Interactive Brokers Review 2025: Pros and Cons, Trading Tools and Regulations Covered

Interactive Brokers

United States

United States

-

Minimum Deposit $0.01

-

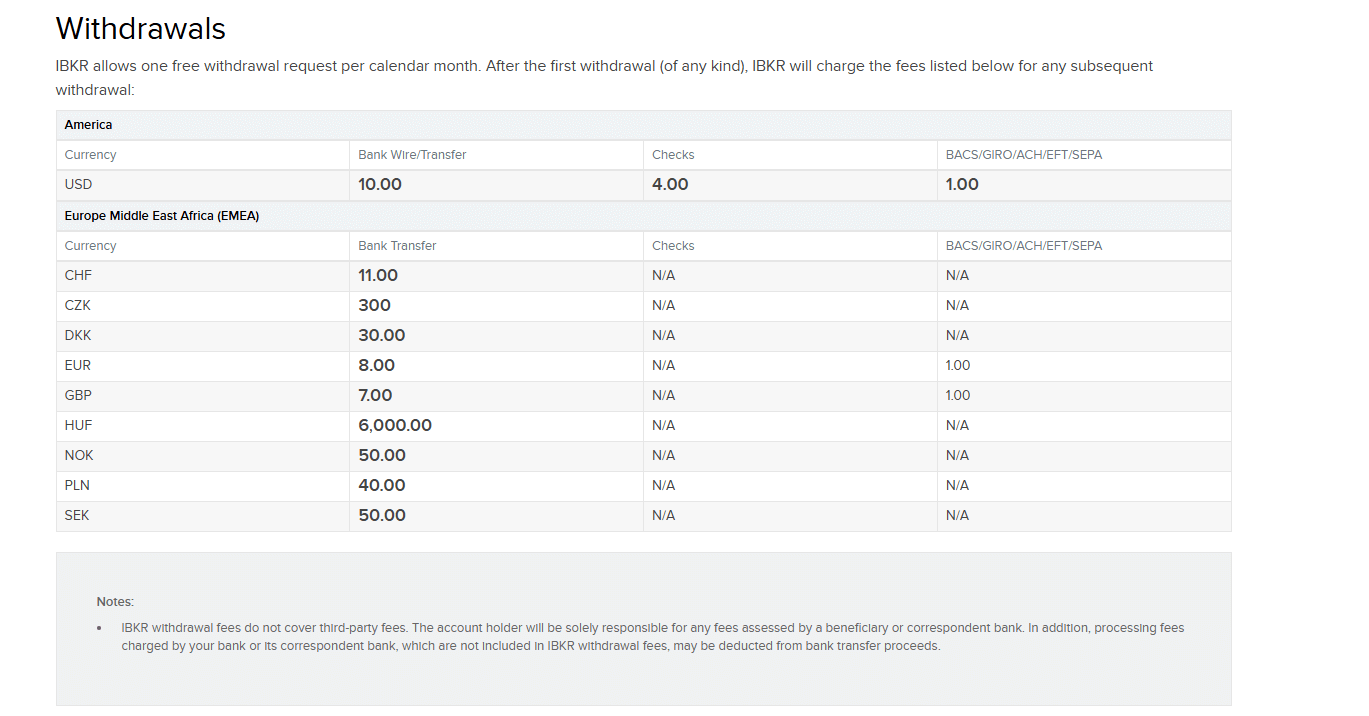

Withdrawal Fee $10

-

Leverage 1:100

-

Spread From 0.1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Unavailable

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Japan Forex Trading License

Japan Forex Trading License

Hong Kong Securities and Futures License

Hong Kong Securities and Futures License

Australia Retail Forex License

Australia Retail Forex License

US Commodity Trading License

US Commodity Trading License

Singapore Financial Services License

Singapore Financial Services License

US Securities License

US Securities License

IIROC Investment Dealer

IIROC Investment Dealer

Softwares & Platforms

Customer Support

+18774422757

(English)

+18774422757

(English)

Supported language: Chinese (Simplified), English, French, German, Italian, Japanese, Russian, Spanish

Social Media

Summary

Interactive Brokers is a global brokerage firm known for its low-cost trading, extensive market access, and advanced trading tools. It caters to both retail and institutional investors, offering a wide range of assets, including stocks, options, futures, forex, and bonds. The platform is particularly popular among professional traders due to its competitive pricing and powerful analytical tools. However, its complex interface may be challenging for beginners, though it provides educational resources to help users get started.

- Wide range of tradable assets across global markets

- Low fees and competitive pricing for active traders

- Advanced trading platforms with powerful tools and customization options

- Strong regulatory compliance with multiple tier-1 authorities

- Reliable customer support with 24/6 availability and multiple channels

- Comprehensive educational resources for traders of all levels

- User-friendly interfaces for less experienced traders (IBKR GlobalTrader and IBKR Mobile)

- Commitment to transparency in operations and communication

- Robust risk management features and portfolio analysis tools

- Integrated research and news from multiple reputable sources

- Complex platform (TWS) may have a steep learning curve for novice traders

- Limited availability of promotional offers compared to some competitors

- Inactivity fees for accounts with low balances or trading activity

- Higher margin rates for IBKR Lite accounts compared to IBKR Pro

- Limited cryptocurrency trading options compared to dedicated crypto exchanges

- No direct phone support for onboarding and account opening

- Fewer educational resources specific to forex trading compared to other asset classes

- Account approval process may take longer than some competitors

- Minimum account balance requirements for some advanced features and services

- Less emphasis on fundamental analysis tools compared to technical analysis

Overview

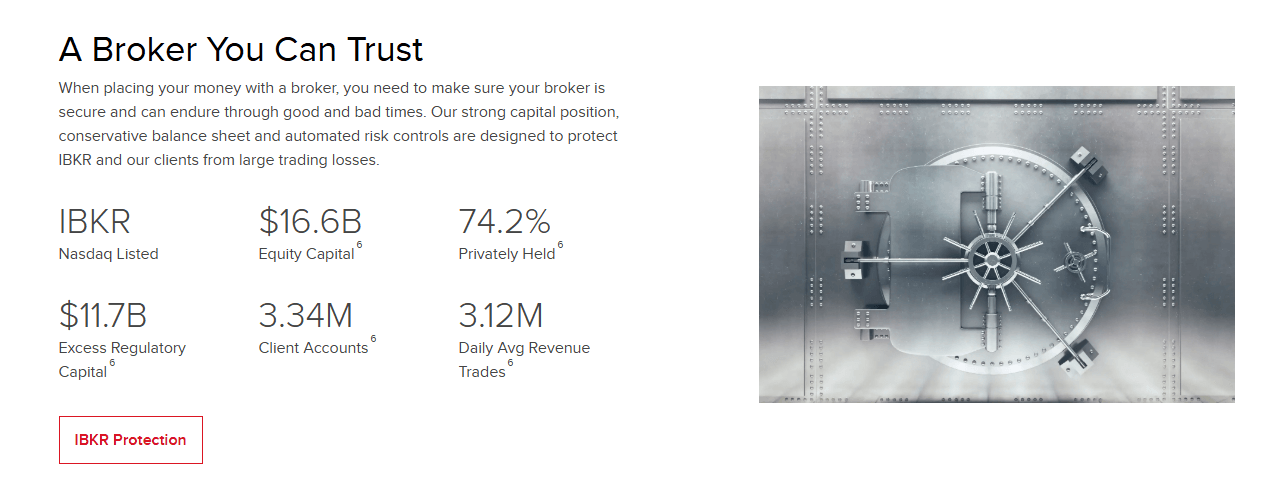

Interactive Brokers (IBKR) is a well-established online brokerage firm, founded in 1977 by Thomas Peterffy and headquartered in Greenwich, Connecticut. With a global presence across 150 markets in 33 countries, IBKR serves over 2.75 million client accounts and employs more than 2,900 staff worldwide. The company has consistently earned recognition for its advanced trading platforms, wide range of tradable securities, and competitive pricing. In 2025, IBKR was named the #1 broker for professional traders by Investopedia for the 5th consecutive year.

IBKR caters to both sophisticated, high-volume traders and casual investors, offering powerful tools and low costs. The broker provides access to stocks, options, futures, forex, bonds, and funds from global markets. IBKR's flagship platform, Trader Workstation (TWS), is known for its extensive customization options and advanced features. The company has also launched more user-friendly platforms like IBKR GlobalTrader and IBKR Desktop to meet the needs of beginner and intermediate investors.

IBKR is committed to providing high-quality trade execution, competitive margin rates, and a wide array of research and educational resources. However, the complexity of its tiered commission structure and the learning curve associated with its advanced platforms may be drawbacks for some users. To learn more about Interactive Brokers' offerings, visit their official website at interactivebrokers.com. While IBKR is a reputable broker, it's essential to carefully consider your investment goals and risk tolerance before choosing a brokerage firm.

Interactive Brokers Licenses and Regulatory

Interactive Brokers operates under a robust regulatory framework, holding licenses from multiple tier-1 authorities worldwide. As a publicly traded company (NASDAQ: IBKR), IBKR is subject to additional oversight and transparency requirements. The broker's primary regulator in the United States is the Securities and Exchange Commission (SEC), which enforces strict rules to protect investors and maintain fair, orderly, and efficient markets.

IBKR is also a member of the Financial Industry Regulatory Authority (FINRA), a self-regulatory organization that oversees U.S. broker-dealers. FINRA membership ensures that IBKR complies with high standards of ethical conduct and financial responsibility. Additionally, IBKR is regulated by the Commodity Futures Trading Commission (CFTC) for its futures and options trading services.

Internationally, IBKR holds licenses from several respected regulatory bodies, such as the Financial Conduct Authority (FCA) in the United Kingdom, the Investment Industry Regulatory Organization of Canada (IIROC), and the Hong Kong Securities and Futures Commission (SFC).5 These licenses demonstrate IBKR's commitment to meeting stringent regulatory requirements across its global operations.

Having multiple regulatory licenses is crucial for a brokerage firm as it enhances client security and trust. Regulators enforce strict rules related to capital adequacy, segregation of client funds, and transparent reporting.6 For example, the SEC requires broker-dealers to maintain a minimum net capital and keep client assets separate from the firm's own funds.7 These measures help protect clients' investments and reduce the risk of financial misconduct.

Compared to industry standards, IBKR stands out for its strong regulatory compliance and global presence. The broker's long history of operation without significant regulatory issues is a testament to its commitment to maintaining high standards.8 However, it's essential for investors to understand that regulatory oversight does not eliminate all risks associated with trading, and they should carefully consider their investment objectives and risk tolerance before choosing a broker.

| Country | Regulatory Authority |

|---|---|

| United States | Securities and Exchange Commission (SEC) |

| Financial Industry Regulatory Authority (FINRA) | |

| Commodity Futures Trading Commission (CFTC) | |

| United Kingdom | Financial Conduct Authority (FCA) |

| Canada | Investment Industry Regulatory Organization of Canada (IIROC) |

| Hong Kong | Securities and Futures Commission (SFC) |

| Japan | Financial Services Agency (FSA) |

| Singapore | Monetary Authority of Singapore (MAS) |

| Australia | Australian Securities and Investments Commission (ASIC) |

| India | Securities and Exchange Board of India (SEBI) |

| Ireland | Central Bank of Ireland |

| Luxembourg | Commission de Surveillance du Secteur Financier (CSSF) |

Trading Instruments

Interactive Brokers offers an extensive range of tradable assets, catering to the diverse needs of investors and traders worldwide. With access to over 150 markets in 33 countries, IBKR provides a comprehensive selection of financial instruments across multiple asset classes. This broad offering allows clients to construct well-diversified portfolios and take advantage of various market opportunities.

| Asset Class | Details |

|---|---|

| Stocks and ETFs | IBKR offers trading in stocks and ETFs from major global markets, including the U.S., Europe, Asia, and Australia. Clients can access over 135 stock exchanges and trade more than 2,300 ETFs. Supports fractional share trading. |

| Options and Futures | Access to options and futures contracts on stocks, indices, commodities, and currencies. Offers over 100 options markets and 30+ futures markets worldwide. Advanced tools available on Trader Workstation (TWS). |

| Forex and Metals | Forex trading in 24 currency pairs with competitive spreads and low commissions. Spot trading available for gold and silver. Supports advanced order types and real-time market data. |

| Bonds and Mutual Funds | Access to corporate bonds, municipal bonds, treasury bonds, and certificates of deposit (CDs). Over 1 million bond offerings from 170+ countries. Offers more than 43,000 mutual funds from 600+ fund families, with 19,000+ funds commission-free. |

| Cryptocurrencies | Allows trading of Bitcoin, Ethereum, Litecoin, and Bitcoin Cash. Available 24/7 with competitive spreads and low commissions. |

The breadth and depth of Interactive Brokers' tradable assets demonstrate the broker's commitment to meeting the evolving needs of investors and traders. By providing access to a diverse range of financial instruments, IBKR enables clients to pursue various investment strategies and adapt to changing market conditions. The broker's extensive offerings also reflect its strong global presence and ability to cater to the needs of both retail and institutional clients.

Compared to industry standards, IBKR stands out for its comprehensive selection of tradable assets, particularly in terms of global market access and the variety of asset classes supported. The broker's commitment to expanding its offerings, such as the recent addition of cryptocurrency trading, further demonstrates its adaptability to market trends and client demands.

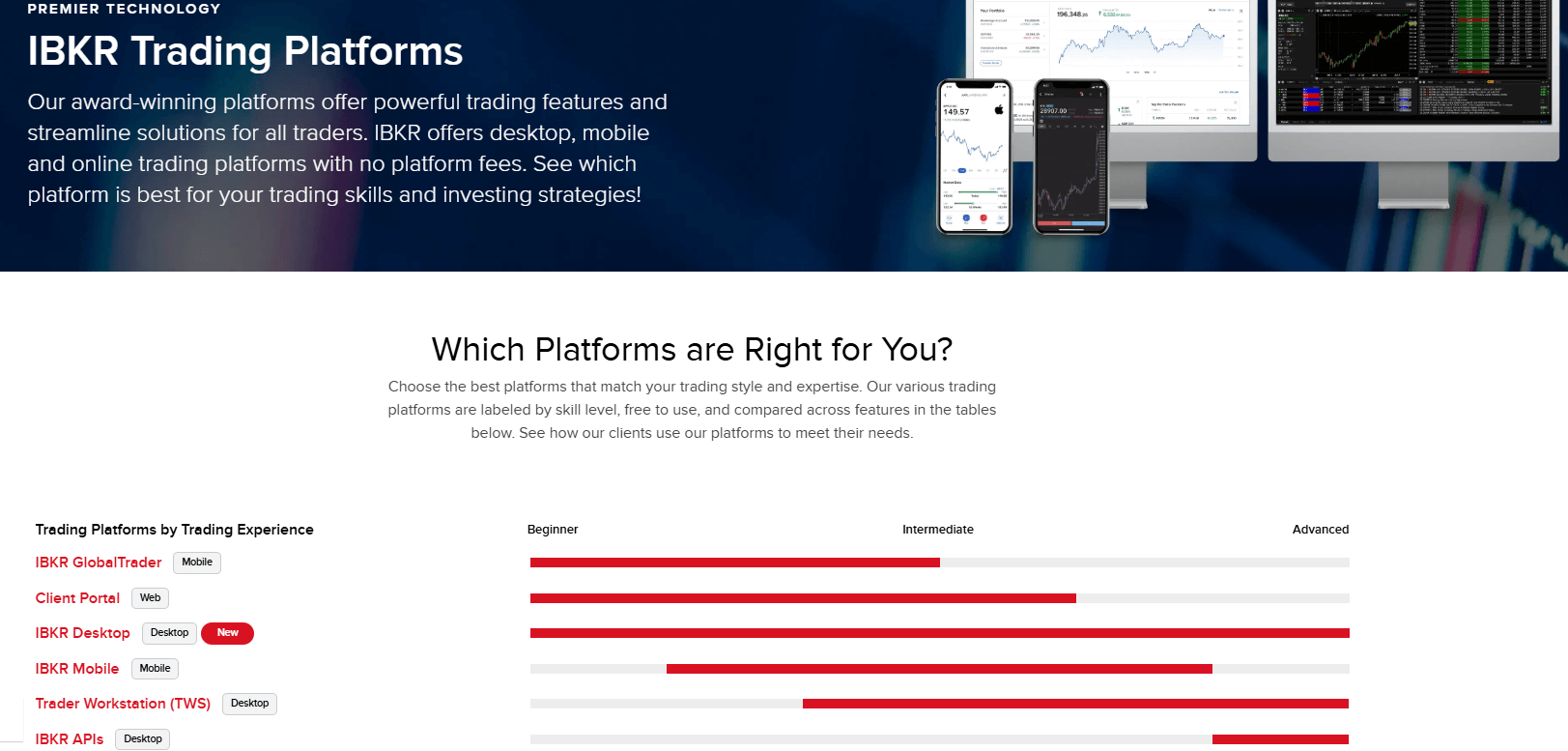

Trading Platforms

Interactive Brokers offers a range of trading platforms to cater to the diverse needs of its clients, from advanced traders to casual investors. The broker's proprietary platforms, along with its web-based and mobile solutions, provide users with the tools and flexibility needed to execute their trading strategies effectively.

- Trader Workstation (TWS): IBKR's flagship trading platform, Trader Workstation (TWS), is a powerful and customizable desktop application designed for professional traders and institutions. TWS offers advanced features such as real-time market data, charting tools, risk management options, and algorithmic trading capabilities. The platform supports multiple asset classes, including stocks, options, futures, forex, and bonds, and provides access to over 150 global markets.

- IBKR WebTrader: For traders who prefer a web-based solution, IBKR WebTrader offers a streamlined interface accessible through a web browser. WebTrader provides real-time quotes, interactive charts, and a variety of order types, allowing users to manage their portfolios and execute trades with ease. The platform is suitable for both new and experienced traders who value simplicity and accessibility.

- IBKR Mobile: IBKR's mobile trading apps, available for iOS and Android devices, enable clients to trade on the go. The mobile apps offer advanced features such as real-time quotes, charting tools, and the ability to place and manage orders across multiple asset classes. IBKR Mobile also includes a range of research and analysis tools, empowering traders to make informed decisions even when away from their desktops.

- API Solutions: For traders and developers who require custom trading solutions, IBKR offers a range of API solutions. These include the IBKR TWS API, which allows users to connect their own trading applications to IBKR's trading platform, and the IBKR Client Portal API, which enables access to account and trade data. The broker also supports the industry-standard Financial Information eXchange (FIX) protocol for direct market access.

The stability and reliability of Interactive Brokers' trading platforms are crucial for ensuring a seamless trading experience. IBKR consistently invests in technology to maintain the performance and security of its platforms, regularly updating and enhancing its offerings to meet evolving market demands and client expectations.

Trading Platforms Comparison Table

| Feature | Trader Workstation (TWS) | IBKR WebTrader | IBKR Mobile |

|---|---|---|---|

| Real-time market data | ✓ | ✓ | ✓ |

| Charting tools | ✓ | ✓ | ✓ |

| Risk management options | ✓ | ✓ | ✓ |

| Algorithmic trading | ✓ | ||

| Asset classes supported | Stocks, options, futures, forex, bonds | Stocks, options, futures, forex, bonds | Stocks, options, futures, forex, bonds |

| Global markets access | 150+ | 150+ | 150+ |

| Customizable interface | ✓ | ||

| Order types | Advanced | Basic | Advanced |

| Research and analysis tools | ✓ | ✓ | ✓ |

| Platform availability | Desktop | Web browser | iOS and Android |

Interactive Brokers How to Open an Account: A Step-by-Step Guide

Opening an account with Interactive Brokers is a straightforward process that can be completed online. The broker offers a user-friendly application process, allowing potential clients to start trading quickly. To begin, visit the IBKR website and follow these steps:

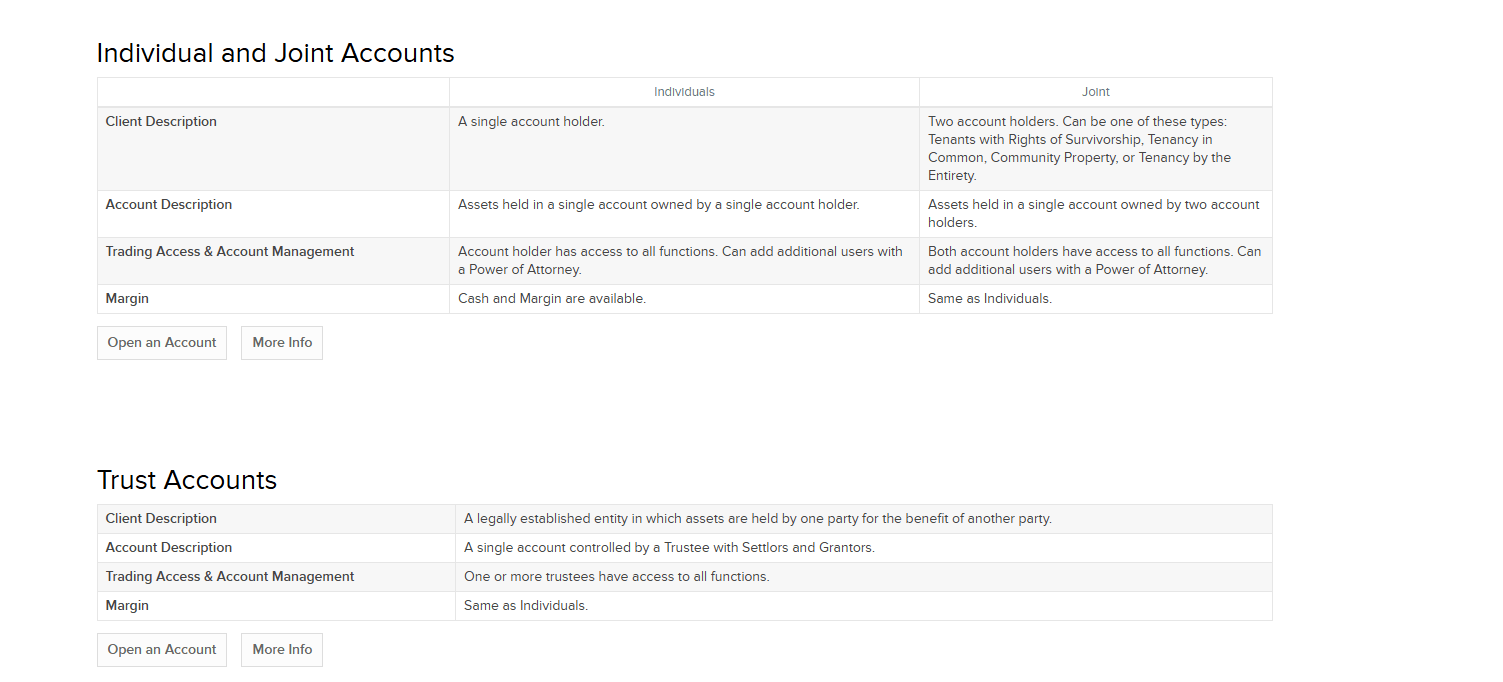

Step 1: Choose an Account Type Interactive Brokers offers a variety of account types, including individual, joint, trust, and IRA accounts. Select the account type that best suits your needs and investment goals.

Step 2: Provide Personal Information Fill out the online application form with your personal details, such as your name, address, date of birth, and contact information. You'll also need to provide your Social Security number or tax identification number.

Step 3: Complete the Questionnaire IBKR requires potential clients to complete a questionnaire to assess their financial situation, trading experience, and risk tolerance. Answer these questions accurately to ensure that the broker can provide you with appropriate services and support.

Step 4: Submit Identification Documents To comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, Interactive Brokers requires you to submit proof of identity and address. This typically includes a government-issued ID, such as a passport or driver's license, and a recent utility bill or bank statement.

Step 5: Choose Your Account Funding Method Interactive Brokers offers several account funding options, including bank wire transfers, ACH deposits, and check deposits. Select your preferred method and follow the instructions provided to fund your account.

Step 6: Review and Sign Agreements Before your account can be activated, you'll need to review and sign various agreements, such as the customer agreement and the margin agreement (if applicable). These agreements outline the terms and conditions of your relationship with Interactive Brokers.

Step 7: Wait for Account Approval Once you've submitted your application and all required documents, Interactive Brokers will review your information. The approval process typically takes 1-2 business days but may be longer in some cases.

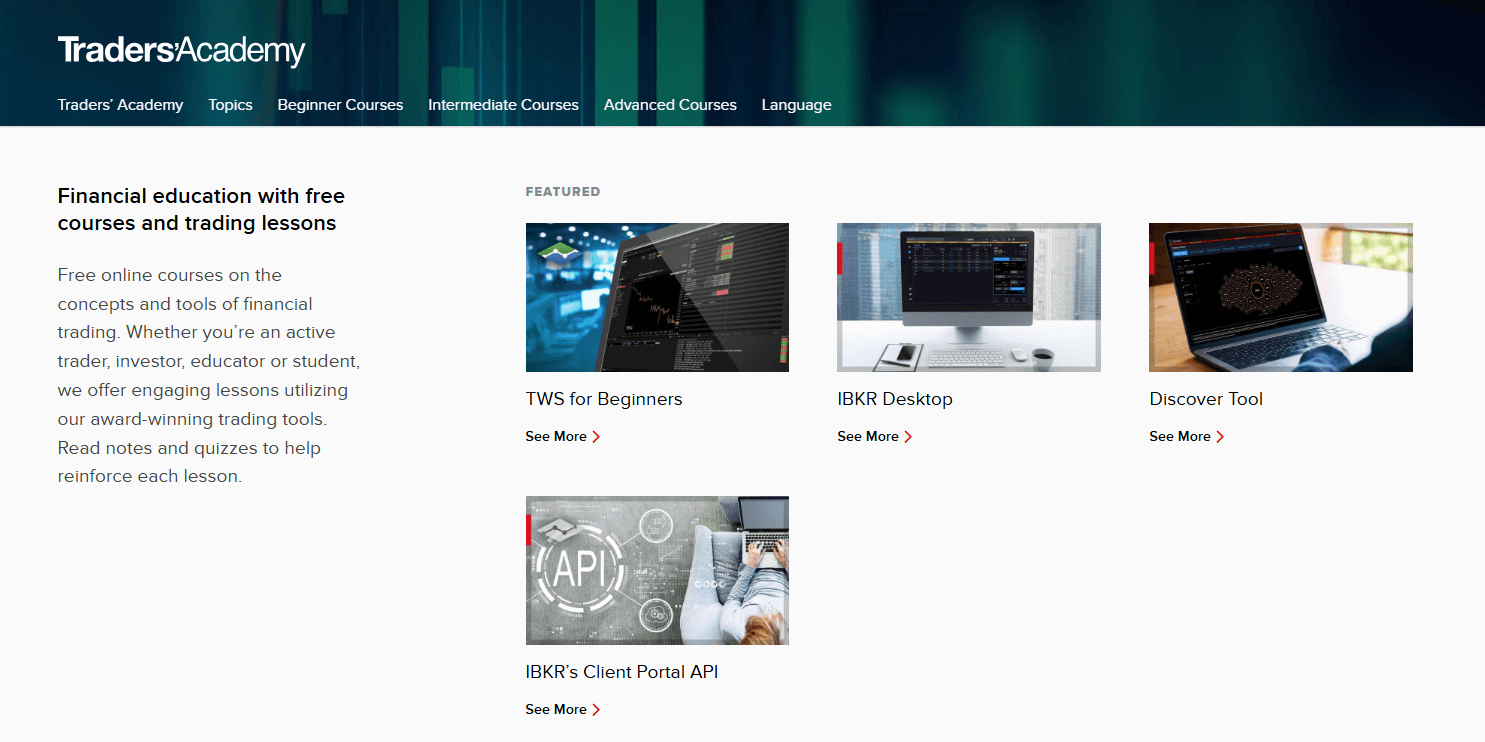

Charts and Analysis

Interactive Brokers offers a comprehensive suite of educational trading resources and tools to help clients enhance their knowledge and skills in the financial markets. These resources cater to traders and investors of all levels, from beginners to experienced professionals, and cover a wide range of topics related to trading, investing, and market analysis.

| Feature | Details |

|---|---|

| Trader's Academy | An online learning portal offering video courses, webinars, and tutorials organized by skill level (beginner, intermediate, advanced). Covers trading strategies, platform tutorials, and market analysis. Includes interactive quizzes and progress tracking. |

| IBKR Quant Blog | A resource for traders interested in quantitative trading, machine learning, and algorithmic strategies. Features articles, tutorials, and code samples on portfolio optimization, risk management, and market microstructure. |

| Traders' Insight | A daily market commentary and analysis blog with articles and videos from IBKR analysts and third-party contributors. Covers stocks, options, futures, forex, and fixed income with insights into market trends and economic events. |

| Trading Tools and Calculators | Provides real-time charts, technical indicators, options strategy builders, margin calculators, and portfolio analysis tools. Integrated into IBKR's trading platforms for seamless access. |

| Research and Market Data | Offers real-time quotes, fundamentals, news, and analyst ratings. Partners with providers like Thomson Reuters, Morningstar, and Zacks. Includes a Market Data Assistant tool for customization. |

| Webinars and Events | Regular webinars and events featuring industry experts, analysts, and traders. Covers market outlooks, trading strategies, and platform tutorials with opportunities for client interaction. |

Compared to industry standards, Interactive Brokers' educational resources and tools are extensive and well-developed. The broker's commitment to education is evident in the breadth and depth of its offerings, which cater to a wide range of skill levels and interests. By providing a diverse suite of resources, IBKR empowers its clients to continuously improve their trading knowledge and skills, which can ultimately lead to better investment decisions and outcomes.

Interactive Brokers Account Types

Interactive Brokers offers a range of account types to cater to the diverse needs of traders and investors. Whether you're a casual investor or a professional trader, IBKR has an account type that suits your requirements. Let's take a closer look at the main account types available:

| Account Type | Description | Key Features |

|---|---|---|

| IBKR Pro | Designed for active traders and investors who need advanced trading tools and capabilities. Offers access to IBKR's full range of platforms and asset classes across 150+ global markets. | - Competitive tiered pricing based on trading volume - Advanced order types and algorithms - Real-time market data and research - Customizable trading layouts and charts - API access for automated trading |

| IBKR Lite | A low-cost account for casual investors, offering commission-free trades on U.S. stocks and ETFs. Ideal for long-term investors and beginners. | - Commission-free trades on U.S. stocks and ETFs - No account minimums or inactivity fees - Access to IBKR's web and mobile trading platforms - Free market data for U.S. stocks and ETFs - Managed portfolios and robo-advisory services |

| Institutional Accounts | Tailored for hedge funds, proprietary trading groups, and financial advisors. Provides customized pricing, dedicated support, and specialized trading tools. | - Customized pricing based on trading volume and assets under management - Access to prime brokerage services - Advanced reporting and portfolio management tools - Dedicated account management and support - Compliance and regulatory support |

| Individual Retirement Accounts (IRAs) | Various IRA options, including Traditional, Roth, Rollover, and SEP IRAs. Designed to help clients invest for retirement with tax advantages. | - Tax-deferred or tax-free growth potential - Access to a wide range of investment options - Low trading costs and no account minimums - Seamless transfer of existing IRAs to IBKR - Comprehensive reporting and tax documentation |

By offering multiple account types, Interactive Brokers demonstrates its commitment to serving a diverse client base with varying trading needs and preferences. The flexibility and range of options allow traders and investors to select an account type that best aligns with their goals, experience level, and trading style.

Moreover, IBKR's account types are designed to be cost-effective and transparent, with competitive fees and no hidden charges. The broker's focus on technology and automation enables it to offer low-cost trading across all account types, making it an attractive choice for cost-conscious traders.

Account Types Comparison Table

| Feature | IBKR Pro | IBKR Lite | Institutional | IRAs |

|---|---|---|---|---|

| Minimum Deposit | $0 | $0 | Varies | $0 |

| Commissions | Tiered | $0 for US stocks/ETFs | Customized | Tiered |

| Market Data | Paid | Free for US stocks/ETFs | Paid | Paid |

| Trading Platforms | TWS, Web, Mobile | Web, Mobile | TWS, Web, Mobile | TWS, Web, Mobile |

| Order Types | Advanced | Basic | Advanced | Advanced |

| Research and Tools | Extensive | Basic | Extensive | Extensive |

| Margin Rates | Tiered | Flat | Customized | N/A |

| API Access | Yes | No | Yes | Yes |

| Dedicated Support | No | No | Yes | No |

| Account Types | Individual, Joint, Trust, IRA | Individual, Joint, IRA | Hedge Fund, Prop Trading, RIA | Traditional, Roth, Rollover, SEP |

| Asset Classes | Stocks, Options, Futures, Forex, Bonds, Funds | Stocks and ETFs | All | All |

| Short Selling | Yes | Yes | Yes | No |

| Fractional Shares | Yes | Yes | Yes | Yes |

| FDIC Insurance | $250,000 | $250,000 | $250,000 | $250,000 |

| SIPC Insurance | $500,000 | $500,000 | $500,000 | $500,000 |

Negative Balance Protection

In the world of online trading, negative balance protection is a crucial feature that helps mitigate the risk of losses exceeding a trader's account balance. This protection is especially important for traders who use leverage or margin, as sudden market movements can potentially lead to significant losses that surpass the funds available in their account. Interactive Brokers offers negative balance protection to its clients, ensuring that they cannot lose more money than they have deposited in their account. This policy safeguards traders from the risks associated with volatile markets and unforeseen events that may cause their positions to incur substantial losses. Without negative balance protection, a trader could potentially face a scenario where their account balance becomes negative, meaning they owe money to the broker. This situation can arise when a highly leveraged position moves against the trader, resulting in losses that exceed the account's available funds. In extreme cases, such as the Swiss franc shock of 2015 or the extreme volatility caused by the COVID-19 pandemic in 2020, traders without negative balance protection found themselves owing significant sums to their brokers. Interactive Brokers' negative balance protection policy ensures that clients' losses are limited to the funds in their accounts. If a trader's position incurs losses that exceed their account balance, IBKR will absorb the negative balance, effectively protecting the trader from additional financial obligations. It is important to note that negative balance protection does not prevent losses within the account itself. Traders can still lose all of the money they have deposited if their positions move against them. However, this protection provides peace of mind, knowing that losses cannot extend beyond the account balance, even in extreme market conditions. Interactive Brokers' negative balance protection applies to all account types, including individual, joint, and institutional accounts. This universal coverage demonstrates IBKR's commitment to managing risk and safeguarding clients' funds across its entire user base. To maintain negative balance protection, traders must ensure that they manage their positions responsibly and maintain sufficient funds in their accounts to cover potential losses. This includes monitoring margin requirements, using appropriate risk management techniques, and avoiding excessive leverage. In summary, Interactive Brokers' negative balance protection is a vital feature that helps protect traders from losses exceeding their account balance. By absorbing negative balances, IBKR ensures that clients cannot lose more money than they have deposited, providing a crucial safety net in volatile market conditions. This protection, combined with responsible trading practices, can help traders manage risk effectively and trade with greater confidence.

Interactive Brokers Deposits and Withdrawals

Interactive Brokers offers a range of convenient and secure deposit and withdrawal options to cater to the needs of its diverse client base. The broker's streamlined processes ensure that traders can efficiently manage their funds and focus on their trading activities.

Deposit Options

Interactive Brokers accepts several methods for funding your account:| Funding Method | Description | Processing Time | Fees |

|---|---|---|---|

| Bank Wire Transfer | The quickest and most common way to fund an IBKR account. Funds are available for trading immediately upon receipt. | 1-2 business days | No fees from IBKR |

| ACH (Automated Clearing House) Transfer | U.S. clients can transfer funds from their bank accounts to IBKR. | 2-3 business days | Free |

| Check Deposit | U.S. clients can mail checks to IBKR's New York office. | 3-5 business days | $10 processing fee |

| Online Bill Payment | U.S. clients can use their bank’s online bill payment system for deposits. | 1-2 business days | Free |

| Direct Rollover | Clients can roll over assets from another brokerage or retirement account. | 3-5 business days | May incur fees from the sending institution |

Withdrawal Options

Interactive Brokers offers several methods for withdrawing funds from your account:| Withdrawal Method | Description | Processing Time | Fees |

|---|---|---|---|

| Bank Wire Transfer | Fastest way to withdraw funds from IBKR. | 1-2 business days | $10 (domestic), $25 (international) |

| ACH Transfer | U.S. clients can transfer funds from IBKR to their bank accounts. | 2-3 business days | Free |

| Check Withdrawal | Clients can request a check mailed to their registered address. | 3-5 business days | $10 fee |

| Debit Mastercard | Clients with an IBKR Debit Mastercard can make ATM withdrawals and purchases. | Instant (depending on transaction) | Transaction fees may apply |

It's important to note that Interactive Brokers may require additional verification for large or frequent withdrawals to ensure the security of clients' funds. The broker also reserves the right to hold withdrawal requests for up to seven business days to protect against fraud and ensure compliance with anti-money laundering regulations.

Interactive Brokers' deposit and withdrawal policies are designed to be transparent, efficient, and secure. The broker's wide range of funding and withdrawal options cater to the diverse needs of its global client base, while its commitment to safeguarding clients' assets ensures a safe and reliable trading experience.

It's important to note that Interactive Brokers may require additional verification for large or frequent withdrawals to ensure the security of clients' funds. The broker also reserves the right to hold withdrawal requests for up to seven business days to protect against fraud and ensure compliance with anti-money laundering regulations.

Interactive Brokers' deposit and withdrawal policies are designed to be transparent, efficient, and secure. The broker's wide range of funding and withdrawal options cater to the diverse needs of its global client base, while its commitment to safeguarding clients' assets ensures a safe and reliable trading experience.

Support Service for Customer

Reliable customer support is a critical component of a positive trading experience. In the fast-paced world of online trading, having access to knowledgeable and responsive support can make a significant difference in a trader's success and satisfaction. Interactive Brokers recognizes the importance of providing excellent customer support and offers a range of channels to assist traders with their queries and concerns. Interactive Brokers' customer support team is available 24 hours a day, 6 days a week, ensuring that traders can access assistance whenever they need it. This extended availability is particularly beneficial for traders who operate in different time zones or prefer to trade outside of traditional business hours. Traders can reach out to Interactive Brokers' customer support through the following channels:

| Support Channel | Description | Response Time |

|---|---|---|

| Live Chat | Real-time chat feature on IBKR's website for quick queries and general assistance. | Instant |

| Traders can email IBKR's support team at help@interactivebrokers.com. Suitable for less urgent matters. | Within 24 hours | |

| Phone Support | Local phone support available in various countries for multilingual assistance. | 2-3 minutes wait time |

| Ticket System | Support tickets can be submitted through the Client Portal for easy tracking and response management. | Within 24 hours |

| Knowledge Base | Comprehensive knowledge base with articles, tutorials, and FAQs, available 24/7 for self-help. | Instant (24/7 availability) |

Customer Support Comparison Table

| Feature | Interactive Brokers |

|---|---|

| Availability | 24/6 |

| Live Chat | Yes |

| Email Support | Yes (help@interactivebrokers.com) |

| Phone Support | Yes (local numbers) |

| Support Tickets | Yes (via Client Portal) |

| Knowledge Base | Yes |

| Social Media Support | Yes (Twitter, Facebook) |

| Languages | English, Chinese, Japanese, Russian, French, German, Italian, Spanish |

| Average Response Time | Live Chat: 2-3 minutes, Email: 24 hours, Phone: 2-3 minutes, Tickets: 24 hours |

Prohibited Countries

Interactive Brokers is a global brokerage firm that aims to provide its services to traders and investors worldwide. However, due to various factors such as local regulations, licensing requirements, and geopolitical considerations, IBKR is prohibited from operating or offering its services in certain countries and regions.

The primary reason behind these restrictions is compliance with international laws and regulations. Each country has its own set of rules governing financial services, and failure to adhere to these regulations can result in legal consequences for the broker and its clients. Interactive Brokers prioritizes compliance and takes a proactive approach to ensure that it operates within the legal framework of each jurisdiction.

Another factor that influences IBKR's ability to provide services in certain countries is the availability of necessary licenses and authorizations. In some regions, brokers are required to obtain specific licenses or meet certain requirements before they can offer their services to local residents. If Interactive Brokers is unable to secure these licenses or meet the necessary criteria, it may be prohibited from operating in those countries.

Geopolitical factors, such as economic sanctions, trade embargoes, or political instability, can also impact a broker's ability to serve clients in specific regions. Interactive Brokers complies with all applicable sanctions and restrictions imposed by the United States, the European Union, and other relevant authorities to ensure that it does not engage in prohibited activities or transactions.

It is essential for traders and investors to be aware of the countries where Interactive Brokers is prohibited from operating. Attempting to access IBKR's services from a restricted country may result in the violation of local laws and regulations, which can lead to legal consequences and the potential freezing or closure of trading accounts.

To help traders identify whether they are eligible to open an account with Interactive Brokers, the following is a list of regions where IBKR is allowed to operate:

Regions where Interactive Brokers is allowed to operate:

- North America, South America, Europe, Asia, Australia and New Zealand, Africa (except for prohibited countries)5

Please note that this list is subject to change based on evolving regulations and geopolitical developments. For the most up-to-date information on prohibited countries and eligibility requirements, it is recommended to visit Interactive Brokers' official website or contact their customer support team.

Special Offers for Customers

Interactive Brokers occasionally provides special offers and promotions to attract new clients and reward existing ones for their loyalty. These offers can include discounted commissions, bonus funds, or other incentives that help traders maximize their returns and minimize their costs. However, it's important to note that IBKR's promotions are generally less frequent and less generous compared to some other online brokers, as the company focuses more on providing consistently low fees and high-quality services.

As of February 2025, Interactive Brokers has the following special offer available:

- IBKR Pro Margin Rate Reduction: New clients who open an IBKR Pro account and fund it with at least $100,000 are eligible for a 0.25% reduction on their margin rates for the first 6 months. This offer is designed to help high-volume traders and investors save on borrowing costs and maximize their returns. To qualify, clients must maintain a minimum balance of $100,000 and meet certain trading activity thresholds.

It's important to carefully review the terms and conditions of any special offer before participating. Some promotions may have specific requirements, such as minimum deposit amounts, trading volume thresholds, or time limitations, that could impact a trader's ability to fully benefit from the offer. Additionally, it's crucial to consider the long-term value and quality of a broker's services, rather than basing decisions solely on short-term promotions.

Conclusion

Throughout this comprehensive review, I have thoroughly examined Interactive Brokers' services, platforms, and offerings to provide an informed assessment of their safety, reliability, and overall reputation as an online broker.

One of the most compelling aspects of Interactive Brokers is their strong regulatory compliance. They are regulated by multiple tier-1 authorities, including the SEC, FINRA, and FCA, which demonstrates their commitment to maintaining high standards of security and transparency. This robust regulatory framework instills confidence in their clients, as it ensures that IBKR operates within strict guidelines designed to protect investors' interests.

Interactive Brokers' global presence is another testament to their reliability. With a wide range of tradable assets across 150 markets in 33 countries, they have established themselves as a trusted broker for traders and investors worldwide. Their ability to navigate diverse regulatory landscapes and offer services in multiple languages further underscores their dedication to serving a global clientele.

In terms of customer support, Interactive Brokers has shown a strong commitment to assisting their clients. With 24/6 availability, multiple support channels, and an extensive knowledge base, they provide traders with the resources needed to address their concerns and make informed decisions. While their special offers may not be as frequent or generous as some competitors, IBKR's focus on providing consistently low fees and high-quality services demonstrates their prioritization of long-term client satisfaction over short-term promotions.

Interactive Brokers' advanced trading platforms and tools are a significant draw for experienced traders and investors. Their flagship platform, Trader Workstation (TWS), offers a wide range of customization options and powerful features, empowering users to execute complex strategies and analyze market data effectively. At the same time, IBKR has made efforts to cater to less experienced traders through more user-friendly interfaces like IBKR GlobalTrader and IBKR Mobile.

Another area where Interactive Brokers excels is in their educational resources. With offerings like Trader's Academy, IBKR Quant Blog, and Traders' Insight, they provide a wealth of information and insights to help traders improve their skills and stay informed about market trends. This commitment to education and knowledge-sharing further reinforces their reputation as a broker that prioritizes the success and growth of their clients.

However, it's important to acknowledge that Interactive Brokers' extensive offerings and advanced platforms may come with a learning curve for some users. While they have taken steps to simplify their interfaces and provide educational resources, the sheer depth of their features and tools may be overwhelming for novice traders.

In conclusion, Interactive Brokers has established itself as a reputable and reliable online broker, with a strong focus on regulatory compliance, global market access, and advanced trading tools. Their commitment to transparency, education, and customer support instills confidence in their clients, while their competitive fees and diverse range of offerings make them an attractive choice for experienced traders and investors. Although their platforms may require some learning and adaptation, the benefits of choosing Interactive Brokers as a broker are clear for those seeking a comprehensive and trustworthy trading partner.