Just2Trade Review: A Trusted Broker for Forex, Stocks, CFDs & More

Just2Trade

Cyprus

Cyprus

-

Minimum Deposit $100

-

Leverage 500:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Unavailable

-

Stock Available

-

Indices Unavailable

Licenses

Cyprus Market Making (MM)

Cyprus Market Making (MM)

Softwares & Platforms

Customer Support

+35725055966

(English)

+35725055966

(English)

Supported language: English

Social Media

Summary

Just2Trade is a Cyprus-based online broker founded in 2015 and regulated by CySEC. It offers a wide range of trading instruments, including forex, stocks, futures, CFDs, metals, and options. With competitive spreads from 0 pips and commissions starting at $0, the broker suits both beginner and professional traders. Clients can trade on popular platforms like MT4, MT5, CQG, and Sterling Trader Pro, with a minimum deposit starting at $100. Just2Trade also provides a demo account, negative balance protection, and 24/7 customer support.

- Wide range of tradable instruments

- Competitive spreads starting from 0 pips

- Low commission rates

- Multiple trading platforms, including MT4 and MT5

- Regulated by CySEC, ensuring client protection

- Demo account available for practice trading

- Attractive promotions and bonuses

- 24/7 customer support via multiple channels

- Extensive educational resources and market analysis tools

- Negative balance protection available

- Relatively new broker with limited track record

- Not available to clients in certain countries

- Limited cryptocurrency offerings compared to some competitors

- Inactivity fees charged on dormant accounts

- Some funding methods may incur additional fees

Overview

Just2Trade is an online broker founded in 2015 with its headquarters in Cyprus. The broker is regulated by the Cyprus Securities and Exchange Commission (CySEC), ensuring a high level of oversight and security for its clients. Just2Trade offers a comprehensive range of trading instruments, including forex, stocks, futures, CFDs, metals, and options. With competitive spreads starting from 0 pips and commissions as low as $0, Just2Trade caters to both novice and experienced traders.

The broker provides access to popular trading platforms such as MetaTrader 4, MetaTrader 5, CQG, and Sterling Trader Pro. Clients can also benefit from a demo account to practise trading strategies risk-free.

For more information, visit the official Just2Trade website at just2trade.online.

Overview table

| Key Information | Details |

|---|---|

| Founded | 2015 |

| Headquarters | Cyprus |

| Regulation | Cyprus Securities and Exchange Commission (CySEC) |

| Minimum Deposit | $100 |

| Instruments | Forex, Stocks, Futures, CFDs Metals, Options |

| Platforms | MT4, MT5, CQG, Sterling Trader Pro |

| Spreads | From 0 pips |

| Commissions | From $0 |

| Demo Account | Yes |

Facts lists

- Just2Trade was founded in 2015 and is based in Cyprus.

- The broker is regulated by the Cyprus Securities and Exchange Commission (CySEC).

- Just2Trade offers a wide range of tradable instruments, including forex, stocks, futures, CFDs, metals, and options.

- Spreads start from 0 pips, and commissions are as low as $0.

- The minimum deposit to open an account ranges from $100 to $200, depending on the account type.

- Just2Trade supports popular trading platforms such as MetaTrader 4, MetaTrader 5, CQG, and Sterling Trader Pro.

- Clients can access a demo account to practise trading strategies without risk.

- The broker provides negative balance protection to help mitigate potential losses.

- Just2Trade offers 24/7 customer support through live chat, email, phone, and social media channels.

- Educational resources and market analysis tools are available to support traders' growth and decision-making.

Just2Trade Licenses and Regulatory

Just2Trade operates under the regulatory oversight of the Cyprus Securities and Exchange Commission (CySEC), holding license number 281/15. CySEC is a well-respected financial regulatory body in the European Union, known for its strict standards and investor protection measures. By being regulated by CySEC, Just2Trade demonstrates its commitment to transparency, fair business practices, and the safeguarding of client funds.

In addition to its CySEC license, Just2Trade also holds the following licenses:

- National Futures Association (NFA) – USA

- Central Bank of the Russian Federation (CBR) – Russia

The multiple licenses held by Just2Trade across different jurisdictions highlight the broker's dedication to compliance and its ability to serve clients in various regions. This global presence and adherence to strict regulatory standards instil confidence in traders, knowing that their funds are held with a reputable and well-supervised broker.

It's important to note that while Just2Trade is regulated by respected authorities, trading always carries inherent risks. Traders should carefully consider their risk tolerance and financial goals before engaging in any trading activities.

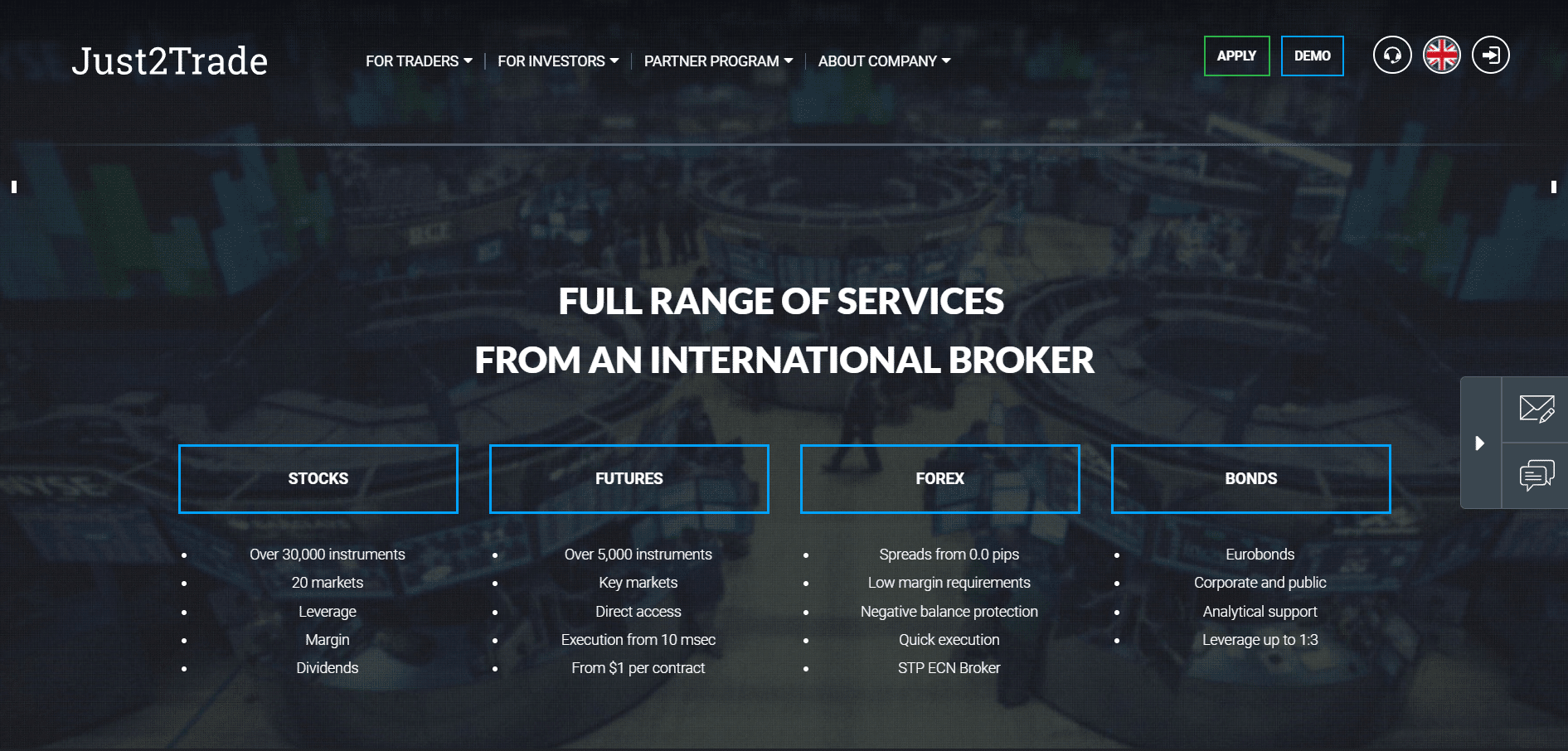

Trading Instruments

Just2Trade provides access to an extensive range of tradable instruments, empowering traders to diversify their portfolios and seize opportunities across different markets.

The broker offers the following asset categories:

| Asset Class | Details |

|---|---|

| Forex | Over 60 currency pairs, including majors, minors, and exotics. Competitive spreads on popular pairs like EUR/USD. |

| Stocks | Trade shares from 14 global markets. |

| Futures | Access to more than 20 futures contracts across various sectors. |

| Metals | Invest in 7 precious metals, including gold, silver, and platinum. |

| Options | Trade options contracts on multiple underlying assets. |

| CFDs | Speculate on indices, commodities, and cryptocurrencies via Contracts for Difference. |

The comprehensive range of tradable instruments offered by Just2Trade allows traders to implement diverse strategies and capitalise on market trends. Whether you're interested in forex, stocks, futures, or other assets, Just2Trade provides the necessary tools and platforms to execute your trades efficiently.

Trading Platforms

Just2Trade offers a choice of powerful trading platforms to suit the preferences and needs of different traders:

MetaTrader 4 (MT4)

- Industry-standard platform known for its reliability and advanced features

- Customizable interface with a wide range of technical indicators and charting tools

- Supports automated trading through Expert Advisors (EAs)

- Available on desktop, web, and mobile devices

MetaTrader 5 (MT5)

- Next-generation platform with enhanced functionality and speed

- Offers more technical indicators, timeframes, and graphical objects compared to MT4

- Supports trading across multiple asset classes, including forex, stocks, and futures

- Available on desktop, web, and mobile devices

CQG

- Advanced platform designed for professional traders

- Provides real-time market data, charting tools, and risk management features

- Offers direct market access (DMA) to multiple global exchanges

- Available on desktop and mobile devices

Sterling Trader Pro

- Powerful platform tailored for active traders

- Offers advanced order management, real-time market data, and risk management tools

- Supports algorithmic trading and complex order types

- Available on desktop

These platforms cater to traders of all levels, from beginners to professionals. Just2Trade ensures that clients have access to the tools and features necessary to analyse markets, execute trades, and manage their portfolios effectively.

Trading Platforms Comparison Table

| Platform | Availability | Key Features |

|---|---|---|

| MT4 | Desktop, Web, Mobile | Customizable, EAs, technical analysis |

| MT5 | Desktop, Web, Mobile | Enhanced features, multi-asset trading |

| CQG | Desktop, Mobile | Advanced charting, DMA, risk management |

| Sterling Trader Pro | Desktop | Advanced order management, algorithmic trading |

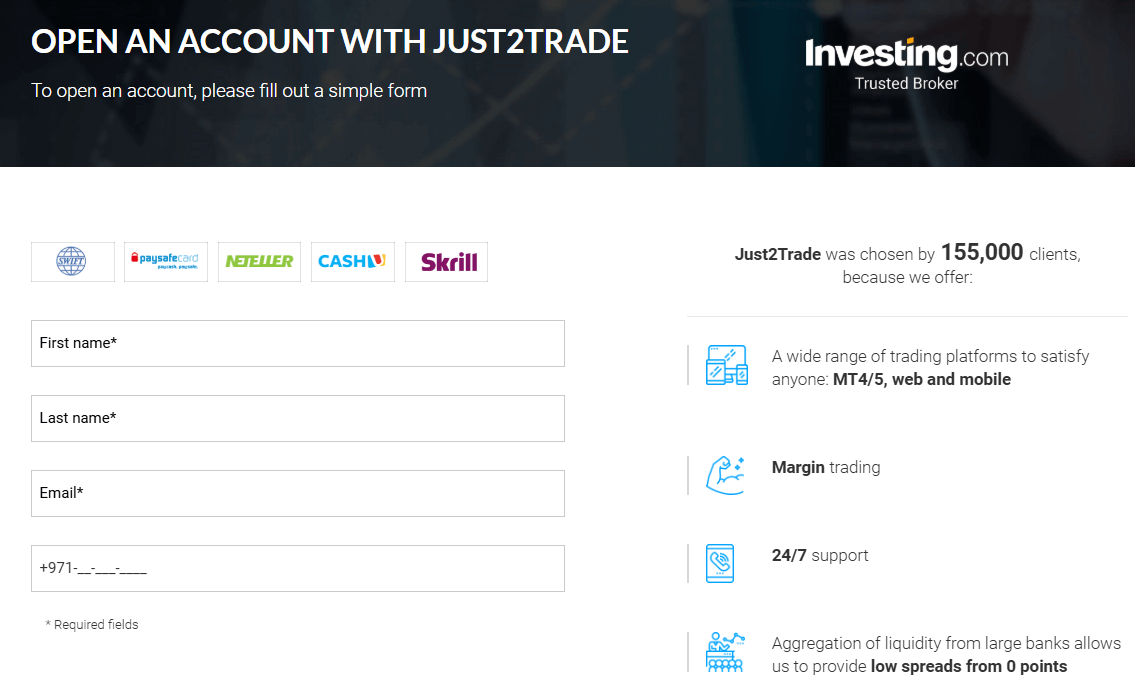

Just2Trade How to Open an Account: A Step-by-Step Guide

Opening an account with Just2Trade is a straightforward process. Follow these steps to get started:

- Visit the Just2Trade website and click on the "Open an Account" button.

- Fill out the registration form with your personal details, including name, email address, and phone number.

- Choose your account type (e.g., Forex and CFD Standard, Forex ECN, or MT5 Global) and base currency.

- Provide proof of identity and proof of residence documents, such as a passport and utility bill, for verification purposes.

- Complete the online questionnaire to assess your trading knowledge and experience.

- Review and accept the broker's terms and conditions.

- Make an initial deposit using one of the available funding methods, such as bank transfer, credit/debit card, or e-wallet.

- Once your account is verified and funded, you can download the trading platform of your choice and start trading.

The account opening process is designed to be efficient and user-friendly. Just2Trade aims to verify accounts within 24 hours, subject to the provision of all required documents.

To ensure a smooth experience, prepare high-quality scans or photos of your identification documents in advance. If you encounter any difficulties during the registration process, don't hesitate to contact Just2Trade's customer support team for assistance.

Charts and Analysis

Just2Trade provides a variety of tools and resources to help traders analyse markets and make informed decisions:

| Feature | Description |

|---|---|

| Trading Central | Access expert insights, technical analysis, and trade ideas from a top financial research provider. |

| Advanced Charts | MetaTrader platforms offer multiple chart types, timeframes, and 50+ built-in technical indicators. |

| Economic Calendar | Stay informed about key economic events and data releases affecting market volatility. |

| Market News | Get real-time news updates and analysis from reputable financial sources. |

| Sentiment Indicators | Analyse market sentiment using trading volume, open interest, and long/short ratios. |

| Heatmaps | Visual market data visualisation to spot strong and weak instruments at a glance. |

| Technical Analysis Tools | Use tools like trend lines, Fibonacci retracements, and pivot points to find trading setups. |

| Trading Signals | Receive actionable trading signals based on technical analysis for informed decisions. |

These resources can be accessed directly through the Just2Trade website and trading platforms, empowering traders to perform comprehensive market analysis and make data-driven decisions.

Just2Trade Account Types

Just2Trade offers a range of account types to cater to the diverse needs of traders:

- Forex and CFD Standard Account:

- Minimum deposit: $100

- Spreads from 0.5 pips

- No commission

- Margin trading available

- Forex ECN Account:

- Minimum deposit: $200

- Spreads from 0 pips

- Commission: ≤$3 per lot

- Margin trading available

- MT5 Global Account:

- Minimum deposit: $100

- Spreads from 0 pips

- Commission: ≤$2 per lot

- Access to MT5 platform

In addition, Just2Trade provides:

- Islamic (swap-free) accounts for clients following Sharia principles

- Demo accounts for risk-free practice trading

- Segregated accounts for added fund security

Account Types Comparison Table

| Account Type | Min. Deposit | Spreads | Commission | Platform |

|---|---|---|---|---|

| Forex & CFD Standard | $100 | From 0.5 pips | None | MT4 |

| Forex ECN | $200 | From 0 pips | ≤$3 per lot | MT4 |

| MT5 Global | $100 | From 0 pips | ≤$2 per lot | MT5 |

Negative Balance Protection

Just2Trade offers negative balance protection to its clients, providing an additional layer of security to mitigate potential losses. Negative balance protection ensures that a trader's account balance cannot fall below zero, even in the event of extreme market volatility or unexpected market gaps. With negative balance protection, if a trader's account equity becomes negative due to trading losses, Just2Trade will absorb the negative balance, effectively resetting the account balance to zero. This feature helps to limit a trader's maximum potential loss to the funds available in their trading account, preventing them from falling into debt due to adverse market movements. It's important to note that while negative balance protection can provide peace of mind, it should not be relied upon as a substitute for proper risk management. Traders should still implement appropriate risk management strategies, such as setting stop-loss orders and maintaining reasonable leverage levels, to protect their capital and minimise potential losses.

Just2Trade Deposits and Withdrawals

Just2Trade provides traders with a variety of convenient deposit and withdrawal options:

Deposit Methods

| Payment Method | Processing Time | Fees | Available Currencies |

|---|---|---|---|

| Bank Transfer | 2-3 days | Bank’s fee (may apply) | EUR, USD, RUB |

| Credit/Debit Card | Instant | No fees | EUR, USD, RUB |

| E-wallets | Instant | No fees | EUR, USD, RUB |

| Local Payment Methods | Instant | Varies (check provider) | Local currency (e.g., OXXO, SPEI) |

| Cryptocurrency | Instant | No fees | BTC, ETH, etc. |

Withdrawal Methods

| Payment Method | Processing Time | Fees | Available Currencies |

|---|---|---|---|

| Bank Transfer | 2-3 days | 0.5% fee for USD (min. $10), 0.4% for USD (min. $80), 25 EUR fee for EUR | USD, EUR, RUB |

| Credit/Debit Card | 5-10 minutes (up to 5 days) | 2.5% fee (min. €1/$1/₽50) | EUR, USD, RUB |

| E-wallets | 2-3 days | 2% to 2.8% fee | EUR, USD, RUB |

| Local Payment Methods | Varies | Varies (check provider) | Local currency (e.g., OXXO, SPEI) |

| Cryptocurrency | 1-2 days | No fees | BTC, ETH, etc. |

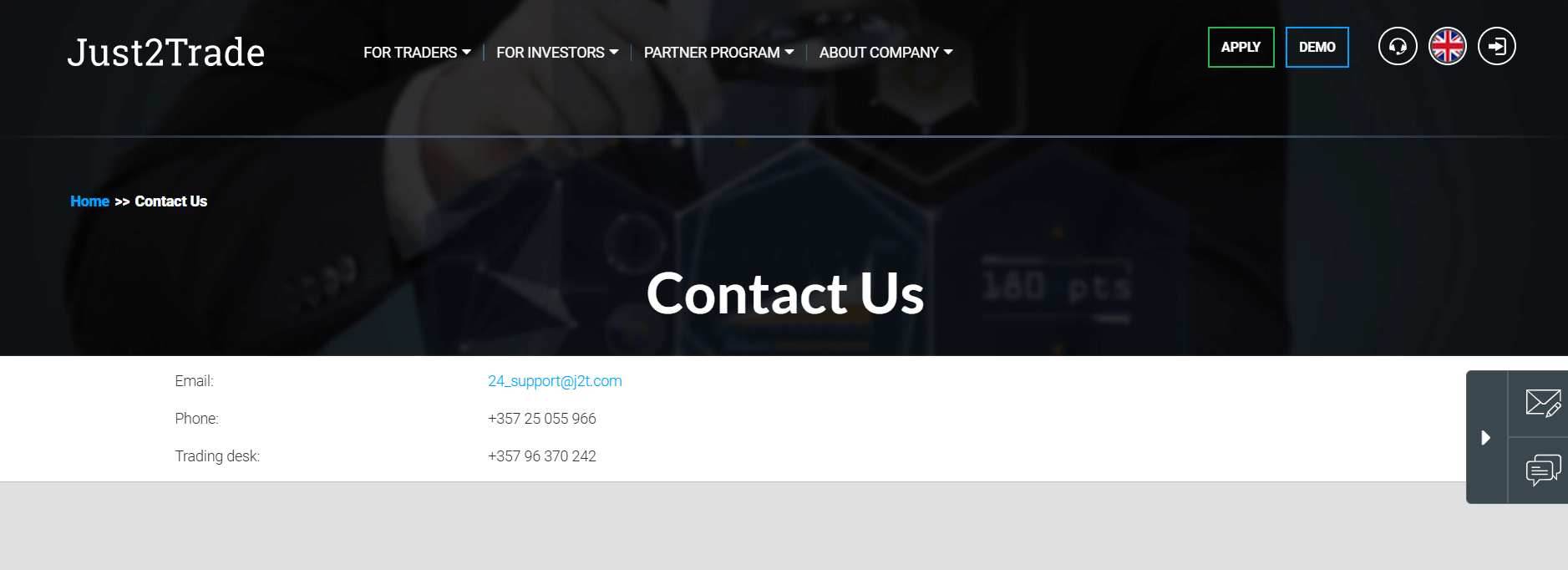

Support Service for Customer

Just2Trade offers multiple channels for customer support to ensure that traders can receive assistance whenever needed:

- Live Chat: Access instant support directly through the Just2Trade website.

- Email: Get in touch with the support team by sending an email to 24_support@just2trade.online.

- Phone: Call +357 25 344563 to speak with a customer support representative.

- Social Media: Reach out via Just2Trade's official Facebook, Instagram, LinkedIn, YouTube, and Twitter accounts for general enquiries.

Customer support Comparison Table

| Channel | Details | Availability |

|---|---|---|

| Live Chat | On Just2Trade website | 24/7 |

| 24_support@just2trade.online | 24/7 | |

| Phone | +357 25 055 966 | 24/7 |

| Social Media | Facebook, Instagram, LinkedIn, YouTube, Twitter | 24/7 |

Prohibited Countries

Just2Trade provides services to clients in most countries worldwide, with a few exceptions. The broker complies with international regulations and restrictions, which may limit its ability to offer services in certain jurisdictions.

The following regions are currently prohibited from accessing Just2Trade's services:

- United States

- Canada

- Belgium

- Israel

- Palestine

- Sudan

- Syria

- North Korea

- Iran

Please note that this list is subject to change based on updates to international regulations and Just2Trade's internal policies. It is always recommended to check the broker's website or contact their customer support for the most up-to-date information on restricted countries.

If you reside in a prohibited country, you will not be able to open an account or access Just2Trade's trading services. Attempting to circumvent these restrictions may result in the termination of your account and potential legal consequences.

Special Offers for Customers

Just2Trade offers a range of attractive promotions and bonus programs to reward both new and existing clients:

- Welcome Bonus: New traders can receive a bonus of up to 100% on their first deposit, providing additional trading capital.

- Loyalty Program: Earn points for each trade you make, which can be redeemed for cash bonuses, trading tools, or other rewards.

- Refer-a-Friend: Introduce Just2Trade to your friends and earn a referral bonus when they open and fund a trading account.

- Trading Competitions: Participate in regular trading contests for the chance to win cash prizes and other rewards.

- Educational Webinars: Attend free online webinars hosted by Just2Trade's expert analysts and expand your trading knowledge.

Please note that the specific promotions and offers may vary over time. Visit the Just2Trade website for the most up-to-date information on available promotions and their respective terms and conditions.

When considering any promotional offer, it's crucial to carefully review the associated requirements, such as minimum deposit amounts, trading volume targets, and time limitations. Ensure that you fully understand and comply with the terms to be eligible for the stated benefits.

Remember that while promotions can provide additional value and incentives, they should not be the sole basis for choosing a broker. Always consider the overall trading conditions, platform quality, and customer support when making your decision.

Conclusion

After thorough research and analysis, I can confidently conclude that Just2Trade is a reliable and trustworthy online broker. With its strong regulatory oversight from CySEC, global presence, and commitment to client safety, Just2Trade has established itself as a reputable player in the industry.

One of the standout features of Just2Trade is its wide range of tradable instruments, covering forex, stocks, futures, CFDs, metals, and options. This diverse offering allows traders to access multiple markets and implement various strategies. The competitive spreads starting from 0 pips and low commissions further enhance the broker's appeal.

Just2Trade's choice of trading platforms, including MT4, MT5, CQG, and Sterling Trader Pro, caters to traders of all levels. The platforms provide advanced charting tools, automated trading capabilities, and mobile accessibility, ensuring a seamless trading experience.

The broker's educational resources and market analysis tools demonstrate its commitment to supporting traders' growth and knowledge. The availability of a demo account allows beginners to practise trading risk-free and familiarise themselves with the platforms.

Customer support is another area where Just2Trade excels, offering 24/7 assistance through multiple channels, including live chat, email, phone, and social media. The efficient account opening process and wide range of deposit and withdrawal methods add to the broker's user-friendly nature.

While Just2Trade has many strengths, it's important to note that as a relatively young broker established in 2015, it may not have the same extensive track record as some more established industry players. Additionally, traders from certain countries may face restrictions in accessing Just2Trade's services.

Overall, I believe that Just2Trade is a solid choice for traders seeking a reliable, well-regulated broker with a comprehensive offering and competitive trading conditions. As with any financial decision, it's crucial to conduct thorough due diligence, consider your individual trading needs and risk tolerance, and carefully review the broker's terms and conditions before opening an account.