NordFX Review 2025: Unraveling the Pros, Cons, and Key Features

NordFX

Mauritius

Mauritius

-

Minimum Deposit $10

-

Withdrawal Fee $varies

-

Leverage 1000:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

Softwares & Platforms

Customer Support

+442081448744

(English)

+442081448744

(English)

Supported language: Chinese (Simplified), English, Russian, Spanish

Social Media

Summary

NordFX is a trusted online broker offering a wide range of trading instruments, including Forex, cryptocurrencies, indices, stocks, and commodities. The broker provides multiple account types, such as Saving, Pro, and Zero, catering to traders of all experience levels. With tight spreads, high leverage up to 1:1000, and fast execution, NordFX ensures optimal trading conditions. The platform supports MetaTrader 4 and MetaTrader 5, offering advanced tools and automated trading capabilities. Additionally, NordFX provides Islamic accounts, educational resources, and reliable customer support to enhance the trading experience.

- Wide range of tradable assets, including forex, cryptocurrencies, stocks, indices, and commodities.

- Multiple account types catering to different trader preferences and skill levels.

- Supports popular trading platforms MetaTrader 4 and MetaTrader 5.

- Competitive trading conditions with leverage up to 1:1000 and tight spreads.

- Comprehensive educational resources, including webinars, tutorials, and market analysis tools.

- Multilingual customer support via live chat, email, phone, and contact form.

- Special promotions like the "$100,000 Super Lottery" and "Refer a Friend" program.

- Low minimum deposit requirements starting from $10.

- Wide range of payment methods for deposits and withdrawals.

- Long operational history since 2008, serving clients in over 190 countries.

- Unregulated broker, lacking oversight from major financial authorities.

- Potential risks associated with trading with an unregulated broker.

- Limited investor protection and recourse in case of disputes or financial issues.

- Restricted services in some countries and regions due to regulatory constraints.

- Potential fees associated with certain payment methods for deposits and withdrawals.

- High leverage can amplify both profits and losses, posing risks for inexperienced traders.

- Some promotions and bonuses may have specific terms and conditions that limit their value.

- No guaranteed stop-loss orders, which may expose traders to increased risk.

- Limited customisation options for trading platforms compared to some competitors.

- Absence of additional trading tools like social trading or copy trading platforms.

Overview

NordFX is a global forex and CFD broker established in 2008, with a presence in over 190 countries and more than 1.7 million trading accounts. The company has received numerous industry awards, including "Best Affiliate Program" (Forex Awards, 2020-2021), "The Most Transparent Broker" (World Forex Award, 2021), and "Best Cryptocurrency Broker" (multiple, 2017-2023).

NordFX offers a diverse range of tradable assets, including 33 forex pairs, 11 cryptocurrencies, commodities, indices, and stocks. The broker provides the popular MetaTrader 4 and MetaTrader 5 platforms, along with competitive trading conditions such as leverage up to 1:1000, tight spreads from 0 pips, and fast order execution.

Clients can choose from various account types tailored to their needs, with minimum deposits starting at just $10. NordFX supports over 25 payment methods for convenient funding and withdrawal, and offers educational resources, market analysis, and multilingual customer support.

While NordFX boasts an extensive track record and attractive trading conditions, it's essential to note that the broker is currently unregulated, which may raise concerns for some traders regarding fund security and dispute resolution. As with any financial decision, thorough research and careful consideration of individual risk tolerance are advised. For more details on NordFX's offerings and services, visit their official website at nordfx.com.

NordFX Overview Table

| Broker | NordFX |

|---|---|

| Established | 2008 |

| Headquarters | Saint Lucia |

| Regulation | Unregulated |

| Minimum Deposit | $10 |

| Trading Platforms | MetaTrader 4, MetaTrader 5 |

| Instruments | Forex, CFDs, Cryptocurrencies, Stocks, Indices, Commodities |

| Leverage | Up to 1:1000 |

| Spreads | From 0 pips |

| Commission | 0-0.06% (Zero accounts) |

| Account Types | Fix, Pro, Zero, Savings |

| Funding Methods | 25+ options including cards, e-wallets, crypto |

| Withdrawal Methods | Bank transfer, e-wallets, crypto |

| Customer Support | 24/5 via live chat, email, phone |

NordFX Facts List

- NordFX was founded in 2008 and operates in over 190 countries.

- The broker has more than 1.7 million trading accounts worldwide.

- NordFX offers trading in forex, CFDs, cryptocurrencies, stocks, indices, and commodities.

- Clients can trade on the MetaTrader 4 and MetaTrader 5 platforms.

- NordFX provides leverage up to 1:1000 and tight spreads starting from 0 pips.

- The minimum deposit to open an account is just $10.

- NordFX supports over 25 payment methods for deposits and withdrawals.

- The broker offers several account types, including Fix, Pro, Zero, and Savings accounts.

- NordFX provides educational resources, market analysis, and trading tools to support clients.

- The company is currently unregulated, which may present a higher risk compared to regulated brokers.

NordFX Licenses and Regulatory

NordFX operates as an unregulated broker, meaning it does not hold licenses from major financial regulatory bodies such as the Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC). The absence of oversight from these well-recognised authorities may raise concerns for some traders regarding client fund security, dispute resolution, and overall trust.

In the forex and CFD trading industry, reputable brokers often seek regulation from multiple jurisdictions to demonstrate their commitment to compliance, transparency, and client protection. Regulated brokers must adhere to strict guidelines, including segregation of client funds, regular audits, and maintaining adequate capital reserves. These measures help to ensure a safer trading environment and provide recourse for clients in case of disputes.

While NordFX has been operating since 2008 and has reportedly amassed over 1.7 million trading accounts, the lack of regulation from respected authorities may be a red flag for traders who prioritise the security and peace of mind that comes with a regulated broker. Without the backing of a strong regulatory framework, clients may face increased risks, such as difficulty withdrawing funds or resolving disputes.

It's crucial for traders to thoroughly research and consider the potential implications of trading with an unregulated broker like NordFX. Comparing the broker's offerings and practices to industry standards set by regulated peers can help in making an informed decision. Traders should also assess their own risk tolerance and weigh the potential benefits of trading with NordFX against the absence of regulatory safeguards.

For those who decide to trade with NordFX, it's advisable to start with smaller investments and closely monitor the broker's performance, responsiveness, and adherence to its stated policies. As with any financial decision, diversification and careful risk management are essential to mitigate potential losses.

Regulations List

- NordFX does not currently hold any licenses with major financial regulators such as the FCA, ASIC, or CySEC.

- The broker operates as an unregulated entity, which may present higher risks for traders compared to regulated brokers.

Trading Instruments

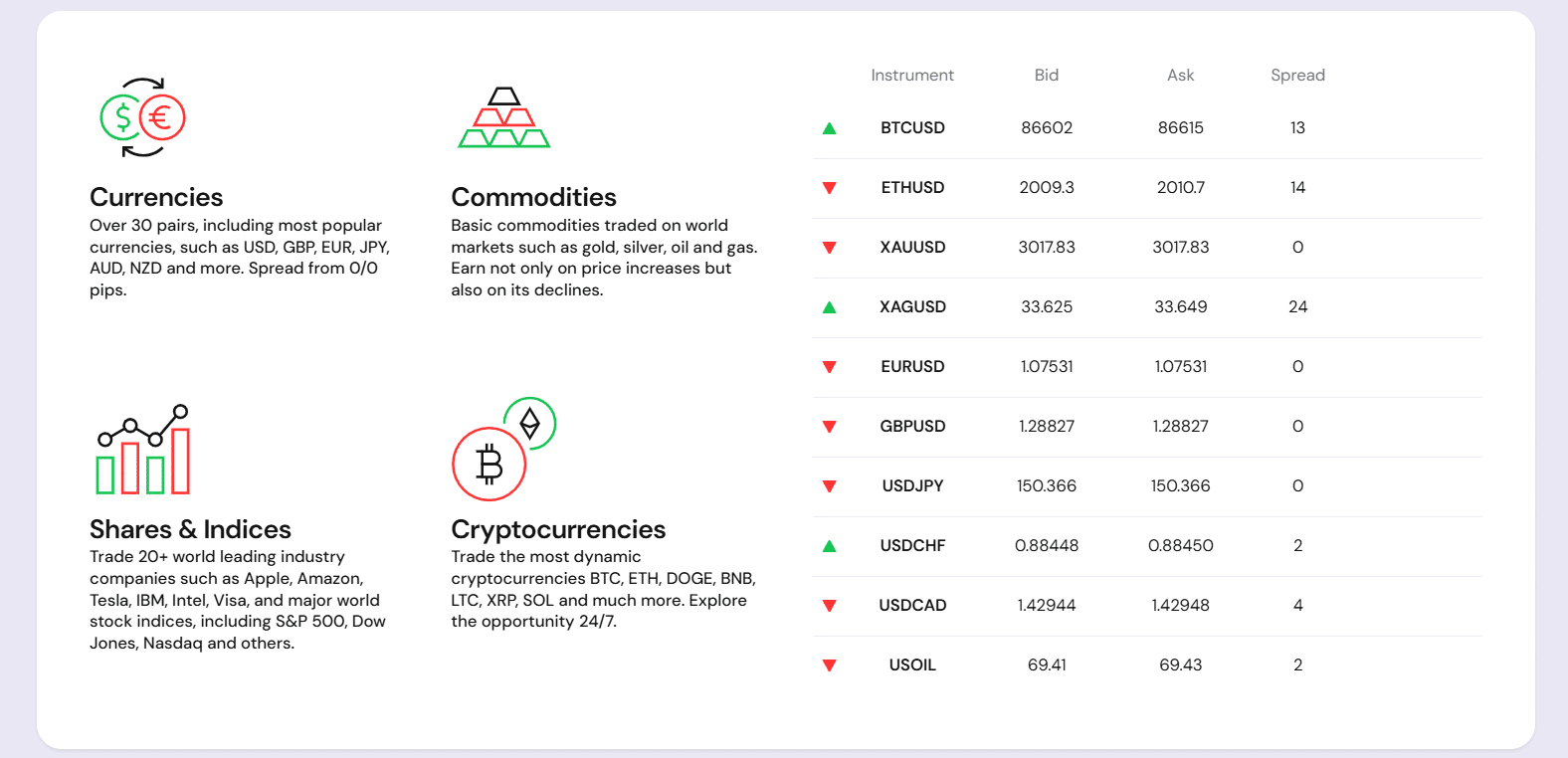

NordFX offers a wide array of tradable assets, suitable for traders of different levels. The broker provides access to multiple financial markets, allowing clients to build well-rounded portfolios and capitalise on different market conditions.

| Category | Details |

|---|---|

| Forex | 33 currency pairs (major, minor, exotic) including EUR/USD, GBP/USD, USD/JPY. Spreads: From 0.9 pips (Pro accounts), 0.0 pips (Zero accounts). High liquidity, 24/5 trading. |

| Cryptocurrencies | 11 cryptocurrency pairs including BTC/USD, ETH/USD, XRP/USD. Leverage up to 1:1000. 24/7 trading. |

| Stocks | CFD trading on selected stocks. Allows speculation on price movements without owning assets. Limited selection compared to some brokers. |

| Indices | CFDs on global indices such as S&P 500, NASDAQ 100, DAX 30. Enables speculation on market performance and diversification. |

| Commodities | Trading in gold, silver, oil, and gas. Used for hedging against inflation and geopolitical risks. Opportunities based on supply and demand. |

Having a wide array of tradable assets is crucial for traders looking to diversify their portfolios and adapt to changing market conditions. NordFX's selection of assets is competitive within the industry, particularly in the forex and crypto markets. However, some traders may find the range of stocks and indices more limited compared to larger, regulated brokers.

Ultimately, the suitability of NordFX's tradable assets will depend on an individual trader's goals, strategies, and risk tolerance. It's essential to carefully consider the potential benefits and drawbacks of each asset class and ensure that the broker's offerings align with one's trading needs.

Trading Platforms

NordFX provides clients with access to the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, ensuring a seamless and familiar trading experience. These platforms are known for their stability, advanced features, and wide range of tools, making them popular choices among traders worldwide.

MetaTrader 4 (MT4)

MT4 is a user-friendly platform suitable for both beginners and experienced traders. It offers a comprehensive set of features, including customisable charts, a wide selection of technical indicators, and the ability to create and use Expert Advisors (EAs) for automated trading. NordFX provides MT4 as a downloadable desktop application, web-based platform, and mobile app for iOS and Android devices.

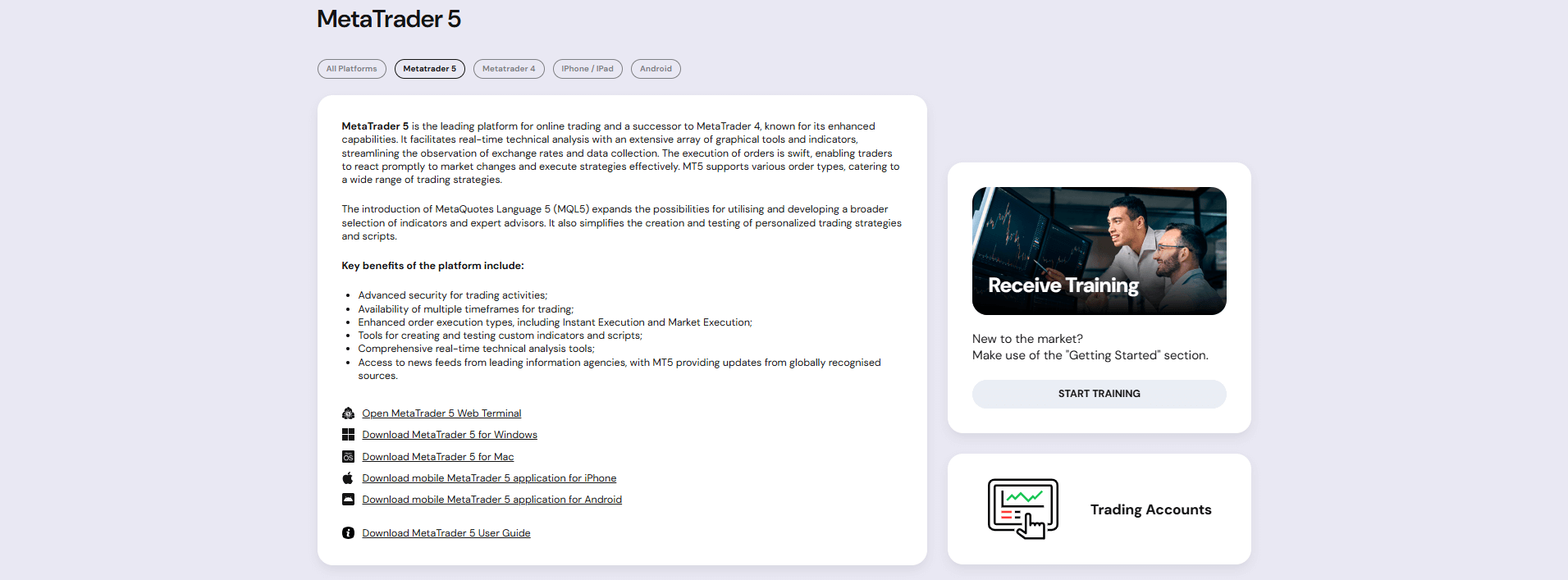

MetaTrader 5 (MT5)

The broker also provides MT5 , the successor to MT4, offering enhanced functionality and additional features. It supports more advanced trading strategies, such as hedging and netting, and provides access to a broader range of markets, including stocks and commodities. Like MT4, NordFX offers MT5 as a desktop, web, and mobile platform, catering to various trading preferences.

Mobile Trading

NordFX's mobile apps for MT4 and MT5 allow traders to access their accounts, execute trades, and monitor the markets on the go making it suitable for traders. The apps provide a streamlined interface optimised for mobile devices, enabling traders to stay connected to the markets and react to opportunities quickly.

Platform Features

Both MT4 and MT5 offer a robust set of features to support traders' needs. These include:

- Customizable charting with a wide range of timeframes and chart types

- A vast selection of built-in technical indicators and drawing tools

- The ability to create, backtest, and optimize Expert Advisors (EAs) for automated trading

- Real-time market news and analysis

- One-click trading and the ability to set stop-loss and take-profit levels

- Multilingual support and a user-friendly interface

NordFX's choice of offering MT4 and MT5 demonstrates its commitment to providing clients with reliable, feature-rich, and widely accepted trading platforms. These platforms cater to various trading styles and strategies, empowering traders to make informed decisions and execute their trades efficiently.

While some brokers may offer proprietary platforms, NordFX's decision to focus on the MetaTrader suite ensures that clients have access to a vast ecosystem of third-party tools, resources, and educational materials. This can be particularly beneficial for novice traders who can leverage the extensive community support and resources available for MT4 and MT5.

Overall, NordFX's trading platforms are well-suited to meet the needs of a wide range of traders, from beginners to professionals. The broker's offerings align with industry standards and provide a solid foundation for traders to develop and execute their strategies effectively.

Trading Platforms Comparison Table

| Feature | MetaTrader 4 (MT4) | MetaTrader 5 (MT5) |

|---|---|---|

| Desktop Platform | ✔️ | ✔️ |

| Web Platform | ✔️ | ✔️ |

| Mobile App (iOS & Android) | ✔️ | ✔️ |

| Customizable Charts | ✔️ | ✔️ |

| Technical Indicators | 30+ | 38+ |

| Timeframes | 9 | 21 |

| Expert Advisors (EAs) | ✔️ | ✔️ |

| Hedging | ❌ | ✔️ |

| Netting | ✔️ | ✔️ |

| Automated Trading | ✔️ | ✔️ |

| Market Depth | ❌ | ✔️ |

| Market News | ✔️ | ✔️ |

NordFX How to Open an Account: A Step-by-Step Guide

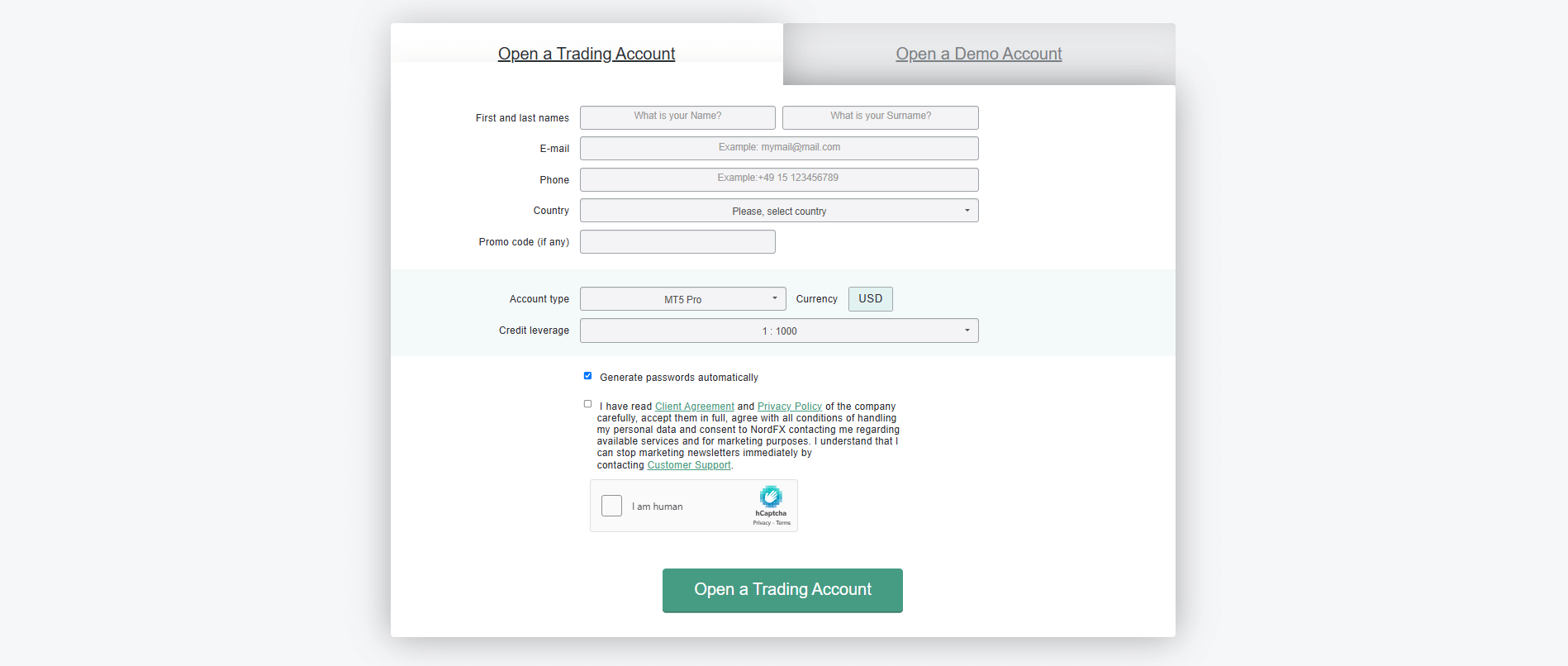

Opening an account with NordFX is a straightforward process designed to get traders started quickly and easily. By following a few simple steps, clients can create an account, fund it, and begin trading in a matter of minutes. Here's a step-by-step guide to help you get started:

Step 1: Visit the NordFX website Go to the official NordFX website at nordfx.com and click on the "Open an Account" button located on the homepage.

Step 2: Choose your account type Select the account type that best suits your trading needs and experience level. NordFX offers several account types, including Fix, Pro, Zero, and Savings accounts, each with different minimum deposit requirements and trading conditions.

Step 3: Fill out the registration form Provide your personal information, such as your full name, email address, phone number, and country of residence. Ensure that all information is accurate and up-to-date to avoid any issues during the account verification process.

Step 4: Verify your identity To comply with anti-money laundering (AML) and know your customer (KYC) regulations, NordFX requires clients to submit proof of identity and address. This typically involves uploading a copy of your government-issued ID, such as a passport or driver's license, and a recent utility bill or bank statement.

Step 5: Fund your account Once your account is verified, you can proceed to fund it using one of the many payment methods available at NordFX. The broker supports over 25 deposit options, including bank transfers, credit/debit cards, e-wallets like Skrill and Neteller, and cryptocurrencies. Minimum deposits start at just $10, depending on the account type you've chosen.

Step 6: Download the trading platform NordFX offers the MetaTrader 4 and MetaTrader 5 platforms for desktop, web, and mobile devices. Download the appropriate platform for your device and log in using the credentials provided by NordFX.

Step 7: Start trading With your account funded and the trading platform installed, you're ready to start trading. Take some time to familiarise yourself with the platform's features and tools, and be sure to implement proper risk management strategies to protect your capital.

NordFX's account opening process is designed to be user-friendly and efficient, allowing traders to start exploring the markets quickly. The low minimum deposit requirements and wide range of payment methods make it accessible to traders with varying levels of experience and financial resources.

Charts and Analysis

NordFX provides a comprehensive suite of educational resources and tools designed to support traders in their journey, regardless of their experience level. These resources aim to enhance traders' knowledge, skills, and decision-making abilities, empowering them to navigate the financial markets with confidence. For a more detailed overview of NordFX's educational offerings, visit their official website at nordfx.com.

| Category | Details |

|---|---|

| Market Analysis | Daily Market Reviews: Insights into forex, crypto, and stock markets, covering economic events, technical levels, and trading opportunities. |

| Weekly Market Outlook: Forecasts on upcoming market trends for major currency pairs, indices, and commodities. | |

| Forex & Cryptocurrency Forecasts: Expert opinions based on technical and fundamental analysis. | |

| Educational Resources | Forex & CFD Tutorials: Step-by-step guides covering market basics, terminology, order types, and risk management. |

| Webinars: Live and recorded seminars by industry experts on trading strategies and market insights. | |

| E-books & Articles: Downloadable PDFs and articles on trading psychology, money management, and advanced concepts. | |

| Economic Calendar: A comprehensive calendar of key economic events and data releases impacting financial markets. | |

| Trading Tools | Advanced Charting Package: Customisable charts with technical indicators, drawing tools, and multiple timeframes. |

| Trading Calculators: Includes pivot points, margin calculations, and profit/loss estimations. | |

| Market Sentiment Indicators: Real-time data on sentiment, including long/short ratios and open interest. | |

| Volatility Indicators: Tools to analyse market volatility and potential trading ranges. |

NordFX's commitment to providing a comprehensive educational suite sets it apart from many competitors, particularly in the unregulated broker space. The breadth and depth of the resources offered demonstrate an understanding of the importance of ongoing education and support for traders at all levels.

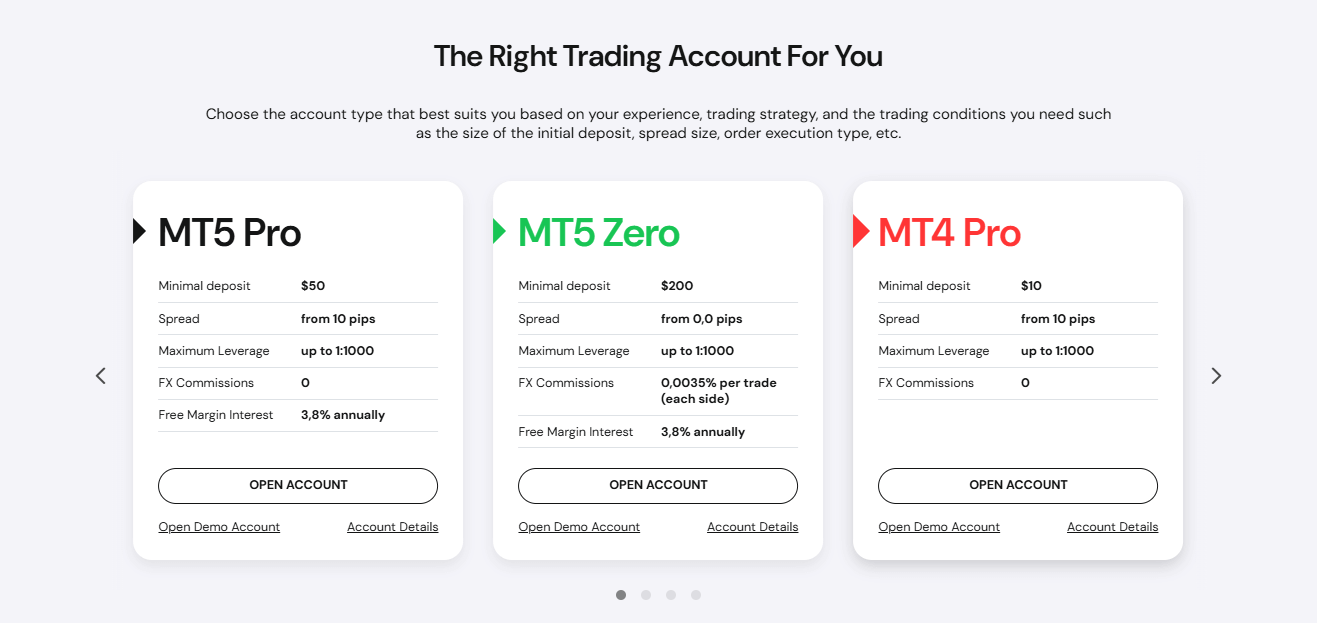

NordFX Account Types

NordFX offers a diverse range of trading account options, catering to the unique needs and preferences of traders at various levels of experience and with different trading styles. By providing multiple account types, the broker ensures that clients can select an account that aligns with their specific goals, risk tolerance, and investment capital. For more detailed information on each account type, visit NordFX's official website at nordfx.com.

Pro Accounts (MT4 & MT5)

Pro accounts are designed for traders who prefer a traditional trading environment with competitive spreads and no commissions. These accounts offer spreads starting from 0.9 pips, making them an attractive option for those looking to minimise trading costs. The minimum deposit for MT4 Pro accounts is just $10, while MT5 Pro accounts require a minimum of $50, making them accessible to traders with limited initial capital.

Zero Accounts (MT4 & MT5)

Zero accounts are tailored for more experienced traders seeking the lowest possible spreads and faster execution speeds. These accounts feature raw spreads starting from 0.0 pips and a small commission of 0.0035% per trade (per side). The minimum deposit for MT4 Zero accounts is $100, while MT5 Zero accounts require a minimum of $200. Zero accounts provide access to interbank liquidity and are suitable for high-volume traders and those employing scalping strategies.

Savings Account

NordFX's Savings account is an innovative offering that combines the benefits of a classic savings account with the potential for higher returns through trading. This account allows clients to earn an annual interest rate of up to 30% on their deposited funds, which can be withdrawn at any time. The minimum deposit for the Savings account is $500, making it an attractive option for investors looking to grow their capital passively.

Demo Account

For traders who are new to the markets or wish to test out NordFX's trading platforms and conditions, the broker offers a demo account with virtual funds. Demo accounts provide access to the same trading instruments and features as live accounts, allowing traders to practise their strategies and familiarise themselves with the platform in a risk-free environment.

The variety of account types offered by NordFX demonstrates the broker's commitment to accommodating the diverse needs of its clientele. By providing options for both beginner and experienced traders, as well as those looking for passive investment opportunities, NordFX ensures that clients can find an account that best suits their individual trading requirements.

Account Types Comparison Table

| Feature | MT4 Pro | MT5 Pro | MT4 Zero | MT5 Zero |

|---|---|---|---|---|

| Minimum Deposit | $10 | $50 | $100 | $200 |

| Spread (EUR/USD) | From 0.9 | From 0.9 | From 0.0 | From 0.0 |

| Commission (per trade) | None | None | 0.0035% | 0.0035% |

| Leverage | Up to 1:1000 | Up to 1:1000 | Up to 1:1000 | Up to 1:1000 |

| Margin Interest | None | 3% p.a. | None | 3% p.a. |

| Trading Instruments | 70+ | 150+ | 70+ | 150+ |

| Feature | Savings Account | Demo Account |

|---|---|---|

| Minimum Deposit | $500 | N/A |

| Interest Rate (p.a.) | Up to 30% | N/A |

| Withdraw | N/A | N/A |

Negative Balance Protection

As an unregulated broker, NordFX's lack of transparency regarding negative balance protection raises questions about the potential risks traders may face. Regulated brokers are often required to provide negative balance protection as part of their licensing conditions, ensuring a level of security for their clients. When choosing a broker, it is essential for traders to consider the presence of negative balance protection and other risk management features. Regulated brokers that clearly state their negative balance protection policy offer a higher level of security and peace of mind for traders.

NordFX Deposits and Withdrawals

NordFX offers a wide range of deposit and withdrawal options, providing traders with flexibility and convenience when managing their funds. The broker supports various payment methods, including bank transfers, credit/debit cards, e-wallets, and cryptocurrencies, catering to the diverse preferences of their clientele. For a comprehensive list of available payment methods and associated fees, visit NordFX's official website at nordfx.com.

Deposit Methods

| Payment Method | Details |

|---|---|

| Bank Transfer | Secure and reliable; may take longer to process compared to other methods. |

| Credit/Debit Cards | Supports Visa, Mastercard, and Maestro; instant processing. |

| E-wallets | Includes Skrill, Neteller, and WebMoney; typically processed instantly. |

| Cryptocurrencies | Supports Bitcoin, Ethereum, Litecoin, and more; fast processing times with added privacy. |

| Minimum Deposit | Varies by account type: MT4 Pro - $10, MT5 Pro - $50. |

Withdrawal Methods

| Category | Details |

|---|---|

| Processing Time | Most withdrawals are completed within 24 hours. |

| Withdrawal Methods | Traders must use the same method as their deposit, subject to verification. |

| Request Procedure | Withdrawals must be initiated via the NordFX account portal. |

| Verification Requirements | Proof of identity and address may be required for AML and KYC compliance. |

| Withdrawal Fees | NordFX does not charge fees, but payment providers may impose their own charges. |

| Crypto Withdrawals | Available option with faster processing times and potentially lower fees than traditional methods. |

Support Service for Customer

Reliable customer support is a critical aspect of a positive trading experience, as it ensures that traders can receive timely assistance and guidance when needed. NordFX recognises the importance of providing efficient and responsive customer support to its clients, offering multiple channels through which traders can reach out for help.

Live Chat

NordFX offers a live chat feature on their website, allowing traders to connect with a support representative in real-time. This is often the quickest way to receive assistance for general enquiries or minor issues.Phone Support

NordFX provides phone support in several countries, with dedicated numbers for traders in specific regions. This allows clients to speak directly with a support representative and receive immediate assistance. Country-Specific Phone Numbers:- LATAM: +593-9-80-909032

- Europe: +357-25030262

- China: +86 108 4053677

- Thailand: +66600035101

- Sri Lanka: +972559661848

Contact Form

Traders can submit a contact form on the NordFX website, providing details about their inquiry or issue. The customer support team aims to respond to contact form submissions within 24 hours. NordFX's customer support is available 24/5, ensuring that traders can access assistance during the most active trading hours. The multilingual support team can help traders in 15 different languages, catering to the broker's global clientele. While NordFX offers a range of support channels and aims to provide prompt assistance, it's important to note that as an unregulated broker, the level of support and issue resolution may not be as robust as that offered by regulated brokers. Traders should keep this in mind and carefully assess their expectations for customer support when considering NordFX.Customer Support Comparison Table

| Feature | NordFX |

|---|---|

| Support Channels | Live Chat, Email, Phone, Contact Form |

| Support Hours | 24/5 |

| Support Languages | 15 |

| Average Response Time (Live Chat) | 2 minutes |

| Average Response Time (Email) | 24 hours |

| Average Response Time (Contact Form) | 24 hours |

Prohibited Countries

NordFX operates in a global market, aiming to provide its services to traders worldwide. However, due to varying regulations, licensing requirements, and geopolitical factors, the broker is prohibited from operating or offering its services in certain countries and regions.

The primary reason behind these restrictions is compliance with local laws and regulations. Each country has its own set of rules governing the provision of financial services, including online trading. In some jurisdictions, brokers are required to obtain specific licenses or adhere to strict guidelines to operate legally. Failure to comply with these regulations can result in legal consequences and potential risks for both the broker and its clients.

Another factor that may influence NordFX's ability to offer services in certain regions is geopolitical tensions or economic sanctions. In some cases, international sanctions or trade restrictions may prohibit brokers from engaging with clients from specific countries.

It's crucial for traders to be aware of these restrictions and ensure that they are not residing in a prohibited country before attempting to open an account with NordFX. Attempting to trade from a prohibited jurisdiction may result in account termination, funds being frozen, or other legal consequences.

NordFX is currently prohibited from offering its services in the following countries and regions:

- United States

- Canada

- European Union

- Australia

- Japan

- Russian Federation

- Belarus

- Ukraine

- Israel

- Palestine

- Iran

- North Korea

- Sudan

- Syria

- Cuba

- Iraq

- Afghanistan

- Liberia

- Myanmar

Traders from these countries should seek alternative brokers that are properly licensed and authorised to operate in their jurisdiction. It's essential to conduct thorough research and due diligence when selecting a broker to ensure compliance with local regulations and protect one's investments.

Special Offers for Customers

NordFX provides a range of special promotions and offers designed to attract new traders and reward existing clients for their loyalty. These offers can help traders maximise their potential returns and enhance their overall trading experience. However, it's essential to carefully review the terms and conditions associated with each promotion to ensure a clear understanding of the requirements and limitations.

One of NordFX's standout offers is the "$100,000 Super Lottery." This promotion gives traders the chance to win a share of $100,000 in real money prizes. To participate, clients need to open a Pro account, deposit at least $200, and trade a minimum of 2 lots. The more deposits and trades made, the more lottery tickets earned, increasing the chances of winning.

Another notable offer is the "Refer a Friend" program, which rewards traders for introducing new clients to NordFX. When a referred friend opens an account and makes a deposit, the referring trader receives a bonus equal to 10% of their friend's deposit amount. This offer encourages traders to spread the word about NordFX and potentially earn additional funds to support their trading activities.

NordFX occasionally runs trading competitions, allowing traders to showcase their skills and compete for prizes. These competitions often have specific rules and requirements, such as trading certain instruments or achieving a minimum trading volume within a designated time frame. Successful participants can win cash prizes or other rewards, adding an element of excitement and motivation to their trading experience.

While these special offers can be attractive, traders should always consider the potential impact on their overall trading strategy and risk management approach. It's crucial to read and understand the full terms and conditions of each promotion, including any minimum deposit requirements, trading volume thresholds, or time limitations. Some offers may have restrictions on withdrawals or require a certain level of trading activity to qualify for the benefits.

In comparison to other brokers, NordFX's special offers are relatively competitive, particularly the "$100,000 Super Lottery," which provides a unique opportunity for traders to win substantial prizes. However, as with any promotional offer, traders should evaluate the potential benefits against their individual trading goals and risk tolerance.

Special Offers List

- $100,000 Super Lottery: Chance to win a share of $100,000 in real money prizes by opening a Pro account, depositing at least $200, and trading a minimum of 2 lots.

- Refer a Friend: Earn a bonus equal to 10% of a referred friend's deposit amount when they open an account and make a deposit.

- Trading Competitions: Participate in occasional trading competitions to showcase skills and compete for cash prizes or other rewards.

Conclusion

As I approach the end of this comprehensive review of NordFX, it's essential to consolidate the findings and insights gathered throughout the article to provide a cohesive summary that addresses their safety, reliability, and overall reputation as a broker.

One of the primary concerns that emerges from the analysis is NordFX's lack of regulation by major financial authorities. As an unregulated broker, they may not provide the same level of investor protection and oversight as their regulated counterparts. This absence of regulatory compliance raises questions about the safety of client funds and the broker's accountability in the event of disputes or financial issues.

However, it's important to acknowledge that NordFX has been operating since 2008 and has expanded its services to over 190 countries, suggesting a level of stability and client acceptance. They offer a diverse range of tradable assets, competitive trading conditions, and multiple account types to cater to various trader preferences and skill levels.

NordFX's commitment to providing comprehensive educational resources and market analysis tools is commendable, as it empowers traders to make informed decisions and continuously improve their skills. The broker's support for the popular MetaTrader 4 and MetaTrader 5 platforms ensures a seamless and familiar trading experience for many users.

In terms of customer support, NordFX offers multiple channels for traders to seek assistance, including live chat, email, phone support, and a contact form. The availability of multilingual support and country-specific phone numbers demonstrates their efforts to cater to a global clientele.

NordFX's special offers and promotions, such as the "$100,000 Super Lottery" and the "Refer a Friend" program, add an element of excitement and potential rewards for traders. However, it's crucial to carefully review the terms and conditions associated with these offers to understand the requirements and limitations.

When considering NordFX as a potential broker, traders should weigh the attractive features and benefits against the lack of regulatory oversight. It's essential to conduct thorough due diligence, assess individual risk tolerance, and consider the implications of trading with an unregulated broker.

For traders who prioritise the security and peace of mind that comes with a regulated broker, NordFX may not be the ideal choice. However, for those comfortable with the risks and seeking a broker with a long operational history, diverse trading options, and competitive conditions, NordFX could be a suitable fit.

Ultimately, the decision to trade with NordFX should be based on a careful evaluation of one's trading goals, experience level, and risk appetite. It's crucial to stay informed, regularly monitor the broker's performance and reputation, and make decisions that align with individual financial objectives and personal comfort levels.