstaForex is an international broker that strives to provide its services to traders worldwide. However, due to various factors such as local regulations, licensing requirements, and geopolitical considerations, the broker is prohibited from operating in certain countries and regions.

Reasons for Restrictions

- Local Regulations: Some countries have strict regulations governing forex and CFD trading, requiring brokers to obtain specific licenses or meet certain criteria to operate legally. If InstaForex does not hold the necessary licenses or meet the required standards in a particular jurisdiction, it may be prohibited from offering its services there.

- Geopolitical Factors: Political tensions, economic sanctions, or international trade agreements can also impact a broker's ability to operate in specific regions. InstaForex must comply with international laws and regulations, which may restrict its services in certain countries.

- Investor Protection: In some jurisdictions, local authorities may deem the level of investor protection offered by InstaForex insufficient, leading to a prohibition on its services to protect citizens from potential financial risks.

Consequences of Trading from Prohibited Countries

Attempting to trade with InstaForex from a prohibited country can result in several risks and consequences:

- Account Termination: If InstaForex detects that a client is trading from a prohibited jurisdiction, the broker reserves the right to terminate the account immediately, potentially resulting in the loss of funds.

- Legal Consequences: Trading with an unauthorised broker from a prohibited country may violate local laws, leading to potential legal consequences, such as fines or other penalties.

- Lack of Regulatory Protection: Traders from prohibited countries who manage to open an account with InstaForex may not be entitled to the same level of regulatory protection as those from permitted jurisdictions, leaving them vulnerable to potential fraud or malpractice.

List of Prohibited Countries

As of 2025, InstaForex is prohibited from operating in the following countries and regions:

- United States of America

- Canada

- North Korea

- Iran

- Syria

- Sudan

- Cuba

- Crimea

It is essential for traders to check the most up-to-date list of prohibited countries on InstaForex's official website before attempting to open an account, as regulations and restrictions may change over time.

Traders from permitted countries can proceed with account registration, ensuring they comply with all applicable terms and conditions. However, those from prohibited jurisdictions are advised to seek alternative brokers that are properly licensed and authorised to operate in their region.

Special Offers for Customers

InstaForex is known for providing a wide range of special promotions and offers to both new and existing traders, enhancing their trading experience and offering additional value. These offers are designed to cater to various trading preferences and help traders maximise their potential returns.

Sign-Up Bonuses:

- 30% Welcome Bonus: New traders can receive a 30% bonus on their first deposit, up to a maximum of $3,000. The bonus is automatically credited to the trading account and can be used for trading purposes. To withdraw the bonus, traders must execute a trading volume of 25 lots for every $1 bonus received.

- 100% Welcome Bonus: This exclusive offer is available to new clients who make a minimum deposit of $1,000. The bonus is credited instantly and can be used for trading, with a maximum bonus amount of $10,000. To withdraw the bonus, traders must achieve a trading volume of 40 lots for every $1 bonus.

Loyalty Program: InstaForex's loyalty program rewards active traders with InstaPoints, which can be exchanged for various benefits, such as trading bonuses, merchandise, or VIP services. Traders earn InstaPoints based on their trading volume, with 1 lot traded equalling 1 InstaPoint. The more points a trader accumulates, the higher their loyalty tier and the more exclusive benefits they can access.

Trading Competitions:

- InstaForex Great Race: This monthly demo trading contest offers a prize pool of $5,000, distributed among the top 10 traders with the highest equity increase. Participants compete with a virtual starting balance of $10,000, and the winner receives a real cash prize of $2,000.

- InstaForex Sniper: This weekly contest challenges traders to achieve the highest profit with the lowest drawdown. The top 5 performers share a prize pool of $1,500, with the winner receiving $500 in real funds.

- InstaForex Lucky Trader: In this daily random draw, 5 lucky traders are selected to receive a cash prize of $200 each. To participate, traders must make a minimum deposit of $200 and trade at least 2 lots within the promotional period.

Partnerships:

- ForexCopy: InstaForex has partnered with ForexCopy, a leading social trading platform, allowing traders to automatically copy the trades of successful strategies. Traders can allocate funds to expert traders and benefit from their expertise without actively managing their own trades.

- AutoChartist: InstaForex clients have access to AutoChartist, an advanced pattern recognition and market analysis tool. This partnership provides traders with real-time insights, trade ideas, and automated chart analysis to help them make informed trading decisions.

Conclusion

After conducting a thorough review of InstaForex, I have gained valuable insights into their operations, reputation, and overall standing as a broker in the trading industry. By examining various aspects of their business, including regulatory compliance, trading conditions, platforms, and customer support, I have arrived at a well-informed conclusion regarding their trustworthiness and suitability for traders.

One of the key factors that contribute to InstaForex's reliability is their regulatory status. As a broker licensed by the Financial Services Commission (FSC) of the British Virgin Islands, InstaForex operates under a well-established regulatory framework. While the BVI FSC may not be considered a top-tier regulator, it still provides a level of oversight and protection for clients. Additionally, InstaForex implements standard security measures, such as segregated client funds and negative balance protection, which further enhance the safety of trading with them.

Throughout my review, I have been impressed by InstaForex's commitment to providing a user-friendly and accessible trading environment. With a wide range of account types, including Cent accounts and Islamic accounts, InstaForex caters to the diverse needs of traders at various skill levels and with different trading preferences. The low minimum deposit requirement of just $1 makes it easy for beginner traders to start exploring the markets without risking significant capital.

InstaForex's offering of multiple trading platforms, including the industry-standard MetaTrader 4 and MetaTrader 5, along with their proprietary WebTrader and mobile apps, ensures that traders have access to the tools and features they need to analyse markets, execute trades, and manage their positions effectively. The broker's extensive range of tradable instruments, spanning forex, stocks, indices, commodities, and cryptocurrencies, allows traders to diversify their portfolios and seize opportunities across various asset classes.

Another area where InstaForex shines is in their educational resources and customer support. The broker provides a comprehensive collection of educational materials, including video tutorials, webinars, e-books, and a demo account, enabling traders to enhance their knowledge and skills at their own pace. InstaForex's multi-language customer support, available 24/7 through live chat, email, phone, and social media, ensures that traders can access prompt and reliable assistance whenever they need it.

While InstaForex has a lot to offer, it's essential to acknowledge that no broker is perfect. The broker's relatively high spreads on some account types and the absence of a top-tier regulatory license might be drawbacks for some traders. However, these concerns are mitigated by the broker's transparent fee structure and additional services, such as the ForexCopy social trading platform and AutoChartist market analysis tool.

In conclusion, I believe that InstaForex is a reliable and trustworthy broker that provides a solid trading experience for both beginners and experienced traders. With a strong regulatory foundation, competitive trading conditions, advanced platforms, and comprehensive educational resources, InstaForex has established itself as a reputable player in the online trading industry. While traders should always conduct their own due diligence and consider their individual trading needs, InstaForex is undoubtedly a strong contender for those seeking a well-rounded and user-focused broker.