Moneta Markets Review 2025: A Comprehensive Guide to Forex & CFD Trading

Moneta Markets

Australia

Australia

-

Minimum Deposit $50

-

Withdrawal Fee $0

-

Leverage 1000:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Unavailable

-

Indices Available

Licenses

South Africa Retail Forex License

South Africa Retail Forex License

Japan Forex Trading License

Japan Forex Trading License

Softwares & Platforms

Customer Support

()

()

Supported language: Arabic, Chinese (Simplified), English, French, Korean, Malay, Portuguese

Social Media

Summary

Moneta Markets is a globally recognized online broker offering a range of trading solutions for both beginner and professional traders. The broker provides access to Forex, indices, commodities, shares, crypto CFDs, and ETFs with competitive spreads and high leverage. With Direct STP, Prime ECN, and Ultra ECN account options, traders can choose the best fit for their strategies. Moneta Markets supports MetaTrader 4, MetaTrader 5, and AppTrader, ensuring a seamless trading experience. The broker also offers Islamic accounts, fast execution, and advanced trading tools to enhance user experience.

- Wide range of over 1,000 tradable instruments across multiple asset classes

- Competitive spreads starting from 0.0 pips on Prime ECN accounts

- Low minimum deposit requirement of $50, making it accessible to a wide range of traders

- Multiple trading platforms, including MetaTrader 4, MetaTrader 5, and the proprietary PRO Trader platform

- Free VPS hosting for qualifying accounts, enhancing trading experience and enabling low-latency trading

- Responsive customer support available 24/5 through multiple channels and in several languages

- Comprehensive educational resources and market analysis tools, catering to traders of all levels

- Attractive special offers, such as a 50% deposit bonus and free VPS hosting

- Negative balance protection ensures traders cannot lose more than their account balance

- Partnerships with reputable third-party providers, such as Trading Central, for advanced market insights

- Regulated by second-tier authorities, which may not provide the same level of oversight as top-tier regulators

- Some users have reported occasional platform glitches and delays in withdrawals

- Limited range of deposit and withdrawal options compared to some competitors

- Higher spreads on the Direct STP account compared to industry averages

- Swap-free Islamic accounts are subject to an internal processing fee after ten days

- Maximum leverage of 1:1000 may be too high for inexperienced traders and can amplify losses

- No direct telephone support for clients outside of the UK and Australia

- Educational content is not as extensive as some leading brokers in the industry

- Inactivity fees may apply to dormant accounts, which can erode account balances over time

- Not available to residents of several countries, including the US, Canada, and Japan

Overview

Moneta Markets is a global forex and CFD broker established in 2019, with headquarters in Dubai, United Arab Emirates. The broker operates through multiple regulated entities, including Moneta Markets South Africa (Pty) Ltd, regulated by the Financial Sector Conduct Authority (FSCA), and Moneta Markets Ltd, registered in Saint Lucia and regulated by the Financial Services Authority (FSA) in Seychelles.

Offering over 1,000 tradable instruments across forex, commodities, indices, share CFDs, ETFs, and cryptocurrencies, Moneta Markets caters to a wide range of traders. The broker provides competitive trading conditions, with leverage up to 1:1000, spreads from 0.0 pips, and a low minimum deposit of $50.

Moneta Markets supports multiple trading platforms, including MetaTrader 4, MetaTrader 5, the proprietary PRO Trader web platform powered by TradingView, and the user-friendly AppTrader mobile app. The broker also offers free VPS hosting for qualifying clients and supports copy trading through ZuluTrade integration and PAMM accounts.

With a strong focus on customer support, Moneta Markets provides 24/5 multilingual assistance via live chat, email, and phone. The broker also offers an extensive range of educational resources and market analysis tools to support traders of all levels.

For more details on Moneta Markets' offerings, visit their official website at www.monetamarkets.com.

Overview Table

| Category | Information |

|---|---|

| Founded | 2019 |

| Headquarters | Dubai, United Arab Emirates |

| Regulation | FSCA (South Africa), FSA (Seychelles), Registered in Saint Lucia |

| Instruments | Forex, Commodities, Indices, Share CFDs, ETFs, Cryptocurrencies |

| Platforms | MetaTrader 4, MetaTrader 5, PRO Trader, AppTrader |

| Minimum Deposit | $50 |

| Maximum Leverage | 1:1000 |

| Spreads | From 0.0 pips |

| Commission | $0 - $6 per lot per side |

| Copy Trading | ZuluTrade, PAMM accounts |

| Customer Support | 24/5 via Live Chat, Email, Phone |

| Education | Articles, Videos, Webinars, Trading Academy |

Facts List

- Moneta Markets was founded in 2019 and is headquartered in Dubai, UAE.

- The broker is regulated by the FSCA in South Africa and the FSA in Seychelles, with a registered entity in Saint Lucia.

- Moneta Markets offers over 1,000 tradable instruments, including forex, commodities, indices, share CFDs, ETFs, and cryptocurrencies.

- Traders can access leverage up to 1:1000 and spreads starting from 0.0 pips.

- The minimum deposit requirement is $50, making it accessible to a wide range of traders.

- Moneta Markets supports popular trading platforms such as MetaTrader 4, MetaTrader 5, the PRO Trader web platform, and the AppTrader mobile app.

- The broker offers free VPS hosting for clients who maintain a $500 balance and trade a minimum of 5 lots per month.

- Copy trading is available through ZuluTrade integration and PAMM accounts.

- Customer support is provided 24/5 in multiple languages via live chat, email, and phone.

- Moneta Markets offers a comprehensive range of educational resources, including articles, videos, webinars, and a Trading Academy.

Moneta Markets Licenses and Regulatory

Moneta Markets operates through multiple regulated entities, ensuring compliance with various financial authorities worldwide. The broker's primary licenses include:

- Financial Sector Conduct Authority (FSCA) - South Africa Moneta Markets South Africa (Pty) Ltd is regulated by the FSCA under license number 47490. The FSCA is a well-respected regulatory body that oversees financial services providers in South Africa, ensuring that they adhere to strict standards of conduct and client protection. An FSCA license demonstrates Moneta Markets' commitment to transparency, fair trading practices, and the safeguarding of client funds.

- Financial Services Authority (FSA) - Seychelles Moneta Markets Ltd is regulated by the FSA in Seychelles under license number SD144. The FSA is responsible for supervising and regulating non-bank financial services in Seychelles, including forex and CFD brokers. While not as stringent as top-tier regulators like the FCA or ASIC, an FSA license still requires brokers to maintain certain standards of operation and client protection.

- Registry of International Business Companies - Saint Lucia Moneta Markets Ltd is also registered under the Saint Lucia Registry of International Business Companies with registration number 2023-00068. Although not a regulatory license, this registration demonstrates the broker's legal establishment and compliance with Saint Lucia's business laws.

The significance of multiple regulatory licenses lies in the enhanced security and trust they provide to clients. By adhering to the requirements of various financial authorities, Moneta Markets demonstrates its commitment to operating transparently and ethically. This is particularly important in the online trading industry, where the safety of client funds and the fairness of trading practices are paramount.

Compared to industry standards, Moneta Markets' regulatory framework is adequate, though not as comprehensive as some top-tier brokers. The FSCA license is a strong point, as South Africa has a well-developed financial regulatory system. However, the FSA license and Saint Lucia registration provide a lower level of oversight and client protection compared to licenses from authorities like the FCA, ASIC, or CySEC.

It's essential for traders to understand the implications of a broker's regulatory status and to assess whether the level of protection offered aligns with their individual needs and risk tolerance. While Moneta Markets' licenses provide a foundation of trust, traders should still exercise caution and due diligence when engaging with any online broker.

Regulations List

- Financial Sector Conduct Authority (FSCA) - South Africa: License number 47490

- Financial Services Authority (FSA) - Seychelles: License number SD144

- Registry of International Business Companies - Saint Lucia: Registration number 2023-00068

Trading Instruments

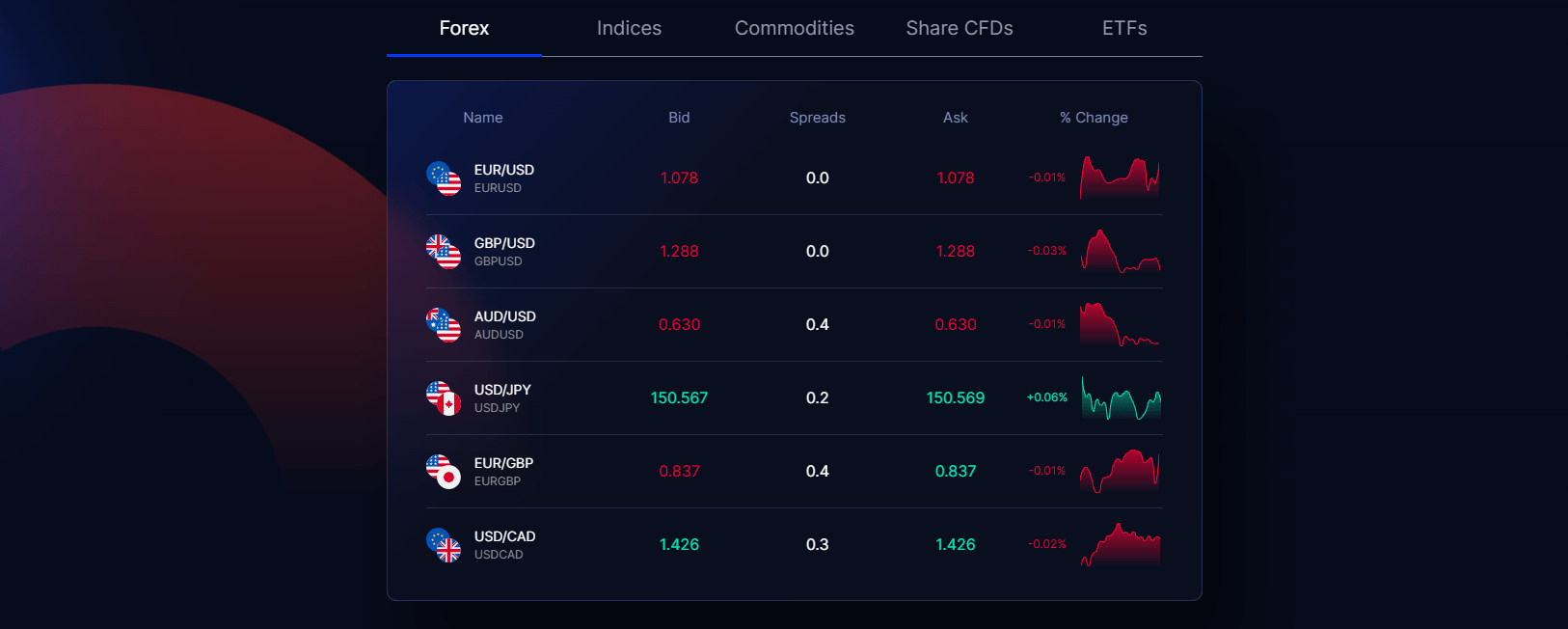

Moneta Markets offers a wide range of tradable assets, catering to the diverse needs and preferences of traders worldwide. With over 1,000 instruments across multiple asset classes, the broker provides ample opportunities for portfolio diversification and exposure to various market sectors.

| Instrument | Details |

|---|---|

| Forex | 44 currency pairs (majors, minors, exotics). Spreads from 1.2 pips (Direct STP) and 0.0 pips (Prime ECN). Competitive costs with global market exposure. |

| Indices | 16 indices including S&P 500, NASDAQ 100, FTSE 100, DAX 30. Leverage up to 1:1000. Competitive spreads. Exposure to sectors/economies in a single trade. |

| Commodities | 19 commodities including gold, silver, crude oil, natural gas, wheat, and sugar. Diversification and hedging opportunities. |

| Share CFDs | 700+ global share CFDs. Exposure to leading companies across multiple sectors and countries without owning stocks. |

| Cryptocurrencies | 30+ crypto CFDs including Bitcoin, Ethereum, Litecoin, Ripple. No digital wallet required. Trade crypto market volatility. |

| ETFs | 50+ ETFs. Track indices, sectors, or asset classes. Diversified and cost-effective trading. |

| Bonds | 7 bond markets including U.S. and European government bonds. Trade interest rate movements and seek fixed-income returns. |

The extensive range of tradable assets offered by Moneta Markets is a significant advantage for traders, as it allows them to diversify their portfolios and adapt to changing market conditions. By providing exposure to multiple asset classes, the broker caters to various trading strategies and risk preferences, from short-term scalping to long-term investing.

Trading Platforms

Moneta Markets offers a diverse range of trading platforms to cater to the varying needs and preferences of traders worldwide. By providing access to popular third-party platforms and innovative proprietary solutions, the broker ensures that clients can trade efficiently and effectively in today's fast-paced financial markets.

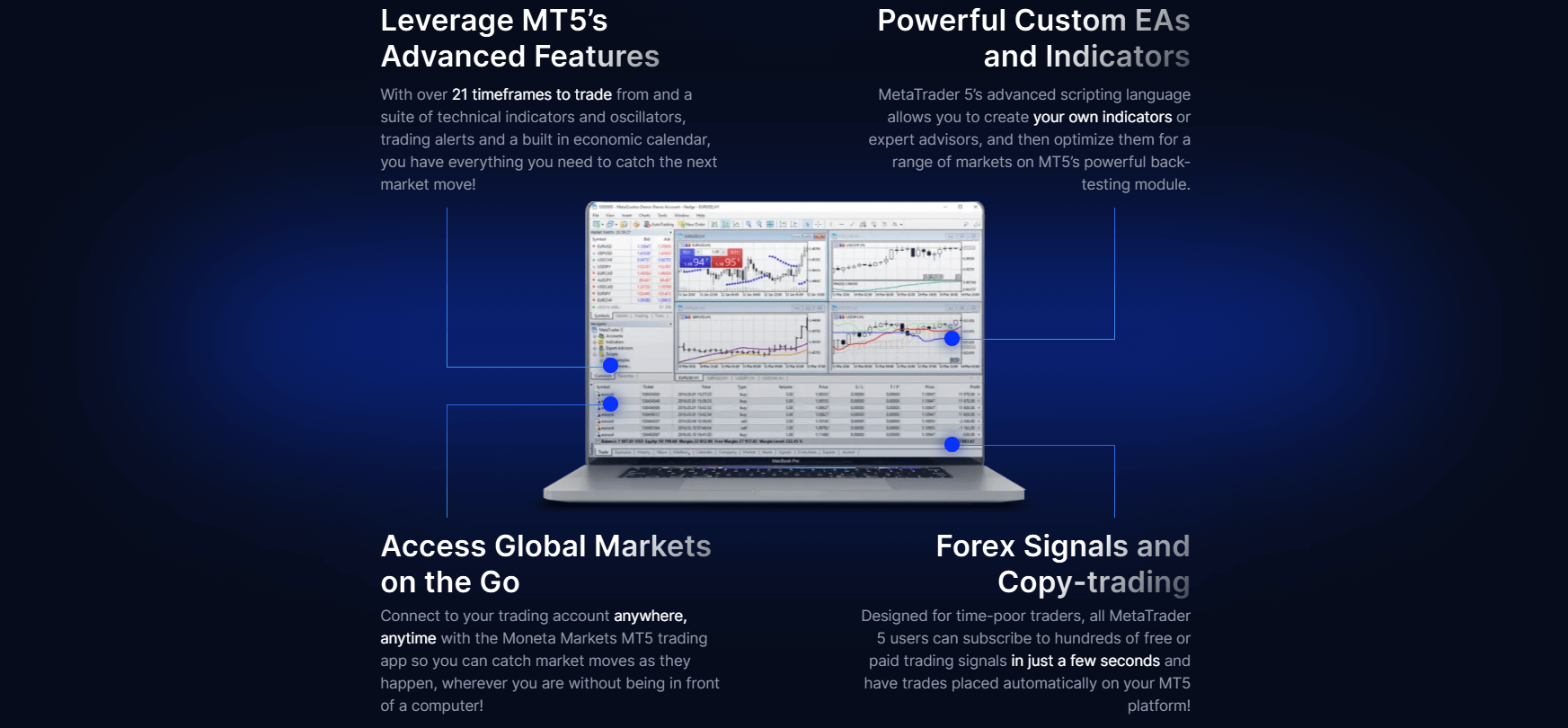

MetaTrader 4 (MT4) and MetaTrader 5 (MT5)

Moneta Markets supports the industry-standard MetaTrader platforms, which are renowned for their reliability, advanced charting tools, and extensive customisation options. MT4 and MT5 offer a wide range of technical indicators, expert advisors (EAs), and automated trading capabilities, empowering traders to execute their strategies seamlessly.

PRO Trader

The broker's proprietary PRO Trader platform, powered by TradingView, offers a cutting-edge web-based trading experience. With an intuitive interface and advanced charting tools, PRO Trader enables traders to analyse market trends, execute trades, and manage their positions directly from their web browser, without the need for any software installation.

AppTrader

For traders who prefer to stay connected to the markets on the go, Moneta Markets provides the AppTrader mobile application. Available on both iOS and Android devices, AppTrader offers a streamlined and user-friendly interface, allowing traders to monitor their positions, access real-time market data, and execute trades seamlessly from their smartphones or tablets.

Copy Trading

Moneta Markets supports copy trading through the ZuluTrade platform and PAMM (Percentage Allocation Management Module) accounts. Copy trading enables less experienced traders to automatically mirror the trades of successful traders, while PAMM accounts allow investors to allocate funds to professional money managers who trade on their behalf.

The availability of multiple trading platforms is a significant advantage for Moneta Markets' clients, as it allows them to choose the tools that best suit their trading style and expertise level. The combination of MT4, MT5, PRO Trader, and AppTrader ensures that traders can access the markets efficiently and make informed trading decisions based on real-time data and advanced analysis tools.

Moneta Markets' platforms are designed to facilitate various trading strategies, from short-term scalping to long-term investing. The broker's technological offerings are in line with current market demands and client expectations, providing a stable, reliable, and feature-rich trading environment.

Trading Platforms Comparison Table

| Feature | MetaTrader 4 (MT4) | MetaTrader 5 (MT5) | PRO Trader | AppTrader |

|---|---|---|---|---|

| Platform Type | Desktop, Web, Mobile | Desktop, Web, Mobile | Web-based | Mobile |

| Charting Tools | Advanced | Advanced | Advanced (powered by TradingView) | Basic |

| Technical Indicators | 30+ | 38+ | 50+ | 30+ |

| Timeframes | 9 | 21 | 12 | 9 |

| Automated Trading (EAs) | Yes | Yes | No | No |

| Hedging | Yes | Yes | Yes | Yes |

| Customization Options | High | High | Medium | Low |

| Social Trading | Yes (via signals) | Yes (via signals) | No | No |

| Order Types | Market, Limit, Stop, Trailing Stop | Market, Limit, Stop, Trailing Stop | Market, Limit, Stop | Market, Limit, Stop |

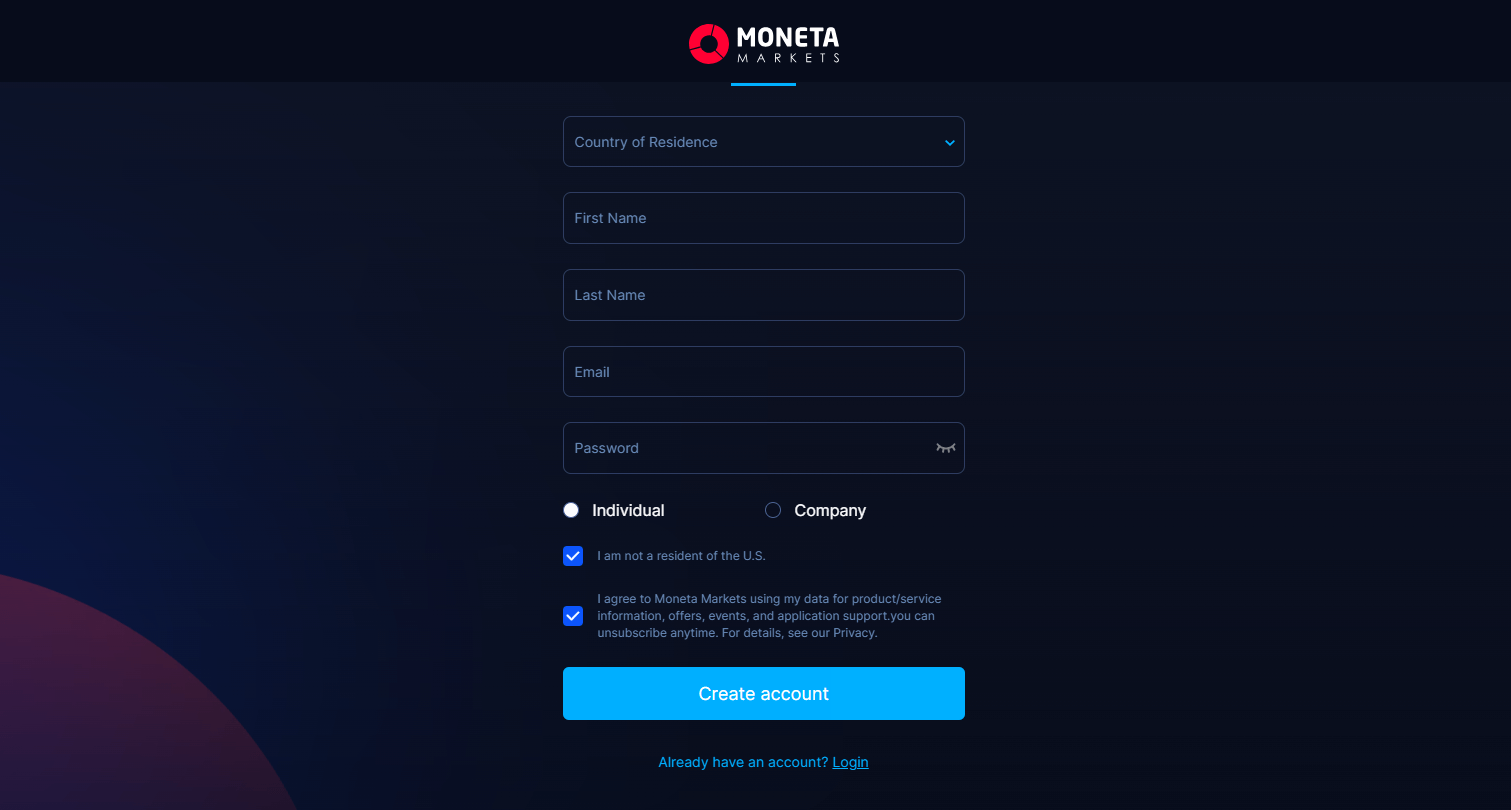

Moneta Markets How to Open an Account: A Step-by-Step Guide

Opening an account with Moneta Markets is a straightforward and user-friendly process. To start trading with this forex and CFD broker, follow these simple steps:

Step 1: Visit the Moneta Markets website Go to the official Moneta Markets website at www.monetamarkets.com and click on the "Open an Account" or "Sign Up" button.

Step 2: Complete the registration form Fill in the required personal information, including your name, email address, phone number, country of residence, and preferred account currency. You will also need to create a secure password for your account.

Step 3: Verify your identity To comply with anti-money laundering (AML) and know your customer (KYC) regulations, Moneta Markets requires clients to submit proof of identity and proof of residence. You can upload a copy of your government-issued ID, such as a passport or driver's license, and a recent utility bill or bank statement to verify your address.

Step 4: Choose your account type Select the account type that best suits your trading style and preferences. Moneta Markets offers two main account types: Direct STP and Prime ECN. The minimum deposit for both account types is $50.

Step 5: Fund your account Once your account is approved, you can fund it using one of the accepted payment methods. Moneta Markets supports deposits via credit/debit cards, bank wire transfers, and various e-wallets, such as FasaPay, JCB, and Sticpay. Most deposit methods are processed instantly, while bank transfers may take 2-5 business days.

Step 6: Start trading After your account is funded, you can download the trading platform of your choice (MetaTrader 4, MetaTrader 5, or AppTrader) or log in to the web-based PRO Trader platform. You can now start trading Moneta Markets' wide range of instruments, including forex, indices, commodities, share CFDs, cryptocurrencies, ETFs, and bonds.

Moneta Markets offers a streamlined account opening process, with most applications approved within 1 business day. The low minimum deposit requirement of $50 makes it accessible for beginner traders, while the variety of account types caters to more experienced traders as well.

The broker's user-friendly website and dedicated customer support team ensure that clients can easily navigate the account opening process and get assistance whenever needed.

Charts and Analysis

Moneta Markets offers a comprehensive suite of educational resources and trading tools to support clients in enhancing their knowledge and skills. By providing access to high-quality charts, analysis tools, and learning materials, the broker empowers traders to make informed decisions and develop effective trading strategies.

| Feature | Details |

|---|---|

| Charting Tools | Available on MT4, MT5, and PRO Trader. Includes advanced charting, multiple timeframes, chart types, technical indicators, drawing tools, and customisable templates. |

| Market Analysis | Regular updates via blog and market news section. Expert analysts provide insights on trends, economic events, and trading opportunities across asset classes. |

| Economic Calendar | Displays key upcoming events like central bank decisions, data releases, and political developments. Helps traders prepare for market volatility and plan strategies accordingly. |

| Educational Resources | Webinars, video tutorials, downloadable PDFs, trading glossary. Covers basic to advanced topics including strategy development and risk management. |

| Trading Central | Integrated access to Trading Central’s analysis, trading ideas, and market reports. Enhances technical analysis and supports better decision-making. |

Compared to industry standards, Moneta Markets' educational resources and trading tools are competitive and well-rounded. The broker's commitment to providing high-quality educational content and advanced charting capabilities demonstrates its dedication to supporting clients in their trading journey.

The availability of diverse educational resources is crucial for traders, as it allows them to continuously improve their skills and adapt to changing market conditions. By offering a comprehensive range of tools and learning materials, Moneta Markets empowers its clients to make informed trading decisions and develop effective trading strategies.

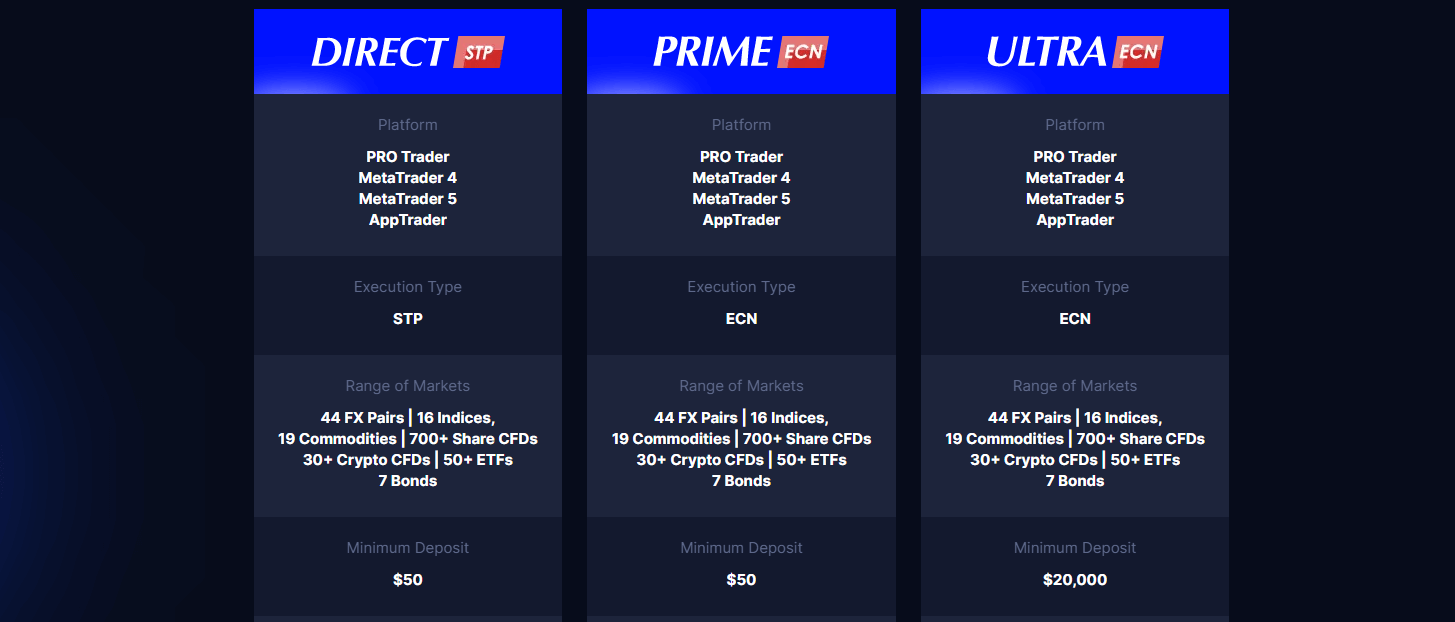

Moneta Markets Account Types

Moneta Markets offers a range of trading account types to suit the diverse needs and preferences of traders worldwide. By providing multiple account options, the broker ensures that clients can choose the most suitable trading environment based on their experience level, trading style, and financial goals.

Direct STP Account

The Direct STP (Straight-Through Processing) account is designed for traders who prefer a more traditional trading experience. This account type offers competitive spreads starting from 1.2 pips and does not charge any commissions. With a minimum deposit of just $50, the Direct STP account is accessible to a wide range of traders, including beginners.

Prime ECN Account

The Prime ECN (Electronic Communication Network) account is ideal for more experienced traders who prioritize tight spreads and fast execution speeds. This account type offers raw spreads starting from 0.0 pips and charges a commission of $3 per lot per side. The minimum deposit for the Prime ECN account is also $50, making it an attractive option for traders seeking cost-effective trading conditions.

Ultra ECN Account

The Ultra ECN account is tailored for professional traders and institutional clients who demand the most competitive trading conditions. This account type offers raw spreads starting from 0.0 pips and charges a reduced commission of $1 per lot per side. However, the minimum deposit for the Ultra ECN account is significantly higher at $20,000, reflecting its premium status.

Demo Account

Moneta Markets offers a demo account that allows traders to practice trading strategies and familiarize themselves with the broker's trading platforms without risking real money. The demo account provides access to live market data and a virtual balance, enabling traders to experience real trading conditions in a risk-free environment.

Islamic Account

For traders who adhere to Islamic religious principles, Moneta Markets offers Islamic accounts that comply with Sharia law. These accounts are swap-free, meaning that no interest is charged or earned on overnight positions. Islamic accounts are available for both the Direct STP and Prime ECN account types.

The variety of account types offered by Moneta Markets demonstrates the broker's commitment to catering to the diverse needs of its clientele. By providing a range of options with varying spreads, commissions, and minimum deposit requirements, Moneta Markets ensures that traders can select the account type that best aligns with their trading style and financial objectives.

This flexibility in account types is crucial for traders, as it allows them to optimize their trading experience and maximize their potential for success in the financial markets.

Account Types Comparison Table

| Feature | STP Account (Beginners) | ECN Account (Scalpers & EAs) | ECN Account (Pro Traders) |

|---|---|---|---|

| Platform | PRO Trader, MT4, MT5, AppTrader | PRO Trader, MT4, MT5, AppTrader | PRO Trader, MT4, MT5, AppTrader |

| Execution Type | STP | ECN | ECN |

| Range of Markets | 44 FX Pairs, 16 Indices, 19 Commodities, 700+ Share CFDs, 30+ Crypto CFDs, 50+ ETFs, 7 Bonds | 44 FX Pairs, 16 Indices, 19 Commodities, 700+ Share CFDs, 30+ Crypto CFDs, 50+ ETFs, 7 Bonds | 44 FX Pairs, 16 Indices, 19 Commodities, 700+ Share CFDs, 30+ Crypto CFDs, 50+ ETFs, 7 Bonds |

| Minimum Deposit | $50 | $50 | $20,000 |

| Minimum Volume | 0.01 Lot | 0.01 Lot | 0.01 Lot |

| Leverage | Up to 1000:1 | Up to 1000:1 | Up to 500:1 |

| Spreads From | 1.2 Pips | 0.0 Pips | 0.0 Pips |

| Commission | $0 | $3 per lot per side | $1 per lot per side |

| Account Base Currencies | AUD, USD, GBP, EUR, SGD, CAD, NZD, JPY, HKD, BRL | AUD, USD, GBP, EUR, SGD, CAD, NZD, JPY, HKD, BRL | AUD, USD, GBP, EUR, SGD, CAD, NZD, JPY, HKD, BRL |

| Islamic Account | Yes | Yes | Yes |

| Suitable for | Beginners | Scalpers & EAs | Professional traders & money managers |

| Stop Out | 50% | 50% | 50% |

| Hedging | Yes | Yes | Yes |

Negative Balance Protection

Moneta Markets understands the importance of protecting its clients from such scenarios and has implemented a robust negative balance protection policy across all its trading accounts. This means that traders cannot lose more money than they have deposited in their account, providing a safety net against unexpected market events or technical issues. How Negative Balance Protection Works: In the event of extreme market volatility or unexpected gaps in pricing, a trader's open positions may be closed at a loss greater than their account balance. Without negative balance protection, the trader would be liable for the excess loss, potentially leading to significant financial strain. However, with Moneta Markets' negative balance protection policy in place, the broker absorbs any losses that exceed the trader's account balance, effectively limiting the trader's maximum loss to the funds available in their account. This provides traders with peace of mind, knowing that they cannot fall into debt due to their trading activities. Scenarios That Can Lead to Negative Balances:

- Extreme market volatility: Sudden and significant price movements, often triggered by economic events or geopolitical developments, can cause substantial gaps in pricing.

- Overleveraged positions: Trading with high leverage can amplify both profits and losses. If a highly leveraged position moves against the trader, it can quickly deplete their account balance.

- Technology issues: In rare cases, technical problems with trading platforms or connectivity issues can prevent traders from managing their positions effectively, potentially leading to negative balances.

Moneta Markets Deposits and Withdrawals

Moneta Markets offers a range of convenient deposit and withdrawal options to ensure that clients can manage their funds efficiently and securely. The broker understands the importance of smooth financial transactions and has implemented policies to streamline the process while maintaining strict security measures.

Deposit Methods

| Category | Details |

|---|---|

| Deposit Methods | |

| Credit/Debit Cards | Visa, Mastercard – Instant processing, No fees |

| Bank Wire Transfer | 2–5 business days processing – No fees |

| FasaPay | Instant processing – No fees |

| JCB | Instant processing – No fees |

| Sticpay | Instant processing – No fees |

| Accepted Currencies | USD, GBP, EUR, SGD, JPY, NZD, CAD, HKD, BRL |

| Minimum Deposit | |

| Direct STP Account | $50 |

| Prime ECN Account | $50 |

| Ultra ECN Account | $20,000 |

Withdrawal Methods

| Payment Method | Deposit Processing Time | Withdrawal Processing Time | Fees (Moneta Markets) |

|---|---|---|---|

| Credit/Debit Cards (Visa, Mastercard) | Instant | Up to 24 hours | No fees |

| Bank Wire Transfer | 2–5 business days | 2–5 business days | No fees |

| FasaPay | Instant | Up to 24 hours | No fees |

| JCB | Instant | Up to 24 hours | No fees |

| Sticpay | Instant | Up to 24 hours | No fees |

Verification Requirements

To comply with anti-money laundering (AML) and know your customer (KYC) regulations, Moneta Markets requires clients to verify their identity before processing withdrawals. This involves submitting proof of identification and proof of address, such as a government-issued ID and a recent utility bill or bank statement. The verification process is straightforward and can be completed by uploading the necessary documents through the client portal. Moneta Markets' dedicated support team is available to assist clients throughout the verification process, ensuring a smooth and hassle-free experience.Unique Features

One of the standout features of Moneta Markets' deposit and withdrawal process is the absence of any fees imposed by the broker. This commitment to cost-effective transactions sets Moneta Markets apart from competitors who may charge deposit or withdrawal fees. Additionally, the broker's wide range of payment methods caters to the diverse needs of its global clientele, offering flexibility and convenience in managing funds. In conclusion, Moneta Markets' deposit and withdrawal policies prioritise efficiency, security, and client satisfaction. With multiple payment methods, competitive processing times, and no broker-imposed fees, clients can focus on their trading activities with the peace of mind that their funds are safe and easily accessible.Support Service for Customer

In the fast-paced world of online trading, reliable customer support is crucial for a positive trading experience. Moneta Markets understands the importance of providing prompt and efficient assistance to its clients, ensuring that they can navigate the trading environment with confidence and ease.

Support Channels

Moneta Markets offers multiple channels for traders to reach out to their customer support team:- Live Chat: Available 24/5 directly from the Moneta Markets website.

- Email: support@monetamarkets.com

- Phone: +44 (113) 3204819

- Social Media: Facebook, Twitter, Instagram, LinkedIn

Support Languages

Moneta Markets caters to a global clientele by providing customer support in multiple languages, including:- English

- Chinese

- Arabic

- Malay

- Korean

- French

- Portuguese

Support Hours and Response Times

Moneta Markets' customer support team is available 24/5, from Monday to Friday, to assist traders during the most active trading hours. The broker strives to provide prompt and efficient responses to all enquiries, with the following average response times:- Live Chat: Within 1 minute

- Email: Within 24 hours

- Phone: Within 1 minute

- Social Media: Within 4 hours

Customer Support Comparison Table

| Support Channel | Availability | Average Response Time | Languages |

|---|---|---|---|

| Live Chat | 24/5 | Within 1 minute | English, Chinese, Arabic, Malay, Korean, French, Portuguese |

| 24/5 | Within 24 hours | English, Chinese, Arabic, Malay, Korean, French, Portuguese | |

| Phone | 24/5 | Within 1 minute | English, Chinese, Arabic, Malay, Korean, French, Portuguese |

| Social Media | Monday to Friday | Within 4 hours | English, Chinese, Arabic, Malay, Korean, French, Portuguese |

Prohibited Countries

Moneta Markets, like many international forex and CFD brokers, is subject to various regulations and licensing requirements that restrict its operations in certain countries and regions. These restrictions are put in place to ensure compliance with local laws and protect both the broker and its clients from potential legal and financial risks.

Reasons for Restrictions

The primary reasons behind Moneta Markets' country restrictions include:

- Local regulations: Some countries have strict laws governing online trading, requiring brokers to obtain specific licenses or meet certain criteria to operate legally.

- Licensing limitations: Moneta Markets' current regulatory licenses may not cover all jurisdictions, limiting its ability to provide services in certain countries.

- Geopolitical factors: Political instability, economic sanctions, or other geopolitical issues may prevent Moneta Markets from operating in specific regions.

Prohibited Countries List

Moneta Markets does not provide services to residents of the following countries:

- Afghanistan, Albania, American Samoa, Australia, Belarus, Bermuda, Bosnia And Herzegovina, Bulgaria, Burundi, Canada, Central African Republic, Croatia, Cuba, Cyprus, Democratic Republic of the Congo, Eritrea, France, Guam, Hong Kong, Iran, Iraq, Italy, Ivory Coast, Japan, Liberia, Libya, Mali, Myanmar, North Korea, Puerto Rico, Russia, Seychelles, Singapore, Slovenia, Somalia, South Sudan, Spain, Sudan, Syria, United Kingdom, United States, Venezuela, Virgin Islands (U.S.), Yemen, Zimbabwe

Consequences of Trading from a Prohibited Country

Attempting to trade with Moneta Markets from a prohibited country may result in several consequences:

- Account termination: If Moneta Markets discovers that a client is trading from a prohibited country, the broker reserves the right to terminate the account immediately.

- Funds forfeiture: In some cases, clients from prohibited countries may face the risk of having their funds forfeited or frozen due to legal or regulatory issues.

- Legal consequences: Trading with an unlicensed broker in a country where such activities are prohibited may result in legal consequences, including fines or other penalties.

It is essential for traders to carefully review the list of prohibited countries and ensure that they are eligible to open an account with Moneta Markets before proceeding with the registration process. Traders should also be aware of any changes in local regulations that may affect their ability to trade with the broker.

Moneta Markets is committed to maintaining a transparent and compliant trading environment, and its country restrictions are designed to protect the interests of both the broker and its clients.

Regions where Moneta Markets is allowed to operate:

- South Africa, Saint Lucia

Special Offers for Customers

Moneta Markets provides a range of special promotions and offers designed to enhance traders' experiences and reward their loyalty. These offers can help traders maximise their potential returns, access additional resources, and benefit from exclusive partnerships.

50% Deposit Bonus

Moneta Markets offers a generous 50% deposit bonus to traders who fund their accounts with at least $500. This bonus is credited to the trader's account as a rebate on qualifying trades, with the following conditions:

- STP account holders receive a $2 rebate per lot traded on forex pairs, gold, and oil.

- Prime ECN account holders receive a $0.50 rebate per lot traded on the same assets.

- The rebate is calculated and credited to the trader's account at the beginning of each month.

This deposit bonus provides traders with additional trading capital and can help them manage their risk more effectively by reducing their overall exposure.

Free VPS Hosting

Moneta Markets provides free Virtual Private Server (VPS) hosting to traders who maintain a minimum account balance of $500 and trade at least 5 lots per month. VPS hosting offers several benefits, including:

- Improved trading speed and reliability

- Reduced latency and slippage

- 24/7 access to trading platforms

- Enhanced security and data protection

By offering free VPS hosting, Moneta Markets demonstrates its commitment to providing traders with the tools and resources they need to succeed in the fast-paced world of online trading.

Trading Central Partnership

Moneta Markets has partnered with Trading Central, a leading provider of market analysis and trading insights, to offer clients exclusive access to expert research and analysis. Through this partnership, traders can access:

- Daily market analysis and trading ideas

- Advanced technical analysis and pattern recognition tools

- Sentiment indicators and market news

The Trading Central partnership adds significant value to Moneta Markets' offering, providing traders with the insights and knowledge they need to make informed trading decisions.

Moneta Markets' special offers are designed to cater to a wide range of trading styles and preferences, offering tangible benefits to both new and experienced traders. By combining competitive promotions with robust trading tools and educational resources, Moneta Markets aims to create a comprehensive and rewarding trading environment for its clients.

Conclusion

Throughout this comprehensive review, I have closely examined Moneta Markets' operations, offerings, and overall reputation as a forex and CFD broker. By analysing various aspects of their business, including regulatory compliance, trading platforms, customer support, and special offers, I have gained a thorough understanding of their strengths, weaknesses, and unique features.

One of the key factors that contribute to Moneta Markets' trustworthiness is their commitment to regulatory compliance. They operate through multiple regulated entities, including Moneta Markets South Africa (Pty) Ltd, regulated by the Financial Sector Conduct Authority (FSCA), and Moneta Markets Ltd, registered in Saint Lucia and regulated by the Financial Services Authority (FSA) in Seychelles. While these regulatory bodies provide a level of oversight and protection for traders, it is important to note that they may not be as stringent as top-tier regulators like the FCA or ASIC.

Moneta Markets offers a diverse range of trading instruments, with over 1,000 assets across forex, commodities, indices, shares, cryptocurrencies, ETFs, and bonds. This extensive selection caters to the needs of various types of traders, from beginners to experienced professionals. The broker's competitive spreads, starting from 0.0 pips on the Prime ECN account, and the low minimum deposit requirement of $50 make their services accessible to a wide audience.

In terms of trading platforms, Moneta Markets provides a strong lineup, including the industry-standard MetaTrader 4 and MetaTrader 5, as well as their proprietary PRO Trader platform powered by TradingView. The broker's platform offering is complemented by a user-friendly mobile app, allowing traders to access the markets on the go. The availability of free VPS hosting for qualifying accounts is another notable feature that enhances the trading experience.

Customer support is another area where Moneta Markets shines, with a responsive and knowledgeable team available 24/5 through multiple channels, including live chat, email, phone, and social media. The broker's commitment to providing prompt and reliable support in multiple languages is commendable and demonstrates their dedication to client satisfaction.

Moneta Markets' educational resources and market analysis tools are comprehensive and cater to traders of all levels. The combination of in-house market insights and third-party content from Trading Central provides clients with valuable information to make informed trading decisions. The broker's special offers, such as the 50% deposit bonus and free VPS hosting, add value to their overall proposition.

While Moneta Markets has many positive attributes, there are a few areas where they could improve. The broker's regulatory status, while adequate, may not provide the same level of protection as top-tier regulators. Additionally, some users have reported occasional platform glitches and delays in withdrawals, although these issues seem to be relatively rare.

In conclusion, Moneta Markets is a well-rounded broker that offers a competitive trading environment, a wide range of assets, and a strong commitment to customer support and education. Their user-friendly platforms, accessible account types, and attractive special offers make them a compelling choice for both new and experienced traders. However, as with any broker, it is essential to consider individual trading needs, risk tolerance, and regulatory preferences before making a decision.

For those seeking a reliable and feature-rich broker with a focus on client satisfaction, Moneta Markets is definitely worth considering. As always, it is recommended to conduct thorough due diligence, start with a small investment, and test the broker's services before committing substantial funds.