Traze Forex Broker Review: Regulation, Trading Conditions, and More

Traze

Seychelles

Seychelles

-

Minimum Deposit $15

-

Withdrawal Fee $varies

-

Leverage 1:2000

-

Spread From 0.2

-

Minimum Order 0.01

-

Forex Available

-

Crypto Unavailable

-

Stock Unavailable

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Japan Forex Trading License

Japan Forex Trading License

Softwares & Platforms

Customer Support

+2484008692878

(English)

+2484008692878

(English)

Supported language: English, Malay, Portuguese, Spanish, Thai, Vietnamese

Social Media

Summary

Traze is a regulated forex broker committed to providing a transparent and accessible trading environment. Traders can access a diverse range of financial instruments, including forex pairs, commodities, indices, and cryptocurrencies, through user-friendly platforms like MetaTrader 4 and the Traze Mobile App. With tailored account types, competitive spreads, and leverage options, Traze caters to both novice and experienced traders. The broker emphasizes client protection by offering negative balance protection and operates under the regulation of the Financial Services Authority of Seychelles (FSA) under license number SD027, as well as being regulated by the Financial Conduct Authority (FCA) in the UK.

- Regulated by top-tier authorities (FCA and FSA)

- Negative balance protection on all account types

- Financial Compensation Scheme (FSCS) protection up to £85,000

- Wide range of deposit and withdrawal methods

- 24/7 customer support through various channels

- Partnership programs for Introducing Brokers and Affiliates

- User-friendly and intuitive trading platform (MetaTrader 4)

- Limited promotional and special offers for new clients

- Not available in certain countries due to regulations and restrictions

- No promotions currently available for retail clients

- Broker relatively new in the industry

Overview

Traze, a relatively new entrant in the online trading industry, has quickly gained traction as a reliable and regulated forex and CFD broker. Established in 2004 and headquartered in Seychelles, Traze operates globally, offering a wide range of tradable instruments and user-friendly platforms to cater to both novice and experienced traders.

Despite its short history, Traze has earned recognition for its commitment to providing a secure and transparent trading environment. The broker is regulated by top-tier authorities, including the Financial Conduct Authority (FCA) in the UK and the Financial Services Authority (FSA) in Seychelles, ensuring strict compliance with industry standards and client protection measures.

Traze's product offerings span over 100 instruments, including forex, indices, shares, commodities, and cryptocurrencies. The broker provides a choice of account types to suit different trading styles and experience levels, with features such as negative balance protection, competitive spreads, and leverage up to 1:2000.

Clients can access Traze's services through the popular MetaTrader 4 (MT4) platform, available on desktop, web, and mobile devices. The broker also offers a proprietary mobile trading app and Multi-Account Manager (MAM) services for professional money managers and institutional clients.

While Traze may not have the longest track record or most extensive suite of features compared to some established brokers, it has quickly built a reputation for its user-friendly interface, responsive customer support, and commitment to client satisfaction. The broker's official website provides detailed information on account types, trading conditions, and educational resources.

As with any financial service provider, potential clients should carefully consider their individual needs, risk tolerance, and local regulations before engaging with Traze. By prioritizing transparency, security, and client support, Traze aims to establish itself as a trusted partner for traders seeking a reliable and efficient online trading experience. For more information visit Traze.com.

Overview Table

| Broker | Traze |

|---|---|

| Year Established | 2004 |

| Headquarters | Seychelles |

| Regulation | FCA (UK), FSA (Seychelles) |

| Trading Platforms | MT4, Traze Mobile App, MAM |

| Tradable Instruments | Forex, Indices, Shares, Commodities, Cryptocurrencies |

| Account Types | Cent, Standard (STP), ECN |

| Minimum Deposit | $15 - $200 (depending on account type) |

| Maximum Leverage | 1:2000 |

| Customer Support | 24/7 via phone, email, live chat, contact form |

Facts List

- Traze is regulated by the FCA (UK) and FSA (Seychelles), ensuring a secure and transparent trading environment.

- The broker offers over 100 tradable instruments, including forex, indices, shares, commodities, and cryptocurrencies.

- Clients can choose from Cent, Standard (STP), and ECN account types, catering to different trading styles and experience levels.

- Traze provides the popular MT4 platform for desktop, web, and mobile trading, as well as a proprietary mobile app.

- The broker offers leverage up to 1:2000 and competitive spreads starting from 0.2 pips.

- Negative balance protection is available on all account types, safeguarding clients' funds.

- Traze supports multiple deposit and withdrawal methods, including bank transfers, credit/debit cards, and e-wallets.

- The minimum deposit ranges from $15 to $200, depending on the account type, making it accessible to a wide range of traders.

- Customer support is available 24/7 through various channels, including phone, email, live chat, and a contact form.

- Traze provides educational resources, such as an economic calendar and copy trading program, to support clients' trading journeys.

Traze Licenses and Regulatory

Traze operates under a robust regulatory framework, ensuring a secure and transparent trading environment for its clients. The broker holds licences from two well-respected regulatory bodies: the Financial Conduct Authority (FCA) in the United Kingdom and the Financial Services Authority (FSA) in Seychelles.

Traze's UK entity, Zeal Capital Market (UK) Limited, is authorised and regulated by the FCA under the firm reference number 768451. The FCA is known for its strict regulations and oversight, requiring brokers to adhere to high standards of financial conduct, client protection, and transparency. FCA-regulated brokers must segregate client funds, maintain adequate capital reserves, and follow strict reporting and auditing requirements.

In Seychelles, Traze operates through Zeal Capital Market (Seychelles) Limited, which is regulated by the FSA under licence number SD027. While the FSA's regulations may not be as stringent as the FCA's, the authority still ensures that brokers maintain compliance with anti-money laundering (AML) and counter-terrorist financing (CTF) regulations.

Regulations List

Financial Conduct Authority (FCA) - United Kingdom

- Firm Reference Number: 768451

- Regulated Entity: Zeal Capital Market (UK) Limited

Financial Services Authority (FSA) – Seychelles

- License Number: SD027

- Regulated Entity: Zeal Capital Market (Seychelles) Limited

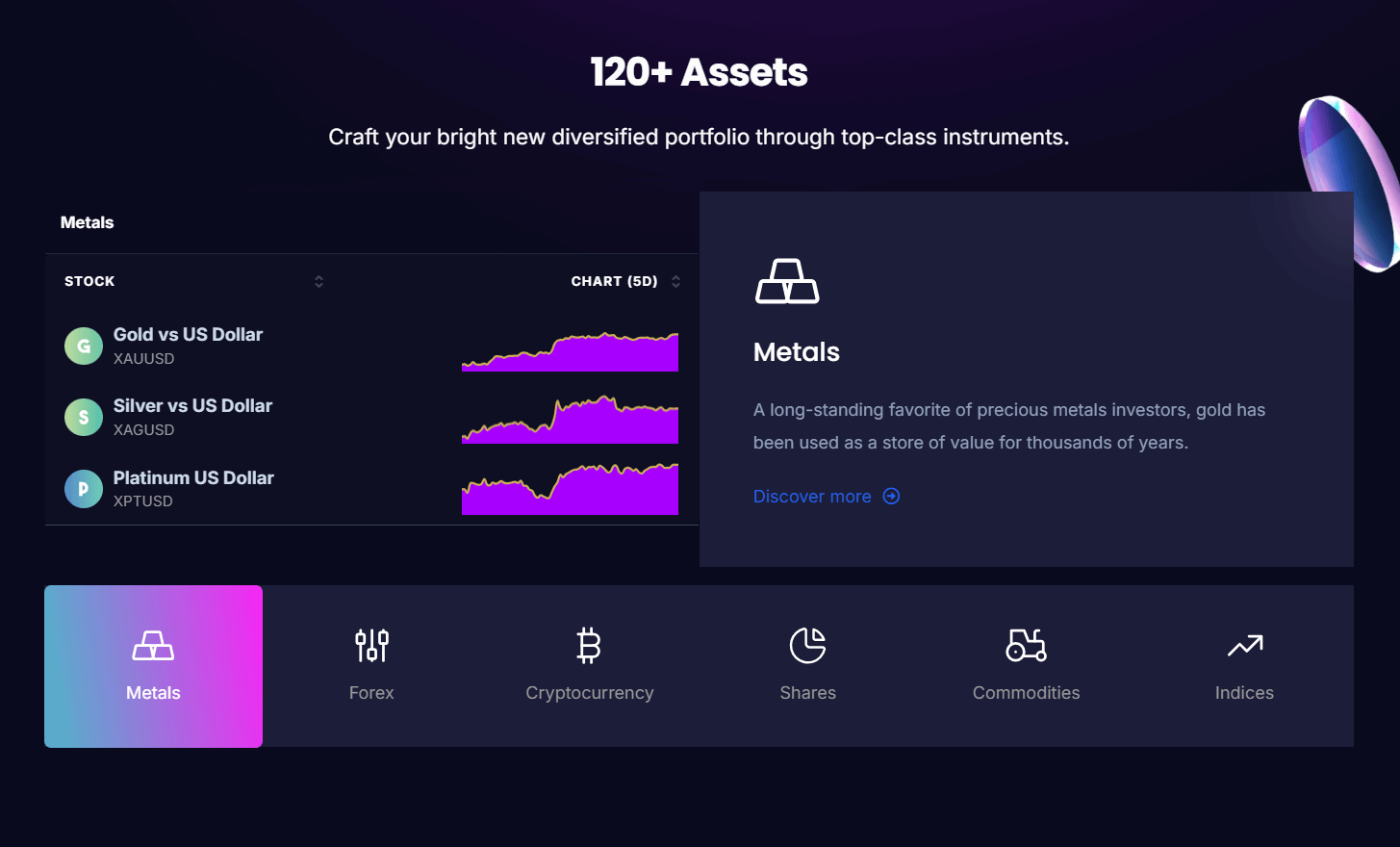

Trading Instruments

Traze offers a diverse range of tradable assets, catering to the varied interests and investment strategies of its clients. The broker's extensive portfolio spans multiple asset classes, including forex, indices, shares, commodities, and cryptocurrencies. This comprehensive offering allows traders to diversify their investments and capitalise on opportunities across different markets.

| Tradable Instruments | Details |

|---|---|

| Forex | Access to major, minor, and exotic currency pairs with competitive spreads and deep liquidity. The website features a live counter of available pairs, detailed trading information, and FAQs. |

| Indices | Trade global stock market indices such as S&P 500, FTSE 100, DAX 30, and Nikkei 225. A live counter of available indices and educational resources are provided on the website. |

| Shares | Trade shares from leading global companies. The website showcases a live counter of available shares and provides informative content to assist traders. |

| Commodities | Includes precious metals (gold, silver), energies (oil, natural gas), and agricultural products (wheat, coffee). A live counter and educational resources are available on the website. |

| Cryptocurrencies | Trade digital assets like Bitcoin, Ethereum, Litecoin, and Ripple. Informative content on cryptocurrency trading is available to help traders understand risks and opportunities. |

Traze's extensive range of tradable assets sets it apart from many competitors, demonstrating the broker's commitment to meeting the diverse needs of its clients. By offering exposure to multiple markets and sectors, Traze empowers traders to create well-rounded portfolios and seize opportunities across the global financial landscape.

Trading Platforms

Traze offers a range of trading platforms to cater to the diverse needs and preferences of its clients. The broker's platforms include the industry-standard MetaTrader 4 (MT4) and a proprietary mobile trading app, providing traders with flexibility, reliability, and advanced features to enhance their trading experience.

MetaTrader 4 (MT4)

Traze provides the widely-used MT4 platform, which is known for its user-friendly interface, extensive charting tools, and advanced technical analysis capabilities. MT4 is available for desktop (Windows and Mac), web, and mobile (iOS and Android) devices, allowing traders to access their accounts and trade on the go.

Key features of MT4 include:

- Multiple chart types and timeframes

- 50+ pre-installed technical indicators

- 24 analytical objects

- Customizable charts and templates

- Automated trading with Expert Advisors (EAs)

- Backtesting and strategy optimization tools

Traze Mobile App

In addition to MT4, Traze offers a proprietary mobile trading app designed to provide a seamless and intuitive trading experience on smartphones and tablets. The Traze Mobile App is available for both iOS and Android devices and features a user-friendly interface, real-time market updates, and integrated trading tools.

Key features of the Traze Mobile App include:

- Real-time quotes and charts for various instruments

- One-tap trading functionality

- Account management tools (deposits, withdrawals, and transaction history)

- Personalized watchlists and price alerts

- Access to market analysis and financial news

Multi-Account Manager (MAM)

For professional money managers and institutional clients, Traze offers the Multi-Account Manager (MAM) service. MAM allows money managers to efficiently handle multiple client accounts from a single interface, allocating funds, and executing trades according to predefined strategies and risk parameters.

Traze's diverse range of trading platforms caters to the needs of both novice and experienced traders, providing them with the tools and features necessary to analyse markets, execute trades, and manage their portfolios effectively. The broker's commitment to offering stable, reliable, and user-friendly platforms sets it apart from many competitors and ensures that clients can focus on their trading activities without technological limitations.

Trading Platforms Comparison Table

| Feature | MT4 | Traze Mobile App | MAM |

|---|---|---|---|

| One-Click or One-Tap Trading | Yes | Yes | Yes |

| Trade Straight off Charts | Yes | Yes | No |

| Email Alerts or Push Notifications | Yes | Yes | No |

| Mobile Alerts | No | Yes | No |

| Stop Order | Yes | Yes | Yes |

| Market Order | Yes | Yes | Yes |

| Trailing Stop Order | Yes | Yes | Yes |

| OCO Orders (One-Cancels-The-Other) | Yes | Yes | No |

| Limit Order | Yes | Yes | Yes |

| 24-Hour Trading | Yes | Yes | Yes |

| Charting Package | Yes | Yes | No |

| Streaming News Feed | Yes | Yes | No |

Traze How to Open an Account: A Step-by-Step Guide

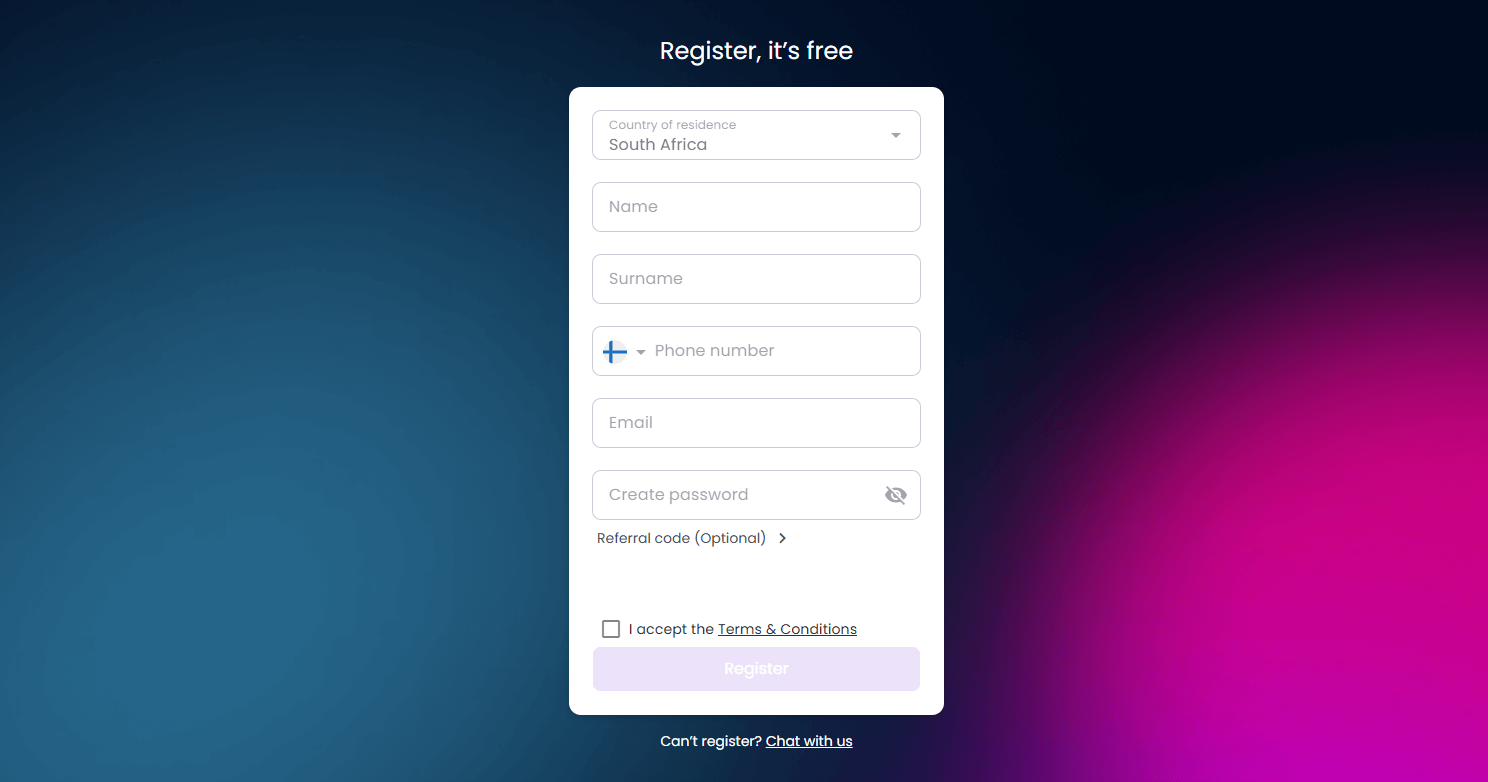

Opening a trading account with Traze is a straightforward process that can be completed in just a few simple steps. Before getting started, ensure that you meet the minimum age requirement (18 years old) and have a valid government-issued ID and proof of residence ready for the verification process.

Step 1: Visit the Traze website and click on the "Live Account" button located in the header.

Step 2: On the registration page, fill out your personal information, including your full name, mobile number, email address, and a secure password. Traze will send an OTP (One-Time Password) to your provided email for verification purposes.

Step 3: After completing the first page, you will be asked to confirm your country of residence and select your preferred account type (Standard or ECN). Residents of Malaysia can also choose a Cent (mini) account. Carefully read through the terms and agreements, tick the box to accept them, and click "Sign Up."

Step 4: Upon successful registration, you will be presented with your MT4 login details and account type information. Take note of these details, as you will need them to access your trading account on the MT4 platform.

Step 5: Download and install the MT4 trading platform on your desktop or mobile device using the links provided by Traze.

Step 6: To access your Traze client area (My Traze), click on the "Home Page" button after completing the registration process.

Step 7: Before you can start trading, you will need to fund your account. Navigate to the "Deposit" section in your client area and choose your preferred payment method. Traze offers several deposit options, including bank transfers, credit/debit cards, and e-wallets. Keep in mind that the minimum deposit amount varies depending on your account type.

Step 8: Once your deposit is processed, you can log in to the MT4 platform using the login details provided during the registration process and start trading.

Traze's account opening process is designed to be user-friendly and efficient, allowing traders to start their trading journey quickly. The broker's client area (My Traze) serves as a centralised hub for managing your account, making deposits and withdrawals, and accessing various resources and tools.

Charts and Analysis

As a relatively new entrant in the online trading industry, Traze is actively working on expanding its suite of educational resources and tools to support its clients' trading journeys. While the current offerings may be somewhat limited compared to more established brokers, Traze demonstrates a commitment to providing value-added services that can enhance traders' knowledge and skills.

| Feature | Description |

|---|---|

| CFD Expiration Date | Provides information on CFD expiration dates, helping traders manage positions effectively by closing, rolling over, or letting contracts expire. |

| Economic Calendar | A tool that tracks key market-moving events like economic data releases and geopolitical developments, helping traders anticipate market volatility and refine strategies. |

| Copy-Trading Platform | Enables clients to automatically mirror trades of experienced traders, making it a useful tool for beginners and those looking for passive trading opportunities. |

While Traze's current educational resources may not be as extensive as those offered by some of its more established competitors, the broker's commitment to providing these tools demonstrates its dedication to supporting its clients' growth and success. As Traze continues to develop and expand its offerings, traders can expect to see a more comprehensive suite of resources designed to cater to their diverse needs and skill levels.

Traze Account Types

Traze offers a range of trading account types tailored to suit the diverse needs and preferences of its clients. From novice traders to experienced professionals, the broker provides a solution to cater to various trading styles, budgets, and goals.

Cent Trading Account

The Cent Trading Account is an ideal choice for beginners who want to explore the world of trading with minimal risk. With a low minimum deposit requirement of just $15, traders can start their journey without committing substantial funds. This account type utilises micro lot sizes (1,000 units), allowing for more precise position sizing and risk management. The Cent Account is also suitable for intermediate traders looking to test new strategies or diversify their portfolio with multiple small-sized accounts.

Key Features:

- Minimum deposit: $15

- Base currency: US Cents

- Leverage: Up to 1:2000

- Minimum trade size: 0.01 lots

- Maximum open positions: 200

- Spreads: From 1.5 pips

Standard (STP) Trading Account

The Standard Trading Account is designed for the everyday trader seeking competitive pricing and fast execution. Utilising the Straight Through Processing (STP) model, this account type offers direct access to liquidity providers, ensuring that trades are executed at the best available market prices without dealing desk intervention. With a minimum deposit of $50, the Standard Account provides a balance between accessibility and trading conditions, making it suitable for a wide range of traders.

Key Features:

- Minimum deposit: $50

- Base currency: USD

- Leverage: Up to 1:500

- Minimum trade size: 0.01 lots

- Maximum open positions: 200

- Spreads: From 1.3 pips

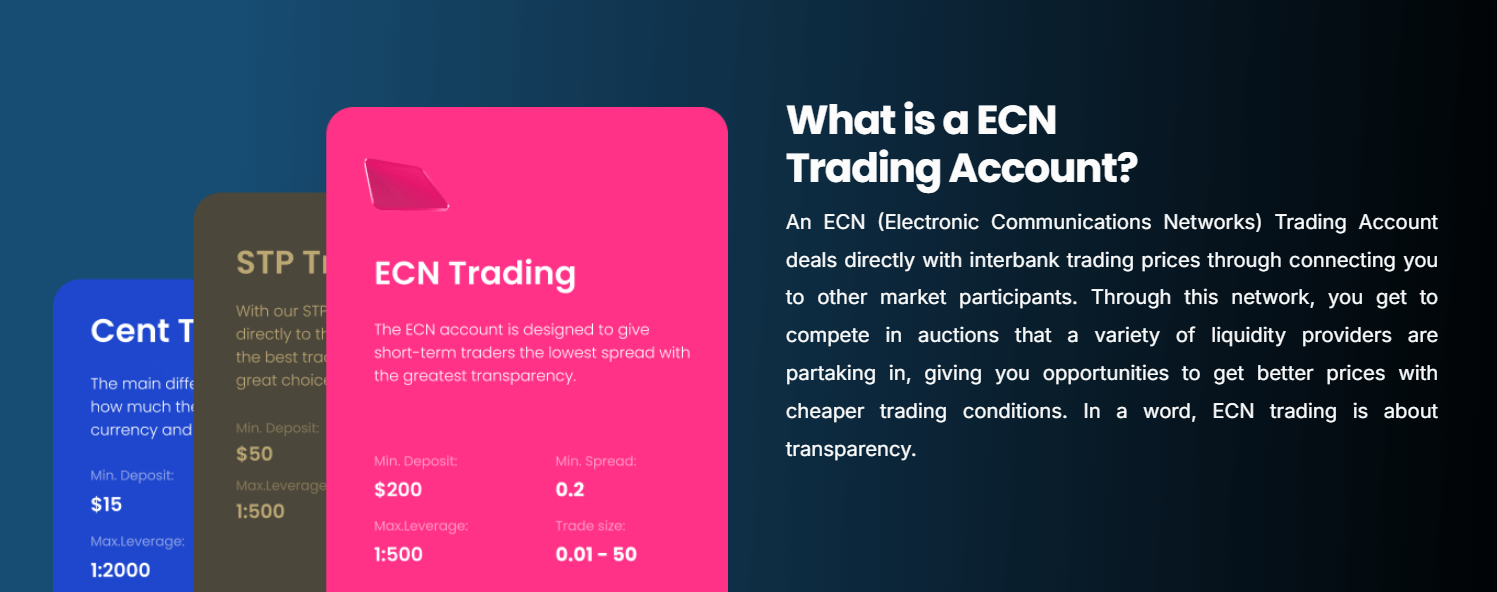

ECN Trading Account

The ECN Trading Account is tailored for experienced traders and professionals who demand the most competitive spreads and fastest execution speeds. By connecting directly to liquidity providers through an Electronic Communication Network (ECN), this account type offers raw spreads from as low as 0.2 pips. ECN accounts provide a transparent and efficient trading environment, ideal for scalpers, high-frequency traders, and those employing expert advisors (EAs). A minimum deposit of $200 is required to open an ECN Trading Account.

Key Features:

- Minimum deposit: $200

- Base currency: USD

- Leverage: Up to 1:500

- Minimum trade size: 0.01 lots

- Maximum open positions: 200

- Spreads: From 0.2 pips

By offering a diverse array of account types, Traze demonstrates its commitment to catering to the unique requirements of its clientele. Whether you are a novice trader taking your first steps in the market or a seasoned professional seeking optimal trading conditions, Traze has an account type to match your needs. This flexibility ensures that traders can select an account that aligns with their risk tolerance, trading style, and financial goals, ultimately enhancing their overall trading experience.

Account Types Comparison Table

| Feature | Cent Account | Standard (STP) Account | ECN Account |

|---|---|---|---|

| Minimum Deposit | $15 | $50 | $200 |

| Base Currency | US Cents | USD | USD |

| Leverage | Up to 1:2000 | Up to 1:500 | Up to 1:500 |

| Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| Maximum Open Positions | 200 | 200 | 200 |

| Spreads (Minimum) | 1.5 pips | 1.3 pips | 0.2 pips |

| Commission | No | No | Yes |

| Execution Type | Instant | STP | ECN |

| Suitable For | Beginners, Testing Strategies | Everyday Traders | Experienced Traders, Scalpers |

| Negative Balance Protection | Yes | Yes | Yes |

Negative Balance Protection

In the dynamic world of online trading, where market volatility can lead to unexpected losses, negative balance protection has emerged as a crucial safety net for traders. Traze, a regulated broker committed to client welfare, offers negative balance protection to all its account holders, ensuring that traders never lose more than their account balance. Negative balance protection is a risk management feature that prevents a trader's account from falling below zero, even in extreme market conditions. This means that if a trader's losses exceed their account balance, the broker will absorb the excess loss, effectively limiting the trader's liability to the funds available in their account. Scenarios that could lead to negative balances include:

- Highly volatile market conditions, such as those seen during major economic events or geopolitical tensions.

- Sudden price gaps, which can occur when markets open after weekends or holidays.

- Overexposure to high-risk trading instruments, such as leveraged products or exotic currency pairs.

- Technical issues or connectivity problems that prevent timely trade execution or closure.

Traze Deposits and Withdrawals

Traze offers a range of convenient deposit and withdrawal methods to facilitate seamless transactions for its clients. The broker understands the importance of efficient and secure payment processing, ensuring that traders can quickly fund their accounts and access their profits without unnecessary delays or complications.

Deposit Methods

Traze accepts the following deposit methods:| Deposit Method | Currency | Minimum Deposit | Maximum Deposit | Processing Time | Additional Notes |

|---|---|---|---|---|---|

| International Bank Transfer | USD | $1,000 | No Limit | Within 2 business days | Funds transferred to a designated bank account in Singapore |

| Local Bank Transfer | Local Currencies (THB, MYR, IDR, VND) | Varies by country | No Limit | Fast processing | Available for traders in Thailand, Malaysia, Indonesia, and Vietnam |

| Credit/Debit Card | USD | $200 | $10,000 | Instant | Accepted cards: VISA, Mastercard |

| E-wallets | USD | Varies by provider | No Limit | Instant | Supported: Skrill, Neteller, Perfect Money |

Withdrawal Methods

To withdraw funds, traders can use the following methods:| Withdrawal Method | Withdrawal Limit | Processing Time | Additional Notes |

|---|---|---|---|

| Original Payment Method | Up to the deposited amount | Varies by payment provider | Funds are returned to the original deposit method for security |

| Bank Transfer | Profits exceeding deposits | Processed within 24 hours | Requires identity and bank account verification |

Support Service for Customer

In the fast-paced world of online trading, reliable and responsive customer support is crucial for a positive trading experience. Traze recognises the importance of providing its clients with multiple channels to reach out for assistance, ensuring that traders can access the help they need when they need it.

- 24/7 Live Chat: Traders can access the live chat feature directly from Traze's website, connecting them with a support representative in real-time. This option is ideal for quick queries or urgent matters that require immediate attention.

- Email Support: Clients can send their enquiries to Traze's dedicated support email address (cs@traze.com). The customer support team aims to respond to all emails within 24 hours, providing detailed and personalised assistance.

- Phone Support: Traze offers a 24-hour hotline (+1 400-8692-878) for traders who prefer to discuss their concerns over the phone. This option is particularly helpful for complex issues that may require a more in-depth conversation.

- Social Media: Traders can reach out to Traze's customer support team through the broker's official social media channels, such as Facebook and Twitter. While response times may vary, social media provides an alternative avenue for clients to engage with the support team and stay updated on the latest news and developments.

Customer Support Comparison Table

| Feature | Details |

|---|---|

| Supported Languages | English, Spanish, Arabic, and several others |

| Customer Service By | Traze Customer Service |

| Customer Service Hours | 24/7 |

| Email Response Time | Within 24 hours |

| Telephonic Support | Yes |

| Personal Account Manager | Yes |

Prohibited Countries

Traze, like many international online brokers, is subject to various regulations and restrictions that limit its ability to offer services in certain countries and regions. These restrictions are put in place by local governments, financial regulatory bodies, and international organisations to protect consumers, maintain market integrity, and prevent financial crimes.

The primary reasons behind these restrictions include:

- Local regulations: Some countries have strict laws and regulations governing the provision of financial services, including online trading. These regulations may require brokers to obtain specific licences, comply with local capital requirements, or adhere to certain operational standards.

- Licensing requirements: Many jurisdictions require brokers to obtain a local licence before offering services to residents. Obtaining these licences can be a time-consuming and costly process, and brokers may choose not to pursue licensing in certain countries due to the associated costs and regulatory burdens.

- Geopolitical factors: International sanctions, political instability, or economic restrictions can also prevent brokers from operating in specific countries. These factors may include sanctions imposed by the United Nations, the European Union, or individual countries like the United States.

Based on the information provided, Traze is prohibited from offering its services in the following countries:

- North Korea

- Iran

- Canada

- United States

- Syria

Traders from these countries are not permitted to open an account with Traze or access its trading platforms and services. Attempting to circumvent these restrictions by providing false information or using virtual private networks (VPNs) to mask one's location can result in account termination, legal consequences, and potential loss of funds.

Allowed Regions List: United Kingdom, South Africa.

Special Offers for Customers

As a relatively new entrant in the competitive online trading industry, Traze is focused on establishing a strong foundation built on trust, reliability, and exceptional service. While the broker does not currently offer a wide range of promotional activities or special offers, it has developed a robust partnership program designed to attract and support introducing Brokers (IBs) and Marketing Affiliates.

Traze's partnership program is a testament to the broker's commitment to growth and collaboration within the industry. By providing attractive incentives and support to its partners, Traze aims to expand its reach and offer its services to a broader audience of traders.

- Introducing Broker (IB) Program: Traze's IB program is designed to reward partners who refer clients to the broker. IBs can benefit from competitive commissions, a multi-level structure that allows them to earn from sub-IBs, and a range of tools to monitor their performance and client activity. Some key features of the IB program include:

- Flexible commission structures

- Multi-level IB hierarchy

- Real-time commission tracking

- Detailed reporting on client activity

- Dedicated support from Traze's partnership team

- Marketing Affiliate Program: Traze's Marketing Affiliate program is tailored for individuals or organizations with a strong online presence and a desire to promote the broker's services. Affiliates can earn attractive commissions for referring new clients to Traze, with various payment models available, such as CPA (Cost Per Acquisition), Revenue Share, or Hybrid plans. Benefits of the Marketing Affiliate program include:

- Competitive commission rates

- Flexible payment models

- Access to promotional materials and marketing tools

- Dedicated affiliate management and support

- Detailed performance tracking and reporting

While Traze may not currently offer a wide array of special offers or promotions for retail traders, the broker's focus on building strong partnerships demonstrates its commitment to growth and expanding its reach within the industry. As Traze continues to establish itself as a reliable and trusted broker, it may introduce more promotional activities and special offers to attract and retain retail clients.

Conclusion

In conclusion, after conducting a thorough review of Traze, I believe that they have established themselves as a safe and reliable broker in the industry. Despite being a relatively new entrant in the online trading space, Traze has quickly gained traction by prioritising security, transparency, and client satisfaction.

One of the key factors contributing to Traze's trustworthiness is their strong regulatory framework. With licences from top-tier authorities such as the FCA (UK) and FSA (Seychelles), Traze demonstrates a commitment to operating within the confines of the law and prioritising client protection. The broker's adherence to strict guidelines and maintaining adequate capital reserves further enhance their credibility.

Traze's dedication to client security is evident in their offering of negative balance protection across all account types and an Investor Compensation Fund for eligible clients. These measures provide traders with peace of mind, knowing that their funds are safeguarded and their interests are protected.

In terms of trading offerings, Traze provides a diverse range of tradable instruments, including forex, indices, shares, commodities, and cryptocurrencies. This extensive product portfolio caters to the needs of both novice and experienced traders, allowing them to diversify their investments and capitalise on various market opportunities.

The broker's user-friendly trading platforms, which include the industry-standard MT4 and a proprietary mobile app, ensure that clients can access the markets and manage their trades seamlessly. The availability of tools such as the Economic Calendar and a copy trading program further enhances the trading experience and supports traders in their decision-making process.

Traze's commitment to client support is commendable, with a knowledgeable and responsive customer service team available 24/7 through multiple channels. The broker's efforts to provide educational resources and maintain transparency in their operations demonstrate their dedication to empowering traders and fostering long-term relationships.

While Traze's current promotional offerings may be limited, their focus on building strong partnerships through their Introducing Broker and Affiliate programs showcases their commitment to growth and expanding their reach within the industry.

Overall, Traze presents itself as a reliable and trustworthy broker that prioritises client security, offers a comprehensive trading experience, and maintains a transparent and user-focused approach. As they continue to grow and evolve, I believe that Traze has the potential to become a leading player in the online trading industry, offering traders a secure and rewarding platform to pursue their financial goals.