M4Markets Review 2025: Trusted Forex & CFD Broker

M4Markets

Cyprus

Cyprus

-

Minimum Deposit $100

-

Withdrawal Fee $0

-

Leverage 30:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

Japan Forex Trading License

Japan Forex Trading License

UAE Financial Services License

UAE Financial Services License

Cyprus Market Making (MM)

Cyprus Market Making (MM)

Softwares & Platforms

Customer Support

+357291788410

(English)

+357291788410

(English)

Supported language: English, Chinese (Simplified), Indonesian, Malay, Vietnamese, Spanish, Arabic, Korean

Social Media

Summary

M4Markets is an online forex and CFD broker, founded in 2019 and headquartered in Limassol, Cyprus.

Operated by Trinota Markets Global Limited, it is regulated by CySEC, DFSA, and FSA Seychelles.

The broker offers trading in forex, indices, stocks, commodities, and cryptocurrencies.

Clients can trade on MT4, MT5, and WebTrader across Standard, VIP, Premium, and other account types.

Spreads start from 0.0 pips with leverage up to 1:30 and deposits ranging from $100 to $10,000.

M4Markets provides 24/5 multilingual support via live chat, email, and phone.

- Multiple regulatory licenses (CySEC, DFSA, FSA Seychelles)

- Wide range of tradable assets across Forex, Indices, Stocks, Commodities, and Cryptocurrencies

- Competitive spreads starting from 0.0 pips

- User-friendly trading platforms (MT4 and MT5)

- Flexible account types catering to different trading needs and experience levels

- minimum deposit requirement of $100 for Standard account

- High maximum leverage up to 1:30 (depending on account type)

- Multilingual customer support available 24/5

- Various deposit and withdrawal methods supported

- Educational resources and market analysis tools provided

- Limited information on specific spreads and commissions for each asset class

- Restricted services in certain countries due to regulatory constraints

- High minimum deposit requirements for Raw Spread and Premium accounts

- Limited customization options for the MT4 platform compared to MT5

- No guaranteed stop-loss orders available

- Lack of transparency regarding overnight swap rates and financing charges

- Limited social trading features or copy trading options

- No clear information on the average execution speed or slippage rates

Overview

M4Markets is an online forex and CFD broker headquartered in Limassol, Cyprus. Founded in 2019 by Trinota Markets Global Limited, the broker has rapidly grown in the financial services sector under the M4Markets brand.

Their primary objective is to provide investors with optimal trading conditions by collaborating with leading financial institutions, both banks and non-banks, to generate high liquidity and offer the most competitive market prices. This commitment has positioned M4Markets as one of the most sought-after brokers in the current market landscape.

For more comprehensive information about M4Markets' offerings and services, please visit their official website at www.m4markets.com.

Overview Table

| Feature | Details |

|---|---|

| Headquarters | Limassol, Cyprus |

| Founded | 2019 |

| Regulation | CySEC, DFSA, FSA Seychelles |

| Instruments | Forex, Indices, Stocks, Commodities, Cryptocurrencies |

| Platforms | MT4, MT5, WebTrader |

| Account Types | Standard, Vip , Premium |

| Minimum Deposit | $100-$10,000 (depending on account type) |

| Leverage | Up to 1:30 |

| Spreads | Starting from 0.0 pips |

| Customer Support | 24/5 via live chat, email, phone |

Facts List

- M4Markets was established in 2019 by Trinota Markets Global Limited.

- The broker is headquartered in Limassol, Cyprus.

- M4Markets is regulated by CySEC, DFSA, and FSA Seychelles.

- The broker offers a wide range of instruments, including Forex, Indices, Stocks, Commodities, and Cryptocurrencies.

- M4Markets provides access to popular trading platforms such as MT4 and MT5.

- There are four account types available: Standard, Raw Spread, Premium, and Dynamic Leverage.

- Minimum deposit requirements range from $100 to $10,000, depending on the account type.

- Maximum leverage varies based on account type, with up to 1:30 available.

- Spreads start from as low as 0.0 pips.

- Customer support is available 24/5 through live chat, email, and phone.

M4Markets Licenses and Regulatory

M4Markets operates under the regulatory oversight of several reputable authorities, ensuring a secure and transparent trading environment for its clients. The broker holds licenses from the following regulators:

- Seychelles Financial Services Authority (FSA)—License No. SD035 under Trinota Markets (Global) Limited.

- Dubai Financial Services Authority (DFSA) – License No. F007051 under Oryx Finance Ltd.

- Cyprus Securities and Exchange Commission (CySEC) – License No. 301/16 under Harindale Ltd.

The multiple regulatory licenses held by M4Markets demonstrate the broker's commitment to operating in compliance with industry standards and providing a trustworthy environment for its clients. This level of regulatory oversight instills confidence in traders, as it ensures that the broker adheres to strict guidelines and maintains a high level of financial security.

Regulations List

- Seychelles Financial Services Authority (FSA) – License No. SD035

- Dubai Financial Services Authority (DFSA) – License No. F007051

- Cyprus Securities and Exchange Commission (CySEC) – License No. 301/16

Trading Instruments

M4Markets offers a comprehensive selection of tradable assets, catering to the diverse needs and preferences of its clients. The broker provides access to the following asset classes:

| Asset Class | Description | Key Features |

|---|---|---|

| Forex | Trade 50+ popular currency pairs | Spreads from 0.0 pips, high liquidity |

| Stocks (CFDs) | Trade CFDs on major US and European stocks | No ownership of underlying asset, sector diversification |

| Indices | Speculate on global indices like S&P 500, NASDAQ, DAX, FTSE | Spreads from 0.0 pips, zero commission |

| Commodities | Trade gold, oil, and other global commodities | Profit in rising or falling markets |

| Cryptocurrencies | Trade 24/7 on popular crypto pairs (e.g., BTC/USD, ETH/USD) | Multiplied returns, around-the-clock availability |

For a more detailed overview of the specific assets available within each class, please refer to the M4Markets official website at www.m4markets.com/instruments.

Trading Platforms

M4Markets provides clients with access to two industry-leading trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

- MT4: MetaTrader 4 is a user-friendly trading platform suitable for both novice and experienced traders. Known for its simplicity, convenience, and speed, MT4 is an ideal choice for those starting their trading journey.

- MT5: MetaTrader 5 is a multi-asset trading platform that supports Forex, stocks, and futures. Equipped with advanced analysis tools, an extensive range of indicators, and automated trading capabilities, MT5 offers a fast and flexible order management system, making it a popular choice among traders.

Both platforms are accessible via desktop, web, and mobile devices, ensuring that traders can stay connected to the markets and execute trades seamlessly, regardless of their location.

Trading Platforms Comparison Table

| Feature | MT4 | MT5 |

|---|---|---|

| Asset Classes | Forex, CFDs | Forex, CFDs, Stocks, Futures |

| Indicators | 30+ built-in | 40+ built-in |

| Timeframes | 9 | 21 |

| Order Types | 4 | 6 |

| Automated Trading | Yes | Yes |

| Web Platform | Yes | Yes |

| Mobile Apps | iOS, Android | iOS, Android |

| Customization | Limited | Advanced |

| Backtesting | Yes | Yes |

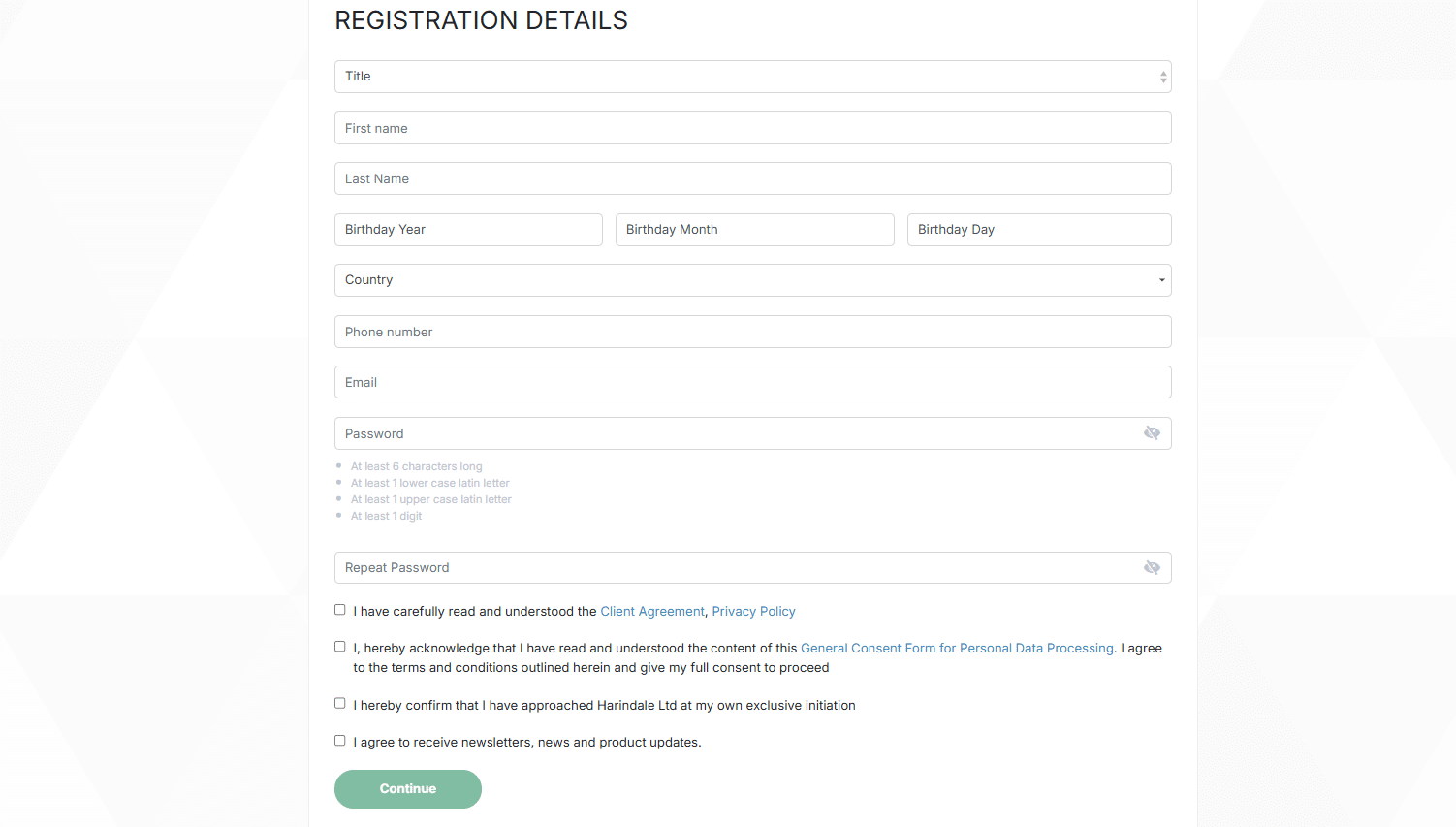

M4Markets How to Open an Account: A Step-by-Step Guide

Opening an account with M4Markets is a straightforward process that can be completed in just a few steps:

- Visit the M4Markets website and click on the "Open Account" button.

- Fill out the registration form with your personal details, including name, email address, and phone number.

- Choose your preferred account type (Standard, Vip , Premium) and base currency.

- Provide the required identification documents (e.g., passport or ID card) and proof of residence (e.g., utility bill or bank statement) for account verification.

- Complete the online questionnaire to assess your trading knowledge and experience.

- Review and accept the terms and conditions.

- Once your account is approved, log in to the client portal and proceed to fund your account using one of the available payment methods.

- Download and install the desired trading platform (MT4 or MT5) on your device.

- Start trading on the M4Markets platform.

The account opening process is designed to be user-friendly and efficient, allowing traders to begin their trading journey with M4Markets quickly and easily.

Charts and Analysis

M4Markets provides traders with various resources and tools to enhance their market analysis and trading decisions.

| Feature | Description |

|---|---|

| Platform Support | MT4 (MetaTrader 4), MT5 (MetaTrader 5) |

| Charting Capabilities | Advanced and customizable charts |

| Timeframes | Multiple timeframes available for chart customization |

| Technical Indicators | Over 30 built-in indicators |

| Drawing Tools | Extensive tools for technical and price analysis |

| Market Data | Real-time price quotes and live market data |

| Economic Calendar | Includes key financial events, economic data releases, and market-moving news |

| Strategy Support | Enables traders to adjust strategies based on fundamental and technical inputs |

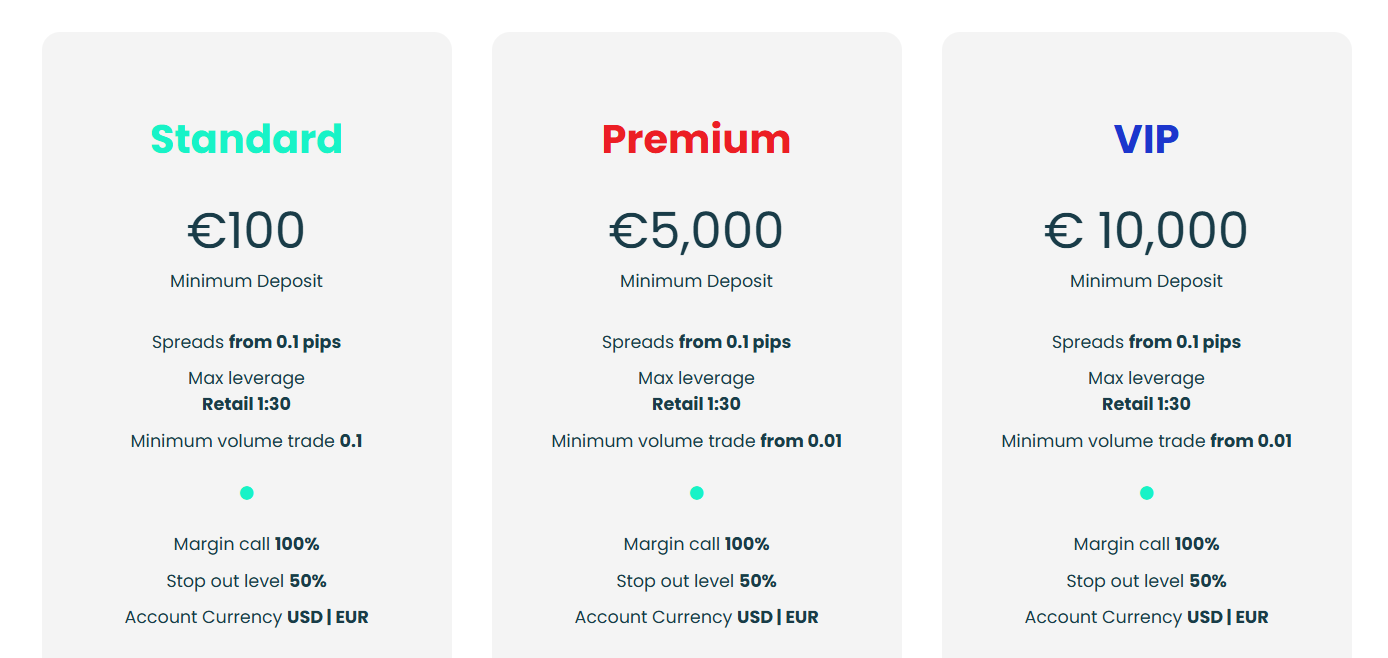

M4Markets Account Types

M4Markets offers four distinct account types to cater to the varied needs and preferences of its clients. Each account type provides unique features and trading conditions tailored to different trading styles and experience levels.

- Standard Account:

- Minimum deposit: $100

- Spreads starting from 1.2 pips

- Maximum leverage: 1:30

- Minimum trading volume: 0.1 lots

- Commission-free trading

- Premium Account:

- Minimum deposit: $5,000

- Spreads starting from 0.8 pips

- Maximum leverage: 1:30

- Minimum trading volume: 0.01 lots

- Commission-free trading

- Vip Account:

- Minimum deposit: $10,000

- Spreads starting from 0.0 pips

- Maximum leverage: 1:30

- Minimum trading volume: 0.01 lots

- Commission-free trading

All account types come with negative balance protection, ensuring that traders cannot lose more than their account balance.

Account Types Comparison Table

| Feature | Standard | Premium | Vip |

|---|---|---|---|

| Minimum Deposit | $100 | $5,000 | $10,000 |

| Spreads (from) | 1.2 pips | 0.8 pips | 0.0 pips |

| Maximum Leverage | 1:30 | 1:30 | 1:30 |

| Commission | No | No | No |

| Minimum Volume | 0.1 lots | 0.01 lots | 0.01 lots |

| Margin Call | 100% | 100% | 100% |

| Stop Out | 50% | 50% | 50% |

Negative Balance Protection

the broker provides negative balance protection for all account types. This means that if a trader's account balance falls below zero due to trading losses, M4Markets will absorb the negative balance and reset the account balance to zero. Traders will not be required to pay additional funds to cover the negative balance. Negative balance protection is particularly important for traders who use high leverage, as it can significantly amplify both gains and losses. Without this protection, traders could potentially face substantial losses that exceed their account balance, leading to a debt owed to the broker. However, it is essential to note that negative balance protection should not be relied upon as a substitute for proper risk management. Traders should still implement appropriate risk management strategies, such as setting stop-loss orders, maintaining reasonable leverage levels, and diversifying their portfolio to minimise potential losses. M4Markets' commitment to providing negative balance protection demonstrates their focus on client protection and ensuring a secure trading environment. Nonetheless, traders should carefully review the terms and conditions related to negative balance protection and any other risk management features offered by the broker to fully understand their implications and limitations. In summary, M4Markets offers negative balance protection for all account types, safeguarding traders from losing more than their account balance. This feature provides an added layer of security and peace of mind for traders, especially those utilising higher leverage. However, it should be used in conjunction with sound risk management practices to minimise potential losses and ensure a sustainable trading experience.

M4Markets Deposits and Withdrawals

M4Markets supports a wide range of deposit and withdrawal methods to ensure convenient and secure transactions for its clients.

Deposit Methods

| Method | Processing Time | Fees | Minimum Deposit |

|---|---|---|---|

| Bank Wire Transfer | 1–3 business days | May vary by bank | $500 |

| Credit/Debit Card | Instant to 1 hour | Usually free | $10 |

| E-wallets (Skrill, Neteller) | Instant to a few hours | Usually free | $10 |

| Crypto Payments | Varies (up to 1 hour) | Network fees apply | $50 |

| Local Payment Methods | Instant to 1 business day | Varies | $10–$100 |

Withdrawal Methods

| Method | Processing Time | Fees | Minimum Withdrawal |

|---|---|---|---|

| Bank Wire Transfer | 1–3 business days | Varies (may apply) | $100 |

| Credit/Debit Card | 1–3 business days | Usually free | $10 |

| E-wallets (Skrill, Neteller) | Within 24 hours | Usually free | $10 |

| Crypto Wallet | Varies (1–3 hours) | Network fees apply | $50 |

| Local Payment Methods | 1–2 business days | Varies | $10–$100 |

Support Service for Customer

M4Markets provides multilingual customer support to assist traders from various regions.

- Email: support@m4markets.com

- Live Chat: Available on the M4Markets website

- Phone: +357 25 585 00

- Contact Form: Available on the M4Markets website

Customer Support Comparison Table

| Support Channel | Availability | Languages |

|---|---|---|

| 24/5 | English, Chinese, Indonesian, Malaysian, Vietnamese, Thai, Spanish, Portuguese, Japanese, Arabic, Korean | |

| Live Chat | 24/5 | English, Chinese, Indonesian, Malaysian, Vietnamese, Thai, Spanish, Portuguese, Japanese, Arabic, Korean |

| Phone | 24/5 | English, Chinese, Indonesian, Malaysian, Vietnamese, Thai, Spanish, Portuguese, Japanese, Arabic, Korean |

| Contact Form | 24/5 | English, Chinese, Indonesian, Malaysian, Vietnamese, Thai, Spanish, Portuguese, Japanese, Arabic, Korean |

Prohibited Countries

M4Markets does not provide a clear list of prohibited countries on their website or in their terms and conditions. However, it is important to note that the broker operates under different regulatory licenses, each with its own jurisdiction and potential restrictions.

Special Offers for Customers

M4Markets occasionally provides special promotions and bonus offers to incentivise new and existing clients.

These offers may include:

- Welcome Bonus: A percentage bonus on the initial deposit amount for new clients.

- Loyalty Program: Rewards for consistent trading activity, such as cash rebates or trading credits.

- Trading Contests: Competitions with prize pools for top-performing traders over a specified period.

It is essential to carefully review the terms and conditions associated with each offer, as they may have specific requirements, such as minimum deposit amounts, trading volume thresholds, or time limitations. M4Markets occasionally provides exclusive promotions through its partnerships with third-party service providers, offering additional benefits to its clients.

Conclusion

As I come to the end of this comprehensive review of M4Markets, I find myself impressed by their overall commitment to providing a safe, reliable, and transparent trading environment for their clients. With multiple regulatory licenses from well-respected authorities like CySEC, DFSA, and FSA Seychelles, M4Markets demonstrates a strong dedication to operating within the confines of the law and maintaining high standards of financial security.

Throughout this review, I have analysed various aspects of M4Markets' offerings, including their wide range of tradable assets, competitive trading conditions, user-friendly platforms, and responsive customer support. I am particularly impressed by their efforts to cater to traders of all skill levels and preferences, offering flexible account types and educational resources to support their clients' growth and success.

While there are a few areas where M4Markets could improve, such as providing more detailed information on specific spreads and commissions, as well as addressing reported issues with high withdrawal fees, I believe that the broker's strengths outweigh these concerns. Their commitment to negative balance protection, coupled with their efforts to provide a diverse array of trading instruments and tools, positions them as a strong contender in the highly competitive online brokerage industry.

In conclusion, I find M4Markets to be a reputable and trustworthy broker that strives to create a secure and supportive trading environment for its clients. While no broker is perfect, I believe that M4Markets' dedication to regulatory compliance, combined with their focus on client satisfaction and success, makes them a solid choice for traders seeking a reliable partner in their trading journey.