Plus500 Review 2025: Pros, Cons & Key Features

Plus500

Israel

Israel

-

Minimum Deposit $100

-

Withdrawal Fee $0

-

Leverage 1:300

-

Spread From 0.8

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Cyprus Market Making (MM)

Cyprus Market Making (MM)

South Africa Retail Forex License

South Africa Retail Forex License

Australia Retail Forex License

Australia Retail Forex License

Singapore Financial Services License

Singapore Financial Services License

Austria Financial Services License

Austria Financial Services License

Softwares & Platforms

Customer Support

+44

(English)

+44

(English)

Supported language: Arabic, English, French, German, Italian, Russian, Spanish

Social Media

Summary

Established in 2008, Plus500 is a global CFD broker operating across more than 50 countries. Regulated by prominent authorities such as the FCA, CySEC, and ASIC, Plus500 is also publicly traded on the London Stock Exchange. The broker provides a user-friendly platform for trading forex, stocks, indices, commodities, and cryptocurrencies. Renowned for its intuitive interface and exceptional customer support, Plus500 has received numerous awards.

- Highly regulated by top-tier authorities

- User-friendly proprietary trading platform

- Competitive spreads on forex pairs

- Wide range of 2,000+ tradable CFDs

- Fast and easy account opening process

- Responsive 24/7 customer support

- Low $100 minimum deposit and no fees

- Unlimited demo account for risk-free practice

- Listed on LSE for added transparency

- Beginner-friendly educational resources

- No MetaTrader 4/5 platform available

- Limited advanced tools for expert traders

- Inactivity fee after 3 months

- Lacks phone support; only chat and email

- No USA or Canada clients accepted.

- High stock CFD fees compared to some brokers

- Doesn't offer copy trading or social features

- Relatively small selection of crypto CFDs

- High 0.7% currency conversion fee on some trades

Overview

Plus500, founded in 2008, is a global CFD broker operating in over 50 countries. Regulated by major authorities like FCA, CySEC, and ASIC, Plus500 is publicly listed on the London Stock Exchange. The broker offers a user-friendly trading platform for forex, stocks, indices, commodities, and cryptocurrencies. Plus500 has won awards for its easy-to-use platform and quality customer service. Visitplus500.com for more details.

Overview Table

| Category | Details |

| Headquarters | Israel |

| Year Established | 2008 |

| Regulation | FCA, CySEC, ASIC, FMA, FSCA, MAS |

| Instruments | Forex, stocks, indices, commodities, crypto, options |

| Platforms | Proprietary WebTrader, Mobile Apps |

| Min. Deposit | $100 |

| Customer Support | 24/7 Live Chat, Email, WhatsApp |

Plus500 Facts List

- Globally regulated by 7 top-tier authorities

- Listed on the London Stock Exchange, providing transparency

- Offers 2,800+ CFD instruments across multiple asset classes

- Intuitive proprietary WebTrader platform and highly rated mobile apps

- Competitive spreads on major forex pairs like EUR/USD

- Innovative trader sentiment and analytics tools

- Fast account opening with a low $100 minimum deposit

- Helpful 24/7 customer support via live chat and email

- Free educational resources, including webinars and demo accounts

- Negative balance protection but no added deposit insurance

Plus500 Licenses and Regulatory

Plus500SEY Ltd. is authorized and regulated by top-tier regulators, including the Seychelles Financial Services Authority (License No. SD039), providing a high level of client protection and trust. The broker holds licenses from the following regulators:

| Regulatory Authority | Country |

|---|---|

| Financial Conduct Authority (FCA) | United Kingdom |

| Cyprus Securities and Exchange Commission (CySEC) | Cyprus |

| Australian Securities and Investments Commission (ASIC) | Australia |

| Financial Markets Authority (FMA) | New Zealand |

| Financial Sector Conduct Authority (FSCA) | South Africa |

| Monetary Authority of Singapore (MAS) | Singapore |

| Seychelles Financial Services Authority (FSA) | Seychelles |

Trading Instruments

Plus500 offers a wide range of over 2,800 CFD instruments across several asset classes:

| Asset Class | Details |

|---|---|

| Forex | 60+ currency pairs, including majors, minors, and exotics. Tight spreads on EUR/USD from 0.6 pips. |

| Stocks | 1,900+ global stocks from popular exchanges. Competitive spreads and no commissions. |

| Indices | 29 indices tracking major global markets. Spreads from 0.4 points on FTSE 100. |

| Commodities | 24 commodities, including metals, energy, and agriculture. |

| Cryptocurrencies | 19 popular coins like Bitcoin, Ethereum, and Litecoin. |

| Options | CFDs on options for select stocks and indices. |

| ETFs | 96 ETF CFDs across various sectors and themes. |

This diverse selection lets traders build flexible portfolios and adapt to changing markets.

Trading Platforms

Plus500 offers its own proprietary WebTrader platform for online trading via web browsers and mobile apps:

WebTrader Platform (Web-based)

- Clean, user-friendly interface with customizable layouts

- Advanced charting with 100+ indicators and drawing tools

- Supports all order types, including guaranteed stop losses

- Real-time price alerts and trader sentiment data

- Unique "+Insights" analytics tool showing trader trends

- No automated trading options like Expert Advisors

Mobile Trading Apps

- Intuitive apps for iOS and Android devices

- Closely mirrors WebTrader functionality for a seamless experience.

- Full account management and trading capabilities

- Convenient features like price alerts and biometric login

- Robust charting with indicators, multiple chart types, and timeframes

Plus500 Trading Platforms Comparison Table

| Feature | WebTrader | Mobile App |

| Charts | 100+ indicators | 100+ indicators |

| Order Types | Market, Limit, Stop, Guaranteed Stop | Market, Limit, Stop, Guaranteed Stop |

| Automated Trading | No | No |

| Alerts | Price, Sentiment | Price, Sentiment |

| News | No | No |

Plus500 How to Open an Account: A Step-by-Step Guide

Opening a live trading account at Plus500 is a quick and fully digital process. Here's a step-by-step guide:

Plus500 Account Opening Process List

- Visit Plus500.com and click "Start Trading Now."

- Enter your email and choose a strong password.

- Fill in the registration form with your personal details.

- Select your preferred trading platform: WebTrader or mobile

- Choose your account currency from 16 base currencies.

- Upload proof of identity and proof of residence documents.

- Answer a short trading experience questionnaire.

- Make a deposit using a credit card, PayPal, Skrill, or bank transfer.

- Start trading on your live account or practice on a demo.

Requirements

- Personal details like name, address, date of birth

- Proof of identity (passport, national ID card, driver's license)

- Proof of residence (bank statement, utility bill, credit card statement)

- Minimum deposit of $100 ($500 for wire transfer)

| Feature | Details |

|---|---|

| Verification Time | Typically under 24 hours. |

| Minimum Deposit | $100 for credit cards and e-wallets, $500 for bank transfers. |

| Deposit Fees | None. |

| Deposit Methods | Credit/Debit Card, PayPal, Skrill (instant processing); Bank Transfers (a few business days). |

| Sign-Up Process | Streamlined, secure, and beginner-friendly. Most traders can start within a day. |

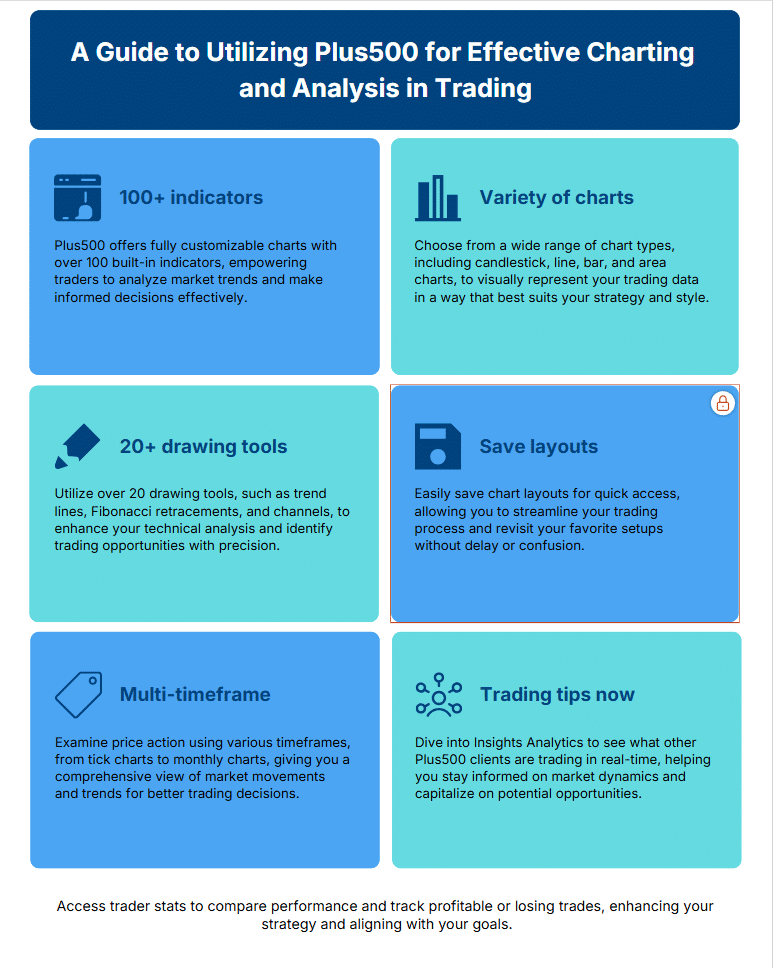

Charts and Analysis

Plus500 provides several useful charting and analysis tools for active traders:

WebTrader Charts

- Fully customizable charts with 100+ built-in indicators

- Wide range of chart types, including candlestick, line, bar, and area

- Over 20 drawing tools like trend lines, Fibonacci retracements, and channels

- Save chart layouts for quick access to favorite setups.

- Analyze price action across multiple timeframes (tick chart to monthly).

Insights Analytics

- Explore what other Plus500 clients are trading in real-time.

- Discover the most popular or top-moving instruments.

- Gauge crowd sentiment with long/short positioning data.

- Track the most profitable and loss-making trades.

- Filter data by asset class, region, and time period.

- Access individual trader statistics to compare performance.

- Charts and Analysis list:

- Daily "Market Insights" articles covering key news and events

- Weekly "Traders' Talk" videos with market analysis and trade ideas

- Economic calendar highlighting upcoming data releases

- Instrument details with symbol info, trading hours, margin, and description

- "Trader's Guide" articles on basic strategies, tools, and concepts

- Short video tutorials on using the Plus500 platform

Plus500 Account Types

Plus500 offers the following account types tailored for the needs of both beginner and advanced traders:

Retail Account

- Standard account for most clients

- Leverage up to 1:30 (varies by instrument)

- Minimum deposit: $100

Plus500 Demo Account

- Unlimited practice account with virtual funds

- Mirrors live account conditions

Negative Balance Protection

Negative Balance Protection (NBP) shields traders from losses exceeding their account balance, preventing them from owing money to the broker. Key points about Plus500's NBP policy:

- Applies to retail clients, but not professional accounts.

- Protects against extreme market volatility or gaps

- Ensures clients cannot lose more than their account balance

- No additional terms or conditions beyond standard T&Cs

Plus500 Deposits and Withdrawals

Plus500 supports the following Deposits and Withdrawals methods:

| Category | Details |

|---|---|

| Payment Methods | Credit/Debit Cards: Visa, Mastercard, Maestro |

| Bank Transfer | |

| E-wallets: PayPal, Skrill, iDeal, POLi, PayNow, Blik, BPay, Klarna, GiroPay | |

| Key Points | - No deposit or withdrawal fees from Plus500 |

| - Deposits are instant (except bank transfers: 3-5 days) | |

| - Withdrawals processed within 1 business day | |

| Minimum Deposit/Withdrawal | - $100 for credit/debit cards and e-wallets |

| - $500 for bank transfer | |

| Verification Required | Proof of ID and address |

Support Service for Customer

Fast, reliable support is crucial for a positive trading experience. Plus500 offers:

| Category | Details |

|---|---|

| Customer Support | - Live Chat: Available 24/7 |

| - Email: Accessible via web form | |

| - WhatsApp Chat: Available | |

| - Languages: Support in 16 languages, including English, Spanish, German, Italian, French, Russian, and Arabic | |

| - Response Time: Fast, typically within minutes | |

| - Drawback: No phone support, which is a disadvantage compared to competitors |

Prohibited Countries

Plus500 does not accept clients from certain jurisdictions due to regulatory restrictions or company policy. These include:

- USA

- Canada

- North Korea

- Iran

- Syria

- Sudan

- Cuba

- Belgium

- Japan

The reasons vary but often relate to local licensing requirements, economic sanctions, or anti-money laundering rules.

Attempting to trade from a prohibited country violates Plus500's terms of service. Accounts may be blocked or funds withheld. Always check your eligibility before signing up.

Special Offers for Customers

At the time of writing, Plus500 does not have any active promotions like deposit bonuses, competitions, or loyalty programs. The broker's main offer is a free unlimited demo account for practicing.

Plus500 focuses on providing tight spreads and a user-friendly platform rather than short-term incentives. Promotional deals in the CFD industry often come with restrictive terms and high trading requirements that can be hard to meet.

The lack of deposit bonuses aligns with Plus500's transparent, no-frills approach. Traders can still benefit from competitive pricing and low minimum deposits.

Plus500 Special Offers List

- Free unlimited demo account for all clients

- Competitive spreads with no deposit bonuses or promotions currently available

Conclusion

After an in-depth analysis of Plus500, I believe they are a solid choice for most CFD traders. Here's why:

First, Plus500 is highly regulated in top-tier jurisdictions like the UK, Australia, and Singapore. This strong oversight provides crucial client protections. Being listed on the London Stock Exchange adds transparency.

Their proprietary web and mobile platforms are designed for a smooth trading experience. While lacking some advanced features, the interface is intuitive and user-friendly, especially for beginners. The unlimited demo account is a great way to practice risk-free.

With 2,000+ instruments across forex, stocks, indices, commodities, options, and crypto, Plus500 offers a good range of markets. Spreads are competitive on FX and reasonable on other CFDs.

Customer support is responsive 24/7, though no phone support may bother some. The Education section could be expanded but has helpful articles and webinars to get started.

Account funding is easy with a low $100 minimum deposit and fee-free payments. Withdrawal requests are processed quickly.

On the downside, professional clients don't get negative balance protection, which is standard at other brokers. There are no bonuses currently offered. And some countries, like the USA and Canada, aren't accepted.

Overall, I rate Plus500 as a trusted, user-friendly CFD broker best for beginners or casual traders. For more advanced needs, a MetaTrader broker with tools for automation and analysis may be better.

But with strong regulation, diverse markets, quality platforms, and great support, Plus500 ticks the key boxes. For the trader seeking an accessible, reputable CFD provider, they are definitely worth considering.