JustMarkets Review 2025: A Comprehensive Guide to This Forex Broker

JustMarkets

Cyprus

Cyprus

-

Minimum Deposit $10

-

Withdrawal Fee $varies

-

Leverage 3000:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

Cyprus Market Making (MM)

Cyprus Market Making (MM)

South Africa Retail Forex License

South Africa Retail Forex License

Global Business License

Global Business License

Securities Dealer License

Securities Dealer License

Softwares & Platforms

Customer Support

+2484632027

(English)

+2484632027

(English)

Supported language: English, Indonesian, Finnish, Spanish, Vietnamese, Malay

Social Media

Summary

JustMarkets is a globally regulated forex and CFD broker established in 2012, with headquarters in Limassol, Cyprus. Regulated by CySEC, FSA, FSCA, and FSC, the broker provides a secure trading environment with client fund segregation and negative balance protection. Traders can access over 170 instruments across forex, commodities, stocks, indices, and crypto, using platforms like MetaTrader 4, MetaTrader 5, and the JustMarkets app. With account types suited for both beginners and pros, a low $10 minimum deposit, and 24/7 multilingual support, JustMarkets is a reliable choice for diverse trading needs.

- Well-regulated by multiple top-tier authorities

- Wide range of tradable assets

- User-friendly trading platforms (MT4/5 and proprietary app)

- Competitive trading conditions

- Diverse account types with low minimum deposits

- Excellent copy trading offering with zero extra fees

- Ensures safety of client funds

- Provides 24/7 multilingual customer support

- Offers comprehensive educational resources

- Seamless trading experience and straightforward account opening

- Not available to residents of the US, UK, EU, and several other countries

- Limited research tools compared to some competitors

- No support for automated trading on the proprietary mobile app

- Lacks additional platform options beyond MT4/5

- Doesn't offer traditional investment products like stocks or bonds

Overview

JustMarkets is a global forex and CFD broker established in 2012, with its headquarters in Limassol, Cyprus. The broker is regulated by top-tier authorities such as the Cyprus Securities and Exchange Commission (CySEC), Financial Services Authority (FSA) of Seychelles, Financial Sector Conduct Authority (FSCA) of South Africa, and Financial Services Commission (FSC) of Mauritius.

JustMarkets offers over 170 tradable instruments, including forex pairs, commodities, indices, stocks, and cryptocurrencies. The broker caters to both beginner and experienced traders by providing a range of account types, competitive trading conditions, and user-friendly trading platforms.

With a focus on safety and transparency, JustMarkets ensures the segregation of client funds and provides negative balance protection. The broker also offers excellent copy trading opportunities, 24/7 multilingual customer support, and a variety of educational resources to support traders in their journey.

For more details on JustMarkets' offerings, visit their official website at www.justmarkets.com.

Overview Table

| Feature | Details |

|---|---|

| Established | 2012 |

| Headquarters | Limassol, Cyprus |

| Regulation | CySEC, FSA (Seychelles), FSCA (South Africa), FSC (Mauritius) |

| Tradable Instruments | 170+ (Forex, Commodities, Indices, Stocks, Cryptocurrencies) |

| Account Types | Standard, Pro, Raw Spread, Copytrading Standard, Copytrading Pro, Standard Cent, Islamic |

| Trading Platforms | MetaTrader 4, MetaTrader 5, JustMarkets App |

| Minimum Deposit | $10 |

| Customer Support | 24/7, Multilingual (Live Chat, Email, Phone) |

| Educational Resources | Articles, Webinars, Market Analysis, Trading Tools |

Facts List

- JustMarkets was founded in 2012 and is headquartered in Limassol, Cyprus.

- The broker is regulated by CySEC, FSA (Seychelles), FSCA (South Africa), and FSC (Mauritius).

- JustMarkets offers over 170 tradable instruments, including forex, commodities, indices, stocks, and cryptocurrencies.

- The broker provides a range of account types, including Standard, Pro, Raw Spread, Copytrading Standard, Copytrading Pro, Standard Cent, and Islamic accounts.

- JustMarkets supports trading on MetaTrader 4, MetaTrader 5, and its proprietary mobile app.

- The minimum deposit requirement is just $10, making it accessible for beginners.

- JustMarkets offers competitive spreads starting from 0.0 pips on the Raw Spread account and 0.1 pips on the Pro account.

- The broker provides 24/7 multilingual customer support via live chat, email, and phone.

- JustMarkets offers a variety of educational resources, such as articles, webinars, market analysis, and trading tools.

- The broker ensures the safety of client funds through segregated accounts and provides negative balance protection.

JustMarkets Licenses and Regulatory

The primary regulatory bodies overseeing JustMarkets' operations include:

- Cyprus Securities and Exchange Commission (CySEC) – JustMarkets Ltd, based in Limassol, Cyprus, is licensed and regulated by CySEC under license number 401/21. CySEC is known for its rigorous oversight and investor protection measures, making it one of the most respected regulatory authorities in the industry.

- Financial Services Authority (FSA) of Seychelles – Just Global Markets Ltd, operating from Mahe, Seychelles, is licensed and regulated by the FSA under license number SD088. The FSA ensures that brokers maintain high standards of operation and transparency.

- Financial Sector Conduct Authority (FSCA) of South Africa – Just Global Markets (Pty) Ltd, located in Gauteng, South Africa, is licensed and regulated by the FSCA under license number 51114. The FSCA is responsible for overseeing the non-banking financial services industry in South Africa, ensuring fair treatment of clients and market integrity.

- Financial Services Commission (FSC) of Mauritius – Just Global Markets (MU) Limited, based in Ebene, Mauritius, is licensed and regulated by the FSC under license number GB22200881. The FSC is the integrated regulator for the non-banking financial services sector and global business in Mauritius.

JustMarkets' commitment to maintaining licenses from multiple respected regulatory bodies demonstrates their dedication to providing a safe and secure trading environment for their clients. These licenses ensure that the broker operates with transparency, maintains segregated client funds, and adheres to strict financial reporting and auditing requirements.

By subjecting themselves to the oversight of multiple regulatory authorities, JustMarkets goes above and beyond industry standards, instilling confidence in traders who choose to partner with them. This robust regulatory framework serves as a foundation for JustMarkets' reputation as a reliable and trustworthy broker in the competitive world of online trading.

Trading Instruments

JustMarkets' extensive offering of tradable assets sets them apart from many competitors, providing traders with the flexibility to diversify their portfolios and adapt to changing market conditions. By offering a wide array of instruments across multiple asset classes, JustMarkets demonstrates their commitment to meeting the needs of a diverse client base and staying at the forefront of industry trends.

| Asset Class | Instruments Offered | Examples | Highlights |

|---|---|---|---|

| Forex Pairs | Majors, minors, and exotics | EUR/USD, GBP/USD, USD/JPY, USD/TRY, USD/ZAR | Competitive spreads, deep liquidity, broad pair selection |

| Commodities | Precious metals, energies, and agricultural products | Gold, Silver, Crude Oil, Natural Gas, Corn, Wheat | Access to global commodity markets, volatility opportunities |

| Indices | Global stock market indices (via CFDs) | S&P 500, NASDAQ 100, FTSE 100, DAX 30 | Exposure to entire market sectors, without owning individual stocks |

| Stocks | CFDs on shares from various sectors | Apple, Amazon, Meta (Facebook), Google | Profit potential in both rising and falling markets |

| Cryptocurrencies | CFDs on major digital assets | Bitcoin, Ethereum, Litecoin, Ripple | Speculate on crypto volatility without owning coins |

Trading Platforms

JustMarkets offers a range of trading platforms to cater to the diverse needs of their clients, ensuring a seamless and efficient trading experience for both beginners and experienced traders alike.

MetaTrader 4 (MT4)

MetaTrader 4 is a widely used trading platform known for its user-friendly interface, advanced charting capabilities, and extensive range of technical indicators. JustMarkets' MT4 platform is available for desktop, web, and mobile devices, allowing traders to access the markets anytime, anywhere.

MetaTrader 5 (MT5)

MetaTrader 5 is the next-generation trading platform, offering enhanced features and functionality compared to its predecessor. MT5 supports multi-asset trading, including stocks and commodities, and provides a more advanced charting package, as well as additional order types and timeframes.

JustMarkets Trading App

For traders who prefer to manage their accounts on the go, JustMarkets offers a proprietary mobile trading app. The app, available for both iOS and Android devices, provides a streamlined and intuitive interface, enabling users to place trades, monitor positions, and access market analysis with just a few taps.

Trading Platforms Comparison Table

| Feature | MetaTrader 4 (MT4) | MetaTrader 5 (MT5) | JustMarkets Trading App |

|---|---|---|---|

| Platforms | Desktop, Web, Mobile | Desktop, Web, Mobile | iOS, Android |

| Order Types | Market, Pending | Market, Pending, Stop, Trailing Stop | Market, Pending, Stop, Trailing Stop |

| Charting | 30 indicators, 24 analytical objects | 38 indicators, 44 analytical objects | Advanced charting with technical analysis |

| Timeframes | 9 | 21 | 9 |

| Automated Trading | Yes (Expert Advisors) | Yes (Expert Advisors) | No |

| Customizable Workspace | Yes | Yes | Limited |

| Asset Classes | Forex, CFDs | Forex, CFDs, Stocks, Futures | Forex, CFDs |

| Market Depth | Yes | Yes | No |

| Alerts | Yes | Yes | Yes |

| One-Click Trading | Yes | Yes | Yes |

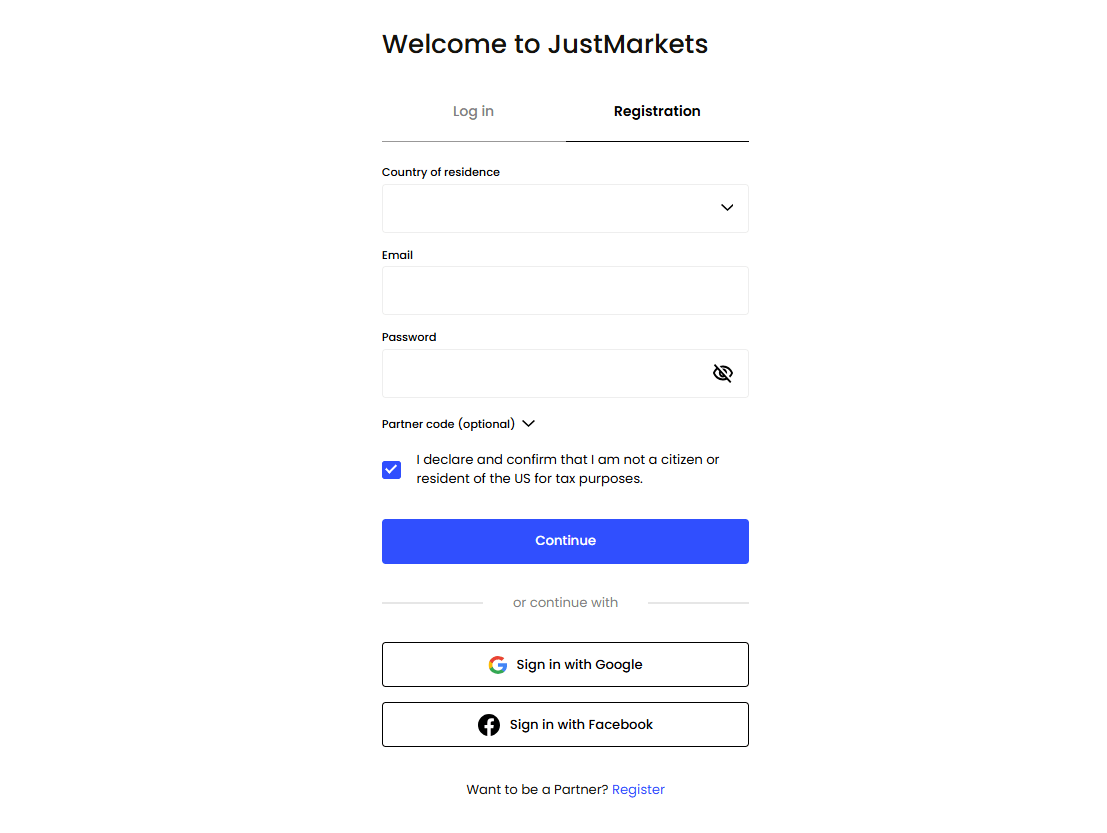

JustMarkets How to Open an Account: A Step-by-Step Guide

Opening an account with JustMarkets is a straightforward process that can be completed in just a few simple steps. To get started, follow this guide:

- Visit the JustMarkets website at www.justmarkets.com and click on the "Open an Account" button.

- Fill out the registration form with your personal information, including your name, email address, phone number, and country of residence.

- Choose your preferred account type (Standard, Pro, Raw Spread, Standard Cent, Copytrading Standard, or Copytrading Pro) and base currency.

- If prompted, complete the appropriateness test to assess your trading knowledge and experience.

- Submit the required identification documents, such as a valid government-issued ID and proof of address, to verify your account.

- Once your account is verified, log in to the client portal and navigate to the deposit section to fund your account. JustMarkets accepts various payment methods, including credit/debit cards, bank wire transfers, and e-wallets.

- After your deposit is processed, download and install the trading platform of your choice (MT4, MT5, or JustMarkets Trading App) and log in using the credentials provided by JustMarkets.

- You are now ready to start trading with JustMarkets!

JustMarkets' account opening process is designed to be user-friendly and efficient, with most accounts being approved within 24 hours. The broker's minimum deposit requirements are also among the lowest in the industry, with the Standard and Standard Cent accounts requiring just $10 to get started.

By offering a streamlined application process, quick account verification, and a variety of account types to suit different trading styles and budgets, JustMarkets demonstrates their commitment to providing a seamless and accessible trading experience for all clients.

Charts and Analysis

JustMarkets provides a comprehensive suite of educational trading resources and tools to support their clients in making informed trading decisions and enhancing their skills.

| Feature | Description | Benefits |

|---|---|---|

| Charts & Indicators | Integrated into MT4 and MT5 platforms with a wide range of technical indicators and customisable charts. | Enables detailed technical analysis and trend identification. |

| Economic Calendar | Real-time calendar of key economic events (e.g., central bank decisions, GDP, employment data). | Helps traders anticipate volatility and adjust trading strategies. |

| Webinars & Seminars | Live and recorded sessions led by professionals covering beginner to advanced trading topics. | Offers direct learning from market experts and enhances trading knowledge. |

| Market News & Analysis | Daily insights, technical & fundamental analysis, and trade ideas shared via blog and newsletter. | Keeps traders informed and supports strategic planning. |

| Trading Guides & eBooks | Downloadable content covering various trading strategies, risk management, and market psychology. | Accessible education for all experience levels to enhance skill development. |

JustMarkets Account Types

JustMarkets offers a range of trading account options designed to cater to the diverse needs and preferences of their clients, from novice traders to experienced professionals.

Standard Account

- Minimum deposit: $10

- Spreads from 0.3 pips

- No commissions

- Leverage up to 1:3000

- Ideal for beginners and casual traders

Pro Account

- Minimum deposit: $200

- Spreads from 0.1 pips

- No commissions

- Leverage up to 1:3000

- Suitable for more experienced traders

Raw Spread Account

- Minimum deposit: $200

- Raw spreads from 0.0 pips

- Commission: $3 per lot per side

- Leverage up to 1:3000

- Designed for high-volume traders and scalpers

Standard Cent Account (MT4 only)

- Minimum deposit: $10

- Spreads from 0.3 pips

- No commissions

- Leverage up to 1:3000

- Perfect for beginners trading with smaller volumes

Copytrading Standard Account (MT4 only)

- Minimum deposit: $10

- Spreads from 0.3 pips

- No commissions

- Leverage up to 1:3000

- Ideal for copy traders and signal providers

Copytrading Pro Account (MT4 only)

- Minimum deposit: $200

- Spreads from 0.1 pips

- No commissions

- Leverage up to 1:3000

- Suitable for experienced copy traders and signal providers

In addition to these account types, JustMarkets also offers demo accounts, which allow traders to practise their strategies and familiarise themselves with the trading platforms in a risk-free environment. Islamic (swap-free) accounts are also available upon request for traders who adhere to Sharia law principles.

By providing a diverse range of account types with varying minimum deposit requirements, spread structures, and commission models, JustMarkets ensures that traders can select an account that aligns with their trading style, experience level, and financial goals. This flexibility demonstrates the broker's commitment to accommodating the unique needs of their clients and providing a tailored trading experience.

Account Types Comparison Table

| Feature | Standard | Pro | Raw Spread | Standard Cent | Copytrading Standard | Copytrading Pro |

|---|---|---|---|---|---|---|

| Min. Deposit | $10 | $200 | $200 | $10 | $10 | $200 |

| Spread | From 0.3 | From 0.1 | From 0.0 | From 0.3 | From 0.3 | From 0.1 |

| Commission | No | No | $3/lot | No | No | No |

| Leverage | 1:3000 | 1:3000 | 1:3000 | 1:3000 | 1:3000 | 1:3000 |

| Trading Platform | MT4, MT5 | MT4, MT5 | MT4, MT5 | MT4 | MT4 | MT4 |

| Ideal For | Beginners | Experienced | High-volume | Beginners | Copy Traders | Experienced Copy Traders |

Negative Balance Protection

Negative balance protection is a risk management feature that ensures a trader's account balance never falls below zero, even in the event of extreme market volatility or unexpected trading losses. This protection is crucial for limiting a trader's potential losses and preventing them from owing money to the broker. In the context of online trading, negative balances can occur when a trader's losses exceed their account balance, typically due to the use of leverage. For example, if a trader with a $1,000 account balance opens a highly leveraged position and the market moves sharply against them, their losses could potentially exceed their initial investment, resulting in a negative balance. JustMarkets offers negative balance protection to all its clients, regardless of their account type or trading volume. This policy ensures that traders cannot lose more than the funds available in their trading account, providing peace of mind and limiting their risk exposure. Under JustMarkets' negative balance protection policy, if a trader's account balance falls into negative territory due to trading losses, the broker will automatically adjust the balance back to zero, effectively waiving the negative balance. This protection applies to both normal market conditions and instances of extreme market volatility, such as during major news events or unexpected market disruptions. It is important to note that while negative balance protection provides a safety net for traders, it should not be relied upon as a substitute for proper risk management and disciplined trading practices. Traders should always use appropriate leverage levels, set stop-loss orders, and manage their positions responsibly to minimise the risk of substantial losses. By offering negative balance protection, JustMarkets demonstrates its commitment to safeguarding its clients' funds and promoting responsible trading practices. This feature provides traders with an added layer of security and helps to foster a safer and more trustworthy trading environment.

JustMarkets Deposits and Withdrawals

JustMarkets offers a wide range of deposit and withdrawal options to cater to the preferences and needs of their global client base. The broker aims to provide a seamless and efficient funding experience, ensuring that traders can quickly and securely manage their account balances.

Deposit Methods

| Deposit Method | Processing Time | Minimum Deposit | Notes |

|---|---|---|---|

| Credit/Debit Cards | Instant | $10 | Visa, Mastercard supported |

| Bank Wire Transfer | 2–5 business days | $100 | May involve bank fees |

| E-wallets | Instant | $10 | Skrill, Neteller, Perfect Money, Sticpay, Airtm |

| Cryptocurrencies | Up to 1 hour | $10 | Bitcoin, Ethereum, Litecoin, and more |

| Local Bank Transfers | Within 24 hours | $10 | Available in supported countries |

| African Mobile Money | Instant | $10 | Available in select African regions |

| Pay Retailers | Instant | $10 | Region-specific convenience stores and payment points |

| Boleto (Brazil) | 1–3 business days | $10 | For clients based in Brazil |

| Momo (Vietnam) | Instant | $10 | Popular local method in Vietnam |

| Fasapay | Instant | $10 | Available in supported regions |

Withdrawal Methods

| Withdrawal Method | Processing Time | Fees | Notes |

|---|---|---|---|

| Credit/Debit Cards | 1–6 business days | No broker fee | Visa, Mastercard supported; may incur bank/provider fees |

| Bank Wire Transfer | 1–6 business days | No broker fee | Bank fees may apply |

| E-wallets | Up to 2 hours | No broker fee | Skrill, Neteller, Perfect Money, Sticpay, Airtm |

| Cryptocurrencies | Up to 2 hours | No broker fee | Bitcoin, Ethereum, Litecoin, and more |

| Local Bank Transfers | 1–3 business days | No broker fee | Time varies by country |

| African Mobile Money | Up to 24 hours | No broker fee | Available in supported African countries |

| Pay Retailers | 1–3 business days | No broker fee | Region-specific convenience points |

| Fasapay | Up to 2 hours | No broker fee | Fast and supported in selected regions |

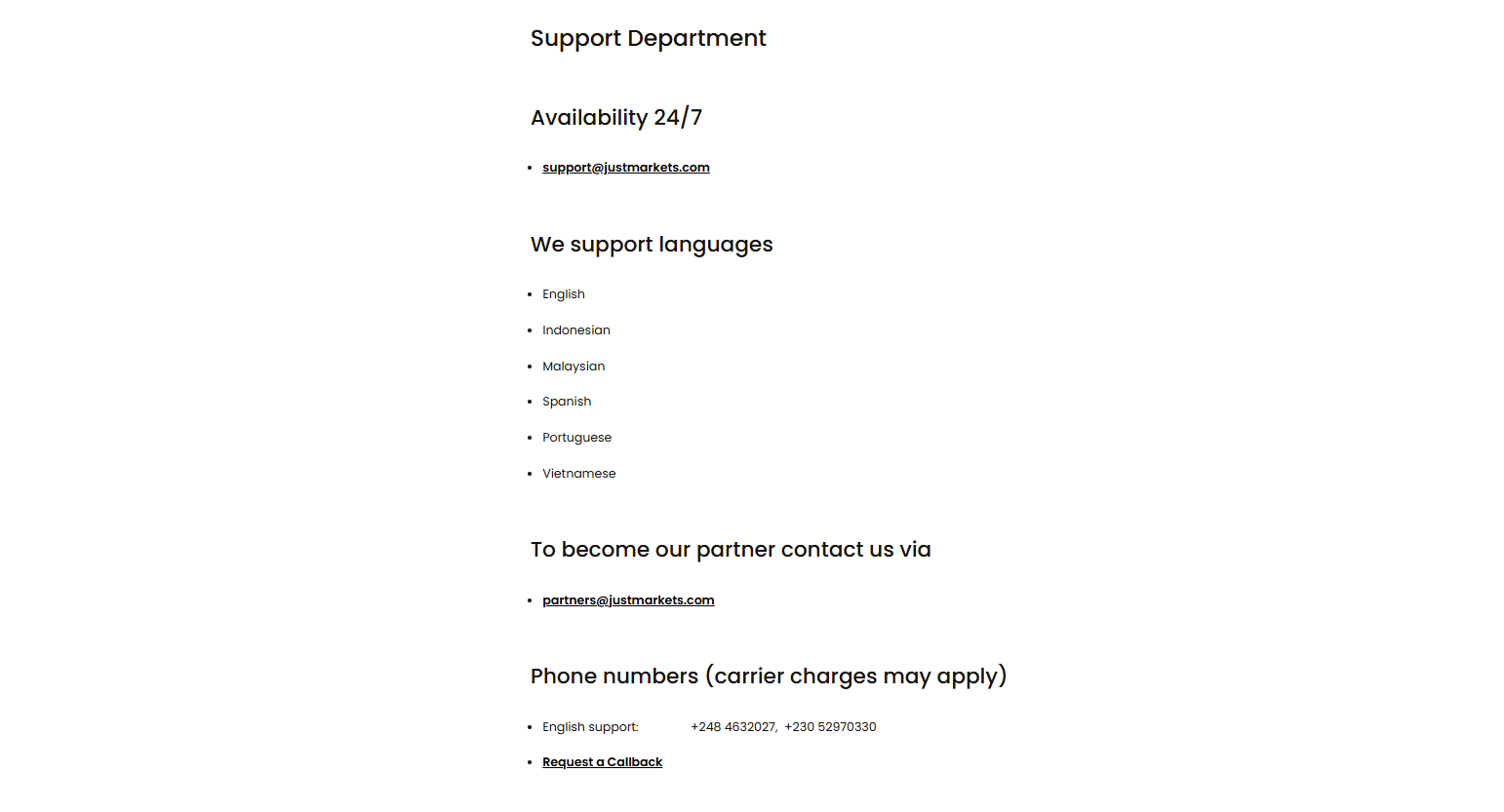

Support Service for Customer

In the fast-paced world of online trading, reliable and efficient customer support is crucial for ensuring a positive trading experience. JustMarkets understands the importance of providing prompt and helpful assistance to their clients, offering a comprehensive support system that caters to traders' needs around the clock.

- Live Chat: Available 24/7, the live chat feature allows traders to connect with a support representative in real-time, ideal for quick queries and immediate assistance.

- Email: Traders can send their enquiries to support@justmarkets.com, with the support team typically responding within 24 hours.

- Phone: JustMarkets provides international phone support, with numbers available for traders worldwide. The main support numbers are +248 4632027 and +230 52970330.

- Social Media: Traders can also reach out to JustMarkets through various social media platforms, such as Telegram, Instagram, Viber, iMessage, Messenger, and WhatsApp.

Customer Support Comparison Table

| Support Channel | Availability | Languages | Response Time |

|---|---|---|---|

| Live Chat | 24/7 | English, Indonesian, Malaysian, Spanish, Portuguese, Vietnamese | Within minutes |

| 24/7 | English, Indonesian, Malaysian, Spanish, Portuguese, Vietnamese | Within 24 hours | |

| Phone | 24/7 | English, Indonesian, Malaysian, Spanish, Portuguese, Vietnamese | Immediate |

| Social Media | 24/7 | English, Indonesian, Malaysian, Spanish, Portuguese, Vietnamese | Within 24 hours |

Prohibited Countries

Due to various regulatory requirements, licensing restrictions, and geopolitical factors, JustMarkets is unable to provide its services to residents of certain countries and regions. It is essential for traders to be aware of these restrictions to avoid any potential legal consequences or issues with account opening and funding.

The primary regions where JustMarkets is not permitted to operate include:

- United States

- Canada

- Australia

- Japan

- United Kingdom

- European Union countries

- Countries sanctioned by the European Union

These restrictions are in place to ensure that JustMarkets complies with the legal and regulatory frameworks of the jurisdictions in which it operates. Offering services to residents of prohibited countries could result in legal repercussions for the broker and potential difficulties for traders in accessing their funds or resolving disputes.

Traders from prohibited countries who attempt to open an account with JustMarkets may face account termination, delays in withdrawal processing, or even legal action. It is crucial for traders to provide accurate information during the account opening process to avoid such issues.

JustMarkets is committed to transparency regarding its prohibited countries list and strives to keep traders informed about any changes to these restrictions. The broker encourages potential clients to review the list of prohibited countries on their website and contact customer support if they have any questions or concerns.

Special Offers for Customers

JustMarkets provides a range of special promotions and offers designed to enhance traders' experience and offer additional value to their clients. These offers can help traders maximise their trading potential, increase their account balances, and take advantage of unique features and benefits.

One of the most notable offers provided by JustMarkets is the 50% deposit bonus with no maximum limit. This promotion allows traders to receive a bonus equal to 50% of their deposit amount, effectively increasing their trading capital. To qualify for this bonus, traders must make a minimum deposit of $10. The bonus can be used as additional margin for trading, providing more flexibility in managing positions.

In addition to the deposit bonus, JustMarkets occasionally runs trading competitions, giving traders the opportunity to showcase their skills and potentially win prizes. These competitions often feature attractive prize pools and can be an exciting way for traders to engage with the broker and the trading community.

JustMarkets also offers a loyalty program that rewards traders for their continued trading activity. As traders reach certain milestones or trading volumes, they can unlock various benefits, such as reduced spreads, cashback rewards, or exclusive access to educational resources and market analysis.

Conclusion

As I come to the end of this comprehensive review of JustMarkets, I can confidently say that they have established themselves as a reliable and trustworthy broker in the competitive world of online trading. Throughout my analysis, I have been impressed by their commitment to providing a safe, transparent, and user-focused trading environment.

One of the standout features of JustMarkets is their strong regulatory compliance, with licenses from top-tier authorities such as CySEC, FSA, FSCA, and FSC. This multi-jurisdictional approach to regulation ensures that they adhere to strict industry standards and prioritise the security of their clients' funds. The fact that they offer negative balance protection and segregate client funds further demonstrates their dedication to risk management and client safety.

Another area where JustMarkets excels is in their diverse range of account types and trading instruments. With six different account types, including the unique Copytrading accounts and the beginner-friendly Standard Cent account, they cater to traders of all experience levels and trading styles. The wide selection of tradable assets, spanning forex, commodities, indices, stocks, and cryptocurrencies, allows traders to diversify their portfolios and take advantage of various market opportunities.

JustMarkets' trading platforms, particularly the industry-standard MT4 and MT5, offer a seamless and efficient trading experience. The platforms' advanced charting tools, technical indicators, and automated trading capabilities provide traders with the necessary tools to analyse markets and execute trades effectively. The JustMarkets Trading App also deserves praise for its intuitive interface and mobile-friendly features, enabling traders to manage their accounts on the go.

In terms of customer support, JustMarkets has set a high standard with their 24/7 multilingual support, available through live chat, email, phone, and social media channels. The knowledgeable and responsive support team ensures that traders can access assistance whenever they need it, demonstrating the broker's commitment to client satisfaction.

While JustMarkets has many strengths, it is essential to acknowledge some limitations. For instance, the broker's educational resources, while comprehensive, may lack the depth and variety offered by some competitors. Additionally, JustMarkets does not currently offer social trading or copy trading capabilities directly within their platforms, which may be a drawback for some traders.

Despite these limitations, I believe that JustMarkets' overall offering is solid and well-rounded. Their competitive spreads, fast execution speeds, and wide range of deposit and withdrawal options further contribute to a positive trading experience.

In conclusion, based on my thorough review, I can confidently recommend JustMarkets as a reliable and reputable broker for both beginner and experienced traders. Their strong regulatory compliance, diverse account types and tradable assets, user-friendly platforms, and excellent customer support make them a compelling choice in the online trading space. As with any broker, traders should carefully consider their individual needs and trading goals before making a decision, but JustMarkets undoubtedly offers a solid foundation for those seeking a trustworthy and efficient trading partner.