RoboForex review : A Comprehensive Guide to Trading with This Forex Broker

RoboForex

Belize

Belize

-

Minimum Deposit $10

-

Withdrawal Fee $varies

-

Leverage 2000:1

-

Forex Available

-

Crypto Unavailable

-

Stock Available

-

Indices Available

Licenses

Cyprus Market Making (MM)

Cyprus Market Making (MM)

Forex & CFD Brokerage License

Forex & CFD Brokerage License

Softwares & Platforms

Customer Support

+5012231189

(English)

+5012231189

(English)

Supported language: Chinese (Simplified), English, Russian, Spanish

Social Media

Summary

RoboForex is a globally recognized forex broker offering a wide range of trading instruments, including forex, stocks, indices, commodities, and cryptocurrencies. With competitive spreads, fast order execution, and access to five powerful trading platforms, it caters to both beginner and experienced traders. The broker provides flexible account types, high leverage up to 1:2000, and various deposit and withdrawal options, including cryptocurrencies. RoboForex also offers bonuses, loyalty rewards, and trading competitions, making it an attractive choice for traders seeking a feature-rich and reliable trading environment.

- RoboForex is regulated by the FSC, CySEC, and NBRB, demonstrating a commitment to compliance.

- Wide range of tradable assets, including forex, stocks, indices, commodities, metals, and energies.

- Multiple account types with competitive trading conditions and flexible leverage options.

- Supports popular trading platforms like MetaTrader 4/5 and proprietary platforms.

- Offers negative balance protection and segregated client funds for enhanced security.

- Provides 24/7 multilingual customer support through various channels.

- Offers educational resources and tools to support traders' growth and development.

- Special promotions and loyalty programs, including welcome bonuses and trading competitions.

- Low minimum deposit requirement of $10 for most account types.

- Quick and easy account opening process with multiple funding options.

- The primary regulator, the FSC, is not considered a top-tier authority.

- Some trading instruments, such as cryptocurrencies, are not available.

- Limited number of free withdrawals per month, with fees applied to subsequent withdrawals.

- Educational resources may not be as extensive as some competitors.

- Prohibited from offering services in several countries, including the USA, Canada, and Japan.

- Relatively high minimum deposit requirement of $100 for the R StocksTrader account.

- Maximum high leverage of 1:2000 may be too high for some traders and increase risk.

- No guaranteed stop-loss orders, which can lead to slippage during volatile market conditions.

- Limited social trading features compared to some other brokers.

- Some promotions and bonuses may have strict terms and conditions or trading requirements.

Overview

RoboForex is an international forex and CFD broker founded in 2009, with a strong presence in Europe and Asia. Headquartered in Belize, the company is regulated by the Financial Services Commission (FSC) under license number 000138/32. RoboForex has steadily expanded its offerings over the years, now providing access to over 12,000 trading instruments, including forex, stocks, indices, commodities, metals, and energies.

With a focus on innovation and client satisfaction, RoboForex has developed a suite of advanced trading platforms, including MetaTrader 4, MetaTrader 5, WebTrader, MobileTrader, and R StocksTrader. The broker caters to traders of all experience levels, offering a range of account types with flexible trading conditions and competitive spreads starting from 0 pips.

RoboForex has garnered numerous industry awards, including "Best Trading Conditions" and "Best Partnership Program" at the IAFT Awards 2023, highlighting their commitment to excellence. As a member of the Financial Commission, an independent self-regulatory organisation, RoboForex provides clients with access to a compensation fund of up to €20,000 per case.

Overview Table

| Feature | Details |

|---|---|

| Founded | 2009 |

| Headquarters | Belize City, Belize |

| Regulation | FSC (Belize), CySEC (Cyprus), NBRB (Belarus) |

| Trading Platforms | MetaTrader 4, MetaTrader 5, WebTrader, MobileTrader, R StocksTrader |

| Minimum Deposit | $10 |

| Maximum Leverage | 1:2000 |

| Instruments | Forex, Stocks, Indices, Commodities, Metals, Energies |

| Account Types | Prime, ECN, R StocksTrader, Pro Cent, Pro |

| Customer Support | 24/7 live chat, email, phone |

| Fees | No deposit fees, withdrawal fees apply after 2 free withdrawals per month |

Facts List

- RoboForex was established in 2009 and is headquartered in Belize City, Belize.

- The company is regulated by the Financial Services Commission (FSC) of Belize, the Cyprus Securities and Exchange Commission (CySEC), and the National Bank of the Republic of Belarus (NBRB).

- RoboForex offers over 12,000 trading instruments, including forex, stocks, indices, commodities, metals, and energies.

- Clients can choose from a variety of trading platforms, such as MetaTrader 4, MetaTrader 5, WebTrader, MobileTrader, and R StocksTrader.

- The minimum deposit required to open an account with RoboForex is $10.

- RoboForex provides leverage up to 1:2000, depending on the account type and instrument.

- The broker offers several account types, including Prime, ECN, R StocksTrader, Pro Cent, and Pro, catering to traders with different needs and experience levels.

- As a member of the Financial Commission, RoboForex participates in a compensation fund that provides protection of up to €20,000 per case.

- RoboForex has won numerous industry awards, such as "Best Trading Conditions" and "Best Partnership Program" at the IAFT Awards 2023.

- Customer support is available 24/7 through live chat, email, and phone, ensuring clients can receive assistance whenever needed.

RoboForex Licenses and Regulatory

RoboForex operates under a multi-tiered regulatory framework, holding licenses from several reputable authorities worldwide. The primary regulator overseeing RoboForex's operations is the Financial Services Commission (FSC) of Belize, which issued the company a license (No. 000138/32) to provide forex and CFD trading services.

In addition to the FSC license, RoboForex's subsidiaries are regulated by the Cyprus Securities and Exchange Commission (CySEC) and the National Bank of the Republic of Belarus (NBRB). RoboMarkets Ltd, a RoboForex group company, holds a CySEC license (No. 191/13), while RoboMarkets, LLC is licensed by the NBRB under license number 193179482.

The multi-jurisdictional regulatory oversight demonstrates RoboForex's commitment to maintaining high standards of compliance and operational integrity. By submitting to the rules and guidelines set forth by these regulators, RoboForex provides clients with an enhanced level of security and trust.

Furthermore, RoboForex is a member of the Financial Commission, an independent external dispute resolution organisation. As a member, RoboForex participates in the Financial Commission's Compensation Fund, which offers clients protection of up to €20,000 per case in the event of a dispute.

While RoboForex's primary regulator, the FSC, is not considered a top-tier regulatory authority like the UK's Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC), the broker's commitment to maintaining multiple licenses and its membership in the Financial Commission demonstrate a strong focus on compliance and client protection.

Regulations List

- Financial Services Commission (FSC) of Belize: License No. 000138/32

- Cyprus Securities and Exchange Commission (CySEC): License No. 191/13 (held by RoboMarkets Ltd)

- National Bank of the Republic of Belarus (NBRB): License No. 193179482 (held by RoboMarkets, LLC)

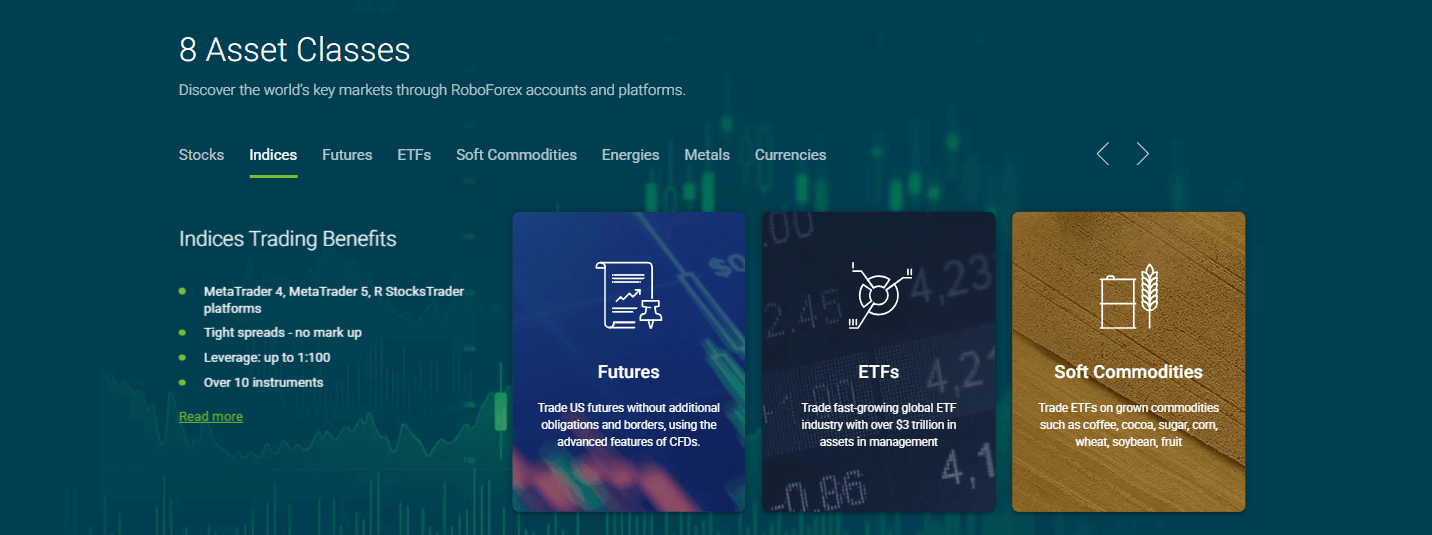

Trading Instruments

RoboForex offers an extensive range of tradable assets, catering to the diverse needs and preferences of traders worldwide. With over 12,000 instruments available, the broker provides access to a wide array of markets, including forex, stocks, indices, commodities, metals, and energies.

| Instrument | Details |

|---|---|

| Forex | RoboForex offers trading on major, minor, and exotic currency pairs with competitive spreads starting from 0 pips on the Prime account. |

| Stocks | Access to over 12,000 real stocks from NYSE, NASDAQ, and other global exchanges through the R StocksTrader account, with leveraged trading options. |

| Indices | Trade major global indices, including S&P 500, NASDAQ 100, FTSE 100, DAX 30, and Nikkei 225, with leverage available. |

| Commodities & Metals | Includes gold, silver, oil, and agricultural products, allowing for speculation and hedging against market volatility. |

| Energies | Trade crude oil and natural gas with competitive fees and leverage options to capitalise on global energy price fluctuations. |

The diverse range of tradable assets offered by RoboForex allows traders to create well-rounded portfolios and capitalise on opportunities across various markets. By providing access to such a wide array of instruments, the broker demonstrates its adaptability to market trends and commitment to meeting the evolving needs of its clients.

Trading Platforms

RoboForex provides clients with a comprehensive suite of trading platforms, catering to the diverse needs and preferences of traders at all levels of expertise. The broker offers access to the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, as well as its proprietary solutions, WebTrader, MobileTrader, and R StocksTrader.

MetaTrader 4 and MetaTrader 5

MT4 and MT5 are widely recognised as the go-to platforms for forex and CFD trading. RoboForex offers both versions, ensuring compatibility with a vast array of trading tools, indicators, and expert advisors (EAs). These platforms provide a user-friendly interface, advanced charting capabilities, and the ability to automate trading strategies through EAs. MT4 and MT5 are available for desktop, web, and mobile devices, allowing traders to access their accounts and execute trades on the go.

WebTrader

RoboForex's proprietary WebTrader platform is a browser-based solution that enables clients to trade directly from their web browser without the need to download or install any software. WebTrader offers a streamlined and intuitive interface, making it easy for traders to navigate markets, analyse price movements, and execute trades. The platform supports multiple asset classes and provides a range of trading tools and indicators.

MobileTrader

For traders who prefer to trade on their smartphones or tablets, RoboForex offers the MobileTrader app. Available for both iOS and Android devices, MobileTrader provides a seamless trading experience on the go. The app offers real-time quotes, interactive charts, and the ability to place and manage trades directly from the mobile device. MobileTrader is user-friendly and optimised for smaller screens, ensuring that clients can stay connected to the markets at all times.

R StocksTrader

RoboForex's R StocksTrader is a specialised platform designed for trading stocks and ETFs. The platform offers access to over 12,000 instruments from major global exchanges, providing traders with ample opportunities for portfolio diversification. R StocksTrader features advanced charting tools, real-time market data, and competitive fees. The platform is available as a web-based solution and as a mobile app for iOS and Android devices.

By offering 5 platforms, RoboForex ensures that clients can choose the solution that best suits their needs and preferences. The broker's commitment to providing stable, reliable, and feature-rich platforms demonstrates its focus on delivering a satisfactory trading experience to its clients. With a range of options, traders can access advanced tools and execute trades efficiently across multiple markets.

Trading Platforms Comparison Table

| Feature | MT4 | MT5 | WebTrader | MobileTrader | R StocksTrader |

|---|---|---|---|---|---|

| Asset Classes | Forex, CFDs | Forex, CFDs | Forex, CFDs | Forex, CFDs | Stocks, ETFs |

| Charting | Advanced | Advanced | Basic | Basic | Advanced |

| Technical Indicators | 50+ | 80+ | 30+ | 20+ | 50+ |

| Expert Advisors (EAs) | Yes | Yes | No | No | No |

| Automated Trading | Yes | Yes | No | No | No |

| Web-based | Yes | Yes | Yes | No | Yes |

| Mobile Apps | Android and Ios | Android and ios | No | Android and ios | Android and ios |

RoboForex How to Open an Account: A Step-by-Step Guide

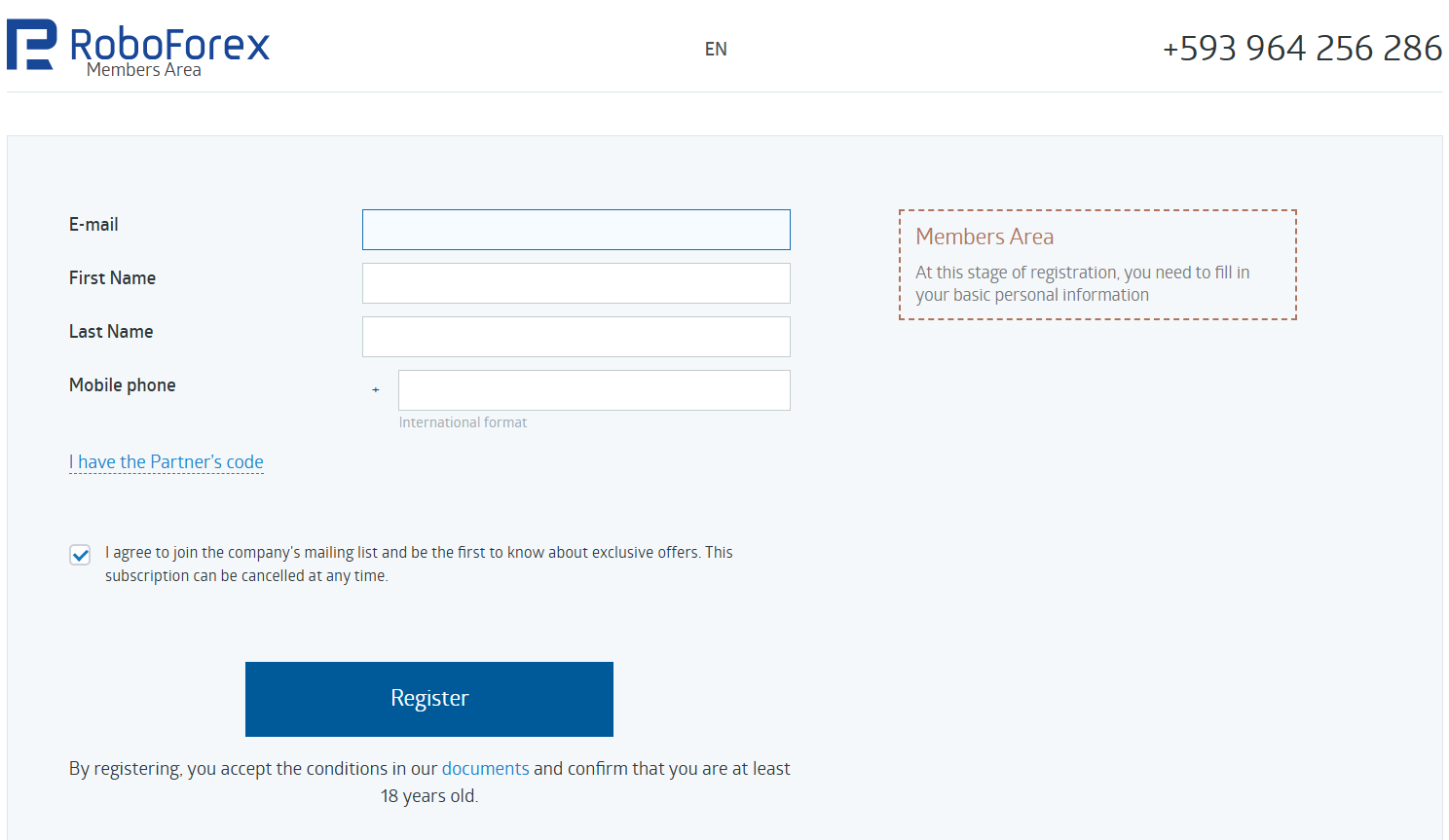

Registering an account with RoboForex is a straightforward process that can be completed in just a few simple steps. Before getting started, ensure that you meet the minimum age requirement of 18 years old and have a valid government-issued ID for verification purposes.

Step 1: Visit RoboForex's official website at www.roboforex.com and click on the "Open an Account" button located in the top right corner of the page.

Step 2: Choose the account type that best suits your trading needs and preferences. RoboForex offers several account options, including Prime, ECN, R StocksTrader, Pro Cent, and Pro.

Step 3: Fill out the registration form with your personal information, such as your full name, date of birth, country of residence, and contact details. Ensure that all information provided is accurate and up-to-date.

Step 4: Select your preferred base currency for the account. RoboForex supports various currencies, including USD, EUR, GBP, and more.

Step 5: Choose your desired leverage and trading platform. RoboForex offers leverage up to 1:2000 and supports popular platforms like MetaTrader 4, MetaTrader 5, and its proprietary solutions, WebTrader, MobileTrader, and R StocksTrader.

Step 6: Agree to RoboForex's terms and conditions and submit your registration form.

Step 7: Verify your account by providing proof of identity and proof of residence. This typically involves uploading a copy of your government-issued ID and a recent utility bill or bank statement.

Step 8: Once your account is verified, you can fund it using one of the many payment methods supported by RoboForex, such as bank transfers, credit/debit cards, and e-wallets like Skrill and Neteller.

RoboForex has a low minimum deposit requirement of just $10 for most account types, making it accessible to traders with various budgets. The broker also offers a quick and hassle-free account opening process, with most accounts being approved within 24 hours.

Charts and Analysis

RoboForex provides a comprehensive suite of educational resources and tools to support traders in enhancing their knowledge and skills. These resources cater to both novice and experienced traders, offering valuable insights into market dynamics, trading strategies, and risk management.

| Feature | Description |

|---|---|

| Charting Tools | RoboForex provides advanced charting tools on MetaTrader 4, MetaTrader 5, and R StocksTrader, offering technical indicators, drawing tools, and customisable charts for in-depth market analysis. |

| Market Analysis | Regular market reviews, technical and fundamental analysis, and expert insights are available through RoboForex’s blog and news section to help traders stay informed. |

| Economic Calendar | A detailed economic calendar keeps traders updated on key market events and data releases, helping them plan trades based on fundamental analysis. |

| Educational Resources | RoboForex offers FAQs, articles, video tutorials, and webinars covering topics such as risk management, technical analysis, and trading psychology to enhance traders’ knowledge. |

While RoboForex's educational resources are informative and cater to traders of different experience levels, they may not be as extensive as those offered by some of its competitors. However, the broker's commitment to providing a well-rounded suite of educational tools demonstrates its dedication to supporting its clients' trading journeys.

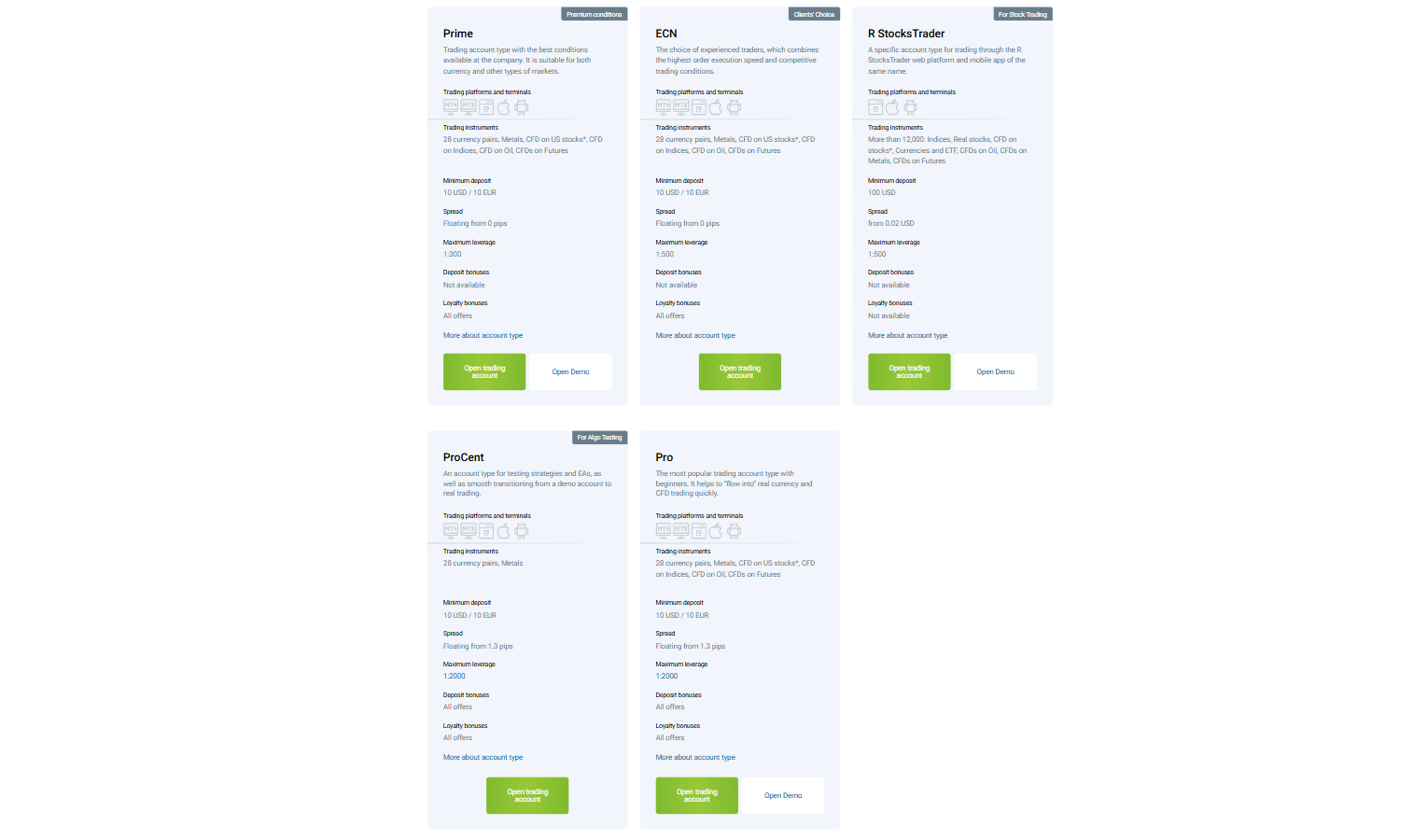

RoboForex Account Types

RoboForex offers a diverse range of trading account types, catering to the needs of both novice and experienced traders. The broker's account options include Prime, ECN, R StocksTrader, Pro Cent, and Pro, each with its unique features and benefits.

Prime Account

The Prime account is designed for traders who prioritise competitive spreads and low commissions. With spreads starting from 0 pips and a commission of just $1.5 per standard lot, this account type offers cost-effective trading conditions. The Prime account also features a minimum deposit of only $10, making it accessible to a wide range of traders. Leverage up to 1:300 is available, and traders can access 28 currency pairs, metals, CFDs on US stocks, indices, oil, and futures.

ECN Account

The ECN account is ideal for traders who prefer raw spreads and direct access to liquidity providers. This account type offers spreads from 0 pips and a commission of $2 per standard lot. With a minimum deposit of $10, the ECN account is suitable for traders of all experience levels. Leverage up to 1:500 is available, and traders can access a wide range of assets, including forex, stocks, indices, commodities, and futures.

R StocksTrader Account

The R StocksTrader account is a unique offering that caters to traders interested in investing in real stocks and ETFs. This account provides access to over 12,000 instruments from major global exchanges, allowing for extensive portfolio diversification. The R StocksTrader account features competitive commissions and leveraged trading options, with a minimum deposit of $100.

Pro Cent Account

The Pro Cent account is designed for novice traders who wish to gain experience in a low-risk environment. This account type offers micro-lot trading, with a minimum trade size of 0.1 lot and a minimum deposit of just $10. Leverage up to 1:2000 is available, and traders can access 28 currency pairs, metals, CFDs on US stocks, indices, oil, and futures. The Pro Cent account features floating spreads from 1.3 pips.

Pro Account

The Pro account is a standard trading account suitable for traders of all levels. With a minimum deposit of $10 and leverage up to 1:2000, this account type offers flexible trading conditions. Traders can access a wide range of assets, including forex, stocks, indices, commodities, and futures. The Pro account features floating spreads from 1.3 pips.

RoboForex also offers demo accounts for each account type, allowing traders to practise their strategies and familiarise themselves with the trading platforms without risking real funds. The broker's diverse account offerings demonstrate its commitment to catering to the needs of different types of traders and providing a flexible trading experience.

Account Types Comparison Table

| Feature | Prime | ECN | R StocksTrader | Pro Cent | Pro |

|---|---|---|---|---|---|

| Minimum Deposit | $10 | $10 | $100 | $10 | $10 |

| Leverage | Up to 1:300 | Up to 1:500 | Up to 1:20 | Up to 1:2000 | Up to 1:2000 |

| Spread | From 0 pips | From 0 pips | From $0.02 | From 1.3 pips | From 1.3 pips |

| Commission | $ 1.5 per lot | $ 2 per lot | $ 1.5 per lot | N/A | N/A |

| Instruments | 28 currency pairs, metals, CFDs on US stocks, indices, oil, futures | Forex, stocks, indices, commodities, futures | 12,000+ stocks and ETFs | 28 currency pairs, metals, CFDs on US stocks, indices, oil, futures | Forex, stocks, indices, commodities, futures |

| Minimum Trade Size | 0.01 lot | 0.01 lot | 1 stock | 0.1 lot | 0.01 lot |

Negative Balance Protection

RoboForex offers negative balance protection to all its clients, regardless of the account type or trading platform used. This means that even if a trader's position incurs a negative balance due to unfavourable market conditions, RoboForex will absorb the loss and reset the account balance to zero. Traders can benefit from this protection without any additional costs or requirements. It is important to note that while negative balance protection provides a safety net for traders, it should not be relied upon as a substitute for proper risk management. Traders should still employ responsible trading practices, such as setting appropriate stop-loss levels, managing position sizes, and avoiding excessive leverage. RoboForex's commitment to providing negative balance protection demonstrates the broker's dedication to safeguarding its clients' funds and promoting a secure trading environment. This feature offers peace of mind to traders, knowing that their potential losses are limited to the funds available in their trading accounts. Traders should be aware that the specific terms and conditions of RoboForex's negative balance protection policy may be subject to change. It is advisable to review the broker's official website and contact customer support for the most up-to-date information regarding this feature. In conclusion, RoboForex's negative balance protection is a valuable risk management tool that helps traders mitigate potential losses and maintain control over their trading capital. By offering this protection, RoboForex demonstrates its commitment to providing a secure and transparent trading environment for its clients.

RoboForex Deposits and Withdrawals

RoboForex offers a wide range of convenient deposit and withdrawal options to cater to the needs of traders worldwide. The broker supports various payment methods, including bank transfers, credit/debit cards, and popular e-wallets, ensuring that clients can easily manage their funds.

Deposit Methods

| Deposit Method | Minimum Deposit | Deposit Fees | Processing Time |

|---|---|---|---|

| Bank Transfer | Varies by account | No fees | 1-3 business days |

| Credit/Debit Cards | $10 | No fees | Instant |

| E-wallets | $10 | No fees | Instant |

| Cryptocurrencies | Varies | No fees | Up to 1 hour |

Withdrawal Methods

| Withdrawal Method | Minimum Withdrawal | Fees |

|---|---|---|

| Bank Transfer | $10 | No fees for first two withdrawals per month; up to 3% fee for additional withdrawals |

| Credit/Debit Cards | $10 | No fees for first two withdrawals per month; up to 2.6% + $1.3 fee for additional withdrawals |

| E-wallets (Skrill, Neteller, WebMoney) | $10 | No fees for first two withdrawals per month; up to 3% fee for additional withdrawals |

| Cryptocurrencies | Varies by cryptocurrency | Fees depend on specific cryptocurrency and network conditions |

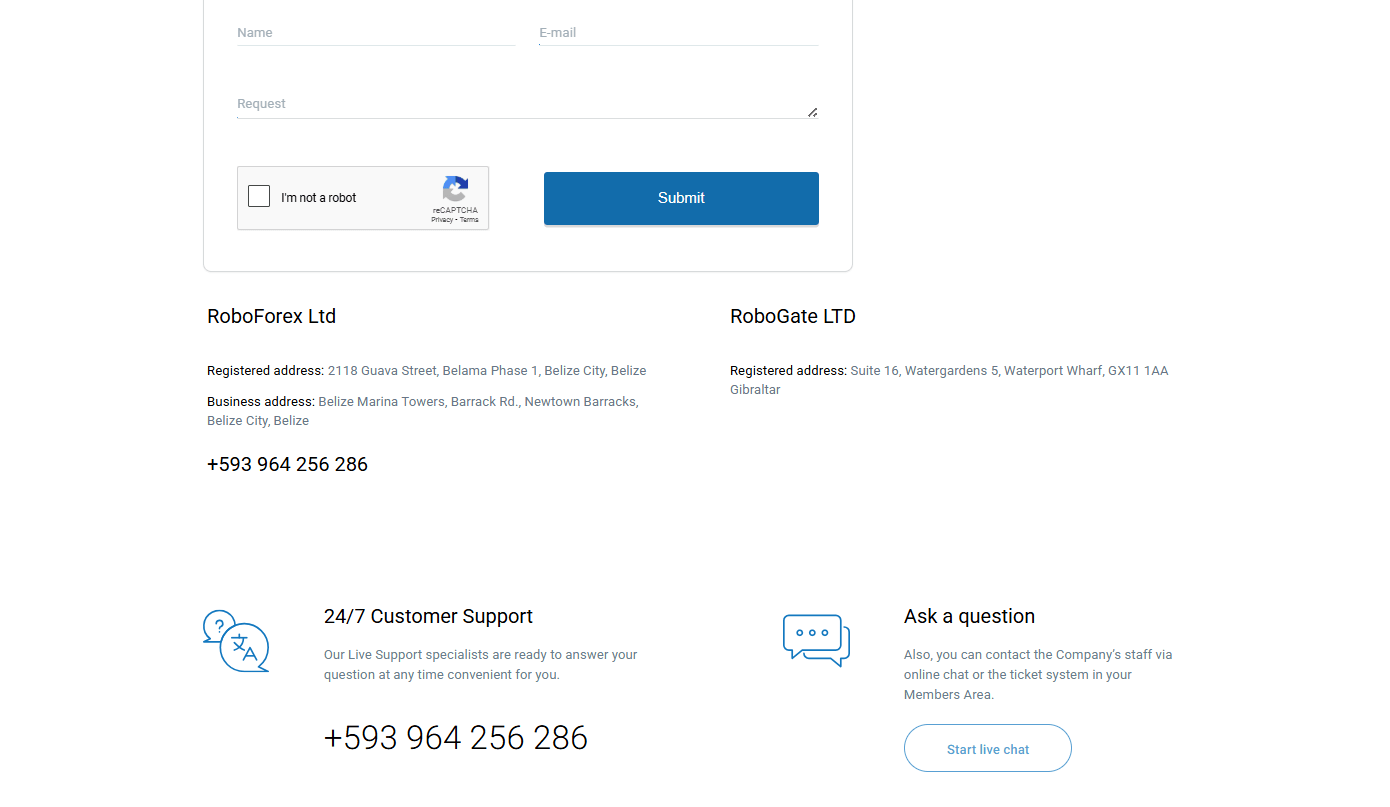

Support Service for Customer

Reliable customer service support is a crucial aspect of a positive trading experience, as it ensures that traders can access assistance whenever they need it. RoboForex understands the importance of providing prompt and efficient support to its clients, offering multiple channels for traders to reach out to their customer support team.

- Live Chat: Traders can access 24/7 live chat support directly through the RoboForex website. This channel is ideal for quick queries and immediate assistance.

- Email: Clients can send their enquiries to support@roboforex.com for general questions or to info@roboforex.com for more specific account-related matters. The support team aims to respond to all emails within 24 hours.

- Phone: RoboForex provides country-specific phone numbers for clients to reach their support team. The main support number is +372 60 82 908, and additional numbers are available for Russia, Poland, Indonesia, Belarus, and more.

- Social Media: Traders can contact RoboForex through their official Facebook, Twitter, and Telegram channels for general enquiries and updates.

Customer Support Comparison Table

| Channel | Availability | Languages | Average Response Time |

|---|---|---|---|

| Live Chat | 24/7 | English, Russian, Indonesian, Chinese, Spanish, Arabic | < 5 minutes |

| 24/7 | English, Russian, Indonesian, Chinese, Spanish, Arabic | Within 24 hours | |

| Phone | Business hours | English, Russian, Indonesian, Chinese, Spanish, Arabic | < 3 minutes |

| Social Media | 24/7 | English, Russian, Indonesian, Chinese, Spanish, Arabic | Within 24 hours |

Prohibited Countries

RoboForex is an international broker that aims to provide its services to traders worldwide. However, due to local regulations, licensing requirements, and geopolitical factors, the broker is prohibited from operating or offering its services in certain countries and regions.

The primary reason behind these restrictions is to ensure compliance with international laws and regulations. Each country has its own set of rules governing financial services, and failure to adhere to these regulations can result in legal consequences for both the broker and its clients.

RoboForex is currently prohibited from providing services to residents of the following countries:

- United States

- Canada

- Japan

- Australia

- Belgium

- Israel

- Palestine

- Iran

- North Korea

- Sudan

- Syria

- Afghanistan

- Pakistan

It is essential for traders to be aware of these restrictions before attempting to open an account with RoboForex. Attempting to trade with RoboForex from a prohibited country may result in the rejection of the account application, the suspension of trading activities, or the freezing of funds.

Traders from prohibited countries are encouraged to seek alternative brokers that are properly licensed and authorised to provide services in their respective jurisdictions. Trading with a broker that is not allowed to operate in one's country of residence can lead to legal and financial risks.

RoboForex is committed to maintaining compliance with international regulations and ensuring a safe and secure trading environment for its clients. By clearly outlining the prohibited countries and regions, RoboForex demonstrates its dedication to operating within the boundaries of the law and protecting its clients' interests.

Prohibited Countries List

- RoboForex is allowed to operate in all regions except the United States, Canada, Japan, Australia, Belgium, Israel, Palestine, Iran, North Korea, Sudan, Syria, Afghanistan, Pakistan.

Special Offers for Customers

RoboForex provides a range of special promotions and offers to both new and existing traders, designed to enhance their trading experience and provide additional value. These offers include sign-up bonuses, loyalty programs, trading competitions, and more.

| Promotion | Details |

|---|---|

| Welcome Bonus | New traders who open an account with a minimum deposit of $10 can receive a welcome bonus of up to $30. The bonus is subject to trading volume requirements before withdrawal. |

| Loyalty Rewards | Traders earn points based on trading activity, which can be redeemed for cash bonuses, trading discounts, or merchandise. Higher trading levels unlock more benefits. |

| Trading Competitions | RoboForex hosts regular trading competitions where traders can compete for prizes like cash rewards, bonus funds, and other incentives. Specific asset classes or themes are often the focus. |

| Refer-a-Friend Program | Traders can earn cash bonuses by referring friends and family who meet certain trading requirements. It’s a great way to earn extra income while sharing the benefits of RoboForex. |

| Third-Party Partnerships | RoboForex partners with service providers to offer discounts on VPS hosting and other services, which can benefit traders using automated trading strategies. |

Conclusion

Throughout this comprehensive review, I've analysed various aspects of RoboForex's operations, from their regulatory compliance and geographical reach to their customer support and special offers. By consolidating these findings, I aim to provide a cohesive evaluation of their safety, reliability, and overall reputation as a broker.

One of the key factors that contribute to RoboForex's trustworthiness is their commitment to regulatory compliance. They hold licenses from the Financial Services Commission (FSC) of Belize, as well as the Cyprus Securities and Exchange Commission (CySEC) and the National Bank of the Republic of Belarus (NBRB) for their subsidiary entities. While their primary regulator, the FSC, may not be considered a top-tier authority, RoboForex's membership in the Financial Commission demonstrates their dedication to maintaining high standards and resolving potential disputes.

RoboForex's extensive geographical reach, serving clients in over 169 countries, is a testament to their reliability and adaptability. However, it's crucial for traders to be aware of the prohibited countries list and ensure they are eligible to open an account with RoboForex.

The broker's wide range of tradable assets, competitive account types, and user-friendly trading platforms cater to the diverse needs of both novice and experienced traders. Their commitment to providing negative balance protection, segregated client funds, and a transparent fee structure further enhances their reputation as a dependable broker.

RoboForex's customer support is another area where they excel, offering 24/7 assistance through multiple channels and in several languages. This level of accessibility and responsiveness is essential for building trust and ensuring a positive trading experience.

While RoboForex's special offers and promotions can provide added value to traders, it's important to carefully review the terms and conditions associated with each offer. These incentives should be viewed as a bonus rather than the sole reason for choosing a broker.

In conclusion, RoboForex's strong regulatory compliance, wide range of trading instruments and account types, advanced trading platforms, and responsive customer support make them a reliable choice for traders seeking a trustworthy and user-focused broker. However, as with any financial decision, traders should conduct their own due diligence and consider their individual trading needs and risk tolerance before opening an account.