MultiBank Group Review 2025: Reliable Trading with a Multi-Regulated Forex Broker

MultiBank group

United States

United States

-

Minimum Deposit $50

-

Withdrawal Fee $0

-

Leverage 500:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

Cyprus Market Making (MM)

Cyprus Market Making (MM)

Australia Retail Forex License

Australia Retail Forex License

Germany Financial Services License

Germany Financial Services License

Singapore Financial Services License

Singapore Financial Services License

Austria Financial Services License

Austria Financial Services License

Forex Trading License

Forex Trading License

Softwares & Platforms

Customer Support

+9716465689702

(English)

+9716465689702

(English)

Supported language: Arabic, Chinese (Simplified), English, Filipino, French, Malay, Russian, Spanish, Vietnamese

Social Media

Summary

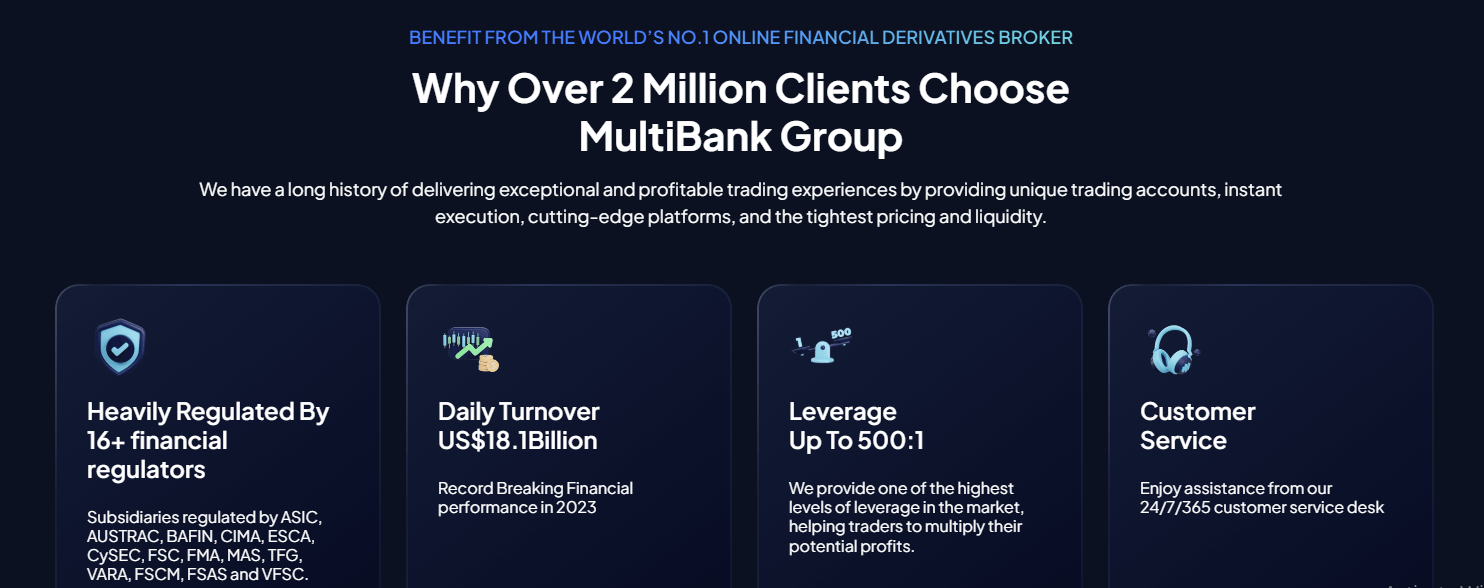

MultiBank Group, established in California in 2005, has evolved into one of the world's largest financial derivatives providers. With a paid-up capital exceeding $322 million, it serves over one million clients across more than 100 countries. The Group offers a diverse range of products, including Forex, metals, shares, commodities, indices, and digital assets, through award-winning trading platforms. In 2022, MultiBank Group relocated its headquarters to Dubai, aligning with the UAE's vision to become a global financial hub. The company is regulated by 16 financial authorities worldwide, ensuring compliance and security for its clients

- 1. Strong regulatory oversight from top-tier authorities like ASIC, MAS, and CySEC

- 2. Wide range of 20,000+ tradable instruments across multiple asset classes

- 3. Competitive spreads and leverage up to 1:500 on Pro and ECN accounts

- 4. Reliable MT4, MT5, and proprietary MultiBank-Plus trading platforms

- 5. 24/7 multilingual customer support via live chat, email, and phone

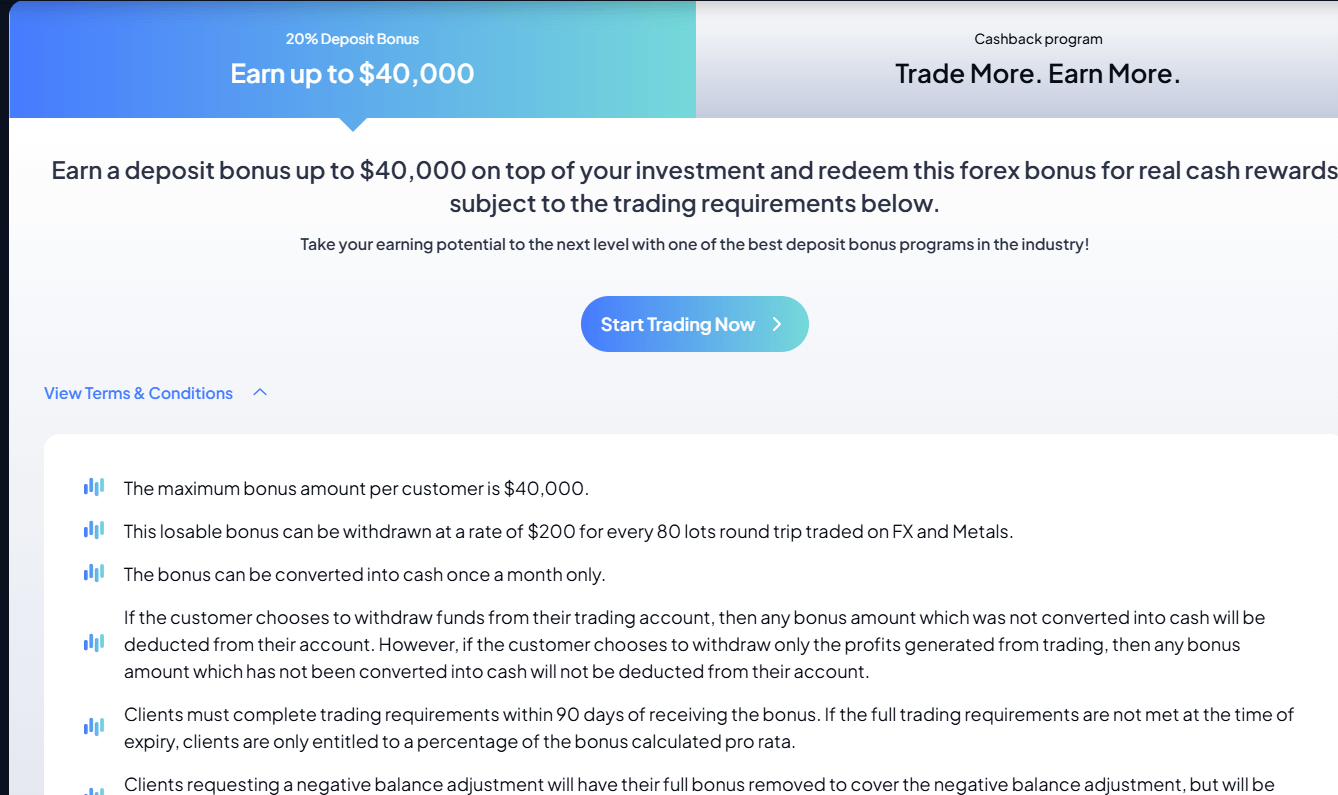

- 6. Attractive promotions like 20% deposit bonus and cashback program

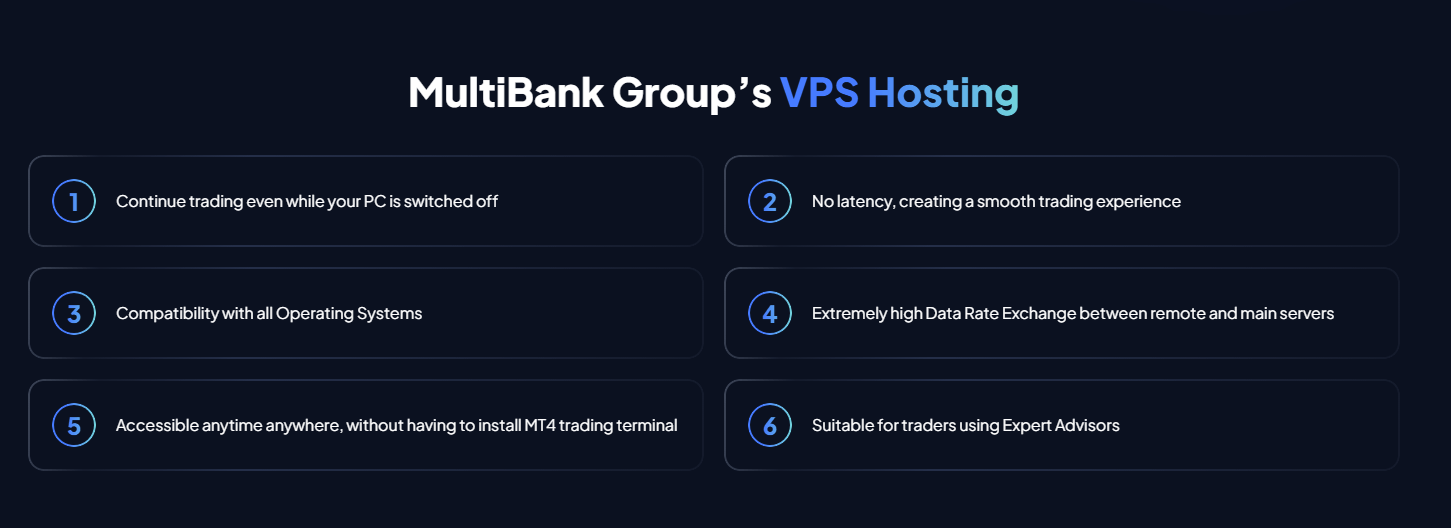

- 7. Free VPS hosting and Trading Central analysis for advanced traders

- 8. Segregated client funds and negative balance protection for added security

- 9. Multiple payment options with no deposit or withdrawal fees

- 10. Regular trading competitions with cash prizes for demo and live accounts

- 1. Limited educational resources compared to some industry leaders

- 2. High minimum deposit requirement of $10,000 for ECN accounts

- 3. Restrictions on clients from certain countries, including the US and Japan

- 4. Swap rates on overnight positions can be high for some instruments

- 5. MultiBank-Plus platform lacks some advanced features of MT4/MT5

- 6. Inactivity fee of $50 per month after 3 months of no trading activity

- 7. Bonuses come with high trading volume requirements for withdrawal

- 8. Occasional slow response times for email support during peak periods

- 9. No straight-through processing (STP) execution model available

- 10. Cryptocurrency CFDs have higher spreads than the industry average

Overview

MultiBank Overview Table

| Category | Details |

|---|---|

| Founded | 2005 |

| Headquarters | United Arab Emirates |

| Regulation | ASIC, MAS, CySEC, BaFin, FMA, CIMA, ESCA, FSC |

| Products Offered | Forex, CFDs, Shares, Indices, Commodities, Cryptocurrencies |

| Instruments Available | Over 20,000 instruments |

| Trading Platforms | MetaTrader 4, MetaTrader 5, MultiBank-Plus |

| Standard Account | Minimum Deposit: $50Spread: From 1.5 pips |

| Pro Account | Minimum Deposit: $1,000Spread: From 0.8 pips |

| ECN Account | Minimum Deposit: $10,000Spread: From 0.0 pips + $3 commission |

| Leverage | Up to 1:500 (entity dependent) |

| Payment Options | Credit/debit card, bank wire, e-wallets, crypto (no fees) |

| Customer Support | 24/7 live chat, email, phone |

| Educational Resources | Trading guides, video courses, webinars, ebooks |

| Extra Features | Trading Central, VPS hosting, FIX API, social trading |

Facts List

1. MultiBank Group was founded in 2005 and is headquartered in the UAE.

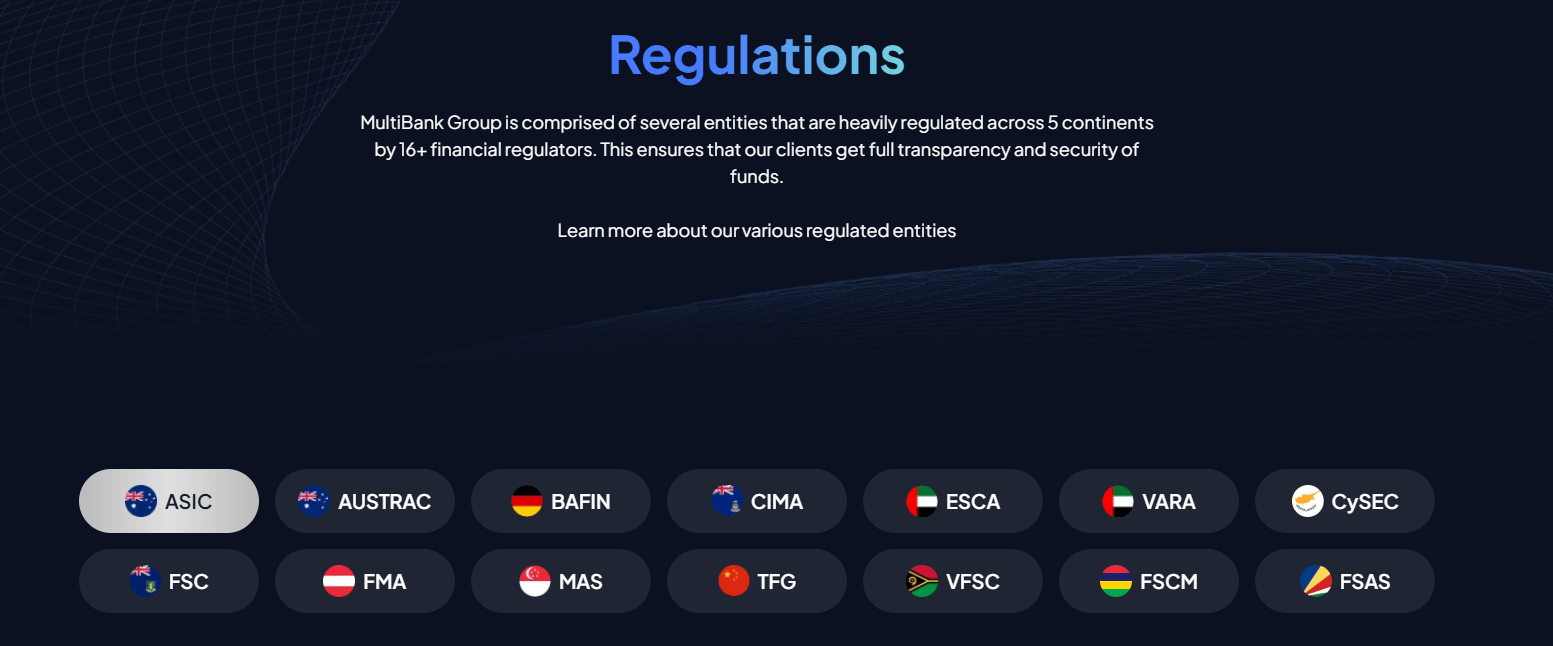

2. The broker is regulated by 10 entities including 5 tier-1 regulators like ASIC, MAS, and CySEC.

3. MultiBank Group offers over 20,000 tradable instruments across forex, shares, indices, commodities, and crypto.

4. Trading is available on the MetaTrader 4, MetaTrader 5, and proprietary MultiBank-Plus platforms.

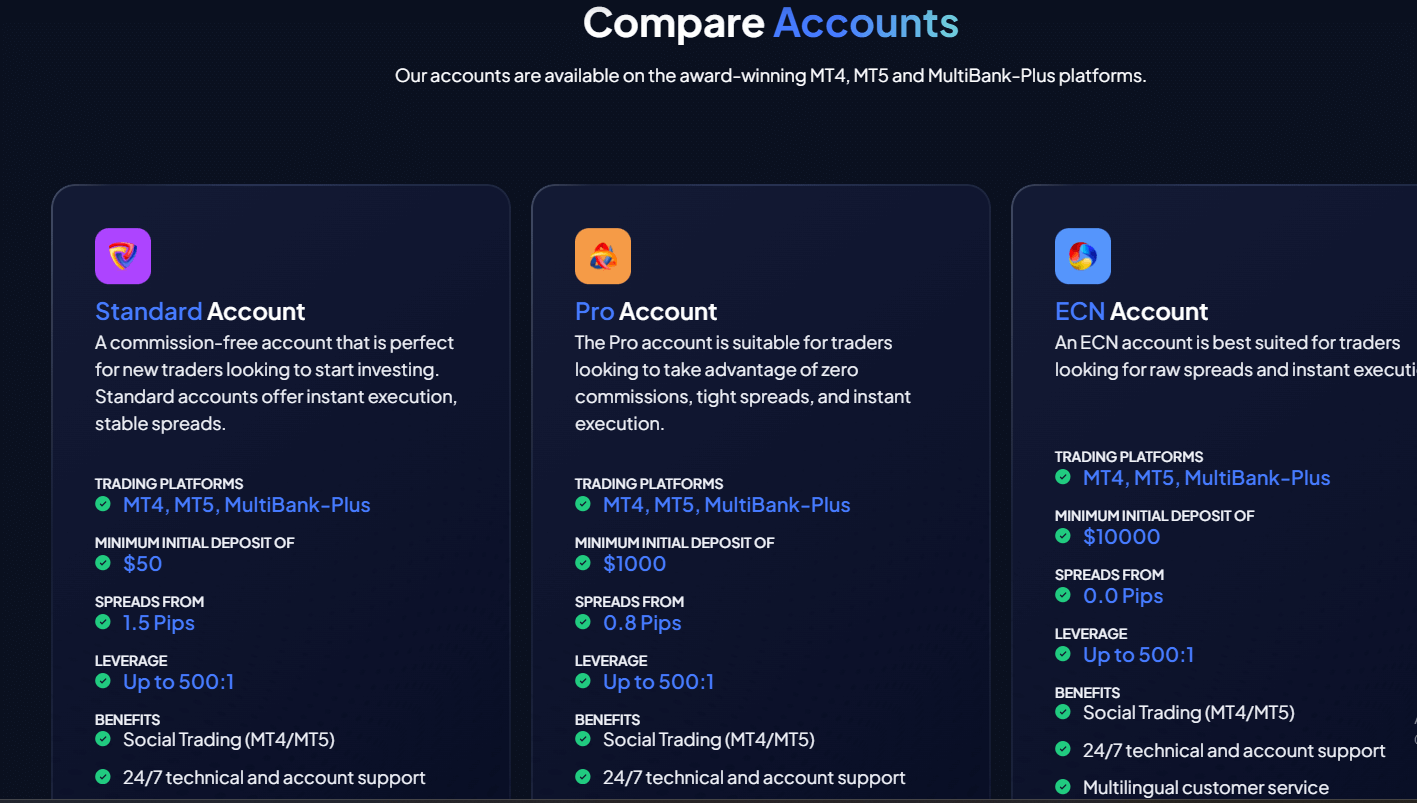

5. Three account types are offered: Standard ($50 minimum deposit), Pro ($1000), and ECN ($10,000).

6. Spreads start from 1.5 pips on Standard, 0.8 pips on Pro, and 0.0 pips + $3/lot commission on ECN.

7. Leverage up to 1:500 is available depending on the entity and instrument.

8. Payment options include credit/debit cards, bank wire, e-wallets, and crypto with no deposit or withdrawal fees.

9. 24/7 customer support is provided via live chat, email, and local phone numbers in multiple languages.

10. Extra features include Trading Central analyses, VPS hosting, FIX API, and social trading.

MultiBank group Licenses and Regulatory

As one of the best forex brokers, MultiBank Group operates under 10 regulated entities, including 5 tier-1 authorities:

| Regulator | Entity |

|---|---|

| ASIC (Australia) | MEX Australia Pty Ltd |

| MAS (Singapore) | MEX Global Markets Pte Ltd |

| CySEC (Cyprus) | MEX Europe Ltd |

| BaFin (Germany) | MEX Asset Management GmbH |

| FMA (Austria) | MEX Asset Management GmbH - Austria Branch |

| CIMA (Cayman Islands) | Regulated Entity |

| ESCA (UAE) | Regulated Entity |

| FSC (BVI) | Regulated Entity |

| TFG (India) | Regulated Entity |

| VFSC (Vanuatu) | Regulated Entity |

Trading Instruments

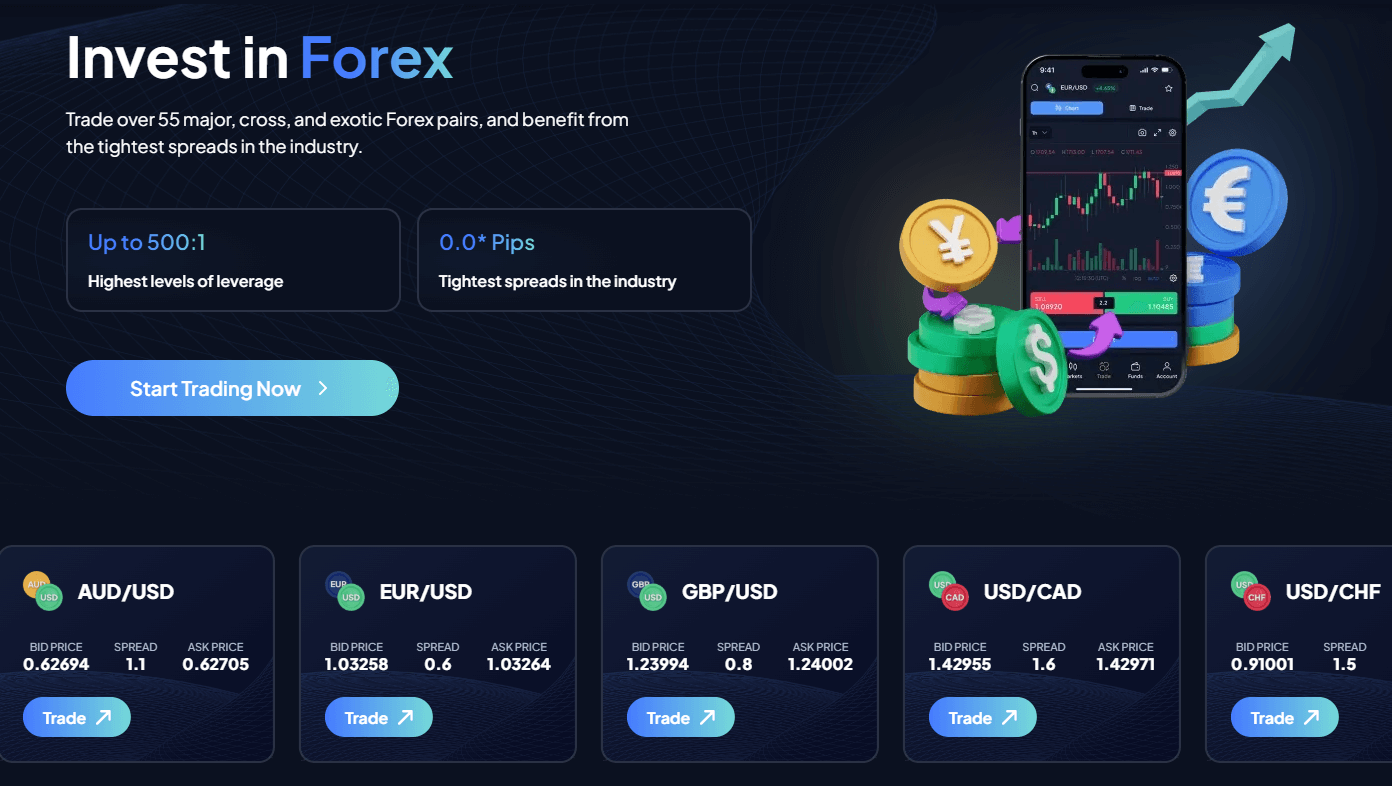

MultiBank Group offers 20,000+ tradable instruments across 5 asset classes, including CFDs, and forex pairs:

| Asset Class | Details |

|---|---|

| Forex | 55 currency pairs (majors, minors, crosses, exotics) |

| Spot trades | |

| Share CFDs | 20,000+ global share CFDs (US, Europe, Asia & more) |

| Spot trades | |

| Indices | 22 index CFDs (major global indices) |

| Spot and futures | |

| Commodities | 18 commodity CFDs (metals, energies) |

| Spot and futures | |

| Cryptocurrencies | 200+ crypto CFDs (Bitcoin, Ethereum, altcoins) |

| Spot trades |

Trading Platforms

MultiBank offers three main trading platforms:

MetaTrader 4

- Industry-standard platform

- Advanced charting and analysis tools

- Automated trading via Expert Advisors (EAs)

- Available for Windows, Mac, web, iOS, Android

MetaTrader 5

- Upgraded MT4 with additional features

- Expanded timeframes and order types

- Hedging and netting

- Available for Windows, Mac, web, iOS, Android

MultiBank-Plus

- Proprietary platform launched in 2024

- Clean, modern web and mobile interface

- TradingView charts and news

- Still lacks some advanced tools vs MT4/5

The inclusion of popular MT4 and MT5 ensures clients can utilize familiar, powerful platforms. MultiBank-Plus offers a streamlined experience for new traders. VPS hosting allows 24/7 low-latency execution.

Trading Platform Comparison Table

| Feature | MT4 | MT5 | MultiBank-Plus |

|---|---|---|---|

| Charting | Advanced | Advanced | TradingView |

| Timeframes | 9 | 21 | -- |

| Order Types | 4 | 6 | -- |

| Automated Trading | EAs (Expert Advisors) | EAs (Expert Advisors) | -- |

| Hedging | No | Yes | -- |

| Web Platform | Yes | Yes | Yes |

| Mobile Apps | iOS, Android | iOS, Android | iOS, Android |

MultiBank group How to Open an Account: A Step-by-Step Guide

1. Go to the MultiBank Group website and click the "Start Trading" button located in the top right corner of the page.

2. On the account registration page, enter your personal information including your full name, email address, phone number, country of residence, and preferred account currency.

3. Create a strong password for your account and agree to the broker's terms and conditions.

4. Enter the one-time password (OTP) sent to your registered email address or phone number to verify your contact details.

5. Choose your account type - Standard, Pro, or ECN - based on your trading preferences and minimum deposit requirements:

- Standard: $50 minimum deposit

- Pro: $1000 minimum deposit

- ECN: $10,000 minimum deposit

6. Select your preferred deposit method from the 20+ options available, such as bank wire transfer, credit/debit card, e-wallets like Skrill or Neteller, or cryptocurrency.

7. Upload a copy of your government-issued ID (passport, national ID card, or driver's license) and a recent proof of address (utility bill or bank statement) for account verification purposes. Ensure the documents are clear and legible.

8. Take a photo of yourself holding your ID document next to your face using your device's camera. This is required as part of MultiBank Group's Know Your Customer (KYC) procedures.

9. Submit your completed application and wait for the broker to review and approve your account. This process typically takes 1-2 business days.

10. Once your account is approved, log in to the client portal and download the trading platform of your choice (MetaTrader 4, MetaTrader 5, or MultiBank-Plus).

11. Fund your account using your selected deposit method and start trading. Deposit processing times vary:

- Bank wire: 1-2 business days

- Credit/debit card: Instant

- E-wallets: Up to 24 hours

- Cryptocurrency: Instant

For Islamic traders, MultiBank Group offers swap-free accounts that adhere to Shariah principles. Contact customer support to request an Islamic account.

If you have any issues during the account opening process, reach out to MultiBank Group's customer support team via live chat, email, or phone for assistance.

Charts and Analysis

MultiBank Group offers a solid range of educational resources and trading tools to support its clients' trading knowledge and decision-making. These include:

Educational Content

- 68 video lessons covering trading basics, technical analysis, and and psychology. Includes quizzes.

- 10 courses with 68 lessons on essential trading topics and CFDs.

- eBooks focused on technical analysis strategies and trading psychology.

- 11 platform tutorial videos for MT4, MT5, and MultiBank-Plus.

The educational materials cater to both beginners and more experienced traders. The diverse formats allow clients to learn in their preferred medium.

Trading Central Analysis

MultiBank Group incorporates frequent technical analysis ideas from the reputable Trading Central. These actionable insights help clients spot potential trade opportunities and market movements.

Charting

MetaTrader 4 and 5 offer advanced charting with multiple trading tools:

- 38 technical indicators

- 24 drawing tools

- 21 timeframes

- 3 chart types

MultiBank group Account Types

There are 3 main account types offered by MultiBank Group, including Pro and Standard accounts:

Standard

- Spreads from 1.5 pips

- $50 minimum deposit

- Best for beginners

Pro

- Spreads from 0.8 pips

- $1000 minimum deposit

- Suits intermediate traders

ECN

- Raw spreads from 0.0 pips

- $3/lot commission

- $10,000 minimum deposit

- Designed for advanced traders

Key features

- Up to 1:500 leverage (entity dependent)

- Swap-free Islamic accounts available

- Free demo accounts

- 20,000+ tradable instruments

The diverse account offerings cater to traders of all levels. Lower minimum deposits make trading accessible, while tighter spreads benefit high-volume traders.

MultiBank Group Account Types Comparison

| Feature | Standard | Pro | ECN |

|---|---|---|---|

| Spread | From 1.5 pips | From 0.8 pips | From 0.0 pips |

| Commission | $0 | $0 | $3/lot |

| Minimum Deposit | $50 | $1,000 | $10,000 |

| Leverage | Up to 1:500 | Up to 1:500 | Up to 1:500 |

| Instruments | 20,000+ | 20,000+ | 20,000+ |

| Islamic Account | Yes | Yes | Yes |

| Demo Account | Yes | Yes | Yes |

Negative Balance Protection

MultiBank Group offers negative balance protection across all its regulated entities. Key points:

- Applies to all account types

- No additional terms or conditions

- Fully protects clients' funds

- Aligns with regulatory requirements

MultiBank group Deposits and Withdrawals

MultiBank Group provides clients with a wide array of secure and convenient methods to fund their trading accounts and withdraw profits. Understanding these options is crucial for a smooth trading experience.

Deposit Methods

MultiBank Group accepts over 20 deposit methods, ensuring flexibility for its global client base. These include:| Payment Method | Supported Options/Currencies |

|---|---|

| Bank Wire Transfer | USD, EUR, GBP, CHF, AUD, NZD, CAD |

| Credit/Debit Cards | Visa, Mastercard |

| E-wallets | Skrill, Neteller, PayTrust88, Plus Wallets |

| Cryptocurrencies | Bitcoin, USDT (ERC20/TRC20) |

| Regional Options | pagsmile, My Fatoorah, Thai QR Payment, Pay Retailers |

Withdrawal Methods

Withdrawals can be made via the same methods as deposits, giving traders a seamless experience in managing their funds. Like deposits, MultiBank Group does not impose fees on withdrawals. To initiate a withdrawal, traders must submit a request form. The broker aims to process requests within 24 hours, but actual receipt of funds depends on the chosen method: - Bank wires: 1-2 business days - Cards and e-wallets: Instant to 24 hours - Cryptocurrencies: Instant Before processing a withdrawal, MultiBank Group may request additional verification documents like proof of identity and address to ensure account security and regulatory compliance. Promptly providing these documents helps avoid delays.Unique Features

One standout aspect of MultiBank Group's payment options is the support for cryptocurrencies. This allows tech-savvy traders to move funds quickly and securely without relying on traditional finance systems. The broker also offers an unusually diverse range of local payment methods for key markets like Southeast Asia, the Middle East, and Latin America. This localized approach makes it easier for clients in these regions to trade global markets.Key Takeaways

MultiBank Group's extensive deposit and withdrawal options cater to the needs of its worldwide client base. The broker's commitment to not charging internal fees and supporting local payment methods demonstrates a customer-centric approach. As with any financial dealings, traders should take care to understand applicable third-party fees and processing times. Promptly providing requested verification documents ensures a smooth withdrawal experience. By offering a blend of traditional and innovative payment solutions, MultiBank Group empowers traders to efficiently manage their funds and focus on their trading goals. For the most current information on deposit and withdrawal options, visit the broker's official website.Support Service for Customer

Traders can reach MultiBank Group's customer support through several channels:

| Channel | Description | Contact Details | Availability |

|---|---|---|---|

| Live Chat | Quick assistance directly from the website. Simply click on the chat icon and a support representative will be there to help you. | Via website chat widget | 24/7 |

| Suitable for less urgent inquiries or sending documents. The support team aims to respond to all emails within 24 hours. | support@multibankfx.com | Within 24 hours | |

| Phone | Direct voice support available in multiple languages. The main support number is provided along with local numbers for key markets. | Main: +97145896200Local numbers for Australia, Malaysia, Cyprus | Not specified (available as per local operating hours) |

| Social Media | Monitored for client queries, though not a primary support channel. You can expect a response within 48 hours. | Facebook, Twitter, LinkedIn | Within 48 hours |

| Provides quick and informal assistance. | +97145896200 | Not specified |

Language Support

As a global broker, MultiBank Group offers support in 9 languages:- English

- Arabic

- Spanish

- French

- Chinese

- Malay

- Vietnamese

- Filipino

- Russian

Support Hours and Response Times

One of MultiBank Group's standout features is its 24/7 live chat support. No matter what time zone you're in, you can always get immediate assistance. For email inquiries, the broker aims to respond within 24 hours, although during peak times it may take up to 48 hours. Phone support hours vary by region but generally cover standard business hours in the respective time zone. Calls are typically answered within a few minutes. Here is a detailed overview of MultiBank Group's customer support: Here is a list of MultiBank Group's customer support channels: - Live chat: 24/7 from website - Email: support@multibankfx.com - Phone: +97145896200 (main), local numbers for some countries - Social media: Facebook, Twitter, LinkedIn - WhatsApp: +97145896200 MultiBank Group's customer support| Support Channel | Availability | Languages | Response Time |

|---|---|---|---|

| Live Chat | 24/7 | English, Arabic, Spanish, French, Chinese, Malay, Vietnamese, Filipino, Russian | Immediate |

| 24/7 | English, Arabic, Spanish, French, Chinese, Malay, Vietnamese, Filipino, Russian | 24-48 hours | |

| Phone | Varies by region, business hours | English, Arabic, Spanish, French, Chinese, Malay, Vietnamese, Filipino, Russian | Within minutes |

| Social Media | Monitored 24/7 | English | Within 48 hours |

| 24/7 | English, Arabic, Spanish, French, Chinese, Malay, Vietnamese, Filipino, Russian | Varies |

Prohibited Countries

According to MultiBank Group's website and regulatory documents, the broker does not accept clients from the following countries:

- United States

- Japan

- Canada

- Democratic People's Republic of Korea (North Korea)

- Iran

- Cuba

- Syria

- Sudan

This list is subject to change based on evolving regulations and MultiBank Group's business decisions. It's always best to check the broker's website for the most up-to-date information.

Consequences of Trading from a Prohibited Country

Attempting to trade with MultiBank Group from a prohibited country could have serious consequences:

- Account closure: If MultiBank Group discovers that a client is from a prohibited country, it may immediately close their account and return any remaining funds.

- Legal action: In some cases, trading from a prohibited country may violate local laws. This could result in legal penalties for the trader.

- Lack of protections: Traders from prohibited countries may not have access to the same dispute resolution mechanisms or investor protections as those from permitted jurisdictions.

MultiBank Group offers several exciting promotions to both new and existing clients. These offers are designed to enhance your trading experience and provide extra value. Let's dive into the details of each promotion and explore how you can benefit from them.

Special Offers for Customers

MultiBank Group offers several exciting promotions to both new and existing clients. These offers are designed to enhance your trading experience and provide extra value. Let's dive into the details of each promotion and explore how you can benefit from them.

20% Deposit Bonus

MultiBank Group's 20% deposit bonus is a great way to boost your trading capital. Here's how it works:

- Open a new Standard or Pro account with MultiBank Group.

- Make a deposit of at least $100.

- Receive a bonus equal to 20% of your deposit, up to a maximum of $15,000.

Cashback Program

MultiBank Group also offers a cashback program that rewards you for your trading activity. The more you trade, the more you can earn. Here's how the tiers work:

| Monthly Trading Volume (Lots) | Cashback per Lot |

|---|---|

| 1 - 100 | $2 |

| 101 - 200 | $4 |

| 201 - 300 | $6 |

| 301 - 400 | $8 |

| 401+ | $10 |

Trading Competitions

Throughout the year, MultiBank Group runs various trading competitions. These often have attractive prize pools and can add an element of fun and excitement to your trading.

Conclusion

Throughout this comprehensive review, I've delved into the various aspects that define MultiBank Group as a broker. From their regulatory compliance to their trading platforms, customer support, and special offers, I've aimed to provide a well-rounded picture of their services and evaluate their overall trustworthiness and suitability for traders.

One of the standout features of MultiBank Group is their strong regulatory compliance. They operate under the oversight of multiple tier-1 regulators, including ASIC, MAS, and CySEC, which speaks to their commitment to providing a safe and transparent trading environment. This level of regulation is a key factor in establishing trust, as it ensures that the broker adheres to strict financial guidelines and maintains the highest operational standards.

MultiBank Group's global presence, with entities regulated in several jurisdictions, allows them to serve a wide client base. However, it's important to note that they are prohibited from offering services in certain countries, such as the United States, Japan, and Canada. Traders should always verify that MultiBank Group is authorized to operate in their country of residence before opening an account.

In terms of trading offerings, MultiBank Group provides a diverse selection of instruments across forex pairs, shares, indices, commodities, and cryptocurrencies. Their 20,000+ tradable symbols cater to a variety of trading strategies and preferences. The broker's account types—Standard, Pro, and ECN—offer a range of options suitable for both beginner and experienced traders, with competitive spreads and leverage up to 1:500.

MultiBank Group's trading platforms include the industry-standard MetaTrader 4 and MetaTrader 5, as well as their proprietary MultiBank-Plus web and mobile platform. While MT4 and MT5 provide advanced charting and automation capabilities, MultiBank-Plus offers a more streamlined and user-friendly experience. The addition of tools like Trading Central further enhances the trading experience, providing valuable insights and analysis.

Customer support is another area where MultiBank Group shines. With 24/7 live chat, email, and phone support in multiple languages, traders can access assistance whenever they need it. The support team is knowledgeable and responsive, which is crucial for maintaining a smooth trading experience.

MultiBank Group also offers several attractive promotions, including a 20% deposit bonus and a cashback program. While these offers can provide extra value, it's essential to carefully consider the terms and conditions, such as trading volume requirements, before participating.

One aspect where MultiBank Group could improve is their educational resources. While they offer a decent selection of articles, videos, and platform tutorials, their educational content is not as comprehensive as some other brokers in the industry. Expanding their educational offerings would further demonstrate their commitment to supporting traders' growth and success.

Overall, MultiBank Group established itself as a reputable and trustworthy broker. Their strong regulatory compliance, wide range of trading instruments, competitive trading conditions, and reliable customer support make them a solid choice for traders seeking a secure and professional trading environment.

However, as with any financial decision, it's crucial to conduct thorough research and consider your individual trading needs and goals before choosing a broker. Take the time to explore MultiBank Group's website, review their legal documents, and test their platforms with a demo account to ensure they align with your expectations.

By providing this comprehensive review, I aim to equip you with the knowledge and insights necessary to make an informed decision about whether MultiBank Group is the right broker for you. Remember, successful trading relies not only on the broker you choose but also on your own trading strategy, risk management, and continuous education.

If you have any further questions or would like to learn more about MultiBank Group's offerings, I encourage you to visit their official website or reach out to their customer support team. They'll be happy to provide additional information and guide you through the account opening process.