IQ Option Review: Regulatory Compliance, Platform Features, pros and cons, and More

IQ Option

Cyprus

Cyprus

-

Minimum Deposit $10

-

Withdrawal Fee $0

-

Leverage 500:1

-

Spread From 0.6

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Unavailable

Licenses

Cyprus Market Making (MM)

Cyprus Market Making (MM)

Softwares & Platforms

Customer Support

()

()

Supported language: Chinese (Simplified), English, German, Italian, Portuguese, Spanish

Social Media

Summary

IQ Option is a popular online trading platform offering a wide range of financial instruments, including forex, stocks, cryptocurrencies, and options. The broker provides a user-friendly proprietary trading platform with advanced charting tools and technical indicators. Traders benefit from a low minimum deposit, competitive spreads, and various educational resources. IQ Option also offers a demo account for risk-free practice. With multiple payment methods and responsive customer support, it caters to traders of all levels worldwide.

- Regulated by CySEC, ensuring client protection and adherence to strict financial guidelines

- User-friendly proprietary trading platform with a wide range of tradable assets

- Competitive spreads and low minimum deposit requirement of just $10

- Free demo account with $10,000 in virtual funds for risk-free practice trading

- 24/7 multilingual customer support via live chat, email, and phone

- Unique "Multicharts" feature for simultaneous analysis of up to 4 assets

- Supports cryptocurrency deposits and withdrawals for added flexibility

- Offers a range of educational resources, including video tutorials and webinars

- Regular market analysis and insights from expert analysts

- Accessible to traders worldwide, with support for multiple languages and payment methods

- Limited range of tradable assets compared to some competitors

- No support for popular third-party platforms like MetaTrader 4 or 5

- Some users have reported slow withdrawal processing times

- Occasional delays in account verification, which can be frustrating for traders

- Lack of extensive promotional offers or loyalty programs

- No guaranteed stop-loss or negative balance protection

- Relatively high spreads on some assets compared to industry averages

- Limited customization options for the trading platform

- No support for social or copy trading features

- Cryptocurrency deposits and withdrawals may be subject to higher fees

Overview

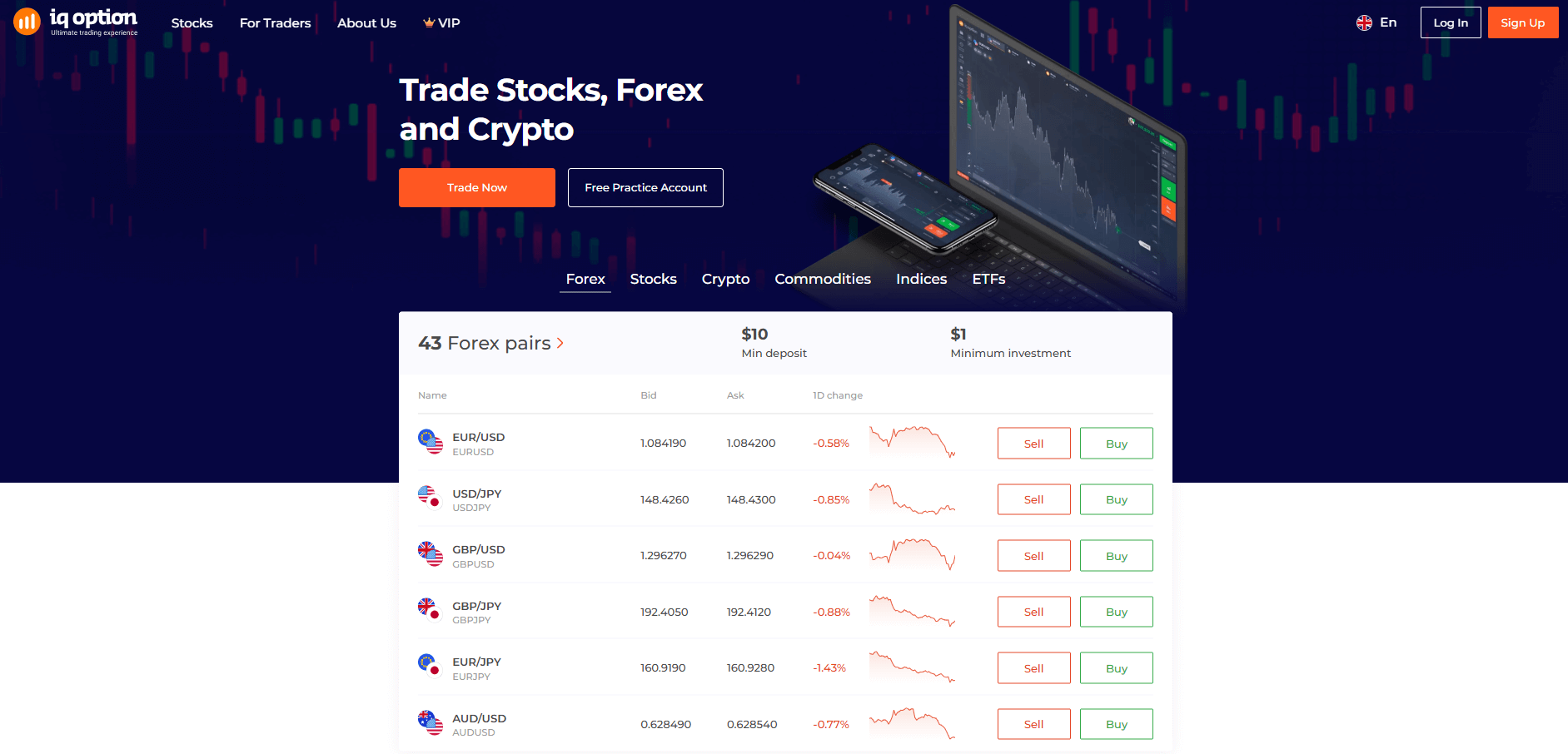

IQ Option is an online trading platform founded in 2013 that has rapidly grown to become a prominent player in the industry. With over 140 million registered users across more than 170 countries as of 2025, IQ Option offers access to 300+ financial instruments including forex, stocks, cryptocurrencies, commodities, and ETFs.

The broker has been recognised with several awards in recent years such as "Best Trading Platform" by FX Daily Info and "Fastest-Growing Online Broker in Asia" by International Business Magazine, both in 2022. Detailed information about the company's offerings and regulatory status can be found on their official website at iqoption.com.

IQ Option provides a proprietary web-based and mobile trading platform designed for ease of use. The minimum deposit required is just $10, making it accessible to beginner traders. They also offer a free demo account funded with $10,000 in virtual money to practise trading risk-free.

For those who prioritise trust and safety, it's important to note that IQ Option is regulated by the Cyprus Securities and Exchange Commission (CySEC) through their subsidiary IQOption Europe Ltd. However, some users have reported issues with slow withdrawal processing times and account verification delays.

While IQ Option can be an attractive choice for those seeking a user-friendly platform with access to multiple global markets, it's crucial to be aware of the high-risk nature of trading. Potential clients should thoroughly evaluate their financial goals and risk tolerance before investing real money. As with any broker, due diligence is recommended.

Overview Table

| Category | Information |

|---|---|

| Foundation | 2013 |

| Headquarters | Cyprus |

| Regulation | CySEC license 247/14 (held by IQOption Europe Ltd) |

| Countries Served | 170+ |

| Registered Users | 140+ million |

| Available Markets | Forex, Stocks, Cryptocurrencies, Commodities, ETFs (300+ instruments total) |

| Minimum Deposit | $10 |

| Demo Account | Yes – $10,000 in virtual funds |

| Trading Platform | Proprietary web and mobile platforms |

| Customer Support | 24/7, multilingual |

Facts List

- Founded in 2013, IQ Option has grown to 140+ million users globally by 2025

- Low $10 minimum deposit and free $10K demo account make it beginner-friendly

- Offers 300+ tradable instruments across forex, stocks, crypto, commodities, ETFs

- Provides an intuitive proprietary web and mobile platform (no MT4/5 support)

- CySEC regulated under license 247/14 held by EU subsidiary IQOption Europe Ltd

- 24/7 customer support available in multiple languages

- Binary options can provide payouts up to 95% on successful trades

- Lacks some advanced features/customization compared to platforms like MT4

- Some users report withdrawal delays and verification issues

- As with any trading, carefully consider risks and never invest more than you can afford to lose

IQ Option Licenses and Regulatory

IQ Option operates under the regulatory oversight of the Cyprus Securities and Exchange Commission (CySEC), a respected financial regulatory authority in the European Union. The broker's CySEC-regulated entity, IQOption Europe Ltd, holds license number 247/14, which can be verified on the official CySEC website.

CySEC regulation is a strong indicator of a broker's commitment to maintaining high operational standards and providing a secure trading environment for clients. Brokers licensed by CySEC must adhere to strict rules designed to protect investors, such as maintaining segregated client funds, submitting regular financial reports, and following transparent pricing and execution practices.

While IQ Option is not regulated in every country where it operates, its CySEC licence allows it to serve clients across most European Economic Area countries. The broker also complies with international anti-money laundering (AML) and know-your-customer (KYC) regulations.

Licenses List

- Cyprus Securities and Exchange Commission (CySEC): License #247/14 held by IQOption Europe Ltd

Trading Instruments

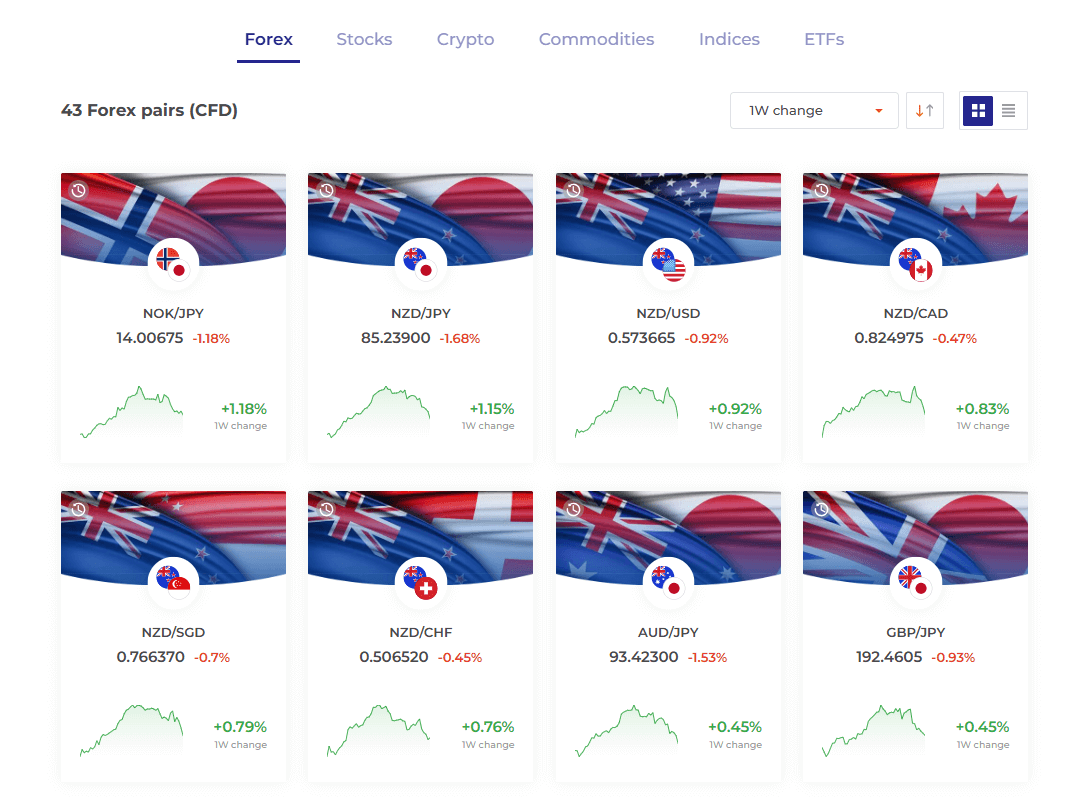

IQ Option offers a diverse range of tradable assets, providing investors with ample opportunities to build a well-rounded portfolio. With over 300 instruments available, the broker caters to traders with various risk appetites and financial goals. Detailed information about each asset class can be found on IQ Option's official website.

| Asset Class | Details |

|---|---|

| Forex | Over 50 currency pairs, including majors (EUR/USD, GBP/USD) and exotics. Spreads start from 0.6 pips, suitable for both beginners and experienced traders. |

| Stocks | Trade shares of 150+ major global companies (Apple, Amazon, Microsoft). Covers various sectors for diversification and market opportunities. |

| Cryptocurrencies | Wide selection of digital assets, including Bitcoin, Ethereum, and Litecoin, plus smaller altcoins. 24/7 trading with high volatility. |

| Commodities | Includes popular assets like gold, silver, oil, and gas. Useful for hedging against market uncertainty and portfolio diversification. |

| ETFs | A selection of Exchange-Traded Funds covering various sectors and geographies. Provides exposure to multiple assets in a single trade. |

| Binary Options | Available in select jurisdictions with potential payouts up to 95%. Traders speculate on asset price movements within a set timeframe. High risk, high reward. |

By providing access to such a wide array of tradable assets, IQ Option empowers its clients to create custom portfolios aligned with their unique financial goals and risk tolerances. The broker's commitment to asset diversity also demonstrates its adaptability to evolving market trends and investor demands.

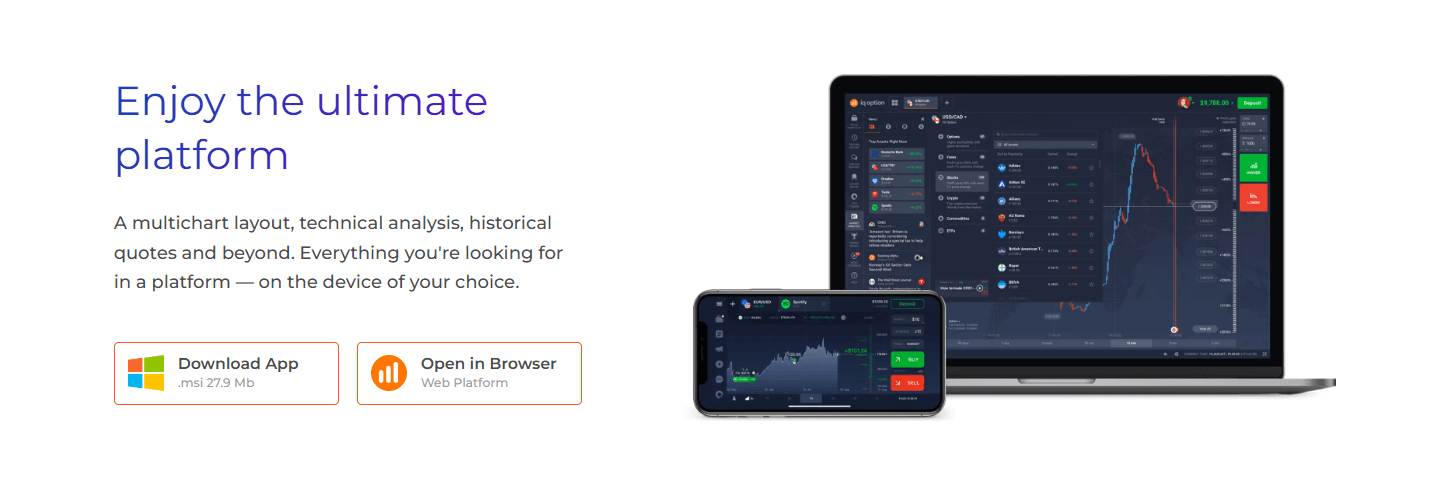

Trading Platforms

IQ Option provides clients with a user-friendly proprietary trading platform that caters to both beginner and experienced traders. While the broker does not offer the popular MetaTrader 4 (MT4) or MetaTrader 5 (MT5) platforms, its in-house solution is designed to meet the needs of modern traders.

Web Trading Platform

IQ Option's web-based platform can be accessed directly through a browser, eliminating the need for any software downloads or installations. The platform features a clean, intuitive interface that allows traders to quickly navigate between assets, view real-time quotes, and execute trades with just a few clicks.

The web platform also includes a comprehensive suite of charting tools and technical indicators, empowering traders to perform in-depth market analysis. Customisable layouts and the ability to save preferred settings enhance the platform's usability and efficiency.

Mobile Trading Apps

For traders who value flexibility and the ability to manage their portfolios on the go, IQ Option offers mobile apps for both iOS and Android devices. The mobile apps provide full access to the broker's range of tradable assets, as well as essential features like real-time quotes, charting tools, and secure account management.

The mobile apps feature a streamlined interface optimised for smaller screens, ensuring that traders can easily view their positions, monitor markets, and execute trades from anywhere at any time.

Unique Platform Features

One of the standout features of IQ Option's trading platform is the "Multicharts" tool, which allows traders to view and analyse up to 4 assets simultaneously. This feature is particularly valuable for those who employ cross-asset analysis or hedge their positions across multiple markets.

IQ Option also offers a range of free trading indicators and graphical tools, including volatility alerts, market sentiment, and economic calendars. These resources help traders stay informed about market conditions and make data-driven decisions.

Trading Platforms Comparison Table

| Feature | IQ Option Proprietary Platform |

|---|---|

| Web-based | Yes |

| Mobile Apps | Yes |

| Demo Account | Yes |

| Automated Trading | No |

| Custom Indicators | Limited |

| Multicharts (4 Assets) | Yes |

| Built-in News & Analysis | Yes |

IQ Option How to Open an Account: A Step-by-Step Guide

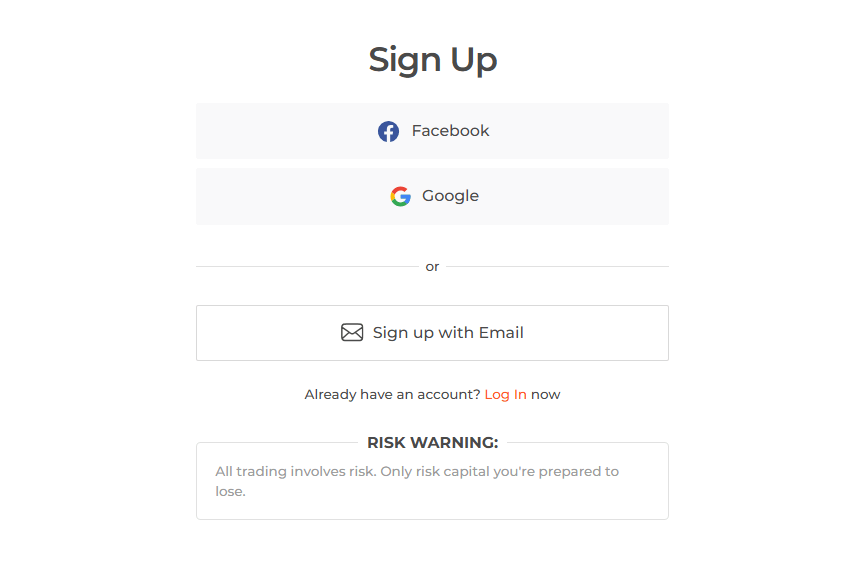

Opening an account with IQ Option is a straightforward process that can be completed entirely online. The broker has streamlined the registration procedure to make it user-friendly and accessible to traders of all experience levels. Here's a step-by-step guide on how to get started:

Step 1: Visit the IQ Option Website Go to the official IQ Option website. Click on the "Sign Up" button located in the top right corner of the homepage.

Step 2: Complete the Registration Form Fill out the registration form with your personal information, including your full name, email address, and a secure password. You'll also need to select your preferred account currency and agree to the broker's terms and conditions.

Step 3: Verify Your Email After submitting the registration form, you'll receive an email from IQ Option with a verification link. Click on the link to confirm your email address and activate your trading account.

Step 4: Make a Deposit To start trading with real money, you'll need to fund your account. IQ Option accepts various payment methods, including credit/debit cards, e-wallets like Skrill and Neteller, and bank transfers. The minimum deposit required is just $10, making it accessible for traders with smaller budgets.

Step 5: Verify Your Identity To comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, IQ Option requires clients to verify their identity. This typically involves uploading a copy of your government-issued ID, such as a passport or driver's license, and a proof of address, like a utility bill or bank statement.

Step 6: Start Trading Once your account is funded and verified, you can begin trading on IQ Option's platform. You'll have access to a wide range of tradable assets, including forex, stocks, cryptocurrencies, and more. It's recommended to start with a demo account to familiarize yourself with the platform and test your trading strategies risk-free.

Benefits of Opening an Account with IQ Option

- Low minimum deposit of just $10

- Free demo account with $10,000 in virtual funds

- User-friendly web and mobile trading platforms

- Wide selection of tradable assets across multiple markets

- Competitive spreads and fast execution speeds

- 24/7 customer support in multiple languages

Charts and Analysis

IQ Option provides a range of educational resources and tools to support its clients in making informed trading decisions. These resources cater to traders of all experience levels, from beginners seeking to understand the fundamentals of trading to advanced traders looking to refine their strategies. More detailed information on these offerings can be found on IQ Option's official website.

| Feature | Details |

|---|---|

| Trading Charts | Advanced charting tools with customisable timeframes, technical indicators, and graphical objects (trend lines, Fibonacci retracements). The Multicharts feature allows viewing up to 4 assets simultaneously. |

| Economic Calendar | Displays key market events, including central bank announcements, GDP reports, and employment figures, helping traders manage risk and seize opportunities. |

| Market Analysis | Regular updates from expert analysts covering fundamental and technical insights. Delivered via articles, videos, and webinars. |

| Educational Resources | A variety of learning materials, including: |

| - Video Tutorials | Covers trading basics, platform usage, and risk management. |

| - E-books & PDFs | Downloadable content on trading strategies and concepts. |

| - Webinars | Live and recorded sessions hosted by experienced traders and analysts. |

| - FAQ Section | Answers to common trading and platform-related questions. |

While IQ Option's educational offerings are respectable, they may not be as extensive as some industry leaders known for their emphasis on trader education. The broker could benefit from expanding its range of interactive courses, live workshops, and personalised mentoring programs to further support its clients' learning and development.

IQ Option Account Types

IQ Option offers a streamlined approach to account types, providing traders with a single, versatile account that grants access to all the broker's assets and features. This all-in-one account is designed to cater to the needs of both beginner and experienced traders, offering flexibility and simplicity.

Standard Account

IQ Option's Standard Account is the default option for all clients. With a minimum deposit of just $10, this account type is highly accessible, even for those new to trading. Despite its low entry threshold, the Standard Account provides access to the broker's full range of tradable assets, including forex, stocks, cryptocurrencies, commodities, and ETFs.

One of the standout features of IQ Option's Standard Account is its competitive spreads, which start from 0.6 pips on popular forex pairs. This allows traders to keep their trading costs low and potentially maximise their returns. The account also offers leverage of up to 1:500 on forex, allowing clients to control larger positions with smaller capital outlays.

Demo Account

In addition to the Standard Account, IQ Option provides a free Demo Account funded with $10,000 in virtual currency. This account type is invaluable for beginners looking to practise trading strategies and familiarise themselves with the platform's features without risking real money. Experienced traders can also benefit from the Demo Account by testing new strategies or experimenting with different assets.

The Demo Account mirrors the functionality and trading conditions of the Standard Account, ensuring that clients can seamlessly transition to real money trading when they feel confident and prepared.

Islamic Account

For traders who adhere to Islamic religious principles, IQ Option offers a swap-free Islamic Account. This account type complies with Sharia law by removing overnight interest charges (swaps) on positions held open past the end of the trading day. To open an Islamic Account, clients must contact IQ Option's customer support team and provide proof of their religious affiliation.

While IQ Option's single account type approach may lack the tiered structure offered by some competitors, it has the advantage of simplicity and accessibility. Traders don't need to navigate complex account hierarchies or meet high minimum deposit thresholds to access the broker's full range of features and assets.

Account Types Comparison Table

| Feature | Standard Account | Demo Account | Islamic Account |

|---|---|---|---|

| Minimum Deposit | $10 | N/A | $10 |

| Tradable Assets | All | All | All |

| Spreads (EUR/USD) | From 0.6 pips | From 0.6 pips | From 0.6 pips |

| Leverage (Forex) | Up to 1:500 | Up to 1:500 | Up to 1:500 |

| Virtual Funds | N/A | $10,000 | N/A |

| Swap-Free | No | N/A | Yes |

| Requires Religious Proof | No | N/A | Yes |

Negative Balance Protection

IQ Option offers negative balance protection to all its clients as part of its commitment to responsible trading and risk management. This means that if a trader's account balance falls below zero due to trading losses, IQ Option will absorb the negative balance and reset the account to zero. For example, if a trader has a $1,000 account balance and experiences a series of losing trades that would have resulted in a -$200 balance, IQ Option's negative balance protection will kick in, and the account balance will be adjusted to $0. The trader will not be required to pay the additional $200 to the broker. It's important to note that negative balance protection does not prevent losses; it only limits the potential losses to the funds available in the trader's account. Traders should still exercise caution and employ sound risk management strategies, such as setting appropriate stop-loss orders and maintaining reasonable leverage levels.

Terms and Conditions

IQ Option's negative balance protection policy applies to all trading accounts and instruments offered by the broker. However, traders should be aware that this protection may not cover losses resulting from technical issues, such as platform malfunctions or connectivity problems. Additionally, IQ Option reserves the right to review and adjust negative balances on a case-by-case basis, particularly in instances where the broker suspects abuse or manipulation of the policy.IQ Option Deposits and Withdrawals

IQ Option provides a range of convenient deposit and withdrawal options to cater to the diverse needs of its global client base. The broker understands the importance of efficient and secure transactions, ensuring that traders can easily fund their accounts and access their profits.

Deposit Methods

IQ Option accepts the following deposit methods:| Payment Method | Processing Time | Fees |

|---|---|---|

| Credit/Debit Cards (Visa, Mastercard) | Instant | No fees |

| E-Wallets (Skrill, Neteller, WebMoney) | Instant | No fees |

| Bank Transfer | 1-3 business days | Fees may apply depending on the bank |

| Cryptocurrencies (Bitcoin, Ethereum, Litecoin) | Instant (subject to blockchain confirmation times) | No fees |

Withdrawal Methods

IQ Option supports the following withdrawal methods:| Payment Method | Processing Time | Fees |

|---|---|---|

| Credit/Debit Cards (Visa, Mastercard) | 1-3 business days | No fees |

| E-Wallets (Skrill, Neteller, WebMoney) | Instant | No fees |

| Bank Transfer | 1-5 business days | Fees may apply depending on the bank |

| Cryptocurrencies (Bitcoin, Ethereum, Litecoin) | Instant (subject to blockchain confirmation times) | No fees |

Deposit and Withdrawal Policies

IQ Option implements several policies to ensure the security and integrity of transactions:- Account Verification: Traders must verify their identity and address by submitting official documents before making a withdrawal. This process helps prevent fraud and comply with anti-money laundering (AML) regulations.

- Closed Account Policy: If a trader requests to close their account, IQ Option will refund the remaining balance to the original deposit source within 3 business days.

- Inactive Account Policy: If an account remains inactive for 90 consecutive days, IQ Option reserves the right to charge a monthly inactivity fee of $10 until the balance reaches zero or the account is reactivated.

- Withdrawal Restrictions: Traders can only withdraw funds to payment methods in their name. IQ Option may require additional verification for large withdrawals to ensure the funds' security.

Unique Features

One of IQ Option's standout features is its support for cryptocurrency deposits and withdrawals. This allows traders to fund their accounts and access their profits using popular digital currencies like Bitcoin, Ethereum, and Litecoin, offering an additional layer of privacy and flexibility.Support Service for Customer

In the fast-paced world of online trading, reliable customer support is a crucial factor in ensuring a positive trading experience. Traders need access to prompt and knowledgeable assistance when dealing with technical issues, account queries, or trading-related questions. IQ Option recognises the importance of customer support and provides multiple channels for traders to reach out for help.

Support Channels

IQ Option offers the following customer support channels:- Live Chat: Available 24/7, live chat is the quickest way to get in touch with IQ Option's support team. Traders can access live chat directly from the trading platform or website.

- Email: Traders can send their enquiries to support@iqoption.com for less urgent matters. IQ Option aims to respond to all emails within 24 hours.

- Phone: IQ Option provides phone support in several countries, with local numbers available for traders in the United Kingdom, South Africa, Brazil, and more. Phone support hours may vary depending on the region.

- Social Media: Traders can reach out to IQ Option via their official Facebook, Twitter, and Instagram accounts for general enquiries and updates.

Multilingual Support

IQ Option caters to a global audience by providing customer support in multiple languages, including:- English

- Spanish

- Portuguese

- French

- German

- Italian

- Arabic

- Chinese

- Thai

- Indonesian

- Korean

- Turkish

Support Hours and Response Times

IQ Option's live chat support is available 24/7, ensuring that traders can get help whenever they need it, regardless of their time zone. The broker strives to provide immediate assistance through live chat, with an average response time of under 5 minutes. Email support is also available 24/7, with IQ Option committing to respond to all enquiries within 24 hours. However, response times may be longer during peak periods or for more complex issues. Phone support hours vary depending on the country, with most offices operating during local business hours. IQ Option aims to answer all calls within 3 minutes, providing traders with prompt and efficient assistance.Prohibited Countries

IQ Option is a global online trading platform that strives to provide its services to traders worldwide. However, due to various legal, regulatory, and operational constraints, the broker is prohibited from operating in certain countries and regions. It is essential for traders to understand these restrictions to avoid any potential legal consequences or risks associated with attempting to trade with IQ Option from a prohibited jurisdiction.

Reasons for Restrictions

There are several reasons why IQ Option may be prohibited from operating in certain countries:

- Local Regulations: Some countries have strict regulations governing online trading, requiring brokers to obtain specific licences or adhere to certain rules. If IQ Option does not meet these requirements, it may be prohibited from offering its services in those jurisdictions.

- Licensing Requirements: Obtaining and maintaining licenses in every country can be a complex and costly process. IQ Option may choose not to pursue licenses in certain countries due to the associated costs and regulatory burdens.

- Geopolitical Factors: Political instability, economic sanctions, or other geopolitical factors may make it difficult or impossible for IQ Option to operate in certain regions.

- Operational Constraints: IQ Option may lack the necessary infrastructure, payment processing capabilities, or language support to effectively serve traders in certain countries.

Consequences of Trading from Prohibited Countries

Attempting to trade with IQ Option from a prohibited country can result in several negative consequences:

- Account Termination: If IQ Option discovers that a trader is accessing its platform from a prohibited jurisdiction, the broker may immediately terminate the account and freeze any associated funds.

- Legal Consequences: Trading with an unlicensed broker from a prohibited country may violate local laws and regulations, potentially resulting in legal penalties or fines.

- Loss of Funds: Traders from prohibited countries may face difficulties when attempting to withdraw their funds, as IQ Option may be unable to process transactions to bank accounts or payment methods in those jurisdictions.

List of Prohibited Countries

As of 2023, IQ Option is prohibited from operating in the following regions:

- United States

- Canada

- European Union

- Australia

- United Kingdom

- Japan

- Israel

- Iran

- North Korea

- Sudan

- Syria

Special Offers for Customers

"IQ Option occasionally offers Online Tournaments for its traders, according to its website."

However, no other specific ongoing offers like sign-up bonuses, loyalty programs, or third-party partnerships are highlighted. The lack of emphasis on promotional offers in the reviews suggests that IQ Option may not rely heavily on such incentives to attract and retain clients.

When brokers do provide special offers, it's important for traders to carefully review the associated terms and conditions. Sign-up bonuses, for example, often come with minimum deposit requirements or trading volume thresholds that must be met before the bonus funds can be withdrawn. Time limitations may also apply, requiring traders to use the bonus within a specific period.

Conclusion

As I near the end of this comprehensive review of IQ Option, it's time to consolidate the findings and insights gathered throughout the article to provide a cohesive summary that addresses their safety, reliability, and overall reputation as a broker.

Drawing upon the analysis conducted across various aspects of IQ Option's operations, I can confidently say that they have established themselves as a trustworthy and dependable broker in the online trading industry. Their commitment to regulatory compliance, as evidenced by their CySEC licence, provides a strong foundation for client protection and ensures that they adhere to strict financial guidelines.

One of the standout features of IQ Option is their user-friendly proprietary trading platform, which caters to both beginner and experienced traders alike. The platform's intuitive interface, coupled with a wide range of tradable assets and competitive spreads, makes for a seamless and efficient trading experience. The inclusion of unique tools like the "Multicharts" feature further sets IQ Option apart from its competitors.

In terms of customer support, IQ Option demonstrates a clear commitment to providing prompt and reliable assistance to its clients. The availability of 24/7 live chat support, along with multilingual assistance and multiple contact channels, ensures that traders can access the help they need whenever they require it. This level of support is crucial in building trust and fostering long-term relationships with clients.

While IQ Option may not offer an extensive array of promotional offers or bonuses, they make up for it by providing a low minimum deposit requirement and a free demo account. These features make the broker accessible to a wide range of traders, allowing them to test strategies and familiarise themselves with the platform risk-free.

It's important to acknowledge that no broker is perfect, and IQ Option is no exception. Some traders have reported issues with slow withdrawal times and occasional delays in account verification. However, these concerns are not uncommon in the industry, and IQ Option appears to be proactive in addressing them and maintaining open communication with its clients.

In conclusion, based on the information gathered and analysed in this review, I believe that IQ Option is a reliable and trustworthy broker that offers a solid trading experience for both beginner and experienced traders. Their commitment to regulatory compliance, user-friendly platform, and responsive customer support make them a strong contender in the competitive world of online trading.