Saxo Review 2025: A Trusted Forex Broker for Global Trading

Saxo

Denmark

Denmark

-

Minimum Deposit $2000

-

Withdrawal Fee $0

-

Leverage 100:1

-

Spread From 0.4

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Japan Forex Trading License

Japan Forex Trading License

Hong Kong Securities and Futures License

Hong Kong Securities and Futures License

Australia Retail Forex License

Australia Retail Forex License

Switzerland Financial Services License

Switzerland Financial Services License

Singapore Financial Services License

Singapore Financial Services License

Softwares & Platforms

Customer Support

+4539774000

(English)

+4539774000

(English)

Supported language: Chinese (Simplified), Danish, English, French, German, Italian, Spanish

Social Media

Summary

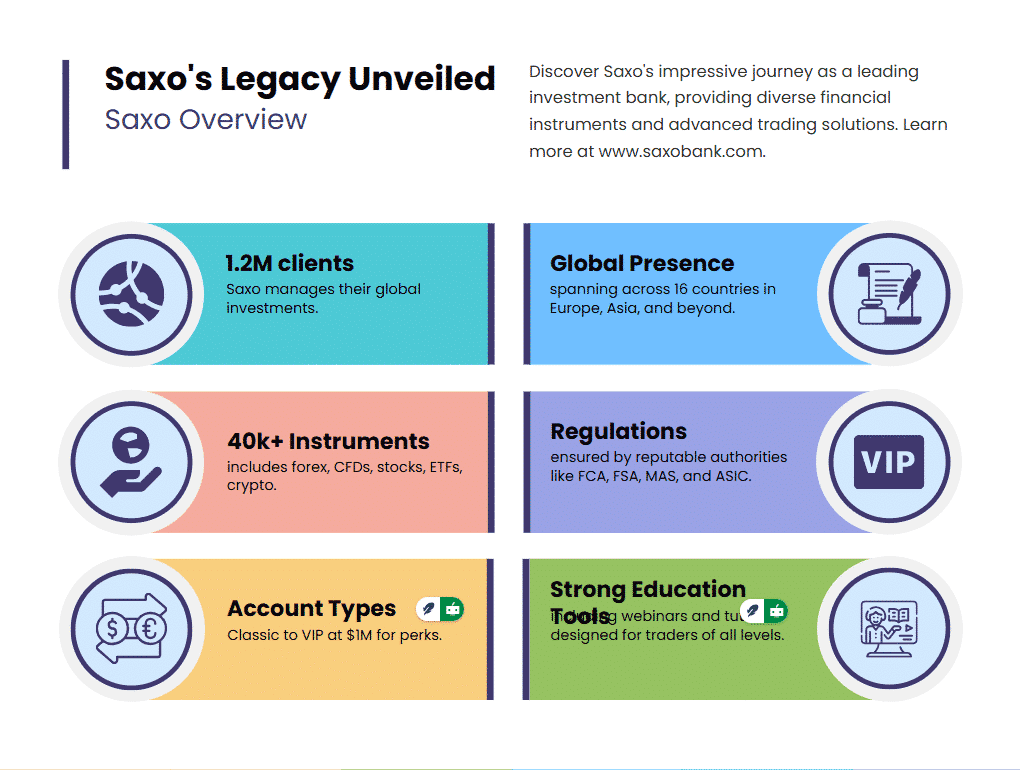

Saxo is a leading Danish investment bank and multi-asset broker founded in 1992. With over 30 years of experience, Saxo has expanded its presence to 16 countries across Europe, Asia, the Middle East, and Australia, serving more than 1.2 million clients worldwide. The broker offers access to 40,000+ instruments, including forex, CFDs, stocks, ETFs, mutual funds, bonds, options, futures, and cryptocurrencies.

- Regulated by top-tier authorities globally

- 40,000+ tradable instruments across asset classes

- Advanced trading platforms with powerful tools

- Competitive pricing for high-volume traders

- Quality research and educational content

- 24/5 multilingual customer support

- Negative balance protection for EU/UK clients

- Interest paid on idle cash for some account tiers

- Established bank with long history of stability

- Comprehensive market access and asset variety

- Inactivity fees on dormant accounts

- High minimum deposits for Platinum/VIP accounts

- Spreads can be higher than some competitors

- No MT4/MT5 support, only proprietary platforms

- Educational materials could be more interactive

- Overnight financing and custody fees apply

- Doesn't accept US clients

- Live chat only for registered clients

- Switching between platforms requires re-authentication

- Withdrawals only via bank transfer, no e-wallets

Overview

Saxo Overview

Saxo is known for its advanced trading platforms, SaxoTraderGO and SaxoTraderPRO, which provide professional-grade tools and integrated research for experienced traders. The broker has received numerous industry awards, including Best Forex Broker 2021 by Forex Brokers and Best Forex Trading Platform 2021 by FX Empire.

As a fully licensed and regulated broker, Saxo operates under the supervision of top-tier financial authorities such as the UK Financial Conduct Authority (FCA), the Danish Financial Supervisory Authority (FSA), and the Monetary Authority of Singapore (MAS). This extensive regulation ensures a high level of security and transparency for Saxo's clients.

For more information, visit their official website.

Saxo Overview Table

| Category | Details |

| Founded | 1992 |

| Headquarters | Copenhagen, Denmark |

| Regulation | FCA (UK), FSA (Denmark), MAS (Singapore), FINMA (Switzerland), ASIC (Australia), FSA (Japan), SFC (Hong Kong) |

| Instruments | Forex, CFDs, stocks, ETFs, mutual funds, bonds, options, futures, cryptocurrencies |

| Platforms | SaxoTraderGO, SaxoTraderPRO, SaxoInvestor |

| Minimum Deposit | $0 (Classic Account), $200,000 (Platinum Account), $1,000,000 (VIP Account) |

| Leverage | Up to 1:500 (depending on instrument and regulation) |

| Education | Extensive educational resources, including webinars, video tutorials, and online courses |

| Research | In-house research team providing daily market analysis, quarterly outlooks, and trading ideas |

| Customer Support | 24/5 support via live chat, email, and phone in over 20 languages |

Facts List

- Saxo Bank was founded in 1992 and is headquartered in Copenhagen, Denmark.

- The broker is regulated by top-tier financial authorities, including the FCA, FSA, MAS, FINMA, ASIC, FSA Japan, and SFC.

- Saxo offers access to over 40,000 instruments across multiple asset classes, including forex, CFDs, stocks, ETFs, mutual funds, bonds, options, futures, and cryptocurrencies.

- Clients can trade using Saxo's advanced platforms: SaxoTraderGO, SaxoTraderPRO, and SaxoInvestor.

- Saxo provides competitive spreads and commissions, with minimum spreads as low as 0.6 pips for forex and 0.1 points for indices.

- The broker offers three account tiers: Classic (no minimum deposit), Platinum ($200,000 minimum), and VIP ($1,000,000 minimum), with progressively lower spreads and additional services at each level.

- Saxo provides extensive educational resources, including webinars, video tutorials, and online courses, suitable for both beginner and advanced traders.

- The broker's in-house research team delivers daily market analysis, quarterly outlooks, and trading ideas to help clients make informed decisions.

- Saxo offers 24/5 customer support via live chat, email, and phone in over 20 languages.

- The broker has won numerous industry awards, including Best Forex Broker 2021 by Forex Brokers and Best Forex Trading Platform 2021 by FX Empire.

Saxo Licenses and Regulatory

The broker's primary entity, Saxo Bank A/S, is licensed and regulated by the Danish Financial Supervisory Authority (FSA). This license is passed across the European Union, allowing Saxo to offer its services to clients in member states. The Danish FSA is known for its stringent regulatory requirements, which include regular audits, financial reporting, and maintaining segregated client funds.

In addition to its Danish license, Saxo holds licenses from several other respected regulatory bodies:

| Regulatory Authority | Country | Entity Regulated |

|---|---|---|

| UK Financial Conduct Authority (FCA) | United Kingdom | Saxo Capital Markets UK Limited |

| Swiss Financial Market Supervisory Authority (FINMA) | Switzerland | Saxo Bank (Switzerland) AG |

| Monetary Authority of Singapore (MAS) | Singapore | Saxo Capital Markets Pte. Ltd. |

| Australian Securities and Investments Commission (ASIC) | Australia | Saxo Capital Markets (Australia) Pty Ltd. |

| Japanese Financial Services Agency (FSA) | Japan | Saxo Bank Japan K.K. |

| Hong Kong Securities and Futures Commission (SFC) | Hong Kong | Saxo Capital Markets HK Limited |

Trading Instruments

Saxo offers an extensive range of tradable assets, providing investors with access to over 40,000 instruments across multiple asset classes. This diverse offering allows clients to build well-rounded portfolios and take advantage of various market opportunities.

| Asset Class | Instruments Offered | Key Features | Pricing/Commissions |

|---|---|---|---|

| Forex | 180+ forex pairs (majors, minors, exotics) | Spot and forward trading, competitive spreads, deep liquidity | Minimum spreads as low as 0.4 pips for popular pairs like EUR/USD |

| Stocks | 23,500+ stocks from 50+ exchanges (e.g., NYSE, NASDAQ, LSE, HKEX) | Broad sectoral and geographical coverage for portfolio diversification | Starting from $0.02 per share for US stocks |

| ETFs | 7,000+ ETFs from 30+ exchanges | Exposure to various asset classes, sectors, and geographies | Starting from 0.1% for US ETFs |

| Indices | 20+ index CFDs (e.g., S&P 500, FTSE 100, DAX 30, Nikkei 225) | Gain exposure to entire markets or sectors; competitive spreads | Typical spreads of 1 point on the S&P 500 |

| Commodities | 25+ commodities (e.g., precious metals, energy, agricultural products) | Spot and futures contracts for diversification and inflation hedging | Competitive spreads with flexible contract sizes |

| Bonds | 5,000+ bonds from 20 countries in 21 currencies (government and corporate bonds) | Access to fixed-income securities for portfolio diversification | Starting from 0.05% for government bonds |

| Options | 1,200+ listed options on stocks, indices, and futures | Strategies like hedging, income generation, and speculation | Starting from $0.75 per contract for US options |

| Futures | 250+ futures contracts on indices, commodities, and currencies | Hedge risk or speculate on price movements | Starting from $1.25 per contract for US futures |

| Mutual Funds | 3,000+ mutual funds from reputable providers | Professionally managed portfolios | No commission, custody, or platform fees for mutual fund investments |

| Cryptocurrencies | Crypto ETPs and Crypto FX pairs (e.g., Bitcoin, Ethereum) | Exposure to cryptocurrency markets through ETPs and FX pairs; no direct underlying asset trading | Pricing varies based on ETP or FX instrument |

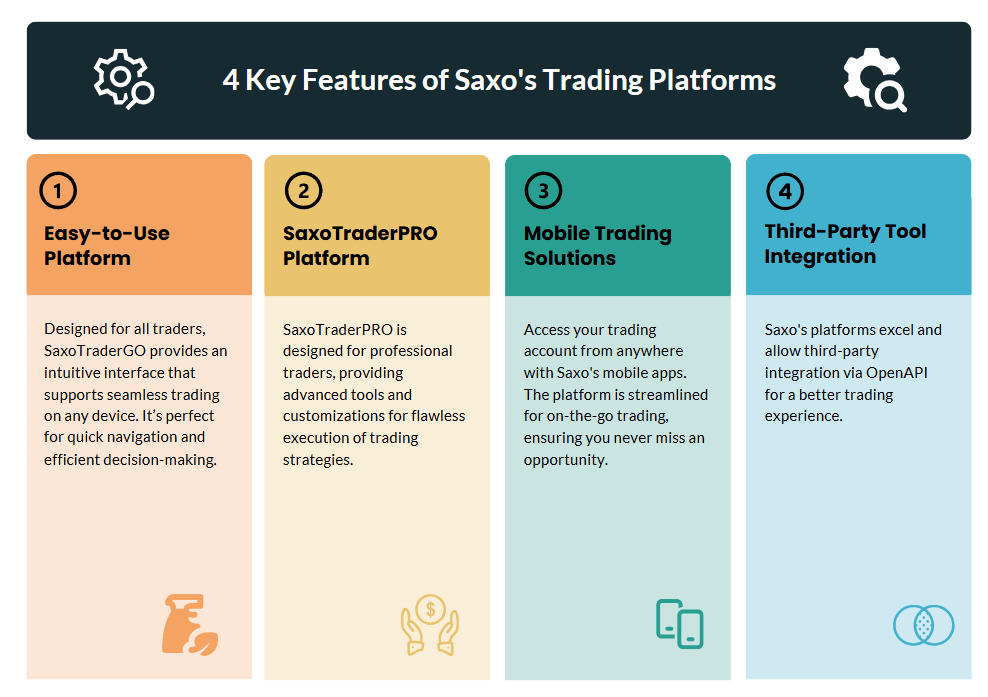

Trading Platforms

Saxo offers clients a choice of advanced trading platforms, ensuring a seamless and efficient trading experience across devices. The broker's proprietary platforms, SaxoTraderGO and SaxoTraderPRO, cater to both novice and experienced traders, providing a range of tools and features to suit various trading styles and strategies.

SaxoTraderGO

SaxoTraderGO is a user-friendly, web-based platform that allows clients to trade on any device with an internet connection. The platform features an intuitive interface, advanced charting tools, and integrated research and analysis. Some key features of SaxoTraderGO include:

- Customizable workspace with drag-and-drop functionality

- Advanced charting with 60+ technical indicators and drawing tools

- Integrated news, research, and market analysis

- Trade from charts with one-click execution.

- Personalized watch lists and alerts

- Risk management tools, including stop-loss and take-profit orders

SaxoTraderPRO

SaxoTraderPRO is a powerful, desktop-based platform designed for professional traders and institutions. The platform offers advanced trading capabilities, extensive customization options, and a range of tools for automated trading and risk management. Key features of SaxoTraderPRO include:

- Multi-screen support for up to six monitors

- Advanced order types, including algorithmic orders and bracket orders

- Integrated charting with 60+ technical indicators and drawing tools

- Real-time market depth and direct market access (DMA)

- Automated trading with API support and algorithmic orders

- Risk management tools, including position sizing and portfolio stress testing

Mobile Trading

Saxo offers mobile trading apps for both iOS and Android devices, allowing clients to manage their accounts and trade on the go. The mobile apps provide a streamlined version of the SaxoTraderGO platform, with key features including:

- Real-time quotes and charts

- Customizable watch lists and alerts

- One-click trading and advanced order types

- Secure login with biometric authentication

- Access to news, research, and market analysis

Trading Platforms Comparison Table

| Feature | SaxoTraderGO | SaxoTraderPRO |

| Platform Type | Web-based | Desktop-based |

| Customizable Workspace | Yes | Yes |

| Advanced Charting | 60+ indicators | 60+ indicators |

| Integrated Research | Yes | Yes |

| Trade from Charts | Yes | Yes |

| Personalized Watch Lists | Yes | Yes |

| Risk Management Tools | Yes | Yes |

| Multi-Screen Support | No | Up to 6 monitors |

| Advanced Order Types | Yes | Yes, including algorithmic orders |

| Real-Time Market Depth | No | Yes |

| Direct Market Access (DMA) | No | Yes |

| Automated Trading | No | Yes, with API support |

Saxo How to Open an Account: A Step-by-Step Guide

Step 1: Visit the Saxo website. Go to the official Saxo website at home.saxo and click on the "Open Account" button in the top right corner of the page.

Step 2: Choose your account type. Select the account type that best suits your trading needs and objectives. Saxo offers three main account types:

| Account Type | Minimum Deposit | Spreads |

|---|---|---|

| Classic | No minimum deposit | From 0.9 pips |

| Platinum | $200,000 | From 0.8 pips |

| VIP | $1,000,000 | From 0.7 pips |

Step 3: Provide personal information Fill in the required personal information, including your name, address, date of birth, and contact details. Saxo uses this information to verify your identity and comply with anti-money laundering (AML) and know-your-customer (KYC) regulations.

Step 4: Complete the questionnaire. Answer a series of questions about your trading experience, financial knowledge, and risk tolerance. This information helps Saxo determine the suitability of its products and services for your needs and ensures that you understand the risks involved in trading.

Step 5: Upload identification documents Provide proof of identity and address by uploading a copy of your passport or government-issued ID and a recent utility bill or bank statement. Saxo requires these documents to verify your identity and comply with regulatory requirements.

Step 6: Choose your account currency and funding method. Select the base currency for your account and choose a funding method from the available options, which include bank wire transfer, credit/debit card, and e-wallets. Saxo does not charge any fees for deposits, but some third-party fees may apply.

Step 7: Review and accept the terms and conditions. Carefully read and accept the broker's terms and conditions, including the risk disclosure statement and privacy policy. By accepting these terms, you acknowledge that you understand the risks involved in trading and agree to Saxo's policies and procedures.

Step 8: Verify your email address. Once you have completed the registration process, Saxo will send a verification email to the address you provided. Click on the verification link to activate your account.

Step 9: Fund your account To start trading, you need to fund your account with the minimum deposit amount for your chosen account type. Once your funds have been credited, you can begin trading on Saxo's platforms.

Charts and Analysis

Saxo offers a comprehensive suite of educational resources and trading tools to help clients enhance their knowledge and skills. Key offerings include:

| Category | Features |

|---|---|

| Charts | - Advanced charting with 50+ technical indicators - Customizable chart layouts and drawing tools - Chart sharing and linking features |

| Analysis | - Equity research with fundamental data and ratings - Quarterly Outlook publications covering global markets - Saxo Strats market analysis and trade ideas |

| News and Insights | - Real-time news from trusted providers like Dow Jones Newswires - TradingFloor.com articles and analysis from Saxo's experts - Regular webinars, podcasts, and morning call briefings |

| Trader Education | - Online courses on trading, investing, and platform tutorials - Educational videos, webinars, and events - Guides on trading strategies, asset classes, and risk management |

| Economic Calendar | - Global economic calendar covering key data releases - Filterable by region, importance, and volatility impact - Includes Saxo analysts' previews and market reactions |

Saxo Account Types

Saxo offers three main account types:

| Feature | Classic | Platinum | VIP |

|---|---|---|---|

| Minimum Deposit | $0 | $200,000 | $1,000,000 |

| Spreads | From 0.9 pips | From 0.8 pips | From 0.7 pips |

| Commissions | Standard | Reduced | Lowest |

| Support | Standard | Priority | Dedicated |

| Features | Full access | + VIP webinars | + Event invitations, premium reports |

Key differences include minimum deposit requirements, spreads, commissions, and level of personalized service. A range of account types allows Saxo to cater to diverse trader needs.

Demo accounts are available for 20 days with $100,000 in virtual funds. Islamic swap-free accounts are not offered.

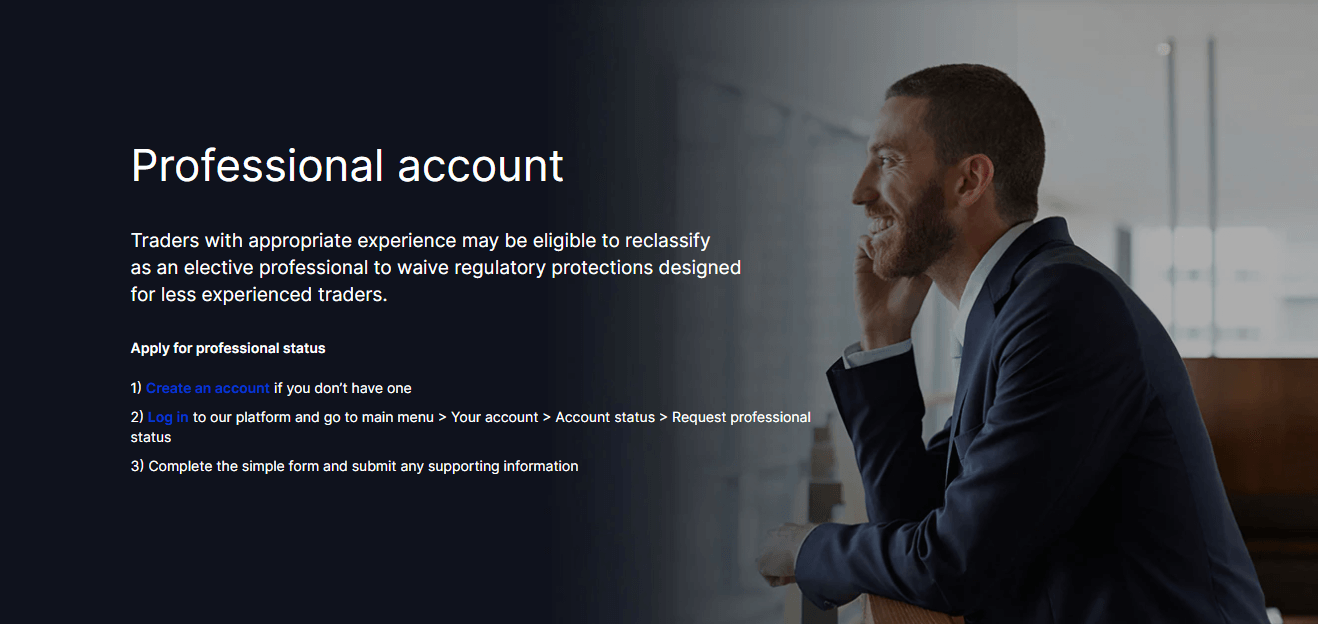

Negative Balance Protection

Saxo Bank offers negative balance protection for forex and CFD trading to retail clients in the EU and UK. If a client's equity falls below zero, Saxo will absorb the negative balance. The policy is automatic and comes at no additional cost. Some key terms:

- Limited to retail (non-professional) clients

- Applies to forex and CFD trades

- Excludes dealers who need to opt in

- May not apply in cases of abuse like arbitrage trading.

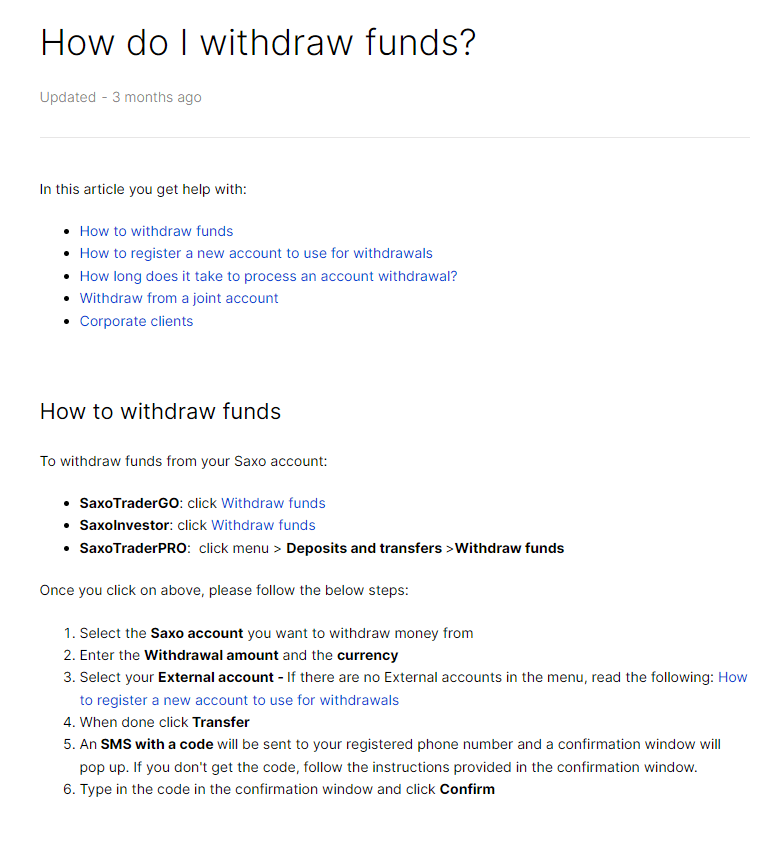

Saxo Deposits and Withdrawals

Saxo offers a range of suitable deposit and withdrawal options to cater to the needs of traders around the world. The broker aims to provide a seamless and secure funding experience, ensuring that clients can efficiently manage their trading accounts.

| Category | Deposits | Withdrawals |

|---|---|---|

| Methods | - Bank Transfer- Credit/Debit Card- E-wallets (Skrill, Neteller) | - Bank Transfer only |

| Minimum Amount | No minimum | Varies by currency (e.g., USD 100, EUR 100, GBP 50) |

| Processing Time | - Instant for Cards and E-wallets- 2-3 days for Bank Transfers | - 1 day for Saxo to process- 2-5 days to reach the account |

| Fees | - None from Saxo- Banks may charge fees | - None from Saxo- Banks may charge fees |

Support Service for Customer

In the fast-paced world of online trading, reliable customer support is crucial for a positive trading experience. Traders need access to knowledgeable and responsive support teams to address their questions, concerns, and technical issues promptly. Saxo understands these needs and provides convenient customer support for trades worldwide.

Customer Support Details

| Support Channel | Availability | Response Time | Languages Supported |

|---|---|---|---|

| Phone | 24/5 | Immediate | 20+ languages (e.g., English, Chinese, Arabic, German, French, Italian, etc.) |

| 24/5 | 1 business day | 20+ languages | |

| Live Chat | 24/5 (for clients only) | <30 seconds | 20+ languages |

| Contact Form | 24/5 | Varies | 20+ languages |

Prohibited Countries

As a legit and trusted broker, Saxo follows the laws and jurisdictions it operates in. Having said that, you must keep in mind that Saxo does not accept clients from:

- the United States

- Iran

- North Korea

- Syria

- Cuba

- Sudan

- Iraq

- occupied Palestinian territory

Main reasons include:

- Local regulations and licensing requirements prohibiting foreign brokers

- International sanctions and financial restrictions

- Geopolitical risks and instability

Attempting to trade from a restricted country may lead to frozen funds, legal consequences, and inability to access the platform.

Special Offers for Customers

Saxo Rewards Loyalty Program: Saxo's standout promotion is its Saxo Rewards loyalty program. Traders can earn points for each trade they make, with the number of points varying based on the asset class and trade volume. For example, forex trades earn 30 points per standard lot, while stock trades earn 3 points per $3,000 in trading costs.

Accumulated points can be used to upgrade to higher account tiers (Platinum and VIP), which offer progressively lower spreads, reduced commissions, and additional VIP services. Platinum requires 120,000 points, while VIP demands 500,000. Points expire after 12 months, incentivizing consistent trading activity.

This unique program rewards frequent traders with tangible benefits, potentially offsetting Saxo's higher fees compared to some discount brokers. However, casual investors may struggle to accumulate enough points for meaningful perks.

Refer-a-Friend Program: Saxo also offers a refer-a-friend program where existing clients can earn rewards for introducing new traders to the platform. The specific reward varies by country but typically ranges from $100 to $500 per referred client who funds their account and starts trading.

To qualify, the referred client must maintain the minimum deposit and trade a certain volume within 90 days, ensuring only serious referrals are rewarded. This program is an attractive way for satisfied Saxo clients to earn passive income, though it may be less compelling than cash bonuses offered by some competitors.

Conclusion

After thoroughly reviewing Saxo, I can confidently say they are a trustworthy and reputable broker. Here's why:

Saxo is well-regulated by top-tier authorities globally, providing a high level of safety and security. Their extensive range of tradable assets, competitive pricing, and advanced trading platforms cater to both beginner and experienced traders.

While their fees may be higher than some ccompetitors,and the high minimum deposits for Platinum and VIP accounts could be a barrier, Saxo's overall offering is strong. The educational resources, negative balance protection, and 24/5 customer support in 20+ languages are valuable perks.

Ultimately, Saxo is a reliable choice for traders seeking a regulated, multi-asset broker with professional-grade tools. Their time in the industry and commitment to innovation make them a solid option to consider.