Scope Markets Review 2025: Scam or Legit for Global Markets?

Scope Markets

Belize

Belize

-

Minimum Deposit $10

-

Withdrawal Fee $varies

-

Leverage 1000:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

Cyprus Market Making (MM)

Cyprus Market Making (MM)

Forex & CFD Brokerage License

Forex & CFD Brokerage License

Softwares & Platforms

Customer Support

+442030516959

(English)

+442030516959

(English)

Supported language: English

Social Media

Summary

Scope Markets, part of the Rostro Group, is a global forex and CFD broker regulated by CySEC and FSC, offering a secure trading environment. Founded in 2014, it provides access to over 40,000 financial instruments including forex, stocks, crypto, and commodities. With a low $10 minimum deposit, spreads from 0.0 pips, and leverage up to 1:1000, it caters to both beginners and experienced traders. The broker supports MT4, MT5, web, and mobile platforms, and offers account options like "One Account" and Scope Invest.

- Well-regulated by CySEC and FSC Belize

- Wide range of 40,000+ tradable instruments across multiple asset classes

- Low minimum deposit of $10

- Competitive spreads from 0.0 pips and leverage up to 1:1000

- Innovative "One Account" combining features of previous account tiers

- Fractional stock investing available through Scope Invest account

- MT4, MT5, web, and mobile trading platforms provided

- Part of established Rostro financial group

- Responsive customer support via multiple channels

- Negative balance protection

- Limited educational resources compared to larger brokers

- Restricted in several countries, including the USA, Canada, and Singapore

- Scope Elite account requires $20,000 minimum deposit, which may be too high for some traders

- Relatively limited research and analysis tools compared to industry leaders

- High fees for inactivity and account closures

- No support for social trading platforms like ZuluTrade or cTrader

- Limited customization options for trading platforms

- No VPS hosting for MT4/MT5 expert advisors

- Funding options are limited compared to some competitors, with no support for PayPal or other e-wallets

Overview

Scope Markets (formerly SMFX) is a global forex and CFD broker that has been providing institutional and retail trading services worldwide for over 10 years. As part of the Rostro Group, a full-service financial services group focused on delivering a wide range of trading solutions, Scope Markets offers access to more than 40,000 financial instruments across forex, indices, metals, energies, shares, commodities, cryptocurrencies, and fractional stocks

Regulated by the Cyprus Securities and Exchange Commission (CySEC) under SM Capital Markets Ltd and the Financial Services Commission (FSC) of Belize through its offshore entity Scope Markets Ltd, the broker prioritises client security and trust. Scope Markets empowers traders to participate in global financial markets through its innovative technology and advanced trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Overview Table

| Aspect | Information |

|---|---|

| Registered Country/Area | Belize, Cyprus |

| Founded Year | 2014 |

| Regulation | CySEC (SM Capital Markets Ltd), FSC (Scope Markets Ltd) |

| Minimum Deposit | $10 |

| Maximum Leverage | Up to 1:1000 |

| Spreads | From 0.0 pips |

| Trading Platforms | MT4, MT5, Web Trader, Mobile Apps |

| Tradable Assets | Forex, Indices, Metals, Energies, Shares, Commodities, Cryptocurrencies, Fractional Stocks |

| Account Types | One Account, Scope Invest, Scope Elite |

| Demo Account | Yes |

| Customer Support | Email, Phone, Live Chat |

| Education | Limited (Economic Calendar, Video Tutorials) |

Facts List

- Scope Markets is regulated by top-tier authorities, including CySEC and FSC, ensuring a secure trading environment.

- The broker offers an extensive range of over 40,000 tradable instruments across multiple asset classes.

- Scope Markets provides access to popular trading platforms like MT4 and MT5, as well as web and mobile trading solutions.

- Traders can choose from various account types, including the innovative "One Account" that combines the benefits of all previous account tiers.

- The minimum deposit requirement is just $10, making it accessible for beginner traders.

- Scope Markets offers competitive spreads starting from 0.0 pips and leverage up to 1:1000, depending on the instrument and account type.

- Clients can invest in fractional shares and ETFs, allowing for portfolio diversification and long-term investment opportunities.

- The broker provides negative balance protection to help mitigate the risk of losses exceeding account balances.

- Scope Markets supports multiple deposit and withdrawal methods, ensuring convenient funds management for traders.

- As part of the established Rostro Group, Scope Markets benefits from additional resources and financial stability.

Scope Markets Licenses and Regulatory

Scope Markets operates under the strict regulatory oversight of the Cyprus Securities and Exchange Commission (CySEC) and the Financial Services Commission (FSC) of Belize. The broker's commitment to compliance with industry standards instills confidence in traders, as it guarantees a secure and transparent trading environment.

- CySEC Regulation:

- SM Capital Markets Ltd, a Scope Markets entity, is authorised and regulated by CySEC under license number 339/17.

- CySEC regulation adheres to European Union (EU) directives, ensuring robust consumer protection and strict financial controls.

- Client funds are segregated from company funds and held in Tier-1 banks, minimising the risk of misappropriation.

- CySEC regulation provides up to €20,000 in deposit insurance for eligible clients, safeguarding their investments.

- FSC Belize Regulation:

- Scope Markets Ltd, the broker's offshore entity, is authorised and regulated by the FSC under registration number 000274/2.

- While FSC Belize regulation may not be as stringent as CySEC, it still demonstrates Scope Markets' commitment to legal compliance and oversight.

Scope Markets' dual regulation by CySEC and FSC Belize showcases the broker's dedication to upholding industry standards and providing a trustworthy trading environment for its clients. However, traders should be aware that the level of protection and oversight may vary between the two regulatory bodies.

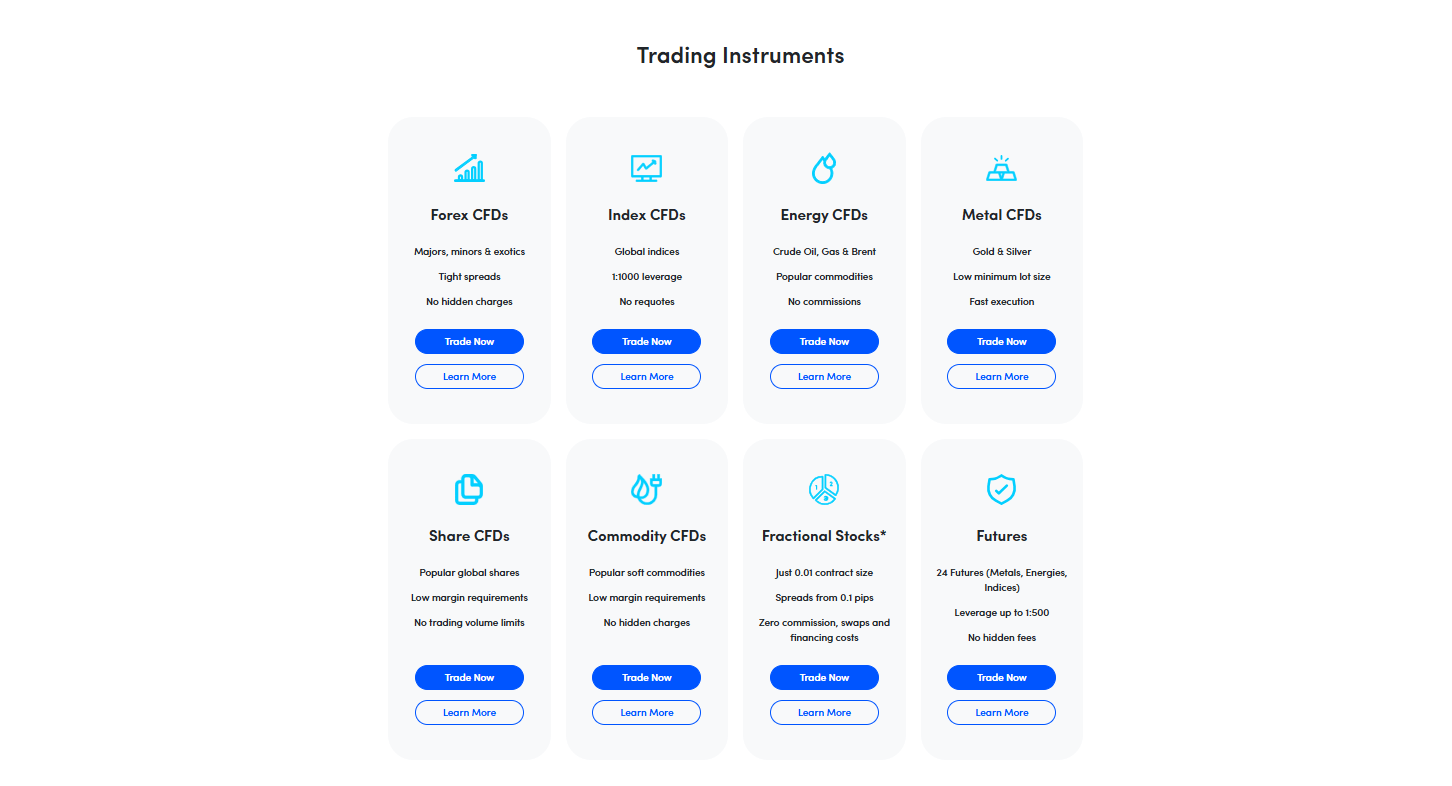

Trading Instruments

Scope Markets offers a comprehensive range of tradable assets, enabling traders to diversify their portfolios and seize opportunities across various markets. With over 40,000 financial instruments available, the broker caters to the needs of both novice and experienced traders.

| Asset Class | Details |

|---|---|

| Forex | 40+ currency pairs including majors, minors, and exotics |

| Indices | Major global indices like S&P 500, FTSE 100, DAX 30, etc. |

| Metals | Precious metals such as gold, silver, and platinum |

| Energies | Includes crude oil, natural gas, and other energy products |

| Shares | 1000+ global company stocks from diverse industries |

| Commodities | Agricultural products, soft commodities, and more |

| Cryptocurrencies | Popular digital assets like Bitcoin, Ethereum, Litecoin |

| Fractional Stocks | Invest in portions of leading company shares |

| ETFs | Multiple exchange-traded funds for diversified, long-term investments |

Scope Markets' extensive offering allows traders to implement diverse trading strategies and capitalise on market trends across different asset classes. The broker's competitive spreads and leverage options further enhance the trading experience, providing flexibility and potential for increased returns.

Trading Platforms

Scope Markets offers a range of powerful trading platforms to cater to the diverse needs of its clients.

The broker's platform suite includes:

MetaTrader 4 (MT4)

- An industry-standard platform known for its user-friendly interface and advanced features

- Supports automated trading through Expert Advisors (EAs) and custom indicators

- Available on desktop, web, and mobile devices

MetaTrader 5 (MT5)

- An upgraded version of the MT4 platform with enhanced features and functionality

- Offers additional order types, an expanded set of technical indicators, and improved charting capabilities

- Accessible on desktop, web, and mobile platforms

Scope Trader (Web Platform)

- A browser-based trading platform that requires no additional downloads or installations

- Provides a user-friendly interface with advanced charting tools and in-depth financial analysis

- Supports one-click trading and customizable workspaces

Scope Trader App (Mobile Platform)

- A native mobile trading application for iOS and Android devices

- Offers a seamless trading experience with full account management capabilities

- Includes advanced charting, technical analysis tools, and real-time market updates

Scope Markets' diverse range of trading platforms ensures that traders can choose the most suitable option based on their preferences, trading style, and device compatibility. The broker's commitment to providing stable, reliable, and feature-rich platforms enhances the overall trading experience for its clients.

Trading Platforms Comparison Table

| Platform | MT4 | MT5 | Scope Trader Web | Scope Trader App |

|---|---|---|---|---|

| Type | Desktop, Web, Mobile | Desktop, Web, Mobile | Web-based | Mobile |

| Language | MQL4 | MQL5 | N/A | N/A |

| Execution | Instant, Market, Pending | Instant, Market, Pending, Stop Orders, Trailing Stop | Instant | Instant |

| Automated Trading | Yes (EAs) | Yes (EAs) | No | No |

| Analysis Tools | 30+ indicators, 9 timeframes, 3 chart types | 38+ indicators, 21 timeframes, 4 chart types | Advanced charts, drawing tools | Advanced charts, technical indicators |

| Customization | High | High | Medium | Medium |

| Ease of Use | High | High | High | High |

Scope Markets How to Open an Account: A Step-by-Step Guide

Opening an account with Scope Markets is a straightforward process that can be completed online in a few simple steps:

- Visit Scope Markets' official website and click on the "Open an Account" button.

- Fill in the required personal information, including your name, email address, phone number, and country of residence.

- Choose your preferred account type (e.g., One Account, Scope Invest, or Scope Elite) and trading platform (MT4 or MT5).

- Provide proof of identity and address by uploading the required documents, such as a passport or driver's license and a recent utility bill or bank statement.

- Complete the online questionnaire to assess your trading knowledge and experience.

- Review and accept the broker's terms and conditions.

- Fund your account using one of the available deposit methods, such as bank transfer, credit/debit card, or e-wallet.

Once your account is verified and funded, you can start trading on Scope Markets' platforms. The broker also offers a demo account option, allowing traders to practise and familiarise themselves with the trading environment using virtual funds before committing real money.

Charts and Analysis

Scope Markets provides a range of charting and analysis tools to help traders make informed decisions and enhance their trading experience. The broker's main trading platforms, MetaTrader 4 (MT4) and MetaTrader 5 (MT5), offer advanced charting capabilities and a variety of technical indicators.

| Category | Key Features & Tools |

|---|---|

| Charting Features | Multiple chart types (line, bar, candlestick, Heiken Ashi), customisable timeframes (1 min to monthly), drawing tools (trendlines, Fibonacci, etc.), chart templates and multiple chart windows. |

| Technical Indicators | Built-in indicators including moving averages (SMA, EMA, WMA), oscillators (RSI, MACD, Stochastic, CCI), volatility tools (Bollinger Bands, ATR), trend-following tools (SAR, Ichimoku), volume indicators (OBV, MFI). Customisable parameters. |

| Trading Tools | Economic calendar, PIP calculator, margin calculator, swap calculator, profit calculator – all integrated within the platform or available on the broker’s site. |

| AutoChartist | Not available – traders seeking automated chart pattern recognition must look for alternatives. |

| Third-Party Tools | MT4/MT5-compatible plugins and tools via MetaTrader Market or independent sources – use with caution and ensure credibility. |

Scope Markets offers a robust set of charting and analysis tools through its MetaTrader 4 and MetaTrader 5 trading platforms. The advanced charting features, wide range of technical indicators, and useful trading tools provide traders with the necessary resources to analyse the markets and make informed trading decisions.

Scope Markets Account Types

Scope Markets offers a streamlined selection of account types designed to cater to the needs of different traders:

One Account

- A premium account designed for traders of all levels, combining the benefits of the broker's previous account tiers

- Offers competitive spreads from 0.9 pips and maximum leverage up to 1:1000

- Requires a minimum deposit of $10

- Supports a wide range of tradable assets, including forex, indices, metals, energies, shares, and cryptocurrencies

- Provides access to the MT4 and MT5 trading platforms

Scope Invest

- An account tailored for long-term investors interested in fractional stock investing

- Offers spreads from 0.1 pips and 1:1 leverage

- Requires a minimum deposit of $10

- Allows for fractional share trading from 0.01 contract size

- Provides zero swaps and financing costs

Scope Elite

- A premium account designed for high-volume and institutional traders

- Offers raw spreads from 0.0 pips and maximum leverage up to 1:1000

- Requires a minimum deposit of $20,000

- Provides access to a wide range of tradable assets and the MT4 and MT5 platforms

- Includes additional benefits such as a dedicated account manager, expedited request handling, and reduced trading costs

Scope Markets' account types cater to a diverse range of traders, from beginners to professionals, and offer competitive trading conditions. The broker's innovative "One Account" combines the best features of its previous account tiers, simplifying the choice for traders.

Account Types comparison table

| Feature | One Account | Scope Invest | Scope Elite |

|---|---|---|---|

| Minimum Deposit | $10 | $10 | $20,000 |

| Spread | From 0.9 pips | From 0.1 pips | From 0.0 pips |

| Maximum Leverage | Up to 1:1000 | 1:1 | Up to 1:1000 |

| Commission | $0 | $0 | $3.50 per lot |

| Tradable Assets | Wide range | Fractional Stocks | Wide range |

| Trading Platforms | MT4, MT5 | MT5 | MT4, MT5 |

| Swap-Free | Available | Yes | Up to 7 days |

| Dedicated Account Manager | No | No | Yes |

Negative Balance Protection

Negative balance protection is a risk management feature that ensures a trader's account balance never falls below zero, even in the event of extreme market volatility or unexpected gaps in pricing. This protection is crucial for traders, as it limits their potential losses to the funds available in their trading account, preventing them from owing money to the broker. Scope Markets offers negative balance protection to all its clients, regardless of their account type or trading platform. This feature is automatically applied to all trades, ensuring that traders cannot lose more than their account balance. In the event of a market gap or extreme volatility that causes a trader's account balance to turn negative, Scope Markets will absorb the negative balance and reset the account to zero. This protection provides traders with peace of mind, knowing that their losses are limited to the funds they have deposited into their trading account. It is important to note that while negative balance protection is an essential risk management tool, it should not be relied upon as a substitute for proper risk management practices. Traders should still employ sound risk management strategies, such as setting appropriate stop-loss orders, maintaining reasonable position sizes, and diversifying their trading portfolio.

Scope Markets Deposits and Withdrawals

Scope Markets provides a range of convenient deposit and withdrawal methods to facilitate smooth funds management for its clients.

Deposit Methods

| Method | Minimum Deposit | Processing Time | Fees |

|---|---|---|---|

| Bank Transfer | $10 | 3–5 business days | No internal fees |

| Credit/Debit Card | $10 | 1–3 business days | No internal fees |

| E-wallets | $10 | 1–2 business days | No internal fees |

Withdrawal Methods

| Method | Minimum Withdrawal | Processing Time | Fees |

|---|---|---|---|

| Bank Transfer | $100 | 3–5 business days | No internal fees |

| Credit/Debit Card | $100 | 1–3 business days | No internal fees |

| E-wallets | $100 | 1–2 business days | No internal fees |

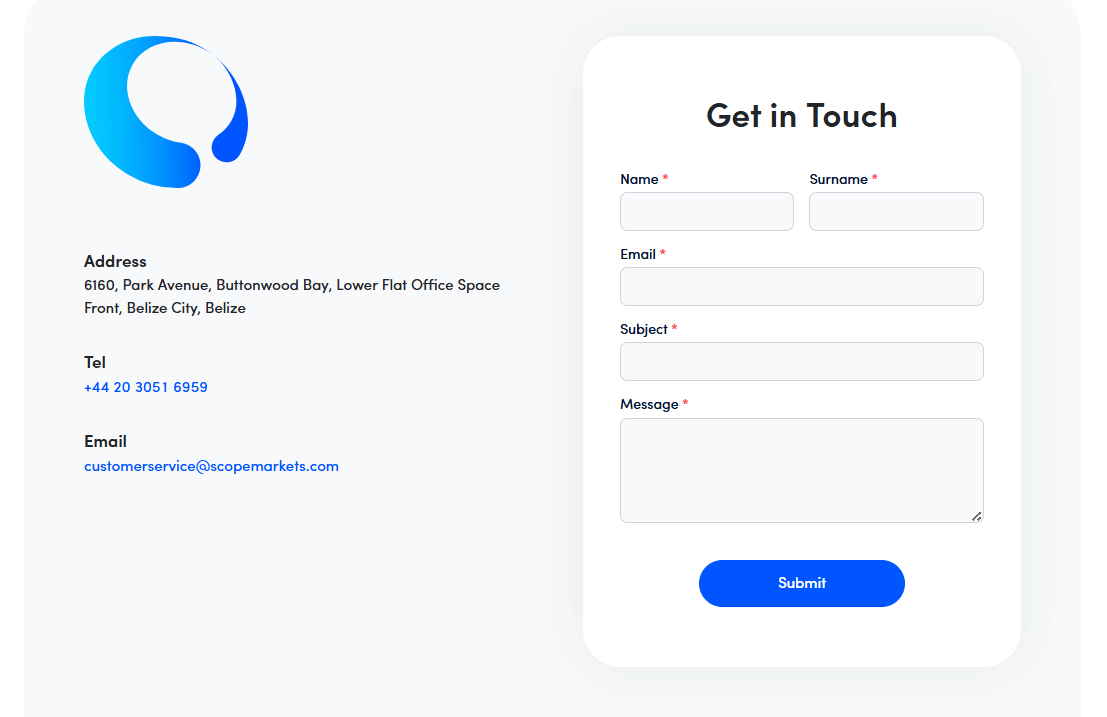

Support Service for Customer

Scope Markets offers multilingual customer support to assist traders with their enquiries and concerns.

- Email: support@scopemarkets.eu

- Phone: +357 25 281811

- Live Chat: Available on the broker's website

customer support comparison table

| Channel | Availability | Languages | Response Time |

|---|---|---|---|

| 24/5 | Multilingual | 24 hours | |

| Phone | 24/5 | Multilingual | 10 minutes |

| Live Chat | 24/5 | Multilingual | 5 minutes |

Prohibited Countries

Due to regulatory restrictions and licensing limitations, Scope Markets does not offer its services to residents of certain countries.

The list of prohibited countries includes:

- United States of America

- Canada

- North Korea

- Iran

- Syria

- Cuba

- Sudan

- American Samoa

- Guam

- Northern Mariana Islands

- Puerto Rico

- US Virgin Islands

- Israel

Traders from these countries are not permitted to open an account with Scope Markets. Attempting to circumvent these restrictions may result in the immediate termination of the trading account and potential legal consequences.

It is essential for traders to review the broker's terms and conditions and verify their eligibility before attempting to register an account with Scope Markets.

Special Offers for Customers

Scope Markets provides a range of special offers and promotions to attract new clients and reward existing ones. These offers may vary depending on the trader's location, account type, and market conditions. Some of the notable promotions include:

- Welcome Bonus: New clients may be eligible for a welcome bonus upon signing up and making their first deposit. The bonus amount and terms may vary depending on the promotion.

- Deposit Bonus: From time to time, Scope Markets may offer deposit bonuses to encourage clients to fund their accounts. These bonuses typically match a percentage of the deposited amount, up to a specified maximum.

- Loyalty Program: Scope Markets may offer a loyalty program that rewards clients based on their trading volume or account balance. Rewards can include cashback, reduced trading fees, or access to exclusive events and promotions.

- Trading Competitions: The broker may organize trading competitions where clients compete against each other for prizes based on their trading performance or other criteria.

- Refer-a-Friend: Scope Markets may offer a referral program where clients can earn rewards for introducing new clients to the broker.

It is essential for traders to carefully review the terms and conditions of any special offer or promotion before participating. Some offers may have specific requirements, such as minimum trading volumes or time limits, which must be met before any bonuses or rewards can be withdrawn.

Conclusion

After conducting a thorough review of Scope Markets, I have found them to be a reliable and trustworthy broker that offers a comprehensive trading experience for both novice and experienced traders.

With regulation from top-tier authorities like CySEC and FSC Belize, Scope Markets prioritises the security of client funds and maintains a transparent trading environment. Their wide range of tradable assets, competitive trading conditions, and user-friendly platforms cater to the diverse needs of traders worldwide.

The broker's innovative "One Account" simplifies the account selection process by combining the best features of their previous account tiers, making it an attractive choice for traders of all levels. The low minimum deposit requirement and the availability of fractional stock investing through the Scope Invest account further demonstrate the broker's commitment to accessibility and flexibility.

While Scope Markets' educational resources may be limited compared to some larger brokers, they still provide essential tools like an economic calendar and video tutorials to support traders' learning journeys.

The broker's customer support is responsive and available through multiple channels, ensuring that clients receive timely assistance when needed.

However, it is important to note that Scope Markets does not accept clients from several countries due to regulatory restrictions, which may be a drawback for some traders.

Overall, I believe that Scope Markets is a solid choice for traders looking for a reliable and well-rounded broker that offers a wide range of trading opportunities and competitive conditions. As with any financial decision, traders should carefully consider their individual needs and risk tolerance before choosing a broker.