LiteFinance Review 2025: A Legit Forex Broker for Pro and New Traders

LiteFinance

Cyprus

Cyprus

-

Minimum Deposit $50

-

Withdrawal Fee $varies

-

Leverage 1000:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

Cyprus Market Making (MM)

Cyprus Market Making (MM)

Softwares & Platforms

Customer Support

+447520644437

(English)

+447520644437

(English)

Supported language: English, Portuguese, Indonesian, Russian, Spanish

Social Media

Summary

LiteFinance (formerly LiteForex) is a globally recognized forex and CFD broker established in 2005, serving over 3.3 million clients across 50+ countries. It offers more than 600 tradable instruments, including forex, commodities, indices, stocks, and cryptocurrencies, with tight spreads from 0.0 pips and leverage up to 1:1000. Traders can choose from MT4, MT5, cTrader, or a proprietary platform with integrated signals. Regulated by CySEC, LiteFinance ensures secure fund management, fast execution, and educational support for both beginners and experienced traders.

- Regulated by CySEC, ensuring client protection and transparency

- Wide range of tradable assets across multiple markets

- Competitive spreads starting from 0.0 pips

- Flexible leverage options up to 1:1000 for non-EU clients

- Choice of popular trading platforms, including MT4, MT5, cTrader, and proprietary platform

- Extensive educational resources and market analysis tools

- Responsive customer support available in multiple languages

- Negative balance protection and segregated client funds for added security

- Variety of deposit and withdrawal methods with no fees

- Special promotions and bonuses, including welcome bonus and loyalty program

- Services limited to specific countries and jurisdictions

- Varying regulations and client protection levels across different entities

- High leverage may increase risk exposure for inexperienced traders

- Third-party fees may apply for certain deposit and withdrawal methods

- Limited range of tradable assets compared to some larger brokers

- No 24/7 customer support available

- Occasional slippage may occur during high market volatility

- Restrictions on trading strategies, such as expert advisors and scalping, may apply

- Promotional offers may have specific terms and conditions that limit their benefit

- Pricing and execution may differ between the broker's entities

Overview

LiteFinance, also known as LiteForex, is a well-established forex and CFD broker that has been serving clients worldwide since 2005. With a strong presence in over 50 countries and a client base exceeding 3.31 million traders, LiteFinance has earned a reputation for providing competitive trading conditions and a user-friendly experience.

Throughout its 19 years in the market, LiteFinance has been recognised with numerous prestigious awards, highlighting its commitment to excellence and innovation. More information about the company's history, achievements, and services can be found on their official website ( LiteFinance.com )

LiteFinance offers a diverse range of tradable assets, including over 600 instruments across forex, commodities, indices, stocks, and cryptocurrencies. The broker provides access to popular trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, as well as its own proprietary platform with advanced features and tools.

With a strong focus on technology and client satisfaction, LiteFinance ensures fast execution speeds, tight spreads starting from 0.0 pips, and flexible leverage options up to 1:1000. The broker also prioritises the safety and security of client funds, employing strict protocols and advanced technological solutions.

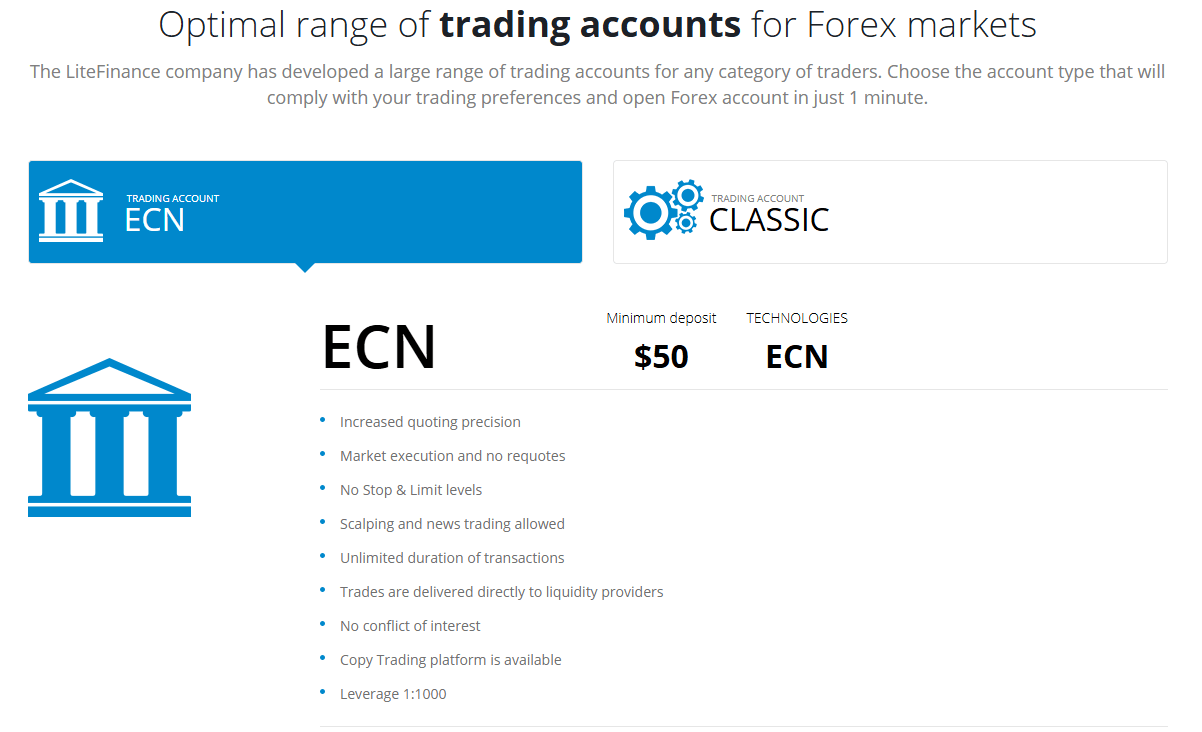

To cater to the diverse needs of traders, LiteFinance offers two main account types – ECN and Classic – both with a low minimum deposit of just $50. The broker also provides extensive educational resources, daily market analysis, and responsive customer support to help traders succeed.

Whether you're a beginner or an experienced trader, LiteFinance aims to provide a comprehensive and reliable trading environment that empowers you to achieve your financial goals. With its competitive offerings, cutting-edge technology, and commitment to client success, LiteFinance is a broker worth considering for your trading needs.

Overview Table

| Attribute | Details |

|---|---|

| Name | LiteFinance (LiteForex) |

| Founded | 2005 |

| Headquarters | Limassol, Cyprus |

| Regulation | Cyprus Securities and Exchange Commission (CySEC) |

| Trading Platforms | MetaTrader 4, MetaTrader 5, cTrader, Proprietary Platform |

| Account Types | ECN, Classic |

| Minimum Deposit | $50 |

| Leverage | Up to 1:1000 |

| Tradable Assets | Forex, Commodities, Stock Indices, CFDs, Cryptocurrencies |

| Spreads | Starting from 0.0 pips |

| Commission | Varies based on account type and asset |

| Customer Support | 24/5 via Live Chat, Email, Phone |

| Education | Daily Market Analysis, Trading Signals, Webinars, Tutorials |

Facts List

- LiteFinance has been operating for over 19 years, having been founded in 2005.

- The broker serves more than 3.31 million traders worldwide.

- LiteFinance offers access to over 600 trading instruments across multiple asset classes.

- Clients can choose from popular platforms like MT4, MT5, cTrader, and a proprietary platform.

- The minimum deposit requirement for both ECN and Classic accounts is just $50.

- LiteFinance provides leverage up to 1:1000 for non-EU clients.

- Spreads start from 0.0 pips, with fast execution speeds from 0.01 seconds.

- The broker employs an ECN+STP processing model for transparent and efficient trade execution.

- LiteFinance offers 24/5 customer support via live chat, email, and phone.

- Extensive educational resources, including daily market analysis and trading signals, are available to clients.

LiteFinance Licenses and Regulatory

LiteFinance operates under the jurisdiction of the Cyprus Securities and Exchange Commission (CySEC), a well-respected and stringent financial regulator in the European Union. The broker's adherence to CySEC regulations ensures a high level of client protection, transparency, and fair business practices.

CySEC requires regulated brokers to maintain segregated client funds, implement negative balance protection, and participate in investor compensation schemes. These measures safeguard clients' investments and provide an additional layer of security in the event of broker insolvency.

LiteFinance's regulation by CySEC demonstrates the broker's commitment to operating in compliance with industry standards and providing a safe trading environment for its clients. The broker's regulatory status can be verified on the official CySEC website, further enhancing its credibility and trustworthiness.

Regulations List

- Cyprus Securities and Exchange Commission (CySEC): License number 093/08

Trading Instruments

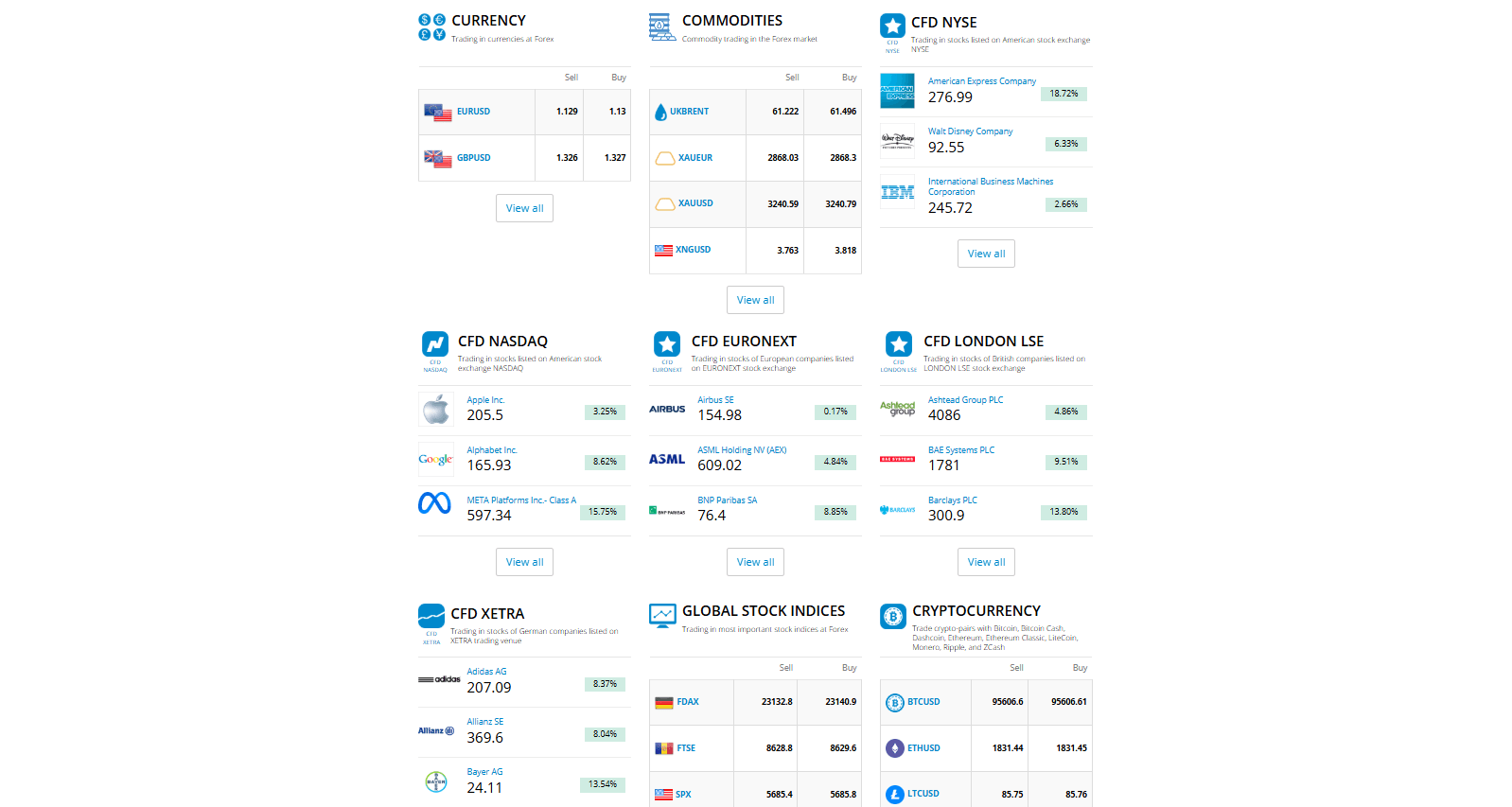

LiteFinance offers a comprehensive range of tradable assets, catering to the diverse needs and preferences of traders. The broker provides access to over 600 instruments across multiple asset classes, including:

| Asset Class | Description | Examples |

|---|---|---|

| Forex | Wide selection of currency pairs (majors, minors, exotics) with competitive spreads and leverage | EUR/USD, GBP/JPY, USD/ZAR |

| Commodities | Trade popular commodities with flexible contract sizes | Gold, Silver, Oil, Natural Gas |

| Stock Indices | CFDs on global indices for market-wide speculation | S&P 500, NASDAQ, FTSE 100, DAX 30 |

| CFD NYSE | Trade U.S. stock CFDs from NYSE | American Express, Walt Disney, IBM |

| CFD NASDAQ | CFDs on tech-heavy NASDAQ-listed stocks | Apple, Alphabet (Google), Meta Platforms (Facebook) |

| CFD EURONEXT | CFDs on European stocks listed on EURONEXT | Airbus, ASML Holding, BNP Paribas |

| CFD LONDON LSE | CFDs on UK stocks listed on LSE | Ashtead Group, BAE Systems, Barclays |

| CFD XETRA | CFDs on German stocks listed on XETRA | Adidas, Allianz, Bayer |

| Cryptocurrencies | Crypto pair trading against USD | Bitcoin (BTC/USD), Ethereum (ETH/USD), Litecoin (LTC/USD), Ripple (XRP/USD) |

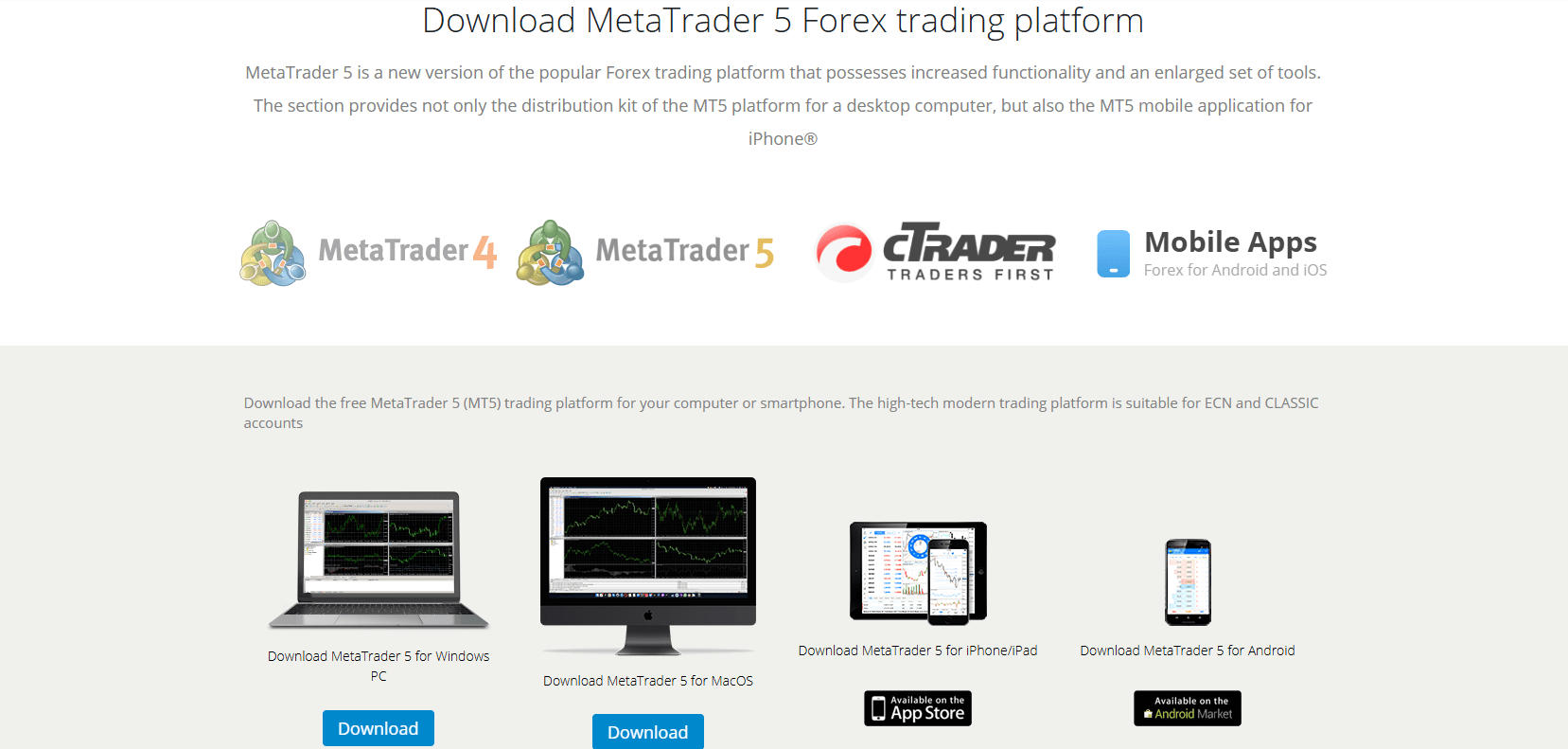

Trading Platforms

LiteFinance provides traders with a choice of powerful and user-friendly trading platforms, catering to different levels of experience and trading styles. The available platforms include:

MetaTrader 4 (MT4)

A widely used and trusted platform, MT4 offers a comprehensive suite of trading tools, advanced charting capabilities, and automated trading options. The platform is available for desktop, web, and mobile devices.

MetaTrader 5 (MT5)

The next-generation platform, MT5, builds upon the features of MT4 and offers additional functionalities such as expanded timeframes, advanced indicators, and an integrated economic calendar. MT5 is available for desktop and mobile trading.

cTrader

A cutting-edge platform designed for demanding traders, cTrader offers advanced charting tools, fast execution speeds, Level 2 market depth, and algorithmic trading capabilities. The platform is accessible via web, desktop, and mobile apps.

Proprietary platform

LiteFinance's proprietary trading platform provides a sleek and intuitive interface powered by TradingView charts. The platform offers advanced charting tools, a wide range of indicators, and integrated trading signals.

LiteFinance's trading platforms are designed to accommodate various trading strategies, from manual trading to automated and algorithmic approaches. The broker also offers VPS hosting services for uninterrupted and low-latency trading, ensuring that traders can execute their strategies efficiently and securely.

To access the trading platforms, traders can log in to their LiteFinance account and download the desired platform from the broker's website. Mobile apps are also available for both iOS and Android devices, enabling traders to manage their accounts and execute trades on the go.

Trading Platforms Comparison Table

| Feature | MT4 | MT5 | cTrader | Proprietary |

|---|---|---|---|---|

| Charting tools | Yes | Yes | Yes | Yes |

| Indicators | 30+ | 40+ | 50+ | 30+ |

| Timeframes | 9 | 21 | 21 | 9 |

| Automated trading | Yes | Yes | Yes | No |

| Mobile trading | Yes | Yes | Yes | No |

| Web platform | Yes | No | Yes | Yes |

| Desktop platform | Yes | Yes | Yes | No |

| Integrated signals | No | No | No | Yes |

| Integrated calendar | No | Yes | Yes | No |

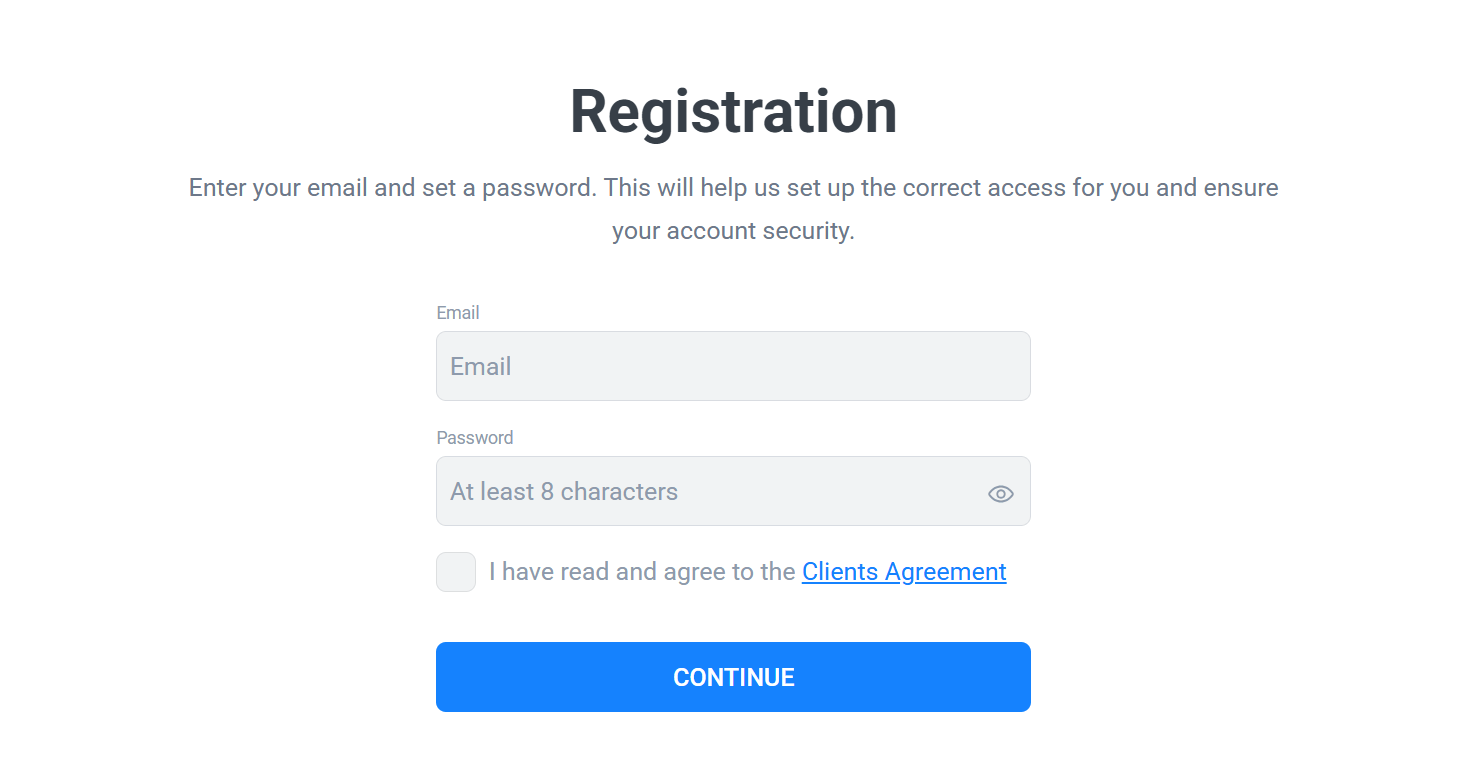

LiteFinance How to Open an Account: A Step-by-Step Guide

Opening an account with LiteFinance is a simple and straightforward process. To get started, follow these steps:

- Visit the LiteFinance official website and click on the "Open Account" or "Register" button.

- Fill out the registration form with your personal details, including your full name, email address, phone number, and country of residence.

- Select your preferred account type (ECN or Classic) and trading platform (MT4, MT5, cTrader, or Proprietary).

- Choose your account base currency and desired leverage level.

- Read and agree to the broker's terms and conditions, privacy policy, and risk disclosure statement.

- Submit your registration form and wait for a confirmation email from LiteFinance.

- Verify your account by providing proof of identity (POI) and proof of address (POA) documents. This step is necessary to comply with anti-money laundering (AML) and know your customer (KYC) regulations.

- Once your account is verified, log in to your LiteFinance client area and navigate to the deposit section.

- Choose your preferred deposit method and follow the instructions to fund your account. LiteFinance offers a variety of deposit options, including bank wire transfers, credit/debit cards, and e-wallets like Skrill and Neteller.

- After your deposit is processed, you can download your chosen trading platform and start trading.

Charts and Analysis

LiteFinance provides traders with a comprehensive suite of tools and resources for market analysis and informed decision-making. The broker offers a wide range of charts, technical analysis tools, and educational materials, including:

| Feature | Description |

|---|---|

| Interactive Charts | Advanced charting tools with multiple timeframes, chart types (candlestick, bar, line), and customisable indicators for price analysis and trend spotting. |

| Economic Calendar | Integrated calendar with upcoming economic events, expected market impact, and historical data for context. |

| Market News & Analysis | Daily updates and expert insights covering various asset classes with fundamental and technical analysis. |

| Trading Signals | Technical and fundamental-based trading ideas from professional analysts to support decision-making. |

| Webinars & Educational Videos | Library of videos and live webinars covering trading strategies, concepts, and market analysis. |

| Tutorials & Guides | Step-by-step instructions on using trading platforms, tools, and features for all experience levels. |

LiteFinance Account Types

LiteFinance offers two main account types to cater to the diverse needs and preferences of traders:

ECN Account

- Minimum deposit: $50

- Spread: Floating, starting from 0.0 pips

- Commission: Varies based on the traded asset

- Leverage: Up to 1:1000

- Trading platform: MT4, MT5, cTrader

- Execution: ECN, Market Execution with no requotes

- Scalping and news trading allowed

- Copy Trading available

The ECN account is designed for experienced traders seeking raw market spreads, fast execution speeds, and the ability to trade with deep liquidity. This account type offers direct access to liquidity providers and supports various trading strategies.

Classic Account

- Minimum deposit: $50

- Spread: Floating, starting from 2.0 pips

- Commission: No additional commission

- Leverage: Up to 1:1000

- Trading platform: MT4, MT5

- Execution: Market Execution with no requotes

- Suitable for both beginners and experienced traders

The Classic account is a standard account type that offers competitive spreads and no additional commissions. It is suitable for traders of all levels who prefer a straightforward pricing structure and the flexibility to trade with high leverage.

Both account types offer access to a wide range of tradable assets, including forex, commodities, indices, stocks, and cryptocurrencies. LiteFinance also provides Islamic (swap-free) accounts for traders who adhere to Sharia law.

Account Types Comparison Table

| Feature | ECN | Classic |

|---|---|---|

| Minimum Deposit | $50 | $50 |

| Spread | From 0.0 pips | From 2.0 pips |

| Commission | Asset-based | None |

| Leverage | Up to 1:1000 | Up to 1:1000 |

| Trading Platforms | MT4, MT5, cTrader | MT4, MT5 |

| Execution | ECN, Market Execution | Market Execution |

| Scalping | Allowed | Allowed |

| News Trading | Allowed | Allowed |

| Copy Trading | Available | Available |

| Islamic Account | Available | Available |

Negative Balance Protection

LiteFinance offers negative balance protection to all clients, ensuring that traders cannot lose more than their account balance. This important risk management feature safeguards traders from unpredictable market events and limits their potential losses. Negative balance protection is crucial in volatile market conditions, where sudden price movements can cause positions to incur losses exceeding the account balance. With LiteFinance's negative balance protection, traders can have peace of mind knowing that their losses will be capped at the available funds in their trading account. This protection is automatically applied to all LiteFinance trading accounts and does not require any additional setup or activation. In case of extreme market movements that cause the account balance to turn negative, LiteFinance will absorb the negative balance, effectively resetting the account balance to zero. It is essential to note that negative balance protection does not negate the importance of proper risk management and responsible trading practices. Traders should always utilise stop-loss orders, manage their leverage, and maintain a well-diversified portfolio to minimise potential losses. By offering negative balance protection, LiteFinance demonstrates its commitment to providing a safe and secure trading environment for its clients, prioritising their interests and helping them manage risks effectively.

LiteFinance Deposits and Withdrawals

LiteFinance offers a variety of convenient deposit and withdrawal methods to facilitate smooth and secure transactions for its clients. The available options include:

Deposit Methods

| Method | Processing Time | Minimum Amount |

|---|---|---|

| Bank Wire Transfer | 1–5 business days | $50 |

| Credit/Debit Cards (Visa, Mastercard) | Instant or same-day | $50 |

| E-wallets (Skrill, Neteller) | Instant or same-day | $50 |

Withdrawal Methods

| Method | Fees | Processing Time |

|---|---|---|

| Bank Wire Transfer | No fees by LiteFinance (third-party fees may apply) | 2–5 business days |

| Credit/Debit Cards (Visa, Mastercard) | No fees by LiteFinance (third-party fees may apply) | Within 24 hours |

| E-wallets (Skrill, Neteller) | No fees by LiteFinance (third-party fees may apply) | Instant or same-day |

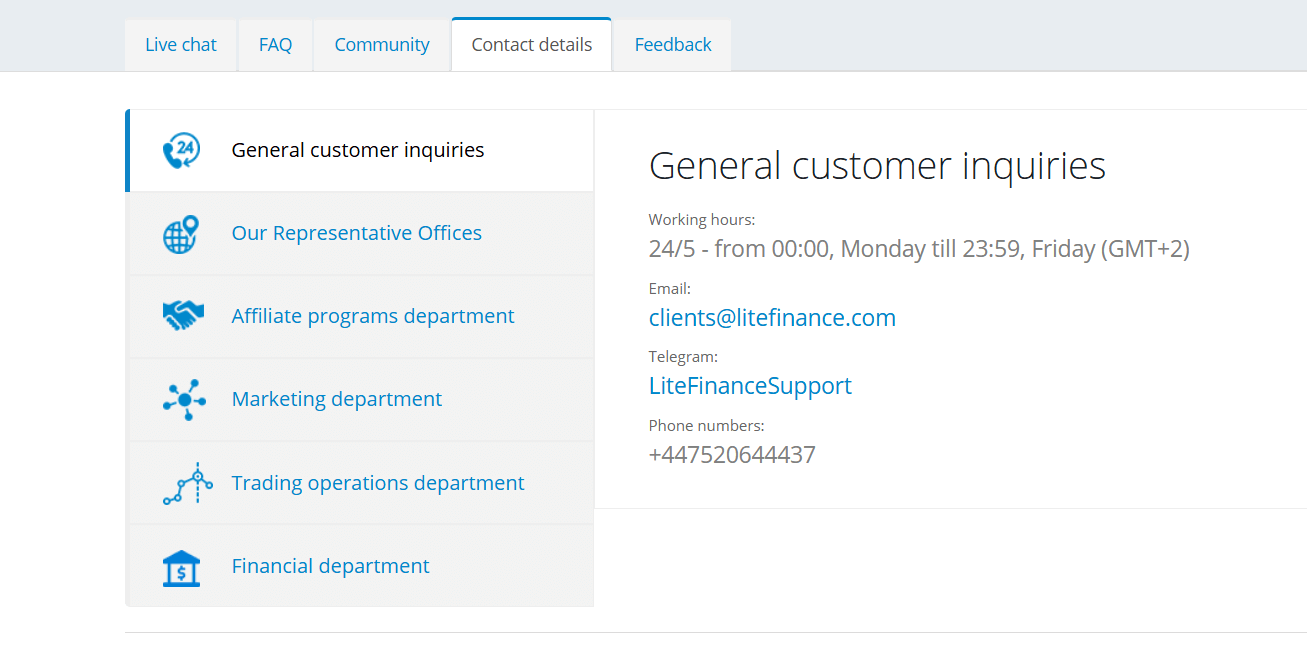

Support Service for Customer

LiteFinance provides comprehensive customer support to ensure that clients receive prompt assistance and guidance whenever needed. The broker offers multiple support channels, including:

- Live Chat: Available 24/5, LiteFinance's live chat feature allows clients to connect with a support representative in real-time directly from the website.

- Email: Clients can send their enquiries or concerns to LiteFinance's support email address (support@liteforex.eu) and expect a response within 24 hours.

- Phone: LiteFinance offers phone support via its dedicated support line (+357-25-750-555), allowing clients to speak directly with a customer service representative during working hours.

- Telegram: Clients can also reach out to LiteFinance's support team through the official Telegram channel (@LiteFinanceSupport) for quick and convenient assistance.

Customer Support Comparison Table

| Feature | LiteFinance |

|---|---|

| Support Channels | Live Chat, Email, Phone, Telegram |

| Available Languages | English, Russian, Indonesian, Portuguese, Spanish, Bahasa |

| Support Hours | 24/5 |

| Response Time | Live Chat: Instant , Email: Within 24 hours , Phone: During working hours , Telegram: Quick response |

| FAQ Section | Yes |

| Social Media Presence | Yes |

Prohibited Countries

LiteFinance provides services only to the residents of countries from the European Economic Area (EEA), the United Arab Emirates (UAE), and the Marshall Islands, as well as to clients from a limited number of other countries. The broker does not offer services to residents of certain jurisdictions due to regulatory restrictions or company policies.

Special Offers for Customers

LiteFinance offers a range of special promotions and bonuses to enhance the trading experience for its clients. Some of the current offers include:

- Loyalty Program: LiteFinance rewards its loyal clients with exclusive benefits, such as tighter spreads, higher leverage, and personalised support, based on their trading activity and account balance.

- Trading Contests: Participate in regular trading contests and competitions for a chance to win cash prizes, trading bonuses, and other exciting rewards.

- Refer-a-Friend: Earn a referral bonus by introducing your friends and family to LiteFinance. You can receive a percentage of your referrals' trading volume as a reward for your recommendation.

- Seasonal Promotions: LiteFinance periodically offers special seasonal promotions, such as increased deposit bonuses, reduced spreads, or cashback offers, during holidays or special events.

It is essential to note that the availability and terms of these special offers may vary depending on the client's country of residence and the regulatory requirements in their jurisdiction. Clients should carefully review the terms and conditions of each promotion before participating to ensure they meet the eligibility criteria and understand the associated rules and requirements.

Conclusion

After conducting a thorough review of LiteFinance, I can confidently say that they are a reliable and reputable broker with a strong commitment to providing a safe and user-friendly trading environment for their clients.

One of the standout features of LiteFinance is their regulation by CySEC, a highly respected regulatory body in the European Union. This oversight ensures that the broker adheres to strict financial guidelines and maintains transparency in its operations, ultimately protecting the interests of its clients.

LiteFinance's wide range of tradable assets, competitive spreads, and flexible leverage options cater to the needs of both novice and experienced traders. The broker's choice of trading platforms, including MT4, MT5, cTrader, and their proprietary platform, ensures that clients have access to cutting-edge technology and tools to facilitate their trading activities.

The broker's commitment to providing educational resources and market analysis tools is commendable, as it empowers traders to make informed decisions and continuously improve their skills. The responsive and knowledgeable customer support team, available through multiple channels and in several languages, is another testament to LiteFinance's dedication to client satisfaction.

While LiteFinance offers an impressive array of features and services, it is essential to consider the potential limitations, such as the restricted availability of services in certain countries and the varying regulations across different jurisdictions. However, these limitations are not unique to LiteFinance and are common among many international brokers.

Overall, I believe that LiteFinance is a trusted and capable broker that prioritises the needs and success of its clients. With its strong regulatory compliance, competitive trading conditions, and comprehensive support and educational resources, LiteFinance is well-positioned to serve traders of all levels and backgrounds.